Issue 40 – Extorted for my lambo

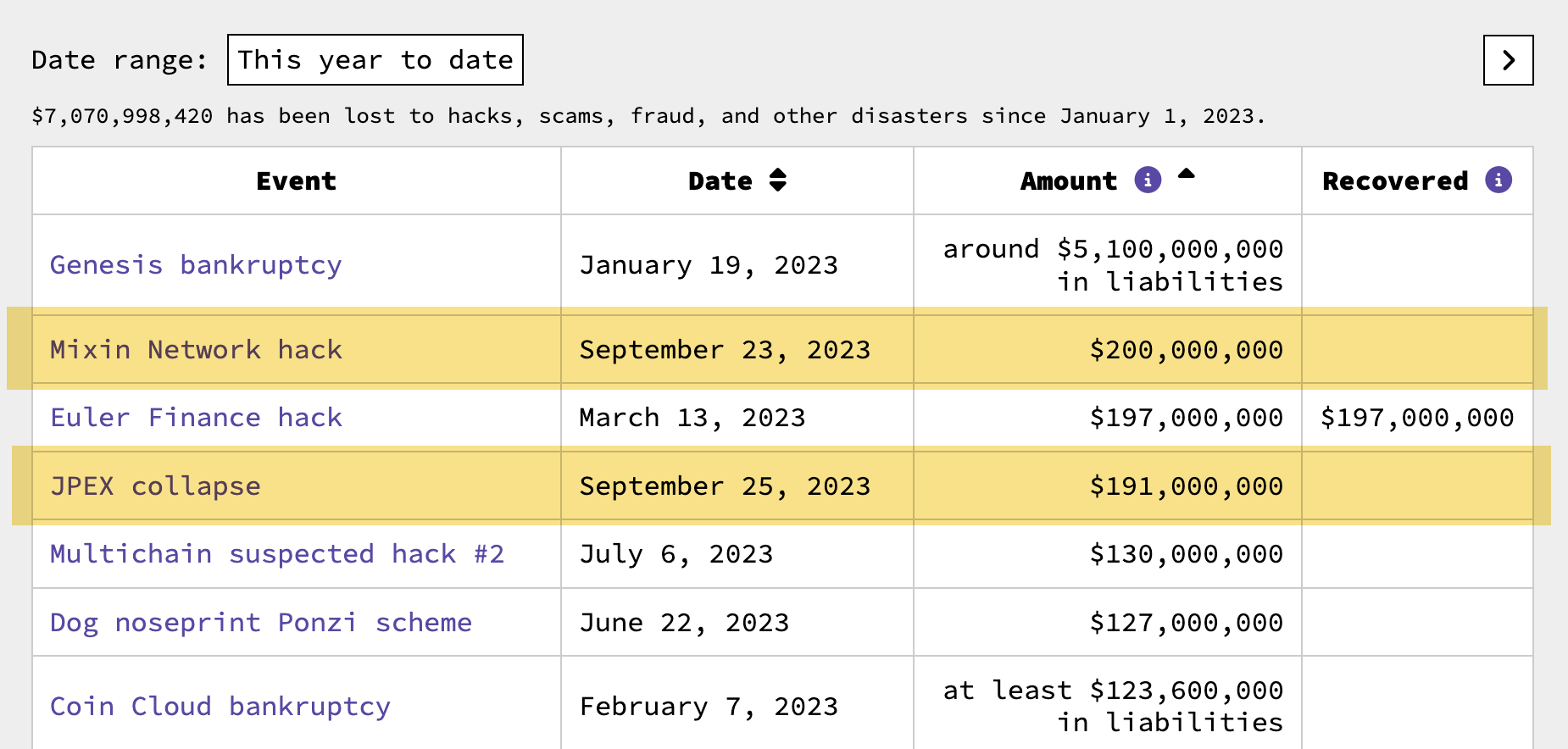

And they say crypto is dead: two $200 million disasters in a single week may be a new record.

The dollar-amount-per-disaster ratio is high this week, with two incidents torching a combined $391 million in assets. We're back, baby!

In the courts

FTX

Sam Bankman-Fried — once again — wants out of jail.

To recap, in a decision issued on September 21, the Second Circuit Court of Appeals upheld the August 11 decision by Judge Kaplan to remand SBF to jail, finding that Kaplan had "thoroughly considered all the relevant factors" and had not erred.1 On September 12, Judge Kaplan also denied a newer request that SBF be released, but instructed his attorneys that they could file another application for release "on a more factually grounded and persuasive showing".2

His team is indeed trying again, now arguing that SBF should be released under strict conditions for the duration of the trial. They're concerned that MDC's limited visiting hours will prevent him from meeting with his attorneys after each day of trial to review the day's events and prepare for the next day, and so have suggested he be allowed to spend the duration of trial either in the courtroom, with his attorneys, or under the supervision of a babysitter security guard in a temporary residence in New York City. They've also suggested a few other conditions, including a gag order that would prevent SBF from speaking to anyone besides his attorneys, parents, and brother. They threaten that they might use the judge's refusal of such a request as basis for an appeal.3 The trial starts next week.

Meanwhile, all seven expert witnesses proposed by SBF and his team have been rejected by Judge Kaplan after objections from the justice department. Some could still appear at trial if they provide proper disclosures, which were lacking in the original applications. However, others have been denied outright. One, who intended to argue that FTX was innovative and successful, and that its "operational problems were, in fact, predictable" and "quite common to providers offering new financial products", was denied particularly harshly, with Judge Kaplan writing that "The Court harbors serious doubts regarding [his] qualifications as an expert in the subject matter of his proffered testimony," though adding that that was not why he was disqualified. The government's one proposed expert witness, an accounting professor, will be allowed.4

In bankruptcies

FTX

SBF's parents, Joseph Bankman and Barbara Fried, have denied the allegations of unjust enrichment that have been leveled against them by the FTX bankruptcy estate. "This is a dangerous attempt to intimidate Joe and Barbara and undermine the jury process just days before their child's trial begins," said their lawyers, who issued a joint statement describing the allegations as "completely false" and echoing some of SBF's claims that all this pesky litigation is just a waste of the bankrupt estate's funds.5 A (rather sympathetic) article (archive) published in the New Yorker mentions that Bankman and Fried earlier this year hired a "high-powered P.R. consultant" to help them spread the narrative that the press has unfairly assumed SBF to be guilty, and has not put enough scrutiny into the government's case against him, or FTX's lawyers' alleged role in FTX's collapse. New York Magazine had previously described Risa Heller, said consultant, as "the crisis-communications warrior of choice for the city's most cancellable elites", and outlined her role in helping patch up the public reputations of men accused of sexual misconduct including Anthony Weiner, Mario Batali, Arcade Fire singer Win Butler, and Jeffrey Toobin. Given the rather friendly tone of the New Yorker piece, she seems to be earning her salary from the Bankman-Fried family too.

Meanwhile, Stanford University has opted to return the more than $5.5 million donated by FTX and the Bankman-Fried family, which they say all went towards "pandemic-related prevention and research".6

SBF's parents aren't the only ones being pursued by the FTX estate. On September 21, the company also filed a lawsuit against several former employees of an FTX company based in Hong Kong, hoping to recover $157.3 million.7 The company alleges that these employees used their connections to other FTX employees to prioritize withdrawing their assets, and those belonging to their families, from the exchange ahead of other customers as it collapsed.

Celsius

Celsius creditors have overwhelmingly supported a recovery plan that would see them recover 67–85% of their assets, if approved. The plan involves reorganizing the company into an entity that will stake Ethereum, mine Bitcoin, and perform various other crypto services. Creditors will receive stake in this company. The plan still needs to be approved by the bankruptcy court before it can move forward.8

One additional hurdle will be that the SEC has objected to Coinbase's proposed role in the bankruptcy.9 Celsius has suggested using Coinbase to handle returning crypto assets to customers, but the SEC asserts that they have not been given access to a sealed agreement between the companies. According to the SEC, the proposal goes "far beyond the services of a distribution agent, contemplating brokerage services and master trading services".

TechCrunch founder Michael Arrington had been on the board of "NewCo", the placeholder name for the company that will be formed if the reorganization plan goes through. However, he left the board on September 24 with a cryptic tweet, writing that "I am not able to go into much detail on why I requested this change, but that information will come out in due time. This statement was heavily edited by attorneys. I disagree with some of the decisions made around board constitution and, in particular, the board observers." He was replaced by Ravi Kaza, an investor and advisor in his Arrington Capital business.10

In other crypto news

JPEX collapse

Hong Kong police are now describing the collapse of the JPEX exchange as an apparent fraud involving more than $190 million in possible losses (and counting) [W3IGG]. They've arrested twelve people, including several YouTube influencers, though they've stated that the alleged ringleaders of the fraud are not among those arrested, and are apparently on the run.

Reacting to the incident, Hong Kong's Securities and Futures Commission have decided that they will publish a list of companies that have applied for crypto exchange licenses. They will also publish a list of suspicious virtual asset trading platforms (VATPs) in hopes of warning the public.11

BitBoy meltdown

You might remember crypto influencer Ben "BitBoy" Armstrong from two issues ago, when I wrote that his messy public ouster from his "BitBoy Crypto" business might just be a publicity stunt.

What probably wasn't just a publicity stunt was him getting arrested while streaming live, after showing up at the house of his former associate and screaming in the street about how he had been extorted for his lambo and about how the Houston Mafia has tried to have him killed, with both his mistress and a gun in the backseat of his truck. Armstrong is somehow already out on bail, and tweeting at great length about how his former business partners wanted to break up the affair between him and Cassie Wolfe, who also happens to be his co-founder and COO.

Yikes.

The Web3 is Going Just Great recap

There were seven entries between September 18 and 26, averaging 0.9 entries per day. $403.7 million was added to the grift counter.

"Decentralized" Mixin project hacked for $200 million

[link]

Contributing to the massive grift counter number this week was the hack of the Mixin Network, a Hong Kong-based "decentralized" cross-chain network for zero-fee transfers. The group wrote on Twitter that $200 million had been stolen after "the database of Mixin Network's cloud service provider was attacked by hackers". This led to a lot of questions from community members, who questioned how or why a supposedly decentralized network had a single cloud service database that was apparently vulnerable to attack. It seems likely that Mixin was storing private keys on a cloud server, which was then compromised and used to transfer the assets.

This $200 million theft is the largest this year so far, just squeaking by the $197 million Euler Finance theft in March (though the Euler funds were ultimately returned).

Mixin has said they will return 50% of assets to affected users, with the remainder to be reimbursed via "tokenized liability claims" against future profits — i.e., IOUs.

Huobi — er, HTX — hacked

[link]

If there can be a bright side to your exchange being hacked, it would be if it happened in the same few days as another exchange collapsed, and another crypto project was hacked for 25x as much. Justin Sun lucked out in that sense, because he's been able to downplay the $8 million Huobi hack amidst the massive Mixin theft and JPEX collapse.

This disclosure is also how I and many others are finding out that Justin Sun decided a few days ago to rebrand Huobi to "HTX", which he says stands for Huobi, Tron, eXchange. He's shocked — just shocked! — that anyone would think the name sounds a lot like FTX.

Everything else

- Chase UK to block payments for crypto [link]

- JPEX appears to be a $191 million fraud [link]

- Upbit briefly suspends Aptos transactions after people were able to deposit counterfeit tokens [link]

- Wallet phished for $4.46 million in fake mining scam [link]

- Balancer frontend compromised [link]

Worth a read

Brian Merchant's book Blood in the Machine: The Origins of the Rebellion Against Big Tech published today, and you should read it. In his history of the Luddites that goes far beyond the "technology bad!" stereotypes we're used to seeing in popular culture, Merchant draws parallels to modern technology criticism and pushback against Big Tech. I was lucky enough to score an advance copy, and it's a great read.

Some of my colleagues at the Library Innovation Lab did a little digging after the reports that an Iowa school district used ChatGPT to decide which books to ban from school libraries. Their proposed "AI Librarianship" model is an intriguing way to think about AI guardrails.

That's all for now, folks. Until next time,

– Molly White

References

US v. Bankman-Fried, United States Court of Appeals for the Second Circuit. ↩

Memorandum endorsement filed on September 12, 2023. Document #278 in United States v. Bankman-Fried. ↩

Letter motion filed September 25, 2023. Document #288 in United States v. Bankman-Fried. ↩

Order filed on September 21, 2023. Document #287 in United States v. Bankman-Fried. ↩

"FTX sues founder Bankman-Fried's parents", Reuters. ↩

"Stanford University says it will return all gifts from bankrupt crypto exchange FTX", CNN. ↩

Adversary complaint filed on September 21, 2023. Document #2654 in In re: FTX. ↩

"Celsius Network Creditors Approve $2B Restructuring Plan", Decrypt. ↩

Objection, Confirmation of Plan filed on September 22, 2023. Document #3522 in In re: Celsius Network, LLC. ↩

Press release by the Securities and Futures Commission. ↩