Issue 98 – The world’s most corrupt crypto startup operation

Terra’s Do Kwon gets 15 years, crypto banks get the green light, and the Trump family’s crypto grift expands even as one of their treasury companies goes off the rails

I’m back from my hiatus, and it’s so good to be with you again! There’s plenty to catch up on, so let’s get right to it.

In the courts

Do Kwon

Do Kwon, founder of the collapsed Terra/Luna project, has been sentenced to fifteen years in prison — three more than the twelve years sought by prosecutors1a and well above the five requested by his defense.2 Judge Paul Engelmayer said the upward variance reflected the scale of Kwon’s fraud — both monetarily and in its more than one million victims — and Kwon’s decision to flee [I4], remaining at large for months before he was caught in Montenegro attempting to travel to Dubai on a fake passport [I23]. The disparity from fellow crypto fraudster Sam Bankman‑Fried’s 25‑year term likely stems from Kwon’s decision to plead guilty to two wire‑fraud counts rather than take the case to trial, securing a deal in which prosecutors dropped seven other charges.

Kwon’s Terra project unraveled in May 2022 in a $40 billion crash after the algorithmic stablecoin lost its dollar peg and ultimately went to zero. Investors drawn by supposedly “risk‑free” yields for holding “dollars” learned that Terra (UST) was not a dollar, and that the yields were anything but risk‑free. One victim who spoke at Kwon’s sentencing, a Russian woman living in the country of Georgia, explained that she had been living on the streets after her “$81,000 turned into $13 that I could hold in the palm of my hand.” Other victims described suicides of friends who had invested in Terra, their own thoughts of ending their lives, families breaking up, postponed retirements and schooling, the inability to pay medical bills, and lives ruined.3 I purchased the PACER documents so that anyone can read the victim impact statements for themselves, and highlighted some of them.

Kwon, a South Korean national, also faces charges at home. Before sentencing, Judge Engelmayer asked about likely outcomes there, including the likely sentence length if he is convicted and whether it would run concurrently with any US sentence. Prosecutors reported they had limited insight but noted that Korean sentencing could range from six years to indefinite; however, Korea has never imposed indefinite terms for fraud offenses, sentences of 30 or more years are rare, and courts frequently depart below prosecutorial recommendations. They also noted that any sentence imposed in Korea would be reduced by the amount of time he serves in the US.4 Engelmeyer ultimately included a requirement that Kwon serve at least half of his fifteen-year sentence in the US before he can apply for a transfer to South Korea.5

Citation Needed is an independent publication, entirely supported by readers like you. Consider signing up for a free or pay-what-you-want subscription — it really helps me to keep doing this work.

After Samourai Wallet cofounder Keonne Rodriguez received the maximum five-year sentence for conspiracy to operate an unlicensed money transmitting business last month [I96], cofounder William Lonergan Hill has been sentenced to four years on the same charge. Both pleaded guilty in July under an agreement in which prosecutors dropped a more serious money laundering conspiracy charge [I90]. Hill’s lawyers argued that his autism led to “magical thinking” that he was “insulated from breaking the law” because Samourai Wallet was non-custodial. Judge Denise Cote imposed a somewhat shorter sentence than his cofounder’s — not because she bought the argument that Hill was less culpable, but because she believes his autism will result in “a more difficult time in prison for the defendant than for many people”.6

Paxful [I24], a bitcoin marketplace, pleaded guilty and agreed to pay a $4 million fine following a case alleging it “knowingly enabled its platform to serve as a conduit for criminal activity — including fraud and illegal prostitution”. Investigators pointed to Paxful’s work with Backpage (the shuttered classifieds site popular among sex workers) and a similar service, alleging more than $17 million in illicit payments flowed through Paxful for those partners alone, yielding about $2.7 million in fees. Altogether, prosecutors claim Paxful processed nearly $3 billion in illicit transactions and took in close to $30 million in revenue. Although the Justice Department initially calculated a $112.5 million penalty, it reduced the amount by more than 96% based on Paxful’s inability to pay, resulting in the $4 million fine.7 Paxful co-founder and former CTO, Artur Schaback, pleaded guilty in July 2024 to conspiracy to fail to maintain an effective AML program in relation to the same issues [I62]; he has not yet been sentenced.8

Two more members of a crypto crime ring have entered guilty pleas in connection to an operation that stole hundreds of millions of dollars in crypto from victims between October 2023 and March 2025. The group met through online gaming, later turning their friendship into a criminal conspiracy in which they hacked databases to steal personal information that they then used to phish crypto holders. After laundering the money, they spent lavishly on private jets; real estate in the Hamptons, LA, and Miami; a fleet of at least 28 luxury cars; and parties where they gave away luxury handbags. The latest to plead guilty is Kunal Mehta, a 45-year-old outlier in a group of men mostly in their late teens and early twenties. Mehta primarily helped to launder the money, and also set up shell companies to purchase the exotic cars. According to the Justice Department, “The co-conspirators – predominately 18-, 19-, and 20-year-olds – did not want Lamborghinis, Rolls Royces, Porsches, Ferraris and the like held in their true names because it would bring unwanted attention to their unexplained wealth as unemployed young men.”9 Altogether, nine members of the group have pleaded guilty.

Carl Rinsch, known for directing the 2013 Keanu Reeves film 47 Ronin, has been convicted on seven criminal charges after taking $11 million from Netflix and blowing most of it trading crypto and stock options. In 2018, Netflix signed Rinsch to create a science-fiction TV series called White Horse, paying him $44 million over the following two years to fund production. In 2020, Netflix sent him another $11 million after he claimed he needed it to complete the series. Instead, Rinsch transferred most of the money to a brokerage and blew more than half of it within two months on risky securities bets. After that, he turned to crypto trading, and spent several million more of it on luxury purchases including hotels and property rentals, furniture and antiques, cars, and mattresses. If you, like me, found yourself wondering how much one needs to spend on mattresses for it to earn a special mention in a DOJ press release: $638,000 for two, plus $295,000 in bedding.b He also used some of the misappropriated funds to hire lawyers to sue Netflix, seeking more money though he hadn’t finished a single episode.10

In regulators

Office of the Comptroller of the Currency

The Office of the Comptroller of the Currency has conditionally approved the first spate of national trust bank charter applications from five crypto companies: Circle (using an entity called First National Digital Currency Bank), Ripple, BitGo, Fidelity Digital Assets, and Paxos [I88, 95].11 These licenses don’t permit the firms to accept cash deposits or make loans, but they will allow them to hold customer assets. The approvals prompted objections from several banking groups, including the National Community Reinvestment Coalition, which wrote that “Today’s OCC announcement sends a dangerous message to the financial industry: break the law, harm consumers, and facilitate fraud—and you will be rewarded with a bank charter. ... Granting these cryptocurrency charters creates a new and frightful category of banks-in-name-only ... It will further enrich insiders in the crypto industry at the expense of the rest of us.”12

The OCC also recently released preliminary findings from the “debanking” review ordered by an August executive order from the president, which accused banks of denying payments that, among other things, mentioned “Trump” or “MAGA”. The regulator called out JPMorgan Chase, Bank of America, Citibank, Wells Fargo, US Bank, Capital One, PNC Bank, TD Bank, and BMO Bank for making “inappropriate distinctions among customers in the provision of financial services on the basis of their lawful business activities”, which involved oil and gas exploration, development, or production in the Arctic; coal mining or coal-powered power plants; firearms and related items; private prisons; payday and payroll lending, consumer debt collection, and repossession agencies; tobacco or e-cigarettes; adult entertainment; political parties and PACs; and digital asset activities. The report is only six pages long and does not go into detail on the banks’ purported debanking of crypto firms beyond a single sentence: “Many institutions also placed restrictions on banking digital asset activities, including on issuers, exchanges, or administrators, often attributed to financial crime considerations.”13

SEC

The SEC has reportedly ended a two-year-long investigation into Ondo Finance and its tokenization of US Treasuries. In December 2024 and February 2025, the Trump family’s World Liberty Financial crypto business gave Ondo $720,000 to acquire almost 135,000 ONDO tokens for its treasury.1415 In January and February, Ondo Finance contributed $2.1 million to the pro-Trump super PAC MAGA Inc.16 In February, former House Financial Services chair Patrick McHenry joined Ondo as vice chairman of its advisory board [I78]. Also in February, Ondo announced a partnership with the Trump family’s World Liberty Financial crypto business, which was reportedly looking to incorporate into its crypto platform the same Ondo products that drew SEC scrutiny.17 According to Ondo, the SEC closed its investigation with no charges.18

In prediction markets

The CFTC has okayed Polymarket’s return to the US with an Amended Order of Designation.19 The crypto-based prediction market platform, which is headquartered in New York, has been banned from serving US customers since a 2022 CFTC settlement over its failure to register with the regulator.20 The platform paid a $1.4 million fine and implemented some rudimentary geofencing, which has been routinely bypassed by American crypto holders wanting to speculate on anything from election winners to the gender of the baby expected by Buffalo Bills quarterback Josh Allen and actress Hailee Steinfeld. Now that the CFTC has done a 180 on prediction markets, Americans will no longer need to fire up the ol’ VPN to bet on Polymarket — though the beta app the company released for US customers currently offers a more limited, sports-only selection of markets.

The Kalshi prediction market, which has been operating in the US since its 2021 launch, has inked a partnership with CNN and CNBC because everything is gambling now. Much as you can no longer watch a hockey game without seeing a gambling advertisement every 13 seconds21, Kalshi prices will now appear beside news stories — inviting readers both to view them as probabilities, and encouraging them to place their own wagers. While there has been some research validating prediction markets’ accuracy in forecasting, most of this occurred prior to the explosion in uncapped betting, when bettors were limited to wagering small amounts in tightly-constrained academic experiments. Now, with so much money on the line and so much public attention on these markets, I suspect additional factors could influence their accuracy — from bettors attempting to arbitrage between different platforms, to people attempting to manipulate the perceived “odds” of an event to their advantage. The deal is probably a win-win for both Kalshi and the news groups: Kalshi gets the imprimatur of journalistic legitimacy, while CNN — fresh off layoffs — will enjoy an infusion of cash. The specific pricetag isn’t public, but Kalshi’s recent $1 billion raise suggests the platform isn’t exactly cash‑starved.

It’s not all good news for prediction markets, though, as they face multiple cease-and-desist orders and lawsuits from state gaming regulators. A federal court in Nevada issued a devastating ruling late last month that event contracts based on the outcomes of sports games are not swaps that would fall under the Commodity Exchange Act, and dissolving a preliminary injunction protecting Kalshi from civil or criminal action by the Nevada Gaming Control Board. Prediction markets have been relying on the swaps argument, maintaining that the CFTC’s oversight preempts the authority of state gambling commissions. Judge Andrew Gordon, in his ruling, rejected this, and added: “Licensed gaming companies have invested millions of dollars to comply with state regulations only to supposedly find out that they could have just become CFTC-registered exchanges to offer sports gambling nationwide for anyone over the age of 18 without complying with Nevada’s gaming regulatory regime or paying taxes in this state.”22 Kalshi quickly filed for an emergency stay pending appeal, writing that they face “a threat of imminent criminal enforcement by Nevada authorities.”23 The Nevada Gaming Control Board has opposed this, arguing that “Kalshi cannot claim irreparable injury when all of its harms are self-inflicted. That is especially true because this Court and the CFTC warned Kalshi of the risks of expanding its business, and Kalshi went ahead and did it anyway. ... Kalshi has refused to make any good-faith effort to even attempt to comply with Nevada law. In contrast to Crypto.com and Robinhood, which entered into agreements with State Defendants to prevent enforcement, Kalshi flatly refused every option that State Defendants suggested, refused to propose any alternatives, and demanded that State Defendants stand down while it continues to aggressively expand its business.”24 Judge Gordon has not yet made a decision on the stay.

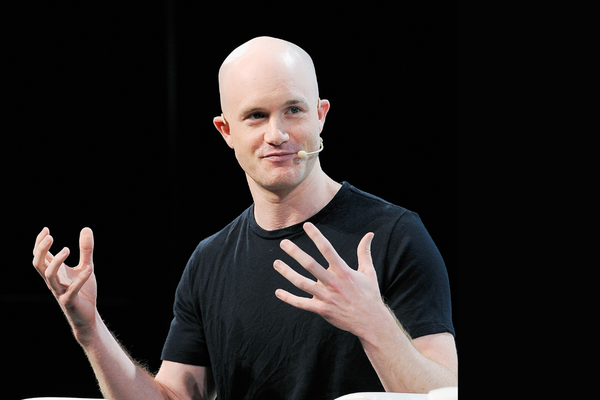

These speedbumps don’t seem to have slowed the flood of companies newly offering or about to launch prediction markets — a list that now includes crypto firms Coinbase, Gemini, and Crypto.com; sports betting platforms FanDuel, DraftKings, and Fanatics; and Trump’s own Truth Social.

And some of these companies are teaming up to fight against gambling regulators. Axios has reported that Kalshi and Crypto.com are working to establish the Coalition for Prediction Markets — which will also include as members Robinhood, Coinbase, and Underdog — and which will lobby for federal protection for prediction markets and against state-level enforcement.25

In Congress

Senate Banking Chair Tim Scott (R‑SC) once predicted the crypto market structure bill would be law by September [I91]. Now it may not even reach markup until next year, according to people familiar with the negotiations.26 With the funding compromise that ended the October–November shutdown expiring in January, the crypto bill could be further sidelined if another budgetary battle breaks out on the Hill. Drafts of both Republican- and Democrat-authored negotiations have leaked, with a Republican proposal suggesting the party is potentially willing to incorporate, in exchange for other concessions, additional language around auditing thresholds, ethics, and consumer protections.27 A response by Democrats suggests they were not satisfied with the Republicans’ proposal, writing that the proposal “still fails to meet the core principles Democrats outlined in September” [I92]. Among the Democrats’ demands are limits on elected officials issuing or promoting crypto tokens, full slates of commissioners being appointed to the SEC and CFTC (the latter of which only has one commissioner at the moment), additional safeguards around terrorist financing, and changes to the process by which a token is classified as a security or commodity.28

New voices have joined the chorus of traditional financial institutions, labor unions, and consumer advocacy groups in opposing the draft market structure bill. On December 8, the AFT — the second largest teacher’s union in the US — sent a letter to Senate leadership outlining concerns about how the bill “poses profound risks to the pensions of working families and the overall stability of the economy. Rather than providing desperately needed regulation and commonsense guardrails, this bill exposes working families — families with no current involvement in or connection to cryptocurrency — to economic risk and threatens the stability of their retirement security.” The union wrote that the proposed crypto regulations are not as stringent as those for other pension fund assets, and that the bill “strips the few safeguards that exist for crypto and erodes many protections for traditional securities.” The union also expresses concern about the possibility of non-crypto companies tokenizing their stocks, thereby evading securities regulations, and about corruption and fraud in the crypto sector.29 The concerns in the AFT letter largely mirror those expressed by the AFL-CIO labor union federation in October [I94].

The next day, a group of 192 consumer protection, financial reform, environmental protection, and advocacy groups, as well as some labor unions, signed a letter urging senators to “oppose any Senate cryptocurrency legislation that fails to meaningfully address the crypto industry’s many systemic failures and harms,” adding that “The legislative initiatives explored in the Senate so far have largely failed to address the widespread harms caused by the crypto industry”. The signatories include financial reform groups Americans for Financial Reform and Better Markets; consumer advocacy groups Public Citizen, the Center for Economic Justice, and the National Consumers League; advocacy groups Accountable.US, Demand Progress, Democracy for America, Our Revolution, and many local Indivisible groups; environmental groups Greenpeace, the Climate and Community Institute, and a long list of regional, state, and local environmental groups; and labor unions AFT and the Communications Workers of America.30

Trump business interests

Alt5 Sigma, the WLFI treasury company established by Eric Trump and several other World Liberty Financial executives, seems to be in crisis. In August, World Liberty Financial announced that it would create a WLFI treasury company using the Nasdaq-listed fintech firm, Alt5 Sigma [I90]. Eric Trump and fellow World Liberty executives Zach Witkoff and Zak Folkman were slated to join Alt5 Sigma’s board, although the Nasdaq later prohibited Eric Trump from joining the board due to the blatant conflict of interest, relegating him to “board observer” [I92].

According to an SEC filing,31 on August 27 — only two weeks after Eric Trump, Donald Trump Jr., Witkoff, and Folkman rang the Nasdaq opening bell to celebrate the deal — the Alt5 board learned that the company and its former president and CEO André Beauchesne had been found criminally liable for money laundering in Rwanda in May and ordered to surrender $3.5 million. The filing claims that the existence of the Rwandan court decision “and other matters” had not previously been disclosed to the board, and were unknown at the time of the World Liberty Financial deal. Two former employees told The Information that World Liberty had been provided with details of the Rwandan court proceedings, though a World Liberty Financial spokesperson refutes this.32

Then, on August 29, Alt5 Sigma employees received a letter from the law firm Thompson Hine warning that “litigation, regulatory investigations and other proceedings are reasonably anticipated” and that they had established a special committee to independently scrutinize Alt5’s financial records. It’s not clear if this was related to the Rwandan criminal case or some other matter. On September 4, Alt5 told employees it had suspended CEO Peter Tassiopoulos and its chief revenue officer pending the outcome of the Thompson Hine investigation, though an October SEC filing claims Tassiopoulos wasn’t suspended until October 16.33 In a November 21 SEC filing, Alt5 Sigma disclosed that Tassiopoulos’ replacement, the company’s CFO Jonathan Hugh, had been removed as both acting CEO and CFO “without cause”. The same filing also announced that the Chief Operating Officer had also been removed, and that a board member had decided to resign, with the latter citing “personal reasons”.34 On December 15, Tassiopoulos formally resigned as CEO and from the board.35

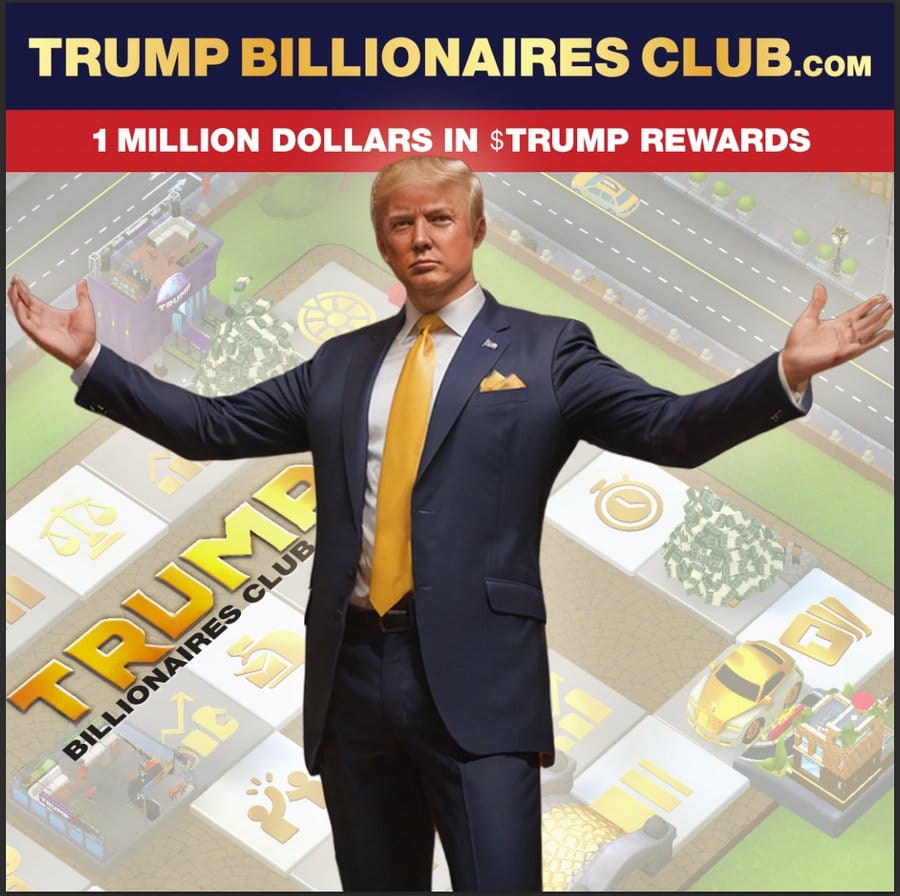

The Trump-themed crypto mobile game rumored in April to be under development by $TRUMP memecoin creator Bill Zanker [Empire] is now slated for a December release with the name Trump Billionaires Club. In April, a Zanker spokesperson denied the project was similar to Monopoly Go!, a microtransaction-infested mobile version of Monopoly,36 but the recent announcement by the $TRUMP memecoin social media account nevertheless shows a real estate-themed game played on a Monopoly-style gameboard. True to form, the branding features an uncanny-valley Trump who appears decades shy of 79, and somehow seems to be getting younger and more uncanny with each promotional illustration. At this rate, his next crypto venture will feature a gold-plated bassinet and a toupéed infant whose eyes seem to track you as you move around the room.

“America’s Superhero” NFT (December 2023), fist-pump illustration for the Trump memecoin (January 2025), memecoin dinner illustration (April 2025), and the Trump Billionaires Club announcement illustration (December 2025)

Democrats on the House Judiciary Committee have published a 27-page staff report titled “Trump, Crypto, and a New Age of Corruption”. According to the report, Trump has amassed billions of dollars from crypto ventures “from the Oval Office by steering investment to his family firm, shielding his investors from federal fraud and securities investigations and prosecutions, bilking his political base, and degrading the federal agencies ordinarily responsible for investigating bribery and tracking known bad actors online.” Among other things, the report cites Trump’s pardon of Changpeng Zhao, which it links to Zhao’s and Binance’s help in promoting Trump’s World Liberty Financial project [I95]; political donations to Trump from companies who later saw cases and investigations from the SEC and DOJ dropped [QPQ]; and the tangled mess of apparent quid pro quo surrounding MGX, Binance, the Trump family’s USD1 stablecoin, and the Emirati AI chips deal [I93, 94]. The report concludes, “[T]he information we do have clearly demonstrates that foreign actors and corporate interests are buying access to and favors from the President and members of his Administration by investing in his family’s cryptocurrency ventures and making large, and plainly politically motivated donations.”37 House Judiciary Committee Ranking Member Jamie Raskin (D-MD) issued a statement alongside the report:

Donald Trump has turned the Oval Office into the world’s most corrupt crypto startup operation, minting staggering personal fortunes for him and his family in less than a year. ... America has never seen corruption on this scale take place inside the White House.

Since Zhao’s pardon, Binance has ramped up its support for the Trump family’s USD1 stablecoin. The exchange announced a set of new no-fee trading pairs for USD1, meaning that people can now exchange their bitcoin, ether, or various other tokens for USD1 without paying fees for the privilege. Binance has also announced it will convert all assets backing its BUSD stablecoin into USD1. According to BUSD’s latest attestation, that’s more than $55 million that will be converted to USD138 — generating millions of dollars in interest for World Liberty between now and the end of Trump’s term if they maintain those USD1 holdings for that duration.c

As for Zhao’s role at Binance, Trump’s pardon doesn’t nullify the stipulation in Binance’s plea agreement that Zhao be prohibited from “any present or future involvement in operating or managing [Binance]”.39d But since Zhao’s release from prison, it’s been clear he remains closely involved with Binance’s operations. Now his influence is even harder to dispute, as his partner in life, parenthood, and business, Yi He, has been named co‑CEO of the exchange.40 She is also the co-founder and namesake of Zhao’s family office, YZi Labs.

In elections and political influence

As the market structure bill plods along, the crypto industry is already eyeing its next punchlist item: tax policy. The Solana Policy Institute penned a letter to President Trump on November 20 urging him to “promote tax clarity for the digital asset economy and American people”, including by creating a de minimis exemption for crypto transactions below $600, making blockchain development eligible for the research and development tax credit, and delaying rules that would require digital asset transactions be reported to the IRS and FinCEN in the same way as cash. The letter also included other requests that the president could achieve with the “stroke of a pen”41 — that is, without needing to go through Congress — including creating defi “safe harbors and sandboxes”, pressuring the SEC and CFTC to create exemptions for crypto, directing FinCEN to carve out non-custodial crypto projects from the Bank Secrecy Act,e and pushing the Justice Department to dismiss the two remaining charges against Tornado Cash developer Roman Storm [I90]. The letter was signed by 62 crypto groups, including Paradigm, various Solana entities, Uniswap, and others.42

Days earlier, the American Innovation Project, an “educational nonprofit” launched in August with backing from the Solana Policy Institute, Paradigm, Kraken, Coinbase, Andreessen Horowitz, DCG, Uniswap, and the Cedar Innovation Foundation pro-crypto dark money group [I91] hosted a private dinner with members of the House Ways and Means Committee and various other pro-crypto Congresspeople to discuss crypto tax policy. As a 501(c)(3), the AIP is prohibited from making a “substantial part of its activities ... attempting to influence legislation”.43 But while many of the AIP’s same backers have directly lobbied President Trump, and the Solana Policy Institute, Paradigm, and Kraken have spent a combined $5.25 million on lobbying around crypto tax issues since 2024,44 the AIP insists that the dinner was purely educational.41

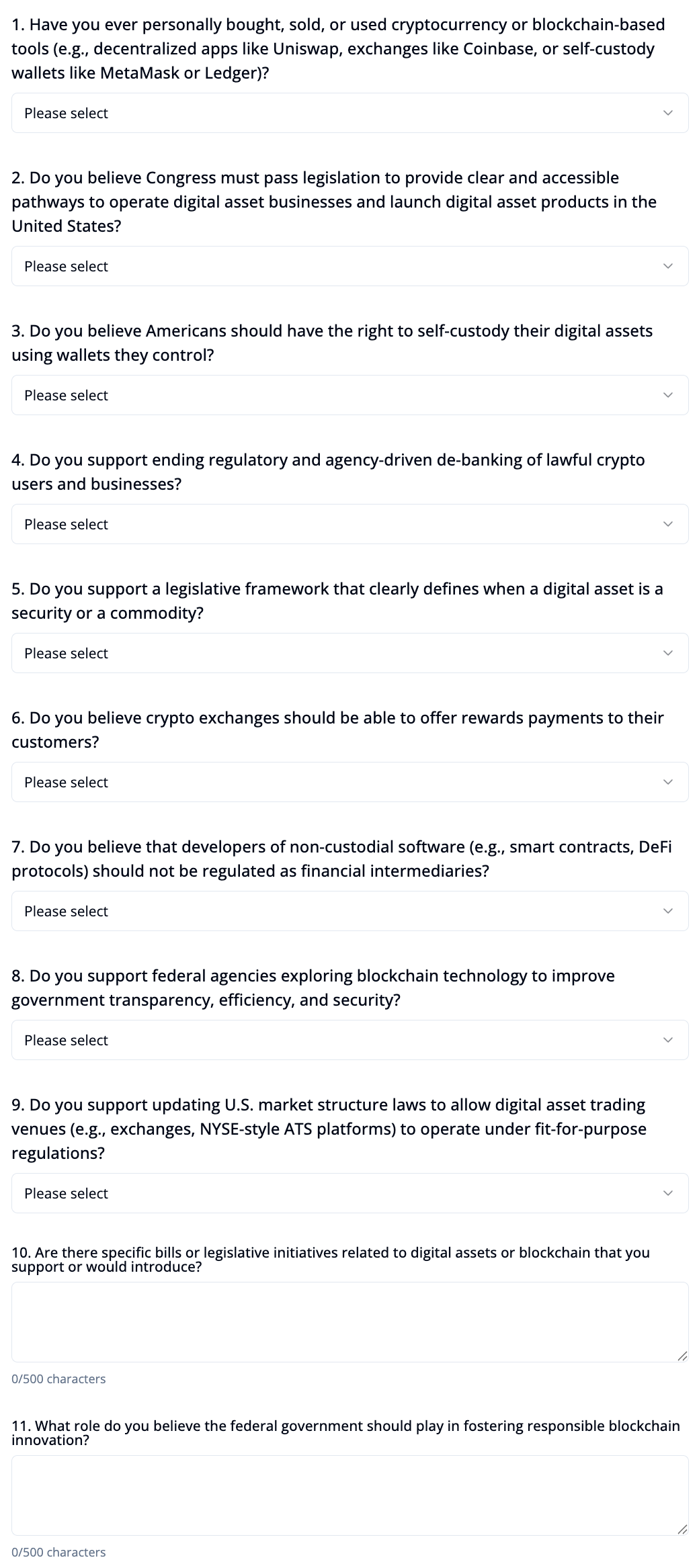

As the midterms approach, the Coinbase-backed crypto advocacy group Stand With Crypto has begun surveying candidates for 2026 federal races, with a goal of issuing them the same letter grades assigned to current officeholders to rank them from “strongly supportive” to “strongly against” crypto. The questionnaire asks whether a candidate has ever purchased cryptocurrency, then launches into a list of questions seeking to evaluate whether the candidate will support the industry’s current legislative focuses. Among them are “Do you support ending regulatory and agency-driven de-banking of lawful crypto users and businesses?”, “Do you believe crypto exchanges should be able to offer rewards payments to their customers?”, and “Do you support updating U.S. market structure laws to allow digital asset trading venues (e.g., exchanges, NYSE-style ATS platforms) to operate under fit-for-purpose regulations?”45

Crypto lobbying has also intensified in the United Kingdom, and the British government is reportedly now considering banning crypto donations to political parties. The proposed ban is motivated by concerns over the difficulty in tracing crypto contributions, which the ban’s supporters fear could allow foreign nationals to circumvent the prohibition on political contributions or allow donations sourced from the proceeds of criminal activity.46

So far, crypto-denominated contributions in the UK have mostly flowed to Nigel Farage and his right-wing Reform UK party, which has recently enthusiastically embraced crypto with Trump-like promises to usher in a “crypto revolution” in the country. Other industry figures have made contributions in fiat currency, such as Tether and Bitfinex backer Christopher Harborne [I53, 56], who earlier this month broke the record for the largest single donation by a living person to a political party in UK history with a £9 million ($12 million) contribution to Reform. Harborne, who lives in Thailand, holds dual citizenship there and in the UK. “[Harborne] just happens to think that we’ve not made the most of Brexit, that we’re not getting into the 21st Century technologies,” said Farage, who also said he speaks with Harborne “maybe once a month, maybe once every six weeks” but claims he has not made any specific promises to him in exchange for his support.47

Outside the US

An Argentine congressional committee has released its final report on the $LIBRA memecoin scandal [I77, 79, 82, 84, 85], concluding that President Milei provided “essential collaboration” for the token team and recommending that the National Congress consider whether Milei committed “misconduct in office”.48 In February, Milei promoted a new memecoin called $LIBRA on his official Twitter account. Within hours, project insiders rug-pulled the project, cashing out at least $100 million. Milei’s attempts to distance himself from the project were not helped by leaked text messages from $LIBRA creator Hayden Davis, who wrote to an associate that “I control that n**** ... I send $$ to his sister [Karina Milei] and he signs whatever I say and does what I want” [I77].

Not everyone is following the US’s gung‑ho lead on crypto. Mexico’s central bank wrote in a year-end financial stability report that it “will continue to promote a healthy distance between digital assets and the traditional financial system” and, if necessary, promote measures to safeguard against crypto-induced financial instability.49 In Italy, at the urging of the Ministry of Economy and Finance, the country’s central bank has launched a review “to assess the adequacy of existing safeguards for direct and indirect investments in crypto-assets by retail investors” after determining that “the risks associated with the spread of crypto-assets could increase due to growing interconnections with the financial system and regulatory fragmentation at the international level.”50

A $30 million hack [W3IGG] was all it tookf to push South Korean lawmakers into considering imposing bank-like compensation rules on cryptocurrency exchanges. If implemented, exchanges would be required to compensate customers for their losses, regardless of who is at fault for the loss.51

And the international credit ratings agency Fitch Ratings has warned that it may downgrade the credit rating of US banks with “significant” crypto exposure. “[W]e may negatively re-assess the business models or risk profiles of U.S. banks with concentrated digital asset exposures. Financial system risks could also increase if adoption of stablecoins expands, particularly if it reaches a level sufficient to influence the Treasury market,” they warned.52 A lower Fitch rating could make it more challenging for banks to borrow money at low interest rates and maintain easy access to funding.

The Web3 is Going Just Great recap

There were eight entries between November 20 and December 15, averaging 0.3 entries per day. $42.01 million was added to the grift counter.

- Ribbon Finance suffers $2.7 million exploit, plans to use "dormant" users' funds to repay active users [link]

- Binance employee suspended after launching a token and promoting it with company accounts [link]

- Prysm consensus client bug causes Ethereum validators to lose over $1 million [link]

- Yearn Finance hacked for the third time [link]

- Upbit hacked for $30 million [link]

- Aerodrome and Velodrome suffer website takeovers, again [link]

- Cardano founder calls the FBI on a user who says his AI mistake caused a chainsplit [link]

- GANA Payment hacked for $3.1 million [link]

In the news

I rejoined the TWiT gang to talk about online age verification, outages that take down half the internet, tech monopolies, and a whole bunch of other things.

For any French speakers, the Multinational Observatory published an interview with me about the politics of crypto — where it started, and how an originally anti-establishment project found it so deeply allied with the establishment in the US.

I joined Matthew Sheffield on his Theory of Change podcast to discuss cryptocurrency, Wikipedia, and the ideological throughline that causes the American right to love one and hate the other.

That's all for now, folks. Until next time,

– Molly White

Have information? Send tips (no PR) to molly0xfff.07 on Signal or molly@mollywhite.net (PGP).

I have disclosures for my work and writing pertaining to cryptocurrencies.

Footnotes

Twelve years was the maximum sentence prosecutors agreed to seek under Kwon’s plea deal. ↩

I did not previously know it was even possible to spend six figures on a mattress. Rinsch evidently purchased two Hästens “Grand Vividus” mattresses, which are handmade from horsehair and other materials, and come with a “bed doctor” who comes to your home to massage the mattress.53 ↩

With USD1’s selected money market fund generating 3.7–4% yield, the new $55 million will generate $6.2–$6.7 million in interest between now and the end of Trump’s term. ↩

While court documents seemed to suggest that this prohibition was limited to a period of three years, Binance’s new CEO stated in September 2024 that the ban was for life.54 ↩

The Bank Secrecy Act is the law that imposes anti–money laundering and know-your-customer requirements on crypto (and other) companies, and is one of the laws under which Binance and Changpeng Zhao; BitMEX, Arthur Hayes, and Ben Delo; Paxful and Artur Schaback; KuCoin, Chun Gan, and Ke Tang; and others have been prosecuted. ↩

This is not to say that $30 million isn’t much money. But it’s a sharp contrast with the US following an $8 billion FTX fraud with a presidential crypto endorsement and OCC approval of national bank trust charters for crypto firms. ↩

References

Sentencing submission by Do Kwon filed on November 26, 2025. Document #54 in US v. Kwon. ↩

Sentencing submission by USA filed on December 4, 2025. Document #57 in US v. Kwon. ↩

Sentencing submission by USA filed on December 11, 2025. Document #61 in US v. Kwon. ↩

Response to sentencing-related questions filed on December 10, 2025. Document #60 in US v. Kwon. ↩

Judgment filed on December 12, 2025. Document #64 in US v. Kwon. ↩

“William Hill Sentenced To Four Years In Prison”, The Rage. ↩

“Virtual Asset Trading Platform Pleads Guilty to Violating the Travel Act and Other Federal Criminal Charges”, U.S. Department of Justice. ↩

“Cryptocurrency Money Launderer Pleads Guilty to RICO Conspiracy in Scheme that Stole $263 Million in Crypto”, U.S. Attorney’s Office, District of Columbia. ↩

“Hollywood Director And Writer Convicted Of $11 Million Fraud On Subscription Streaming Service”, U.S. Attorney’s Office, Southern District of New York. ↩

“OCC Announces Conditional Approvals for Five National Trust Bank Charter Applications”, Office of the Comptroller of the Currency. ↩

“NCRC Statement: OCC Cryptocurrency Charters Create ‘Banks In Name Only’ That Will Prey Upon Consumers, Damage Economy”, press release by the National Community Reinvestment Coalition. ↩

“OCC Releases Preliminary Findings from Its Review of Large Banks’ Debanking Activities”, Office of the Comptroller of the Currency. ↩

December 15, 2024 World Liberty purchase of ONDO tokens, Etherscan. ↩

February 6, 2025 World Liberty purchase of ONDO tokens, Etherscan. ↩

“Trump-supported World Liberty and Ondo Finance partner to expand tokenized RWA adoption”, The Block. ↩

“Case Closed: Clearing the Way for Tokenization”, Ondo Finance. ↩

Amended order of designation, CFTC. ↩

“CFTC Orders Event-Based Binary Options Markets Operator to Pay $1.4 Million Penalty”, CFTC. ↩

“Revealed: gambling logos and ads seen up to every 13 seconds during big sports games in US”, The Guardian. ↩

Order granting motion to dissolve preliminary injunction filed on November 24, 2025. Document #237 in Kalshiex, LLC v. Hendrick. ↩

Plaintiff’s emergency motion for a stay pending appeal of order granting motion to dissolve preliminary injunction filed on November 25, 2025. Document #238 in Kalshiex, LLC v. Hendrick. ↩

State defendants’ opposition to plaintiff’s motion for a stay pending appeal filed on December 8, 2025. Document #250 in Kalshiex, LLC v. Hendrick. ↩

“EXCLUSIVE: Prediction markets launch coalition amid sports betting fight”, Axios. ↩

“Market Structure Markup Could Slide into January as Talks Drag On”, Crypto in America. ↩

“Republicans propose changes to crypto bill in compromise offer to Democrats”, Politico. ↩

“Teachers’ union AFT slams crypto market bill, warns of ‘profound risks’ for America’s retirement plans”, CNBC. ↩

“Press Release: Nearly 200 Groups Oppose Current Slate of Crypto Legislation”, Americans for Financial Reform. ↩

“Trump Family Crypto Deal Runs Aground”, The Information. ↩

“Trump’s latest crypto venture will be a real estate video game”, Fortune Crypto. ↩

“New Report Exposes the Trump Family’s Multi-Billion-Dollar Crypto Empire, Fueled by Self-Dealing and Corrupt Foreign Interests”, House Committee on the Judiciary Democrats. ↩

BUSD attestations, Paxos. ↩

Government’s memorandum regarding plea proceedings, filed on November 20, 2023. Document #15 in US v. Zhao. ↩

“Binance Co-Founder Yi He Appointed Co-CEO as Platform Nears 300 Million Users”, Binance blog. ↩

“Crypto Industry Makes Tax Policy Push With Private Dinner for Lawmakers”, Decrypt. ↩

Letter from the Solana Policy Institute to President Trump, sent November 20, 2025. ↩

Lobbying related to crypto tax issues, Senate Lobbying Disclosure. ↩

Stand With Crypto Questionnaire, Stand With Crypto. ↩

“UK mulls ban on crypto cash in politics — putting Farage in firing line”, Politico. ↩

“Argentina's Milei provided 'essential collaboration' for Libra project, congressional report finds”, The Block. ↩

“Reporte de Estabilidad Financiera”, Banco de México (in Spanish). ↩

Press release by the Committee for Macroprudential Policies. ↩

“Gov't moves to strengthen crypto exchanges' liability after Upbit hacking”, The Korea Times. ↩

“Digital Asset Regulation Raises Opportunities and Risks for U.S. Banks”, Fitch Ratings. ↩

“‘Get all that Hermes stuff now’: Netflix director accused of $11 million fraud rushed to buy luxury goods, texts show”, Business Insider. ↩

“Sorting out CZ's Binance influence”, Axios. ↩