Issue 7 – Stoppable domains

In the courts

The judge overseeing the Voyager bankruptcy has allowed Voyager to move forward with the first steps of a deal in which FTX will buy Voyager's assets for $1.422 billion. This is despite an objection from Texas regulators, who disclosed in a filing that they were investigating whether FTX's yield-bearing accounts violate securities laws, and asked the court to hold off on approving the sale until it is determined that FTX isn't breaking the law.

There are now two lawsuits challenging the US Treasury's sanctioning of Tornado Cash. In addition to the Coinbase-funded lawsuit announced in September, there is now a lawsuit filed by Coin Center and three other individuals, in which a group of Ethereum advocates argue that Ethereum is a privacy nightmare and so people have to be allowed to launder their own money in order to protect themselves.

Remember Nate Chastain, the former head of product at OpenSea who was charged with wire fraud and money laundering after he made trades based on his insider knowledge of which NFTs would be featured on the OpenSea homepage? Well, he tried to have the lawsuit dismissed by arguing that he can't be charged with insider trading because he wasn't trading securities or commodities. Judge Furman denied the motion to dismiss, pointing out that Chastain is not being charged with insider trading, but rather wire fraud and money laundering.

In government

Someone leaked a draft of the Digital Commodities Consumer Protection Act of 2022, aka the DCCPA, which will be considered by the US Congress. There have been mixed reactions from the crypto industry, but the bill has generally been seen to be very tough—even a "ban"—on defi. Sam Bankman-Fried, the founder of the FTX crypto exchange and the Alameda Research quant firm, published a blog post (revised version, original) laying out his thoughts on a regulatory scheme. The blog post was heavily criticized by many defi advocates, who believe the suggested regulations amount to regulatory arbitrage, in which SBF is aiming to solidify FTX's place in crypto in the US by making it harder for decentralized or smaller centralized competitors to comply with regulations.

SBF later revised his post, and wrote that he would continue to make changes to his recommendations.

Meanwhile, the European Commission published a document urging its member states to reduce electricity usage of cryptocurrency miners, and to end tax breaks and other financial advantages for mining companies. Notably, the report states: "In case there is a need for load shedding in the electricity systems, the Member States must also be ready to stop crypto-assets mining." This has Bitcoiners in a bit of a fizz, because Bitcoin is by far the top energy guzzler of the cryptocurrency ecosystem, and has no plans to change that.

The Web3 is Going Just Great recap

Note: If you're an avid follower of the W3IGG site and don't need a recap, you can scroll on past to the "Coming up" section.

There were 18 new entries between October 12 and October 23, averaging 1.5 posts a day.

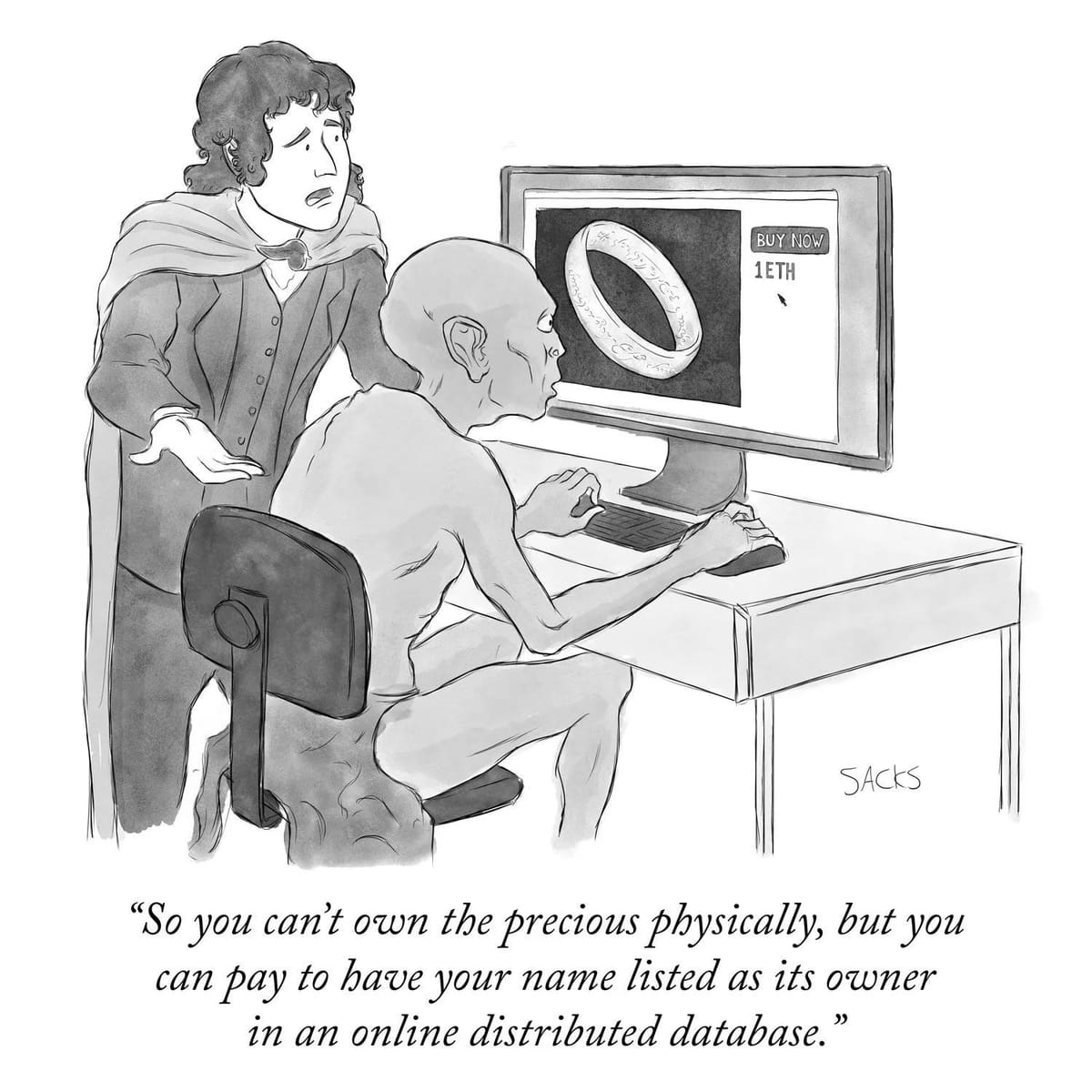

Unstoppable Domains turn out to be pretty stoppable

[link]

Also they're not domains. Unstoppable Domains sells "domains", which work on services that resolve these types of identifiers to blockchain addresses. They're not something you can plug into a browser, but you can put them into some crypto wallet applications, blockchain explorers, and defi applications to avoid having to use unwieldy crypto wallet addresses directly.

Until recently, Unstoppable Domains sold domains with the .coin suffix, and their software would resolve them to the associated crypto address. However, the group has since realized that another company was selling those addresses before them, so they've decided they will stop selling them and cede that ground to their competitor. They will also stop supporting the resolution of these domains in their software libraries.

Domain Name Wire provided some additional context, writing that this was likely to try to help in their argument that because they were the first group to sell .wallet domains, they should be given exclusive rights to the suffix.

Unstoppable Domains wrote in their announcement that "Unstoppable domains are self-custodied NFTs, so you still own your .coin domain, but it won't work with our resolution services or integrations."

That's right, folks, you'll still have your .coin NFT! It just won't resolve, or be otherwise useful in any way.

This is much like the argument that has been common in crypto when describing a use case for NFTs: "if it's an NFT, you'll be able to really own your World of Warcraft sword, and Blizzard won't be able to take it away from you if they arbitrarily decide to ban you or remove the item!" This ignores the fact that the existence of an NFT on a blockchain does not ensure that some functionality initially advertised will continue to work in perpetuity, and you might end up with a domain name or a sword that can do nothing more than sit in your crypto wallet collecting dust.

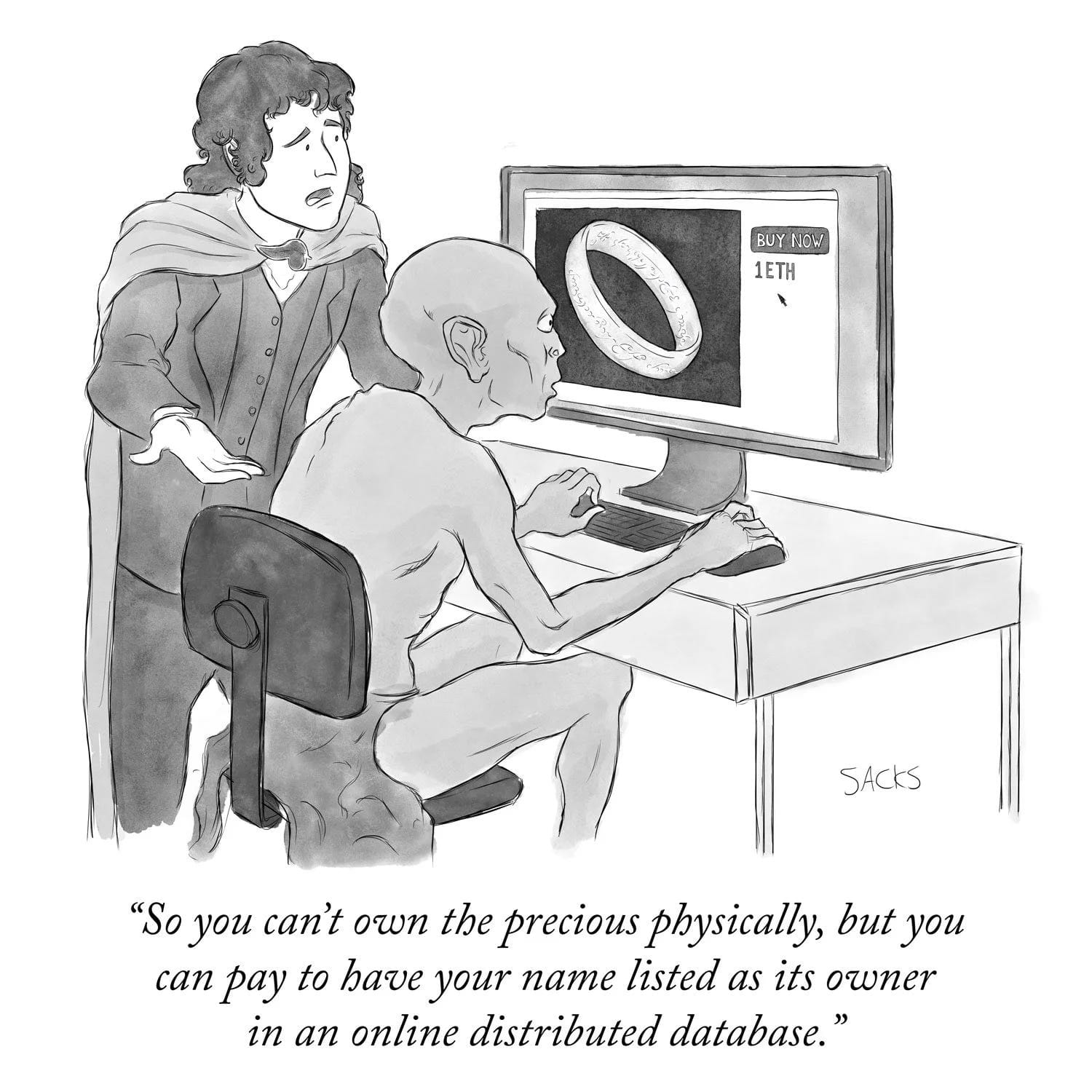

Warner Bros. reinvents DVD navigation menus

[link]

Warner Bros. announced their first "web3 movie experience", which is apparently just a key to unlock a 4K stream of The Lord of the Rings: The Fellowship of the Ring (Extended Version). There are a couple of other bells and whistles, namely "themed navigation menus based on iconic locations from the beloved film". I for one am enjoying the nostalgic thought of those DVD navigation menus from back in the day, but unsure why they would tempt someone to pay $30 or $100 for an NFT rather than just buy the movie for $10.

Warner Bros. writes that users can finally "own and trade the experience in a community marketplace", apparently forgetting that people used to resell DVDs and other physical media too.

As of two days after launch, the $30 NFTs had yet to sell out, and were already reselling for almost 75% less than the mint price.

Freeway accused of $100 million+ rug pull

[link]

The crypto platform Freeway allows its users to buy "Superchargers", which they seem to claim are not actual cryptocurrencies or crypto-derivative assets, but rather "simulations" that pay out their users. Definitely no weird regulatory dodges happening there, I'm sure. They also claimed that these products pay out 43% annual returns (🚩🚩🚩).

Anyway, they suddenly announced that they would no longer be offering these products, and their customers would not be able to withdraw the money they'd put in to Superchargers for an indefinite period of time.

Worryingly, the platform also deleted mentions of their team members from their website, and reportedly also removed an attestation to their financial backing. This led crypto researcher and whistleblower FatMan to accuse them of rug pulling the more than $100 million in assets they've pulled in.

The previous day, FatMan had also published a Twitter thread alleging that Freeway was a Ponzi scheme, writing: "In my opinion, it's likely that Freeway will collapse within the next few months and that all depositors will lose everything." Guess he didn't have to wait long.

Everything else

- Oracle manipulation attack on a QuickSwap market earns exploiter $188,000 [link]

- Attacker drains tokens from Layer2DAO, project buys some of them back [link]

- Several users report losing more than a million dollars each in 3Commas/FTX theft [link]

- Almost $300,000 stolen from Olympus DAO, later returned [link]

- Vulnerability in BitBTC bridge ends in an exploit where the clock is ticking [link]

- Moola Market exploited for $8.4 million [link]

- Roofstock claims to have completed its first one-click NFT home sale [link]

- Much-anticipated "speedy" Aptos chain launches, processing 4 transactions per second and with 80% of tokens allocated to insiders [link]

- Texas regulators are investigating FTX and Sam Bankman-Fried for possible securities violations [link]

- BitKeep Swap hacked for more than $1 million [link]

- Tokens notionally worth $825,000 stolen from Syntropy in venture capital investment deal gone wrong [link]

- Over 51% of blocks validated on the Ethereum chain are censored [link]

- Earning.Farm exploited for $971,000, exploiter gets frontrun by MEV bot [link]

- DAO Maker allegedly tries to dodge hack repayment promises [link]

- Blu3DAO faces claims that they've misused grant money to benefit founders [link]

Coming up

As I've already mentioned, I'll be heading to Lisbon in a week for Web Summit! I'll be giving a talk on the Crypto stage on November 4 titled "Is Web3 bullshit?". Apologies in advance to the speakers doing the "How Web3 will allow you to take back control" talk before me, on whose parade I will presumably rain.

I will also be joining the inimitable Ben McKenzie earlier that day on the skeptics contingent of a panel on "The future of crypto: What's next for this craze?" Charles Hoskinson, a founder of both the Ethereum and Cardano blockchains, will presumably be giving the bull case. That panel will be on the Centre stage, which I think they've livestreamed in previous years, so you might be able to catch a stream (although it will be early morning US time).

In the news

I did an interview with Benjamin Pimentel. We talked about Web3 is Going Just Great, as well as my views on crypto in general.

AFP included a quote from me in their article about law enforcement struggling to catch crypto scammers.

That's all for now folks. Until next time,

– Molly