Issue 94 – Backdoor deals

Trump is still corrupt, a core developer warns bitcoin won’t survive an upcoming code change, and crypto lenders are ratcheting up leverage like it’s 2022.

New corruption concerns have emerged around Trump’s cryptocurrency ventures as reporting has revealed even more troubling connections between his World Liberty Financial and the Emirati firm MGX. Senator Warren is demanding answers about the “shady Abu Dhabi firm” that has “already cut deals to get sensitive American technology while enriching the Trump family’s crypto firm” and is now poised to take a 15% stake in TikTok. A valuation far below analyst estimates has also prompted concerns that Trump is steering the platform to allies at below-market prices.

Meanwhile, the government shutdown has stalled legislative business, threatening the crypto industry’s timeline to pass industry-friendly laws before midterm campaigning begins, potentially resulting in a less pro-crypto Congress. There’s also an unusual wrinkle in the negotiations: one of the bill’s top lobbyists is married to an FTC Commissioner who Trump tried to fire, and whose Supreme Court case challenging presidential authority to fire agency heads could dramatically reshape support for the legislation.

Even in its weakened state, the SEC has begun scrutinizing the wave of over 200 companies that have suddenly pivoted to become crypto treasury firms this year. The agency is investigating suspicious trading patterns as stock prices of these companies have spiked in the days before they announced their crypto plans. Though this signals potential insider trading investigations, it remains to be seen whether the hobbled agency can effectively pursue enforcement in an administration openly hostile to cryptocurrency oversight.

Citation Needed is an independent publication, entirely supported by readers like you. Consider signing up for a free or pay-what-you-want subscription — it really helps me to keep doing this work.

Trump business interests

Hot on the heels of New York Times reporting about questionable timing in deals involving the Trump family’s World Liberty Financial and Emirati firm MGX [I93], The Washington Post has published related reporting focused on MGX’s upcoming 15% stake in the TikTok deal brokered by the Trump administration. Senator Warren (D-MA), who had already demanded an ethics investigation into the World Liberty and MGX deals, has stated that the “shady Abu Dhabi firm” had “already cut deals to get sensitive American technology while enriching the Trump family’s crypto firm. The American people deserve to know if the President has struck another backdoor deal for this billionaire takeover of TikTok.” A White House official has said that MGX’s investment profiting the Trump family crypto project had no bearing on the MGX deals, so... case closed, I guess?

Some have raised separate concerns about the TikTok deal, wondering if it’s a scheme to benefit the Trump allies who will take ownership of the firm. Vice President Vance’s recent statement that the firm was valued at only around $14 billion — a fraction of the $100 billion that one analyst previously estimated for the app — has led some to speculate that the company was intentionally undervalued to allow new investors to profit from an artificially large increase in value. Senator Wyden (D-OR) also commented on the arrangement, stating that “By steering TikTok to allies like Larry Ellison and a fund backed by the United Arab Emirates for a below-market price, Trump is rapidly consolidating control over the major digital and broadcast media companies while he attacks the First Amendment at every level.”1

Speaking alongside Donald Trump Jr. at a conference in Singapore, World Liberty Financial co-founder and ALT5 Sigma chairman Zach Witkoff pitched allowing retail investors to invest in the Trump family’s real estate portfolio using crypto tokens. “What if I told you that you could, you know, go on an exchange and buy one token of Trump Tower Dubai?” he asked. He presented the idea as a boon to everyday people, stating that he, Donald Trump Jr., and everyone else involved with World Liberty believed real estate deals are unfairly “saved for an elite few to be able to invest in”. He failed to highlight that providing the President with a huge new pool of unsophisticated investors for his various real estate projects would likely benefit him far more than it would them.2

The company behind Donald Trump’s memecoin is reportedly seeking to raise $200 million to $1 billion for a $TRUMP treasury company.3 Bill Zanker and others involved with the memecoin side of Trump’s crypto businesses appear to hope this will revive the struggling token, which has fallen roughly 90% from its peak shortly after launch. Whether this plan proves more successful than his previous Trump-related venture remains to be seen — Zanker’s plan to launch a Trump memecoin-branded wallet was hastily abandoned after the Trump sons disavowed any involvement.

If realized, this would be the second Trump-related treasury firm with serious conflicts of interest in its management. ALT5 Sigma, a Nasdaq-listed company that pivoted to a WLFI treasury company, added several of World Liberty Financial’s executives to its board. A similar structure, where the treasury company shares leadership with the company that issues the token held in treasury, would suffer from similar issues: executives responsible for managing the treasury company would also stand to benefit from decisions that inflate the token’s value or promote its use, rather than from prudent management. This conflict was so blatant that the Nasdaq forced Eric Trump’s removal from the planned board of ALT5 Sigma, though other World Liberty executives were still allowed to take leadership and board positions [I92]. A $TRUMP treasury company would certainly benefit President Trump, whose businesses control 80% of the $TRUMP token supply and will require a liquid market to sell those holdings. If the same individuals are involved in both the token-issuing entity and the treasury company, they would effectively be negotiating with themselves — able to set whatever price they wish for the tokens the treasury purchases.

Melania Trump apparently remembered her memecoin exists after months of not mentioning it, and she reposted a tweet from the memecoin account featuring an AI-generated video of her materializing out of thin air. This didn’t do much to bolster the token’s price, which has collapsed more than 97% from launch. It did remind some that the First Lady has not addressed allegations that the team has sold off tens of millions of dollars of tokens from team and community wallets, though questions about those sales continued to go unanswered [Empire].4

In the White House

After rumors that the Trump administration was considering new candidates to replace Brian Quintenz as their nominee for CFTC chair [I93], the White House has officially withdrawn his nomination. Politico remarked on the “stunning turn of events for a nominee who once appeared to be a lock for confirmation”, writing that the incident was an “illustration of the new balance of power in Trump’s Washington” as the Winklevoss twins pressured President Trump to rescind his nomination.5 Quintenz has alleged that the Winklevosses might have “misled” Trump, publishing text messages with the brothers that he said he believed “make it clear what they were after from me, and what I refused to promise.” [I92] An anonymous source quoted by crypto outlet DL News, who they described as “familiar with discussions surrounding the CFTC nomination process”, stated, “They completely nuked him. They made a phone call. They were like, ‘This is not going to fly with us.’ And it was a very short trip from there to [Quintenz’s nomination] being killed.”6 But Winklevosses were not the only ones happy to see Quintenz out of the running. Dina Titus (D-NV), the co-chair of the Congressional Gaming Caucus who had called for an investigation into possible ethics violations by Quintenz pertaining to prediction markets [I90], responded to the news of the withdrawn nomination by writing, “Good. The CFTC deserves strong, independent leadership that will follow and enforce agency regulations.”7

Quintenz’s replacement has not yet been announced, though Mike Selig is reportedly a lead contender.8 Selig has served as chief counsel for the SEC’s Crypto Task Force since March and was previously a crypto lawyer for the international law firm Willkie Farr & Gallagher.

Trump has selected a nominee to lead the FDIC: its acting chairman Travis Hill.9 Hill has been an outspoken supporter of the cryptocurrency industry and has also championed its claims that the agency under its previous leadership had engaged in targeted “debanking” against crypto firms [Debanking]. As acting chair, Hill has pushed the FDIC to ease restrictions on banks wanting to engage with crypto — a concerning development, given that experts like Hilary Allen have argued that banking regulations preventing banks from getting heavily involved with crypto were what helped shield the broader financial system from the 2022 crypto market collapse.10

In Congress

The AFL-CIO, the largest federation of US unions, has slammed proposed crypto market structure legislation in a letter to the Senate Banking Committee. They write, “As drafted, this bill will enable the crypto industry to operate in wider and deeper ways in our financial system without sufficient oversight or meaningful safeguards.” They urge Senators to oppose the proposed bill, citing concerns that it will poorly regulate assets that may be incorporated into pension funds, and that it would increase financial instability. “This legislation provides the perfect environment for the next financial crisis to germinate,” they write.11

Whether anyone’s actually read the letter is unclear, as the government enters its second week of shutdown. With many congressional staff furloughed and legislative business largely stalled, the shutdown has thrown a wrench in the crypto industry’s hopes to get market structure legislation expeditiously passed into law. The industry had been pushing for quick passage before midterm campaigning begins and before a potentially less crypto-friendly Congress could make their preferred rules more challenging to implement [I84, 85].

Another bizarre fly in the market structure ointment is that one of the top lobbyists behind the bill, Justin Slaughter, is married to an FTC Commissioner who President Trump tried to fire in March. Rebecca Slaughter has been fighting her dismissal, and the Supreme Court agreed to take up her case last month. The outcome of that case, which will determine Trump’s ability to fire heads of independent agencies like the FTC or crypto regulators like the SEC and CFTC, could dramatically affect support for the market structure bill. An anonymous source quoted by Decrypt said, “I think it’s ironic that one of the Trump admin’s more monarchical acts six months ago is going to potentially blow up one of their major legislative projects.”12

A group of Senators have written a letter to the CFTC expressing concern that the agency is “overrid[ing] state and tribal law allowing sports betting in all 50 states by permitting some companies to categorize their sports betting activities as ‘event contracts.’” The letter asks why the CFTC has not been enforcing its mandate to prohibit event contracts that involve gaming, and seeks further information from the agency on how they perceive such contracts to interact with state and tribal gambling laws.13 The explosion in events contracts has been largely celebrated by the crypto industry, with numerous crypto firms expressing interest in or already offering such products. For this reason, it’s interesting to note that the letter’s signatories are among the industry’s allies in Congress: Cortez-Masto (D-NV), Curtis (R-UT), Gallego (D-AZ), Slotkin (D-NY), Schiff (D-CA), and Padilla (D-CA). The five Democratic signatories are among the eighteen Democrats who voted for the GENIUS Act; Curtis also voted for it, along with all but three of his fellow Republicans [I86].

Another letter from four House Republicans has expressed concerns about Gary Gensler’s missing text messages [I92]. They write that they are “engaging with the [Office of the Inspector General] to learn more about their report, seek clarity on outstanding questions, and discuss additional areas that require further oversight and investigation.”9

Finally, Senator and Finance Committee Ranking Member Ron Wyden has opened an investigation into whether billionaire Pantera Capital co-founder Dan Morehead evaded more than $100 million in taxes by moving to Puerto Rico, a popular cryptocurrency tax haven. According to Wyden, Morehead may have treated more than $1 billion in capital gains from crypto sales as exempt from US taxes, even though most of those gains occurred while he was a California resident. Wyden had previously inquired about Morehead’s taxes, but writes that Morehead’s attorneys “have all but disappeared” after the initial contact. He also notes that Morehead used the services of the same tax lawyer as Suresh Gajwani, an investor who pleaded guilty in June to dodging $7 million in capital gains tax through a similar strategy.14

In regulators

SEC

Despite being almost completely neutered by the Trump administration, even today’s SEC can’t turn a blind eye to some business that’s simply too shady. The SEC and the Financial Industry Regulatory Authority (FINRA) have reportedly contacted some of the more than 200 companies that have found new life as crypto treasury companies this year. Many of these companies made a dramatic pivot to crypto (such as Justin Sun’s Tron treasury company, which previously sold theme park merchandise [I86]), and in some cases their stock prices moved substantially as they unveiled their new plans. The SEC and FINRA have noted, however, that in some of these cases, trading activity and stock prices spiked in the days prior to the announcement, leading the agencies to write to the firms to underscore that selectively disclosing material non-public information violates Regulation Fair Disclosure. Such communications often signal the beginning of an investigation or insider trading enforcement action, though it’s not clear if they do in this case.15

The SEC also paused trading of the Hong Kong-based QMMM Holdings, a digital ad firm that announced a crypto treasury pivot in early September. The stock soared by more than 2,000%, and the SEC announced on September 26 that they would pause trading for two weeks “because of potential manipulation in the securities of QMMM effectuated through recommendations, made to investors by unknown persons via social media to purchase the securities of QMMM, which appear to be designed to artificially inflate the price and volume of the securities of QMMM.”16 It appears some actors are attempting to import the shady practices commonplace in poorly regulated crypto markets into more regulated stock exchanges. And it’s somewhat understandable why they’d try it, given communications from the Trump administration and from regulators that have insinuated that anything crypto-related is off-limits from any kind of enforcement.

In the same vein, entrepreneur Tai Lopez — who in 2022 tried to sell $200,000+ NFTs that would grant buyers the priceless honor of having his phone number or the privilege of joining Lopez to watch a 2-hour movie of his choice [W3IGG] — is now in hot water after allegedly defrauding investors out of more than $112 million in a Ponzi scheme. He, business partner Alex Mehr, and COO Maya Burkenroad acquired distressed retailers including RadioShack, Pier 1 Imports, and Dress Barn, promising they would turn them into successful e-commerce brands. According to the SEC, they seriously misrepresented the companies to investors, claiming “cash flow is strong”. In reality, the businesses never became profitable, and the group used investments from others, loans, and transfers from other companies to pay interest and dividends. The agency also alleges that Lopez and Mehr took $16.1 million of the money for themselves. The group had tried to take RadioShack in a crypto direction as the last of the previous crypto hype cycle dwindled in 2022, launching a $RADIO token and their own decentralized exchange, and attempting to attract the crypto faithful with an edgy (read: profane) new social media strategy that was mostly just baffling and cringy.

Although the token started at a whopping 3.5¢, it’s down 99.8% to $0.00007. The decentralized exchange has been taken offline. The edgelord tweets have all been deleted, and RadioShack’s most recent tweet is a bland reminder to stock up on batteries for autumn.

The SEC has been further signaling its deference to the crypto industry by issuing a series of no-action letters — regulatory communications that effectively greenlight a company’s activities by stating the SEC won’t pursue enforcement action against the described business practices. One went to DoubleZero, a decentralized physical infrastructure network (DePIN) that plans to use cryptocurrency to incentivize the creation of high-speed private networks for blockchains. The SEC’s no-action letter essentially signed off on the company’s issuance of a token called 2Z, with Commissioner Hester Peirce adding in an explanatory letter that “These tokens are neither shares of stock in a company, nor promises of profits from the managerial efforts of others. They are functional incentives designed to encourage infrastructure buildout.”1718 This is another divergence from the SEC under the previous administration, which filed a case against the creator of the dePIN Helium network that alleged the tokens incentivizing the creation of cell and LoRaWAN networks were unregistered securities [I75]. The case, which also alleged that Helium had misled investors through false claims of partnerships with big-name companies like Salesforce and Lime scooters, was settled with a $200,000 fine in April.19

A second no-action letter gave broad sign-off to investment advisers to use state-chartered trust companies as crypto custodians.20 This garnered dissent from Commissioner Caroline Crenshaw, who wrote that “this relief seeks to poke holes in our custody regime”. She continued, “I am struck that we are eroding our rules to pave the way for a new class of custodians who seem readily to admit they do not meet the current standards of our custody regime,” going on to note the substantial difference between state trust companies and banks or other traditional qualified custodians. She wrote that she has “no idea” why the SEC is carving out an exemption for crypto assets, noting that “even though these assets have a notoriously high risk of loss, we offer no real explanation for why we are comfortable with crypto assets receiving less custodial protections than traditional assets.”21

The SEC is also reportedly working on a plan to allow blockchain-based stock trading, according to The Information. They write that the initiative would provide exemptive relief for tokenized stock trading, meaning that some of the rules that normally apply to stock trading would not apply, though the specifics of the plan are not yet publicly known.22 The SEC has been sending mixed messages on this issue, with SEC Chair Paul Atkins regularly extolling the potential for “innovation” with tokenized stocks and suggesting that the SEC should provide “relief” for companies wishing to issue them without running up against regulatory barriers, but SEC Commissioner Hester Peirce has underscored that “Tokenized securities are still securities” [I88].

IRS

New IRS interim guidance has established that companies will not have to pay the Biden-era Corporate Alternate Minimum Tax (CAMT) on unrealized capital gains on digital asset holdings. This was met with delight from crypto treasury companies like MicroStrategy, which will save somewhere around $2–4 billion in taxes as a result.23 This decision is not yet set in stone, though it is a strong signal of likely proposed rulemaking.

In the states

Democratic legislators in New York have introduced a bill to tax bitcoin mining operations, citing 2021 research that found that crypto mining facilities in upstate New York have added annual costs of around $79 million for individuals and $165 million for small businesses. The proposed tax of 2–5 cents per kWh of energy usage would go towards residential energy affordability programs. Renewable energy usage by crypto miners would not be taxed.2425

In elections and political influence

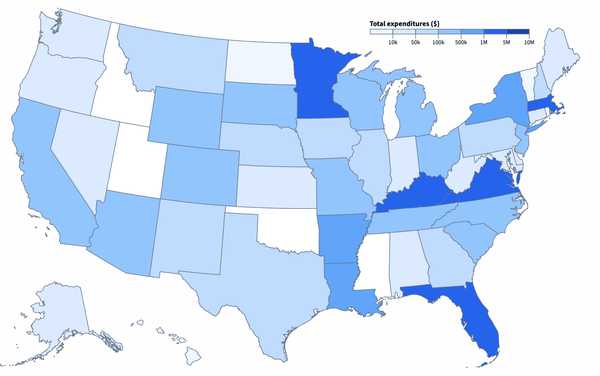

Coinbase has launched a campaign to lobby for passage of a crypto market structure bill and against the recent pressure from financial regulators, consumer advocacy groups, and banking organizations to revisit the GENIUS Act [I91]. One ad reads, “Big banks are coming for your crypto rewards. Don’t give them up. America voted pro-crypto. It’s time for the Senate to act.”26 They link to a website called nomorebailouts.org, where Coinbase and various other supporting crypto firms claim, “Big banks want another bailout. Do you really want to pay for it?” They don’t actually provide any detail as to how this amounts to lobbying for bailouts, nor do they mention the widespread concern that GENIUS and market structure legislation would result in bailouts for the crypto industry [I86]. Nevertheless, they encourage people to send form letters to their Senators which claim that “big banks are asking Congress to reverse law by bailing them out, not because they want to protect consumers, but because they want to stifle competition”. Jason Mikula of Fintech Business Weekly opined, “The effort may also serve as a not so subtle reminder to lawmakers that crypto-aligned PACs have more than $200 million on hand to spend in the 2026 midterm elections.”27

The Bank Policy Institute responded to the campaign, writing “A misleading ‘banks vs. crypto’ narrative and references to ‘bailouts’ — deeply ironic given that a Coinbase partner (Circle) was the largest beneficiary of the Silicon Valley Bank rescue — make it harder to achieve consensus on policies that both encourage competition and address financial stability risks.” They continue: “Bank-like stablecoins without full regulatory protections put the financial system at risk. They are less regulated cousins of the money market mutual funds that required a bailout in 2008 and again in 2020. If the crypto industry wants ‘no more bailouts,’ they should support guardrails against the true bailout risk in this debate: pseudo-banks operating without adequate safeguards.”28

In the courts

Zhimin Qian, also known as Yadi Zhang, has pleaded guilty to defrauding approximately 128,000 people in an investment scheme from 2014 to 2017 [I50]. While victims lost around $860 million at the time, Qian stored the stolen assets as 61,000 bitcoins — now worth approximately $7.6 billion.29 Qian kept diaries describing her plans to pour money into Liberland, a libertarian micronation claiming sovereignty over roughly 1,700 acres of floodland between Croatia and Serbia. (No country recognizes Liberland, and Croatia has arrested self-proclaimed citizens for trespassing [I68].) Qian outlined plans to become “queen of Liberland”, which she believed would provide her with immunity from prosecution, and she planned to spend almost $7 million of the stolen funds to buy herself a set of crown jewels. She also wrote of plans to construct an airport and the largest Buddhist temple in the world, and to convince the Dalai Lama to declare her to be a reincarnated goddess.30

The scheme unraveled in 2018 when Qian traveled to the United Kingdom and recruited Jian Wen to help launder the bitcoins through real estate purchases. British authorities seized the 61,000 bitcoins, likely setting a record for the largest bitcoin seizure to date. Wen ultimately received a six-year prison sentence last year [I59].31 It now remains to be seen what will happen with the seized bitcoins. The United Kingdom is reportedly hoping to use some of the assets to plug a government deficit. China is arguing that the funds belong to them, since the underlying fraud primarily targeted Chinese citizens. And victims of the fraud are hoping to see their money returned — preferably in-kind or at today’s prices, rather than at the price at the time of loss.31

Tornado Cash’s Roman Storm has filed a motion for acquittal on all three counts against him. A jury convicted him on conspiracy to operate an unlicensed money transmitting business in August, but failed to reach a verdict on the other two counts [I90]. Storm’s lawyers argue that the evidence was not sufficient to establish that he acted with criminal intent, and that furthermore the case should never have been tried in New York.32 While motions to acquit are rarely successful, Storm’s lawyer has previously convinced a judge to vacate a conviction in another crypto case: the fraud and market manipulation case against Mango Markets exploiter Avi Eisenberg [I85].33

A California judge has dismissed a 2022 class-action lawsuit against Yuga Labs [I13], the creators of Bored Ape NFTs, ruling that plaintiffs had not adequately proved that said NFTs meet the Howey test for whether an asset is considered a security. The judge ruled that the NFTs are not an “investment”, nor are they a “common enterprise”, and that there was no “expectation of profits”. The reasoning was based on factors including that the NFTs were sold on a secondary marketplace and a public blockchain (unlike some securities cases involving NFTs issued on bespoke blockchains, or marketplaces controlled by the issuer), that Yuga Labs earned royalties on all sales (which “suggest[s] a de-coupling of their fortunes from those of defendants, who stood to gain even if plaintiffs sold their own NFTs at a loss”), and that the plaintiffs failed to adequately argue that the NFTs were purchased as investments rather than for “consumptive purposes”.a This may help some similarly situated NFT projects if they face securities lawsuits, though as other cases demonstrate, the outcome depends heavily on the specific details of each NFT offering. However, law professor Brian Frye (who has previously sued the SEC to establish whether NFTs are securities [I63]) has opined: “[T]he analysis is IMO pretty weak. The idea that BAYC tokens are just consumption goods is … unconvincing. People bought them primarily as investments. And I think vertical commonality is pretty obvious. The value of the NFTs depended on Yuga’s promotion of the brand.”34

Outside the US

The European Systemic Risk Board, an EU financial stability body, has passed a recommendation to ban “multi-issuance stablecoins” — that is, stablecoins that are issued jointly by EU and non-EU entities. The recommendation is based on concerns that, in the event of mismanagement or a run, foreign holders could seek redemption through the EU entity with stronger safeguards, creating cross-border legal disputes and liquidity stress within the bloc. Other concerns reflect the fact that many such stablecoins are dollar-backed, and could impact EU monetary sovereignty. Such a ban, if implemented, would likely impact major stablecoin issuers like Circle (which issues USDC) and Paxos.35

The blockchain research firm Elliptic has analyzed a data leak from companies controlled by Putin ally Ilan Shor, focusing on his use of cryptocurrency to evade sanctions on Russia and to influence elections in Moldova. Shor founded a group of companies called A7, which is 49%-owned by a Russian state-controlled bank, and which was sanctioned by the US in August. Shor claimed in a September conference with Putin that A7 enabled around $89 billion in transactions for Russian businesses, and leaked data suggests Shor has been routing funds through companies in Kyrgyzstan in a mix of cash, promissory notes, and cryptocurrency — particularly the Tether stablecoin and an A7-issued Ruble-backed stablecoin called A7A5.36

The leaks also indicate that Shor and A7 were funding Russian campaigns to interfere with elections in Moldova. (Shor is Israeli and Moldovan, and he lived in Moldova until he fled the country in 2019, following a conviction in a $1 billion bank fraud.) Shor and his companies reportedly used an app called Taito to bribe voters and pay activists with Tether, and a Telegram bot to pay with the Telegram-related Toncoin cryptocurrency.363738

Elsewhere in crypto

Bitcoiners have been embroiled in a battle surrounding an impending update to Bitcoin Core, the reference implementation for bitcoin nodes, which will increase the amount of data that can be included in bitcoin transactions beyond simple payment information. Supporters argue this provides a better method for storing arbitrary data on the bitcoin chain than existing approaches like the controversial Ordinals [I46] or Runes [I56] projects, while reducing the resource burden on node operators. Opponents contend that bitcoin developers should discourage such activity, and have raised concerns about network spam and potential legal liability for node operators, since each bitcoin node must download all transaction data. Some worry that bad actors could upload illicit data, like copyrighted content or child sexual abuse material, to the chain, creating legal problems for anyone running a node. Supporters have pushed back on these concerns, noting that node operators can “prune” (discard) the added data after validation, and that illicit content already exists on the bitcoin chain but hasn’t resulted in legal issues.39

Opponents have framed the update in dire terms. Bitcoin developer Luke Dashjr — a longtime critic of bitcoin “spam” [I20, 46] and maintainer of the alternative Knots node software — has claimed that bitcoin “will cease to exist when Core30 changes it into a CSAM file sharing platform” and that “Bitcoin doesn’t survive if v30 gets widespread adoption.”4041 Dashjr has reportedly discussed creating a trusted group of censors with the authority to alter illicit data recorded on chain —a controversial proposal in an ecosystem that prides itself on being trustless, uncensorable, and immutable. “Right now the only options would be Bitcoin dies or we have to trust someone,” Dashjr wrote in leaked messages published by The Rage.42

Crypto lending is having a renaissance, even after (primarily institutional) lending was a major factor in the 2022 meltdown. Although many firms had to limit or discontinue their borrowing and lending programs in the US as regulators tried to mop up the disaster and prevent a future one, Trump’s deregulatory spree has emboldened crypto firms to relaunch these products [I74, 76]. Both Coinbase and Crypto.com have announced partnerships with the Morpho defi lending protocol, advertising yields of more than 10% to their customers.43 On the borrowing side, customers are allowed to borrow up to $1 million against bitcoin collateral. According to blockchain analysis, Coinbase customers have altogether borrowed over $1 billion since the product’s January launch.44 One major issue with crypto lending is that it introduces systemic leverage that can amplify market crashes. Borrowers often borrow against, say, bitcoin in order to buy more bitcoin. This creates a feedback loop of risk: when bitcoin prices fall, borrowers simultaneously lose value on their original collateral and on their newly acquired bitcoin, rapidly pushing them toward overleveraged positions. When numerous borrowers are forced to liquidate at once, the resulting sell pressure can create a snowball effect that drives prices down further and becomes very difficult to stop. The Coinbase/Morpho partnership has also drawn some scrutiny from crypto media outlets over its opacity, with Decrypt writing, “it’s unclear whether the arrangement poses conflicts of interest or could potentially put user funds at greater risk.”45

Galaxy Digital is also in the crypto lending business, currently offering yields of around 8% with their Galaxy One lending product. To lead the division, they’ve just brought on Zac Prince, a name some readers may recognize from the FTX trial days. He’s the former CEO of BlockFi, a crypto lender that offered similar yields during the early 2020s crypto bubble, before going bankrupt after the FTX collapse. He’s also the one who testified during the FTX trial that “the majority of balance sheets that we received from cryptocurrency firms were unaudited”, and that BlockFi “always relied on the information that we were given by counterparties as being truthful and accurate” [FTX8]. A creditors’ committee in that bankruptcy later issued a report describing Prince as largely responsible for his company’s failure, outlining how he repeatedly overruled concerns about BlockFi’s overexposure to FTX. In August 2021, a little over a year before FTX’s collapse, Prince told his company’s risk management team they needed to “get comfortable [with Alameda] being a three arrows size borrower” [I33]. (In June 2022, Three Arrows Capital blew up, helping to kick off the cascading collapse in the crypto world [W3IGG].)

The Web3 is Going Just Great recap

There were five entries between September 24 and October 8, averaging 0.3 entries per day. $29.4 million was added to the grift counter.

- Abracadabra loses more “Magic Internet Money” to third hack in two years [link]

- Futureverse announces restructuring two years after raising $54 million [link]

- Hypervault rug pulls for $3.6 million [link]

- SBI Crypto likely suffers $21 million theft [link]

- Griffin AI exploited for $3 million one day after launch [link]

Worth a read

Cory Doctorow has just published his treatise on “enshittification”: the predictable playbook tech companies implement to draw in users, lock them in, and then extract as much profit as possible while making everyone miserable. I was lucky enough to read an advance copy, and I would repeat what I said in my blurb for the book: “Witty, incisive, and urgently relevant, this book reveals how we can reclaim our digital lives from the forces that have degraded them.” Go read it.

I’ve mentioned ghost labor in the past in this newsletter, such as in my April 2024 issue about AI, and I’ve shared a few podcast episodes featuring Timnit Gebru talking about AI trainers mostly in the global South. This new report from the Alphabet Workers Union, Communications Workers of America, and Techquity focuses on the reality for workers doing these jobs in North America. As one of them puts it, “[L]ow paid people who are not even treated as humans [are] out there making the 1 billion dollar, trillion dollar AI systems that are supposed to lead our entire society and civilization into the future.”

In the news

I joined Al Letson on an episode of More To The Story to explain cryptocurrency, its risks, the regulatory status of crypto in the US, and the FTX disaster. This accompanies some other podcast episodes and print reporting about the FTX collapse, which are coming out as Sam Bankman-Fried’s appeal hearing draws nearer.

That's all for now, folks. Until next time,

– Molly White

Have information? Send tips (no PR) to molly0xfff.07 on Signal or molly@mollywhite.net (PGP).

I have disclosures for my work and writing pertaining to cryptocurrencies.

Footnotes

Though it sort of sounds like the judge is suggesting the buyers purchased the NFTs in order to eat them, this refers to the fact that the NFTs could be used to access events and other benefits. ↩

References

“TikTok deal sparks criticism over foreign involvement, price tag”, The Washington Post. ↩

“Witkoff’s Son Wants to Turn Trump Real Estate Into Crypto Tokens”, Bloomberg. ↩

“Trump Memecoin Issuer Zanker Is Planning Digital Asset Treasury Company”, Bloomberg. ↩

“Melania Trump promotes memecoin as team faces $10M sale claims”, Cointelegraph. ↩

“White House pulls Brian Quintenz nomination to lead CFTC”, Politico. ↩

“Who is Mike Selig? New CFTC chair frontrunner is a crypto ally”, DLNews. ↩

“Crypto regulator Mike Selig emerges as lead contender to chair CFTC”, PoliticoPro. ↩

Statement by Hilary J. Allen for the Senate Hearing on Crypto Crash: Why the FTX Bubble Burst and the Harm to Consumers, December 14, 2022. ↩

“Letter Raising Concerns About That Would Enable the Crypto Industry to Avoid Oversight Legislation”, AFL-CIO. ↩

“Trump Fired Her From the FTC. Now Her Husband’s Crypto Bill Could Suffer”, Decrypt. ↩

Letter from Senator Cortez-Masto to Acting CFTC Chair Caroline Pham. ↩

“Wyden Unveils Investigation of Crypto Billionaire’s Tax Scheme Involving Puerto Rico Residency Scam”, press release. ↩

“Unusual Trading Ahead of Crypto-Treasury Deals Draws Scrutiny From U.S. Regulators”, The Wall Street Journal. ↩

“QMMM Stock Skyrockets Nearly 1,750% on Bitcoin, Ethereum, Solana Treasury Plan”, Decrypt. ↩

Re: DoubleZero, SEC. ↩

Final judgment filed on April 23, 2025. Document #9 in SEC v. Nova Labs, Inc. ↩

“Poking Holes: Statement in Response to No-Action Relief for State Trust Companies Acting as Crypto Asset Custodians”, SEC. ↩

“SEC Is Moving to Allow Stocks to Trade Like Cryptocurrencies”, The Information. ↩

“Strategy gains $8B in market cap after IRS waiver”, Protos. ↩

“Krueger, Kelles Introduce Legislation to Establish Cryptocurrency Mining Excise Tax”, press release. ↩

“Coinbase Goes Scorched Earth to Protect ‘Rewards’”, Fintech Business Weekly. ↩

“Paying Interest on Stablecoins: Setting the Record Straight”, Bank Policy Institute. ↩

“Woman admits UK bitcoin fraud charges after ‘world’s largest’ crypto seizure”, The Guardian. ↩

“UK and China do battle for the BitQueen’s crypto fortune”, The Times. ↩

“UK Government Wants to Keep $7 Billion in Stolen Bitcoin It Has Seized”, Decrypt. ↩

Motion for judgment of acquittal filed on September 30, 2025. Document #230 in US v. Storm. ↩

“Tornado Cash dev Roman Storm asks judge to toss conviction”, DL News. ↩

Tweet thread by Brian L. Frye. ↩

“EU Watchdog Pushes Multi-Issuance Crypto Ban on Crash Fears”, Bloomberg. ↩

“The A7 leaks: The role of crypto in Russian sanctions evasion and election interference”, Elliptic. ↩

“Moldova uncovers a scheme to bribe voters through an app operated from Russia”, Liga.net. ↩

“Revealed: Putin’s Secret Plan to Hack Moldova’s Pivotal Election”, Bloomberg. ↩

“EXCLUSIVE: Lawyers call Bitcoin Core v30 CSAM concerns ‘overblown’”, Protos. ↩

“LEAKED: Luke Dashjr Plans Hardfork To ‘Save Bitcoin’”, The Rage. ↩

“Crypto.com follows Coinbase’s $1bn DeFi-backed lending with Morpho deal”, DLNews. ↩

“Coinbase Onchain Loans”, Dune. ↩

“How Coinbase Profits on Bitcoin-Backed Loans as a ‘Technology Provider’”, Decrypt. ↩