Sam Bankman-Fried is not a child

But the media is treating him like one.

Sam Bankman-Fried is thirty years old.

He appears to have lived independently of his parents since 2010, when he left his childhood home near Stanford to move in to a big house in Cambridge with other MIT undergrads. After he graduated he went to New York to work at Jane Street, then moved back across the country to Berkeley for a brief stint at the Centre for Effective Altruism. He was 25 when he founded Alameda Research, and 27 when he founded FTX. He moved with FTX to Hong Kong, then took it with him to Nassau in The Bahamas in 2021. Only recently did he return home, moving back in with his parents in their Palo Alto home while he's confined to house arrest.

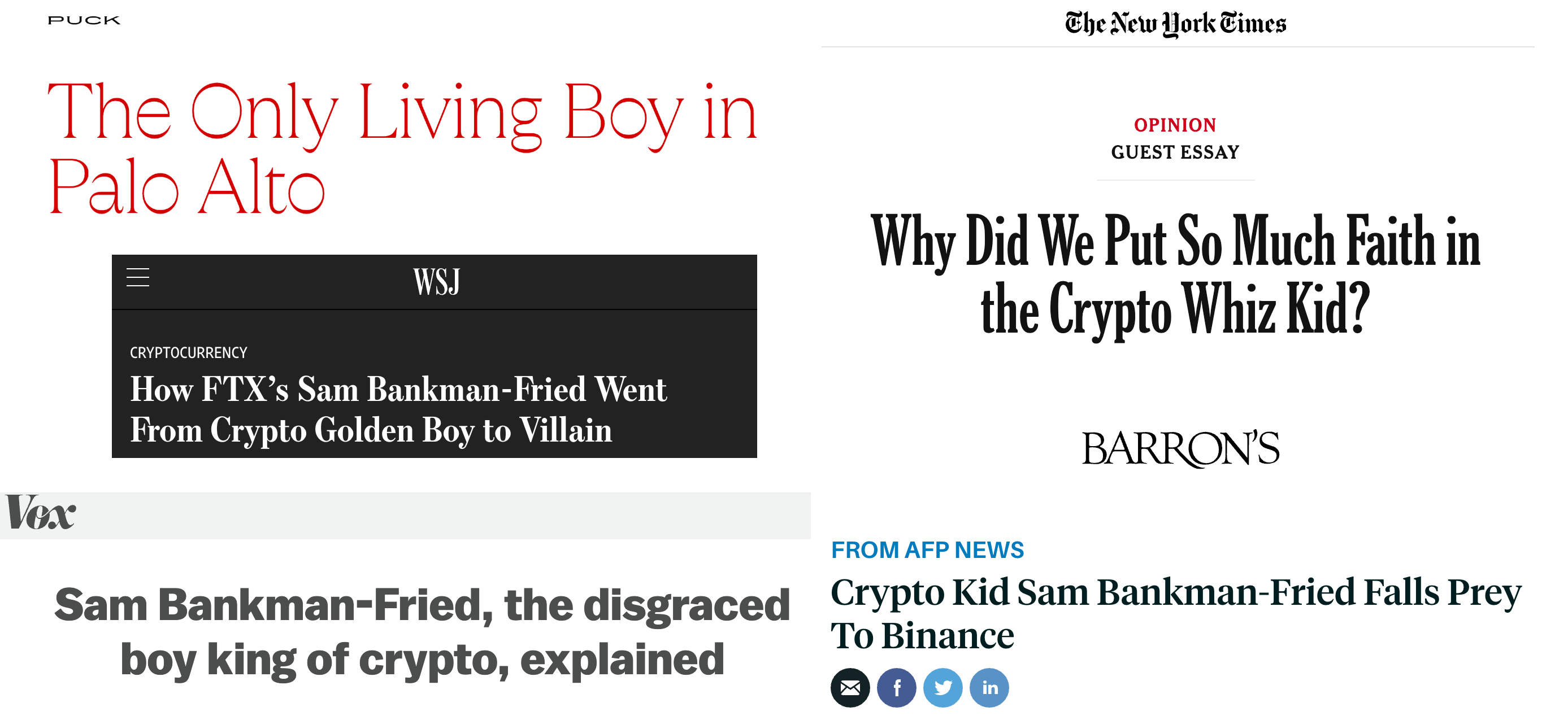

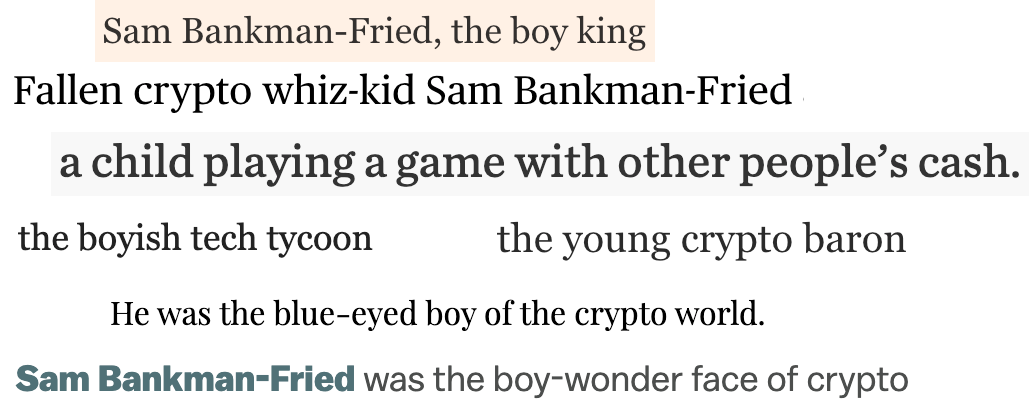

But reading headlines and news stories, you would be forgiven if up until now you had thought he was a teenager still driving around on a learner's permit, who picked up cryptocurrency trading to avoid the types of high school summer jobs that might force him to go outside.

Sam Bankman-Fried was apparently adult enough to start his own company, convince sophisticated venture firms like Sequoia Capital to give him hundreds of millions of dollars, and bring in billions of dollars in trading activity. He dated, picked out meals for himself, and even testified in front of Congress to advise on policy. He presumably voted and paid renta and put his own pants on just like the rest of us grown-ups.

That's not to say he wasn't perceived as youthful, or even childish, before the collapse. He cultivated the image. He played video games constantly, and napped on beanbags in the office wearing his uniform of rumpled FTX t-shirts, shorts, and tube socks. It was a useful persona to portray, even before he was being accused of crimes: with the young white nerdy boy genius forming the archetype of successful tech entrepreneur ever since Bill Gates and Mark Zuckerberg, investors are drawn to it.

The press and crypto community certainly bought it, referring to him often in similar terms as they are now: boy genius, wunderkind, whiz kid. It was odd, to be sure, given that mid-20s founders are not exactly uncommon in the tech industry, but it was also not unique. Vitalik Buterin is also almost thirty and receives similar treatment (though it is more accurate with Buterin than with Bankman-Fried that he got his start unusually young).

But now, more than ever, SBF is benefiting from his childish image. The New York Times' Andrew Ross Sorkin commented in a highly publicized interview with SBF after the FTX collapse that "when you read the stories, it sounds like a bunch of kids who were on Adderall having a sleepover party."1 Thinkpieces have asked if it all could have just been an honest mistake. Maybe this kid just got in over his head? Maybe this naive boy meant well, and was just trying to do the right thing, and running a multi-billion dollar company was just more than he could handle?

Some of the media focus on SBF's parents is deserved, given they appear to have been deeply involved with and to have benefited financially from FTX. But some of it gives the impression that news outlets are wondering "why didn't Mom and Dad put a stop to their kid son's mischief?" Maybe if they'd just grounded him, or took away his League of Legends when he started acting out, they could have kept him on the straight and narrow. Now, the news is covering how his parents bought him a dog, with one popular tabloid speculating that it was an attempt "to cheer him up". Poor kid.

SBF is being extended the benefit of the doubt that many are not so lucky to get. He is affluent, white, male, and accused of white-collar crimes, and so he is granted the charitable characterization of a naive boy. Meanwhile, the perception that Black children, particularly those accused of violent crimes, are adult criminals has earned its own term: adultification bias. The same term is used when abuse of Black children is ignored or even rationalized based on the perception that they are older than they are.

It's jarring to read a story about a neighbor calling the police on a nine-year-old Black girl spraying for invasive lanternflies, describing the girl to a dispatcher as a "little Black woman walking, spraying stuff", and then switch over to another tab with a story on the 30-year old "crypto kid" who might've just made an oopsie with billions of dollars of customer funds. On one hand, literal children are portrayed in the media as adults, and treated as such in the prison system; on the other, a man who's been old enough to vote for over a decade is being described as "a young man in need of both defense and a friend" offering refreshments to a reporter "as if we were there for a playdate".

Sam Bankman-Fried is continuing to cultivate this persona, hanging his head and slumping his shoulders to portray boyish shame, repeating "I made a lot of mistakes". If he can keep it up, and if news outlets continue to fall for his narrative, perhaps he can sway not just some of the general public, but members of a jury.

Footnotes

Well, probably not since he started FTX, given the company's apparent predilection for paying for employees' housing. ↩

References

"Transcript of Sam Bankman-Fried's Interview at the DealBook Summit". New York Times. ↩