Issue 99 – They’ve bought themselves a Congress

Coinbase calls the shots in the Senate, former New York City Mayor Eric Adams faces rug pull allegations, and a crypto executive is breaking up with Trump

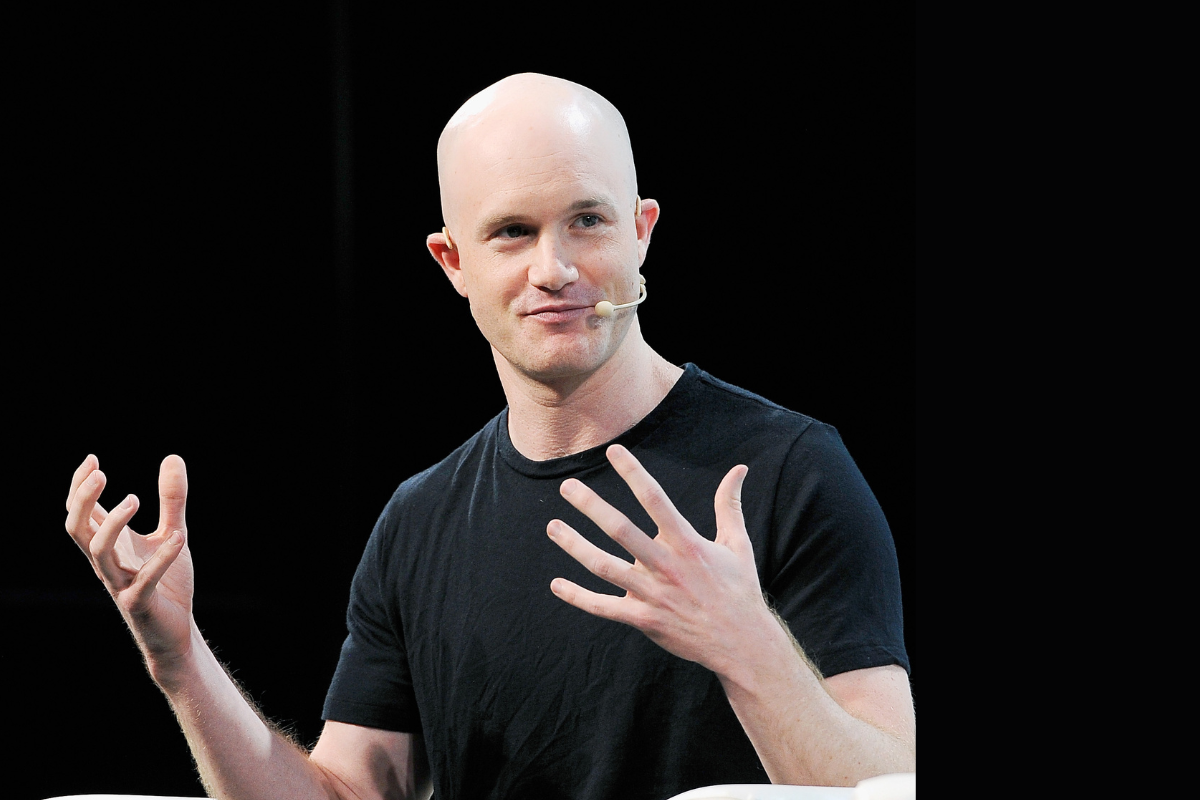

Last Wednesday afternoon, Coinbase withdrew its support for the Senate’s draft market structure bill, citing concerns about limits on tokenized stocks and stablecoin rewards, burdensome requirements for defi protocols, and excessive authority granted to the SEC.1 Within hours, Senate Banking Committee Chair Tim Scott (R-SC) canceled the markup hearing scheduled for the following day.

While mainstream news sources are often hesitant to draw cause and effect between two suspiciously timed events, it was too overt even for them, with the New York Times writing that Coinbase had “scuttled” the vote.2 Coinbase further emphasized its degree of control over the Senate when CEO Brian Armstrong stated in an interview with CNBC, “We’ve got a chance to do a new draft and hopefully get back into a markup in a few weeks” — speaking as if Coinbase, not Congress, controlled both the drafting process and legislative calendar.

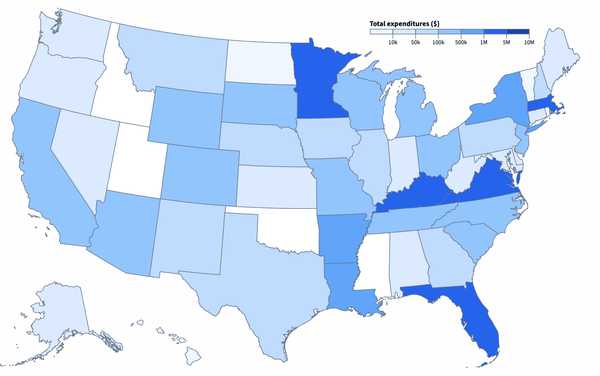

This is nothing new — just the latest demonstration of the crypto industry’s power over Congress after it spent over $130 million installing allies in the 2024 election. Within weeks, House Agriculture Committee Chair GT Thompson (R-PA) made the new power dynamic explicit when he said how crypto legislation was being drafted in “tripartisan” fashion, with the crypto industry forming the new third political wing of Congress [I76].

In an alternate universe, Congress might be focused on passing laws that don’t elevate the interests of corporations and oligarchs above the everyman. Ones that ensure the stability of the American financial system, protect consumers, address officeholder ethics concerns, and prevent financial crimes. Sadly, in this universe, lawmakers are primarily concerned with satisfying the demands of their newest and most generous campaign contributors. Senate Banking Ranking Member Elizabeth Warren (D-MA) told Politico, “These are folks who think that when they’ve bought themselves a Congress, then they expect it to behave the way they say.”3 After a year of this Congress, it would be hard to argue they’re wrong.

Also in this issue: After someone made almost half a million dollars on Polymarket with apparent advance knowledge of the Maduro capture, Trump has announced the “leaker” is in jail. Did Eric Adams rug pull his NYC Token only hours after launch? And one crypto executive is breaking up with Trump.

Citation Needed is an independent publication, entirely supported by readers like you. Consider signing up for a free or pay-what-you-want subscription — it really helps me to keep doing this work.

In Congress

The Senate’s crypto market structure bill has been a big focus entering 2026, with members of the crypto lobby beginning to sweat over whether the Senate will manage to push through this bill before attention shifts to the midterms, where the crypto lobby is concerned they may not be able to maintain their stranglehold over Congress. Though members of Congress and the crypto lobby alike have been promising the bill’s imminent passage since last summer [I91, 97], industry squabbles and Trump’s ever more brazen crypto corruption have complicated negotiations over the bill’s language and proposed amendments.

Stablecoin rewards have been particularly contentious, with banks lobbying against allowing stablecoin issuers to pay yield incentives. They’ve argued that this could result in “deposit flight” as people move their money out of bank accounts and into stablecoins, where they would face more risk due to lack of bank-like regulatory safeguards and deposit insurance. A dramatic reduction in deposits could reduce the funds available for bank lending, diminishing credit availability for people and small businesses that rely on local bank loans.45 The crypto industry has balked at this, claiming that this is a pretense by bank lobbyists who are actually just trying to eliminate competition. Coinbase urged its customers to call their senators, even sending an in-app notification to traders claiming that “Banks are once again trying to take away your crypto rewards. ... Write to your Senator ... and tell them to protect you and not the banks.”6 And CEO Brian Armstrong had previously issued a direct threat that Senators who support restrictions on stablecoin interest could face the full weight of the crypto PACs, writing, “Reminder that [Coinbase-backed advocacy group] Stand With Crypto will be scoringa the Senate markup this week[.] We get to find out which Senators stand for bank profits at the expense of the American people, and which stand for consumer rewards.”7

When the draft market structure bill contained language that would prevent stablecoin issuers from offering rewards on stablecoins that were merely sitting in an account, the crypto lobby was furious.

Other aspects of the 278-page bill, and its 137 proposed amendments, were similarly not to the industry’s liking. Crypto firm Galaxy claimed that the bill’s provisions governing decentralized finance would be the “single largest expansion to financial surveillance authorities since the USA PATRIOT Act”, pointing to provisions that would allow for transactions to be frozen without a court order, or that would impose anti-money laundering requirements on some defi applications.8 Coinbase further felt that the bill doesn’t go far enough in granting authority to the crypto industry’s regulator of choice, the CFTC, with Armstrong writing that the bill would “ero[de] ... the CFTC’s authority, stifling innovation and making it subservient to the SEC”. He also claimed that the bill amounted to a “defacto ban on tokenized equities”, though several firms working to tokenize stocks have disagreed with his interpretation.19

Some were surprised that Scott had even scheduled markup for the bill as Democrats and Republicans struggled to come to agreement on key provisions.10 Ethics requirements for the president and other elected officials have been a major contention, with Democrats demanding language prohibiting officeholders from profiting from crypto, and Scott insisting that ethics language doesn’t belong in the bill at all.11

Coinbase pulled its support for the bill via tweet on Wednesday, with Armstrong later saying he was concerned the draft language “would kill probably three or four different product lines that we have already in market.”12 Banking Committee Chair Scott canceled the next day’s scheduled markup almost immediately. “Evidently, the industry writes the bill and if anybody in Congress has the nerve to slightly amend it, the industry says that the whole thing is off and they have canceled the law,” said Ranking Member Warren.3

This brazen display seems to have caused something of a power struggle between Coinbase and President Trump, who was reportedly infuriated by Coinbase’s surprise “rug pull”. “This is President Trump’s bill at the end of the day, not Brian Armstrong’s,” a source close to the Trump administration told journalist Eleanor Terrett, adding that the White House was considering yanking its support for the bill if Coinbase can’t come up with a satisfactory compromise proposal on stablecoin yield.13 Armstrong later objected to Terrett’s reporting, claiming “The White House has been super constructive here”, but confirming that the White House had directed Coinbase to “go figure out a deal with the banks”.14

Other concerns about the bill came from Senate Judiciary Committee leadership, who sent a private (but later leaked) letter to Senators Scott and Warren stating that they had not been consulted or offered the chance to review language in the bill that they say would exempt “a dangerously broad category of actors” from the federal criminal law against money laundering.15

Markup for the Banking Committee’s draft has not yet been rescheduled. A separate draft bill from the Senate Agriculture Committee was scheduled for markup on January 15, but postponed to January 27.16 Some in the crypto industry are wondering if that may now also be further delayed.17 The text of their latest version of the bill has still not been released. If both committees can get their bills through the markup phase, they will be unified into a combined bill presented to the full Senate for a vote.

Over in the House, Financial Services Committee Ranking Member Waters (D-CA) has sent a letter to SEC Chairman Paul Atkins, blasting the agency for dismissing “important litigated crypto cases without justification”, such as those against Binance, Coinbase, and Kraken, and noting the dismissals as crypto companies pour money into Trump’s crypto businesses “create[] the unmistakable inference of a pay-to-play scheme”. She urges the agency to revisit its request to stay an enforcement action against Justin Sun and his Tron business, writing that “The SEC’s request to stay the Sun litigation, and subsequent efforts to settle the matter, may have been unduly influenced by Sun’s relationship with the Trump family, including his significant financial contributions to their businesses.”18 Previously, Waters had sent a letter to Financial Services Committee Chair French Hill (R-AR) requesting he schedule an oversight hearing with Chairman Atkins, noting that “the Committee has not held a single hearing with Chairman Atkins, despite the agency’s rapid, significant, and questionable policy shifts during the Trump Administration, largely accomplished by unilateral action by the Chairman.”19 No hearing has yet been scheduled.

In regulators

The CFTC has a new Chairman now that the Senate has confirmed Michael Selig. Selig’s background is primarily in private practice representing crypto clients like Paradigm and eToro.20 In 2025, he briefly served as chief counsel for the SEC’s crypto task force, but besides that, Selig has extremely minimal regulatory experience — particularly in the many non-crypto markets the CFTC is expected to regulate.

Selig is also the only commissioner at the normally five-person CFTC, as Trump has seized control of regulators by appointing his own loyalists without appointing replacements for departing commissioners. Acting Chair Caroline Pham had previously announced she planned to leave when a chairman was appointed, and she has followed through on that promise. She immediately rocketed through the revolving door right into the lap of the crypto firm MoonPay, where she is now chief legal and administrative officer.21 You might recognize MoonPay as a frequent Trump crypto partner, helping process payments for both the $TRUMP memecoin and for Melania Trump’s 2021 NFT projects. You also might remember that they snagged that lucrative Trump memecoin partnership only weeks after attempting to make a $250,000 contribution to Trump’s inaugural committee, but got scammed instead [I88].

Trump’s strategy to control the regulators is also playing out over at the SEC, where the single remaining Democratic and crypto-cautious Commissioner Caroline Crenshaw has departed after her renomination vote was canceled in December 2024 after complaints from the crypto industry.22 In her last speech, she expressed concern that the SEC is “shrouding its policymaking in darkness, shunning public comments and, instead, relying on hidden voices to drive its agenda.”22 She summarized the past year:

The appetite to deregulate has been rapacious; the analysis of the costs and benefits of our policies has been non-existent; and, the repercussions, I would argue, could be dire. We live in an echo chamber where politicians and policymakers make their own truth through repetition. But, the markets have a way of correcting themselves—not always immediately, but over time. So, I think the true advisability of these policies will reveal themselves eventually. I certainly wouldn’t be alone in analogizing the trend toward deregulation in the current environment to the period prior to the stock market crash in 1929.

The SEC website still contains the statement that “To ensure that the Commission remains non-partisan, no more than three Commissioners may belong to the same political party.”23 By the strictest possible reading, the Commission is in compliance: there are no more than three Republicans. There are also no more than three Commissioners. The Commission is both technically compliant and entirely partisan.

Those Republican Commissioners have continued to drop investigations into crypto firms, with both defi lending protocol Aave and privacycoin issuer Zcash Foundation issuing statements to announce that the agency has dropped years-long investigations with no action.2425 Aave has partnered with the Trump family’s World Liberty Financial platform.

In the White House

An investigation by ProPublica has revealed that Deputy Attorney General Todd Blanche violated his ethics agreement with the April memo that dismantled the Department of Justice’s National Cryptocurrency Enforcement Team, instructed the agency’s Market Integrity and Major Frauds Unit to “cease cryptocurrency enforcement”, and imposed barriers to prosecutors charging various regulatory violations in crypto cases [I81]. In January 2025, Blanche’s ethics disclosures revealed that he held between $159,000 and $485,000 in cryptocurrency and up to $15,000 in Coinbase stock. In an ethics agreement he signed the following February, he promised to divest those investments within 90 days, and pledged to “not participate personally and substantially” in anything that would affect those investments until that divestment. But Blanche sent his April memo before divesting — an “obvious conflict of interest” for someone invested in crypto, according to a former White House ethics lawyer, and a clear violation of his ethics agreement. When Blanche did later divest, he merely transferred his crypto and crypto-related assets to family members — following a strategy modeled by Commerce Secretary Howard Lutnick [I71] and, of course, Trump himself.26

Trump business interests

The Trump family’s World Liberty Financial crypto company has announced that they have applied for a national trust bank charter with the Office of the Comptroller of the Currency, through a proposed entity called World Liberty Trust Company. Senator Elizabeth Warren quickly sent a letter to Comptroller of the Currency Jonathan Gould to urge him to delay the review of World Liberty Financial’s application “until President Trump divests from WLF and eliminates all financial conflicts of interest involving himself or his family and the company.” She wrote:27

If the application is approved, you would promulgate rules that influence the profitability of the President’s company. You would also be responsible for directly supervising and enforcing the law against the President’s company—and its competitors. You would be in charge of these functions while serving at the pleasure of the President. In effect, for the first time in history, the President of the United States would be in charge of overseeing his own financial company.b

Last recap issue, I wrote about the turmoil at the Trump family’s Alt5 Sigma, which has replaced multiple executives and warned employees about likely regulatory investigations or litigation [I98]. Now they’ve fired the auditor they hired in December, after the Financial Times inquired about why they’d hired a firm that was not permitted to do any auditing since its license expired in August. That firm, Victor Mokuolu CPA PLLC, had previously been fined by two different auditing regulators for repeated violations.28

In prediction markets

After the US military kidnapped Venezuelan President Nicolás Maduro, observers were quick to notice that several Polymarket accounts had all placed large bets on a market pertaining to whether Maduro would be removed from power by the end of January, and other Venezuela-related markets. One account began placing bets in late December, and continued to add thousands of dollars to its positions right up to the day Maduro’s capture was announced, ultimately purchasing $32,000 in shares. The trader profited $410,000 when their predictions came to pass, leading many to believe they had access to inside information.29

Days later, Representative Ritchie Torres (D-NY) introduced a bill seeking to prohibit elected officials and other politicians and staff from participating in prediction markets connected to “government policy, government action, or political outcomes” when they possess or could obtain inside information.30

Then, on January 14, Trump said in a press conference that “The leaker [on Venezuela] has been found and is in jail right now” and would likely face a long sentence. He also noted that “there could be some others”.31 The identity of the leaker, how they gained access to sensitive information, and whether they were also the person who placed the bet has not been disclosed, nor has the charge on which they’ve been jailed.

In elections and political influence

Senator Cynthia Lummis (R-WY), one of Congress’s earliest and fiercest crypto advocates, has announced she won’t be seeking re-election in 2026. This is surely a disappointment for the crypto industry, for whom she has been a champion, and which was already beginning to line up support for her campaign.32

There is now a crypto-denominated political fundraising platform, and surprisingly, it’s looking to elect Democrats. BlueVault was founded by William Schweitzer, a former staffer on numerous political campaigns and an organizer of the Crypto4Harris effort in 2024 [I64]. His project is aiming to be something of a crypto version of ActBlue. Though the project is in its infancy, Schweitzer said in an interview that they’ve already signed up three political committees and three compliance agencies, though he declined to name them. Schweitzer says that BlueVault’s primary focus is on helping campaigns with the onerous process of accepting and properly reporting contributions in crypto, and although the platform is focused on helping Democratic campaigns, he does not expect they will become involved in advocacy for specific candidates.

In the courts

Samourai Wallet co-founder Keonne Rodriguez, who was sentenced to five years in prison in November after he pleaded guilty to conspiracy to operate an unlicensed money transmitting business [I96], has publicly appealed to Trump for a pardon. Describing his prosecution as “lawfare perpetrated by a weaponized Biden DOJ where truth and justice were sidelined in favor of a political anti innovation agenda” and claiming his case was handled by an “activist judge”, Rodriguez wrote that he hoped Trump would pardon him and “restore justice when no one else would.”33 When asked about Rodriguez on December 15, Trump said he had heard about the case and planned to “take a look”.34 The President has granted 14 pardons and 8 commutations since then, but so far no luck for Rodriguez.35

Prosecutors have appealed last year’s acquittal of Avraham Eisenberg [I85], who had been convicted in 2024 of commodities fraud, commodities market manipulation, and wire fraud [I56]. After Eisenberg was sentenced to four years in prison for extracting more than $110 million from the Mango Markets defi lending platform [I6], Judge Arun Subramanian took the unusual step of vacating the commodities fraud conviction and acquitting Eisenberg on the wire fraud charge, finding that the government had not adequately proven that Eisenberg had made false representations to the platform. Despite his lucky break on those charges, Eisenberg has remained in prison on a separate four-year sentence for possession of child sexual abuse material, which was discovered on his devices after he was arrested for his crypto scheme [I38, 81]. Now prosecutors are appealing to the Second Circuit, arguing that Judge Subramanian, in overturning the verdict, “ignored inconvenient evidence, relied on inferences the jury was entitled to reject, and imposed legal barriers to finding fraud that have no basis in the law.”36

A Financial Times investigation into leaked Binance documents has found that the exchange continued to allow highly suspicious accounts to operate on the exchange even after the company’s 2023 plea agreement and the installation of an independent monitor. The FT noted that one account was used by a person claiming to live in a Venezuelan slum, who nevertheless moved $93 million through his Binance account over a four-year period. Some of the money came from a group later accused by the US government of transmitting funds for Hezbollah. Another account, also supposedly belonging to a Venezuelan national, received transfers of more than $177 million in the years following Binance’s plea agreement. This account changed its attached bank account details 647 times in 14 months, suggesting its operator may be transmitting funds on behalf of others. A former chief of the DOJ fraud section told the FT that their investigation “raises concerns about how seriously the government takes its responsibilities with respect to white-collar investigations and prosecutions.”37

Prosecutors in Virginia have charged Venezuelan national Jorge Figueira with conspiracy to launder more than $2.8 billion dollars in crypto in a two-year period from mid-2023 to mid-2025. In charging documents, prosecutors allege that Figueira recommended using the Tether stablecoin (also called USDT) in a conversation with a confidential informant. “Basically, it is used for what we are doing. It is used to transfer money in a quick way, even to make it get to jurisdictions that have some types of issues, etcetera.” He added that Tether is useful to move money out of countries like Venezuela, where they don’t “have the liberty to interact with the international financial institutions because of the sanctions.” Describing how he launders money in Venezuela, Figueira said, “That’s what the USDT is made for, to collaborate with the cleaning of all of that stuff. I think I told you something that I shouldn’t have told you, but a lot is made for that.”38

In bankruptcies

The team overseeing the bankruptcy for Do Kwon’s Terraform Labs has sued US-based Jump Crypto for $4 billion in damages, alleging that Jump “actively exploited the Terraform Labs ecosystem through manipulation, concealment, and self-dealing that enriched Jump while financially devastating thousands of unsuspecting investors.”39 Jump Crypto had participated in numerous secret deals with Terraform Labs to prop up the price of the supposedly “self-healing” stablecoin Terra when it faltered from its peg [I20, 27]. In mid-2024 it was reported that the CFTC was investigating Jump [I60], and the SEC fined a Jump subsidiary $123 million for misleading investors about Terra’s stability later that year [I72].

Everything else

Former New York City Mayor Eric Adams launched “NYC Token”: half memecoin, half social experiment to determine how many glaring red flags you can stuff into one pitch and still convince people to buy. A figurehead who Trump had to rescue from federal bribery and corruption charges: check. An unidentified team running the project: check. Massive quantity of tokens to be held back in “reserve” with no details around custody, access control, or planned use: check. Pointers to documentation that doesn’t exist: check.c Lofty and numerous promises — educating kids about crypto, combatting “antisemitism” and “anti-Americanism” in NYC, and providing financial aid to students seeking higher education — with no specifics whatsoever about how they will fulfill them: check.

With all those red flags flapping in the wind, it’s perhaps no surprise that the token launch quickly turned into disaster [W3IGG]. Almost immediately after the token was launched, the project’s liquidity providerd withdrew more than $2.4 million in USDC from the one-sided liquidity pool,e causing the token price to plummet by about 85%. Though the project team later claimed they had been “rebalanc[ing]” liquidity, they only returned $1.5 million to the liquidity pool, with more than $900,000 of it left sitting in the LP wallet. That same wallet then began making automated purchases of $NYC every minute, which the team claimed is part of a TWAP (time-weighted average price) buying strategy. This is a strange explanation that doesn’t address why the third-party liquidity was withdrawn, why it was only partially returned, or why the remaining USDC is now being used in a way that seems intended to create the appearance of sustained demand without any new money actually coming in.

Since then, Adams has been fighting off allegations that he “rug pulled” the token. It seems too early to tell on that front, as the unaccounted funds are still sitting in the crypto wallet — perhaps to be restored to the liquidity pool, or perhaps to be withdrawn once whoever controls the wallet thinks attention has moved elsewhere. Some have speculated that this was all a way for Adams to surreptitiously accept belated bribes, I guess by having a would-be briber purchase a large amount of the token, and then extracting the funds as we saw. This is certainly possible, I suppose — there are some wallets that spent tens or even hundreds of thousands of dollars to purchase the token. But with Adams out of office and no longer needing to file disclosures, I don’t see why he’d go about it this way rather than just quietly creating a wallet and having people transfer crypto to him directly.

Neither Adams nor the NYC Token team responded to questions about the removal of liquidity, the automated buying strategy, or details about the token, its team, or its plans to follow through on its promises. However, shortly after I sent the questions, the automated token buys stopped.

Meanwhile, Edward Cullen — whose Innovate NY PAC spent nearly $100,000 on AI-generated flyers and other materials to back Andrew Cuomo last October after his last-minute crypto industry appeal — is back. Cullen claims that he pitched the NYC Token idea to Adams last year, and that Adams stole it from him, then “butchered” it for “short-term gain”. Cullen is now threatening to sue, although I’m not sure on what grounds.40

Not too long ago, I found myself wondering if and when we’ll begin to see Trump’s allies in the crypto sector distance themselves as they sense weakness in his administration, or as they come to feel that Trump is doing more damage than good to crypto’s reputation. While the crypto industry was eager to tie themselves to Trump when it benefited them, there may be a point at which the association becomes too noxious even for them. Recently, Cardano founder Charles Hoskinson became the first prominent crypto figure to publicly break with Trump, opining that Trump had left the industry in a worse state than under former President Joe Biden — of whom Hoskinson was an outspoken opponent. Hoskinson criticized Trump’s decision to launch the $TRUMP memecoin, stating, “If you launch something and it’s mostly an extractive venture, then what you’ve effectively done is you’ve collapsed crypto from a public perception, to crypto equals Trump equals bad, you know, amongst the left.” He believes that, thanks to Trump, in the eyes of the general public “crypto equals corruption. It’s a wealth transfer mechanism for Trump and his friends. And that didn’t help any of us.”41 Hoskinson is not one of the crypto industry’s powerful megadonors, nor did he ever achieve the close access to the President he once coveted [I78]. It would be a leap to describe his defection as the beginning of a trend, but it may be worth watching whether others eventually follow.

The Web3 is Going Just Great recap

There were eight entries between December 16 and January 17. $323.7 million was added to the grift counter.

- Former NYC Mayor Eric Adams accused of rug pull as NYC Token crashes [link]

- Crypto holder loses $283 million to scammer impersonating wallet support [link]

- Truebit exploited for over $26 million [link]

- Unleash Protocol exploited for $3.9 million [link]

- Flow blockchain exploited for $3.9 million [link]

- Binance’s Trust Wallet extension hacked; users lose $7 million [link]

- Crypto trader loses $50 million to address poisoning attack [link]

- Yearn Finance suffers fourth exploit only weeks after third [link]

In the news

I joined Anne Applebaum on an episode of The Atlantic’s Autocracy in America podcast to discuss Trump’s deregulation of the cryptocurrency sector as he and his family profit to the tune of billions of dollars, as well as the industry’s growing control over the legislators and regulators who could get in their way.

I returned to The Majority Report to talk about my recent reflection on “The year of technoligarchy”. We discussed what the crypto industry has gotten out of the first year of Trump’s presidency, its influence on the upcoming midterm elections, and the growing presence of prediction markets in day to day life.

That's all for now, folks. Until next time,

– Molly White

Have information? Send tips (no PR) to molly0xfff.07 on Signal or molly@mollywhite.net (PGP).

I have disclosures for my work and writing pertaining to cryptocurrencies.

Footnotes

Stand With Crypto rates politicians with A–F letter grades, deeming whether they are “strongly supportive” (A) of or “strongly against” (F) crypto. ↩

I would argue he already is, national trust bank charter or not. ↩

The NYC Token website’s FAQ invites visitors to “Join our community channels to get access to the full whitepaper”. While a Telegram channel is mentioned elsewhere in the FAQ, only a Twitter account is linked, and it has not shared a whitepaper. ↩

A liquidity pool is a pool of crypto assets that allows people to buy and sell a token. Instead of trading against another person, traders trade against this pool. New tokens generally need a liquidity pool so that there is any market at all — without one, buyers and sellers may be unable to transact due to lack of a counterparty, or may face extreme price swings. Large or sudden withdrawals from a liquidity pool are often interpreted by traders as a sign that insiders may be preparing to rug pull, which can trigger panic selling and price collapse. ↩

A one-sided liquidity pool differs from a typical two-sided pool in that it is funded with only the new asset, $NYC, rather than a matched pair (such as $NYC and USDC). The other side of each trade (e.g. the USDC) is supplied dynamically by traders when they buy the token. ↩

References

“The Biggest U.S. Crypto Company Asserts Its Power in Washington”, The New York Times. ↩

“Capitol agenda: A crypto titan flexes in the Senate”, Politico. ↩

“ABA Community Bankers Council Letter Urging Senators to Close the Stablecoin Loophole”, American Bankers Association. ↩

“Congress must bar interest on payment stablecoins to avoid harming Main Street lending”, CoinDesk. ↩

Bluesky post by JLRay. ↩

“Senate crypto bill could mark biggest financial surveillance expansion since the Patriot Act, Galaxy says”, The Block. ↩

“Tokenization firms reject Coinbase's crypto bill equities claims”, CoinDesk. ↩

“Vault: Tim Scott’s crypto leap of faith”, Punchbowl News. ↩

“Senate banking chairman Scott: Trump-tied ethics clash doesn't belong in his crypto bill”, CoinDesk. ↩

“‘We'll fix it in time': Galaxy CEO Novogratz bucks Coinbase and wants crypto legislation to advance”, The Block. ↩

“Grassley, Durbin raise concerns about Tim Scott’s crypto bill”, Politico. ↩

“Senate Agriculture Committee reschedules its own crypto bill hearing to Jan. 27”, CoinDesk. ↩

“Senate Democrats serious about crypto bill reboot, they said in call with industry”, CoinDesk. ↩

Letter from House Financial Services Committee Ranking Member Maxine Waters to SEC Chairman Paul Atkins, sent January 15, 2026. ↩

Letter from House Financial Services Committee Ranking Member Maxine Waters to HFSC Chair French Hill, sent December 29, 2025. ↩

“CFTC Chairman Nominee Selig Advanced by Senate Panel”, Bloomberg. ↩

“Acting CFTC Chair Caroline Pham To Join Crypto Payments Firm MoonPay”, Forbes. ↩

“The Rubble and the Rebuild: The Future of Financial Regulation Series at The Brookings Institution”, SEC. ↩

SEC Commissioners, SEC. ↩

“Crypto Lending Protocol Aave Says SEC Has Ended 4-Year Investigation: 'DeFi Will Win'”, Decrypt. ↩

“Zcash Foundation says SEC has closed the book on its years-long probe into the organization”, The Block. ↩

“Top DOJ Official Shut Down Enforcement Against Crypto Companies While Holding More Than $150,000 in Crypto Investments”, ProPublica. ↩

Letter from Senate Banking Committee Ranking Member Elizabeth Warren to Comptroller of the Currency Jonathan Gould, sent January 13, 2026. ↩

“Trump-linked crypto venture fires auditor after FT inquiries”, Financial Times. ↩

“Maduro Polymarket bet raises insider trading concerns”, Protos. ↩

“In Response to Suspicious Polymarket Trade Preceding Maduro Operation, Rep. Ritchie Torres Introduces Legislation to Crack Down on Insider Trading on Prediction Markets”, Ritchie Torres. ↩

“Trump: Venezuela ‘leaker’ is in jail”, The Washington Post (video). ↩

“Wyoming GOP Sen. Cynthia Lummis announces she won't seek re-election”, NBC News. ↩

“Trump to ‘look into’ recently convicted Samourai Wallet co-founder”, Cointelegraph. ↩

Clemency Grants by President Donald J. Trump (2025-Present), US Department of Justice. ↩

Brief for the United States of America filed on December 12, 2025. Document #24.1 in US v. Eisenberg (2nd Cir.). ↩

“Binance allowed suspicious accounts to operate even after 2023 US plea agreement”, Financial Times. ↩

Affidavit in support of a criminal complaint and arrest warrant filed on December 23, 2025. Document #2 in US v. Figueira. ↩

“Jump Accused of Contributing to Collapse of Terraform, Do Kwon’s Crypto Empire”, The Wall Street Journal. ↩

“The Eric Adams Crypto Scandal Is Getting Messier”, Intelligencer. ↩

“Charles Hoskinson slams Trump’s crypto policy as 'extractive,' warns of industry fallout”, CoinDesk. ↩