Issue 91 – GDP on the blockchain

The regulator set to take on primary crypto oversight is down to a single Commissioner, and new pro-crypto PACs focus on installing more Republicans in the midterms

The hollowing out of regulatory agencies has reached a critical point, with the CFTC soon to have just a single commissioner as the crypto industry heavily lobbies for it to become their primary regulator. In normal times, outgoing CFTC Commissioners would be replaced by a roughly bipartisan slate of presidential appointees, but Trump has not bothered to nominate any new commissioners besides his controversial pick for Chair. With the current CFTC Acting Chair set to depart after a new Chair is confirmed, Trump may hope to exert control over the independent regulatory body by installing a single pawn who will hold unilateral agency control.

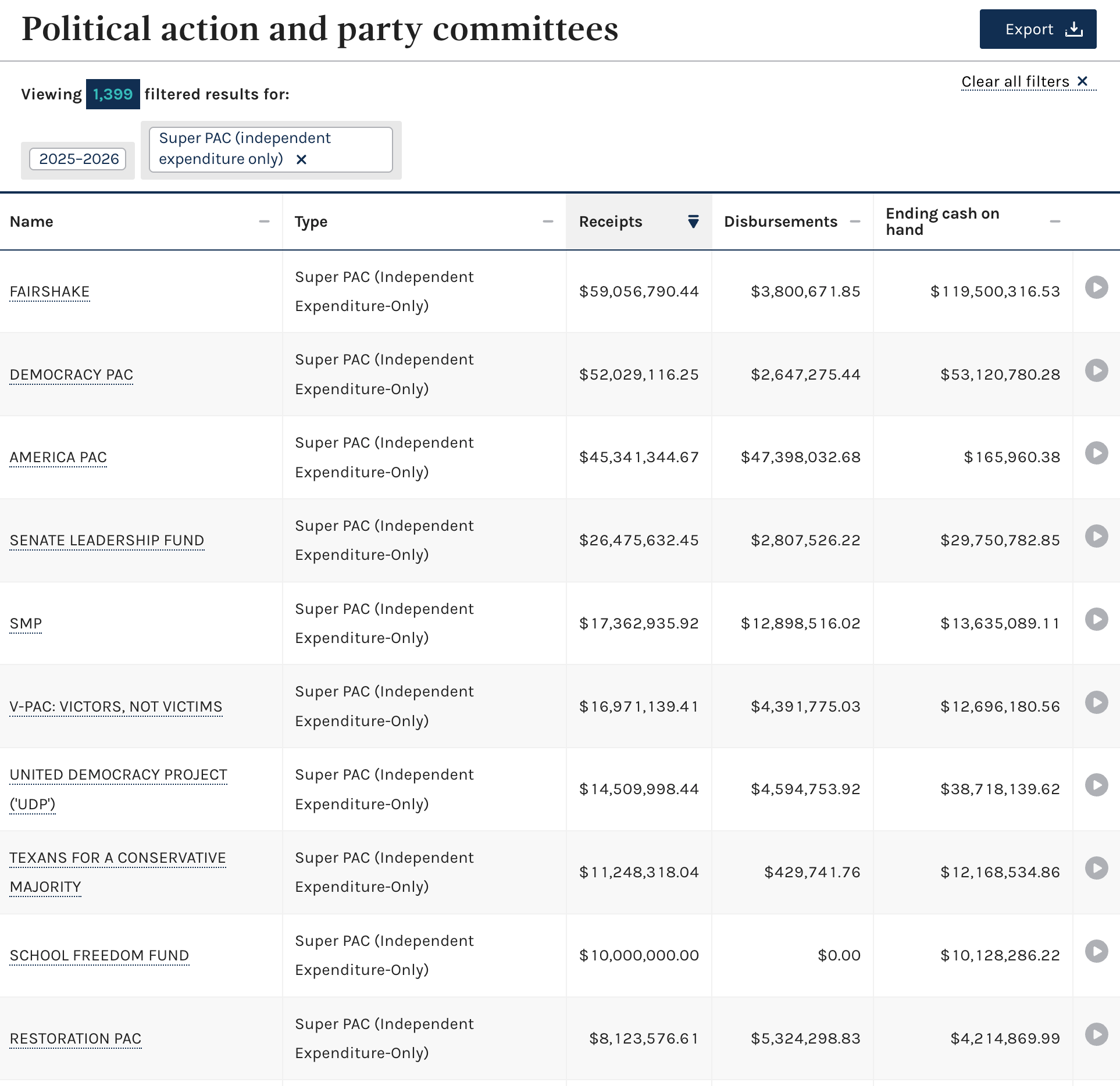

This regulatory vacuum arises as the crypto industry continues to flex its political muscle into the midterms, with pro-crypto super PAC Fairshake leading all super PACs in 2025–2026 fundraising with $59 million raised (giving them a total of $120 million in cash on hand). Though Fairshake portrayed itself as a non-partisan PAC supporting pro-crypto candidates from both parties last election cycle, some wealthy and powerful industry executives have opted to support explicitly partisan PACs this time around. The Winklevoss twins, who run the Gemini cryptocurrency exchange and are major Trump backers, have poured $21 million into a new super PAC for Trump-aligned pro-crypto Congressional candidates, fearing the election of “Democrats [who] will have power to slow down and interfere with President Trump’s agenda.”

Some powerful Congressmembers are explicitly encouraging this overt exchange of industry money for Congressional allies, like Senate Banking Committee Chair Tim Scott (R-SC), who told attendees of a recent crypto conference: “Thank you, to all of y’all, for getting rid of Sherrod Brown. He’s running again by the way. Literally, the industry put Bernie Moreno in the Senate.”

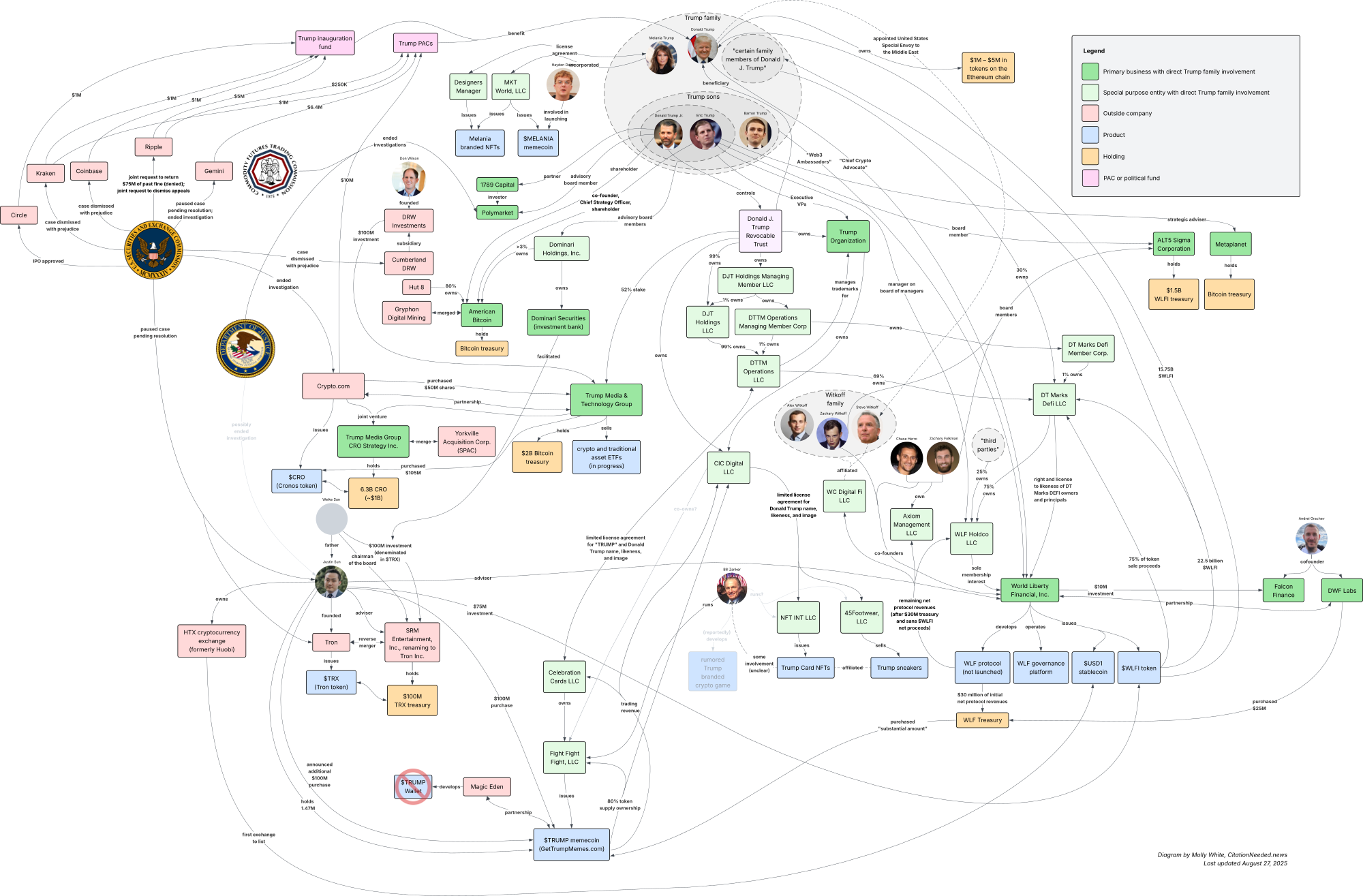

Trump family business interests

Shortly after the announcement that the Trump family’s World Liberty Financial would partner with the ALT5 Sigma Corporation to create a WLFI treasury company [I90], The Information reported that ALT5 “key adviser” Jon Isaac was under SEC investigation for falsely inflating the earnings of a family company to pump its stock price.1 ALT5 Sigma wrote that “Isaac is not — and never was — the President of ALT5 Sigma and he is not an advisor to the company.”2 Isaac himself also denied the reports, claiming “I am NOT under SEC investigation mentioned in these reports.” He acknowledged that he had previously taken over the predecessor company to ALT5 Sigma, JanOne, in a hostile takeover, but is now merely a “large shareholder”.3 However, Isaac remains a party to an ongoing SEC case that names JanOne and Live Ventures, where Isaac is currently CEO.4 Furthermore, Isaac has been a consultant to ALT5 since March 2024, in an agreement intended to last two years.5

The Trump family’s crypto web is only getting more tangled, as Trump family-linked companies are further entwining themselves with various crypto ventures. Trump majority-owned Trump Media and Technology Group, creator of the Truth Social platform, announced a joint venture with Singapore-based exchange Crypto.com. TMTG purchased $105 million of Crypto.com’s CRO token, Crypto.com purchased $50 million of TMTG stock, and the two companies are creating Trump Media Group CRO Strategy Inc., a CRO treasury company they plan to take public through a SPAC merger.

In February, Crypto.com contributed $10 million to the MAGA Inc. Trump super PAC.6 A month later, TMTG and Crypto.com announced their partnership, initially focused on developing “America First investment vehicles” (including crypto ETFs) to be offered by Trump’s social media venture [I80]. Three days after the partnership announcement, Crypto.com said the SEC had dropped an investigation into the company.

This will be either the fifth or sixth Trump family-owned or -linked crypto treasury company, in addition to American Bitcoin,a Trump Media & Technology Group (which itself acquired a substantial bitcoin treasury earlier this month [I90]),b Metaplanet,c and ALT5 Sigma.d Donald Trump Jr. was previously a major shareholder in Thumzup Media;e he sold some or all of his shares,7 though some crypto news outlets continue to describe him as involved with the company.8

Donald Trump Jr. has become a strategic adviser to Polymarket, the crypto prediction markets platform, after a reportedly “double-digit millions of dollars” investment by 1789 Capital, the venture capital firm where he’s been a partner since his father’s 2024 election victory. Polymarket surged in popularity during the 2024 elections, drawing billions of dollars in bets on the presidential race, with some figures in the crypto and political worlds suggesting that betting markets are more reliable than polls, experts, or news media. Donald Trump Jr. echoed this sentiment in a statement about his new role: “Polymarket cuts through media spin and so-called ‘expert’ opinion by letting people bet on what they actually believe will happen in the world.”9

In regulators

Crypto lobbying groups have written a letter to President Trump, reiterating their support for his nomination of Brian Quintenz as CFTC Chair. His confirmation, they write, is “essential to accomplishing the proactive agenda your Administration has established to ensure a golden age for digital assets in America”. The letter praises Quintenz for his “forward-looking vision of this transformative technology”.10 It makes no mention of his recently released emails with CFTC employees, obtained via FOIA request, which lawmakers and crypto industry figures have said raise serious questions about possible ethics violations [I90]. Quintenz’s nomination was scheduled for a vote in front of the Senate Agriculture Committee in late July, but the vote was canceled twice. One of the cancellations was at the request of the White House, which did not elaborate on its reasoning for the delay.

Regardless of Quintenz’s confirmation, the normally five-person CFTC Commission is about to be down to one person. Democrat Kristin Johnson, one of two remaining Commissioners, announced in May that she was planning to leave, and she will do so next week [I85], leaving only Commissioner and Acting Chair Pham behind. However, Pham has said that, when Quintenz is confirmed, she too plans to resign [I84]. Though the Commission is normally roughly bipartisan, with a rule prohibiting more than three of the five Commissioners from a single party, there are questions whether Trump will bother to appoint any Democratic Commissioners — or any new Commissioners — at all.

Johnson published outgoing remarks, warning:11

In a moment when such significant changes to markets and market structure are contemplated, I am concerned that the expert staff at the Commission receive the support and investments needed to be successful.

In advancing an agenda in the name of growth, it is critical not to dismantle the foundational resilience that supports financial stability and protects the broader economy. ... [I]n every instance, consistent with our mission, regulation or any efforts to deregulate or streamline regulation should not leave customers or markets vulnerable to fraud.

Meanwhile, Acting Director Caroline Pham has announced another “crypto sprint” at the agency, explaining, “The Administration has made it clear that enabling immediate trading of digital assets at the Federal level is a top priority.”12 As she signals her plans to implement the industry-friendly rulemaking outlined by Trump in his crypto executive orders, Bloomberg spoke to a large group of insiders who describe a “regulator in disarray”. Bloomberg notes the agency has brought just one new enforcement action since Pham’s takeover (against a futures trader, in parallel with criminal action from New York prosecutors13), compared to over a dozen over the same period last year.14

International regulators and exchange industry groups have urged the SEC to pump the brakes on tokenized stocks, stating, “these products are marketed as stock tokens or the equivalent to stocks when they are not.” They encouraged the SEC to apply securities laws to tokenized stocks, establish clear rules for the asset class, and prohibit marketing tokenized assets as equivalent to stocks.15

In Congress

As the Treasury Department begins the comment process on stablecoin rulemaking, as directed by the newly enacted Genius Act, banking and consumer protection advocates are urging Congress to take a second look at the law. A group of state legislators and financial regulators, consumer advocacy groups, and banking organizations have co-signed a letter urging Congress to remove section 16(d) of the Genius Act, which they fear introduces a loophole into states’ licensing and oversight strategies for uninsured depository institutions. “Ignoring state law in this regard invites regulatory arbitrage, allowing certain uninsured depository institutions special privileges to operate across state lines as federally insured banks currently do, but without the panoply of regulatory and supervisory requirements, or limitations on preemption applicable to those institutions,” they write.16

In separate letters, a group of banking organizations expressed concerns about a “payment of interest loophole” in the bill that could allow stablecoin issuers to easily bypass the bill’s restrictions on paying interest or other forms of yield. They warn this could introduce “risk of significant deposit flight”, and that if a widespread shift away from bank deposits and money market funds and into stablecoins occurs, it could increase costs and reduce the availability of consumer and business lending.17 Another letter by the American Bankers Association and state Bankers Associations raised similar concerns about payments of interest, and also urged Congress to repeal section 16(d) and strengthen prohibitions against non-financial companies issuing stablecoins.18

The crypto lobby has penned a response to the banking groups’ letters, arguing that they are merely trying to “tilt the playing field in favor of legacy institutions, particularly larger banks” and describing the banks’ concerns as “not a loophole—... a feature”.19

Senate Banking Committee Chair Tim Scott (R-SC) has been speaking optimistically to crypto audiences about passing the Senate’s version of a crypto market structure bill by the end of September. This bill, still in discussion draft form, is the Senate’s alternative to the Clarity Act that passed the House in July [I89]. Scott claimed that 12 to 18 Democrats are “at least open to voting for [the bill]”, but “the forces against it, let me just say clearly, like Senator Elizabeth Warren, standing in the way of Democrats wanting to participate, it is a real force to overcome.” Even if the Senate passes their market structure bill, it differs significantly enough from the House’s Clarity Act that it would need a separate House vote or a conference process.20

Former IMF Chief Economist Simon Johnson warns in an op-ed for Project Syndicate that “Unfortunately, the crypto industry has acquired so much political power – primarily through political donations – that the GENIUS Act and the CLARITY Act have been designed to prevent reasonable regulation. The result will most likely be a boom-bust cycle of epic proportions.”21

In the White House

The White House has finally cracked the code on how to publish numbers to the internet. Commerce Secretary Howard Lutnick announced at a Cabinet meeting, “The Department of Commerce is going to start issuing its statistics on the blockchain, because you are the Crypto President, and we are going to put out GDP on the blockchain. So people can use the blockchain for data distribution, and then we're going to make that available to the entire government, so all of you can do it. We're just ironing out all the details so we can do it.”

(via Acyn)

To be extra clear, Lutnick is not proposing moving any funds — just using some unspecified blockchain as a ledger to record statistics like GDP. In a normal timeline, an announcement that the government will publish its statistics in an additional type of database would not warrant announcement from a cabinet official, but it’s 2025 and there’s a Crypto President to indulge.

I am a little concerned that this push is an effort to lean on the supposed inherent reliability of blockchains to lend artificial credibility to questionable numbers cherry-picked by Trump when the real ones are unflattering, as he did recently with jobs data.22 While it is harder to alter information once it has been recorded on a blockchain, this does not mean the information itself is reliable. Blockchain advocates often conflate immutability with accuracy, suggesting that blockchains inherently validate the truth of recorded data. In reality, a blockchain only preserves data in the state it was entered — it doesn’t verify whether that data was correct in the first place. I may be ascribing a far greater degree of forethought to Lutnick’s announcement than it deserves, though — maybe our Commerce Secretary is actually just making sure he tackles the top priority of making sure Polymarket bettors can bet on the future GDP without needing to rely on an oracle.

The Federal Reserve Board has ended its “novel activities supervision program”, created in August 2023 to apply enhanced supervision to crypto-related activities and fintech partnerships with non-banks. The Fed portrays the decision as merely a move to fold such supervision back into their normal supervisory processes,23 though crypto media outlet CoinDesk characterizes the change as a continuation of its “relaxation of crypto oversight”.24

This change has been rather overshadowed by a more serious (attempted) shakeup at the Federal Reserve Board, as President Trump has tried to fire Lisa Cook, one of its six current members.f Members can only be fired for cause, and Trump claims a letter from Federal Housing Finance Agency director William Pulte to Attorney General Pam Bondi alleging that Cook “potentially committ[ed] mortgage fraud” provides such cause. The investigation into Cook’s mortgage is part of a string of inquiries by Pulte into mortgage applications by prominent Democratic enemies of Trump, which have also targeted California Senator Adam Schiff and New York Attorney General Letitia James. None of the three have been charged with crimes.25

Cook issued a statement that “President Trump purported to fire me ‘for cause’ when no cause exists under the law, and he has no authority to do so. I will not resign. I will continue to carry out my duties to help the American economy as I have been doing since 2022.” She has indicated that she is willing to fight the removal in court.25

The attempted firing is another escalation in Trump’s fight with the Federal Reserve, an independent federal agency he has nevertheless been attempting to influence. Trump had previously privately indicated to Republicans in Congress that he would likely try to fire Federal Reserve Chair Jerome Powell, which he also likely can’t do, but later denied saying so. Trump has heavily criticized Powell, saying “He’s a terrible Fed chair. I was surprised he was appointed,” falsely claiming Powell was installed by Biden. (Powell first joined the Federal Reserve Board under Obama, and it was Trump who nominated Powell to the Chair position. Powell was reconfirmed under Biden in 2022 after his term expired.) Trump has also made unsubstantiated insinuations that Powell might have committed fraud related to a costly Federal Reserve headquarters renovation.26

Former Digital Assets Advisory Council director Bo Hines didn’t spend long looking for work, after he abruptly announced on August 9 that he would be resigning and returning to the private sector [I90]. Only ten days later, the revolving door flung him into a position as “Strategic Advisor for Digital Assets and U.S. Strategy” for Tether, an offshore stablecoin company that I’ve previously described as “the most Wild West of the established stablecoin issuers” [I89] Hines had helped back the Genius Act, which will largely dictate Tether’s future operations in the US; the bill also received a stamp of approval from Tether, whose CEO stood in the background as Trump signed it into law.

Bloomberg reported a plan by bitcoin fugitive Roger Ver to pay $30 million in hopes of securing a pardon from President Trump. Ver was charged with tax fraud in April 2024 after allegedly evading around $50 million in expatriation taxes owed after renouncing his US citizenship, and is currently fighting extradition from Spain [I57]. According to Bloomberg, Tether co-founder (and former Mighty Ducks child actor) Brock Pierce schemed with Matt Argall to pitch a plan for Ver’s pardon in exchange for a hefty fee. “It’s unclear whether Argall and his associates had genuine connections to people with power, much less the clout to persuade them that Ver’s pardon was a worthy cause,” writes Bloomberg, noting that, aside from a LinkedIn picture of him at a campaign event with Robert F. Kennedy Jr., Argall doesn’t “appear to have any clear connections to Trump’s inner circle”. Although Ver may have been interested in the offer early on, one of his lawyers may have warned him off, opining that the claims of high-level connections seemed false.27

Ver seems to have opted for more reliable lobbyists like Roger Stone, who I certainly can’t argue lacks experience with presidential pardons. (Stone is, if nothing else, substantially cheaper than Argall, charging a mere $600,000 to lobby for “ending the exit tax and reform of cryptocurrency tax policy”. Ver has also paid $30,000 for lobbying by Sterling Green’s Tracy Ackerman on the same subject, as well as “supporting the Make America Healthy Again (MAHA) agenda” and “criminal justice reform for cryptocurrency related law enforcement and lobbying for the dismissal of charges against Roger Ver.”).2829

In the states

Wyoming launched a state-backed stablecoin called FRNT, short for Frontier Stable Token. “I don’t know how exactly but this ends with Utah buying Wyoming”, wrote a Bluesky commenter.30 In addition to giving us crypto mega-booster Cynthia Lummis on Capitol Hill, Wyoming has long been hot for blockchain at the state level, including by welcoming decentralized autonomous organizations (DAOs) to set up shop there with a bespoke legal framework [I53].

Illinois is taking a different approach, as Governor JB Pritzker has signed two crypto anti-fraud bills into law. One is the Digital Assets and Consumer Protection Act, which gives the state’s financial regulator more authority over crypto firms and requires companies to implement cybersecurity and anti-fraud measures. The other is the Digital Asset Kiosk Act, targeting cryptocurrency ATMs, imposing registration requirements and caps on transaction fees. It requires ATM companies to limit transactions by new customers to $2,500 to limit damage from scammers instructing victims to transfer funds using the kiosks and requires companies to fully refund scam victims. When announcing the laws, Pritzker slammed Trump for “let[ting] crypto bros write federal policy.”31

Texas’ utility commission has sued the state’s Attorney General Ken Paxton after his office largely agreed with journalists who appealed a decision to deny them access to data about cryptocurrency facilities and their energy consumption.g The utility commission’s lawyers argue the information can't be released because “this information could be used by terrorists to plan attacks on Texas’s energy grid and critical infrastructure”. It’s not clear how they plan to argue that this information is any more sensitive than information about power plants, where similar data is publicly available.32 Cryptocurrency miners in Texas and elsewhere have previously resisted attempts to gain more insight into their energy consumption; in 2024 they blocked an attempt by the US Energy Information Administration to collect energy usage data [I52]. (The EIA made a second attempt to issue the survey later that year [I62].)

In elections and political influence

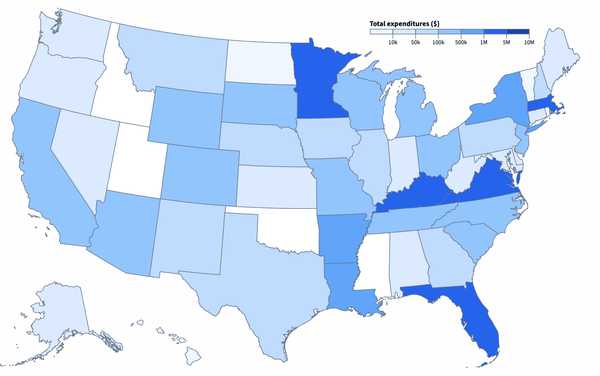

Political fundraising is ramping up for the midterms, and the pro-crypto super PAC Fairshake is number one on the list of super PACs by cash raised in the 2025–2026 cycle. They’ve received about $59 million so far, and have almost $120 million in cash on hand.h This puts them ahead of all other super PACs,i including George Soros’ Democracy PAC, Elon Musk’s America PAC, the Senate Leadership Fund, and the Senate Majority PAC.33 Most of Fairshake’s contributions this period are from Coinbase ($25 million) and Ripple ($23 million).34

Among those excited about the crypto industry’s massive political influence are current, powerful Senators like Senate Banking Committee Chair Tim Scott. Speaking at the recent Wyoming Blockchain Symposium, Scott said, “Thank you, to all of y’all, for getting rid of Sherrod Brown. He’s running again by the way. Literally, the industry put Bernie Moreno in the Senate.”35

(via Coinage)

Sherrod Brown (D-OH) was Scott’s predecessor as Senate Banking Chair. He’s a longtime consumer protection and worker’s advocate, and earned a reputation as a skeptic of not just the crypto industry, but also of Wall Street banks and other powerful financial players. In 2024, Fairshake’s largest expenditure was $40 million to support Republican crypto advocate Bernie Moreno, who defeated Brown and secured his own spot on the Senate Banking Committee. Brown has recently announced he will run again, this time to replace Republican Jon Husted, who was appointed in 2025 to the seat vacated by JD Vance.36

Fairshake will have more company than last election cycle. While in 2024 Fairshake operated alongside the Democrat-focused Protect Progress and Republican-focused Defend American Jobs — with all three PACs essentially functioning as coordinated arms of the same operation — a new set of crypto PACs have sprung up, including:

- Digital Freedom Fund (super PAC): Rejecting Fairshake’s strategy of claimed nonpartisanship, this PAC explicitly supports Republicans who will “help realize President Trump’s vision of making America the crypto capital of the world”. The newly formed committee has not yet filed any fundraising disclosures, but the Winklevoss twins announced a $21 million contribution.37

- First Principles Digital (hybrid PAC): This PAC describes itself as a “Republican-led, Republican-focused organization working to elect pro-crypto leaders to Congress”. It’s affiliated with Cynthia Lummis (R-WY), and has raised $1 million this year so far (entirely from the Winklevoss twins, except for a $5,000 contribution from Trump crypto adviser David Bailey [I90, 84]). First Principles shares leadership with America First Digital, a new dark money group that aims to “help advance pro-crypto policies and regulations, amplify the efforts of industry champions in Washington, and support ongoing education efforts among key decision-makers.”38

The crypto industry has also launched a 501(c)(3) “educational non-profit” called the American Innovation Project, which will focus on “educating” policymakers. Although such groups must by law be cautious about engaging in only minimal lobbying activities, focusing on non-advocacy educational initiatives, I am not confident this will be carefully followed or policed. The group is backed by crypto companies including Coinbase, Kraken, DCG, and others, and funded by DCG and the Cedar Innovation Foundation crypto dark money group.39

AI firms are explicitly naming Fairshake’s massive spending blitz as a blueprint for their own super PAC, Leading the Future, which seeks to support “pro-AI” candidates. The PAC has already received backing from AI companies and executives like OpenAI’s Greg Brockman and Perplexity, and venture capitalists like Andreessen Horowitz.40

Outside the US

As Binance is reportedly lobbying in the US to prematurely remove its anti-money laundering compliance monitor,41 Australia’s financial crimes regulator has just ordered the company’s local branch to appoint one. The regulator stated they had “identif[ied] serious concerns with the crypto exchange’s anti-money laundering and counter terrorism financing (AML/CTF) controls”,42 raising questions around how much the global exchange has actually done to rectify the same problems that led to US criminal charges almost two years ago [I44].

The Bithumb crypto exchange launched a crypto lending program in South Korea in mid-June, quickly attracting around 27,600 customers. Within a month, 13% experienced forced liquidations after crypto prices fluctuated. Korean authorities have announced they will suspend crypto lending until guidelines are established.43

The Web3 is Going Just Great recap

There were three entries between August 14 and August 27, averaging 0.2 entries per day. $141.4 million was added to the grift counter.

- BetterBank exploited, some funds returned [link]

- Bitcoiner socially engineered out of $91 million [link]

- BtcTurk apparently hacked again, for $49 million [link]

In the news

NiemanLab just published this profile of me and my work, which also includes an interview where we talk about my crypto election spending tracker, the crypto industry’s lobbying efforts, my broad views on technology and tech criticism, how I follow and consume news and other media, and some of the ins and outs of my own media operation.

I spoke to Mariel Padilla at The 19th (which I love, by the way!) about the recent dildo-throwing incidents plaguing WNBA players, and the broader crypto environment from which it came.

That's all for now, folks. Until next time,

– Molly White

Have information? Send tips (no PR) to molly0xfff.07 on Signal or molly@mollywhite.net (PGP).

I have disclosures for my work and writing pertaining to cryptocurrencies.

Footnotes

Bitcoin treasury company, part-owned by Eric and Donald Trump Jr. Eric Trump is also a co-founder and Chief Strategy Officer. ↩

Bitcoin treasury company, 52% owned by Donald Trump (via the Donald J. Trump Revocable Trust, controlled by Donald Trump Jr.) ↩

Bitcoin treasury company. Donald Trump Jr. is a shareholder and strategic adviser. ↩

$WLFI treasury company. Eric Trump is a board member, as are Zach Witkoff and Zak Folkman (executives of the Trump family’s World Liberty Financial). ↩

Bitcoin, Dogecoin, Litecoin, Solana, Ripple, Ether, and USDC treasury company. ↩

The Federal Reserve Board normally has seven members, but Adriana Kugler announced her resignation on August 1. She did not provide a reason for her departure. Trump has nominated Stephen Miran to serve the remainder of Kugler’s term, but he has not been confirmed. ↩

Rare Ken Paxton W. ↩

In terms of cash on hand, Fairshake is in second place to Soros’ Democracy PAC II. ↩

This does not include hybrid PACs, which make independent expenditures (like super PACs) and candidate contributions. ↩

References

“Trump Partner in Crypto Venture Faces SEC Allegations”, The Information. ↩

Form 10-K for 2024, filed by ALT5 Sigma Corporation with the US SEC. ↩

Schedule A form filed by MAGA Inc. on July 31, 2025. (Note: Foris DAX is the operator of Crypto.com.) ↩

“Donald Trump Jr. invests in Thumzup crypto treasury firm targeting BTC, ETH, SOL, XRP, and crypto mining”, The Block. ↩

“Trump Family Expands Crypto Bets as Thumzup Pivots Into Dogecoin Mining”, CoinDesk. ↩

“Polymarket secures investment from Trump Jr-backed 1789 Capital”, Reuters. ↩

Digital Asset Industry CFTC Chairman Letter to President Trump, sent August 20, 2025. ↩

“Commissioner Kristin Johnson Announces Departure from CFTC”, CFTC. ↩

“Acting Chairman Pham Announces Next Crypto Sprint Initiative”, CFTC. ↩

“CFTC Charges Syracuse, N.Y., Man, His Firm with Fraud, Misappropriation”, press release by the CFTC. ↩

“Staff Cuts and Turmoil Hit the CFTC While the Crypto It Oversees Booms”, Bloomberg. ↩

“Stock exchanges urge regulators to crack down on ‘tokenised stocks’”, Reuters. ↩

Coalition Letter to Strike Uninsured Depository Institution Flaw of GENIUS Act, sent August 13, 2025. ↩

Closing the Payment of Interest Loophole for Stablecoins, sent August 12, 2025. ↩

State Associations Letter re: Gaps in GENIUS Act, sent August 12, 2025. ↩

Blockchain Association and Crypto Council for Innovation Letter of Opposition to ABA/State Bankers Letter on the GENIUS Act, sent August 19, 2025. ↩

“Senate Banking Chair Tim Scott: 12-18 Dems May Vote for Market Structure Bill”, CoinDesk. ↩

“The Crypto Crises Are Coming”, Project Syndicate. ↩

“Still Fuming Over a Weak Jobs Report, Trump Finds Some Numbers He Likes”, The New York Times. ↩

“Federal Reserve Board announces it will sunset its novel activities supervision program and return to monitoring banks' novel activities through the normal supervisory process”, press release by the Board of Governors of the Federal Reserve System. ↩

“U.S. Fed Officially Scraps Specialist Group Meant to Oversee Crypto Issues”, CoinDesk. ↩

“Trump says he's removing Federal Reserve Gov. Lisa Cook, citing his administration’s allegations of mortgage fraud”, NBC News. ↩

“Trump denies plans to fire Fed Chair Jerome Powell despite what he told Republicans”, USA Today. ↩

“How a $30 Million Pardon Scheme Failed Even Before It Got to Trump”, Bloomberg ↩

Lobbying report filed by Roger Stone, April 17, 2025. ↩

Lobbying disclosures for client Roger Ver. ↩

Bluesky post by proptermalone. ↩

“Illinois Governor Signs First-in-Midwest Crypto Consumer Protection Laws”, Decrypt. ↩

“State utility commission sues Texas attorney general to avoid releasing data on crypto companies’ power use”, The Texas Tribune. ↩

List of super PACs, FEC. ↩

Fairshake receipts, 2025–2026. ↩

“Sherrod Brown to run for Senate”, Politico. ↩

“Scoop: New GOP pro-crypto PACs launch this weekend”, Axios. ↩

“Nonprofit American Innovation Project backed by Coinbase, Uniswap, others launches to educate US lawmakers on crypto”, The Block. ↩

“AI Titans Back $100 Million Super PAC to Boost Industry's Status in Washington”, Decrypt. ↩

“Binance Seeks to Curb U.S. Oversight While in Deal Talks With Trump’s Crypto Company”, The Wall Street Journal. ↩

“AUSTRAC orders audit of global crypto exchange”, AUSTRAC. ↩

“가상자산 이용자 보호를 위해 대여 서비스에 대한 행정지도를 실시합니다.”, South Korea Financial Services Commission (in Korean). ↩