Issue 12 – Destablecoins destabilize

Bankruptcies pile up, Orthogonal Trading goes pear-shaped, and crypto exchanges perform layoffs... again.

This is the week of lists.

I was named to Forbes' "30 Under 30 2023" list last week!

Other crypto critics and I were also named to CoinDesk's "Most Influential 2022" list under the title "Molly White and the Crypto Skeptics", which would probably make for a fun ska band.

We appear on what is clearly intended to be a list of the good (crypto detective zachxbt), the bad (Helium CEO Amir Haleem), and the ugly (a "four horsemen" collection consisting of Terra/Luna founder Do Kwon, Celsius founder Alex Mashinsky, Three Arrows Capital CEO Su Zhu, and Voyager Digital CEO Stephen Ehrlich) of the crypto industry, and I imagine readers of CoinDesk would be split on which category is most appropriate for us.

I regret to inform you I am now an NFT. No, I was not asked, or informed of this in advance.

If you would like to actually support my work, perhaps consider upgrading to a paid subscriber instead!

This has been the week of the unending Sam Bankman-Fried apology tour. As he rambles away everywhere from Twitter spaces to Good Morning America, don't forget your grain of salt: Everything Sam Bankman-Fried is doing is in singular pursuit of not going to jail.

The FTX contagion has continued.

This week has also featured several examples of crypto companies who are struggling even without direct exposure to FTX, highlighting the much broader issues facing the industry at the moment.

In the courts

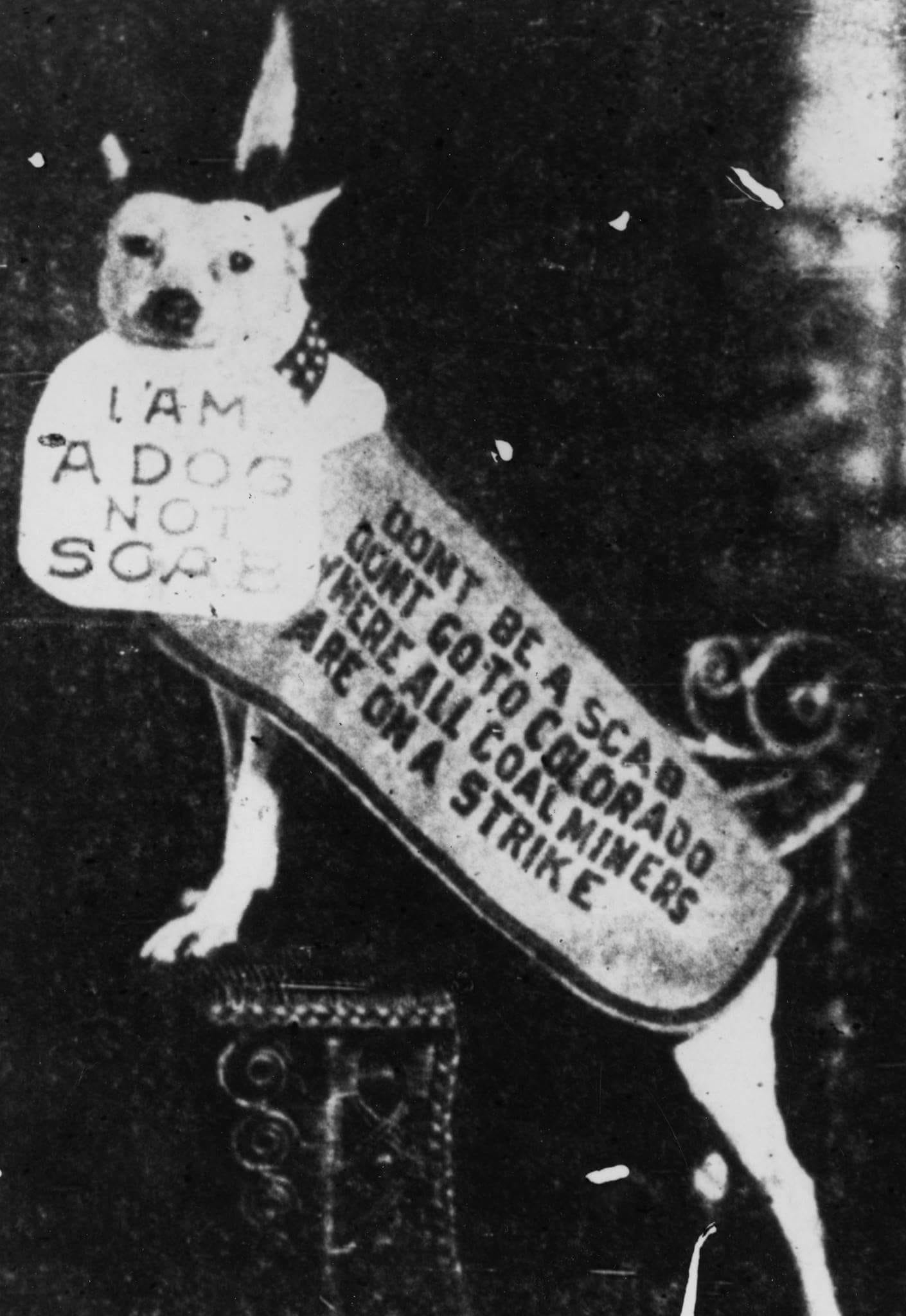

We are now up to four different US bankruptcy proceedings: Voyager (begun July 5), Celsius (July 13), FTX (November 11), and now BlockFi (November 28). Woof.

BlockFi is a crypto lending platform that nearly went under this past summer, along with a slew of other lenders, after the Terra/Luna and Three Arrows Capital blow-ups. However, FTX extended them hundreds of millions in both loans and lines of credit, and they remained afloat. When FTX collapsed, BlockFi wasn't far behind. According to their bankruptcy filing last week, they have more than 100,000 creditors, and $1–10 billion in both assets and liabilities. [W3IGG]

As expected, the U.S. Trustee for the FTX bankruptcy case has moved to appoint an independent examiner in the FTX case. This would be an outside party who is tasked with determining what the hell happened. John Jay Ray III, FTX's new CEO, is also tasked with untangling this whole mess, of course, but his priority is to maximize value for FTX and its creditors—hence the need for a neutral investigator. Furthermore:

An examiner could—and should—investigate the substantial and serious allegations of fraud, dishonesty, incompetence, misconduct, and mismanagement by the Debtors [FTX], the circumstances surrounding the Debtors' collapse, the apparent conversion of exchange customers' property, and whether colorable claims and causes of action exist to remedy losses. Motion of the United States Trustee for Entry of an Order Directing the Appointment of an Examiner

Meanwhile, Celsius has sold its GK8 business to Galaxy Digital. GK8 is a crypto self-custody platform that Celsius bought in January 2021 for $115 million, and which is now being sold to Galaxy for just $44 million. That 60% drop in purchase price likely reflects both Celsius's urgent need to obtain liquid capital, but also the general state of the crypto industry.1

The bidding's on over at Voyager, too, after their planned acquisition by FTX fell through for obvious reasons. Binance.US is in line to bid, as are other crypto firms like CrossTower and Wave Financial, and broker-dealer INX.23

Outside of bankruptcy-land, the US-based crypto exchange Kraken has just agreed to pay more than $360,000 to settle charges from the Treasury's Office of Foreign Assets Control (OFAC), who alleged that they willfully served customers they knew resided in sanctioned countries including Iran. [W3IGG]

The Web3 is Going Just Great recap

There were 14 new entries between November 27 and December 5, averaging 1.5 posts a day.

A double whammy hack and a destablecoin

An attacker was able to exploit a vulnerability in the smart contract for the BNB Chain-based Ankr defi protocol, which allowed them to mint quadrillions of aBNBc tokens and swap them into various other cryptocurrencies.

Very shortly afterwards, another attacker used the same unlimited mint issue in aBNBc to exploit an oracle delay on the Helio staking platform: they swapped the 183,000 aBNBc tokens they had just minted for around $15 million. This brought the $HAY stablecoin crashing down to as low as $0.20.

HAY actually describes itself as a "destablecoin", which is apparently supposed to mean "decentralized stablecoin", but has now taken on a second meaning.

Orthogonal Trading goes pear-shaped

[link]

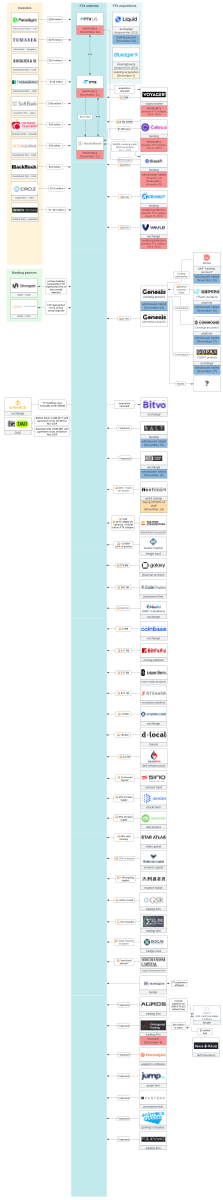

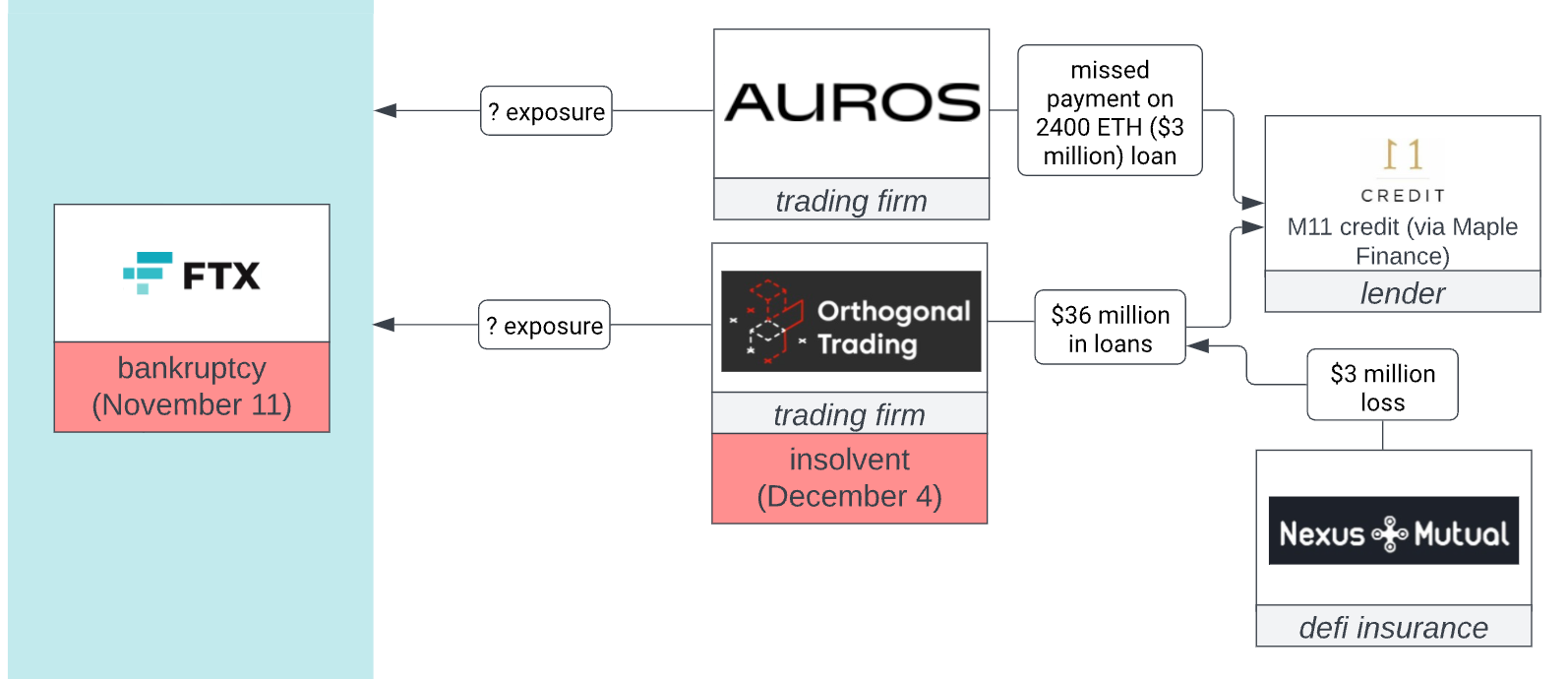

Orthogonal Trading has defaulted on $36 million they've borrowed from Maple Finance, largely from Maple's M11 Credit-backed USDC pool. "It is now clear that they have been operating while effectively insolvent, and it will not be possible for them to continue operating a trading business without outside investment," wrote Maple, who accused them of "misrepresent[ing] their financial position" for a month.

M11 Credit isn't the only one who will suffer as a result of Orthogonal's unpaid loans; the decentralized insurance company Nexus Mutual said they expected to lose 2,461 ETH (~$3 million) thanks to their exposure to the unpaid loan. Amusingly, Nexus Mutual's products claim to try to protect users from the risks inherent to the cryptocurrency ecosystem.4

Four crypto exchanges perform layoffs, three for the second time this year

Latin American crypto exchange Bitso laid off an unspecified number of employees, estimated to be around 100 employees (15–20% of their staff) by Portal do Bitcoin, only months after cutting 10% of staff in May. [link]

US crypto exchange Kraken announced they had laid off 1,100 employees, or around 30% of their staff. [link]

Dubai-based exchange Bybit laid off 30% of their employees, or around 750 people. In June, they had already laid off 20–30% of staff. [link]

Australian crypto exchange Swyftx laid off 40% of employees, after layoffs in August that affected 21% of their staff. [link]

Everything else

- Genesis owes $900 million to customers of Gemini Earn [link]

- AAX customers search for executives [link]

- Maersk and IBM announce the discontinuation of their blockchain-based TradeLens platform [link]

- Auros misses loan payment due to FTX exposure [link]

- Kraken pays over $360,000 to settle violations of sanctions against Iran [link]

- Block subsidiary TBD announces they will trademark "Web5", cancels plans after completely foreseeable backlash [link]

- BlockFi files for bankruptcy [link]

In the news

Delger Erdenesanaa did a great longform dive into Bitcoin mining in Texas, where Bitcoin miners take advantage of cheap electricity at the expense of the Texas electrical grid (and, ultimately, individual Texans). I spoke a little about the history of crypto, and how the supposed benefits of Bitcoin are hardly worth its massive energy costs.

Afiq Fitri writes about how major financial institutions are recoiling from crypto, with some even banning transactions with crypto-related entities. I speak about how it's not surprising to me that banks are taking such a broad approach.

Worth a read

Another great read by Cory Doctorow on the scourge of DRM. "I've always been baffled by the technologists who pursued control over liberation: surely their own formative experiences were of the liberatory power of technology. After experiencing that power, how could these Vichy nerds lend their skills to the project of forging digital shackles?"

Nikki Usher outlines the social media-as-a-publicly-owned-entity idea, one that I think more people should chew on. Ultimately, they suggest a form of Twitter that exists as a public–private partnership, rather than as a fully public service. I'm not sure I agree with that specific suggestion, which they don't elaborate on, but I'm glad to see the general idea of publicly owned platforms getting airtime in a large outlet at an important time.

If you weren't already aware, New York Times employees are striking tomorrow (December 8) and are asking you to not engage with NYT platforms!

That's all for now, folks. Until next time,

– Molly

References

"Galaxy Digital Gets Celsius Assets at 60% Discount After Crypto Lender's Bankruptcy". Bloomberg. ↩

"Binance, other crypto firms line up bids for bankrupt Voyager Digital after FTX collapse". CNBC. ↩

"Broker-Dealer INX Digital Bids to Purchase Voyager Assets". CoinDesk. ↩

"Nexus Mutual moves to divest, expects $3 million loss with Maple Finance". The Block. ↩