Issue 43 – Laser eyes

Two crypto firms emerge from bankruptcy, and a Bored Ape party turns out even worse than it sounds.

The (firsta) trial of Sam Bankman-Fried is over, and I have been reunited with my beloved pets. My pup Atlas was so excited to have me home that I'm pretty sure he levitated. My cats might have noticed I was gone.

Although crypto and mainstream media alike (not to mention this newsletter) were dominated by coverage of the trial, happenings continued to happen in the rest of the crypto world. Let's catch up on what we missed.

But first, there have been a few changes around here:

It's November, which means my year-long fellowship with Harvard's Library Innovation Lab has wrapped up. It was a wonderful experience and I'm so grateful to have had their support for the past year. Now it's time for me to set out on my own, to see if I can maybe make this work, focusing full-time on this without additional funding.

This is a little terrifying, but mostly incredibly exciting. I have a bunch of ideas rattling around in my head, including trying to do more audio or video, since the post voiceovers and trial livestreams have been really well received. Stay tuned, and if you have any ideas of your own for things you'd like to see, please send them my way! (Comment section, email reply, whatever!)

By the way, you might have noticed a branding change to the newsletter, which has finallyb landed on a name: Citation Needed. For those of you not already aware, I've been an active Wikipedia editor for going on two decades (!) and more than 100,000 edits (!!) now. The Wikimedia movement has dramatically shaped my approach to research, writing,c and technology. Citation Needed felt like a good homage to that, and it encapsulates well my fondness compulsion to dig into claims and separate fact from fiction.

![[A man with dark flat hair is standing at a podium. He is speaking to a crowd while standing behind a lectern. The lectern has a microphone on the top and sports an American flag in color on the side. He holds an arm on the lectern and the other arm is held up in front of him with a finger pointing upwards. There are four red stars on the side of the podium below him and behind him something that could be high curtains. There is an empty gap between the podium and the first people in the crowd followed by a stick with a red top, which indicates a fence to keep the crowd at a distance from the podium. After the fence there is a large crowd of people listening, most of them only partly drawn, only a few has hair. Three signs can be seen above the heads of the crowd, but they are all empty white signs. Except in the middle of the crowd, where Cueball has been raised above the rest of the crowd. He is holding a large sign up over his head in both hands. The sign has a blue text in black square brackets:] [Citation needed]](https://www.citationneeded.news/content/images/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https-3a-2f-2fsubstack-post-media.s3.amazonaws.com-2fpublic-2fimages-2f953a8942-1201-4e0a-bfec-cc34096fe71d_500x271.jpg)

I think the newsletter will probably remain at newsletter.mollywhite.net, partly because I'm terrified that changing the domain might break something and ruin everyone's bookmarks, but citationneeded.mollywhite.net and citationneeded.news will get you here now too.

First, a birds-eye view: Crypto prices have been up, particularly over the last month or so. This is great news for people who hold crypto, but it's also great news for those who want to draw new people in with the same old get-rich-quick promises. "Prices will never be this low again! Look, they're already starting to go up, you better buy now!"

Along with price, euphoria has been climbing as well. I've yet to see someone unironically say "have fun staying poor", but if the trend continues I suspect it isn't far away. If history is any guide, along with price increases and exuberance in the crypto world comes an influx of FOMO, hypemen, and — of course — scammers. A defi project is already promising its users 70% annual yields. "Memories are proving to be extremely short in the crypto world," writes Bloomberg.1 This is bullish for W3IGG, I suppose.

In bankruptcies

FTX

As FTX's founder has been on the witness stand, the leadership team installed to replace him has been focused on the bankruptcy. They've been speaking optimistically, suggesting that FTX customers are likely to see a majority of their assets returned to them — something that is not so likely in some of the other ongoing crypto bankruptcies. Recently they've been busy accumulating funds by selling or seeking approval to sell cryptocurrencies2 and trust assets.3

Meanwhile, some have gotten extremely excited on rumors of a possible FTX exchange reboot as three crypto firms have been vying to acquire what remains of the company, and as SEC Chair Gary Gensler gave a rather tepid comment4 in an interview that seems to have been interpreted as a ringing endorsement of the idea. It's not entirely clear to me why people are excited about this, given that the FTX bankruptcy team has just spent a year talking about how the exchange was a pile of hot garbage led by incompetent fraudsters.

Over in the Third Circuit, the US Trustee has been continuing to argue that FTX needs an independent investigator in the bankruptcy case. The Trustee first requested this shortly after FTX's collapse [I12], but was shot down in February when Judge Dorsey agreed with the FTX bankruptcy team that it would be too costly (likely to the tune of more than $100 million).5 The Trustee is continuing to argue — now in appeal — that the bankruptcy court is required to appoint an independent examiner because of the total amount of debts involved in the case.6 In an interesting development, a group of nine law professors have filed an amicus brief agreeing with the Trustee, and also arguing that "there are serious questions about the independence … of Debtors' counsel" and the ability of the debtors to effectively investigate themselves. They've cited concerns that lawyers for the debtors also represented FTX and Sam Bankman-Fried prior to the company's collapse, and even suggested that one of the legal firms, Sullivan & Cromwell, may have advised the debtors to cooperate extensively with criminal prosecutors in Bankman-Fried's trial "to deflect attention from its prebankruptcy role with the Debtors". Spicy! The professors argue that there has been "extraordinary secrecy" surrounding the case, with "such basic items as lists of the Debtors' creditors and parties in interest, who the Debtors will indemnify, orders appointing 'ordinary course' professionals, and who or what the Debtors are investigating" filed under seal or with redactions.7 A hearing on the matter was held on November 8, but the court has not yet reached a decision.

This probably shouldn't surprise anyone, but the debtor team has been complying with FBI subpoenas.8

Celsius

The Celsius bankruptcy case is over. On September 25, creditors overwhelmingly voted to approve a plan to distribute some cryptocurrency assets to creditors, restart the Celsius company, and allocate equity in the new company to creditors. On November 9, the bankruptcy judge confirmed the plan.d Now it's up to the SEC to sign off on it, which it may well not do.

According to the plan, most remaining cryptocurrency assets — amounting to around $2 billion — will be distributed to the roughly 600,000 people whose assets have been frozen since the company halted withdrawals over a year ago [W3IGG]. The new company, just called "NewCo", will continue Celsius' Bitcoin mining and staking ambitions. This seems like a pretty risky gambit to me, given the limited profitability of Bitcoin mining (especially as another Bitcoin halvinge looms) and the questionable legality of staking services according to the SEC.

The bankruptcy plan has been estimated to achieve Celsius' Earn customers a roughly 67% recovery, though this is dependent on the success of the new company and on the success of litigation said company intends to pursue against founder Alex Mashinsky, who is also facing criminal and civil cases.9

BlockFi

Also exiting bankruptcy proceedings is BlockFi, who is still in the process of trying to recover assets from FTX and Three Arrows Capital, but who has begun paying out custodial customers.

BlockFi wrote in a press release that "We are proud to say that BlockFi reached its Effective Date more quickly and efficiently than many other retail crypto companies," which… I guess is a bragworthy achievement? I mean, you still went bankrupt, will be winding down, and are estimating recoveries for Earn customers could be as low as 40% of their assets.10

In the courts

Avraham Eisenberg and Mango Markets

Avi Eisenberg, the guy who allegedly stole $116 million from Mango Markets and then bragged about it online [W3IGG, I15], was set to stand trial in his criminal case in December. However, after a complaint11 from his defense team that Eisenberg's recent (and unexpected) move from his New Jersey jail to MDC Brooklynf has been interfering with their ability to prepare, the trial has been rescheduled to April 2024.12 The case is being overseen by Judge Arun Subramanian.

This case should be an interesting one to watch, because it involves Eisenberg allegedly manipulating futures markets for the MNGO token to wipe out all liquidity on the protocol. Unlike Bankman-Fried's trial, in which prosecutors mostly avoided explaining complex cryptocurrency concepts to the jury by focusing on the plain old fraud, it seems prosecutors may really have to get into the crypto weeds with this one.

Yuga Labs and Ryder Ripps

[W3IGG]

Bored Apes creators Yuga Labs have prevailed in their trademark infringement lawsuit [I25] against artist Ryder Ripps and co-defendant Jeremy Cahen. Ripps will have to pay almost $1.6 million in disgorgement and damages for copying the Bored Ape NFTs, in what he tried to argue was an art project aimed at drawing attention to the racist imagery and allusions used throughout the Bored Apes illustrations.

Because Ripps and Cahen were found by the judge to have been "obstructive and evasive throughout their depositions and during their trial testimony," and "unnecessarily and inappropriately made disgraceful and slanderous statements about Yuga, its founders, and its counsel during litigation, including calling Yuga's counsel 'criminals' who support 'racism, antisemitism, beastiality, pedophilia' and accusing them of 'using cartoons to market drugs to young children'", they were also ordered to pay Yuga's reasonable attorneys' fees. Yuga and Ripps have been ordered to agree on fees once before — when Ripps was ordered to pay some during an earlier decision, and Yuga argued "reasonable" was $223,000 while Ripps argued it was $26,400 — so we'll see how well that all goes.

Gemini and Genesis

The war between Gemini and Genesis rages on, and the latest skirmish is a lawsuit by the former against the latter, seeking to wrest control of 62 million shares of Grayscale Bitcoin Trust (currently priced at ~$1.6 billion). At least according to Gemini, Genesis had pledged the GBTC shares as collateral for the Gemini Earn customer funds they were borrowing from Gemini. Needless to say, the bankrupt Genesis disputes that these belong to Gemini.

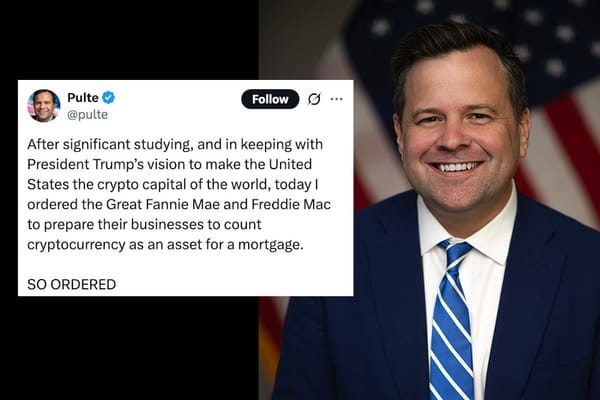

In ETFs

Part of the recent Bitcoin price surge may be attributable to a "window" that some have speculated might invite the SEC approval of Bitcoin ETFs. Many in the crypto world seem to believe it's a foregone conclusion that Bitcoin spot ETFs will be approved, and it's just a question of when. They have latched on to an observation by Bloomberg analysts who noted that if the SEC wanted to approve all twelve spot ETFs at once, as some think would be fairest, they could do so during an eight-day window between deadlines.13

Also, BlackRock is hoping to launch a spot Ethereum ETF. They're now adding to around five other contenders in that particular space.14

In Binance

It's come out that they lost another exec, their head of UK operations, but that's hardly a surprise by now.

What is a surprise is that two of the most pro-crypto Congresspeople out there — Senator Cynthia Lummis (R-WY) and Representative French Hill (R-AR) — are now urging the DOJ to hurry it up and charge Binance and Tether. Evidently, the same Wall Street Journal article about crypto-denominated terrorist financing by Hamas and others that sparked an Angry Letter by Elizabeth Warren also raised concern in Lummis and Hill.

Lummis and Hill also wrote of concerns over the Journal's article's accuracy, which I described last week [I42]. The Journal has since issued a "correction and amplification" to clarify the research they were citing. In fairness to the Journal, much of the error seems to have come from Warren's letter, which overstated the numbers in a way the Journal had not by claiming that Hamas and Palestinian Islamic Jihad had "raised over $130 million in crypto".

The Web3 is Going Just Great recap

There were 10 entries between October 23 and November 8, averaging 0.6 entries per day.g $304.84 million was added to the grift counter.

Himachal Pradesh crypto scam

[link]

Almost all of the grift counter jump this week can be attributed to a massive cryptocurrency scam operating out of Himachal Pradesh, the northernmost state in India. Around 100,000 people fell victim to a scam that particularly targeted police and government officials, some of whom in turn became promoters of the scheme and lent it legitimacy. Altogether, the scam pulled in around ₹2500 crore ($300 million). It's not clear entirely when the scammers first began operating, but it could have been as far back as 2018.

Indian police have arrested eighteen people, including four members of police. The alleged ringleader, Subhash Sharma, is still on the run.

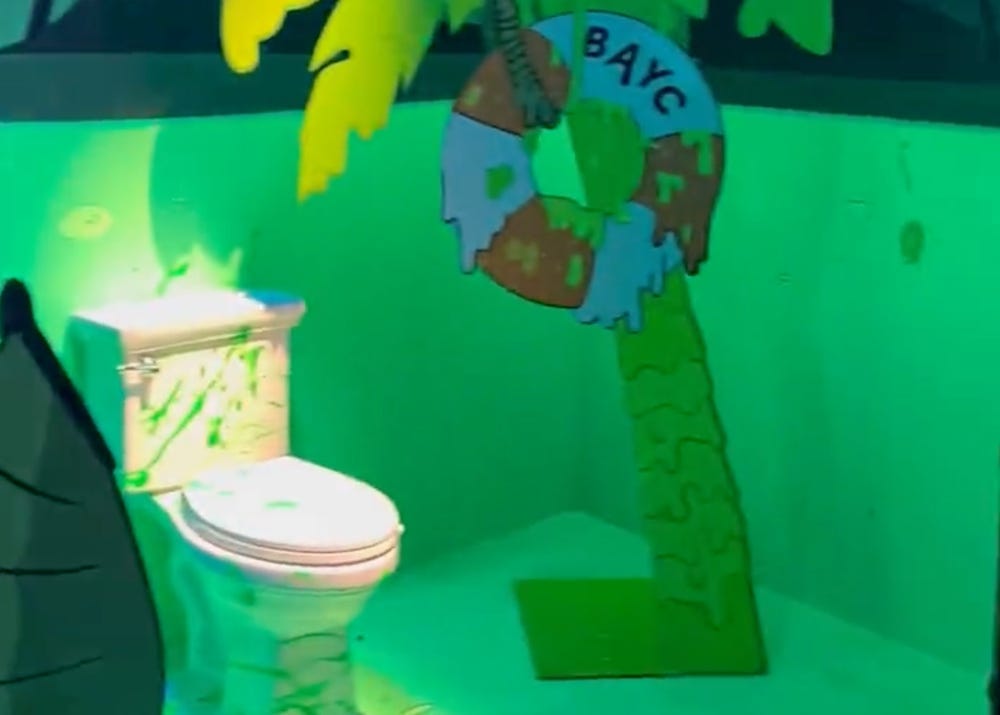

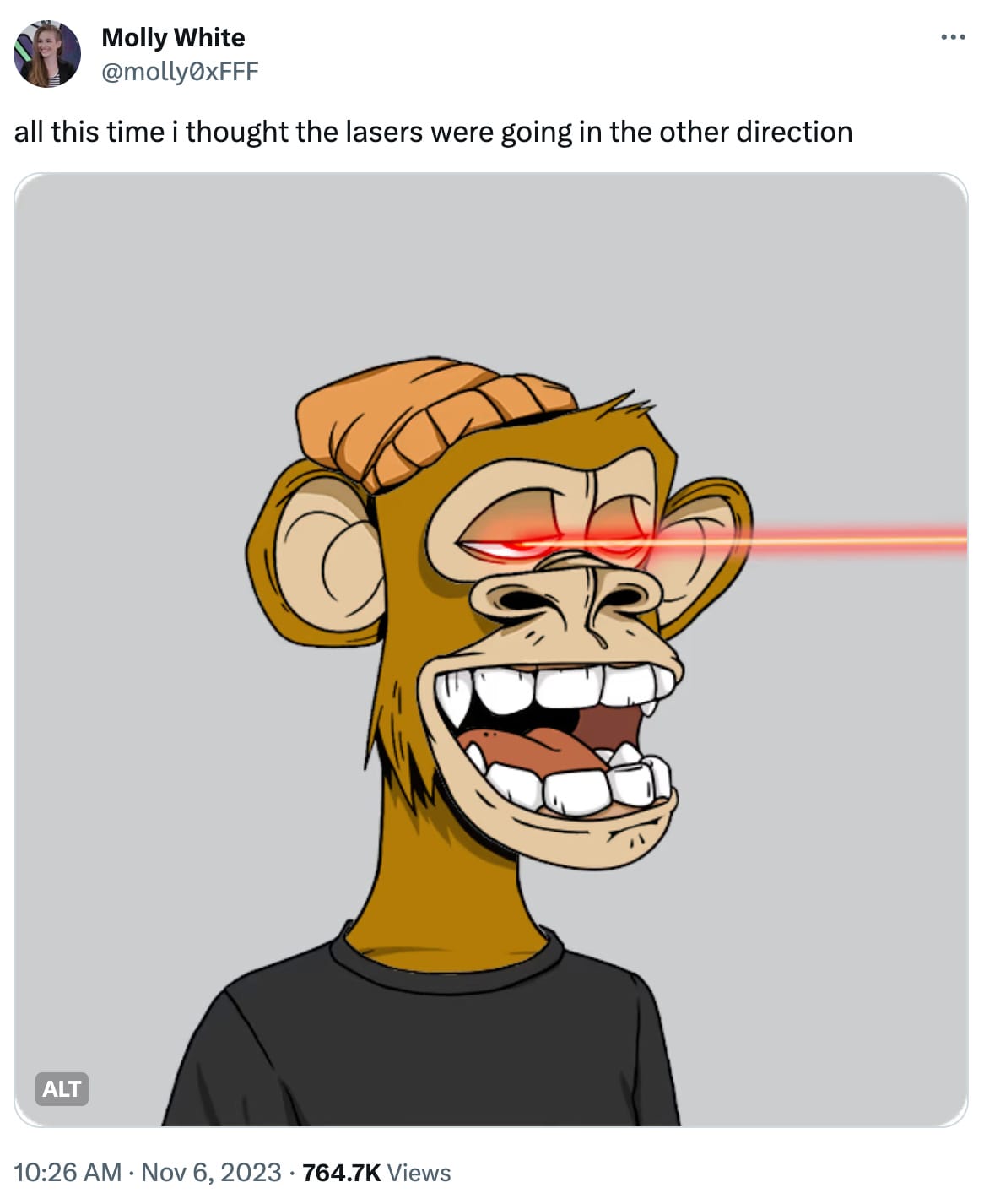

My eyes, they burn

[link]

After spending tens or hundreds of thousands on ugly ape pictures, plus travel tickets to ApeFest in Hong Kong, some members of the Bored Ape Yacht Club have been rewarded with… photokeratitis. The condition, better known as "snow blindness" or "welder's flash" when induced by those things, can be incredibly painful but is — fortunately — almost always temporary. This makes me feel better about all the "laser eyes" jokes I can't help but make.

Apparently an event contractor seeking to produce the optimal swamp/nuclear wasteland/public restroom ambiance decided to install blacklights, but either didn't notice or didn't care that they were of the germicidal rather than entertainment variety.

Reports quickly cropped up on Twitter of attendees who rushed to the hospital after experiencing searing eye pain. "Woke up at 3am with extreme pain and ended up in the ER," wrote one. "I woke up at 04:00 and couldn't see anymore. Had so much pain and my whole skin is burned. Needed to go to the hospital."

Yuga Labs eventually acknowledged the reports, but downplayed them by claiming that "much less than 1% of those attending and working the event had these symptoms". Eventually they reported that lights "installed in one corner of the event was likely the cause of the reported issues related to attendees' eyes and skin".

Better late than never

[link]

The Department of Justice has unsealed an indictment charging the three executives of the massive SafeMoon pump-and-dump with conspiracy to commit securities fraud, conspiracy to commit wire fraud, and money laundering conspiracy. Bolstered by B-list celebrity endorsements from the likes of Jake Paul, Nick Carter, Soulja Boy, and Lil Yachty, the token peaked shortly after its March 2021 launch before rapidly collapsing. Meanwhile, the executives siphoned funds they promised were inaccessible to them, which they used to buy luxury cars and real estate.

Everything else

- CoinSpot exchange exploited [link]

- Wintermute declares friendship over with Near Foundation and Aurora Labs after they refuse to send $11 million [link]

- MEV bot exploited for almost $2 million [link]

- Yuga Labs' social media lead resigns after racist and antisemitic tweets resurface [link]

- Sam Bankman-Fried convicted on seven charges [link]

- Monero discloses that its community crowdfunding wallet was drained [link]

- Ryder Ripps loses Bored Apes infringement lawsuit, ordered to pay $1.6 million and legal fees [link]

In the news

I went on NPR's Weekend Edition to do a brief interview on what FTX's collapse means for the cryptocurrency industry.

Cas and Bennett of Crypto Critics Corner did a series where they invited various people reporting on the Sam Bankman-Fried trial to come on their show and talk about it. It was a great series, and I was delighted to be a part of it!

I talked to Whizy Kim about how some of the chaos at FTX was hardly the anomaly many in the industry are trying to brush off, but rather "pretty normal stuff for the crypto world [where] things are often being run by the seat of someone's pants".

Worth a read

. "A Billion-Dollar Fraud In Plain Sight".

Ed Zitron continues his excellent writing about the "identical Water Brothers" and the shambolic situation over at Gemini and Genesis, in this case writing about the recent lawsuit from the New York Attorney General.

Some great investigative reporting about Cruise, the self-driving car division of General Motors. The organization unleashed its half-baked vehicles on the streets of San Francisco and elsewhere, but according to Biddle, the company knew they couldn't properly detect children — er, sorry, "small Vulnerable Road Users".

Palestinian poet Hiba Abu Nada wrote "I Grant You Refuge" ten days before she was killed by an Israeli airstrike on Gaza. Protean has published an English translation.

That's all for now, folks. Until next time,

– Molly White

Footnotes

Bankman-Fried is scheduled to be tried in March on five additional charges, including bank fraud and bribery of a foreign official. Prosecutors have until February 1 to tell Judge Kaplan if they intend to go forward with that trial. It's really anyone's guess if they will — on the one hand, they just achieved across-the-board convictions on seven major charges, Bankman-Fried is facing the likelihood of serious prison time, and a whole other trial would require substantial resources. On the other hand, the remaining charges are also serious, and prosecutors may want to throw the book at Bankman-Fried for its deterrent effect. ↩

Only a year+ and 89 posts after its launch… ↩

If the abundant footnotes hadn't already tipped you off. ↩

Order confirming Chapter 11 plan filed on November 9, 2023. Document #3972 in In re: Celsius Network LLC, Bankr. S.D.N.Y. ↩

"Bitcoin halving" is an event in which the mining rewards for Bitcoin are cut in half. These events occur every 210,000 blocks, or approximately every four years. The last halving was in May 2020, when miner rewards were reduced to 6.25 BTC per block. After the next halving, in approximately April 2024, miners will begin receiving only 3.125 BTC per block. ↩

Sam Bankman-Fried is also residing in MDC Brooklyn as he awaits sentencing. Let's hope the two are kept carefully separated… ↩

This is, again, likely going to change as I backfill items I inevitably missed during my whirlwind trip to the Bankman-Fried trial. ↩

References

"70% Crypto Yields Are Back With DeFi Becoming a Hot Spot for Leverage Again", Bloomberg. ↩

"FTX and Alameda Research wallets send $13.1M in crypto to exchanges overnight", CoinTelegraph. ↩

"FTX Wants to Sell $744M Worth of Grayscale, Bitwise Assets", CoinDesk. ↩

"Do it within the law," said Gensler to people thinking about trying to resuscitate FTX. "SEC Chair Gensler says rebooted FTX run by ex-NYSE chief is possible if done 'within the law'", CNBC. ↩

Transcript of February 15, 2023 hearing. Document #737 in In re: FTX Trading Ltd, US Bankr. D. Del. ↩

Reply brief for appellant filed on October 16, 2023. Document #52 in In re: FTX Trading, Ltd, 3d Cir. ↩

Amicus brief filed on September 8, 2023. Document #27 in In re: FTX Trading Ltd, 3d Cir. ↩

"FTX Bankruptcy Advisers Provided Customer Trading Data to FBI", Bloomberg. ↩

"Crypto lender Celsius sends bankruptcy plan to creditor vote", Reuters. ↩

"Crypto lender BlockFi begins post-bankruptcy wind-down", Reuters. ↩

Letter motion filed on November 2, 2023. Document #48 in US v. Eisenberg. ↩

Memo endorsement filed on November 6, 2023. Document #51 in US v. Eisenberg. ↩

"BTC Price Pushes Towards $36K Ahead of 2023's Last Approval Period for Bitcoin ETFs", CoinDesk. ↩

Tweet thread by James Seyffart. ↩