The Sam Bankman-Fried empire crumbled. What happened? (part one)

Shorter title: SBF, FTX, WTF?

Yesterday, FTX and Binance announced that they had inked a "non-binding [letter of intent]" for Binance to acquire FTX. Now, the deal is off.

All of this was a complete bombshell.

Binance and FTX are both enormous crypto exchanges. Binance is the largest in the world, and FTX was ranked somewhere between second and fourth depending on when you looked and who you asked.ab Until yesterday, the two were major competitors. In fact, their executives had been feuding right up until the day before the deal was signed.

Let's dive in to what the hell just happened. If you already know most of it, feel free to skip to the analysis:

FTX, SBF, CZ, WTF?

First, some background.

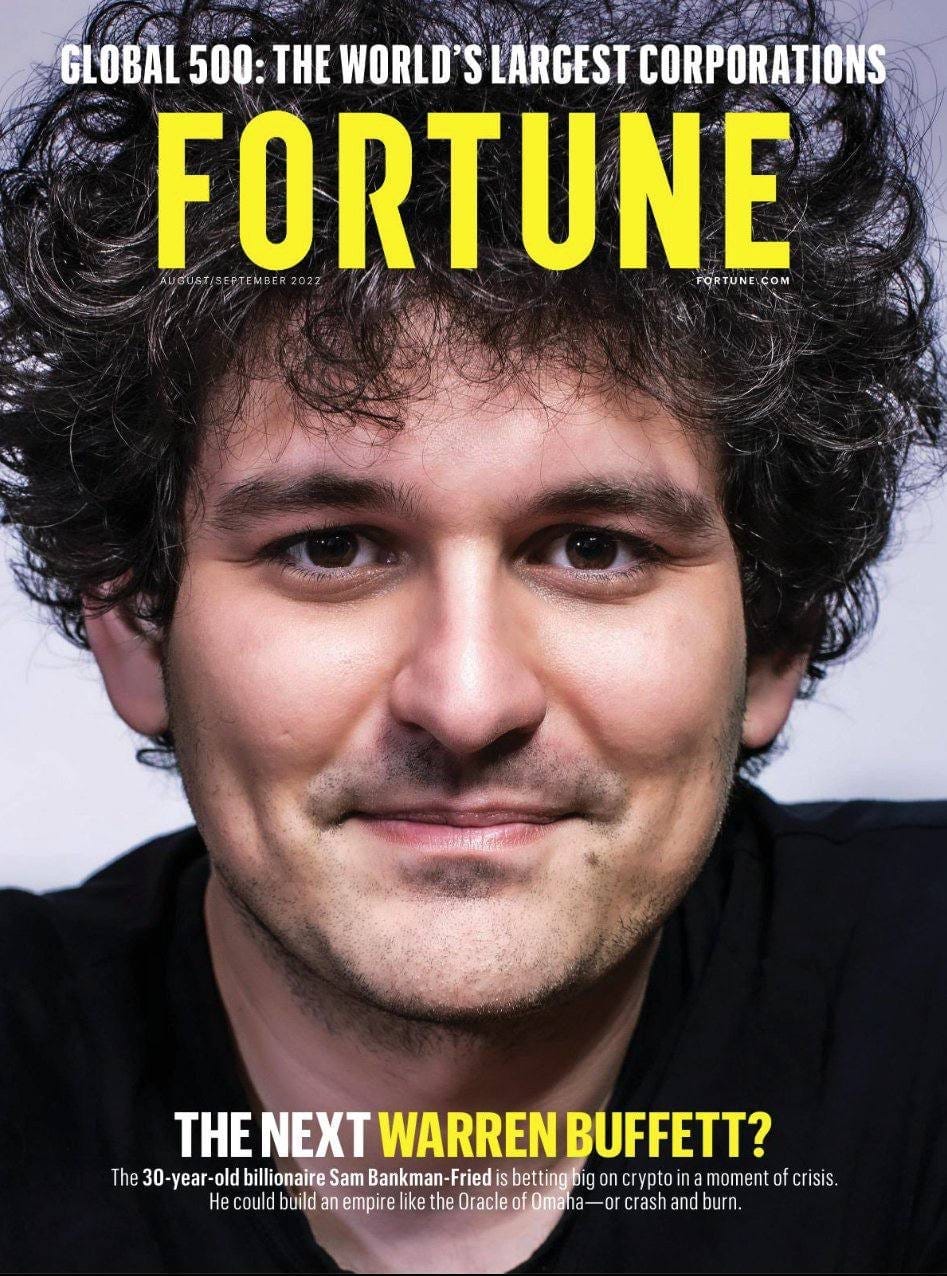

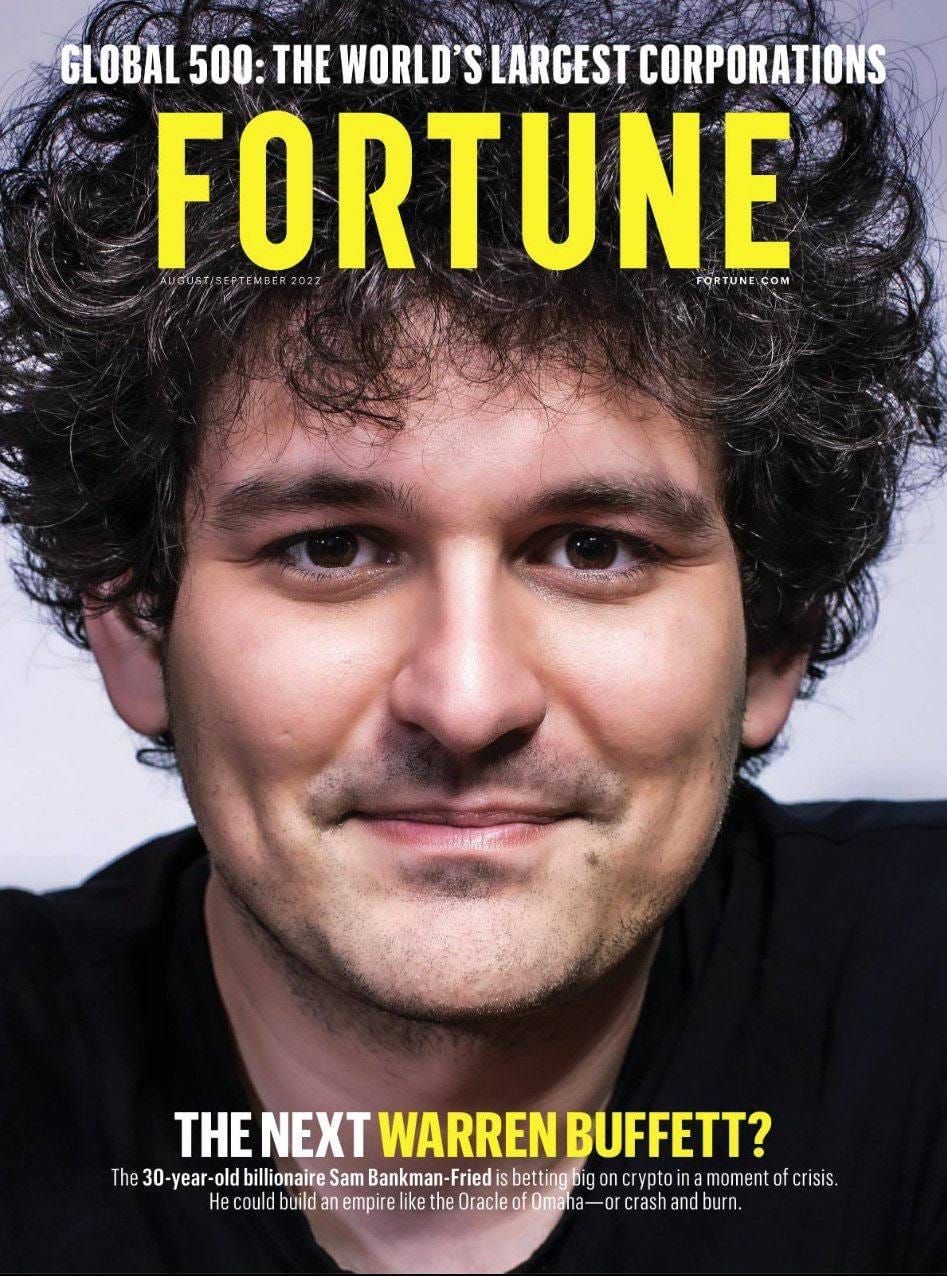

FTX is run by founder and CEO Sam Bankman-Fried. Sam Bankman-Fried is often referred to as SBF to save on typing. Before this whole saga, his net worth was estimated to be at least $10 billion, though he himself acknowledged that his fortune was "mostly illiquid"—aka, it existed primarily on paper.

SBF also founded and runs the quantitative trading firm Alameda Research. "But Molly," you might ask, "isn't it shady for one person to run both a crypto exchange and a market maker/trading firm? Isn't there a potential conflict of interest, where they might end up trading against their own customers?" Yes. Welcome to crypto.

SBF is (or was) also viewed among many crypto enthusiasts as a sort of wunderkind. As is so often the case, the widespread belief that he possesses intellect far beyond the average person, and that his every action is just one carefully coordinated move in an ongoing game of 5D chess, seems to stem mostly from the fact that he is (or was) a multibillionaire.

Among other things, he is known for his sometimes overly honest responses to interview questions, an apparently-cultivated disheveled appearance, working grueling hours punctuated only by naps on a beanbag, and his belief in the "earning to give" brand of effective altruism.

I think of myself as like a fairly cynical person. And that was so much more cynical than how I would've described farming. You're just like, well, I'm in the Ponzi business and it's pretty good. – Matt Levine to SBF in April 2022

After leaving a job as a quantitative analyst at Jane Street Capital, SBF founded Alameda Research in 2017. The firm got off to a rocking start with a wildly profitable trade that arbitraged the higher Bitcoin price in Japan than in the US.

SBF founded the FTX exchange in 2019. Originally based in Hong Kong, he relocated the company to the Bahamas in 2019. The Bahamas, and its neighboring islands of Antigua and Barbuda where FTX is actually incorporated, are known for laws that are quite friendly in terms of both taxes and regulations.

Despite claims that the two firms operated separately, it was an open secret that they were tightly intertwined. People within and outside of the crypto industry (myself included) took to just referring to SBF rather than to FTX or Alameda, since it was often unclear where lines were drawn between the actions of the two entities.

Binance is an enormous crypto exchange run by Changpeng Zhao, more commonly known as CZ. No one really knows where Binance is headquartered, or why some person who's claimed to be a low-level staffer is listed on official documents. A 2018 document exposed that Binance had come up with an elaborate plan to create a US entity that would be used to distract regulators, while behind the scenes they helped US-based customers evade geographic restrictions on the highly leveraged crypto derivatives trading that the US regulates.

All super normal, above-board stuff. Nothing to see here.

SBF the savior

When shit really began to hit the fan in May, as diminishing crypto prices combined with the Terra ecosystem's collapse kicked off death spirals in the crypto industry that continued through summer and into the fall, SBF sprang into action.

As other companies called in loans and tightened their belts to try to remain on stable footing, SBF dipped into a seemingly endless pool of funds to offer bailouts to insolvent companies.

When the crypto broker Voyager Digital disclosed their $660 million exposure to the insolvent Three Arrows Capital crypto hedge fund, SBF (via Alameda) swooped in to extend a loan of $200 million in cash and 15,000 Bitcoin (at the time, priced at around $300 million).

A week later, SBF (via FTX) dropped another $250 million loan on BlockFi, a crypto lender that was also struggling to stay afloat. A week after that, FTX inked a deal that would give them the option to buy BlockFi for up to $240 million, and extended the firm $400 million in revolving credit.

During Voyager bankruptcy proceedings, which began in July and are still ongoing, Voyager announced on September 26 that SBF (via FTX) had submitted the highest bid to acquire their assets. The bid was valued at $1.422 billion.

SBF's repeated attempts to plug the holes of the sinking crypto industry led Anthony Scaramucci to dub him "the new J.P. Morgan" in June, referring to the actions of J.P. Morgan (the human, not the banking firm named for him) to stem the Panic of 1907.

No longer the golden child

In October, Sam Bankman-Fried was no stranger in Washington, D.C., where he spoke with regulators and think tanks about the industry and its possible regulation.

The mononymous Scott, founder of DeFi Pulse, accused him of "spending money to push a law thru congress that may force defi protocols to operate like centralized exchanges", referring to the leaked proposal for a Digital Commodities Consumer Protection Act. "A better name would be the Digital Commodities FTX Protection Act."

The following day, SBF published a blog post titled "Possible Digital Asset Industry Standards", where he laid out detailed recommendations for crypto regulation.

The backlash was swift.

"This absolutely sucks," wrote investor and crypto podcast host Ryan Sean Adams.

"This is the way toward crypto becoming banking 2.0, instead of an actual meaningful change in how money and finance work," wrote libertarian crypto founder Erik Voorhees.

Zefram Lou, a developer of multiple decentralized crypto projects, wrote, "SBF is blatantly trying to kill DeFi and decentralization in general. SBF, FTX, and Alameda have repeatedly demonstrated that their sole purpose is to extract as much value as possible out of crypto with zero regard for its development. Start treating them with zero respect."

The leak

On November 2, CoinDesk published a shocking report based on a leaked Alameda balance sheet, showing that much of Alameda's claimed $14.6 billion in assets were denominated in FTX token ($FTT). FTT is a highly-illiquid token that SBF was creating via FTX, and then using to prop up Alameda with fake "value".

"[The balance sheet] shows Bankman-Fried's trading giant Alameda rests on a foundation largely made up of a coin that a sister company invented, not an independent asset like a fiat currency or another crypto," wrote Ian Allison.

Imagine McDonald's makes its own money, let's call them clown-bucks, keeps most of it, and sells some to the market.

— Lyn Alden (@LynAldenContact) November 8, 2022

McDonald's then uses their remaining clown-bucks as collateral for actual loans.

And then people remember clown-bucks aren't real.

This news sent shockwaves throughout the cryptocurrency ecosystem, kicking off the first whispers of insolvency. Dirty Bubble Media was one of the first to give it the attention it deserved.

Some began withdrawing assets from FTX. Alameda CEO Caroline Ellison tried to get out in front of it, claiming the leaked balance sheet was incomplete and didn't represent the full picture of Alameda's finances.

r/AbruptChaos

Then Binance's CZ piped up. "Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books," announced CZ on Twitter.

All hell broke loose.

Increased withdrawals turned into an all-out run on the bank. SBF later told staff that the exchange experienced $6 billion in net withdrawals within 72 hours.

At first, SBF tried to placate CZ. "I respect the hell out of what y'all have done to build the industry as we see it today, whether or not they reciprocate, and whether or not we use the same methods. Including CZ…. Make love (and blockchain), not war."

CZ had no apparent interest in niceties, instead making a direct reference to SBF's regulatory efforts: "We gave support before, but we won't pretend to make love after divorce. We are not against anyone. But we won't support people who lobby against other industry players behind their backs."

SBF went into damage control mode. "FTX is fine. Assets are fine." tweeted SBF, much in the same manner as other crypto execs whose companies were not even a little bit fine. He fired back at CZ: "A competitor is trying to go after us with false rumors", but ended with another plea: "I'd love it, CZ, if we could work together for the ecosystem."

The following day, withdrawals slowed to a crawl, then stopped. SBF went silent.

A deal is struck

After the public feud between SBF and CZ, it was a shock when the following day, SBF announced there had been a "strategic transaction with Binance for FTX.com". He referred to a "liquidity crunch".

CZ made his own announcement.

In a subsequent tweet, CZ wrote, "Binance has the discretion to pull out from the deal at any time."

If CZ was doing anything in his announcement, it was hedging.

It ends as quickly as it began

If the deal seemed abrupt, so too did its dissolution.

The Wall Street Journal was the first to break the news that Binance was walking away from the deal.

The issues are beyond our control or ability to help. – Binance

The future of FTX, Alameda, and SBF remain unknown but look grim. FTX's shortfall reportedly approaches $8 billion. SBF is hoping to raise emergency funding from investors, but the goose may well be cooked.

Footnotes

Bloomberg puts them at #2 before the deal announcement: "Sam Bankman-Fried Bows to Rescue From Binance's CZ as FTX Buckles", Bloomberg. ↩

CoinMarketCap data from October 28, before the publication of the CoinDesk article which called into question the solvency of FTX, puts FTX at #3. CoinMarketCap. ↩