Issue 39 – Partners in crime (of the criminal sort)

The SEC is stuck in Binance's "house of mirrors", SBF's parents are officially defendants now, and a Hong Kong crypto exchange hurtles towards collapse.

Thanks for bearing with me as I was delayed in putting together this recap! I'll be back on my usual cadence after this, which should hopefully make for slightly shorter recaps than this one.

As I go into in more detail below, we are approaching Sam Bankman-Fried's criminal trial. As some have started to ask me: no, I will not be attending the trial in person to report on it. Even putting aside the question of whether I could obtain a press pass, I'm not based in Manhattan, and don't have the flexibility, funding, or any particular desire to relocate there for upwards of a month. I'll continue to write about it and all the other crypto happenings from my perch up north, and am confident that the many capable journalists who will be attending in person will do an excellent job of keeping everyone apprised of the day-to-day courtroom goings on. I will undoubtedly source their work heavily.

Anyway, back to the present! I'm grouping news by company this week, since so many of these companies have news from across the spectrum of bankruptcy court, civil or criminal court, or other matters.

FTX and Sam Bankman-Fried

Sam Bankman-Fried's day in court looms, and both the prosecutorial and defense teams are busy hammering out specifics as to what evidence will be allowed or excluded, who can be called as expert witnesses, and what questions will be posed to potential jurors during the selection process. As of the latest scheduling update, jury selection will begin a mere two weeks from now on October 3.1

The DOJ doesn't like some of the questions the defense team is hoping to ask prospective jurors during the voir dire process, which include sweeping questions like "Do you have a negative opinion about cryptocurrency, the cryptocurrency markets, cryptocurrency businesses, or people who work in cryptocurrency?", and a host of questions about effective altruism.2 The government has described some of the questions as "unnecessarily intrusive … and beyond the purpose of voir dire". They've objected to questions about effective altruism, scolding that "voir dire is not the appropriate forum to suggest to the jury that the defendant was simply a good guy who wanted to make the world a better place". They're also not pleased with draft questions about SBF's ADHD. The proposal of those questions seems to me to suggest that SBF's team is worried that his behavior and body language — fidgety even under good circumstances — might lead jurors to believe he's being evasive. However, for the first time that I'm aware of, the government has suggested they are doubtful of his ADHD diagnosis, writing that "Thus far, the defense has submitted only a letter from a psychiatrist … who was employed by the defendant as 'FTX's in-house coach,' and whom other witnesses have described as liberally dispensing prescriptions to FTX employees, including for Adderall."3

SBF's team has thus far been unsuccessful in their attempts to spring him loose from jail, where they've been arguing he doesn't have adequate access to a computer and Internet access in order to review voluminous discovery documents. Judge Kaplan denied the latest request on September 12, saying his team can try again if they want to pose a "more factually grounded and persuasive showing", which I believe is judgespeak for "stop wasting my time with your bullshit". SBF's team's latest request didn't mention any further issues with access to adequate food or medication, which makes me hope that those problems have been rectified. As for the computer access, the judge believes the negotiated access to a computer and an Internet connection should be sufficient, particularly given that SBF has already had over seven months to review discovery documents while out on house arrest, and has a very capable legal team to review documents on his behalf.4 I covered Judge Kaplan's memo in a little more detail in a Twitter thread.

More leaked documents have made their way from SBF to the New York Times (archive),5 this time in the form of an unpublished draft apparently meant for Twitter that would have spanned hundreds of tweets if published. SBF shared this document and others with influencer, journalist, and confidant Tiffany Fong in late January 2022, and she later sent it to the Times. In the draft, he denigrates Caroline Ellison as unprepared to run Alameda Research and at fault for what he describes as a lack of "risk management" (as though the "risk" of stealing billions of dollars in customer funds simply needed to be "managed" better, rather than avoided entirely). This leak appears similarly motivated as the last: to cast Ellison in the eyes of the public as at fault for FTX's downfall.

Ryan Salame ("Salem", not "salami") has finally left my dwindling "execs conspicuously missing from FTX criminal proceedings" list now that an indictment has been unsealed and a plea deal reached [W3IGG].6 He's agreed to forfeit $1.5 billion, although it seems at least at this point that he will only actually cough up a small percentage of that in the form of a $6 million payment and the forfeiture of two Massachusetts properties, a 2021 Porsche 911, and equity in a side business.7 Unlike the other three FTX executives who have reached plea deals, Salame won't be cooperating with the investigation. He wore Bitcoin-print socks to his arraignment. His sentencing is scheduled for March 2024.

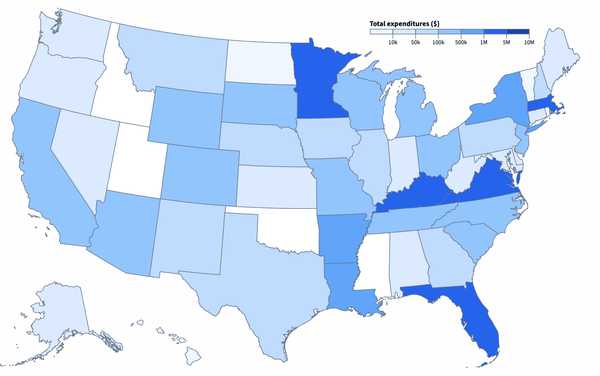

Sam Bankman-Fried's parents, Joseph Bankman and Barbara Fried, have officially been brought into the bankruptcy case in the form of an adversary complaint seeking to recoup FTX funds.8 They were allegedly the recipients of a $10 million "loan" (gift), Bahamas property and related expenses valued at around $19 million, and other gifts and perks from the FTX group. They were also allegedly deeply involved in siphoning FTX funds to their favorite causes — mostly political and charitable causes in the case of Fried, but also at least $1 million in donations arranged by Bankman to their shared employer, Stanford University.

Bankman is described as deeply involved in FTX day-to-day operations, legal work, and finances, despite SBF's repeated claims post-collapse that his parents "weren't involved in any of the relevant parts" of the business.9 The complaint describes Bankman as "virtually the only grown-up in the room" full of young and inexperienced executives, and alleges that both he and Fried "either knew—or ignored bright red flags revealing—that their son, Bankman-Fried, and other FTX Insiders were orchestrating a vast fraudulent scheme to profit and promote their personal and charitable agendas at the Debtors' expense." In November 2021, around the time that FTX was making massive loans to executives to accomplish the buyback of Binance's stake in the business, Bankman allegedly pushed for FTX to begin working to establish "how assets including primary residence can be structured to bankruptcy-remote." He repeatedly discussed transactions from the FTX companies in ways that reveal he had no illusions about the lack of fund segregation between the US and non-US entities.

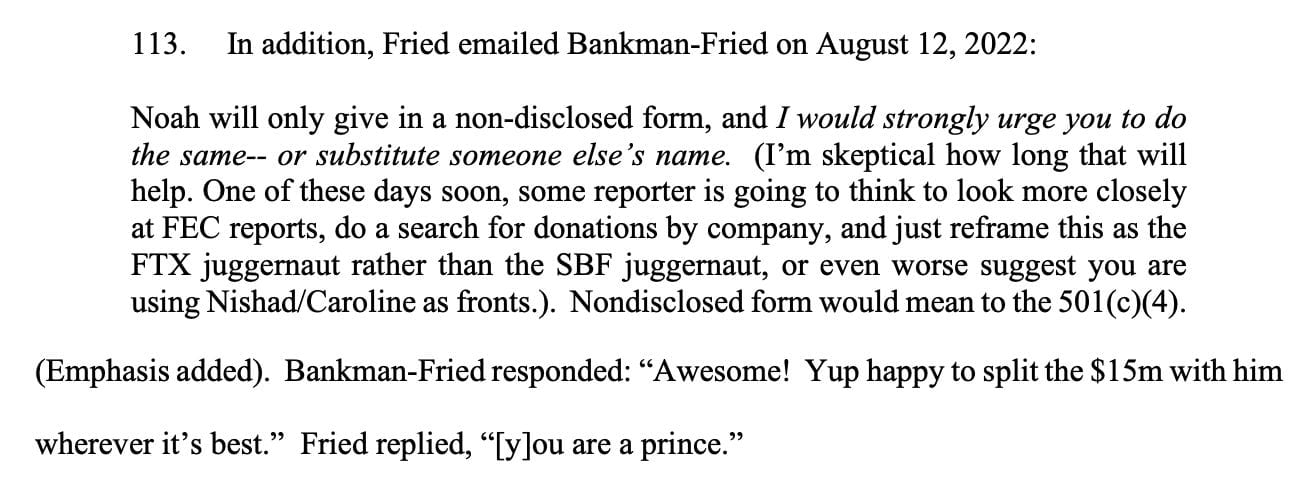

As for Fried, the complaint mentions that Fried regularly referred to her son as her "partner in crime of the noncriminal sort", which certainly at least now comes off as a very weird thing to feel the need to specify. The FTX debtors have their hands on some very damning written communications from her, in which she meticulously instructs various people to make straw donations in apparent violation of campaign finance laws.

Bankman and Fried certainly now have to worry about the bankruptcy estate clawing back tens of millions from them, including the funds that are reportedly being used to finance Sam Bankman-Fried's legal defense. However, some of the behavior outlined in the complaint suggests to me that they may have other worries to contend with as well, likely to come from the Department of Justice.

Financial statements from the FTX bankruptcy revealed that the company paid for former Alameda Research co-CEO Sam Trabucco's $2.5 million, 52-foot personal yacht in March 2022.10 He named it Soak My Deck, because of course he did. Trabucco abruptly resigned from Alameda on August 24, 2022 — less than three months before the dramatic collapse — and wrote in a tweet thread announcing his departure that he had "bought a boat, that's been cool".11 In SBF's tweet draft leaked to the Times, SBF also referenced the yacht, saying that Trabucco preferred "going on dates with a ton of guys while sailing around the world on a boat" to working. So would I, in all fairness. Now that Ryan Salame has reached a plea deal, Sam Trabucco is one of the only remaining execs on my "conspicuously missing" list.

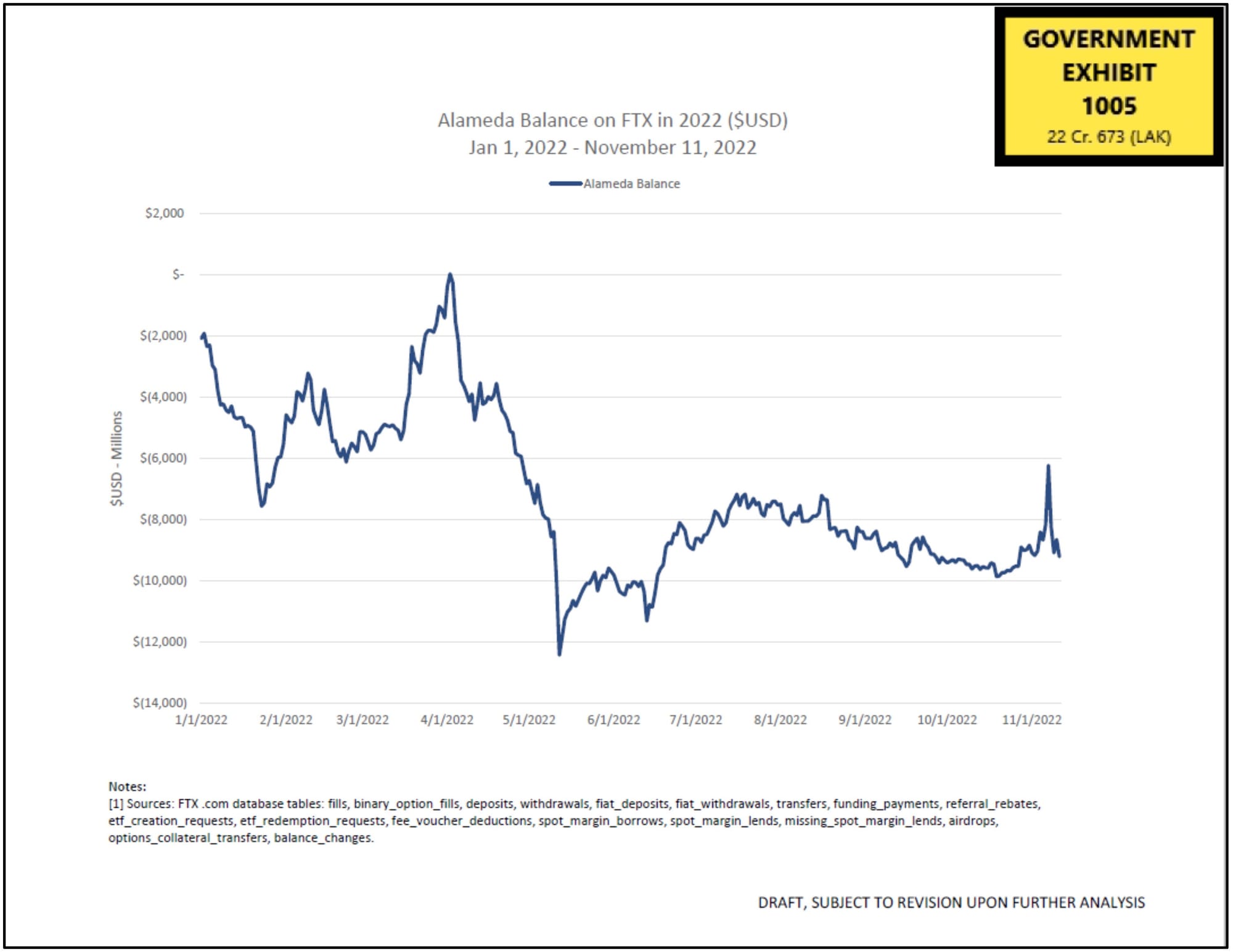

Oh, also, Alameda Research was really bad at trading.12

Binance

Sealed or partially redacted documents have been flying in the SEC v. Binance case. From what we can see, the SEC believes that Binance has been deliberately uncooperative with the discovery process, and Binance believes the SEC is being too aggressive and too broad in its discovery demands. According to the SEC, as of September 14, Binance has produced "a little over 220 documents. Many are unintelligible screenshots of bank account information, documents without dates or signatures, and letters from counsel and tables that appear to be prepared for purposes of this litigation, without any supporting evidence or verification by an individual with knowledge confirming the accuracy of the information."13

The SEC is also very concerned with Binance's ongoing caginess around who actually holds the assets belonging to US customers, and whether the assets are all there. Recently, they've raised concerns about a company called "Ceffu",a which apparently has control over US customer assets and is affiliated with Binance's international business. Although Ceffu insisted in a statement to CoinDesk that it is "independent and separate" from Binance and always has been, that doesn't actually appear to be the case based on public documents showing that it was a part of the Binance Group,14 and the SEC's repeated references to Ceffu as a "Binance affiliate" and "Binance Entity". This is all par for the course with Binance, who at one point claimed that their entire US arm was an independent "partner" of the global company, but such lies are usually reserved for the public and not put in writing in court.

The SEC's frustration is really coming through in some of these documents. In a reply to Binance's objection to the SEC's motion to compel, the SEC wrote that the filing "illustrates the house of mirrors the SEC has been navigating for months."15

The SEC and Binance faced off at a September 18 hearing in which federal Magistrate Judge Zia Faruqui declined — at least at this point — to order Binance to give the SEC access to their software and infrastructure in order to perform an inspection, which Judge Faruqui agreed with Binance was too extreme a request.16 He also didn't grant the SEC's motion to compel discovery documents or testimony, stating "Let's continue to try to work this out… I just want to keep things moving." However, he did agree with the SEC that the court "need[s] more than we've got right now", and commented that he was not "super confident that [Binance US] has total control of their assets". The SEC and Binance will produce a joint report on October 10, and appear at a hearing two days after that.17

Something that probably also ought to concern the SEC as they continue to work to determine the status of US customer funds: blockchain research firm ChainArgos has observed what sure looks like Binance US transferring millions of dollars in tokens to Binance global and a non-US market maker operated by Binance global CEO Changpeng "CZ" Zhao, right around and after the temporary restraining order was granted to try to prevent Binance from transferring US assets to entities outside of the country.18

People more observant than I am19 have also just noticed a mention buried in June court exhibits of a $250 million loan issued in December 2022 from Binance US to Zhao.20 After hearing of all the many millions of dollars in "loans" of customer funds to FTX executives, this doesn't sit well.

The list of departing Binance executives grows longer still, notably now including the CEO of Binance US, Brian Shroder [W3IGG]. Zhao shrugged off the chatter about Shroder's departure as mere "FUD", as he likes to do. Zhao wrote on Twitter that Shroder was simply "taking a deserved break", as though it is eminently normal for a CEO to leave a company so abruptly that legal documents filed by Binance US on the day of Shroder's departure still referred to him as CEO. Those documents were a part of Binance's ongoing attempt to argue that a judge should not allow the SEC to depose Shroder, partly because taking him away from his executive duties would be disruptive to Binance's business. So much for that argument, I guess.

Also departing Binance's US arm are its Head of Legal and its Chief Risk Officer, two of perhaps the most ominous-sounding titles that can possibly jump ship when a company is facing two massive lawsuits from regulators.21 Meanwhile, Binance global lost its Head of Product,22 Head of Eastern Europe and Russia, and General Manager for Russia and CIS.23 Other lower-level employees will be leaving the company less-than-voluntarily, as Binance US announced layoffs for 1/3 of its employees, or around 100 people [W3IGG]. This follows a slew of layoffs in June, shortly after the SEC lawsuit, when Binance US cut 50 roles [W3IGG].

Genesis and DCG

After announcing that they would be closing down U.S. spot trading "voluntarily… and for business reasons" on September 5 [W3IGG], Genesis announced less than two weeks later that they would be closing down all trading, again "voluntarily and for business reasons" [W3IGG]. That is one of those intended-to-be-reassuring sentences that gets a whole lot less reassuring the more often they have to repeat it, and the rapidfire closures rather than a more graceful singular announcement certainly feel more like the hallmarks of an involuntary decision.

Genesis Global Capital is undergoing bankruptcy at the moment, and on September 6 filed two lawsuits against its own parent company, Digital Currency Group (DCG), demanding they repay more than $600 million in overdue loans. Genesis is in the middle of sorting out a possible agreement with DCG regarding these and other loans, as I mentioned last issue. DCG says the deal would result in a "70–90% recovery" for Genesis creditors, and a "95–110% recovery" for Gemini Earn customers, whose funds are also stuck with Genesis. As I mentioned last time, some Genesis creditors think the deal sounds fishy. Now Gemini's Winklevoss twins are saying the same in a characteristically fiery court statement: "DCG continues its campaign of contrived, misleading, and inaccurate assertions in an attempt to gaslight creditors of the Genesis estate… Make no mistake: Gemini Lenders will not actually receive anything close in real value terms to the proposed recovery rates under the current 'agreement in principle.'"24

Celsius

Former Celsius Chief Revenue Officer Roni Cohen-Pavon has pleaded guilty to four charges in the criminal case related to the Celsius collapse. He will cooperate with the investigation, and is due to be sentenced in December 2024.25

Over in bankruptcy land, Celsius has filed suit against private lending company Equities First, which owes them cash and Bitcoin that in July 2022 was priced at around $439 million.26 The complaint was filed under seal, but it's probably safe to assume it has something to do with some incidents outlined in the January examiner's report.27 According to independent examiner Shoba Pillay, Celsius lost hundreds of millions by borrowing against crypto collateral that skyrocketed in value after it was pledged, with no terms pertaining to that possibility, and which Equities First later informed Celsius they were unable to return. Celsius negotiated an agreement for a promissory note in a deal that ultimately was disadvantageous to them.

In other crypto news

I'm beginning to think that the crypto industry is embarking on another massive marketing push to try to drive public perception — and prices — back up. We've just seen the announcement of a crypto-focused Shark Tank-esque competition show that feels like a flashback to 2021 [W3IGG], and which features clips of contestants pitching Anthony "The Mooch" Scaramucci and other judges on things like "Ape Water": Bored Ape-branded pint cans of plain old water that cost $2.80 apiece.

This week we also saw the first high-budget celebrity crypto commercial in a while, reminiscent of Super Bowl 2022. Hopefully Idris Elba has a good legal team, given that Larry David, LeBron James, and other celebs are facing lawsuits over their promotional roles.28

It's summertime here in the great US of A, which means Texas is once again paying bitcoin miners not to mine bitcoin. If they would like to pay me millions of dollars, I will also happily not mine bitcoin. This has become an annual occurrence, though this year's extortion payment of almost $32 million was substantially higher than last year's [W3IGG] thanks to the August heatwave.29 This is good for bitcoin: the more energy bitcoin miners pointlessly burn, the more they contribute to climate change, which results in more heatwaves that cause energy providers to bribe them to stop mining so that people might not die.

The bankrupt Bittrex can't seem to convince customers to file claims for the money they're owed — to such an extreme degree that they may well end up in profit. CoinDesk wrote in their headline that it was "surprising" that few customers of the exchange once known for its very lax anti-money laundering program want to submit identification documents in order to recoup their funds.30 Is it?

Golden, which was supposed to be web3's way to "fix" Wikipedia by adding crypto incentives for editing, no longer gives crypto incentives. They've done a hard pivot to AI, and ditched their previous claims that crypto incentives were crucial to creating the knowledge base they envisioned. Neither crypto-incentivized humans nor AI have thus far managed to write articles on Golden describing even the most basic subjects like "woman" or "carrot", but somehow the a16z-backed company has spent $60 million doing it. It will, however, prominently suggest you consider taking ivermectin to treat COVID. (Twitter thread)

Have you heard the story of the guy in Wales who threw away a hard drive that held the keys to his some 8,000 bitcoins ten years ago, and who has been badgering town officials to let him sift through the landfill ever since? Well, now he's threatening to bankrupt the local council, who have repeatedly told him that it would be environmentally disastrousb for him to excavate the landfill in search of a hard drive that may not even be there, or quite possibly wouldn't be recoverable after spending a decade in a garbage heap. The bitcoins on the drive would be priced at around $214 million today, but he's seeking damages of over $550 million — the highest historical valuation of those tokens.31

I'm sure you'll be shocked to hear that that NFT-holders-only restaurant planned for Salesforce Park in San Francisco [W3IGG] didn't pan out.32 Shame.

The Web3 is Going Just Great recap

There were 31 entries between August 31 and September 17, averaging 1.7 entries per day. $193.13 million was added to the grift counter.

Lazarus strikes twice

The bulk of this week's whopping grift counter amount can be attributed to North Korean state-sponsored hacking group Lazarus, who pilfered more than $40 million from the Stake crypto casino, then struck again a week later with a $70 million theft from the CoinEx exchange.

Lazarus has been blamed for almost $300 million in crypto thefts in just the past few months, after also being linked to the June Atomic Wallet hacks [W3IGG] and a theft from CoinsPaid in July [W3IGG].

A Fortress built out of damp cardboard

[link]

Remember in the last newsletter, when I wrote:

In finance, custodians have a one job: hold on to the assets.

Want to guess what happened? Not only that, it was the same guys.

Scott Purcell started Prime Trust, which notably went bankrupt last month after losing at least $75 million in customer funds. Back in 2021, Prime Trust raised more than $68 million in Series A funding, allocating a whopping $34 million of it to executives and shareholders like Purcell. At some point in 2021, Purcell left to form Fortress Trust. The following year, Prime Trust subsidiary Banq filed a lawsuit against Purcell and Fortress, alleging that he was only able to create the company because he stole everything from trade secrets to employees to the entire computer system that contained R&D documents and other proprietary information. The year after that, Banq filed for bankruptcy. A month later, its parent Prime Trust was shut down by regulators and then went bankrupt itself.

Despite that checkered history, prominent crypto companies like Swan Bitcoin still decided that Fortress Trust, of all places, would be a swell custodian.

Anyway, I was shocked, just shocked, that Fortress announced that they'd been hacked, then lied that no customer funds were stolen, and then were rapidly acquired by Ripple, who then exposed Fortress's lie when they reassured the public that Ripple would backstop the unspecified amount of customer losses that supposedly never happened. The biggest surprise to me is that they're now saying the loss was only $15 million.33 They say it's all the fault of an unnamed third-party company, later revealed to be Retool, which in turn is blaming Google.34

JPEX hurtles toward collapse

[link]

"We believe that the platform will not collapse," wrote Hong Kong-based JPEX in a blog post several days into the platform's apparent collapse. After the Hong Kong Securities and Futures Commission issued a warning on September 13 to consumers about the exchange, which was heavily advertising to retail consumers without a license, or even an application for a license, things seemed to rapidly fall apart.

The following day, attendees of the Token 2049 crypto event noticed that JPEX employees had completely abandoned a booth they'd rented. Shortly after that, JPEX limited customer withdrawals to a mere US$1,000 — but charged fees as high as $999 to those who wanted to begin removing their money. South China Morning Post reported on September 16 that at least 83 complaints had been filed regarding the exchange, relating to around US$4.3 million in assets.35 JPEX halted multiple services they offered, issuing lengthy announcements that blamed regulators for "unfair" treatment and their partnered market makers for "maliciously" freezing funds. On September 18, the SCMP reported that police had arrested six people in connection to an investigation of the JPEX exchange, including two crypto influencers.36

By the 18th, the police reported they had received 1,408 complaints involving HK$1 billion (~US$128 million) in assets. JPEX had claimed to have $2 billion in "global assets and technology under its management" in February 2023.37

OneCoin scammer sentenced to 20 years

[link]

Karl Sebastian Greenwood, one of the co-founders of the infamous OneCoin ponzi scheme, has been sentenced to 20 years in prison after pleading guilty to a fraud which used the allure of cryptocurrency — if not the actual technology — to steal around $4 billion from at least 3.5 million victims. He will also forfeit $300 million, much of which he spent on real estate, luxury vacations, and a yacht.

His other co-founder, Ruja Ignatova, has been dubbed the "Cryptoqueen". She's been on the run for years, and in May 2022 was added to Interpol's most wanted list [W3IGG].

Prosecutors asked for a 30-year sentence — half the guideline — outlining how OneCoin was Greenwood and Ignatova's second fraudulent scheme. "Greenwood targeted the unbanked. Then in private he called them idiots," said Assistant US Attorney Nick Folly. Judge Edgardo Ramos eventually imposed a 20-year sentence, explaining: "He took everything from victims who could not afford to lose money."38

I wonder if the news of Greenwood's sentencing has made it to Sam Bankman-Fried yet. Greenwood at least made out better than Faruk Fatih Özer, who was sentenced earlier this month in Turkey to 11,196 years in prison over his $2 billion crypto exit scam [W3IGG].

Everything else

- PolkaWorld halts operations, blames community governance [link]

- Killer Whales crypto reality show launches about two years too late [link]

- Ethereum bungles "Holesky" testnet launch [link]

- Nouns DAO fractures in $27 million split [link]

- NFL quarterback Trevor Lawrence, others settle FTX class action claims [link]

- Remitano hacked for $2.7 million [link]

- Crypto booster Mark Cuban hacked for $870,000 [link]

- Genesis closes trading entirely [link]

- SEC charges Mila Kunis-backed Stoner Cats NFT project [link]

- Binance.US CEO Brian Shroder bails as the company cuts 1/3 of its employees [link]

- Developer steals $1 million from the group behind Milady NFTs [link]

- Banana Gun bot launches token, sparks rug pull fears as they disclose a bug [link]

- Paxos pays $500,000 fee to send $1,865 [link]

- Vitalik Buterin's Twitter account hacked to promote crypto scam [link]

- NFT startup Glass shuts down a year after raising $5 million [link]

- Founder of the Thodex crypto exchange sentenced to 11,196 years in prison [link]

- CFTC goes after three defi projects [link]

- Fourth FTX exec pleads guilty, agrees to forfeit $1.5 billion [link]

- Victim loses around $24 million in phishing scam [link]

- High-profile streamers bail on MrBeast-promoted Creator League after learning there are blockchains involved [link]

- Stolen LastPass vaults possibly cracked to enable crypto thefts [link]

- GMBL.COMPUTER crypto casino exploited hours after launch [link]

- MetaMask phishing scammers hijack government websites [link]

- Genesis to close U.S. spot trading business [link]

- Nima Capital accused of rug pull [link]

- Gala Games co-founders sue each other over claimed hundreds of millions in losses [link]

Worth a read

I was shocked and saddened to hear that David Golumbia passed away on September 14. I read The Politics of Bitcoin relatively early into my journey into learning about the cryptocurrency world, and it's a crucial history of some of the early days and ideologies that have led to the crypto culture we find ourselves stuck with today. I strongly recommend it. His final book, Cyberlibertarianism, will be published posthumously.

You can also read tributes to David that reveal just how influential he was to so many of us, such as these ones published by David Gerard or Paris Marx.

That's all for now, folks. Until next time,

– Molly White

Additional image credits:

- Social image: Jules Verne Times Two (CC BY-SA 4.0) via Wikimedia Commons.

- Joseph Bankman: via The New York Times

- Barbara Fried: via The New York Post

Footnotes

References

Jury selection was originally scheduled for October 2, but was delayed by one day. Order filed September 13, 2023. Document #279 in United States v. Bankman-Fried. ↩

Proposed Voir Dire Questions by Samuel Bankman-Fried filed on September 11, 2023. Document #273 in United States v. Bankman-Fried. ↩

Letter filed on September 15, 2023. Document #282 in United States v. Bankman-Fried. ↩

Memorandum endorsement filed on September 12, 2023. Document #278 in United States v. Bankman-Fried. ↩

Adding to the diary entries written by Caroline Ellison, which Sam Bankman-Fried leaked to the Times in July in a stunt that ultimately saw him sent back to pre-trial detention. ↩

Superseding information filed September 7, 2023. Document #262 in United States v. Bankman-Fried. ↩

Consent Preliminary Order of Forfeiture as to Substitute Assets/Money Judgment filed on September 7, 2023. Document #268 in United States v. Bankman-Fried. ↩

Adversary case filed on September 18, 2023. Document #2642 in In re: FTX Trading Ltd. ↩

"The Parents in the Middle of FTX's Collapse", The New York Times. ↩

Schedules/statements filed on July 31, 2023. Document #2003 in In re: FTX Trading Ltd. ↩

Memorandum in Opposition by USA filed on September 11, 2023. Document #272 in United States v. Sam Bankman-Fried. ↩

SEC Memorandum in Support of Its Motion To Compel filed on September 14, 2023. Document #110-9 in SEC v. Binance. ↩

"Binance.US Not Playing Ball With Probe, SEC Says, as Focus Turns to Custody Arm Ceffu", CoinDesk. ↩

Reply to Opposition to Motion filed on September 18, 2023. Document #113 in SEC v. Binance. ↩

"SEC Fails to Win Immediate Inspection of Binance US Software", Bloomberg. ↩

"'I Just Want to Keep Things Moving': Judge Makes No Ruling in SEC-Binance Document Dispute", CoinDesk. ↩

Exhibit A-81 filed on June 6, 2023. Document #20-1 in SEC v. Binance. ↩

"Binance.US Legal, Risk Executives Leave the Crypto Exchange", The Wall Street Journal. ↩

"Binance global head of product Mayur Kamat resigns", Reuters. ↩

"Binance exec exodus continues as Russia leadership quits", Protos. ↩

Statement filed on September 15, 2023. Document #704 in In re: Genesis Global Holdco, LLC. ↩

"Ex-Celsius crypto lender exec Cohen-Pavon pleads guilty, will cooperate with US probe", Reuters. ↩

Adversary complaint: Celsius Network Limited v. Equities First Holdings, LLC filed on September 6, 2023. Document #3425 in In re: Celsius Network LLC. ↩

Examiner's report filed on January 31, 2023. Document #1956 in In re: Celsius Network LLC. ↩

"Texas Paid Riot Platforms $31.7M to Slash Bitcoin Mining in August Heatwave", Decrypt. ↩

"Surprisingly Few U.S. Customers Want Their Bittrex Money Back", CoinDesk. ↩

"Bitcoin investor who lost £164m in landfill to sue local council", The Telegraph. ↩

"Looks Like San Francisco Isn't Getting a Fancy NFT Restaurant After All", Eater San Francisco. ↩

"Phishing Attack on Cloud Provider With Fortune 500 Clients Led to $15M Crypto Theft From Fortress Trust", CoinDesk. ↩

"Retool Falls Victim to SMS-Based Phishing Attack Affecting 27 Cloud Clients", The Hacker News. ↩

"JPEX cryptocurrency exchange named in 83 complaints to Hong Kong police over virtual assets worth HK$34 million", South China Morning Post. ↩

"Hong Kong arrests 6 people in fraud probes linked to halted cryptocurrency platform JPEX, in a case that may 'involve HK$1 billion in assets'", South China Morning Post. ↩

"Six Arrested In Hong Kong Probe Of JPEX Crypto Exchange", Barron's. ↩

Tweet thread (archive) by Inner City Press. ↩