In 2022, web3 went just great

Come, reminisce with me.

What. a. year.

2022 brought 855 new entries to Web3 is Going Just Great, which was quite the uptick from the only 147 entries recorded in 2021. This also means that Web3 is Going Just Great just surpassed the 1,000 entry milestone! 🥳

$4.27 billion was stolen in various hacks and scams this year alone, although that is a very conservative estimate — we just don't yet have a great picture of quite how much money was lost to some of the major collapses this year.

To celebrate the New Year, and just over a year of running the W3IGG project, I've put together a new grift leaderboard, where you can explore the site's entries ranked by the amount of money that was lost.

I've also added starred posts, where entries that are particularly noteworthy (based on my completely subjective opinion) show a star icon in the corner. The timeline can be filtered to show only starred posts — a highlight reel, of sorts.

These features have helped me pull together this recap, where I will summarize some of the major themes of this year in the cryptocurrency world. Before we jump in, though, one last celebratory announcement: Subscriptions to this newsletter are 20% off for the next week!

I'm so grateful to those of you who've supported me in writing this newsletter already. If 2022 is any indication, 2023 is going to be a hell of a year, and I'm happy to have you all on this journey with me.

Collapses

I don't think anyone can disagree that major collapses were the primary theme of 2022 in the cryptocurrency world. Terra/Luna was the first major domino to fall, on May 9, and that historic tumble kicked off a string of events that are still unfolding. The enormous contagion throughout the industry has contributed to many more recent collapses, including that of FTX. Terra/Luna's founder is wanted by Interpol, though he insists he's definitely not on the run. He must just be in Serbia because it's so well known for its lovely December weather.

Crypto hedge fund Three Arrows Capital and lender Babel Finance were the next major collapses, occurring nearly simultaneously in mid-June. Much like Do Kwon, Three Arrows Capital's founders Kyle Davies and Su Zhu are also definitely not on the run. Kyle Davies was last known to be in Bali, which at least is a more believable vacation destination, but which also happens to be in a country without an extradition agreement with the U.S.

Then we had the bankruptcies: Voyager on July 6, and Celsius on July 13. This kicked off a deluge of letters from both Voyager customers and Celsius customers, which illustrate some of the devastation to individuals that comes out of disasters like these.

Finally, November brought the spectacular explosion of the FTX cryptocurrency exchange, which (until this post) has been the focus of every single special edition issue of this newsletter to date as I work to cover it in detail. The contagion effect of such an enormous collapse has been impressive, overshadowing even that of the fairly large disasters earlier this year.

Bridge hacks

When looking at 2022's list of hacks by dollar amount, it's clear even at a brief glance that blockchain bridge hacks were the most devastating in terms of total financial loss. Topping the charts is the March 29 hack of the bridge used by the play-to-earn game Axie Infinity — a hack that saw $625 million taken and funneled to the North Korean Lazarus cybercrime group.

Following it in second place is the massive $570 million hack of a Binance bridge on October 6. Fourth on the list is the $320 million Wormhole bridge hack in February, followed by the $190 million Nomad bridge hack in August. The $100 million hack of the Harmony Horizon bridge in June makes a total of five bridge-related entries in the top ten hacks by dollar amount this year.

Ape escapes

The theft of sixteen NFTs, including eight Bored Apes, from collector Todd Kramer led to the catchphrase of the year: "all my apes gone".

Bored Apes were by no means the only NFTs stolen this year, but they were a particularly juicy target. Right now, apes are going for a mere $80,000 on the low end, but in more bubblicious times earlier this year, even the least desirable NFTs from the collection were selling for more than a quarter million.

Web3 is Going Just Great documented at least 45 ape thefts this year, not even counting their less pricey (but still pricey) Mutant counterparts. That's just what was covered on this site; the total number is likely higher. This past August, Immunefi estimated 143 Bored Apes had been stolen in the roughly year-long period since the collection's creation in June 2021.

We saw the standard scam vectors, like buying stolen verified Twitter accounts to promote phishing sites, but scammers also got creative this year. One scammer created their own fake Bored Apes to trade for a collector's real ones. Another scam duo created websites that convinced collectors to grant access to their collections by promising to "turn your [Bored Ape] animated". Yet another scammer spent a month impersonating film studio executives to convince a collector they wanted to license his ape for use in a TV show, only to finally succeed in stealing the collector's fourteen apes and flip them for $1 million.

Crypto people don't know how things work

SpiceDAO thought that spending $3 million to acquire the Jodorowsky Dune storyboard would allow them to build a media empire based on the Dune IP.

At least two companies emerged trying to create NFT-based music platforms without any kind of agreement with the musicians whose work they were selling.

mtgDAO was shocked and horrified when Wizards of the Coast "unfairly discriminate[d] against web3 tech and web3 communities" by sending them a stern letter to say that, no, you can't just rip off Magic the Gathering because there are NFTs involved.

Multiple projects promised to build elaborate video games with no apparent sense of the time or money involved with such an endeavor. "Our vision was to create something similar to [World of Warcraft]... we were, however, overeager and optimistic with regards to how much time it takes to create such a world," explained one.

The deflation of the NFT bubble

I have included for you this rather undignified sound effect of air escaping from a balloon if you would like to play it as you begin reading this section. I think it really maximizes the effect.

Peak NFT mania is a distant memory of late 2021. Gone are the low-effort rip-off NFT projects that still somehow manage to rake in millions of dollars before rug-pulling.

2022 was the year of traders finding out that someone is always left holding the bag when they're in the game of flipping assets with no inherent value for ever-increasing sums, and sometimes that someone just so happens to be them. Various publications, including the Wall Street Journal have tried to estimate just how far down the NFT market has crashed. They can't seem to agree on whether it's 92% or 95% or 99%, but needless to say: interest in NFTs is at a major low.

The collector who dropped $2.9 million on an NFT of Jack Dorsey's first ever tweet found himself in a bind in April, when he tried to resell the NFT and wound up with a top bid of… $280. Highly-publicized plans to auction a set of more than 100 CryptoPunk NFTs at Sotheby's were cancelled at the last minute, likely due to a pretty lukewarm reaction from prospective buyers.

The problem of once-pricey NFTs becoming so valueless that collectors can't even offload them for pennies has apparently become widespread enough that people are paying companies to take their worthless NFTs so they can then try to claim the loss on their taxes. In one case, a buyer paid to dispose of an NFT they had acquired for $12,000 a year ago. Another offloaded a pile of 338 blockchain gaming NFTs that they had acquired for a cumulative ~$84,000 in and around July 2021.

Increased attention from law enforcement and government

Although crypto remains a wild west, law enforcement and regulators stepped it up a bit this past year—mostly because the crypto industry has given them no choice.

Executives at FTX are currently facing the possibility of decades in prison as charges have come down against them from the Department of Justice, and civil lawsuits from the SEC and CFTC could bring more penalties their way. We remain very early in what is likely to be a long process, and there are almost certainly more charges yet to come.

Binance is under scrutiny from multiple angles, including a four-year-long Department of Justice investigation where prosecutors are reportedly considering criminal charges. Other entities including the IRS, SEC, and CFTC are also performing investigations into various matters at Binance, which is the largest crypto exchange in the world. Binance has drawn attention from other regulatory groups outside of the US, as well: they were slapped with a $3.35 million fine in the Netherlands in July, they were shooed out of Ontario, Canada in March, and Israeli regulators shut down their operations in the country in February.

In August, the Office of Foreign Assets Control (OFAC) added Tornado Cash to the sanctions list, prohibiting American individuals and businesses from interacting with the service. This is being challenged in court from a few directions, but has already had a considerable impact:

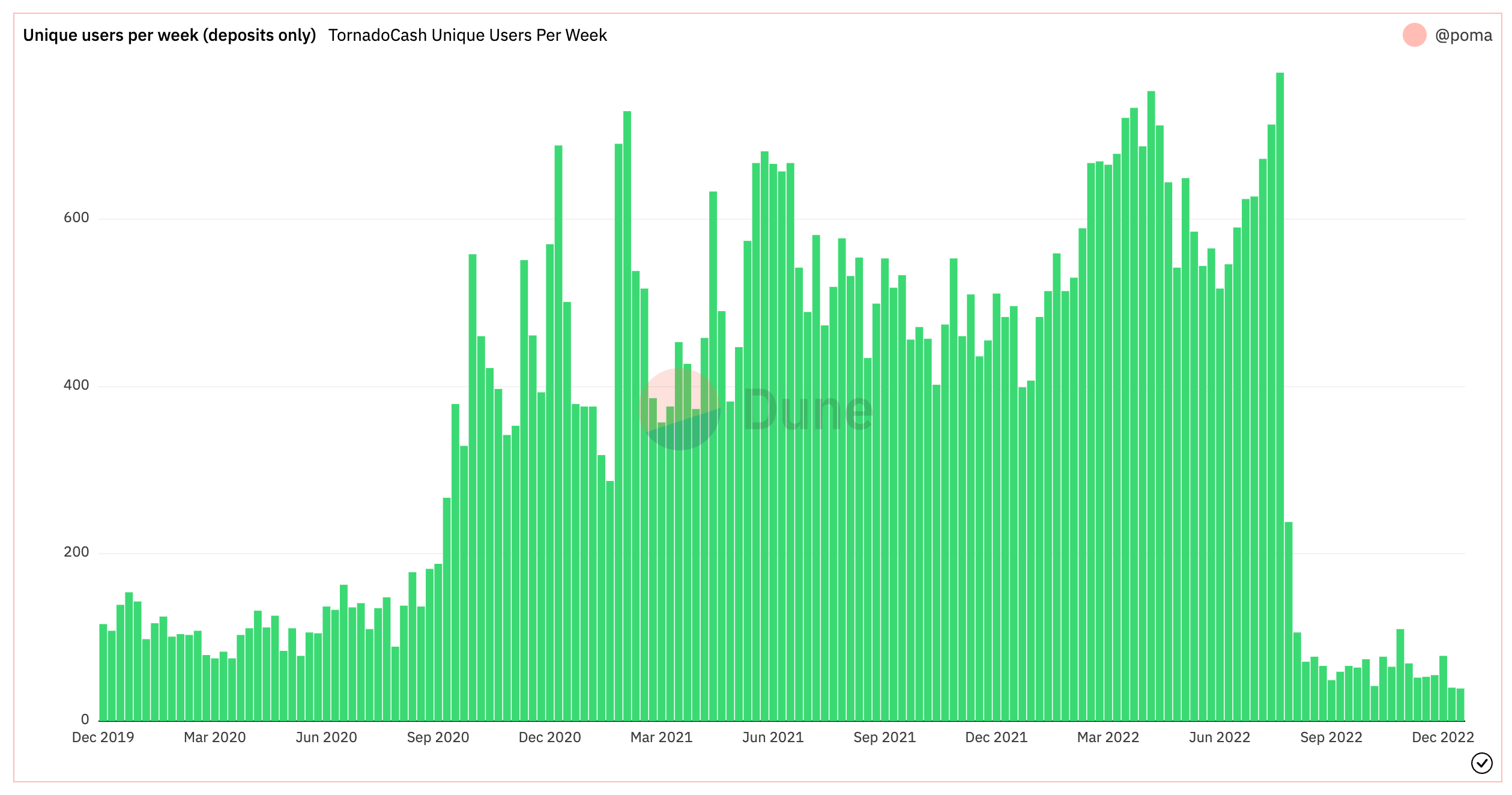

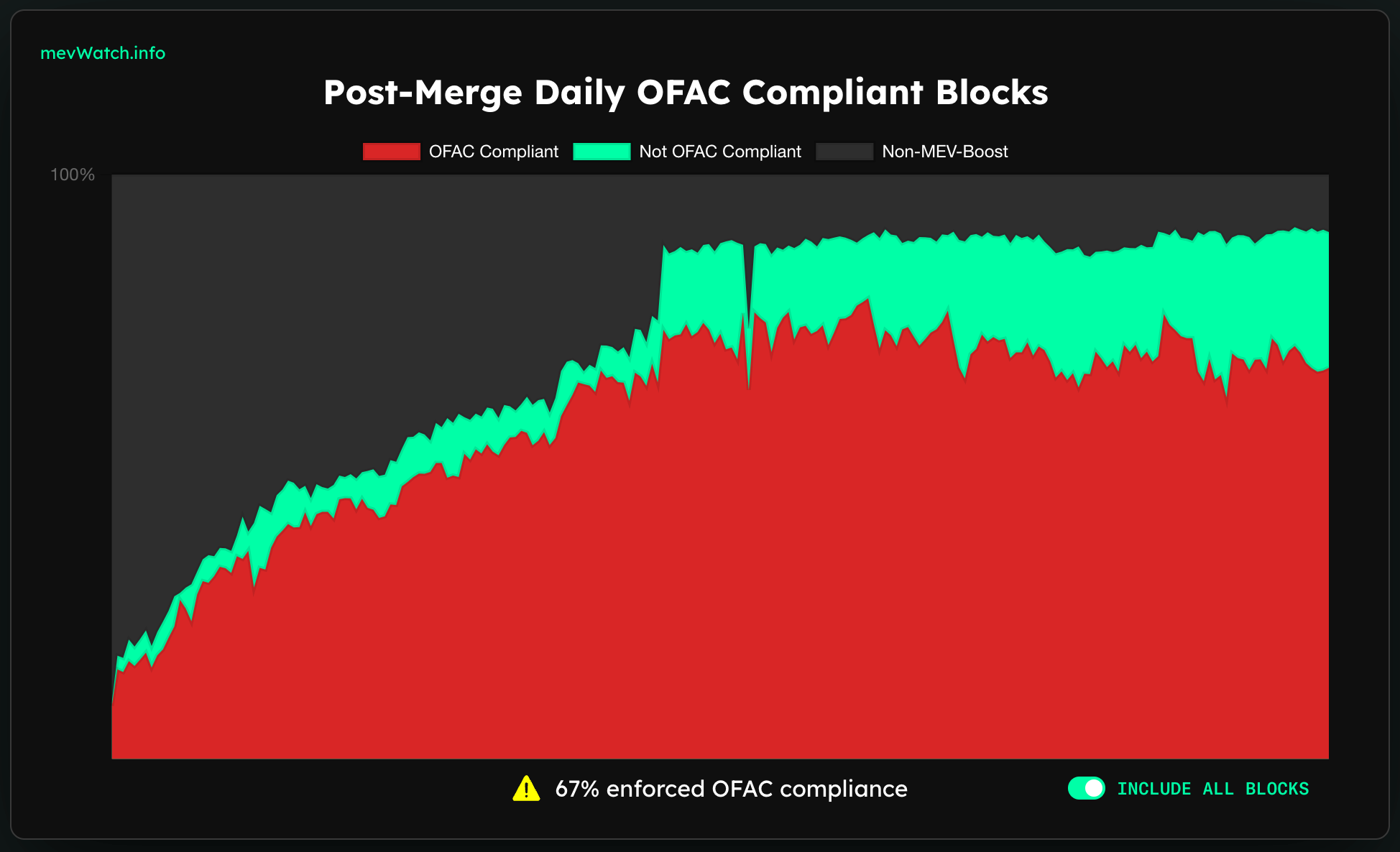

Noticeably fewer users are interacting with the Tornado Cash smart contracts since the sanction in August. Additionally, around 70% of blocks on the Ethereum chain in December were being built by OFAC-compliant relays, meaning that those blocks censor transactions that interact with Tornado Cash.

Thank you all so much for all of the support, laughs, and commiseration over this past year of absolute madness.

I often say that I don't try to predict what will happen in crypto, because reality always seems to be far more absurd than my wildest predictions. Here's to absurdity, and I look forward to writing about the unfathomable wonders that 2023 may bring.

Happy New Year,

– Molly