Issue 86 – State power sponsored by Coinbase

The GENIUS Act passes the Senate after explicit threats to Democrats from the crypto lobby, and shady crypto billionaire Justin Sun cozies up even closer to the Trump family

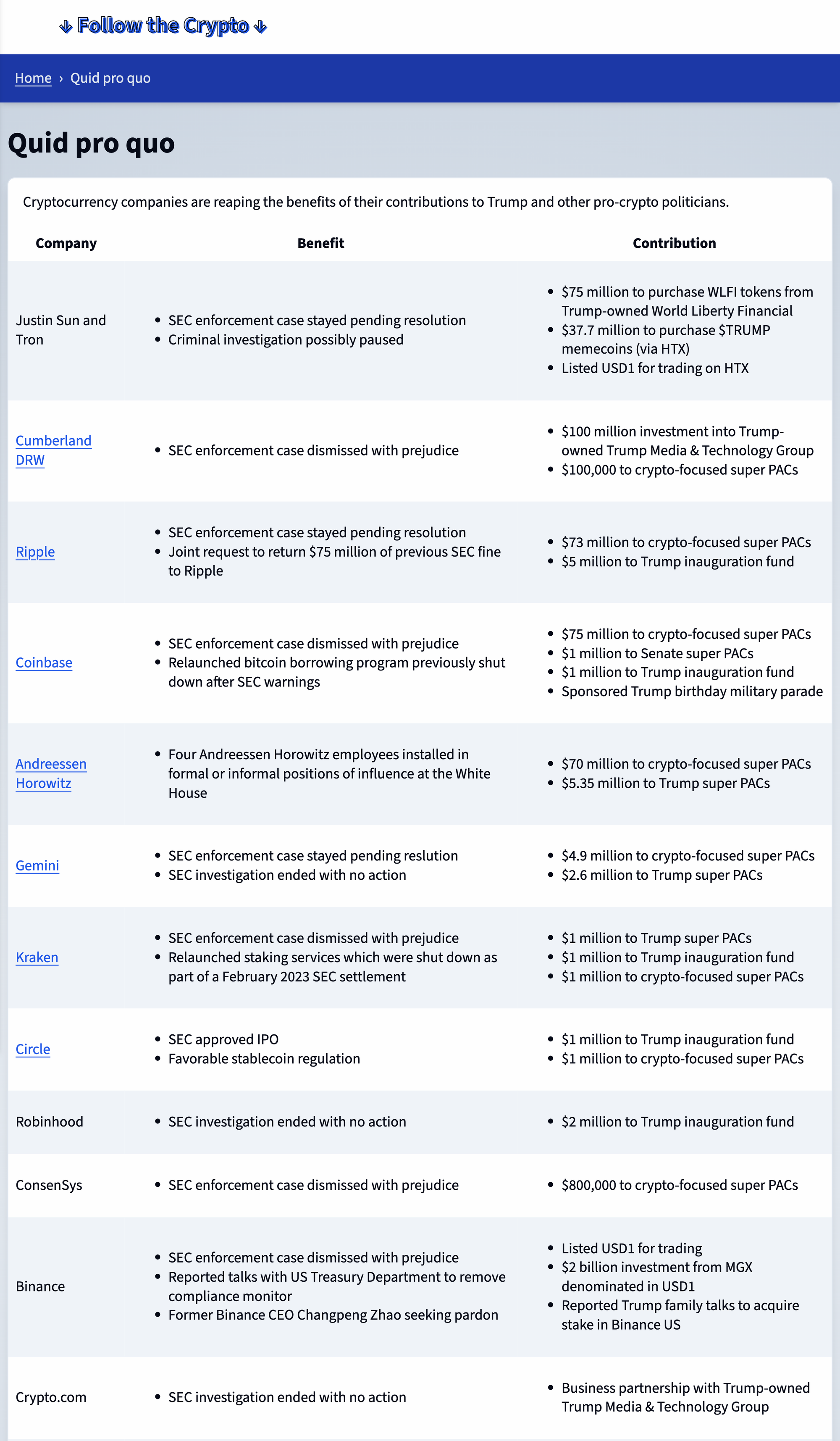

Eighteen Democratic Senators joined nearly all Senate Republicans to vote for the GENIUS Act stablecoin bill, which aims to establish a federal regulatory framework for stablecoins and will serve to lend the asset class governmental imprimatur. The 68–30 vote followed shortly after Lever News published leaked messages from a secret group chat of Democratic strategists and cryptocurrency industry advocates, where the political operatives opined that Democratic Congresspeople could “not afford to alienate a very vocal and wealthy group of donors” by opposing the bill. One such donor, Avichal Garg from Electric Capital, was very explicit: “If Dems bail on this [bill], they will get 0 dollars going forward.” (Garg and his firm contributed around $680,000 to various PACs last election cycle). In addition to the crypto industry’s 2024 election contributions, various cryptocurrency firms and lobbying groups, as well as traditional financial institutions, have spent millions on Senate lobbying related to the GENIUS Act. Crypto.com, Kraken, Digital Currency Group, Paradigm, Tether, Circle, and Coinbase have altogether spent over $2 million in lobbying related to the bill.1

While Senate Majority Leader John Thune (R-SD) had previously promised Democrats that if they supported the cloture vote, they could later amend the bill during an open amendment process on the floor, he quickly reneged on that promise, leaving Democrats unable to force votes on amendments seeking to limit President Trump’s ability to personally profit from stablecoins, prevent Big Tech companies from issuing their own stablecoins, or eliminate the possibility of federal bailouts for stablecoins. The bill ultimately passed the Senate without any amendments. Some Republican Senators who had previously opposed the idea of Facebook issuing its own token back in 2019, such as Senator Kennedy (R-LA) who said “Facebook now wants to control the money supply... What could possibly go wrong?”,2 were evidently perfectly happy to support this bill.

Some Democrats in Congress have also expressed concerns about the fact that President Trump is already profiting from his own stablecoin venture, the USD1 token issued by his World Liberty Financial company. Representative Liccardo (D-CA), speaking about a companion stablecoin bill in the House, explained: “We want to avoid the inevitable conflicts of interest that arise when the President’s appointees, such as the Secretary of the Treasury, are regulating the very product that provides unique and exclusive financial benefit to the President and his family.” Other legislators had more structural concerns about the bill, particularly to do with insufficient consumer protections, poor anti-money laundering and national security controls, and the possibility of federal bailouts for stablecoin issuers. “The GENIUS Act lacks the basic safeguards necessary to ensure that stablecoins don’t blow up our entire financial system,” argued Senator Warren, who also pressed her fellow Democrats to “show a little spine”.3

The Democrats who voted for the bill were mostly the same as the ones who voted in support of the cloture motion last month [I84]: Alsobrooks (MD), Booker (NJ), Cortez Masto (NV), Fetterman (PA), Gallego (AZ), Gillibrand (NY), Hassan (NH), Heinrich (NM), Lujan (NM), Ossoff (GA), Padilla (CA),a Rosen (NV), Schiff (CA), Slotkin (MI), and Warner (VA). Senator Blunt Rochester (DE) is the only Democrat who supported the cloture motion but later voted against the bill. New Democratic support came from Senators Hickenlooper (CO), Kim (NJ), and Warnock (GA). All Republicans voted to support the bill except for Hawley (MO) and Paul (KY), who opposed, and Cotton (AR), who did not vote.4

The House has been working on its own stablecoin legislation, called the STABLE Act, and the two bills have some significant differences. It remains to be seen whether the House will take up the GENIUS Act, or continue to push its own version. Trump has urged the House to opt for the GENIUS Act, describing it on social media as an “incredible bill”. “The House will hopefully move LIGHTNING FAST, and pass a ‘clean’ GENIUS Act. Get it to my desk, ASAP — NO DELAYS, NO ADD ONS,” he wrote5 — presumably concerned about “add-ons” like the various proposed amendments to stop him from personally profiting from his stablecoin business as he pushes for and ratifies favorable rules for his own companies.

Meanwhile, the concerns about massive companies issuing their own tokens are proving justified, with reports that companies including Walmart, Amazon, and Expedia are considering launching their own stablecoins.6 Who knew when they said “Make America Great Again”, they were yearning for 1800s wildcat banking and scrip?

Over in the House, the cryptocurrency market structure bill now known as the Clarity Act [I84] has advanced out of the House Agriculture Committee in a 47–6 vote7 and the House Financial Services Committee in a 32–19 vote.8 Representative David Scott (D-GA), who serves on both Committees, described the bill as “a gift to the worst actors in this industry.”9

The inimitable Tonantzin Carmona recently published an excellent article on the Brookings Institute website outlining some of the principles that most need to be considered when writing crypto legislation (and which, naturally, are completely absent in recent proposed bills).

In the White House

Trump held his $40 million birthday boy military parade on June 14, and apparently offset the cost at least somewhat with contributions from the likes of Coinbase. This didn’t exactly sit well with some of the increasingly rare breed of crypto believers who still champion the technology’s early anti-establishment values.

“What Coinbase did by sponsoring this army parade feels like an insult to everything our industry stands for. Crypto emerged from ideals of decentralization, individual sovereignty, and freedom from oppressive state control—not to funnel resources into institutions whose core purpose involves violence and ending lives,” wrote one crypto enthusiast.10 Another wrote, “I entered the crypto world in 2017 to stand against late stage capitalism...not help crypto bros fund it.”11 Megan Knab, CEO of a crypto payroll company, responded to the sponsorship by eulogizing the industry’s cypherpunk roots in a CoinDesk op-ed, where she wrote: “The ethos of crypto—the cypherpunk values that got us here—is being diluted, co-opted, and in some cases, directly betrayed.”12

“Special thanks to our sponsor: Coinbase” (via Acyn)

This is only the most recent in a rapidly growing list of examples of crypto companies and their executives aligning with state power. Earlier this month, Ripple made a contribution worth $9.4 million to the San Francisco Police Department to establish a new surveillance center that will operate a fleet of drones, surveillance cameras, and license plate readers. “We are proud to help usher in a new era of accountability,” said Ripple CEO Chris Larsen in a statement about the contribution.13 “We’re going to be covering the entire city with drones,” enthused SFPD Captain Thomas MacGuire.14

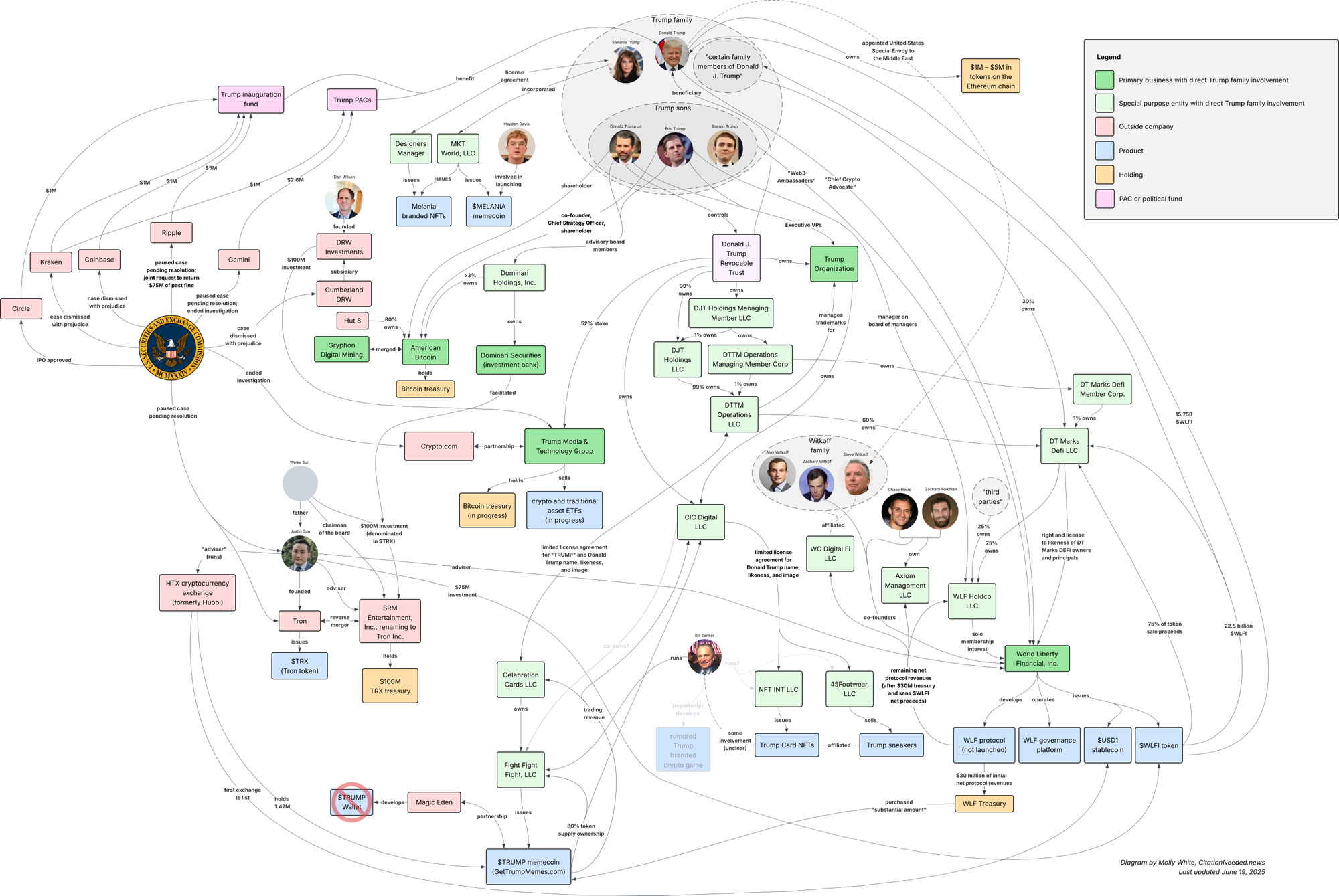

Justin Sun

Shady crypto billionaire Justin Sun continues worming his way into the Trump family’s many crypto ventures, using cryptocurrency to funnel money to Trump that, as a foreign national, he is barred from contributing to officials or their campaigns. He’d already made a $75 million investment into the Trump family’s World Liberty Financial project in exchange for an advisory position [I71], about $56 million of which went directly into Trump’s pocket. His HTX cryptocurrency exchange was the first to list World Liberty’s USD1 stablecoin, and USD1 is now being minted on the Tron blockchain (founded by Sun). Last month, Sun topped the leaderboard to attend the Trump memecoin dinner with his nearly $38 million in $TRUMP memecoin holdings [I85], which earned him a private tour and VIP reception with the president.

And now, Tron has just announced it will be going public via reverse merger with a public company called SRM Entertainment, which previously sold theme park merchandise, but will now rebrand to Tron, Inc. Sun can thank a small investment bank called Dominari Securities for that deal — and perhaps its new board members Eric and Donald Trump Jr. Dominari brokered the $100 million investment into SRM, routed via Justin Sun’s father, who now chairs the board of the new company. Despite serving on the board of Dominari, Eric Trump has claimed not to “have public involvement” in the deal — oddly using a qualifier leading many to question what private involvement he has.15 The new Tron, Inc. will be a public treasury company along the lines of MicroStrategy and its many imitators, and will likely abandon its theme park-related business.

As I mentioned in a recent issue [I84], there’s been a massive surge in crypto treasury companies that go public via merger with an existing public company, and Sun is only the latest to jump on board. Some of these, particularly those that rely on leveraged funding, are beginning to make even the most crypto faithful a little wary. Coinbase’s most recent Monthly Outlook report warned of “systemic risks” from such entities, though they seem to be more or less okay with the whole thing because they see them as “an important source of demand”.16

Sun’s newest financial support for Trump comes after the SEC paused an ongoing enforcement case against him and his companies. The billionaire, who was also once so afraid he’d be arrested on criminal charges if he stepped foot in the United States that he forfeited his $28 million seat on Jeff Bezos’ rocket,17 is now making himself quite at home here — whether it’s cozying up to Trump at his Virginia golf course, or taking a company public on the Nasdaq.

He’s far from the only one to pay Trump for favorable outcomes. In March, I noted that the SEC would be dropping its case against Cumberland DRW, a subsidiary of trader Don Wilson’s DRW Investments [I79]. Now, Wilson has invested $100 million into Trump Media & Technology Group, which he said is intended to support its crypto ventures.18 The President holds a majority stake in TMTG, via his not-at-all-blind trust controlled by his son Don Jr.

In regulators

The Winklevoss twin-owned Gemini cryptocurrency exchange has sent an angry letter to the CFTC’s Inspector General Christopher Skinner, only five months after settling with the agency. It seems to me that perhaps Gemini regrets agreeing to the $5 million settlement only weeks before Trump’s inauguration, and has since realized that with a bit more stalling, they might have been able to convince Trump-appointed CFTC leadership to kill the case (as SEC leadership is in the process of doing with separate enforcement actions against Gemini involving unrelated allegations).

According to Gemini, they “had no other choice” but to settle the case, which they allege was based on a false whistleblower report by a revenge-seeking ex-COO.19 It’s not clear to me why exactly they say they felt like they had no choice but to settle, when they’ve otherwise been quite willing to engage in protracted litigation.

The SEC has withdrawn fourteen proposed rules started under the previous agency leadership, some of which would have imposed stricter regulations on crypto activities. Coinbase Chief Legal Officer Paul Grewal was quick to celebrate, writing on Twitter “[Feels] really good”.20

In the courts

Gotbit founder Aleksei Andriunin has been sentenced to eight months in prison for his company’s wash trading schemes that manipulated cryptocurrency trading volume for his clients.21 Andriunin pleaded guilty in March, and agreed to forfeit almost $23 million. Gotbit will also shut down as a result of the plea [I68, 69, 78, 80].

Haru Invest CEO Lee Hyung-soo has been acquitted on fraud charges in South Korea after he suddenly closed customer withdrawals and shut down the company in June 2023, in the wake of the FTX bankruptcy. While the judge presiding over the case stated that Lee had clearly been negligent in his management of the company, Lee’s actions did not rise to the level of criminal fraud. Other executives were also acquitted of fraud charges, though the company’s Chief Operating Officer was found guilty of embezzlement and sentenced to two years in prison.22 Haru and its executives will still have to face civil complaints from creditors — one of whom was so upset about his claimed loss of 100 BTC (~$10 million) that he came to the courtroom in August 2024 and stabbed Lee in the neck multiple times [I65].

BitGlobal has dropped its antitrust lawsuit against Coinbase, which they filed in December after Coinbase delisted wrapped bitcoin (wBTC) when it was announced that BitGlobal (and, by extension, Justin Sun) would become involved in its management. As I wrote then, “Trump’s new business adviser Justin Sun is so shady that even the broader crypto world wants nothing to do with him”. After the announcement, both Coinbase and Kraken raced to create their own versions of wrapped bitcoin so they wouldn’t be exposed to a Sun-tainted version [I72]. A few weeks ago, Justin Sun posted a photo of himself standing alongside Coinbase Chief Legal Officer Paul Grewal at the annual Bitcoin Conference in Las Vegas, and captioned it, “So glad to meet in person [Paul Grewal]. Thank you for keeping the fight up for the industry and let’s do more great things together to grow crypto in the US!” Though Grewal is smiling in the photo with Sun, his Twitter reply was far from friendly: “Drop your ridiculous, unfounded lawsuit and we can actually have a conversation.”23

Grewal only had to wait a week to get his wish. He then wrote a victorious tweet thread, concluding: “We will not be bullied into continuing to list an asset that puts our customers at risk.”24 Perhaps he ought to share his concerns with the President of the United States.

Shaq will pay $1.8 million in his settlement with FTX creditors, according to CNBC.25 This is the same settlement I wrote about a few issues ago [I83], but the settlement amount had not yet become public. The $1.8 million is about $1 million more than Shaq was paid to appear in the FTX commercial that drew the lawsuit, from creditors who argued he had misled them into believing the exchange was trustworthy.

The Web3 is Going Just Great recap

There were three entries between June 6 and 18, averaging 0.2 entries per day. $98.33 million was added to the grift counter.

- Israeli-linked hackers steal and destroy $90 million from Iranian Nobitex exchange [link]

- Meta Pool exploited [link]

- ALEX Lab exploited again [link]

Worth a read

Rebecca Crosby and Judd Legum at Popular Information published a rundown on the Trump administration’s attacks on free speech and it’s not great! The administration likes to hold itself up as a champion for free speech, and pieces like this are so important to illustrating that it is anything but.

Let’s mix in some happier news. Despite a book-banning crusade by a City Council made up of seven Republicans who call themselves the “MAGA-nificent 7”, voters in Huntington Beach, California have rebuked them on two ballot measures. One dissolves the City Council-appointed “community review board” tasked with restricting access to books they deem “inappropriate” and returns that responsibility to librarians; the other restricts the city from privatizing and selling its library.

Also, if you’re interested in conversations about media literacy or how newspaper headlines can be deeply misleading, I made a quick video about a real stinker of a Wall Street Journal headline I saw last week that claimed that “Democrats Are Wary of Playing Into Trump’s Hands by Supporting ‘No Kings,’ L.A. Protests”. That’s on both TikTok and YouTube.

@molly0xfff Media literacy is important! #medialiteracy #mediabias #wallstreetjournal #wsj #nokings

♬ original sound - Molly White

In the news

Forbes quoted me in an article about the Trump family’s decision to increase their ties to Justin Sun by minting the USD1 stablecoin on the Tron blockchain.

The Hollywood Reporter thinks I am one of “11 Influencers You Need to Know”. Though their article is framed around an influencer convention called VidCon, I will not be there.

That's all for now, folks. Until next time,

– Molly White

Have information? Send tips (no PR) to molly0xfff.07 on Signal or molly@mollywhite.net (PGP).

I have disclosures for my work and writing pertaining to cryptocurrencies.

References

“Facebook Says It Doesn't Want to Control the Money Supply (Video)”, Bloomberg. ↩

“Senate Begins Passage of Stablecoin Bill as House Marks Market-Structure Wins”, CoinDesk. ↩

Roll Call Vote 119th Congress - 1st Session on Passage of the Bill (S. 1582, As Amended). ↩

Truth Social post by Donald Trump. ↩

“Walmart and Amazon Are Exploring Issuing Their Own Stablecoins”, The Wall Street Journal. ↩

“Chairman Hill Applauds Bipartisan CLARITY Act Passing Through Committee”, French Hill. ↩

“Crypto Market Structure Bill Moves Out of House Committees, Stablecoin Action Pending”, CoinDesk. ↩

“Can the Real Cypherpunks Please Stand Up?”, CoinDesk. ↩

“Mayor Lurie Announces New Headquarters for SFPD Real-Time Investigation Center to Continue Work to Improve Safety, Reduce Crime”, SF.gov. ↩

“‘We’re going to be covering the entire city with drones:’ SFPD accepts billionaire’s $9.4M gift”, Mission Local. ↩

Coinbase June 2025 Monthly Outlook report. ↩

“A Crypto Billionaire Who Feared Arrest in the U.S. Returns for Dinner With Trump”, The Wall Street Journal. ↩

“US tycoon pours $100mn into Trump crypto project after SEC reprieve”, Financial Times. ↩

Letter by Gemini to CFTC Inspector General Christopher Skinner. ↩

“Cryptocurrency Financial Services Firm ‘Gotbit’ and Founder Sentenced for Market Manipulation and Fraud Conspiracy”, U.S. Attorney's Office, District of Massachusetts. ↩

“South Korean crypto CEO acquitted of $650 million fraud charges, months after stabbing incident: report”, The Block. ↩

“Shaquille O’Neal to pay $1.8 million to settle FTX investor lawsuit”, CNBC. ↩

Footnotes

Evidently getting tackled to the ground by Trump’s goons wasn’t enough to make Padilla reconsider his support. ↩