Issue 11 – A different sort of animal

Many, many companies look for a bailout in the wake of the FTX collapse while a group of Elon Musk stans take sycophancy to new heights.

It was, blessedly, a slightly quieter week amidst a chaotic month in crypto.

This might surprise some who expected nonstop mayhem after the FTX fiasco. However, if we look back at precedent set earlier this year with the Terra/Luna and Three Arrows Capital blow-ups, there is often a delay between a major contagion event and the ensuing fallout.

Right now I think a lot of people following the crypto industry are holding their breath, watching closely as other major dominoes wobble perilously.

In FTX

Tuesday was the first hearing in the FTX bankruptcy case, which lasted a bit over three hours.

FTX's restructuring attorneys wanted more time to file financial reports, which is to be expected given the nightmare that apparently was FTX's accounting. "What we are dealing with is a different sort of animal…. Unfortunately the FTX debtors were not particularly well run, and that is an understatement," said James Bromley, a partner at Sullivan & Cromwell who is representing FTX.

Another big question at this hearing was whether FTX will be permitted to keep creditors private. In the Celsius bankruptcy, the judge allowed Celsius to redact physical and email addresses of creditors, but made public all of their names and recent transactions—much to the horror of users who did not expect to be exposed in this way. The filing was more than 14,000 pages long. So far, Judge Dorsey has allowed all FTX creditor information to be kept completely private, but has described this as an interim decision that may well change. FTX of course wants to keep all customer information private, but this is a pretty big ask in a bankruptcy case. A lawyer for the US Trustee requested that the court at least require transparency regarding business customers of FTX.

FTX has estimated that the case will involve millions of creditors. Celsius has somewhere north of 100,000, for a sense of scale here.

Finally, there's the question of jurisdiction regarding the Chapter 11 filings in Delaware and the Bahamian Chapter 15 case filed in New York. Judge Dorsey ordered the Chapter 15 case to be moved to Delaware to reduce duplication of efforts. There has been some butting of heads between the US- and Bahamas-based parties.

In government

Governor of New York Kathy Hochul signed into law a two-year ban on issuing permits for crypto-mining operations at fossil fuel plants in the state. New York is home to a number of companies that have revived defunct fossil fuel power plants to transform into Bitcoin mining operations, such as the Greenidge Generation Bitcoin mining plant near Seneca Lake. [W3IGG]

Crypto-friendly NYC Mayor Eric Adams said this past summer that he planned to ask Hochul to veto the bill, but evidently was not successful. However, he shied away from outright condemning her choice to sign the bill into law.

The Web3 is Going Just Great recap

There were 8 new entries between November 18 and November 26, averaging 0.89 posts a day.

150 companies want Binance's rescue, says Binance

[link]

In a blog post elaborating on the "Industry Recovery Initiative" proposed by Binance last week, they divulged that "we have already received around 150 applications from companies seeking support under the [Industry Recovery Initiative]"—only a week and a half after it was announced.

Oh dear.

The fund is at least $1 billion, and aims to "help projects who are otherwise strong, but in a liquidity crisis".

Genesis scrambles for a $1 billion bailout

[link]

Genesis Global Trading has been searching around for someone to lend them a mere billion dollars to keep their ship afloat. They've reportedly begun warning investors that bankruptcy may be the only option if the loan doesn't materialize.

Genesis is a linchpin in institutional crypto lending, as was demonstrated when they halted withdrawals and suddenly so did several other major crypto lenders, including Gemini.

Genesis appears to have become insolvent in the spring, following the Three Arrows blowup, and was bailed out by DCG in an action that's now coming back to haunt them. Sound familiar?

Crypto project spends $600,000 in (as-yet) failed attempt to get Elon Musk to notice them

[link]

If you were in Texas and happened to drive past a flatbed truck hauling an object that appeared to be some sort of Elon Musk caterpillar affixed to a rocket, you may have encountered the crypto enthusiasts who sank more than $600,000 into a desperate attempt to get Elon Musk's attention. Their hope is that a tweet or two from Elon will pump their memecoin.

The group trucked their monument to Tesla's Austin, Texas headquarters and parked it outside, hoping to get Musk's attention. A day later and they've still had no luck, and the project has been tweeting increasingly-dejected messages. "It seems Elon is testing us," they wrote. Six hours later, they posted a video in which a frustrated-sounding narrator said, "again, just a final note to Elon, we're presenting the monument… hoping to hear from you soon…"

The project describes itself as "powered by an almost guaranteed underlying virality factor", but so far that hasn't materialized. At the time of writing, the token is trading at $0.00045, down from its January 2022 launch price of $0.0016.

Everything else

- Lemon Cash crypto exchange lays off almost 40% of its staff [link]

- Users unable to withdraw from CoinList due to protracted "technical difficulties" [link]

- Iris Energy defaults on $100 million+ loan, unplugs miners [link]

- New York institutes two-year ban on new crypto-mining operations at fossil fuel plants [link]

- Grayscale Bitcoin Trust suffers due to FTX collapse and doubts over reserves [link]

In the news

That TV interview that brought me to NYC five weeks ago finally published! It features me, Ben McKenzie, and Tonantzin Carmona talking about why we are critical of the crypto industry, and caps off a series called "Crypto IRL".

If any of you happen to be subscribers to TRASHFUTURE (and I would highly recommend it), you can catch me chatting with Riley and Alice about the FTX collapse. It's hilarious and I very much enjoyed chatting with them. If you don't subscribe, you can catch a 10-minute-long preview.

Worth a read

Dr. Margie Cheesman has published a report about the "growing number of experimental blockchain-based projects such as cryptocurrencies that are targeting refugees, aid beneficiaries, and other low-income communities." Tech people (crypto and non-crypto) really need to stop using at-risk groups as free-for-all testing grounds, exhibit #2887219.

Bonus book list

Shortly before sending this newsletter, I published a tweet about Vitalik Buterin and Sam Bankman-Fried's strange views on reading. SBF has said that "I'm very skeptical of books", a red-flag of a statement no matter who it's coming out of. More generous readers than I interpreted Vitalik's tweet as a mere question posed to book lovers, though he came off to me as skeptical of the idea that "reading is virtuous or even necessary".

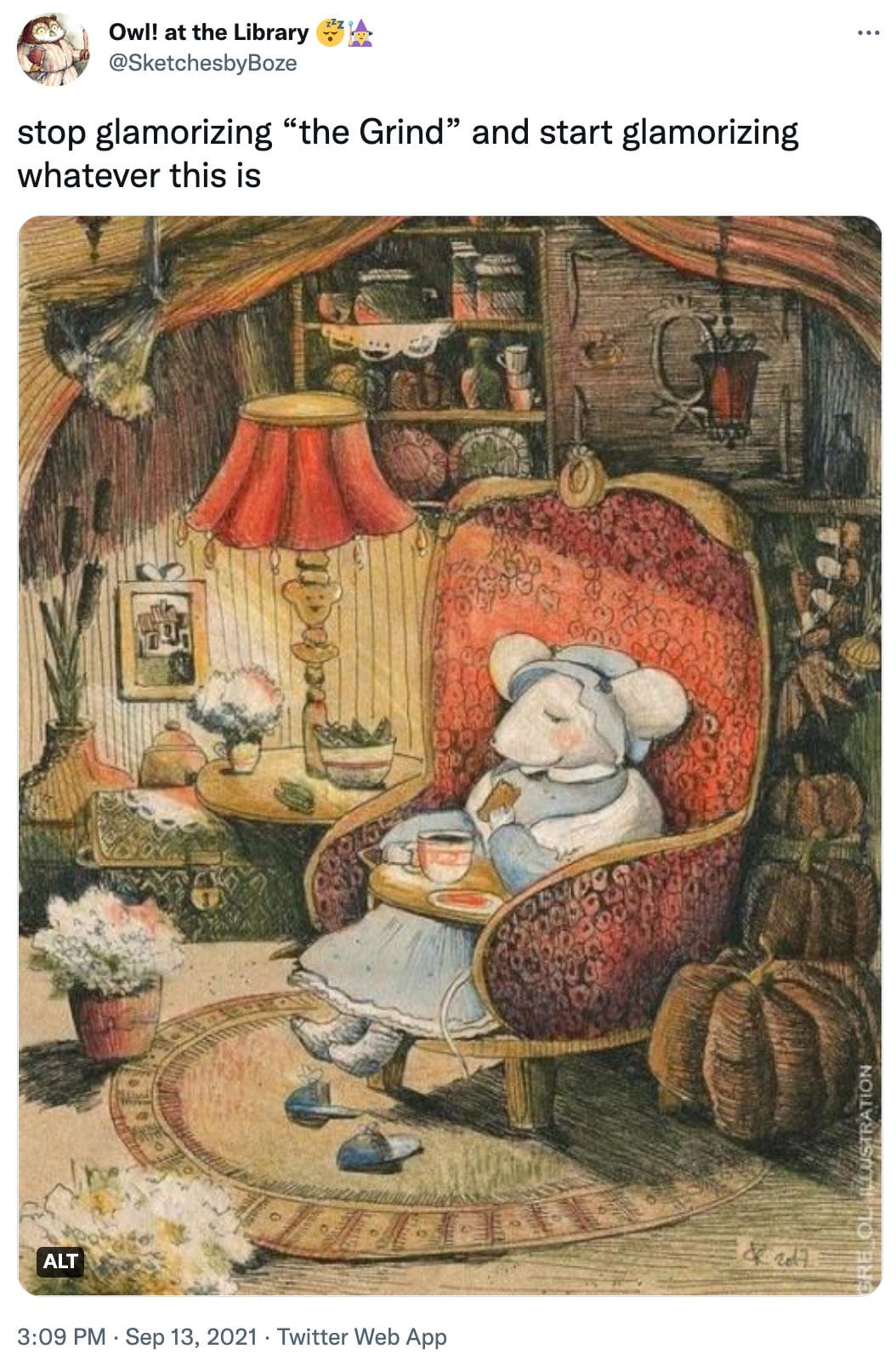

The replies to my tweet reminded me that the people who follow me tend to be voracious readers, and so I decided to shamelessly take advantage of an opportunity to mine my followers for book recommendations. After all, we are entering the time of year where I spend most of my waking hours either parked somewhere cozy with a cup of tea and a book, or wishing I was.

There is a deluge of recommendations you can read through if you like (Twitter thread, Mastodon thread). I read every single reply, and so I figured I would include a list of the books I noticed were mentioned three or more times:

- Babel: Or the Necessity of Violence: An Arcane History of the Oxford Translators' Revolution by R. F. Kuang (fiction, 4 recommendations)

- The Dawn of Everything: A New History of Humanity by David Graeber and David Wengrow (non-fiction, 3 recommendations)

- The Dune series by Frank Herbert (fiction, 5 recommendations)

- The Emperor of All Maladies: A Biography of Cancer by Siddhartha Mukherjee (non-fiction, 3 recommendations)

- The Expanse series by James S. A. Corey (fiction, 3 recommendations)

- Piranesi by Susanna Clarke (fiction, 3 recommendations)

- Project Hail Mary by Andy Weir (fiction, 9(!) recommendations)

- Tracers in the Dark: The Global Hunt for the Crime Lords of Cryptocurrency by Andy Greenberg (non-fiction, 3 recommendations)

- Tomorrow, and Tomorrow, and Tomorrow by Gabrielle Zevin (fiction, 3 recommendations)

If you need me, I will be gleefully downloading far more e-books than I can hope to read any time soon.

That's all for now, folks. Until next time,

– Molly