Digital asset treasury companies are running out of steam

Convincing traders to pay $2 for $1 of bitcoin worked — for a while. As premiums evaporate, an unwind could be painful.

Crypto is always chasing its next infinite money machine. From the 2017 kimchi premium (arbitrage on higher crypto prices in South Korea) to the 2019 Grayscale Bitcoin Trust trade (a bitcoin fund that traded above its holdings) to the 2020s high-yield “savings” platforms (which promised low-risk annual yields of 20% or more) these trades can be lucrative — until they aren’t. The newest is the digital asset treasury company (DATCO), a scheme that has puzzled analysts and is already showing familiar cracks.

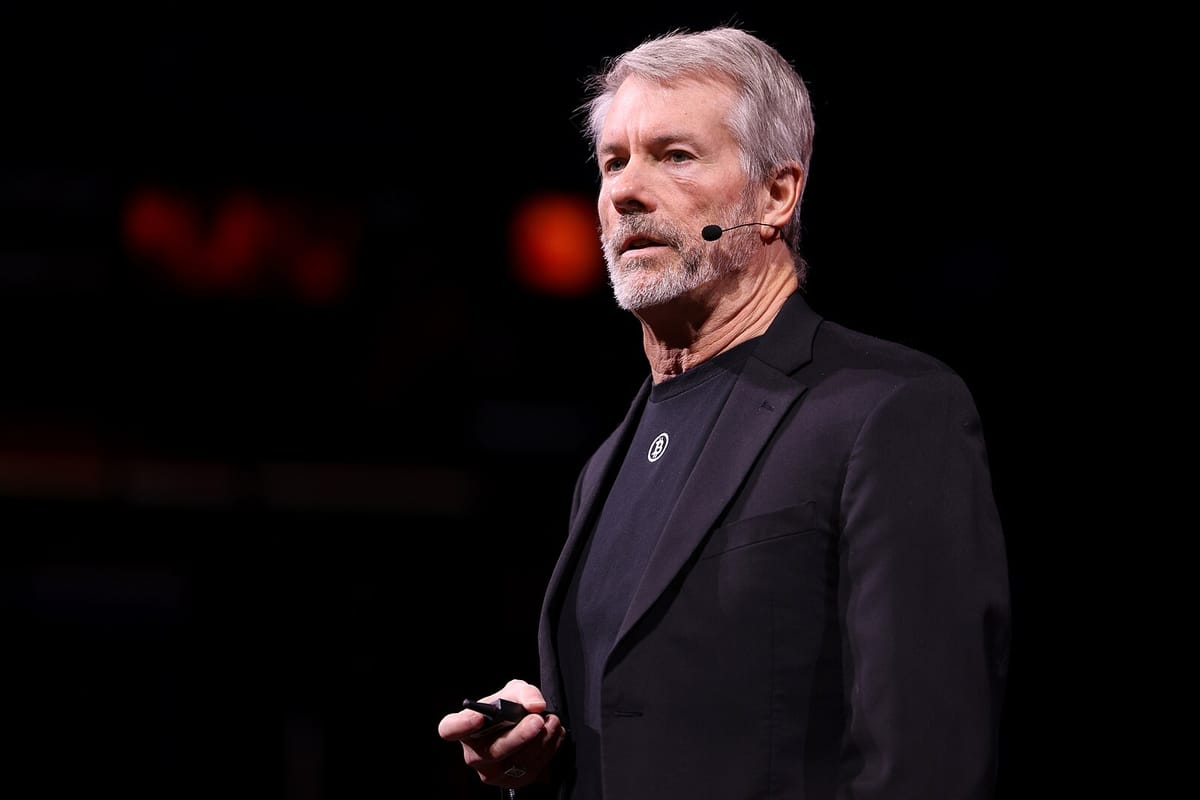

In August 2020, the publicly traded software company MicroStrategy made headlines with a purchase of 21,454 BTC (then worth $250 million) for its corporate treasury.1 The company’s actual business involves developing enterprise analytics software, but its founder and CEO Michael Saylor evangelizes bitcoin with a near-religious zeal. Since his bitcoin-maximalist awakening, he’s urged his followers to go all in: mortgage homes, take loans against family businesses.2 In 2025, he quipped: “Sell a kidney if you must, but keep the Bitcoin.”3

MicroStrategy, which rebranded to just “Strategy” in early 2025, has since then continued to buy as much bitcoin as it possibly could. By now, it holds more than 650,000 bitcoin, priced at over $50 billion.4 Those who purchase its stock often don’t know or care much about its software business, which has taken a backseat to its bitcoin accumulation.

Before the emergence of spot bitcoin ETFs in early 2024 [I49], there was some logic to the scheme. If someone couldn’t or didn’t want to buy bitcoin directly, they could buy shares of a company whose balance sheet was mostly bitcoin. It more or less worked: MicroStrategy stock moved with the price of bitcoin, and often even traded at a premium to the value of its coins. Buying MSTR was, for a time, the easiest way to approximate bitcoin exposure in a brokerage account.

But after spot bitcoin ETFs arrived, the rational case for MSTR grew thin. Investors could now access bitcoin much more directly, without the added corporate risk and whims of a sometimes erratic CEO. It seemed to me that the MicroStrategy premium would quickly dissolve as traders wanting exposure to bitcoin migrated to more efficient options.

Against my expectations, small-cap firms began abandoning old business models and reinventing themselves as digital-asset proxies in droves. The ETFs had solved the plain access issue, but not the hunger for leverage or for the memestock-era spectacle of a cultish CEO and a to-the-moon narrative. These digital asset treasury companies continued trading at a premium to the underlying assets. Part of that was economic: DATCOs can borrow, issue convertible notes, or use their elevated share prices to issue more stock and buy more coins — forms of leverage ETFs lack. But part of it was pure narrative: the belief that headline-making figureheads and the mythos of a magic money machine would keep pushing share prices higher.

There’s no institutional backing behind Citation Needed — it exists because readers like you choose to support it. If you value this coverage, consider signing up for a free or pay-what-you-want subscription.

It worked, for a while. MicroStrategy enjoyed a more than 3,000% increase in its stock price between adopting its bitcoin treasury strategy and its all-time-highs in 2025, at times trading at around three times the value of its bitcoin holdings. Shares of Metaplanet, a Tokyo-based firm that in 2024 pivoted from hotel management to accumulating bitcoin, were in June 2025 trading at around eight times the value of its bitcoin holdings. BitMine, a US-based bitcoin mining firm that became an ethereum treasury company in mid-2025, briefly traded at 2× premium to its holdings. These premiums mystified some analysts. “You are just paying $2 for a one-dollar bill,” Spectra Markets president Brent Donnelly told the Wall Street Journal.5 Jim Chanos, the investor famous for shorting Enron prior to its collapse, predicted MicroStrategy’s premium would soon evaporate, dubbing the model “financial gibberish”.6 (Chanos was short MSTR and long bitcoin — essentially betting against the MSTR premium — until he closed the trade at a profit earlier this month.)

As the list of DATCOs surpassed 200 companies, entrants seeking these outsized premiums began to shy away from becoming yet another bitcoin, ether, or solana treasury company. Some DATCOs instead built around esoteric, illiquid tokens are emerging, with an unusual strategy in which the tokens are transferred to the DATCOs in-kind by DATCO sponsors without any market purchases. This is a boon to the sponsors, who are able to essentially choose their price for the tokens, but a huge risk to shareholders who may be buying DATCO shares at a substantial (and largely unknown) premium to the actual price these tokens might fetch on the open market.7

Some DATCOs, including MicroStrategy, have also moved beyond equity issuance to buy crypto and have begun borrowing or issuing convertible debt.8 While this leverage can amplify gains as crypto prices rise, the amplification goes both ways. When crypto prices fall, DATCOs stand to fall even faster.

Now, with two months of sinking crypto prices, some of these firms are beginning to look pretty shaky, and the warnings from Chanos and others seem prescient. Many DATCOs have flipped from trading at a premium to a discount, meaning shares trade for less than the value of the underlying digital asset. Nakamoto, a bitcoin treasury company that merged with the publicly traded KindlyMD earlier this year, has cratered by 98%. BitMine is down 77% since adopting its DAT strategy this past summer. The OG, MicroStrategy, is down 60%. (Nakamoto and BitMine are trading at a discount to the value of their treasury holdings; MicroStrategy still trades at a premium, though it has been narrowing.)

ETHZilla, which up until August was a pharmaceutical research firm called 180 Life Sciences, sold around $40 million of its ETH treasury to try to bolster its plunging stock price.9 FG Nexus, which also launched an ETH treasury strategy only months ago, has sold nearly $33 million of its holdings for the same purpose.10 Sequans, a semiconductor company that established a bitcoin treasury in June, sold $100 million of its bitcoin to pay down its debt.11

This is a scary trend, particularly for traders holding shares in firms that have relied on debt to accumulate their crypto hoards. If crypto prices fail to rally before that debt comes due, the firms could be forced to sell their crypto. Large forced sales, or forced sales across many DATCOs, can depress prices further, only exacerbating the problem. Researchers with Galaxy Digital have compared the potential “unwind” to the busting of the 1920s investment trust boom, writing:12

The 1920s investment trust boom followed a similar reflexive loop. Trusts traded at premiums to NAV, issued shares, and used the proceeds to buy more assets. When sentiment turned, those same mechanics amplified the downside. Collapsing premiums choked off access to capital while leverage magnified losses on falling assets. These cascading failures were an accelerant of the 1929 crash and subsequent Great Depression.

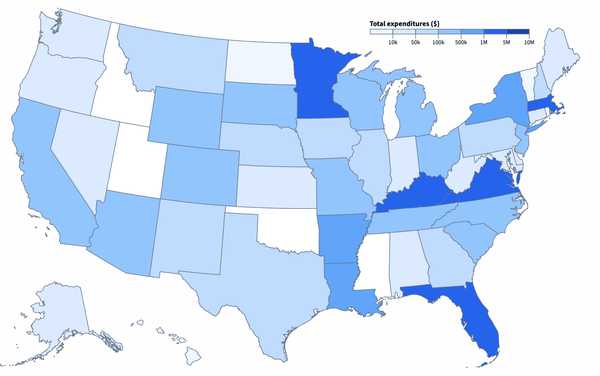

As crypto has become more entangled with traditional finance, the effects of a crypto market crash are more likely to impact the broader financial world. In December 2024, MicroStrategy joined the NASDAQ 100 [I72], and some other indexes have also begun to include various DATCOs.a As DATCO prices falter, they can tug on those indexes, and the funds that track them — some of which are widely held by investors who may not even realize they have exposure to the crypto world.

While DATCOs remain a fairly small portion of the overall crypto ecosystem, holding approximately 4% of the circulating bitcoin supply and 1% of the ETH supply,12 failures in that sector can nevertheless ripple throughout crypto markets. Forced selling pushes prices down, triggering liquidations elsewhere, pushing prices down further. The feedback loop in turn applies more stress to leveraged DATCOs, prompting even more forced selling, depressing prices. These types of death spirals exist throughout crypto, and they can happen quickly and catastrophically. It may be time to consider whether the DATCO model is yet another of crypto’s perpetual-motion machines whose momentum is running out.

Have information? Send tips (no PR) to molly0xfff.07 on Signal or molly@mollywhite.net (PGP).

I have disclosures for my work and writing pertaining to cryptocurrencies.

Footnotes

References

“Software firm MicroStrategy makes a massive bet on Bitcoin with a $250 million purchase”, Fortune. ↩

“Michael Saylor on Economics, Bitcoin and Decision Making”, The Angelo Robles Podcast. ↩

“The Year’s Hottest Crypto Trade Is Crumbling”, The Wall Street Journal. ↩

“Jim Chanos on the Nuttiness of ‘Bitcoin Treasury Companies’”, Odd Lots. ↩

“Retail Traders Left Exposed in High-Stakes Crypto Treasury Deals”, Bloomberg. ↩

“MicroStrategy slips from 24-year high on convertible offering to buy more bitcoins”, Reuters. ↩

“Ether Treasury Firm ETHZilla Sold $40M ETH to Fund Share Buyback Amid Discount to NAV”, CoinDesk. ↩

“Ether Treasury Firm FG Nexus Unloads Nearly 11K ETH to Fund Share Buyback”, CoinDesk. ↩

“Bitcoin Treasury Sequans Sells $100 Million in BTC to Pay Down Debt”, Decrypt. ↩

“The Rise of Digital Asset Treasury Companies (DATCOs)”, Galaxy Digital. ↩

“MSCI May Exclude Digital Asset Treasury Firms, Putting “Meaningful Pressure” on the Sector”, Barron’s. ↩