Issue 29 – SEC showdown

The SEC is gearing up for battle with two crypto giants.

This week has shaken up the crypto industry, as the US Securities and Exchange Commission came down with a one-two punch of lawsuits against Binance (on Monday) and Coinbase (yesterday).

Both companies have issued confident, even blustering, responses. Though they are both attempting to play the lawsuits off as no big deal, and reassure customers that everything is business as usual, I don't think anyone in crypto is truly able to pretend that these are likely to be anything other than landmark cases.

In the courts

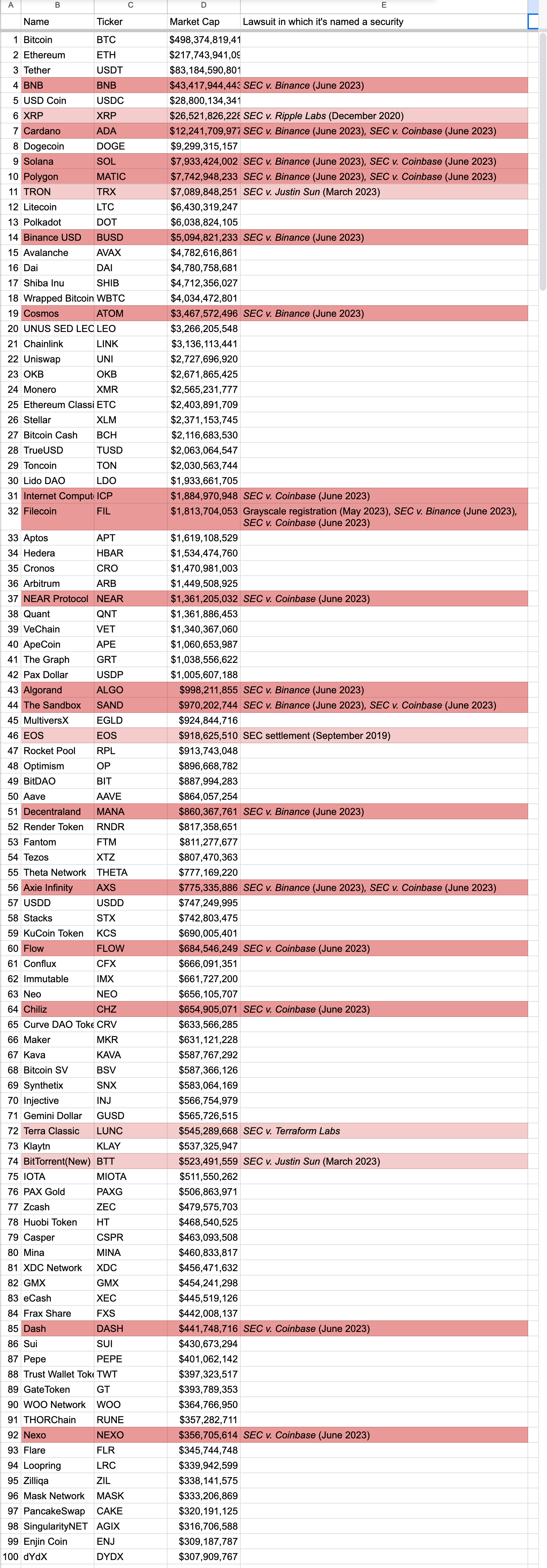

Check out the most recent special edition for considerably more detail on the Binance lawsuit, but long story short: SEC v. Binance will be impactful litigation for the crypto industry, particularly if it makes it to trial. In addition to the ramifications for Binance, the complaint names ten major non-Binance-issued crypto tokens as securities: SOL (Solana), ADA (Cardano), MATIC (Polygon), FIL (Filecoin), ATOM (Cosmos), SAND (The Sandbox), MANA (Decentraland), ALGO (Algorand), AXS (Axie Infinity), and COTI. The two Binance-issued tokens, BNB and BUSD, were also described as securities in the complaint. This is going to make things pretty hairy for other crypto platforms that list these tokens, who now have to decide whether to delist them or possibly risk SEC enforcement. In testimony before the House Agricultural Committee's hearing on digital assets on June 6, Robinhood's Chief Legal Officer told Congress that the company has already begun reviewing the SEC's analysis with respect to these tokens "to determine what, if any, actions to take".1

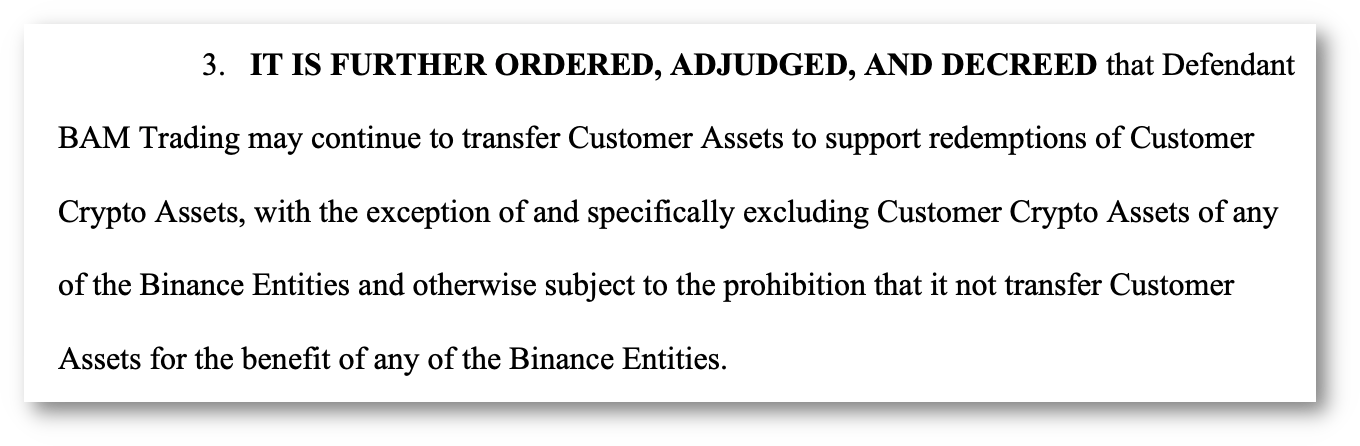

The SEC has also filed an emergency motion to request a temporary restraining order that would limit Binance's activities with respect to assets belonging to customers of Binance.US. Some of the crypto community has panicked at that, worrying that it might result in the same type of indefinite freezing of customer assets as we've seen happen with the various crypto bankruptcies, where customers are without access to their crypto assets for months if not years. Some accused the SEC of malfeasance, including trying to intentionally kick off a run on the exchange. However, looking at the text of the motion, the SEC has specifically asked that the TRO allow Binance to continue processing redemptions for Binance.US customers, and rather seems far more focused on ensuring that Binance and Zhao are not able to transfer these assets out of the SEC's jurisdiction. Given the emergency nature of the motion, it should be handled relatively swiftly. It is an extreme step for a court to take, so it's very much up in the air whether it will be granted.

As for the lawsuit against Coinbase, that was more a matter of "when" not "if", given the Wells notice issued in March [W3IGG]. The SEC's complaint boils down to allegations that Coinbase didn't register with the SEC but listed securities for sale to US consumers. I'll go into it in more detail quite soon. This complaint also lists a slew of crypto assets as securities, including some of the same ones as in the Binance complaint, but also CHZ (Chiliz), FLOW, ICP (Internet Computer), NEAR (NEAR Protocol), VGX (Voyager Token), DASH, and NEXO.

As of these two new lawsuits, the SEC has explicitly named 22 of the top 100 cryptocurrency tokens by market cap2 as securities in its various lawsuits:

Ten state regulators simultaneously made their own demands towards Coinbase, pertaining to their staking program. California, Maryland, and Wisconsin demanded Coinbase stop offering the service immediately, and Kentucky, New Jersey, and South Carolina issued cease and desist letters. Other states, including Alabama, Illinois, and Washington, also kicked off legal action but didn't immediately require Coinbase to cease activities. Securities regulators from two states, New Jersey and South Carolina, also imposed fines totaling $9.3 million.3

Reggie Fowler, the one-time football businessman who ran money for Crypto Capital Corp beginning in 2018 was sentenced after several delays. He pled guilty in April 2022 to a litany of charges in connection to his involvement in processing more than $700 million of unregulated transactions on behalf of crypto exchanges, as well as defrauding the Alliance of American Football. Now he's been sentenced to 75 months (a bit over 6 years) in prison, and ordered to forfeit more than $740 million and pay $53 million in restitution. Amy Castor and David Gerard have the full rundown.

Elon Musk has been accused of pumping-and-dumping Dogecoin in an amended complaint in a proposed class action by investors. They believe they've identified wallets belonging to him that show a pattern of buying Dogecoin before his tweets about the project, then selling it after the price has spiked.4 Setting aside the very real questions of whether the wallets even belong to him or whether the lawsuit is likely to be thrown out, it serves as a somewhat nauseating illustration of the ease with which some crypto tokens can be manipulated — though even Elon Musk seems to be losing his touch with that lately.

In the government

President Biden signed the US debt ceiling bill, averting looming crisis. This also marked the end of road for a proposed "Digital Assets Mining Energy" Tax, or "DAME Tax": a 30% tax on electricity that would be imposed on cryptocurrency miners to "make them pay for costs they impose on others". Needless to say it wasn't popular among the crypto industry. Replying to a question of whether the larger deal negotiated by President Biden and the Republicans meant the proposal was gone, Representative Warren Davidson tweeted, "Yes, one of the victories is blocking proposed taxes."

The House Agricultural Committee held a nearly five-hour-long hearing on digital asset regulation, featuring a star-studded witness lineup of current and former CFTC chairmen and commissioners, as well as legal officers from Coinbase and Robinhood (the latter of whom is also a former commissioner at the SEC). The hearing was a bit ambitious, aiming to discuss a 162-page draft bill published only last week, which would curtail the SEC's approach to regulating the sector and allow more crypto assets a route to being labeled as commodities. Coinbase loves the bill, which should tell you something about how friendly it would be towards the industry.

In bankruptcies

The judge's decision not to appoint an independent examiner in the FTX bankruptcy case has been referred to the US Third Circuit Court of Appeals. The US Trustee maintains that an independent examiner is needed "[g]iven the size of FTX's debts and because the FTX cases present the 'poster-child' circumstances requiring the appointment of a disinterested person to investigate and report publicly on the findings."

Genesis has filed to have FTX's unliquidated claims estimated at zero, meaning that they are denying owing FTX anything. FTX, on the other hand, says Genesis owes them $3.9 billion. There's a bit of a difference between those two numbers. The judge in the Genesis bankruptcy has denied FTX's request to join the confidential mediation sessions that are ongoing between Genesis and DCG, and wants them to wait like everyone else.5

In other amusing crypto news

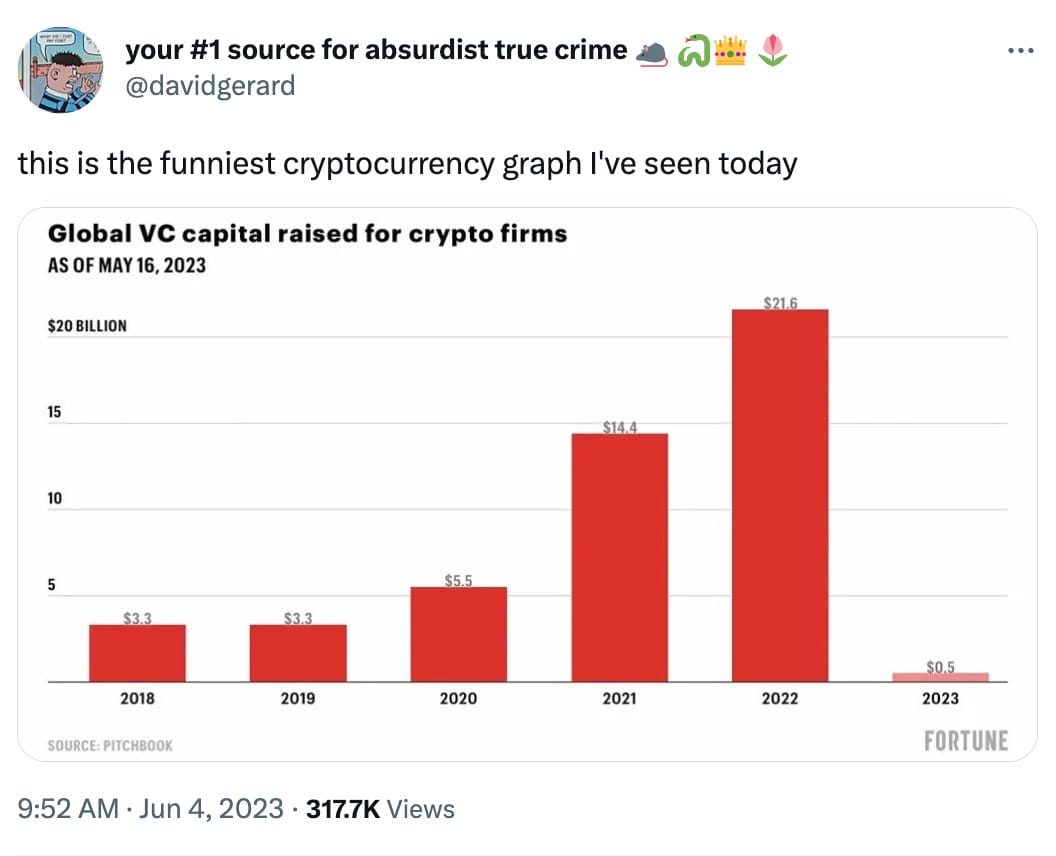

David Gerard spotted this chart in a recent Fortune article titled "'Token projects have to eat that sh*t every day': Crypto VCs face a harsh reality in the bear market".

Some tried to argue that the chart was misleading since we're only halfway through the year, because I guess crypto deals all come in the form of stocking stuffers. Others argued that crypto VCs weren't raising new capital because they'd had such a banner year with the funding rounds in 2022, an explanation that requires one to believe that "no thank you, we have enough money actually" is a phrase that exists within the VC vocabulary.

Perhaps all the crypto-focused VCs that sprung up over the past two years will simply pivot to AI like so many crypto influencers already have.

The Web3 is Going Just Great recap

There were 20 entries between May 25 and June 6, averaging 1.54 entries per day. $43.6 million was added to the grift counter.

MoonPay executives pocketed $150 million raised from Series A

[link]

According to a scoop from The Information, $150 million of the $555 million raised in MoonPay's well-timed November 2021 Series A funding round went directly into the pockets of the company's executives. The funds were used to purchase shares from insiders including MoonPay CEO Ivan Soto-Wright, and never went to the company at all. Several weeks later, Soto-Wright bought himself a $38 million mansion in Miami Beach.

MoonPay is a crypto payments platform known for its "concierge" service in which they buy high-priced NFTs for celebrities and others with deep pockets. They've faced allegations, including via an ongoing class action lawsuit filed in December 2022 [W3IGG], that they're wrapped up in a scheme to use headline-grabbing celebrity NFT purchases as a form of undisclosed promotion for Bored Ape crypto assets.

Self-custodial crypto wallet software breached

[link]

Users of the Atomic Wallet cryptocurrency wallet software suffered a spate of thefts apparently targeting users with relatively large amounts of cryptocurrency. Several individual wallets were drained of multiple millions of dollars worth of tokens in the attack. The largest known individual theft so far involved almost $8 million in USDT (Tether); other individuals lost $2.8 million in USDT and 1,897 ETH (~$3.5 million). Altogether, the thefts have been estimated to total at least $35 million.

Atomic Wallet is a self-custodial wallet, which is supposed to be a more secure way of storing crypto assets than entrusting them to a centralized custodian. However, like any software, they're vulnerable to bugs and hacks, and that seems to be what has happened here.

Atomic Wallet has yet to confirm any attack vector, but has said that they are investigating, along with crypto security firms. In the meantime, they took offline their wallet software download link, likely out of concern that the software was compromised and could affect new users.

Crypto sleuth zachxbt has speculated that the money laundering strategy used by the thieves resembles that of North Korea-linked Lazarus Group, an observation also made by blockchain investigation firm Elliptic.

Poo Finance token hunters find themselves up shit creek

[link]

Some traders were hoping they might get a head start on buying tokens released by Poo Finance, one of the many projects hoping to capitalize on the recent resurgence of memecoins. They used an MEV bot to obtain priority transaction ordering, spending a combined 240 ETH (~$440,000) on the bribes and token payments.

However, the bot malfunctioned and sent the tokens to the wrong Uniswap pool, ultimately returning the traders only 4 ETH (~$7,300) worth of their coveted $POO coins.

Sometimes as I write things like this I find myself staring off into middle distance, wondering how the hell I ended up here and where I went so wrong. Anyway, here's "Pootoshi", Poo Finance's mascot or something:

Everything else

- Scammers capitalize on Binance lawsuit fears to pull off Discord phishing scam [link]

- SEC files complaint against Coinbase [link]

- SEC files complaint against Binance [link]

- unshETH compromised after private key leaked to GitHub [link]

- Trust Reserve employees arrested [link]

- Binance delists privacycoins in various European regions [link]

- Binance reportedly begins layoffs [link]

- NFL labor union is out almost $42 million thanks to crypto collapse [link]

- "Charity NFT project" by supposed cancer patient raises $117,000 with stolen art before being exposed as a fraud [link]

- Bybit exits Canada [link]

- Apparent whitehat exploits El Dorado Exchange, claiming developers built in a backdoor to steal user funds [link]

- BKEX crypto exchange halts withdrawals due to money laundering investigation [link]

- Jimbos Protocol exploited for $7.5 million [link]

- Coinone employees "admit to facts" in case regarding token listing bribes [link]

- Crypto payments firm Unbanked to shut down [link]

- DCG shutters TradeBlock subsidiary [link]

- Hackers steal around $170,000 after compromising Steve Aoki's Twitter account [link]

In the news

Wired did a whole profile about me!

This is just a Wired week, I guess. I'm quoted in this article about the recent SEC lawsuits against Binance and Coinbase, specifically with respect to how the SEC is identifying tokens as securities.

Worth a read

Another must-read on venture capital by Edward Ongweso Jr. You may also recall his March article on the same for Slate, which was published shortly after the SVB collapse, and which I quoted in my article about venture capital.

Continuing on the venture capital theme, David Z. Morris over at CoinDesk wrote a good piece about Worldcoin, describing it as "the apotheosis of Silicon Valley's dangerous delusion that it can both get rich and make the world a better place through the mass harvesting of data."

That's all for now, folks. Until next time,

– Molly White

References

"Robinhood Reviews Crypto Offerings After SEC Crackdown", Bloomberg. ↩

As always, please take "market cap" with a grain of salt. ↩

"Coinbase Crackdown Widens as US States Push to Halt Staking Product", Bloomberg. ↩

"Elon Musk is accused of insider trading by investors in Dogecoin lawsuit", Reuters. ↩

"Genesis Judge Rejects FTX Demand to Join Crypto Bankruptcy Talks", Bloomberg. ↩