Issue 93 – Undermining deregulation

Democratic lawmakers sound corruption alarms while crypto PACs gear up for the midterms

Democratic lawmakers are raising the alarm about one of the most brazen displays of corruption thus far: simultaneous crypto deals involving the United Arab Emirates that have been enormously profitable for Trump and other White House officials, as those same people advocate for and sign off on a massive AI chip deal that will benefit the UAE.

Lawmakers are also urging investigations into other crypto-related corruption concerns, including the SEC’s decision to drop a fraud lawsuit against crypto billionaire Justin Sun as he began a series of investments whose primary purpose seems to be funneling money to President Trump, and ongoing negotiations to drop monitorship requirements on Binance after a separate crypto deal that was also lucrative for the president.

In Wyoming, Senate Banking Committee Chairman Tim Scott gave his “number one” piece of advice to the crypto industry: “fire the legislators that are in your way”. The industry has taken it to heart, and a slew of pro-crypto super PACs have sprung up with over $220 million ready for the midterms — nearly double what crypto spent in 2024.

Citation Needed is an independent publication, entirely supported by readers like you. Consider signing up for a free or pay-what-you-want subscription — it really helps me to keep doing this work.

Trump business interests

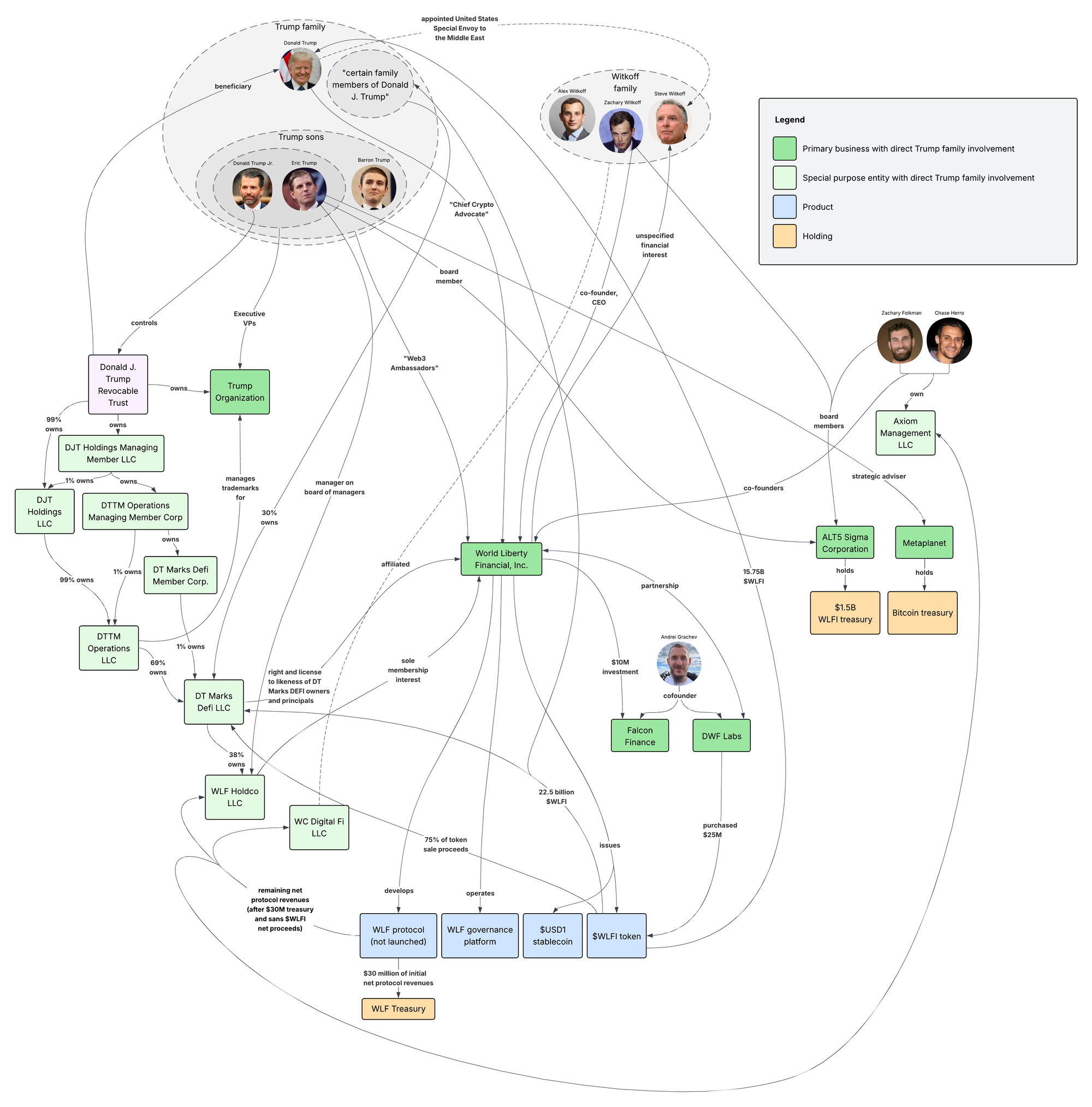

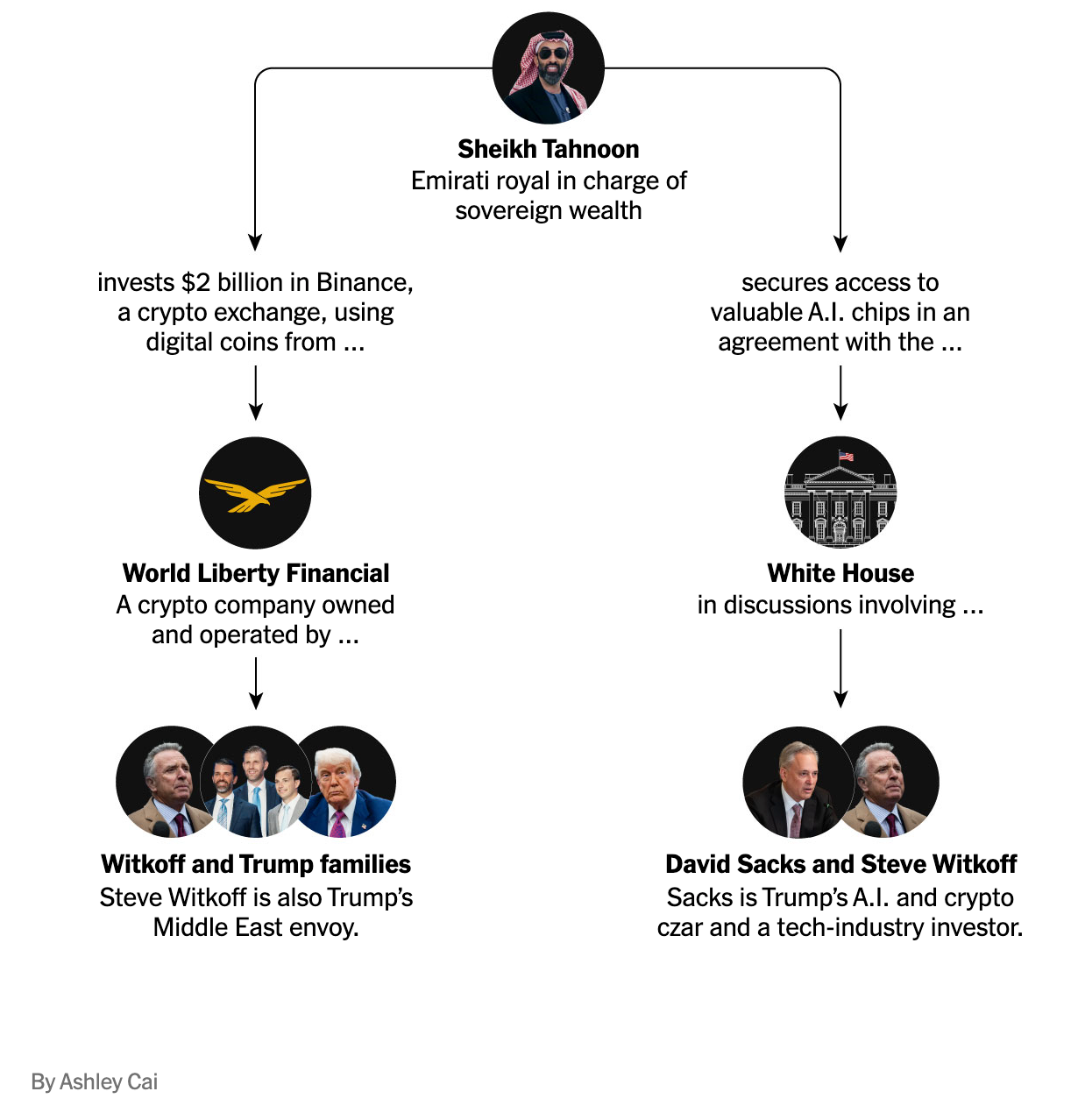

The New York Times published a story on September 15 highlighting the “extraordinary” “confluence” of two business deals, in which Trump and various White House officials appeared to trade access to US computer chips to the United Arab Emirates for personal profits from World Liberty Financial. (The Times was careful to note that “there is no evidence that one deal was explicitly offered in return for the other.”)

They’re referring to the $2 billion investment by the Emirati MGX into Binance, which was denominated in USD1, the stablecoin issued by the Trump family’s World Liberty Financial business [I83]. The New Yorker estimated that Trump and his family will personally profit around $168 million from this deal alone if the assets remain in USD1 through the remainder of Trump’s term.1 In addition to the Trump sons’ direct involvement, Zach Witkoff is CEO and a co-founder of World Liberty. He’s also the son of longtime Trump ally and now Special Envoy to the Middle East, Steve Witkoff, who himself was also involved in World Liberty early on. The company claimed in May that he was “in the process of fully divesting from WLFI”, though he continued to have an unspecified financial interest in the company at least as of August.

The second deal is an agreement to supply a substantial number of advanced computer chips to Emirati AI firms, including G42 — chips which had previously been restricted due to national security concerns. Just as the UAE’s massive USD1-denominated deal was highly lucrative for the Trumps, this chip deal will be highly lucrative for the UAE and the royal family.

The links between the two deals are numerous. Trump and Steve Witkoff have been involved in both World Liberty and in the UAE chip deal. Steve Witkoff is close with Marty Edelman, who serves as general counsel for G42, one of the Emirati technology firms that will receive a substantial portion of the chips. AI and Crypto Czar David Sacks was also a key part of the chip negotiations, despite his own conflicts of interest surrounding the AI industry, in which he and his firm are heavily invested. The UAE has invested in Sacks’ Craft Ventures firm, from which Sacks has not divested. Craft Ventures also invests in BitGo, the crypto company that provides custody services for World Liberty Financial’s stablecoin. A top employee of G42 is simultaneously “chief strategic adviser” to World Liberty. The MGX firm, which made the $2 billion Binance investment, was established with help from G42, and the two firms share a chairman in Sheikh Tahnoon. Zach Witkoff, a co-founder of World Liberty, has described Sheikh Tahnoon as “a close family friend”.

A White House official has described the Times story as “fake news”, and asserted that neither Witkoff nor Sacks has a conflict of interest.2

As part of his ongoing war against the free press, Trump has filed a lawsuit against the New York Times.3 Though it was filed on the same day as the Times published their chip deal story, it involves separate issues. The lawsuit contains an extremely long list of gripes against the Times and a book written by some of its journalists, and seeks $15 billion in damages for reputational harm that Trump claims negatively impacted, among other things, the sales of his $TRUMP memecoin. The Florida judge assigned to the 85-page complaint threw it out almost immediately, apparently annoyed that he had to wade through dozens of pages of effusive praise for the President,a election denialism, and allegations that the Times is a “full-throated mouthpiece of the Democratic party” before eventually getting to the legal point. Judge Merryday continues, “As every lawyer knows (or is presumed to know), a complaint is not a public forum for vituperation and invective — not a protected platform to rage against an adversary. A complaint is not a megaphone for public relations or a podium for a passionate oration at a political rally or the functional equivalent of the Hyde Park Speakers’ Corner.” Merryday will allow Trump’s lawyers to refile a shorter version within the next 28 days.4

In Congress

Letters have been absolutely flying out of Congress. Following reports5 that Binance is nearing a deal with the Justice Department that would allow them to escape the oversight of a compliance monitor years ahead of schedule, Senator Elizabeth Warren and others sent another letter to Attorney General Pam Bondi requesting information about “the Trump Administration’s interactions with, and relationship to, Binance and its employees”. They criticized Bondi for a belated and partial response to a May letter inquiring about Binance’s compliance with its plea agreements, pardon discussions between Binance and DOJ officials, and business deals between Binance and the Trump family’s World Liberty Financial, writing that the DOJ had “fail[ed] to meaningfully answer any of our questions” [I44, 83, 91].6

Warren and seven other members of Congress have also sent a letter to White House Special Advisor for AI and Crypto, David Sacks, inquiring as to whether he has exceeded his 130-day limit as a Special Government Employee. They note that there are “more flexible ethics requirements” for SGEs because of the limited work period, and that Sacks enjoys that flexibility as he simultaneously serves as a General Partner at his Craft Ventures fund.7

A third letter came from Representative Sean Casten and Senator Jeff Merkley and was sent to the SEC, expressing “serious concerns” about business deals between crypto billionaire Justin Sun and the Trump family. They cited the SEC’s decision to drop its fraud lawsuit against Sun and his Tron company, combined with Tron’s recent decision to go public in the US “potentially with the assistance of members of the Trump family”, as raising “significant national security and investor protection concerns.” The lawmakers also argued that recent changes to the World Liberty Financial’s WLFI token design should have triggered SEC oversight, and warned that Sun’s substantial token holdings could pose risks to everyday investors if he were to sell.8

A group of pro-crypto Representatives led by French Hill have sent a letter to the SEC as well, urging them to hurry up and revise regulations to follow Trump’s August executive order, which advocated for allowing a broader swath of assets — including crypto — in 401(k)s.9

Finally, following the Times report, Senators Slotkin and Warren have demanded an ethics probe by various watchdogs into the President, his family, and various White House officials, citing concerns around the deals involving the United Arab Emirates, World Liberty Financial, and AI chips. The Senators wrote, “The pattern of these transactions is deeply troubling and reveals that Mr. Witkoff and Mr. Sacks were in positions to control government decisions to personally enrich themselves – even as they created significant national security concerns.”10

In elections and political influence

A new pro-crypto super PAC has added itself to a rapidly growing list. While 2024 was dominated by Fairshake and its Defend American Jobs and Protect Progress partisan arms, several new crypto PACs have emerged ahead of the midterms, apparently looking to split from Fairshake’s nominally unpartisan approach [I91]. The newest is called the Fellowship PAC, and it says it has more than “$100 million committed” for pro-crypto candidates — nearly as much as Fairshake spent in the 2024 election cycle. Though it has been somewhat tight-lipped on strategy, an announcement document signaled frustration with Fairshake, asserting that “Unlike past political efforts, the Fellowship PAC’s mission is defined by transparency and trust, ensuring political action directly supports the broader ecosystem rather than narrow or individual interests.”11 The PAC has not yet filed any reports beyond a statement of organization, and so its donors are not yet known.12

The Kraken crypto exchange has also ramped up its political spending, announcing a $1 million contribution each to the new Digital Freedom Fund PAC and America First Digital dark money group. Both are pro-crypto groups, and are explicitly Trump- and Republican-aligned.13

In regulators

The Trump administration is reportedly considering other candidates to replace CFTC Chair nominee Brian Quintenz, whose confirmation hearing was canceled at the request of the White House shortly after the influential Winklevoss twins grew angry with him for apparently not signing on to their crusade against the agency. According to the Wall Street Journal, the cancellation was at the direct request of the Winklevoss twins.14 Earlier this month, Quintenz published screenshots of their conversation, citing his “belief that [President Trump] might have been misled” [I92]. Despite support for Quintenz from much of the rest of the influential crypto industry [I91], the Winklevosses’ fury (and their millions of dollars in political support) seem to have been sufficient to cause the White House to start looking for alternatives. Some of the rumored names include Mike Selig, chief counsel for the SEC’s Crypto Task Force, and Tyler Williams, a current Treasury Department crypto adviser who previously worked for the Galaxy Digital crypto firm.15 Former CFTC official and current lawyer for the Kalshi prediction market, Josh Sterling, is also reportedly being vetted as a possible nominee.16 Quintenz also has ties to Kalshi, as a board member and shareholder, and outside commenters and lawmakers have raised concerns about potential unethical behavior after Quintenz may have sought private information from the CFTC about prediction market regulation [I90].

The CFTC has announced an initiative to enable the use of stablecoins as collateral in derivatives markets. Acting Chairman Caroline Pham doesn’t bother to disguise this as a clear gift to the industry, and instead devotes a significant portion of her press release to laudatory quotes from stablecoin and other crypto firms Circle, Coinbase, Crypto.com, Ripple, and Tether.17

After the SEC disclosed it had accidentally deleted a year’s worth of former Chairman Gary Gensler’s text messages [I92], Coinbase submitted a filing in its ongoing case against the agency demanding a hearing to “determine what remedial steps are needed”.18 Coinbase argues that the SEC should have been searching through those messages when they were responding to earlier FOIA requests. The filing is part of one of Coinbase’s ongoing FOIA lawsuits targeting the SEC and FDIC over what they describe as the SEC’s “regulation-by-enforcement campaign against crypto” and the FDIC’s “pressur[ing] banks to pause all crypto-related activity” [I73].

Elsewhere in government

After Coinbase was hit with a lawsuit from Oregon’s Attorney General, who argued that “states must fill [the] enforcement vacuum being left by federal regulators who are abandoning [crypto enforcement] cases under [the] Trump administration” [I82, 85], Coinbase has sent a letter to the Department of Justice asking them to pressure Congress to enact “broad” federal preemption provisions for cryptocurrency markets. They also argue the DOJ should lean on the SEC to issue rules excluding digital assets from securities laws. Besides the list of cases and cease-and-desist orders against Coinbase under state securities laws, they also protest state-level crypto licensing regimes (like New York’s BitLicense). They write, “In signing Illinois’s law just last month, Governor J.B. Pritzker made clear that the law aims squarely to undermine what he called the federal government’s efforts to ‘actively deregulat[e] the crypto industry.’” [I91] Heaven forbid any states should obstruct the deregulation that crypto spent so generously to secure!

The Treasury’s Office of Foreign Assets Control has levied a $750,000 fine against ShapeShift, a cryptocurrency exchange that was run by Erik Vorhees until it shut down corporate operations and transitioned to DAO control in 2021. According to the Treasury Department, ShapeShift’s lack of identity verification and sanctions compliance monitoring allowed for at least $12.5 million in digital asset transfers between 2016 and 2018 involving users from sanctioned countries including Iran, Cuba, Sudan, and Syria. Although the recommended penalty would have been nearly $40 million, OFAC cited the fact that ShapeShift is small and defunct, and its cooperation and later attempts at remediation, as reasons for imposing a relatively small penalty.19

Outside the US

Canadian police have seized CA$56 million (US$40 million) in cryptocurrency from the unlicensed TradeOgre exchange. In a statement, Canadian police said they believed the majority of funds traded on the no-ID-required platform were linked to criminal activities.20 However, some in the crypto world have balked at the action, arguing that the police mischaracterized users simply seeking privacy as criminals, and alleging that police had “stolen” money from innocent people in the seizure.21

In the courts

Crypto billionaire Justin Sun has been denied a temporary restraining order and preliminary injunction in his lawsuit against Bloomberg after they published information about his finances that he himself had provided.22 Sun initially sought emergency relief to prevent Bloomberg from publishing their “Billionaire’s Index” article about him, but withdrew that request after Bloomberg noted they had already published it shortly before he filed suit. He then refiled, asking the judge to force Bloomberg to take down the published article. While Bloomberg responded with arguments about how the requested relief would clearly violate the First Amendment,23 the judge avoided the constitutional question entirely, denying Sun’s motion on the simpler grounds that his case appears weak and he failed to demonstrate irreparable harm if the preliminary relief was denied. The judge found that conversations Sun produced between his team and Bloomberg failed to establish that there had been any promises not to publish specific information, and agreed with Bloomberg that Sun had undermined his own safety argument by previously disclosing far more specific details about his crypto holdings than Bloomberg’s rough estimates contained.

Bloomberg noted in their filings that “we believe Mr. Sun may not want the public to know that he controls a majority of the TRX in circulation and therefore wants Bloomberg to now understate his TRX holdings, despite the credible information he previously provided and on which our profile was based.”24

Eli and Kaitlyn Regalado, the online pastor and wife who claimed the Lord told them to start a cryptocurrency scheme [I49], have been found liable for securities fraud in a lawsuit brought by the Colorado state securities regulator and now face a $3.34 million judgment.25 A criminal case against them remains ongoing [I90].

In bankruptcies

FTX is about to repay another $1.6 billion to creditors in their third round of major payouts to victims of the collapse.26 The FTX estate has also just filed a more than $1 billion lawsuit against bitcoin mining firm Genesis Digital,b arguing that Sam Bankman-Fried’s investment in the firm via Alameda Research was among his “most reckless”, and involved “commingled and misappropriated funds” including assets belonging to customers. The shares in Genesis Digital were purchased at “outrageously inflated prices”, they write, and with limited due diligence based on unaudited financial statements that “bore no relation to reality”. Though the investment was done with FTX funds, all of the benefit went to Alameda Research and Sam Bankman-Fried, its 90% owner. According to the estate, this was another example of “FTX Insiders ... regularly causing Alameda to “borrow” (i.e., loot) billions of dollars from the FTX.com exchange to fund their own profligate lifestyles and vanity investments”.27

The Web3 is Going Just Great recap

There were five entries between September 12 and 23, averaging 0.4 entries per day. $41.15 million was added to the grift counter.

- Seedify launchpad project suffers bridge exploit [link]

- UXLINK exploited for around $28 million, then hacker gets phished [link]

- Yala stablecoin depegs after $7.6 million theft [link]

- Shibarium bridge hit with $2.4 million flash loan attack [link]

- Thorchain founder exploited for $1.35 million [link]

Worth a read

Whitney Curry Wimbish gives an excellent overview of the crypto boom in Wyoming, which has been trying to fashion itself as a haven for crypto entrepreneurs and in doing so has become ground zero for crypto conferences and other events. She describes how, at a recent symposium in Jackson Hole, Senate Banking Committee Chair Tim Scott gave his “number one” piece of advice to crypto attendees: “fire the legislators that are in your way.” Outside of conference halls, the working class in Jackson Hole and elsewhere in Wyoming express skepticism that the crypto billionaires flocking to the state have any interest in improving circumstances for everyday residents, despite altruistic promises. Out of the local workers she spoke to, none of them believed the industry their state is trying so hard to attract would improve their lives.

The Better Markets advocacy group has outlined how the cryptocurrency industry is following a playbook laid out by “too big to fail” banks — one that ended with the 2008 financial crisis. They write: “In the crypto version, firms develop non-compliant or questionably-compliant business models that they hope establish enough incumbency, profitability and political power that Congress and regulators are coerced to rewrite existing laws to retroactively bless them.”

In the news

I went on On Point alongside Steven Harrison, an excellent journalist on the Wikipedia beat. We talked about how the American right has set its targets on Wikipedia, and is using events like the Charlie Kirk assassination to whip up fury against the project. Harrison recently wrote an excellent story in Slate on this topic titled “How a Beloved Website Became MAGA's Latest Villain After Charlie Kirk's Death”.

That's all for now, folks. Until next time,

– Molly White

Have information? Send tips (no PR) to molly0xfff.07 on Signal or molly@mollywhite.net (PGP).

I have disclosures for my work and writing pertaining to cryptocurrencies.

Footnotes

References

“The Number”, The New Yorker. ↩

“US senators signal resistance to market structure over ’foreign crypto deals’”, Cointelegraph. ↩

Complaint filed on September 15, 2025. Document #1 in Trump v. New York Times. ↩

Order filed on September 19, 2025. Document #5 in Trump v. New York Times. ↩

“Binance Nears Deal to Escape Compliance Monitor Imposed by DOJ”, Bloomberg. ↩

Letter from Senator Warren to Attorney General Bondi, September 17, 2025. ↩

Letter from Senator Warren to Special Advisor David Sacks, September 17, 2025. ↩

Letter from Representative Casten to SEC Chair Paul Atkins, September 17, 2025. ↩

Letter from Representative Hill to SEC Chair Paul Atkins, September 22, 2025. ↩

Letter from Senator Slotkin to Acting Inspector General Duane Townsend, September 23, 2024. ↩

“The Bitcoin-Billionaire Winklevoss Brothers Flex Their Washington Clout”, The Wall Street Journal. ↩

“White House Weighs More Candidates for CFTC as Nominee Stalls”, Bloomberg. ↩

“White House vets new candidates for CFTC chairmanship”, Semafor. ↩

“Acting Chairman Pham Launches Tokenized Collateral and Stablecoins Initiative”, CFTC. ↩

Status report filed on September 11, 2025. Document #37 in History Associates v. SEC. ↩

“Settlement Agreement between the U.S. Department of the Treasury's Office of Foreign Assets Control and ShapeShift AG”, U.S. Department of the Treasury's Office of Foreign Assets Control. ↩

“RCMP executes record seizure of more than 56 million dollars in cryptocurrency”, Royal Canadian Mounted Police. ↩

Memorandum order filed on September 22, 2025. Document #39 in Sun v. Bloomberg. ↩

Answering brief filed on September 19, 2025. Document #33 in Sun v. Bloomberg. ↩

Declaration of Tom Maloney filed on September 19, 2025. Document #38 in Sun v. Bloomberg. ↩

“Press Release: Denver District Court Rules INDXcoin Cryptocurrency Scheme was a Fraud”, Colorado Division of Securities. ↩

“FTX Recovery Trust to Distribute Approximately $1.6 Billion to Creditors in Third Distribution on September 30, 2025”, press release by FTX. ↩

Adversary case against Genesis Digital Assets, filed September 22, 2025. ↩