Issue 19 – Down with the crypto banks

Also featuring knockoff NFTs and claims of a wallet hacked via photograph.

I think I mostly got all of the pent-up posts off my chest in my recent writing binge. For now. If you missed any and want to revisit, they're all in the archive where you can peruse them at your leisure!

In FTX

There was a four-hour-long hearing on Monday, which was entirely spent tackling the question of whether to appoint an independent examiner. At the end of it, Judge Dorsey asked the lawyers for all parties to meet him in his chambers, after which he announced that he'd asked them to try to come to an agreement among themselves. Sigh. If they can't, he'll make a decision. I found myself surprised at how skeptical he seemed of appointing an examiner in this case, though it is true that it will be a pricey undertaking.

Dorsey did approve the bankruptcy team's requested subpoenas. That should be quite an interesting production, though I suspect much will remain under seal. See the recent special edition for more details on what they're hoping to learn about and from whom.

Over in the criminal case, SBF's lawyers and the lawyers for the US Government reached an agreement on the modification of bond conditions, which would have left in place the current restriction barring SBF from "contact or communicat[ion] with current or former employees of FTX or Alameda (other than immediate family members) except in the presence of counsel, unless the government or Court exempts an individual from this rule)", and modified the restriction on "us[ing] any encrypted or ephemeral call or messaging application, including but not limited to Signal" to:

The defendant shall not use any encrypted or ephemeral call or messaging application, including but not limited to Signal. The defendant shall be permitted to place voice calls, FaceTime calls, and Zoom audio and video calls, and use iMessage, SMS text message, email, and Facebook messenger. The defendant shall be permitted to use WhatsApp only if monitoring technology is installed on his cellphone that automatically logs and preserves all WhatsApp communications.

SBF's attorneys also agreed to give up on their ridiculous request that the prohibition from "accessing or transferring any FTX or Alameda assets or cryptocurrency, including assets or cryptocurrency purchased with funds from FTX or Alameda" be lifted.

However, Judge Kaplan denied the motion, asking the attorneys to attend a hearing today to discuss it all. Unlike with the bankruptcy, these hearings aren't watchable on Zoom, so I'm limited to what I could glean from some livetweets by a reporter who attended. It seems Kaplan was concerned that the government didn't specify which individuals they planned to exempt from the no-contact order. He also had some questions around the ephemeral messaging:

What does the US mean by encrypted? I've read spy novels

I read last night the Mary Queen of Scots' letter were encrypted, without computers. We are being shortsighted, focusing on apps.

There is still snail mail, and email, without the same risks.

Ultimately, he seemed to accept arguments from SBF's lawyer that SBF should be permitted more than snail mail. SBF's lawyer also promised to provide a list of apps that could be installed on SBF's phone to ensure that any communications are properly preserved.

While I don't necessarily think SBF needs to be restricted to communicating only by letter (although that would be somewhat amusing), it did seem to me like the US Attorney's Office was bending over backward unreasonably far with respect to the whole buffet of communications options they're presenting to SBF. Part of me wonders if they want to leave him with plenty of opportunities to do really dumb things and then put them in writing.

The US Attorneys have filed motions to stay the civil proceedings in front of the CFTC and SEC until the conclusion of the criminal case. SBF's fine with it, and the CFTC and SEC haven't taken a position.

Finally, as expected, SBF filed notice that he intends to appeal the decision to reveal the identities of the two non-family sureties.

In other bankruptcies

Celsius wants a second extension to file their restructuring plan. The US Trustee and the committee of unsecured creditors aren't on board with that plan, stating that Celsius' legal team is burning through cash and hasn't provided any reasons they need more time.

Genesis has put forward a recovery plan in which they would restructure the loans with their parent company (DCG), equitize the $1.1 billion promissory note, and issue convertible preferred stock to Genesis creditors. Gemini also agreed to chip in up to $100 million to help compensate Gemini Earn customers, who have somewhere in the ballpark of $900 million in assets tied up with Genesis.1 The restructuring agreement would apparently allow for a "substantial recovery" for Earn users, though it's not clear what precisely that means.2

Voyager's gotten the okay on the proposed deal with Binance US. Voyager customers will have to create accounts on the Binance US exchange, where they may be able to withdraw the fraction of their cryptocurrency assets that will be returned "as determined by Voyager's rebalancing" as early as March. This introduces a bit of a conundrum for residents of Hawaii, New York, Texas, and Vermont, where Binance US isn't allowed to operate.3

In banking

It's been a rough few weeks for the handful of crypto-friendly banks in the US, and the crypto companies who rely on them.

Almost three weeks ago, Binance announced that customers would no longer be able to use SWIFT for transfers below $100,000 via Signature Bank due to a change in Signature's policies.

A week later, the Federal Reserve denied an application by the Wyoming-based crypto-friendly Custodia Bank to become a member of the Federal Reserve System.

The firm's novel business model and proposed focus on crypto-assets presented significant safety and soundness risks. The Board has previously made clear that such crypto activities are highly likely to be inconsistent with safe and sound banking practices. The Board also found that Custodia's risk management framework was insufficient to address concerns regarding the heightened risks associated with its proposed crypto activities, including its ability to mitigate money laundering and terrorism financing risks.

Federal Reserve Board press release, January 27

That same day, the Federal Reserve published a policy statement that they would presumptively prohibit state banks from holding crypto assets as principal, and reiterated their concerns about crypto assets more broadly. That policy statement was entered into the federal register on February 7.

On February 2, Bloomberg reported that DOJ fraud investigators were probing the Silvergate bank over their services to FTX and Alameda Research.

On February 6, Binance's international division announced with no explanation they would be imminently suspending USD withdrawals. [W3IGG] Binance CEO CZ gestured toward an issue with a banking partner, tweeting that "some banks [are] withdrawing support for crypto" and describing it as a "setback".

Also on February 6, trading firm Statistica Capital filed a class-action lawsuit against Signature Bank alleging that the bank "had actual knowledge of and substantially facilitated the now-infamous FTX fraud. In particular, Signature knew of and permitted the commingling of FTX customer funds within its proprietary, blockchain-based payments network, Signet."4

On February 9, CoinDesk reported that the New York Department of Financial Services was investigating Paxos over its issuance of the Pax dollar (USDP) and Binance USD (BUSD) stablecoins. Paxos, which has a provisional banking charter, was also recently rumored to be under investigation by the OCC, though Paxos has denied that any OCC investigation is underway. [W3IGG]

Over the past few months since the FTX collapse, multiple banks have signaled they will be stepping back from crypto. Metropolitan Commercial Bank announced on January 9 that they would be exiting the crypto space entirely. Signature Bank disclosed to investors a month before that that they were looking to reduce crypto industry exposure from around 24% of their deposits to less than 20%, and potentially to less than 15% — an $8–$10 billion reduction.

The Web3 is Going Just Great recap

There were 12 entries between February 1 and February 9, averaging 1.3 entries per day.

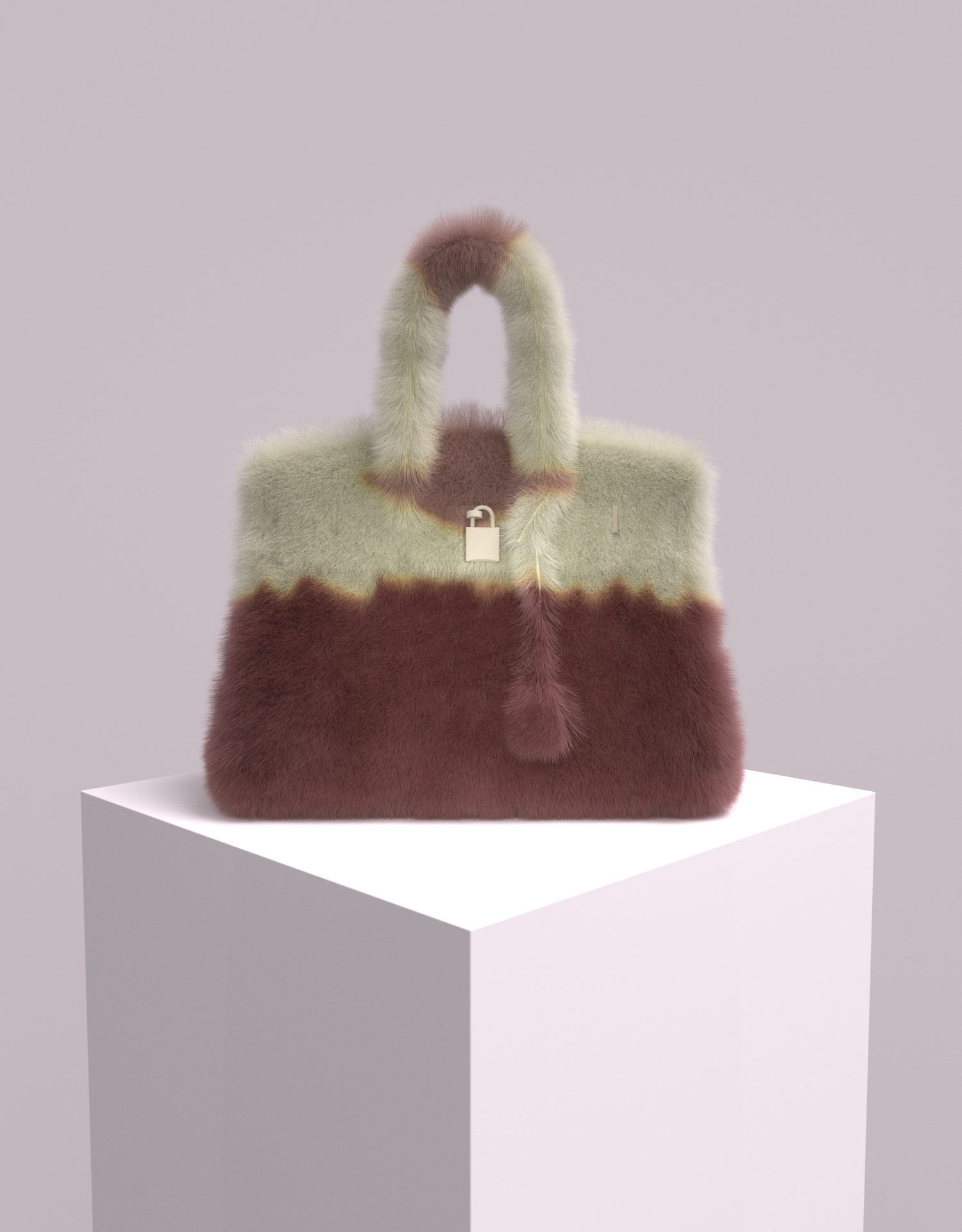

Knockoff Birkin NFTs get slapped down in court

[link]

After a year of litigation, the guy who created the "MetaBirkins" NFT project has been determined by a jury to have infringed upon Hermès' Birkin trademark with his line of 100 NFTs depicting 3D-rendered, faux-fur covered Birkin handbags. He'll pay $133,000 in damages, which is about as much as he personally made off the project. He tried to argue that the furry Birkins were akin to Andy Warhol's Campbell's soup cans, but did not prevail against Hermès arguments that he was simply a "digital speculator" hawking a "get rich quick" scheme, and trying to profit off consumers' confusion that the NFTs were an official Hermès production.

Some (crypto industry) publications have suggested that the jury came to some sort of official, precedent-setting decision that "NFTs are not art", a claim that I can't find a lick of evidence to support. I think that may just be pearl-clutching.

Webaverse discloses a mysterious, $4 million hack

[link]

First of all, Webaverse? Like web-averse?? With that out of the way:

It has not yet been determined whether Webaverse execs are just embarrassed to admit they were phished by a plain ol' malicious PDF, or if Trust Wallet really has some sort of bizarre vulnerability that allows people to steal all your crypto simply by taking a photograph of your cell phone displaying your balance (but not your seed phrase or private key), but something weird happened in Rome last November.

The theft involved a group of individuals posing as venture capitalists — one of whom claimed to be a billionaire's grandchild's lawyer — who convinced the Webaverse executives to meet in person in a hotel lobby in Rome, transfer funds to a new crypto wallet, and show it to them as part of some claimed diligence before investing. Shortly after, the wallet was drained.

Webaverse maintains that Trust Wallet has some sort of crazy vulnerability that allowed them to drain funds without seeing any private keys or seed phrases. Trust Wallet says this was plain old PDF malware.

Surprising absolutely no one, widespread cheating plagues Bored Apes' "Dookey Dash" game

[link]

Despite Bored Apes' founders being in their mid-30s, and their target demographic of people who can afford to spend $5,000 to be able to play a browser game for three weeks presumably also being grown adults, Yuga Labs decided to make their endless runner browser game poop-themed.

Predictably, when Yuga Labs teased that players would be rewarded with NFTs that progressed in rarity based on game scores — which presumably could later be resold for ridiculous prices or serve as status symbols as with other Yuga Labs NFTs — players set out to cheat in any way they could.

Some hired more skilled players to play in their stead, which was not actually disallowed. The going rate was apparently up to 2.5 ETH (~$4,200) for a better player to get a score of 700,000+.

But others, or those they hired, used bots, tweaks to the browser-based game code, or various other methods to boost their scores. Although Yuga Labs deployed anti-cheating software and promised to review gameplay after the fact to weed out cheaters, some are skeptical that they can accurately filter out the apparently rampant bad behavior. Others worry that the people they hired to get higher scores on their behalf might have cheated without their knowledge. Some who played honestly managed to trigger the anti-cheating software — likely due to laggy internet connections — and fear their scores might be tossed.

Womp womp.

Coin Cloud files for bankruptcy after a series of unfortunate events

[link]

When I wrote that the Coin Cloud crypto ATM company had filed for bankruptcy, the number one reaction was "how did a crypto ATM company manage to lose money??" It's a business that seems like it should be fairly foolproof, but then again, this is crypto.

According to their first day filing, the company seems to have encountered one mishap after another dating from 2021. First, the company providing them with software to run the ATMs decided to terminate the agreement, ultimately pushing a software update that caused them to stop functioning for "days to weeks depending on how long it took to get a technician to the machine to fix the problem". Coin Cloud decided to deploy their own unfinished ATM software to replace the vendor's code, which was promptly hacked for around $6.5 million. They hired a chief marketing officer who was later discovered to have lied about his credentials, and who overspent his budget by $20 million on sports deals.

I wonder if he was the one who signed Spike Lee to make one of the most blatant examples of crypto affinity fraud out there:

The mishaps didn't stop there: they signed a deal with a vendor to provide $35 million worth of crypto ATMs, only for the vendor to deliver non-functioning kiosks. They remain in litigation over that particular issue, and are plaintiffs or defendants in seven other lawsuits. Several come from former employees who allege they weren't paid what they were owed.

Everything else

- Paxos faces investigation over stablecoin offerings [link]

- Umami Finance halts yields, CEO dumps tokens amidst accusations of rugpull [link]

- Kraken ends staking, pays $30 million fine in settlement with U.S. SEC [link]

- Peer-to-peer Bitcoin exchange LocalBitcoins to shut down after ten years [link]

- Binance suspends USD bank transfers [link]

- Logan Paul slapped with a class action lawsuit over CryptoZoo rugpull [link]

- Orion Protocol suffers $2.9 million hack [link]

- Bonq defi borrowing project exploited [link]

Worth a read

Some more great reporting out of the FT, though they're also falling into the trap of infantilizing him a bit. I loved the quote from SBF: "It felt to me like everyone around me had lost their minds all at once. And everyone is behaving bizarrely poorly." You know what they say: If everyone around you is an asshole…

David Gerard did a nice rundown of "effective altruism" — the subculture and philosophy favored by SBF, but also weirdly popular among a lot of tech folks. A few months ago I tried to delve into the topic, but found myself an hour later reading LessWrong posts about Roko's basilisk and fearing my brain was only moments away from beginning to dribble out my ears, so I'm glad David's around to just the broad strokes of a supremely weird phenomenon.

That's all for now, folks. Until next time,

– Molly White