Issue 47 – Residual garbage

All my "absolute top tier apes" gone, anti-rug-pull rug pulls, and an update on this newsletter.

Wishing the happiest of holidays, solstice, and (impending) new year to all of you lovely folks! Here's hoping that none of you endured any Bitcoiners trying to follow Cointelegraph's advice on "orange-pilling" you over the holiday table.

My holiday was lovely, and I'm sure you'll all be happy to hear that Atlas was absolutely smothered in both gifts and affection.

Some of you may have already been made aware of Substack's incredibly disappointing reply to the "Substackers Against Nazis" open letter I signed and shared recently. The TL;DR was pretty much "we think our Nazis are actually quite good for our business and so we're keeping them, thankyouverymuch, and oh by the way it's the people who support deplatforming Nazis who are the real Nazis here."

It is Substack's right as a private company to decide who they do and do not want to platform, and they seem to have made a firm choice here.

It's also my right as a writer on their platform to decide that I don't particularly want to hang out at a Nazi bar (or perhaps at a Nazi-tolerant banquet hall), nor do I want the money I bring in for Substack to go towards hosting swastika-emblazoned newsletters spreading racist and hateful garbage. When I decided to begin writing here, I was optimistic that Substack had learned from its past failures when it came to who was invited to the platform and who was asked to leave, and I now know that optimism was misplaced.

It is also your right as a reader on their platform to decide you don't want 10% of the money you pay to subscribe to each of the many wonderful writers here to go towards the same. Some of you have already made that choice, as I can see from the notes that come in along with unsubscription notifications.

All of this to say: I am going to be migrating Citation Needed away from Substack shortly. The important part here is that there should be no action needed from anyone — free or paid subscribers alike — if you wish to continue with your current subscription. For paid subscribers, because you subscribe to me with a cut going to Substack (rather than to Substack, who then pays me), the subscriptions can remain even as I swap out the publishing stack.a The only things that should change on your end are the email from which you receive the newsletters, and for paid subscribers, the description on your credit card statement (previously "Molly White Substack" or MWhiteSub, it will now be "Molly White newsletter" or MWhiteNews).

I don't want to make any firm promises on how quickly I will be able to make this change since I'm still ironing out the details and some key pieces are dependent on other people, but to give you a general idea of what to expect, I'm hoping to have it done by the New Year or within the first week of it. I will shout from the rooftops once it's done via my various social media channels, I will try to send one last note through the Substack platform to let you know what email address will be sending the newsletter next so you can fish it from your spam folders if need be, and I will try to send an email to those who have unsubscribed citing Substack's content moderation decisions in case you wish to join me in my new home.

Although it's a huge bummer to have to spend my time doing this migration instead of on the research and writing and other various projects I have in the works, I am actually pretty excited for some non-Nazi-related changes and opportunities that will also be coming as a result of this. Silver linings! I will give more details about my new destination and setup soon, and I also plan to publish a breakdown of how I did the migration, since I know there are many people currently publishing on Substack who are looking to pull the eject lever but are trying to figure out how and where to go.

Speaking of the folks who are still publishing here, I would urge you to give them some grace. Migrating is tougher than it probably sounds, particularly for less technical folks, and in some cases it's also likely to be an expensiveb undertaking. For some, myself included, this has become our primary source of income, which makes moving a pretty harrowing undertaking with a lot of uncertainties that could directly impact our livelihoods. For example, and to be a little vulnerable for a moment: Substack is quite good at bringing in new readers through its network effects, and I am frankly very nervous about losing that. For me, the choice is still crystal clear, but I do understand why some may not make the same decision.

Thanks in advance for your patience as I'm working on this. I'm hoping it will be a smooth transition, but I apologize if there are any bumps in the road. I figured I should give you all a heads up about what I'm doing just in case there are bumps, and also because I feel the need to explain why I've been a little quiet lately as I've been focusing on this. As always, you can leave a comment or contact me directly if you have any questions or if something seems wrong.

Now, on to the usual topics:

'Tis the season for year-end reports, and the ones in the crypto industry are looking pretty bleak. In particular, crypto venture capital funding plummeted 68% compared to 2022, with a mere $10.7 billion invested into crypto projects this year.1 Some reports are also coming out on crypto hacks, including ones trumpeting that "hacks are down compared to last year!" However, this seems to be primarily driven by the fact that the assets that are being stolen are simply worth less than they used to be, because the total number of hacks are roughly the same as the year before . TRM Labs puts the total amount of money stolen at $1.7 billion.2 This is a bit different from my number, which has surpassed $9.5 billion, although notably mine does include losses attributable to bankruptcies and collapses rather than just hacks.

In the courts

Courts in the British Virgin Islands have issued a worldwide order to freeze $1.1 billion in assets belonging to Kyle Davies and Su Zhu, the two co-founders of Three Arrows Capital. The liquidator is working to handle more than $3 billion in outstanding claims against Three Arrows, and Davies and Zhu have been less than cooperative throughout.3

Authorities in Bulgaria have dropped charges against the founders of Nexo.4 At the time the charges were filed, Nexo made quite a lot of noise about how they were politically motivated and unfounded [Issue 17]. At least one of those things seems to have turned out to be true.

Two issues ago [I45], I wrote about how a judge in the SEC v. Debt Box case was considering sanctioning SEC attorneys for false statements they made in the process of securing an ex parte temporary restraining order against the company. In response, the SEC's legal team submitted a document apologizing and admitting that one of them had "made a representation … that, unbeknownst to him at the time, was inaccurate" and then that they had failed to correct the error when they learned of it later on.5 It still remains to be seen whether the judge will issue any sanctions, but Debt Box has submitted a filing asking that they be allowed to make their case arguing for sanctions, as they have been "most directly and adversely affected by the actions of the SEC".6

Sam Bankman-Fried requested his sentencing and related deadlines be delayed until after his possible second trial has concluded. Judge Kaplan denied the request on the basis that he should have made that objection at the time the sentencing date was scheduled.7 As a result, Bankman-Fried's presentencing interview took place as originally scheduled on December 21. Presentencing interviews tend to be incredibly detailed, and the officer would have probed topics related to Bankman-Fried's charges, but would have also asked about topics including his family background, finances, physical and mental health, and really any other facet of his life. This interview helps to inform the presentence report, which will then be presented to Judge Kaplan to consider as he determines Bankman-Fried's eventual sentence.

In bankruptcies

Underscoring just how brutal bankruptcy proceedings can be for creditors who have money stuck in a business that's gone under, it seems that some Mt. Gox creditors are just now beginning to receive repayments of whatever's left of their money. The Mt. Gox bitcoin exchange filed for bankruptcy in early 2014 after being hacked, meaning it's been just about ten years between the bankruptcy and anyone getting any money back. However, many creditors are still waiting, as it seems to be only those who have opted for fiat (rather than crypto-denominated) repayments via PayPal who are beginning to receive payments. Many, in fact, seem to have received double payments and were then asked to return the extra funds. These reports are coming from people who received payments rather than via any official announcement from the bankruptcy team, so it's not entirely clear how the repayment plan will progress from here. However, the current deadline for repayments to be completed is October 2024.8

Meanwhile, FTX is racking up eye-popping legal bills. Documents filed in its bankruptcy proceedings have revealed that estimated fees pertaining to the bankruptcy have reached $1.45 billion.9

In government and regulators

The SEC has denied Coinbase's July 2022 petition demanding they create bespoke (read: friendly) regulation for the cryptocurrency industry. In previous issues [I26, I27] I've also written about Coinbase's mandamus petition, which asked a judge to force the SEC to reply more quickly. In a statement accompanying the decision, SEC Chairman Gary Gensler repeated his position that "existing laws and regulations already apply to the crypto securities markets".10 Coinbase announced that same day that they would be appealing the decision to the Third Circuit.11

A crypto-focused federal superPAC called "Fairshake" has been created, and has so far received $78 million in the fourth quarter of 2023 from groups and individuals including Coinbase and its CEO Brian Armstrong, Andreessen Horowitz, Kraken, Jump Crypto, Paradigm, Ripple, and the Winklevoss twins.12 It's already spent at least $1.2 million of that on television ads supporting pro-crypto House candidates. Many of the ads don't actually mention crypto, instead making veiled statements that the candidates wish to "attract the jobs of the future" and "build the next generation of the internet".13 Here I'd thought they'd ditched the whole "next generation of the internet" thing along with the "web3" buzzword, but I guess they're running out of ways to say "crypto" without saying "crypto". Just a thought: if your advertisement only works if viewers don't know what's actually being advertised to them, maybe you should reconsider whether you should be advertising that thing.

Elsewhere in crypto

It's been a rough few weeks for Ethereum layer-2 networks. Arbitrum suffered a more than one-hour-long outage on December 15, apparently due to a "significant surge in network traffic" caused by inscriptions, a format for NFTs that originated with the Bitcoin Ordinals project.14 Then, on December 25, zkSync went down for five hours due to a bug that triggered an "automated safety protocol" and required engineers to investigate and bring the service back online.15

Solana has been struggling to sell what by all accounts appears to be a pretty shitty cell phone that claims to be "purpose-built to power web3". No one really wanted one until people discovered that they could make a profit off the airdrops that came with the phone, particularly the dog-inspired $BONK memecoin that has enjoyed a price surge in the past two months. Once people realized they could buy a $600 phone to end up with around $3,000 in various tokens and perks, the phone sold out. I guess even a bad phone can sell out if you pay people $2,400 to take it off your hands, but it's a bummer that the 20,000 phones themselves will probably head straight to the landfill.16

Eyeball-scanning orb startup Worldcoin has stopped scanning eyeballs in India, Brazil, and France. This is all according to plan, they claim, stating for the first time that the roll-outs there were intended to be only for a limited time. I'm sure they just forgot to mention that earlier, and this has nothing to do with the regulatory challenges they've been facing.17

The Web3 is Going Just Great recap

There were 9 entries between December 15 and December 26, averaging 0.8 entries per day. $60.23 million was added to the grift counter.

Residual garbage

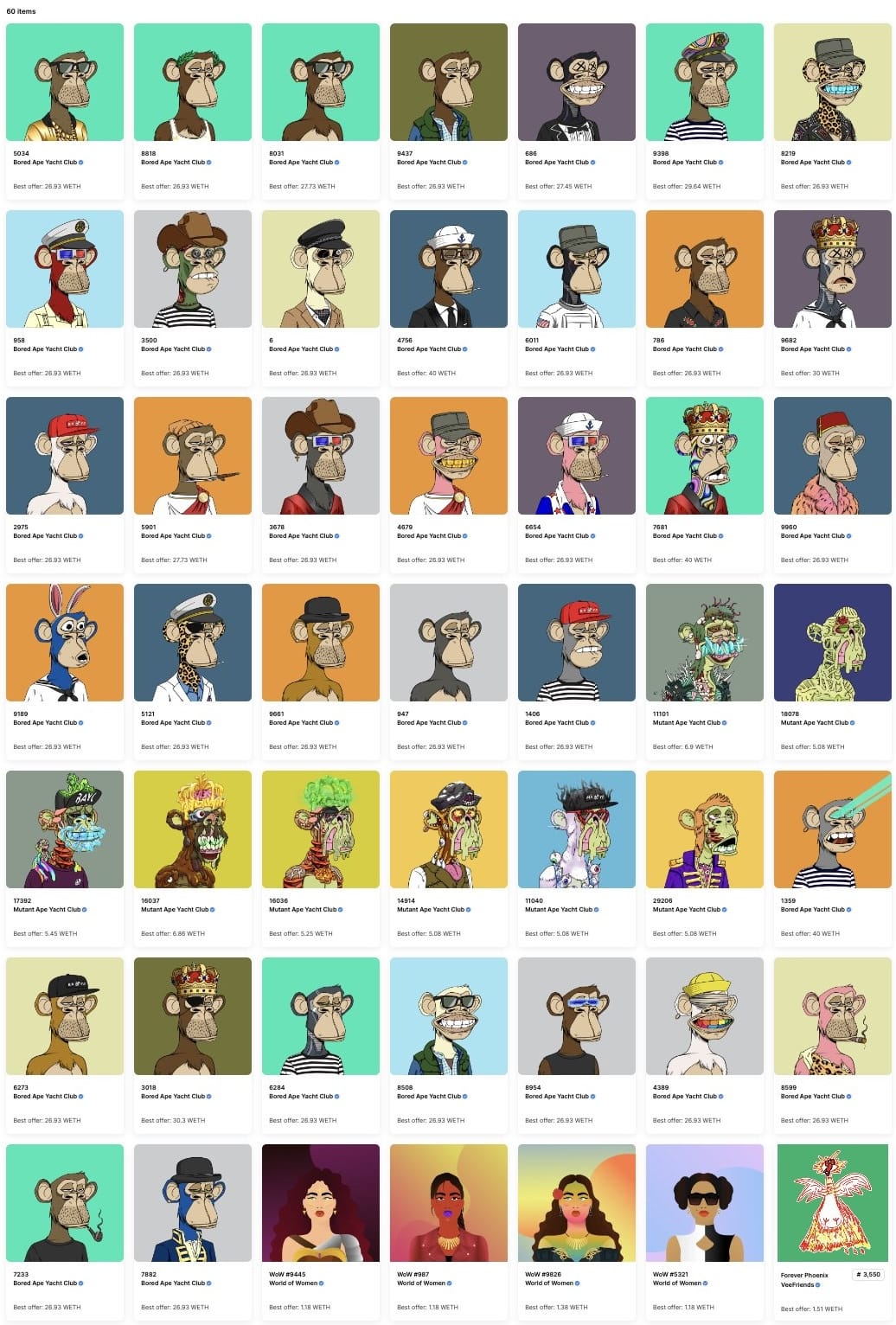

[link]

Attackers compromised old smart contracts from the NFT Trader peer-to-peer NFT trading application, allowing them to drain pricey NFTs from various wallets. At least 37 Bored Apes, 18 Mutant Apes, and other NFTs from collections like VeeFriends and World of Women were stolen. Altogether the NFTs were estimated to be worth $3 million, though NFT prices are tough to estimate, particularly when considering that stolen NFTs can be more challenging to resell.

The theft was worsened by an apparent mistake by the NFT Trader developers, who had included the Pausable module in the smart contract but then forgot to actually write a function that would have paused its operation as intended. This meant that the platform developers were helpless to stop the attack, at least until some community members came up with a clever way to stop the trading and suggested it to NFT Trader's team.

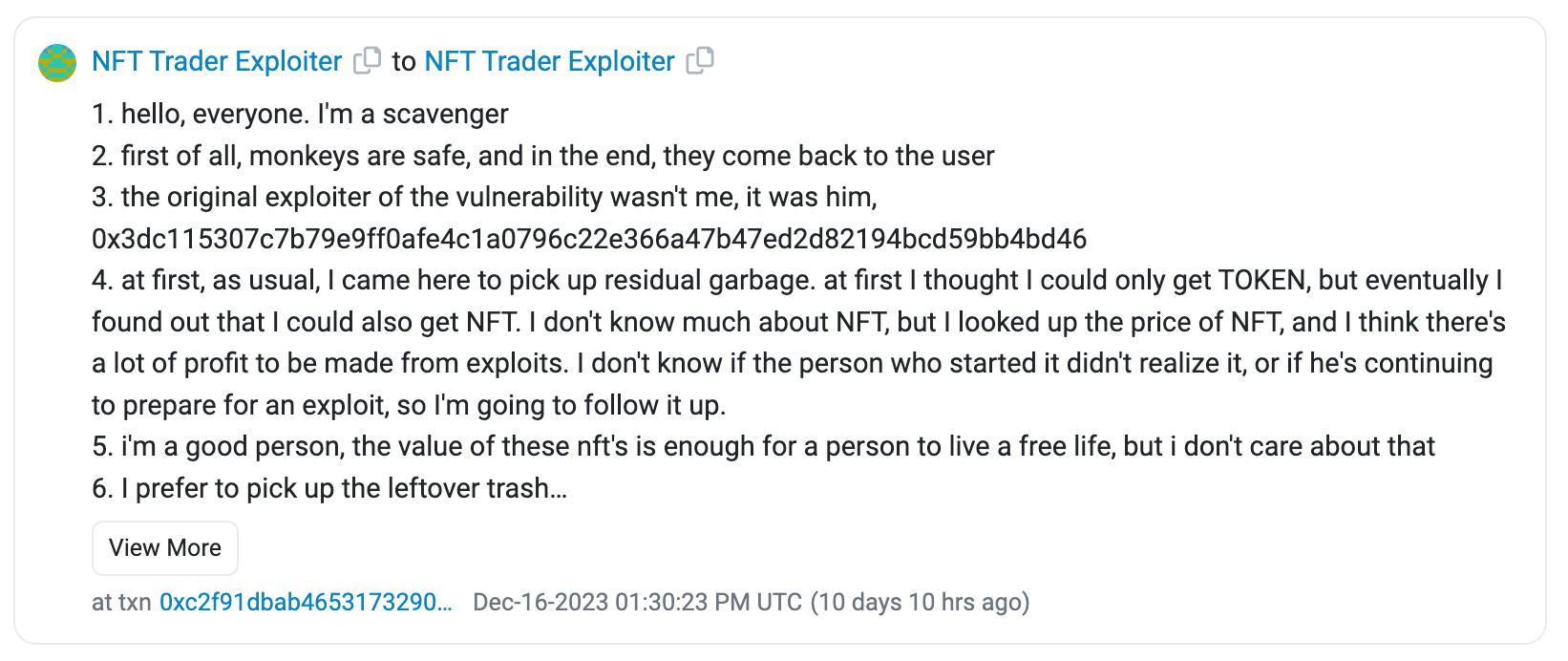

Ultimately, one of the attackers turned out to be a copycat and self-described trash-picker who was willing to negotiate, in what most people (myself included) initially assumed was an attempt to scam victims even further.

However, this exploiter did ultimately return 36 Bored Apes and 18 Mutant Apes after one of the Yuga Labs co-founders agreed to pay a 120 ETH (~$260,000) "bounty".

Anti-rug-pull bot rug pulls

[link]

The Megabot project promised traders an AI trading bot that would earn its users "up to 30% monthly". Besides that, it promised that the bot would trade while "sidestepping potential risks such as honeypots, rugs, and slow rugs". "No one will be able to rug you anymore," its website boasted.

Or at least the website boasted that before it went offline, along with the project's social media accounts, as the project itself rug-pulled. Altogether around $742,000 was stolen, mostly on the Solana network.

Everything else

- Barry Silbert resigns from Grayscale board [link]

- Telcoin exploited for $1.25 million [link]

- Tether mints itself a $1 billion Christmas present [link]

- Defunct BarnBridge reaches $1.7 million settlement with SEC [link]

- Qredo dumps CEO, raises emergency financing after burning through funding [link]

- New wallet drainer steals almost $60 million in 9 months [link]

- Aurory bridge hacked for over $1 million [link]

In the news

The LA Times linked my most recent newsletter, describing me as a "technopolis debunker". I will be putting that on my business cards going forward.

I spoke to Business Insider about the strong overlap between the crypto and e/acc communities and ideologies for their recent piece about the widespread crypto "pivot to AI".

I did an interview for the German technology magazine c't. It's paywalled and in German, but sharing it anyway in case that's not a barrier to someone out there.

Worth a read

The NYT ran a story about a wealthy 23-year-old college student who bought a cryptocurrency mine in Texas with Tether, affording him anonymity and protection from scrutiny from the authorities in either country — at least until he tried to bilk local contractors and his ownership came out in court. The NYT seems a bit overly focused on the fact that he's Chinese — it seems to me that the real concern should just be the general lack of scrutiny afforded by these kinds of deals.

The MIT Technology Review has an interesting piece about real name policies, mandatory location sharing, and other measures imposed on Chinese internet users. It's thoughtfully written, and gives a lot of food for thought when it comes to considering the pros and cons of online anonymity, and what happens to the web and the people on it when that option is no longer available.

That's all for now, folks. Until next time,

– Molly White

Footnotes

Credit where credit is due to Substack on this one — not enough platforms enable users to do this, even though all of them should (to the extent possible). ↩

I'm not expecting this will be the case for me — in fact, if all goes according to plan I should actually end up saving money in the end. But I know for some people who are just getting started, or for people with large readerships but who don't monetize their newsletters, alternatives can be pricey. More so for those who have to outsource some of the various work that goes into migrating. ↩

References

"Crypto VC funding took a nosedive in 2023, down 68% compared to the year before", The Block. ↩

"Hack Hauls Halve From 2022", TRM Labs. ↩

"3AC founders just got $1.1bn in assets frozen as Teneo aims to claw back funds", DL News. ↩

"Nexo's Money Laundering Investigation in Bulgaria Closed Due to Lack of Evidence: Report", CoinDesk. ↩

Response to order to show cause filed on December 21, 2023. Document #233 in SEC v. Digital Licensing. ↩

Motion to respond filed on December 22, 2023. Document #238 in SEC v. Digital Licensing. ↩

Order filed on December 20, 2023. Document #387 in US v. Bankman-Fried. ↩

"Mt. Gox Appears to Have Started PayPal Repayments Tied to 2014 Bitcoin Hack", CoinDesk. ↩

"FTX owes more in legal fees than it does to creditors", Protos. ↩

Statement on the Denial of a Rulemaking Petition Submitted on behalf of Coinbase Global, Inc. by Gary Gensler. ↩

"How a crypto super PAC is trying to swing 2024", Politico. ↩

"Arbitrum network went offline for 78 minutes because of inscriptions", Cointelegraph. ↩

"Solana phone sells out in US as traders spot arbitrage with bonk's skyrocketing price", The Block. ↩

"Worldcoin is no longer offering Orb-verification in India, Brazil and France", TechCrunch. ↩