Issue 31 – FTX spaghetti

His palms are sweaty, knees weak, arms are heavy.

It's a long one this week, thanks to a lot of little interesting bits of news I wanted to jam in. But first, a quick plug: if you like my work, consider a pay-what-you-want subscription to help me keep doing it.

Without further ado, here goes!

In the courts

SBF

After recently agreeing to split the criminal case against Sam Bankman-Fried into two parts, Judge Lewis Kaplan has now denied the remainder of SBF's pile of motions in which he sought to have dismissed, or in the alternative, severed, ten of the thirteen charges against him. Judge Kaplan rejected SBF's argument that the additional charges violated the terms of his extradition — saying that's an argument that would have to be made by The Bahamas, not SBF — and denied the requests to dismiss for failure to state an offense for not meeting the high bar that would be required for dismissal at this stage.1

SBF had also decided he wanted to try to subpoena documents from FTX's former law firm, Fenwick & West LLP, evidently as part of a possible defense that he'd relied on that firm's advice when engaging in the conduct for which he's being charged. Judge Kaplan denied the request, describing it as a "fishing expedition". "Neither Fenwick nor the FTX Debtors are part of the 'prosecution team,' and the government has no obligation to produce materials that are not within its possession, custody, or control," wrote Kaplan.

Celebs who promoted Voyager

For a while now, I've had my eye on a class action lawsuit against Mark Cuban, the Dallas Mavericks, and Voyager CEO Stephen Ehrlich. It was filed in August 2022, and pertains to the promotion of the now-bankrupt Voyager crypto lender. Now, it seems additional parties have been added as defendants: Miami Heat player Victor Oladipo, former NFL star Rob Gronkowski, and NASCAR driver Landon Cassill. All three had partnerships with the platform. The amended complaint that presumably goes into more detail was filed under seal, but the summonses that were issued on June 27 reveal the addition of these three new defendants.

Personally, my favorite of the three partnerships was Gronk's, because he continually called the company "Vorager" in his ads:

That's the defeated face of a man who had to do twenty takes before the producer finally said "fuck it, close enough".

Do Kwon

Do Kwon (of Terra/Luna fame) was convicted of the document forgery charges over in Montenegro and sentenced to four months in jail. This presumably will be concurrent with the six months he's to spend in Montenegrin custody while the extradition issue is under consideration, but I'm not 100% sure on that.2

Separately, Swiss police have frozen around $26 million in Bitcoin and other crypto assets belonging to Kwon and others associated with Terraform Labs, at the request of the U.S. Securities and Exchange Commission.3

Also, apparently the leader of the South Korean investigation into Kwon has said he expects Kwon will receive a 40+ year sentence, which would be a record for a financial fraud sentence in Korea. It's possible he could also be charged in the U.S., and potentially have to serve sentences in both countries.4 Although Kwon is only 31 years old, such a substantial sentence would mean he'd spend much of his life in prison.

Everything else

The executives behind the Haru Invest cryptocurrency platform, which suspended withdrawals earlier this month [W3IGG], have been barred from leaving South Korea, where they are reportedly being investigated for embezzlement and breach of duty.5

SIM swap hacker "PlugwalkJoe", who stole nearly $800,000 worth of cryptocurrency from an undisclosed cryptocurrency company in May 2019, has been sentenced to five years in prison and ordered to forfeit the stolen funds. His charges also cover his role in a spate of SIM swap attacks in July 2020, which allowed his group to compromise extremely high-profile Twitter accounts — including those of Barack Obama, Elon Musk, Apple, and Kanye West — to promote a cryptocurrency scam that netted them $110,000.67

Remember the guy who was found by a jury to have infringed on the Hermès Birkin trademark with his "MetaBirkins" NFTs? Now he has to airdrop a copy of a court order outlining his restrictions to everyone currently holding one of the NFTs. He is also banned from marketing, selling, or minting the NFTs, providing any further incentives to the holders of the NFTs, or making statements that would cause people to associate the NFTs with Hermès. He also has to transfer any financial benefits he received from the project, along with control of the project's URLs, to Hermès.8

In bankruptcies

FTX

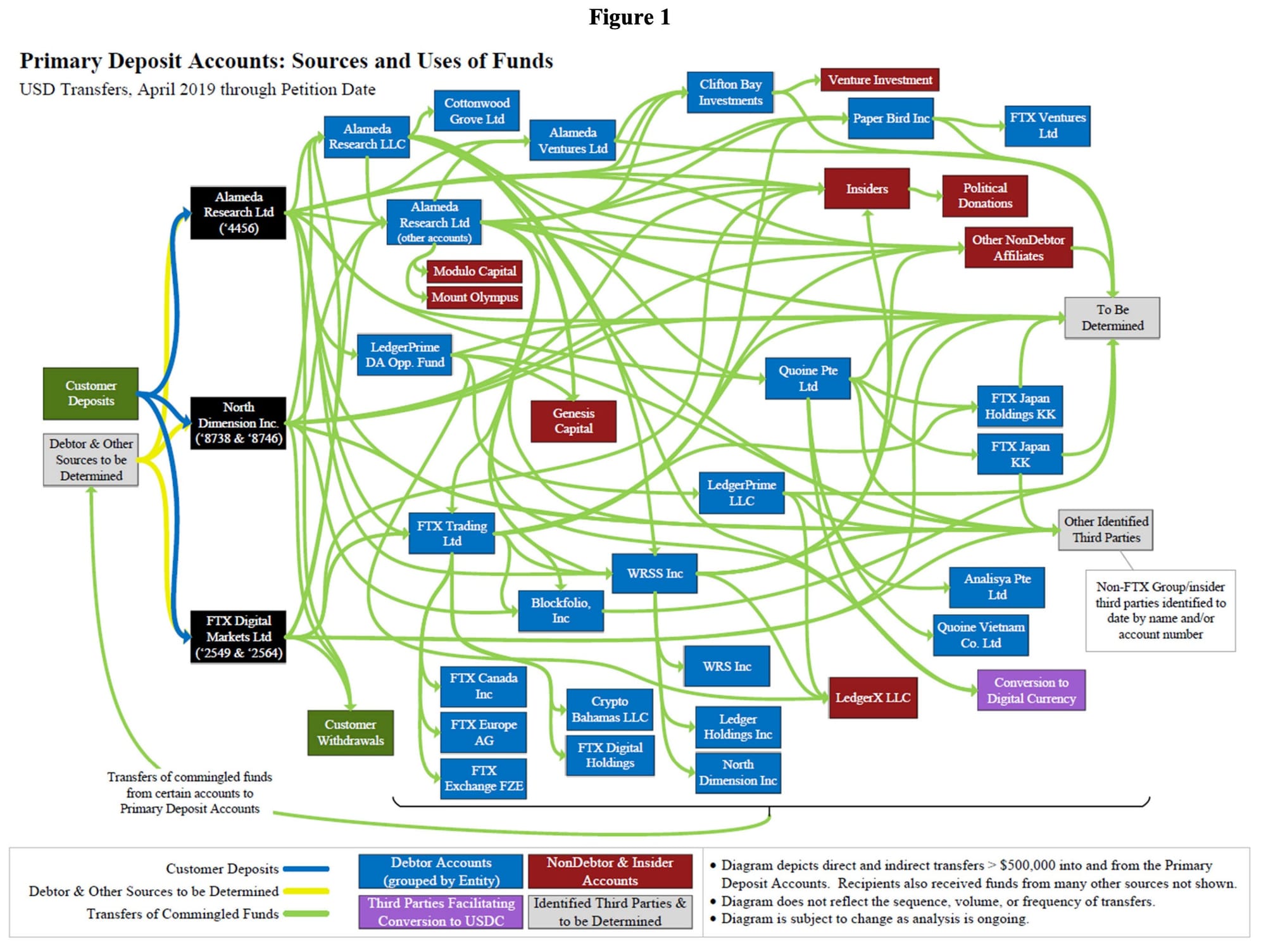

CEO-in-bankruptcy John J. Ray III filed the second interim report in the FTX bankruptcy, which follows the first one that was published in April. If SBF writing "We sometimes find $50m of assets lying around that we lost track of; such is life" rings a bell, that came from report number one.

This new report repeats many of the same things we already knew, but also introduces some interesting details. For one, it explicitly contradicts SBF's story that this was all a big mistake and that he didn't knowingly misuse customer funds. Ray alleges that "from the inception of the FTX.com exchange, the FTX Group commingled customer deposits and corporate funds, and misused them with abandon." Ray also alleges that FTX's top brass knew by August 2022 that FTX was short around $8 billion in customer funds.

The report also introduces a new character, "Attorney-1", who is described only as a "senior FTX Group attorney" who worked closely with Bankman-Fried and other executives. The Wall Street Journal reports that Attorney-1 sure sounds a lot like Daniel Friedberg,9 the former chief regulatory officer at FTX who was reportedly cooperating with U.S. prosecutors as of January.10 The report makes some pretty damning allegations, including that Sam Bankman-Fried and this attorney falsified a "payment agreement" between FTX and Alameda Research, backdated it by around two years, had SBF sign on behalf of both FTX and Alameda Research (using a wet signaturea to avoid the automatic DocuSign timestamp), submitted it to an external auditor, and then used it to obtain a $400 million funding round.

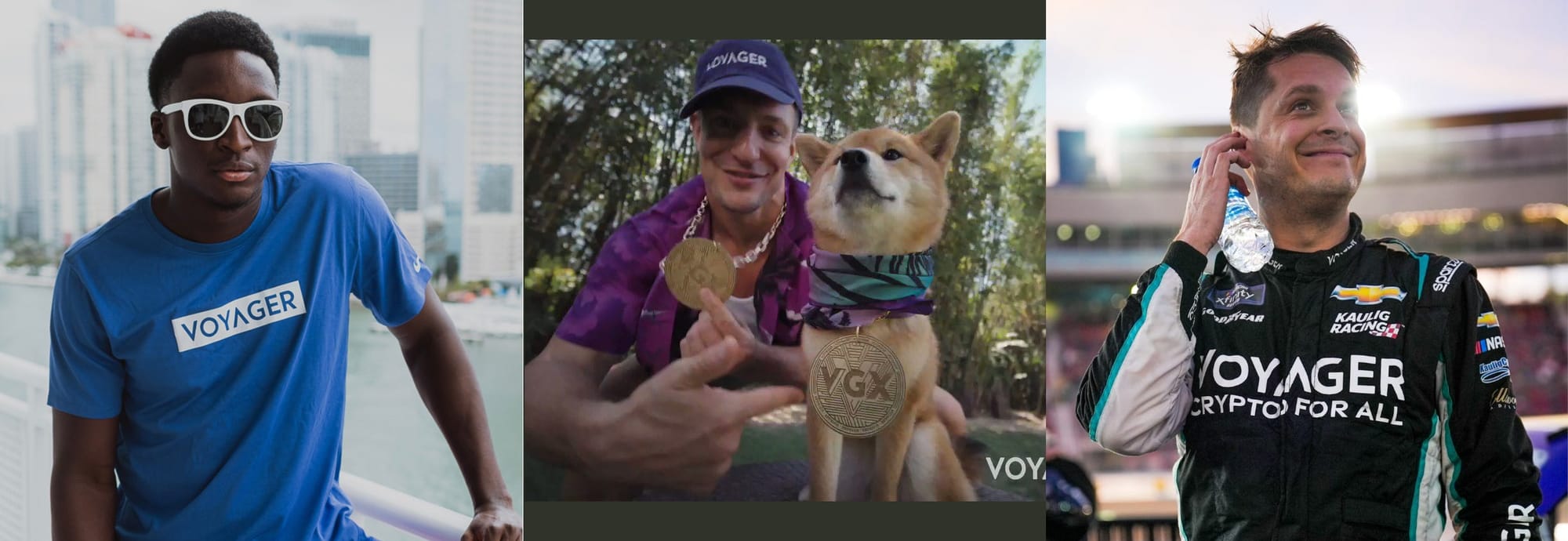

It also provides us with this incredible diagram of FTX's finances:

Or, courtesy of @markstuckert on Twitter:

My favorite are the various boxes for "to be determined".

Finally, the report provides examples of some of SBF's weirder payments, which came out of accounts where customer funds were being commingled. These included a $300,000 "grant" sent "to an individual to '[write] a book about how to figure out what humans' utility function11 is (are)'" and a $400,000 "grant" to "an entity that posted animated videos on YouTube related to 'rationalist and [Effective Altruism] material'". Sounds riveting.

Meanwhile, FTX's lawyers are looking to claw back $700 million that FTX reportedly spent buying influence and celebrity access via a firm called K5 Global, its founder Michael Kives, and its managing member Bryan Baum.12

Also, FTX has suddenly hit the brakes on the sale of its stake in the artificial intelligence startup Anthropic, and for unclear reasons. This stake represents one of FTX's most valuable assets, likely at least in part because of a high valuation due to the newest tech hype bubble: AI. FTX paid $500 million for it; it's not yet clear what it might resell for.13

Prime Trust

While it might be a little early to say for sure if they're headed for bankruptcy, Prime Trust has been placed into receivership by Nevada's Financial Institutions Division [W3IGG], about a week after the regulator ordered them to halt operations and alleged they were insolvent [W3IGG], and their planned acquisition by BitGo fell through for reasons that now seem to be being made clear [W3IGG].

According to the filing, NFID alleges that Prime Trust discovered in December 2021 that it couldn't access some customer wallets, and so "purchased additional digital currency using customer money from its omnibus customer accounts" in order to satisfy withdrawals from said wallets. Now they're facing a more than $83 million shortfall.

This timing is particularly awkward because Prime Trust raised a $107 million Series B funding round in June 2022 — six months after they reportedly learned of these inaccessible wallets. One wonders what kind of due diligence was performed by the eleven firms who invested, and what Prime Trust covered up during that process.14

Everything else

In somewhat brighter bankruptcy news:

Voyager customers are now able to withdraw some of their cryptocurrency, about a year after the exchange initially limited [W3IGG] and then suspended withdrawals [W3IGG]. At this stage, customers will be allowed to withdraw in-kind around 35% of the assets they had on the platform.15

The SEC is postponing the remaining payment of BlockFi's $50 million fine until creditors are paid — avoiding an awkward scenario in which the SEC would likely be getting paid out of BlockFi customer funds due to their preference in the payout order and due to BlockFi's asset shortfall.16

In Binance

Binance gets its very own section this week, because its streak of terrible, horrible, no good, very bad weeks seems to be continuing.

Binance's offices in France were raided by French authorities, and according to Le Monde the company has been under investigation since February 2022 over suspicions of aggravated money laundering. Binance says they weren't raided, they simply "hosted a visit". Nothing to see here folks. These aren't the droids you're looking for.1718

Protos has reported that police and regulators in multiple EU countries are aiding the SEC in their investigation of Binance, helping to provide insight into the company's opaque operations in various European locations. Protos has also, separately, reported that EU authorities believe Binance is faking operations in Ireland and Malta — both jurisdictions where it's not licensed to act as a crypto exchange.

Continuing with the EU theme, Binance has withdrawn its license application in Austria19 and canceled its registration application in the United Kingdom [W3IGG]. It's also been ordered to halt operations in Belgium [W3IGG].

Over in the US, Binance tried to get Judge Amy Berman Jackson to discipline the SEC for issuing press releases pertaining to the case, whining that the SEC had issued a "misleading press release" that threatened to prejudice the case when they wrote that the asset freeze negotiated between Binance and the SEC was "essential to protecting investor assets" because "Changpeng Zhao and Binance have control of the [BAM] platforms' customers' assets and have been able to commingle customer assets or divert customer assets as they please." Judge Jackson responded with essentially "lol, no": "While all of the lawyers in this case should adhere to their ethical obligations at all times, it is not apparent that Court intervention to reiterate that point is needed at this time, or that it is necessary or appropriate for the Court to get involved in wordsmithing the parties' press releases. Nor is it clear that the agency's public relations efforts to date will materially affect proceedings in this case."20

The Web3 is Going Just Great recap

There were 15 entries between June 17 and June 27, averaging 1.4 entries per day. $134.44 million was added to the grift counter.

Dog nose-prints on the blockchain

[link]

Most of the whopping sum in the grift counter this week can be attributed to a ₩166.4 billion (~$127 million) Ponzi scheme out of South Korea, where some enterprising individuals convinced around 22,000 people to put money into a scheme promising a blockchain-powered app that would identify dogs by their nose-prints. Really.

The victims were mostly "in their 60s or older with no expertise in cryptocurrencies", said Korean police. Someone might want to inform them that dog microchips are pretty ubiquitous, low-cost, and — best of all — blockchainless.

Two legally troubled celebs become crypto troubled also

Former Home Improvement child star Zachery Ty Bryan (now 41) took advice from fellow former child star Brock Pierce and sunk a bunch of money into Bitcoin early, which turned out to be a nice financial windfall for him. However, he's since taken to scamming his friends and family, selling them a supposed ICO token from a project that canceled its ICO plans in 2020. Some of them have lost $5,000–$25,000, including a college student he met on the dating app Bumble. At one point, Bryant was actually an investor and advisor associated with the project, which promised to somehow help farmers by "connecting farmers and makers directly to you". However, right around the time Bryan was arrested for felony strangulation in connection to a drunken assault on a girlfriend, the project cut ties with him.

The scam worked the other way around with Jarryd Hayne, who's currently in jail on a rape conviction, and who was once known for his careers in rugby league and, briefly, American football. I guess he decided that the inmate trying to convince him to send Bitcoin to invest on his behalf — an inmate doing twelve years for scamming his own friends and family out of millions in a Ponzi scheme, mind you — sounded pretty legit, because Hayne sent him around AU$780,000 (~US$521,000). The other inmate must have been a damn good salesman, because altogether he successfully pulled in AU$2 million (~US$1.3 million) from at least seven inmates including Hayne.

Kiwi entrepreneur tries to protect his company from losing money to dollar devaluation by losing money in crypto

[link]

The New Zealand-based "ethical travel company" We Are Bamboo blamed their failure on the COVID-19 pandemic and a group of customers whose "actions and online influence have broken us". Those who had paid up-front for trips were denied refunds due to the force majeure provisions of their contracts.

However, now that the company is in liquidation, a liquidator has discovered that company director Colin Salisbury allegedly took more than NZ$3.24 million (~US$2 million) in customer funds, put it into multiple cryptocurrency platforms over a period of almost two years, and lost it all. Another ~US$800,000 was lost in at least four fraudulent crypto platforms which just "ceased to exist". Salisbury apparently claimed that he had put the money into crypto because he was afraid that the US dollar might lose value.

Everything else

- Themis Protocol hacked shortly after going live [link]

- Chibi Finance rug pulls for $1 million [link]

- Prime Trust placed into receivership [link]

- Alleged SpireBit crypto scam loses one senior his life savings [link]

- Binance ordered to halt operations in Belgium [link]

- $1.25 million stolen in 2 months in Polygon NFT phishing scheme [link]

- Prime Trust is insolvent [link]

- Prime Trust halts withdrawals as acquisition falls through [link]

- Web3 influencer Elena tries to sell NFT collection of stolen art [link]

- Binance cancels registration in the United Kingdom [link]

- Financial Times alleges Crypto.com is trading against its own customers [link]

In the news

The BBC had me on to talk a little bit about the Binance and Coinbase lawsuits. I think this is the correct segment — it's unfortunately geolocked to only UK viewers.

Worth a read

John Hyatt at Forbes did some digging into "Heina" Chen (also known as Guangying Chen), a shadowy figure who, despite being downplayed by Binance, appears to hold quite a lot of control over the various Binance- and Changpeng Zhao-related companies and their assets.

Jacob Silverman has also dug into Chen, and went on Scam Economy once to talk about her for those interested in learning more.

Tim Copeland explores the world of NFT drainers, often operated by high schoolers who want to splash out on laptops, phones, food delivery, and… Roblox. Perhaps crypto will transform gaming after all.

I was among the millions of people captivated by the story of the missing (now determined destroyed) submersible Titan this week, which was operated by a company called OceanGate. The New York Times ran this story about how OceanGate founder and CEO Stockton Rush believed that commercial submersible industry standards were stifling innovation, and that it "hasn't innovated or grown — because they have all these regulations". OceanGate also avoided regulations by operating in international waters.

Is any of this sounding familiar?

That's all for now, folks. Until next time,

– Molly White

Footnotes

I discovered on Twitter that "wet signature" is not as well-known a term as I thought. This is not something I coined (I would have called it a "moist signature" to really ick people out, if it was up to me), but rather a term used to describe a pen-on-paper signature rather than an e-signature. ↩

References

Order on June 23, 2023. Document #166 in U.S. v. Bankman-Fried. ↩

"Do Kwon Sentenced to 4 Months Jail in Montenegro Document Forgery Case", CoinDesk. ↩

"Swiss police freeze millions of Do Kwon, TFL assets at request of SEC", Protos. ↩

"Fallen Crypto Mogul Do Kwon Could Face Jail in South Korea and the US, Prosecutor Says", Bloomberg. ↩

"Haru Invest execs grounded in South Korea amid fraud suspicions", CryptoSlate. ↩

"'PlugWalkJoe' indicted for $784K cryptocurrency theft scheme", CoinTelegraph. ↩

"$794K SIM swap hacker PlugwalkJoe sentenced to 5 years in prison", CoinTelegraph. ↩

"Hermès Cements Trademark Win Over 'MetaBirkin' NFTs with Permanent Ban", Decrypt. ↩

"Senior Attorney Helped FTX Founder Misuse Customer Funds, Report Says", Wall Street Journal. ↩

"Exclusive: FTX's former top lawyer aided U.S. authorities in Bankman-Fried case", Reuters. ↩

A "utility function" is an idea popular among rationalists and effective altruists: that there are mathematical functions that can be applied to real-world scenarios to compare the "utility value" (degree of personal satisfaction or benefit) of various choices ↩

"FTX Seeks $700 Million From Firm That Gave Bankman-Fried Celebrity Access", Bloomberg. ↩

"FTX Halts Sale of Its $500 Million Stake in AI Startup Anthropic", Bloomberg. ↩

"Fintech infrastructure startup Prime Trust raises $100M to add IRAs, crypto staking", TechCrunch. ↩

"How to Withdraw Crypto", Voyager. ↩

"SEC waives BlockFi's $30M fine until creditors are paid", CoinTelegraph. ↩

"Binance, principale plate-forme mondiale d'échange de cryptomonnaies, visée par une enquête en France", Le Monde (in French). ↩

"Binance's French arm says money laundering raid was 'regulatory obligation'", Protos. ↩

"Binance withdraws license application in Austria: FinanceFWD", The Block. ↩

Minute order on June 26, 2023. SEC v. Binance. ↩