Issue 92 – The scam of all scams

The Trumps “debank” major customers from their “anti-debanking” cryptocurrency venture, and a CFTC nominee says the Winklevosses are blackballing him

The Trump family saw significant financial gains this week as their World Liberty Financial token began trading on secondary markets and the Trump sons’ American Bitcoin stock debuted on the Nasdaq, though the week brought its share of complications. Shortly after WLFI trading commenced, the project team made the surprising decision to blocklist their largest backer, Justin Sun, preventing him from selling his substantial token holdings — a move that may have been motivated by concerns that his actions were causing the token’s price to decline. Additionally, the Nasdaq forced Eric Trump’s removal from the planned board of ALT5 Sigma, a publicly listed company recently converted into a WLFI treasury vehicle, after the exchange decided it couldn’t abide by that degree of conflict of interest. (The Nasdaq seemed less troubled by similar conflicts arising from other World Liberty executives, who will take positions on ALT5 Sigma’s board as originally planned.)

With Congress back in session, some pro-crypto Senate Democrats are seeking changes to industry-written draft market structure legislation, with several Senators who previously supported the Genius Act now pushing for stronger language to prevent presidential conflicts of interest and ensure more representative SEC and CFTC oversight. It remains to be seen whether these demands will translate into meaningful opposition or simply become bargaining chips in ongoing negotiations.

Citation Needed is an independent publication, entirely supported by readers like you. Consider signing up for a free or pay-what-you-want subscription — it really helps me to keep doing this work.

Trump business interests

WLFI opens for trading

World Liberty Financial’s WLFI token, previously a non-resalable “governance token” available for purchase only by non-US buyers and accredited US investors, has become available for secondary trading following a July governance vote [I88]. After trading opened, the Wall Street Journal ran the headline: “Trump Family Amasses $5 Billion Fortune After Crypto Launch”.1 In the article’s subtitle and body text, the Journal acknowledges that these are merely “paper” profits, quietly walking back the misleading headline figure. Flawed estimates of dollar-denominated windfalls — which ranged from around $4 to $6 billion depending on outlet — are a recurring issue in crypto reporting, as I discussed in my January article “No, Trump didn’t make $50 billion from his memecoin”. For one, the Trumps and other members of the project team are not yet permitted to actually sell any of their tokens. But even if they were, large sales of tokens in low-liquidity markets inevitably cause token prices to collapse, making the price × quantity equation a poor estimate for the dollar value of large holdings. The Trump family faces even further challenges to cashing out: any significant selling of their stash would likely trigger market panic as investors rush to interpret what the insider sales signal.

One could reasonably complain that I’m counting the trees while the forest burns on this point. While I do think it’s important not to present misleading numbers, it’s inarguable that the Trumps have profited enormously from World Liberty. With 75% of WLFI token sale proceeds flowing directly to the Trumps after an initial $30 million threshold was met, the Trumps profited $412.5 million from the early token sales. The token has also served as a mechanism for indirect payments to the president and his family — crypto billionaire Justin Sun’s $75 million purchases of WLFI in November 2024 and January 2025 saw $56 million of it flow directly to the Trumps. Besides that, the family has a massive share of WLFI tokens they will later be allowed to sell (though not for $5 billion) or potentially borrow against. And the family maintains an equity stake in the company, giving them a share of all ongoing operations. One significant revenue stream comes from the USD1 stablecoin — particularly its use by the Emirati firm MGX for an investment into Binance [I83]. This arrangement alone is projected to generate $280 million by the end of Trump’s term, with approximately $168 million of it flowing to the Trump family.2

Though undeniably lucrative for insiders, the token launch has been anything but smooth. The price dropped almost immediately after the token opened for trading at $0.28, following a down-only trajectory to below $0.17 for the two days following the launch.3 (While early investors who got in at $0.015 or $0.05 remained comfortably profitable, retail traders buying early on secondary markets took losses—as did bullish derivatives traders who saw a combined $8.51 million in long positions liquidated.)4 The World Liberty team rushed to staunch the bleeding by proposing a “buyback and burn” plan: a common crypto scheme where projects use protocol fees to purchase their own tokens on the secondary market and permanently destroy them, aiming to boost prices through increased demand and reduced supply. The team began the process, and prices subsequently stabilized at around $0.20 (down almost 30% since listing).

Separately, some holders of WLFI tokens fell victim to various scams and hacks appearing to target holders around the time of the launch. In addition to having to navigate phishing links and social media impersonators who swarmed around the launch, some buyers saw their wallets drained through a combination of private key leaks and an exploit enabled by a May upgrade to the Ethereum blockchain. The attack worked in two stages: first, attackers obtained users’ private keys through phishing. Then, they essentially inserted a backdoor into the wallets, allowing them to transfer valuable tokens to their own wallets — including any additional tokens that victims later added to pay for transaction fees.5

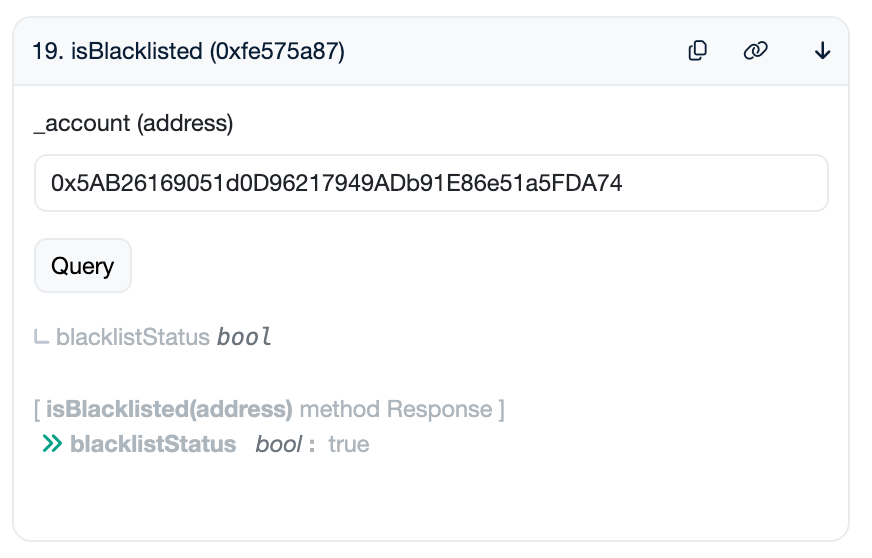

In a surprising turn of events, World Liberty Financial also blocked Justin Sun, their largest known investor, from accessing his tokens. While Sun holds approximately 3 billion WLFI tokens in total, with 595 million unlockeda when secondary trading began, the team froze his wallet after he transferred around 55 million tokens (priced at roughly $9 million at the time). They did this using a function in the WLFI smart contract that allows them to blocklist specific wallet addresses.

isBlacklisted by the WLFI smart contractSuch functions don’t normally exist in more decentralized cryptocurrencies like bitcoin or ether, but are more common in tokens issued by centralized entities who routinely freeze tokens in sanctioned wallets or that are deemed to be associated with thefts or other illicit activity. Sun defended his actions on September 4, tweeting that he had only “carried out a few general exchange deposit tests” and that “no buying or selling was involved”. He insisted these transfers “could not possibly have any impact on the market” — apparently responding to speculation that he had been selling tokens and thus contributing to WLFI’s price decline, though it remains unclear whether this accusation came from the World Liberty team themselves or from public speculation.6

This move by World Liberty Financial stands in stark contrast to the Trump sons’ frequent complaints about being “debanked” by traditional financial institutions who they say arbitrarily denied them loans and services — the very issue they claimed inspired them to create this project. Sun has publicly appealed to the project team, saying his tokens were “unreasonably frozen” and that he “deserve[s] the same rights” as other early buyers. He wrote, “I call on the team to respect these principles, unlock my tokens, and let’s move forward together toward the success of World Liberty Financials [sic].”7 Perhaps in an attempt to mollify the World Liberty Financial team, Sun tweeted the following day that he planned to purchase another $10 million in WLFI and $10 million in shares of Alt5 Sigma, the Trump sons’ newly formed WLFI treasury company.8 But as of writing, over a week later, his wallet has still not been unfrozen.

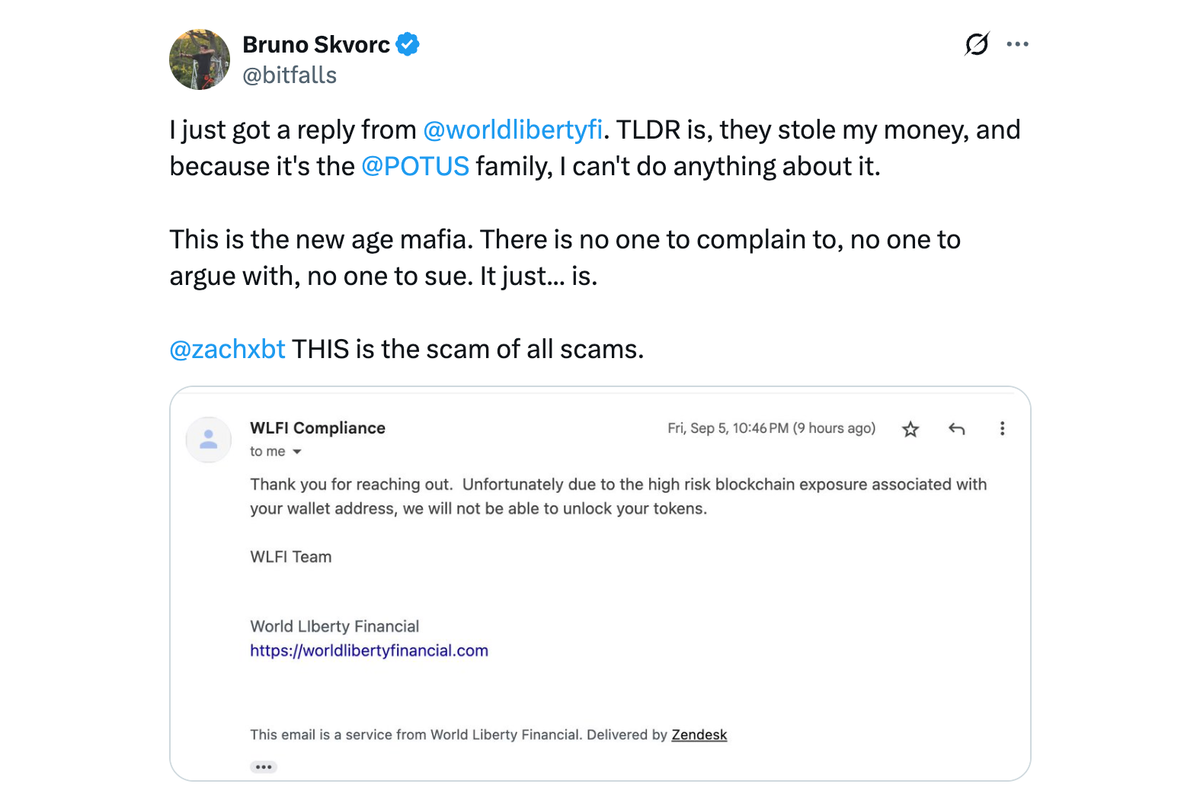

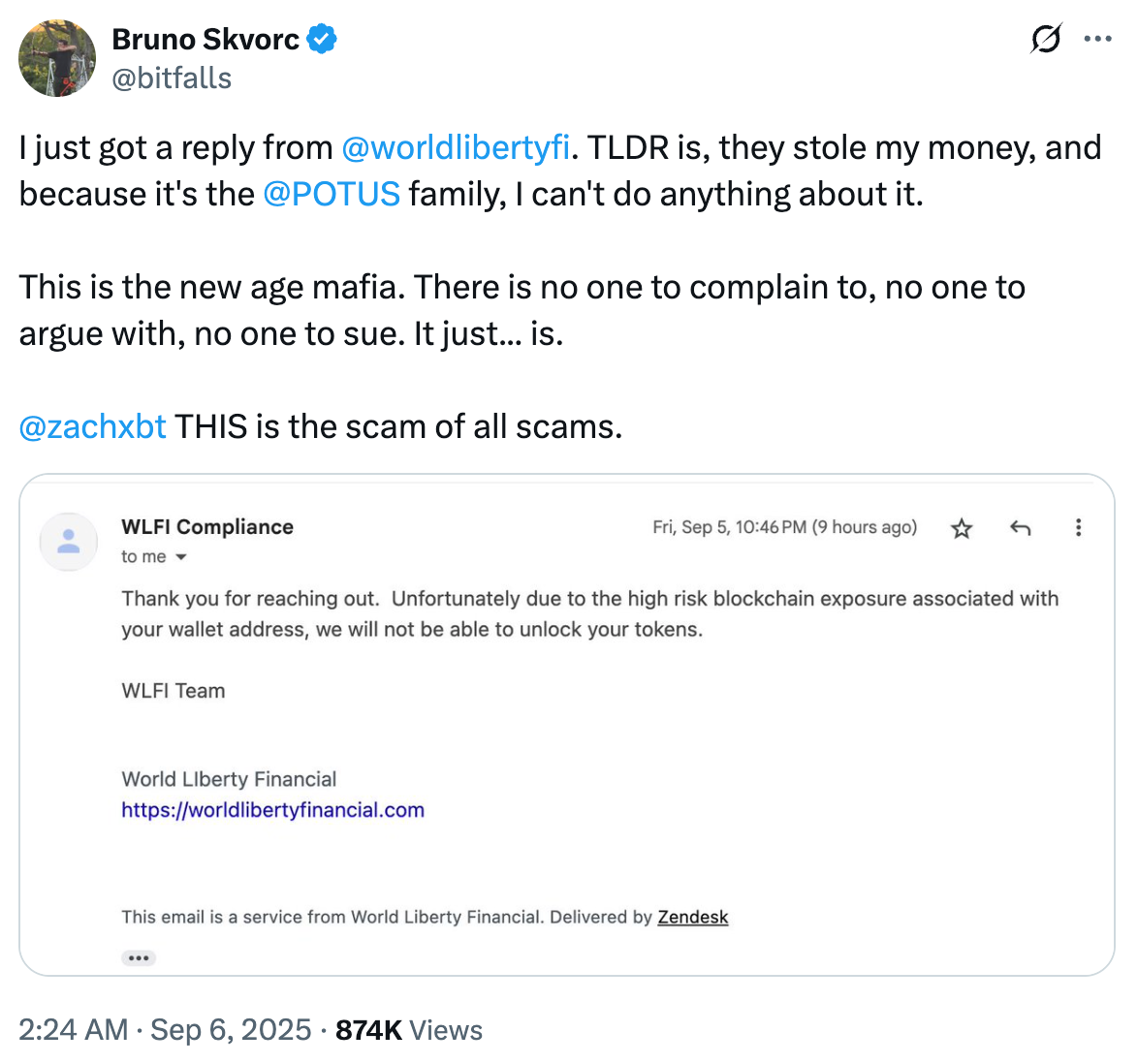

While World Liberty Financial hasn’t directly addressed Sun’s case, they published a Twitter thread defending their freeze policy, insisting they “only intervene to protect users, never to silence normal activity”. According to the team, they blocklisted 272 wallets — mostly belonging to confirmed phishing victims or at the owners’ own request after their addresses were compromised. The team cited “high-risk exposure” for blocking five additional wallets, and “suspected misappropriation of other holders’ funds” for one more.9 Among these was Bruno Skvorc, a Polygon developer relations employee, who received a terse email: “Thank you for reaching out. Unfortunately due to the high risk blockchain exposure associated with your wallet address, we will not be able to unlock your tokens.” Using Chainalysis tools, Skvorc traced his wallet’s alleged red flags: transactions with the Tornado Cash mixer, and indirect connections to sanctioned exchanges Garantex and Netex24. Skvorc wrote, “TLDR is, they stole my money, and because it’s the POTUS family, I can’t do anything about it. This is the new age mafia. There is no one to complain to, no one to argue with, no one to sue. It just... is. ... THIS is the scam of all scams.”10

American Bitcoin

In addition to their profits from the WLFI token launch, Eric and Donald Trump Jr. scored another financial win this week when American Bitcoin, a cryptocurrency mining venture, went public via a merger with Gryphon Digital Mining. Their roughly 20% ownership stake in the newly public company is valued at approximately $1.5 billion. This lucrative position stems from what I’ve previously characterized as a sweetheart arrangement [I81]: the established mining company Hut 8 effectively gifted their mining equipment to create American Bitcoin, while maintaining an 80% ownership stake in the new entity. Without any evidence that cash traded hands, Hut 8 essentially gave Eric Trump and his business partners 20% of their operation.

Alt5 Sigma

When I wrote up the news in August that the Trumps and World Liberty Financial were creating a WLFI treasury company with the Nasdaq-listed ALT5 Sigma, I noted [I90]:

[Alt5 Sigma will] add Eric Trump and World Liberty Financial executives Zach Witkoff and Zak Folkman to its board. All three have a financial interest in World Liberty Financial, presenting a blatant conflict of interest in their roles on the ALT5 board.

Evidently, the Nasdaq at least partly agreed, because a new ALT5 Sigma SEC filing has amended their plans to say that “in order to comply with Nasdaq’s listing rules”, Eric Trump will merely be a board observer. Witkoff will still join the board (as chair, no less); Folkman will be an observer and, subject to stockholder approval, a director.11

ALT5 Sigma’s first action as a company will be to purchase $750 million in WLFI tokens to create its treasury. With 75% of WLFI token proceeds going directly to the Trumps, they’ll pocket a cool $500 million, essentially through a deal with themselves.12

In Congress

Congress has returned from its summer recess, and we will now likely see Republicans pushing hard to pass a crypto market structure bill as quickly as possible. Though the House passed its Clarity Act bill in July [I89], the Senate has so far focused on drafting its own legislation. The Senate Banking Committee published a new draft bill shortly after returning, which, among other things, directs the SEC and CFTC to establish a Joint Advisory Committee on Digital Assets to “further the regulatory harmonization of digital asset policy” between the two agencies. The new bill also includes a new clause regarding tokenized stocks, apparently aimed at addressing concerns (including from me [I88]) that any securities issuer could enjoy a Get Out of SEC Regulation Free card merely by issuing their security on-chain. The new draft states: “any instrument that is a security under the securities laws shall not cease to be a security because that instrument is issued, recorded, represented, or transferred using distributed ledger technology”.13

Banking Committee Ranking Member Elizabeth Warren (D-MA) issued a statement after the draft was released, saying that the newest proposal “reportedly reflects secret feedback from industry and other stakeholders that Republicans refuse to share with Committee Democrats, or the public.” She has slammed the proposals as “industry-written”, and demanded the Republicans release the industry feedback that shaped the bill.14

The pro-crypto wing of the Senate Democrats has indicated willingness to negotiate a market structure bill, but suggested they will not sign off on one without some conditions. This is both good and bad for the crypto industry: on the one hand, they may get a bill through before the midterm elections, which is priority number one for an industry nervous that the Republican trifecta may not survive past 2026, and wants to see a bill signed into law so that the industry’s “progress” cannot be so easily rolled back. On the other hand, the Democrats are asking for more significant changes than they demanded in negotiations over the Genius Act — some of which could be stumbling blocks if the Democrats stick to their guns.

These include things like amendments to the draft regulation to ensure that the SEC and CFTC have the authority and funding to oversee crypto markets without leaving any assets in a regulatory vacuum, and strengthening consumer protections (including by preserving state regulatory and CFPB authorityb). They also want to see elected officials and their families prohibited from “issuing, endorsing, or profiting from digital assets while in office”, and require disclosures from officials who hold digital assets. They demand that “commissioners from both parties sit at the SEC and CFTC to create a quorum for digital asset rulemakings”, seemingly addressing the concern that Trump will leave the CFTC as a one-man agency [I91].15 They’re wise to include that point about the SEC, as well — while the agency currently has four of its five commissioners, lone Democrat Caroline Crenshaw’s term expired in 2024. She’s allowed to remain in her role for 18 months — until December 2025 — if no replacement is confirmed. No nominee has been put forward, and her renomination (by Biden in 2024) was stymied by pro-crypto Republicans in December 2024 when they delayed her confirmation vote so that it would not happen before Biden left office.

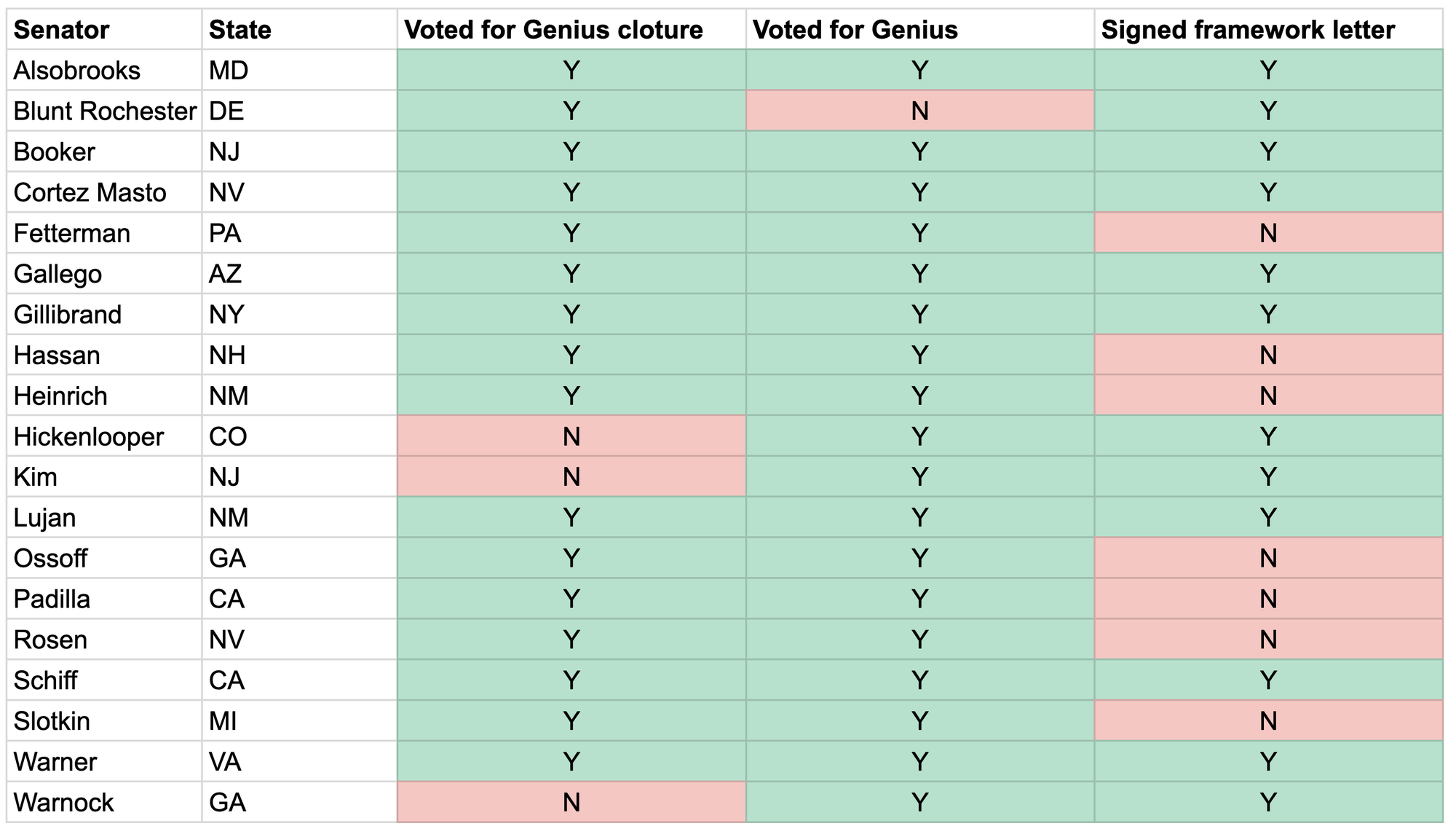

Democrats’ past objections to the Trump family’s crypto self-enrichment, raised during debates over bills like the Genius Act [I84], have yet to seriously threaten the legislation’s passage. However, these objections were raised most loudly by Democrats not likely to support the legislation anyway — not from the same Democratic Senators who provided the necessary votes to pass Genius. This framework was signed by eleven of the eighteen Democrats who voted for the Genius Act, plus Senator Blunt Rochester, who supported Genius during the cloture stage but switched to a no vote on the bill itself. Seven Democratic Senators who voted for Genius did not sign on to this framework: Fetterman (PA), Hassan (NH), Heinrich (NM), Ossoff (GA), Padilla (CA), Rosen (NV), and Slotkin (MI).

It’s certainly possible that some demands will be dropped during negotiations, but this strikes me as the strongest pushback we’ve seen thus far from the set of pro-crypto Democrats who’ve in the past provided the votes needed to pass the industry’s favored legislation. The letter was published by Ruben Gallego, one of the two Senate Democrats who received support from the crypto industry super PACs in 2024. Both Gallego and Elissa Slotkin received $10 million in industry backing; Slotkin did not sign on to the framework. (Other Senate Democrats, such as Kirstin Gillibrand, received contributions from individual crypto executives, but were not supported by the PACs. Gillibrand received the most direct support of any Senate Democrats, but at around $100,000 it was considerably less than the PACs contributed.)

In regulators

The CFTC has issued a no-action letter with respect to QCX, the tiny derivatives exchange Polymarket acquired in July to get their hands on its Designated Contract Markets (DCM) license [I89].16 This essentially gives Polymarket the okay to begin offering their prediction markets in the US — though given how many Americans already trade on the platform despite its supposed prohibitions, more than a few people were surprised to learn they even needed such approval. Prediction markets were once a rare phenomenon in the US — or strictly limited academic exercises — thanks to CFTC oversight that prohibited platforms from offering the types of sports, elections, and current events contracts that are now popular. Now even the academic exercise (a non-profit platform called PredictIt) will be expanding its US operations with a recent okay from the CFTC.17

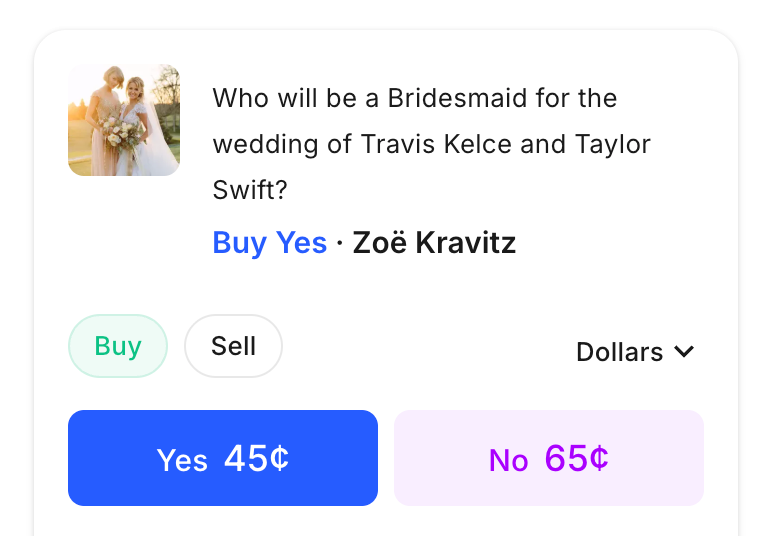

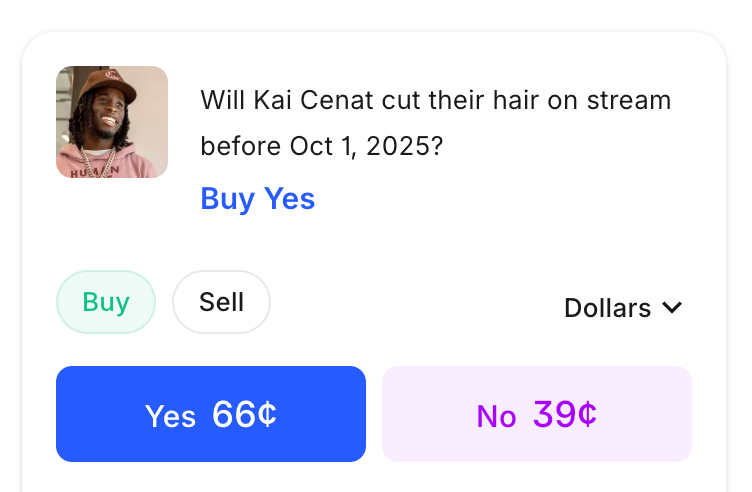

Heavy pressure from these platforms in and outside of court, a favorable court ruling [I66], and new CFTC leadership that thinks these platforms are “an important new frontier”18 has resulted in this explosion of places where people can bet (sorry, trade) on everything from who will win an election or sports game, to what words public officials will use in speeches, to which countries will airstrike one another. Now when Treasury Secretary Scott Bessent threatens to punch Federal Housing Finance Agency director Bill Pulte in the face,19 speculators can gamble on the likelihood that Bessent actually throws a punch (traders are pricing it at about 5%). Welcome to 2025, where not only are Cabinet officials threatening to punch each other, but you can bet on it like it’s an MMA fight.

Thank goodness the CFTC is finally warming up to legitimate hedging activities! As an aside, one of my favorite pasttimes these days is opening up the currently CFTC-regulated Kalshi and trying to imagine who is “legitimately hedging” their business activities in markets like these ones. (Everyone needs a hobby, okay?)

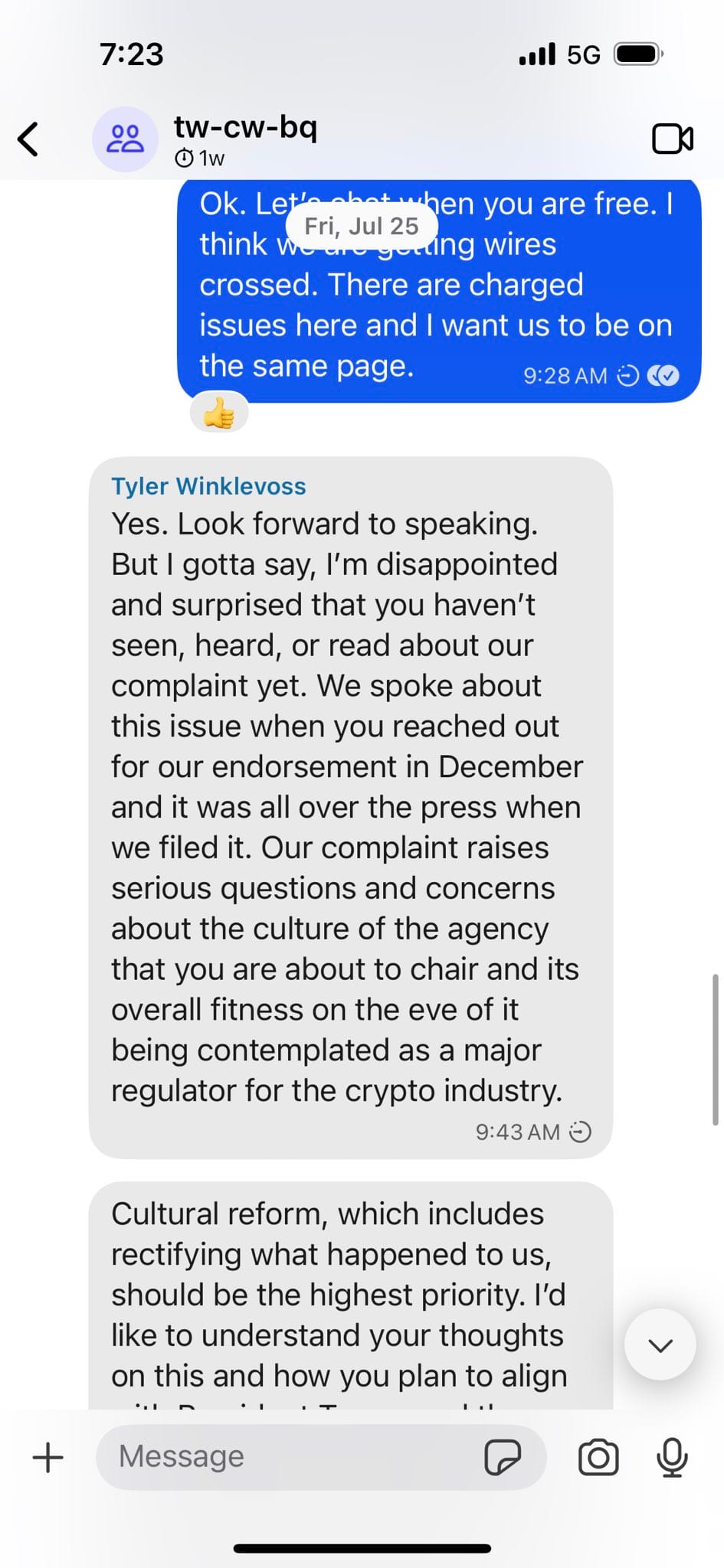

A new chair for the CFTC has still not been confirmed with the Senate in recess, and the conflict over nominee Brian Quintenz is continuing. Setting aside the issues of questionable emails he sent to the current CFTC Commissioners over their regulation of prediction markets — while he has a conflict of interest as a shareholder and board member at Kalshi — I’ve also outlined in past issues how the once supportive Winklevosses turned against him for seemingly strategy-related differences [I90]. Their opposition has diverged from much of the rest of the crypto industry, which recently sent a supportive letter urging his confirmation [I91]. The reason for this divergence may have just become clear, as Quintenz himself published July messages from a group chat with the Winklevoss twins, who pointed him to a furious public letter they sent to the CFTC Inspector General in June after reaching a settlement with the agency [I86].20 “Please take a look and let me know your thoughts after you’ve read our 13-page letter,” wrote Tyler. “7 years of lawfare trophy hunting. It’s outrageous what they did to us.” Quintenz doesn’t really push back in the conversation, though he seems to try to delay the conversation until his confirmation, writing that their complaints “should be unequivocally left to a fully confirmed chair” but that he “will address this fully and fairly if and when I am confirmed.” Later, Tyler states he is “disappointed and surprised that you haven’t seen, heard, or read about our complaint yet. We spoke about this issue when you reached out for our endorsement in December... Cultural reform, which includes rectifying what happened to us, should be the highest priority.” He demands to know “how you plan to align with President Trump and the Administration’s mandate to end the lawfare and make amends for it.” (The Winklevosses have previously suggested that they be repaid 3× their legal costs by the SEC [I78].)

It seems that the Winklevosses hoped that Brian Quintenz would be their man on the inside at the CFTC and have now dropped their endorsements after he failed to immediately and enthusiastically champion their grievances. Along with the messages, Quintenz wrote that he was concerned that President Trump “might have been misled”. He continued, “I believe these texts make it clear what they were after from me, and what I refused to promise. It’s my understanding that after this exchange they contacted the President and asked that my confirmation be paused for reasons other than what is reflected in these texts.”

SEC

Both the CFTC and the SEC have been full steam ahead on their “crypto sprints”, and roughly half of the items on the SEC’s rulemaking agenda are proposals to loosen regulations on the industry.21 “This regulatory agenda reflects that it is a new day at the Securities and Exchange Commission,” announced Chairman Paul Atkins.22

Meanwhile, the SEC has also announced that text messages sent and received by former Chairman Gary Gensler between October 2022 and September 2023 were permanently deleted after a “poorly understood and automated policy that caused an enterprise wipe of Gensler’s government-issued mobile device” in August 2023.23 I imagine this must be rather infuriating news for the dozens of companies that have paid tens of millions of dollars apiece in fines to the SEC over recordkeeping failures.2425 Many in the crypto world have accused Gensler or his SEC of intentionally deleting the messages to hide something, including pro-crypto Representative Tom Emmer (R-MN), who called the deletions “just another example of the less-than-honest behavior that marked the Biden administration.”26

In elections and political influence

Virginia Democrat James Walkinshaw has been elected to the House to fill the seat vacated by Representative Gerry Connolly, who died in office in May 2025. Walkinshaw received just over $1 million in support from the cryptocurrency industry [I87], and his comments about “embrac[ing] the next generation of technology” such as blockchains diverge from his predecessor’s staunch opposition to crypto. Protect Progress, the cryptocurrency-focused super PAC that backed him, was the largest outside spender in the race.27

In the courts

Attorney General for the District of Columbiac Brian Schwalb has announced a lawsuit against crypto ATM operator Athena Bitcoin. “Athena knows its fraud protections do not work,” claimed Schwalb,28 outlining how scammers routinely convince elderly victims to use the machines to transfer money to the scammers' cryptocurrency wallets. Adding insult to injury, Athena also charges massive hidden fees — up to 26% per transaction — on their transfers. In one scam identified by the Attorney General’s office, a victim lost $10,000. About $7,500 of it went to the scammers, and the remaining 25% went to Athena.29 According to an FBI report on 2024 Internet crime, they received almost 11,000 complaints about fraud involving cryptocurrency ATMs or kiosks — a 99% increase from the prior year. Altogether, almost $250 million was reported lost, with $107 million of that coming from victims in the over-60 age group.30

Ryan Salame, who started his lengthy prison sentence back in October of last year, is facing even more trouble. The FTX estate has filed a lawsuit against both Salame and his wife, Michelle Bond, alleging that they transferred money and cryptocurrency assets from his accounts to hers shortly after FTX’s collapse but prior to asset freezes. They also claim that they purchased and transferred ownership of a $4 million property to Bond, which plaintiffs also allege was an attempt to shield it from recovery by the FTX debtors.31

Two former executives of the Cred cryptocurrency lending service have each been sentenced to more than three years in prison for their role in the 2020 collapse of their company [I57]. CEO and co-founder Daniel Schatt and CFO Joseph Podulka claimed to their customers that they engaged in only “collateralized or guaranteed lending”, hedged their investments, and held “comprehensive insurance”. In reality, they were hiding that “virtually all the assets to pay the yield were generated by a single company whose business was to make unsecured micro-loans to Chinese gamers”, and that they had none of the hedges or insurance they claimed. Around $150 million was lost based on prices at the time, though based on current crypto prices the estimate is much larger. Schatt will spend 52 months (4.3 years) in prison; Podulka will serve 3 years.32

Crypto kidnapping continues to be a major issue in France, where police have just arrested seven people and rescued a 20-year-old Swiss man who had been kidnapped and held hostage for several days as his captors demanded a ransom.33

The Web3 is Going Just Great recap

There were five entries between August 28 and September 11, averaging 0.3 entries per day. $55.8 million was added to the grift counter.

- $41.5 million stolen from SwissBorg in Kiln API exploit [link]

- Massive NPM supply chain attack puts crypto transactions at risk [link]

- Nemo Protocol exploited for $2.4 million [link]

- Venus Protocol user exploited for $13.5 million; most funds later recovered [link]

- Bunni decentralized exchange exploited for $8.4 million [link]

Worth a read

A lot of journalists really struggle to accurately cover Wikipedia, but Josh Dzieza did an incredibly good job of it in this very long read in The Verge. In the wake of another First Amendment-violating demand from Congress, he outlines how Wikipedia’s editing community works, the project’s strengths and weaknesses, and the threats it faces.

Parker Molloy wrote up a story about CBS News installing the “bias ombudsman” they promised to hire in order to get their merger approved. You won’t be shocked to learn it’s a Trump lackey. And that’s the way it is... according to the Trump Ministry of Truth.

In the news

I went back on The Majority Report with Emma Vigeland to talk about how Trump is profiting from the cryptocurrency industry while simultaneously demolishing regulations. We also talked about prediction markets, and the crypto industry’s influence in the upcoming midterms.

That's all for now, folks. Until next time,

– Molly White

Have information? Send tips (no PR) to molly0xfff.07 on Signal or molly@mollywhite.net (PGP).

I have disclosures for my work and writing pertaining to cryptocurrencies.

Footnotes

As World Liberty Financial has opened up WLFI for secondary trading, they have imposed a gradual unlocking schedule on early holders, aimed at preventing them from suddenly selling all their tokens at once and crashing the price. This is common practice for projects that have presold or allocated tokens to insiders and early-stage investors. ↩

Prominent figures in the crypto industry have furiously opposed the CFPB, perhaps in part because they’ve proposed consumer protection rules that would require crypto companies to reimburse customers who experience unauthorized transfers from their accounts [I73]. (This rule was rapidly overturned after Trump took office [I82].) ↩

An elected position not to be confused with the United States Attorney for the District of Columbia, a role currently held by Jeanine Pirro. ↩

References

“Trump Family Amasses $5 Billion Fortune After Crypto Launch”, The Wall Street Journal. ↩

“The Number”, The New Yorker. ↩

WLFI price chart on CoinGecko. ↩

“Trump-Backed World Liberty Ethereum Token Debut: Here's How It Played Out”, Decrypt. ↩

“Hackers are using the ‘classic EIP-7702’ exploit to snatch WLFI”, CoinTelegraph. ↩

“The Trumps’ New Crypto Money Maker: Deals With Themselves”, The Wall Street Journal. ↩

September 6 discussion draft. ↩

“Warren Statement on Crypto Market Structure Legislation”, Senate Committee on Banking, Housing, and Urban Affairs. ↩

“A Framework for Market Structure Legislation”, Ruben Gallego. ↩

“CFTC Staff Issues No-Action Letter Regarding Event Contracts”, CFTC. ↩

“Prediction Market PredictIt Launches in October—Here's What to Expect”, Decrypt. ↩

“‘I’m Gonna Punch You in Your F--king Face’: Scott Bessent Threatens an Administration Rival”, Politico. ↩

Agency Rule List - Spring 2025, Securities and Exchange Commission. ↩

“Special Review: Avoidable Errors Led to the Loss of Former SEC Chair Gary Gensler’s Text Messages, Report No. 587”, SEC. ↩

“Twelve Firms to Pay More Than $63 Million Combined to Settle SEC’s Charges for Recordkeeping Failures”, SEC. ↩

“Twenty-Six Firms to Pay More Than $390 Million Combined to Settle SEC’s Charges for Widespread Recordkeeping Failures”, SEC. ↩

Independent expenditures to support or oppose James Walkinshaw in 2025/2026, FEC. ↩

Tweet thread by AG Brian Schwalb. ↩

“Attorney General Schwalb Sues Crypto ATM Operator for Financially Exploiting District Residents”, Office of the Attorney General for the District of Columbia. ↩

“Internet Crime Report 2024”, Federal Bureau of Investigation. ↩

Adversary proceeding: FTX Recovery Trust against Ryan Salame and Michelle Bond, filed on August 28, 2025. Document #1 in FTX Trading Ltd. - Adversary Proceeding (25-52195). ↩

“Former CEO And CFO Of Cryptocurrency Lender Cred LLC Sentenced To Multiple Years In Prison For Wire Fraud Conspiracy Convictions”, US Attorney's Office, Northern District of California. ↩

“Le GIGN libère un Suisse retenu en otage sur fond de cryptomonnaies”, Le Dauphiné (in French). ↩