Issue 17 – Posting through it

Doubly bad weeks for both Genesis and Nexo, and the founders of Three Arrows Capital progress in their quest to become the most hated people in crypto.

Thanks for bearing with me with this very delayed newsletter! Some real-life stuff ended up keeping me offline for a bit longer than I anticipated. Nothing bad, don't worry, just time-consuming.

Fortunately crypto didn't all explode at once while I was offline, which would have been pretty rude timing.

FTX

The phone rings. High-powered criminal defense attorney Mark Cohen answers. A voice on the other side speaks: "I have some bad news about your client… He started a blog." A cold chill runs down Cohen's spine.

That's right, folks. If you haven't already heard, Sam Bankman-Fried has evidently decided that if he can just explain himself well enough on his new Substack, everything will be fine. Someone has helpfully set him up a custom domain—mycrimes.blog—to help people remember the URL. Catchy!

Surprisingly, he's not charging for it. I don't understand why not. If he charged what I do, he would only need 200 million paid subscribers to make up for the hole in FTX's balance sheet.

Rather than go into a lengthy overview in this newsletter, I have instead published an annotation of his first blog post. I don't intend to annotate all of his posts—I suspect there will be many, and that they will be similarly repetitive—but I hope that annotating this first one helps to illustrate just how dishonest he is being even in the face of contradictory evidence.

The other big FTX news this week is that John J. Ray III's team recovered another $5 billion in liquid assets. "Liquid" is crucial here, because so much of FTX and Alameda was bolstered by FTT and other illiquid (and now fairly worthless) tokens. Ray's team has been far more practical than SBF in determining what qualifies as "liquid", so when they say they've discovered liquid assets I believe they're actually fairly liquid. It's probably some combination of cash, stocks, or some of the crypto assets that can be realistically traded in quantity (Bitcoin, Ethereum, etc.) I regret to inform you I have apparently been too optimistic here. Thank you to a reader for pointing this out to me. Ray's team is apparently including "$529 million" of FTT in this number, a substantial amount of tokens compared to the circulating supply, which has enjoyed anywhere between $3 million and $25 million in daily trading volume recently. It could not be liquidated for anywhere near that amount, especially if the plan for FTX is to liquidate it (thus limiting any future value of FTT). Sigh.

It's not entirely clear if these are assets that the team has known about for a while and was delayed in securing, or if they only recently discovered them, but I'm personally amused by the mental picture of John J. Ray III digging through couch cushions in Nassau and stumbling across $5 billion.

While it would be nice to naively subtract $5 billion from the estimated $8 billion shortfall, Ray's team has been pretty clear that they don't have a great estimate for the customer shortfall at this stage (the $8 billion number comes from SBF, not the team overseeing the FTX bankruptcy). Notably, the market for FTX bankruptcy claims didn't skyrocket on this news—people are selling their FTX claims for up to 14.5% of the claim amount at the moment, which does not seem to represent a strong belief that FTX customers will be made substantially whole (or that recovery will happen anytime soon).

Finally, Judge Dorsey approved FTX's retention of the Sullivan & Cromwell law firm, despite objections to their appointment primarily based on potential conflicts of interest. Objections, formal and informal, came from a handful of sources: two independent FTX creditors, the former FTX lawyer Daniel Friedberg, the US Trustee, and a group of four Senators that includes one of the most pro-crypto senators (Lummis, R-WY) and one of the most anti-crypto (Warren, D-MA). The US Trustee ultimately worked out their issues with S&C and retracted their objection. The judge overruled a request to adjourn the hearing, and instead approved S&C's retention.

Genesis

The question around a Genesis bankruptcy was "when", not "if", and it's been answered. The Chapter 11 bankruptcy petition was filed on January 19, and the first day hearing is this afternoon (January 23).

Genesis redacted some, but not all, of their creditors on the top 50 creditors list filed along with the bankruptcy petition, allowing me to add considerably to the spiderweb that is the FTX contagion chart. Let's just say it is a land of confusion in there. I'm beginning to wonder at what size an SVG will threaten to crash a browser.

About a week before the bankruptcy filing, on January 12, the SEC also announced charges against Genesis and Gemini. I described the recent Gemini/Genesis kerfuffle a little bit in the last newsletter, but the tl;dr is that Genesis took in $900 million of Gemini Earn customers' funds and now won't give them back (almost certainly because they no longer have them).

Instead of indulging in the Spiderman finger-pointing between the Winklevoss twins and Barry Silbert, the SEC decided to just charge all of them with securities violations. Why either company thought they could get away with running the Gemini Earn program, even after the SEC had shut down several similar programs, is anyone's guess.

The Web3 is Going Just Great recap

There were 11 entries between January 6 and January 22, averaging 0.6 entries per day. I almost certainly missed some while I was offline, so I will backfill as best I can!

Double trouble for Nexo

Genesis wasn't the only one to receive two doses of bad news. It was also a rough week for the Nexo cryptocurrency lender. On January 12, Bulgarian authorities raided more than fifteen locations in Sofia as a part of an investigation into Nexo, which they believe may have been involved in the setting up of an organized crime group, tax crimes, money laundering, banking activity without a license, and computer fraud.1 Four individuals were charged with organized financial crimes shortly afterward, including the company's two co-founders (who are likely not in Bulgaria anymore).

Nexo brushed off the raid and the charges, accusing the Bulgarian government of corruption and trying to "destroy and loot a prosperous business". They made blustery threats to sue the Bulgarian government over the raid: "The compensations that Bulgaria will pay after the claims are filed and won by Nexo will be another record-breaking amount of hundreds of millions, but, unfortunately, they will be at the expense of the Bulgarian taxpayer."

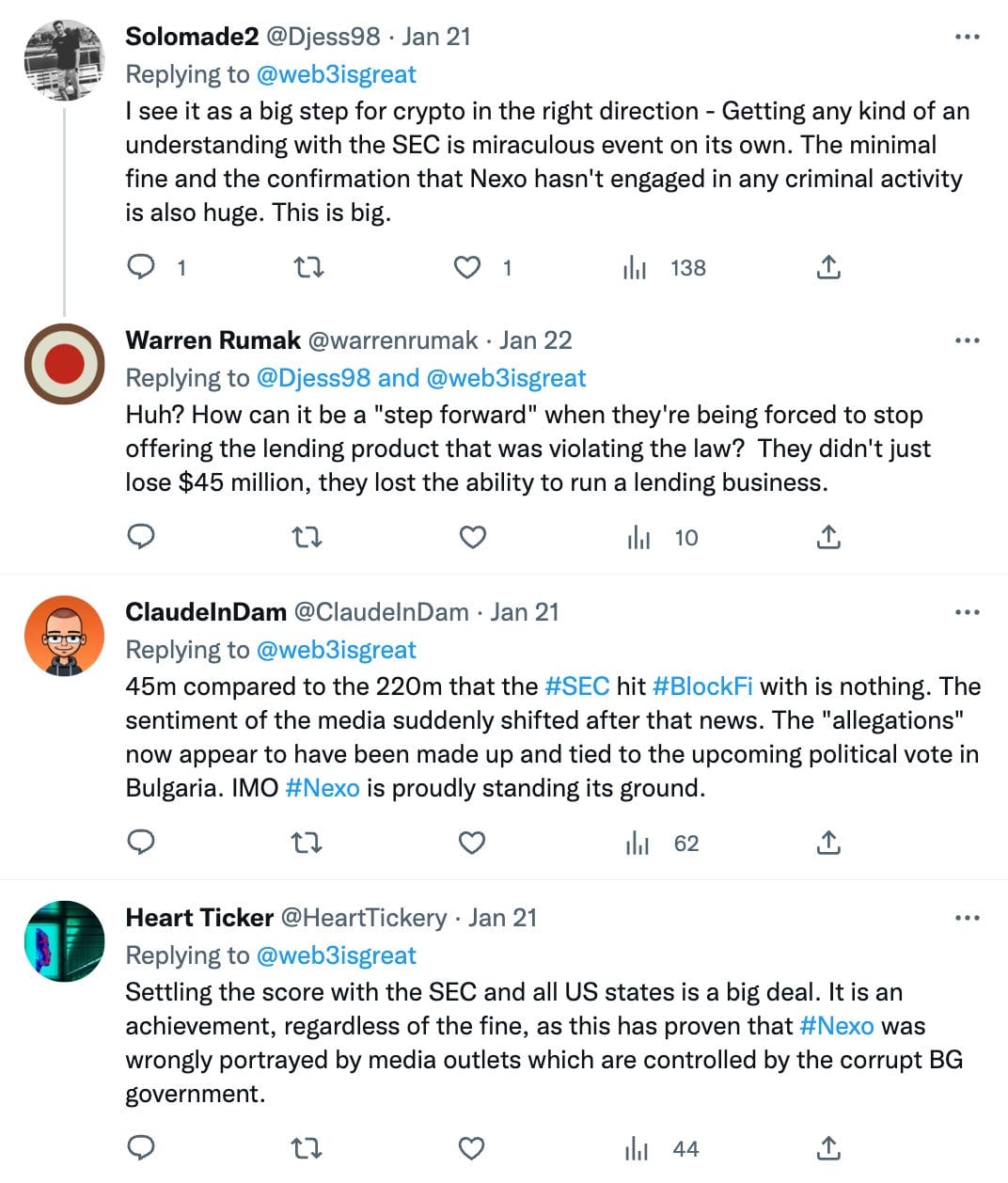

Then, on January 19, Nexo agreed to fork over $45 million to the United States Securities and Exchange Commission and to state securities regulators to settle charges relating to unregistered securities. As with Gemini, I have no idea how they thought they might skirt SEC action with this type of product.

In an incredible attempt at spin, Nexo trumpeted that the SEC had "recognized [Nexo] or what it truly is - a pioneer, like Uber and Airbnb, providing disruptive solutions in a fast-paced environment." They've got Twitter bots genuine fans of their product going around commenting about how this is so great for Nexo, too:

Apparently the SEC prize for this type of pioneering is shutting down your lending product and slapping you with a big fine. Congratulations, Nexo!

Unknown crypto money launderer arrested with great fanfare

[link]

On January 18, the Justice Department announced they would be holding a press conference to announce a "major international cryptocurrency action". Crypto prices dipped, r/buttcoin blew a fuse all trying to microwave popcorn at once, and crypto Twitter worked itself into a frenzy speculating whether the announcement would involve Binance or, god forbid, Tether. (My money was on Binance, by the way.)

The press conference began, and the Department of Justice announced charges against the founder of [drumroll] Bitzlato, a Hong Kong-based cryptocurrency exchange no one had ever heard of. He faces a maximum sentence of five years if convicted of operating an illegal money transmitting business.

The DOJ alleges the exchange had processed some $700 million in illicit transactions related to the Hydra darknet market, so it's not a total whiff, but it was ah… not exactly the blow to the crypto industry that some expected it might have been.

Three Arrows Capital founders seek to raise $25 million for their next bad idea

[link]

Two executives each from two separate bankrupt crypto firms are joining forces to create a new cryptocurrency platform that they're temporarily calling GTX—inspired by FTX, and so named because "G" comes after "F". I wish I was joking.

The goal is to create a platform where customers can trade their claims against any of the many bankrupt crypto platforms, like FTX, Celsius, BlockFi, or Mt. Gox (throwback!). The fact that Three Arrows Capital was a major catalyst in kicking off the string of bankruptcies we saw throughout 2022 was not lost on observers, with Nic Carter of the Castle Island venture capital firm commenting that the endeavor "is akin to arsonists returning to the scene of the crime and offering to charge their victims for buckets of water".

The crypto industry continues to prove that no parody could be more outlandish than what they come up with themselves.

Everything else

- Binance announces that users won't be able to use SWIFT for transfers below $100,000 [link]

- Genesis files for bankruptcy [link]

- NFT GOD's wallet drained, accounts used to phish others after malware infection [link]

- LendHub reports $6 million hack [link]

- FTX liquidators get liquidated [link]

- Coinbase lays off nearly 1,000 people in second round of layoffs over the last year [link]

In the news

I talked to David Segal about how the cryptocurrency industry is extremely good at treating any failure as an isolated incident that isn't reflective upon the industry as a whole.

Matt Binder and I did a fun end-of-year reflection on some of the weirdest moments of 2022 in the web3 world. Sometimes it's fun to turn away from the huge monetary losses and real damage to actual people who are getting sucked into the crypto meatgrinder, and instead laugh at Seth Green who had to pay $300,000 in ransom to retrieve his kidnapped Bored Ape so he could use it in a TV show that may or may not still be being produced.

Worth a read

You had your paragraph of levity, now it's time to turn back to the fact that some people who did not have much to lose have lost everything in Gemini. "I thought I was just parking the money in a high-yield savings account and I can get it out anytime," said one Gemini Earn customer.

This one's outside of the crypto subject area, but Paris Marx did an excellent interview with AI researcher Timnit Gebru, who pushes for ethical practices in artificial intelligence and the tech industry more broadly.

A lot of people are predicting that AI will be the next hype cycle now that the web3 and crypto hype is over. I think it may be a little premature to declare the end of crypto hype, which has ebbed and flowed for over a decade now to varying degrees, but it's undeniable that the AI hype cycle has been kicking into overdrive lately.

That's all for now, folks. Until next time,

– Molly White

References

"Bulgaria Charges Four in Probe Into Crypto Lender Nexo". Bloomberg. ↩