Issue 10 – Speedrunning the evolution of modern finance

The FTX dumpster fire rages on, Crypto.com had a quiet $400 million+ oopsie a month ago, and Binance comes up with a novel idea to add stability to a financial system.

Thanks for your patience on this week's recap! I was working in-person at the Library Innovation Lab this week, not to mention trying to keep up with… [waves arms]… so it's a little delayed.

For those who missed my announcement on social media, I'll be joining the Harvard Library Innovation Lab as a fellow for the next year!

This will enable me to continue doing the research, writing, and other work I've already been doing, so fear not: it will not take away from my big plans for this newsletter. I'm also excited for the opportunities to engage and collaborate with the Harvard community and the brilliant people at the LIL, the Berkman Klein Center, and elsewhere. I will be remote, but hope to show up in person from time to time as I did this past week.

I honestly can't express how delighted I am to be working alongside these folks this year. It's such a cool group of people, and they're working on some incredible projects. The LIL in particular is the group behind perma.cc, the Caselaw Access Project, and H2O. I'll still be focusing on my crypto research while I'm a Fellow at the LIL, but it's very cool that my colleagues are working on some of the other types of things I love: open access to information, web archiving, annotations, and so on.

The LIL published a blog post with some more details about the fellowship. One thing I want to explicitly address: the fellowship is funded by the Filecoin Foundation for the Decentralized Web, which is one of those somewhat confusing nonprofit-foundations-but-it's-created-by-a-crypto-project-but-they're-sort-of-separate. Some of you may already be familiar with Filecoin. The fellowship has no strings attached as far as my independence in researching and analyzing the crypto industry, and I am not obligated to do any work relating to Filecoin (nor am I obligated not to). I have, of course, added this to my crypto disclosures for full transparency. If you have any questions or concerns about this, feel free to ask away (in public or private, whichever you prefer!

This week I published my first article outside of my own various platforms! I wrote a quick piece on "Why did one of the world's biggest cryptocurrency exchanges just collapse?" for The Guardian. It was published near David Gerard's article, "Sam Bankman-Fried was hailed as a crypto wonder child. What happened?" Evidently the Wikipedian contingent of crypto skeptics have The Guardian covered.

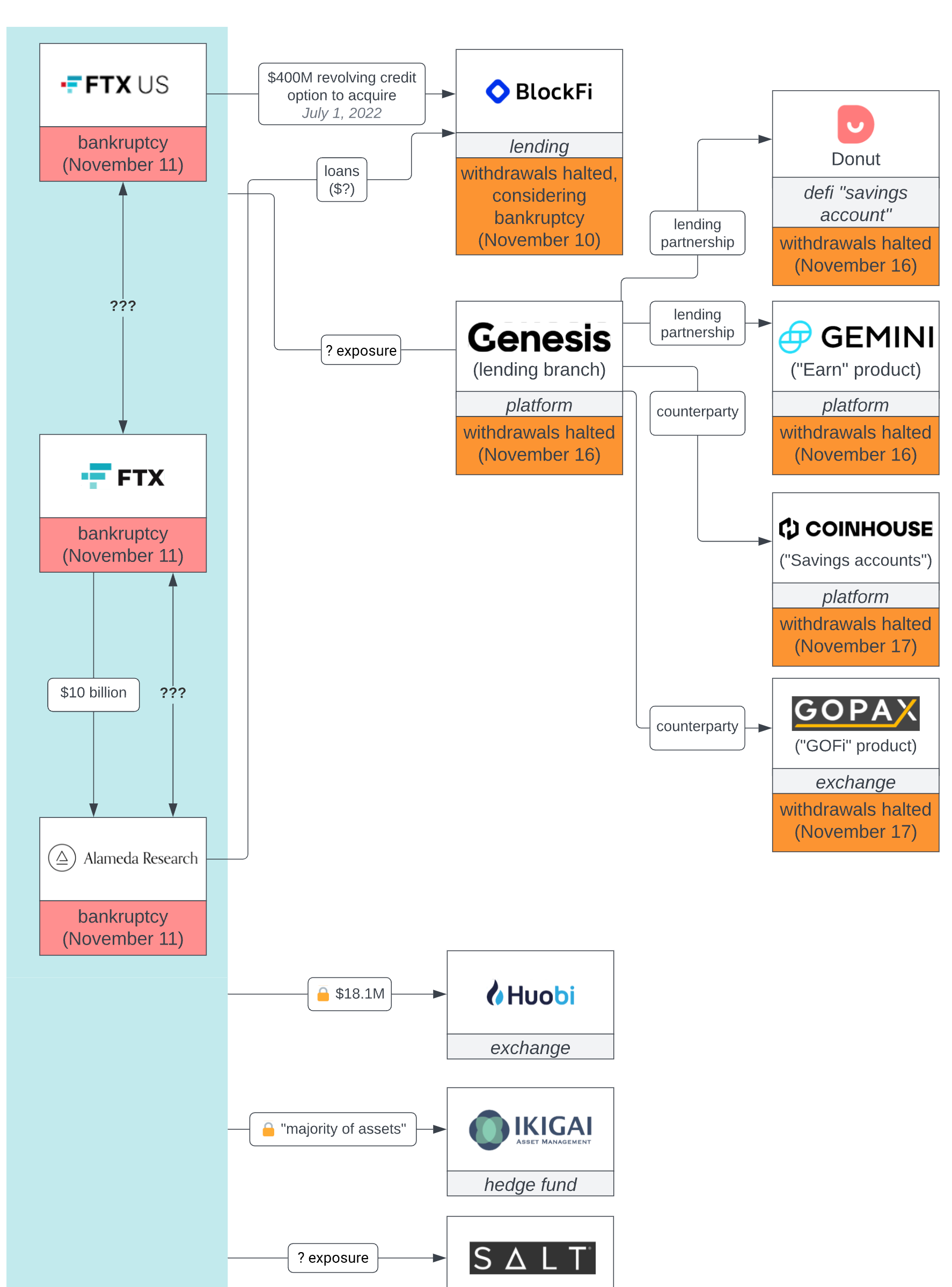

Much of the news in crypto this week revolved around the FTX saga, so I have written a standalone update on that. We also saw the beginnings of contagion from the FTX collapse, where companies with exposure to FTX and its related companies also paused withdrawals or halted services as a result. I have captured that in an FTX contagion chart, which I am updating on an ongoing basis. I am expecting that this will be such a vast web of contagion that I will only write out W3IGG entries for the most severe instances, but I'll try to keep the chart relatively complete.

In the courts

Needless to say, Voyager's deal to be acquired by FTX is kaput. FTX was previously the highest bidder to acquire the assets of the bankrupt Voyager, in a deal which would have moved most Voyager customers to the FTX platform, and allowed them to recover 72% of the assets they held before the bankruptcy.

Voyager's bankruptcy attorneys told the court they were "shocked, disgruntled, dismayed" at the FTX disaster. According to the attorneys, FTX has agreed that Voyager can look for other bids, but has not officially backed out. Regardless, the attorneys stated the obvious when they confirmed there would be "no transaction with FTX".1

The FTX explosion and its ripple effects across the industry are not likely to help matters for Voyager customers. The list of people with the kind of firepower to bail out the Voyager exchange has just gotten a lot shorter, whereas the list of firms that may be seeking bailouts is likely to balloon.

In government

The midterm elections saw some pro-crypto faces returning to Congress. In the House, incumbents Tom Emmer (R-MN) and Patrick McHenry (R-NC) were both re-elected, although so too was outspoken crypto skeptic Brad Sherman (D-CA). McHenry will presumably take the role of Chair of the House Financial Services Committee.

Legislators and regulators alike have responded to the FTX collapse. The House Financial Services Committee have already met once about it, and have another hearing planned at which they expect to hear testimony from Sam Bankman-Fried, Alameda, FTX, Binance, and others.2 The House Oversight Subcommittee on Economic and Consumer Policy sent a letter to FTX, requesting detailed information on the collapse and the events leading up to it. Several Congresspeople individually issued statements, including Brad Sherman and Stephen Lynch (D-MA, Chairman of the Task Force on Financial Technology).

The SEC were already scrutinizing Sam Bankman-Fried's various enterprises, so those probes will continue. Meanwhile, various politicians are using this as an opportunity to attack SEC Chair Gary Gensler, who they blame for missing FTX's malfeasance while focusing on other enforcement actions, such as the one against Kim Kardashian. Representative Tom Emmer accused Gensler of "helping SBF and FTX work on legal loopholes".

The CFTC is also reportedly investigating the FTX collapse,3 as is the Department of Justice.4

The Web3 is Going Just Great recap

Note: If you're an avid follower of the W3IGG site and don't need a recap, you can scroll on past to the "In the news" section.

There were 26 new entries between November 9 and November 17, averaging 2.89 posts a day

Crypto.com sent money to the wrong destination… again

[link]

After a debacle in August where Crypto.com sued a woman to try to get her to return the $7.2 million they'd accidentally sent her, Crypto.com has done it again—but worse. Someone noticed that the exchange had sent 320,000 ETH (~$416 million at the time) to Gate.io, a different cryptocurrency exchange. When they asked about it on Twitter, none other than the Crypto.com CEO responded.

There were briefly some theories that the transfer was actually to help Gate.io pass an audit on their reserves. However, the Gate.io audit in question happened several days prior to the Crypto.com transfer.

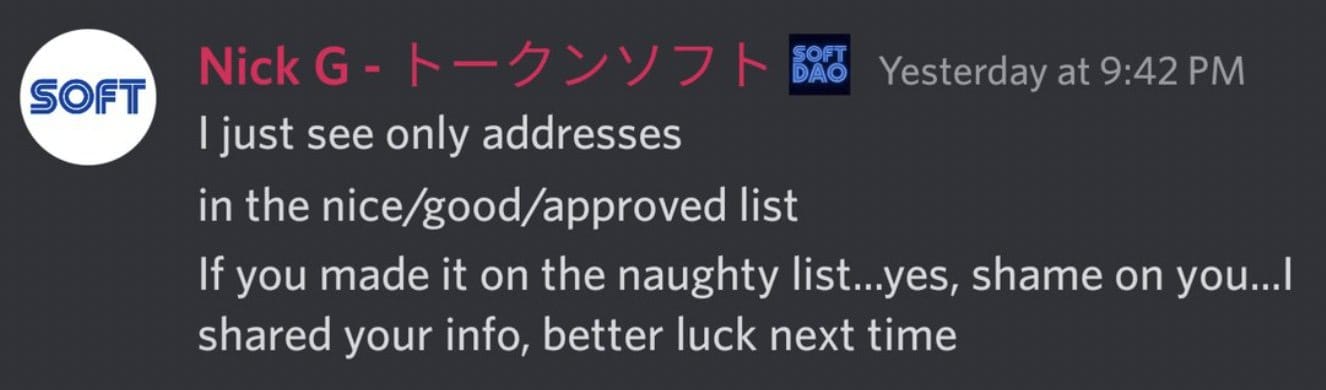

Tokensoft intentionally doxes 5,000 of their users

[link]

Tokensoft aims to help crypto projects from having their token launches or airdrops gamed by people using multiple crypto wallets. The group apparently thought they had found a group of around 5,000 bad actors who had been trying to game airdrops, and so decided to… post a file containing private user data about those users. The file contained users' full names, wallet addresses, and physical and IP addresses.

The project later deleted the link from the Discord server, then tried to claim that it had never been posted at all, then issued a statement that "information was mistakenly posted in Tokensoft's social media channels". Nick G's Discord account was later deactivated.

Flare token rug pulls or is exploited for $71 billion $17 million

[link]

Every once in a while it's useful to get a reminder that naive calculations of # tokens × token price should be carefully scrutinized. Either an exploit or a rug pull ended with 3.9 billion FLARE tokens stolen from the Flare project on BNB Chain. The tokens were nominally worth $71 billion, based on their price of around $18.25 before the attack, but lack of liquidity mean the exploiter received "only" $17 million.

Binance comes up with a novel plan

[link]

Everything else

- Coinhouse suspends "savings accounts" due to Genesis suspension due to FTX collapse [link]

- Australian Securities Exchange scraps its $167 million, seven-year-long blockchain project [link]

- Class action lawsuit filed against celebrities who promoted FTX [link]

- Nigerian startup Nestcoin has nearly all funds locked in FTX, announces layoffs [link]

- Gemini halts withdrawals from their lending service [link]

- Genesis crypto lending service halts withdrawals [link]

- Coachella NFTs stop working due to FTX collapse [link]

- Australian crypto exchange Digital Surge suspends withdrawals [link]

- BlockFi plans layoffs, possible bankruptcy after FTX collapse [link]

- SALT crypto lender halts their service [link]

- Ikigai Asset Management announces "large majority" of assets trapped in FTX [link]

- Huobi exchange announces $18.1 million is locked on FTX, mostly customer funds [link]

- AAX cryptocurrency exchange suspends withdrawals [link]

- Over $4 million drained from DeFiAI [link]

- Bahamas Securities Commission issues statement that they didn't instruct FTX to process withdrawals for Bahamian customers [link]

- FTX claims it was hacked as more than $600 million is withdrawn [link]

- FTX files for bankruptcy, Sam Bankman-Fried resigns [link]

- Users attempt to circumvent FTX withdrawal freeze with bribes and NFTs [link]

- The Securities Commission of the Bahamas freezes FTX assets, appoints provisional liquidator [link]

- DFX Finance suffers $5 million loss [link]

- BlockFi suspends withdrawals [link]

- The Binance/FTX deal is off [link]

In the news

I joined a very pro-crypto podcast to chat with the hosts about our various views on crypto and web3. I thought it was a really interesting conversation, and it didn't devolve too much in the talking-past-each-other types of debates that sometimes happen between two strongly opposing viewpoints. Obviously we disagree on a lot, but there are some fundamental things we do agree on.

This was recorded in October, and scheduled to publish the day that it did (November 14). Obviously things were a little different at the time of recording

There were a lot of articles about the FTX disaster this week. Some of them quoted me, cited me, or linked to my work:

- "FTX and Sam Bankman-Fried are collapsing. How crypto's biggest star imploded." Vox. November 10.

- "Sam Bankman-Fried Fooled the Crypto World and Maybe Even Himself". Bloomberg. November 11, 2022.

- "As FTX sinks, other crypto exchanges are showing their coins". The Verge. November 11, 2022.

- "'People Think He's Just a Straight-Up Sociopath': The 5 Biggest Warning Signs We Missed About SBF". The Information. November 12, 2022.

- "Funds vanish at bankrupt crypto exchange FTX; probe underway". Associated Press. November 12, 2022.

- "Further reading". Financial Times. November 18, 2022.

Worth a read

I have mixed feelings on this, but it is very much worth the read regardless, particularly for people who have used Twitter for a long time and are considering joining Mastodon.

I have definitely noticed some of the mixed use cases clashing a bit with Mastodon, and am curious to see if JWZ's predictions come true. I hope not.

If you're already feeling totally overwhelmed with the amount of FTX content, then maybe skip this one, but Matt Levine does a masterful job of breaking down the leaked FTX balance sheet for those of us who don't usually spend a lot of time poring over company financial statements, and somehow makes it funny, too.

That's all for now, folks. Until next time,

– Molly

References

"FTX's $1.4 Billion Deal for Bankrupt Lender Voyager Is Canceled". Bloomberg. November 15, 2022. ↩

"McHenry, Waters Announce December Hearing to Investigate FTX Collapse". House Financial Services Committee. November 16, 2022. ↩

"Sam Bankman-Fried's FTX Empire Faces US Probe Into Client Funds, Lending". Bloomberg. November 9, 2022. ↩

"SEC, DOJ Investigating Crypto Platform FTX". The Wall Street Journal. November 9, 2022. ↩