The Celsius examiner's report: a picture of fraud and incompetence

Nearly 500 pages of damning evidence that Celsius was little more than a money incinerator that finally ran out of fuel.

I spent a couple hours reading the independent examiner's report in the Celsius bankruptcy, muttering to myself every few paragraphs "oohh, this man is going to JAIL". That's the primary takeaway, I think.

Although Celsius is under scrutiny because of the bankruptcy, and its CEO Alex Mashinsky is facing a civil suit from the New York Attorney General, as of writing, criminal charges have not yet been filed relating to the company's operations. Yet.

It's certainly possible in the finance industry for lenders to face liquidity problems, become insolvent, and even go under, even having operated reasonably competently and in good faith. That's not what happened here. Some decisions made at Celsius were perhaps only completely incompetent, but many clearly involved outright fraud.

Recap

Celsius was a cryptocurrency lending company. Customers could deposit crypto and earn interest, which Celsius said they generated by lending customer funds to low-risk institutional borrowers. Celsius halted withdrawals on June 12, and filed for bankruptcy almost exactly a month later.

Customers haven't had access to their funds since withdrawals were halted, and customers will probably only see a fairly small portion of their deposits ever returned to them even once the bankruptcy proceedings eventually wrap up.

Celsius's customers were particularly devastated by the company's bankruptcy because of the representations the company made about its risk, and its encouragement that customers think of their service like a regular savings account. I've published some excerpts of letters to the bankruptcy judge in which customers describe how they put their life savings into the platform, or convinced family members to do so.

As a part of the bankruptcy process, an independent examiner was appointed. The examiner, Shoba Pillay, is a former federal prosecutor and probably not the type of person you want sniffing around if you committed massive fraud. She published her report on January 31; it's 470 pages long, with another 200 pages of appendices. That sounds long, and yet after reading it cover-to-cover I can tell you that the examiner was actually fairly concise in describing the massive and apparently criminal disaster that was Celsius.

Celsius's advertising

Celsius emphasized to their customers that they cared more than anything about their "community",1 describing themselves as an altruistic company that sought to enrich customers and provide "financial freedom".

Celsius liked to tell customers they could use Celsius like a bank where they could store their crypto and receive interest rates of as high as 19%. In fact, the company regularly told customers that Celsius was better and safer than traditional banks, which Celsius characterized as only paying low interest rates out of greed. They urged customers to use Celsius instead of banks, repeating mantras like "banks are not your friends" and hashtags like "#unbankyourself".

Celsius leaned on talking points about financial exclusion and wealth inequality to draw in customers:

The financial industry has a history of hurting groups of people and thwarting their dreams of financial independence with exclusionary or exploitative practices. But we're not for a wealthy group of a few elites. We're for democratized wealth for all.

– Celsius brand guidelines, dated July 2021

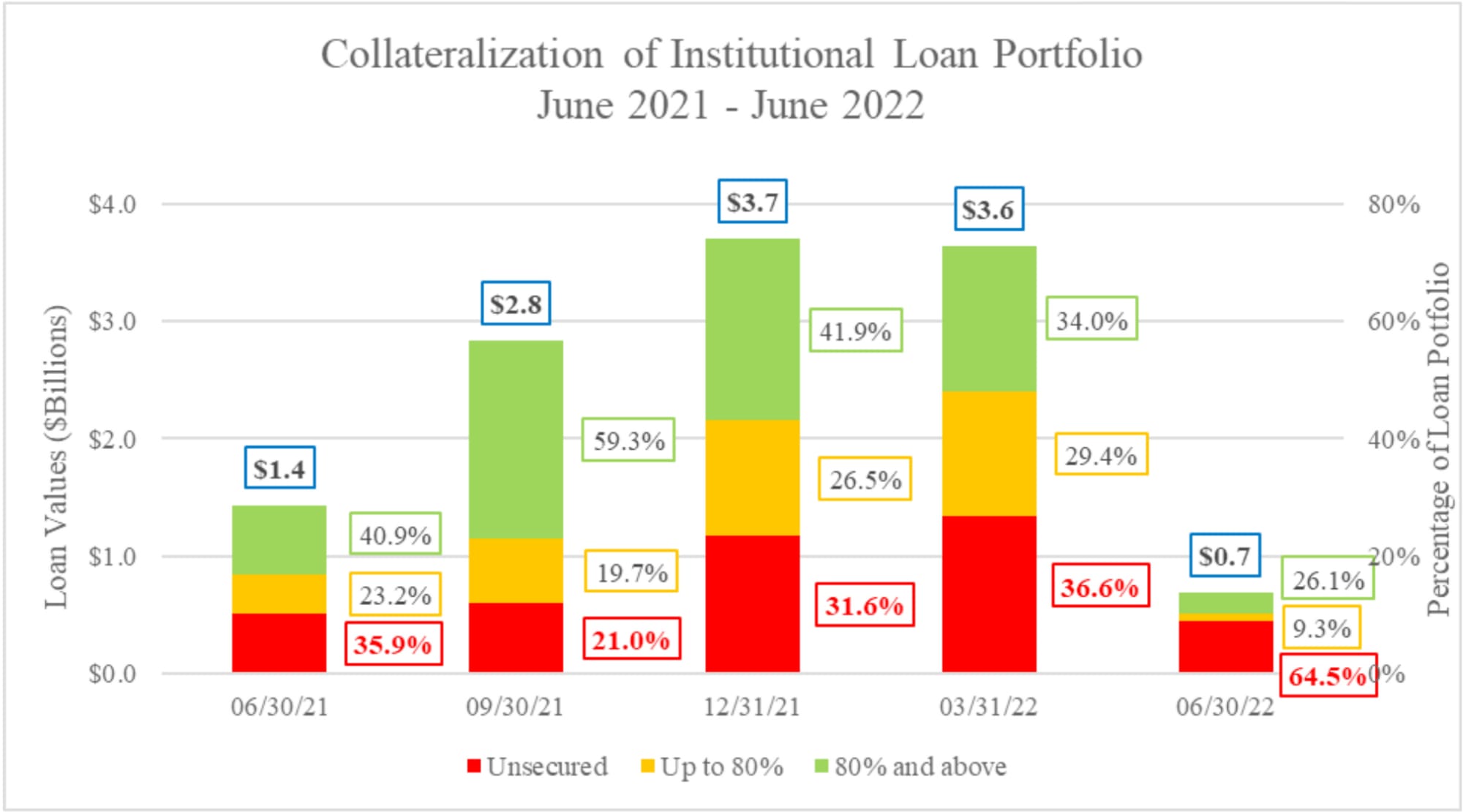

Celsius told customers that the company earned money by lending customer funds in low-risk, high-yield strategies (🚩🚩). Mashinsky repeatedly emphasized that the company never made uncollateralized (unsecured) loans to anyone, when in reality around a third of their institutional loans were uncollateralized:

The loans that they characterized as "collateralized" were also not as low risk as they made them seem: beginning in June 2021, Celsius loaned money to FTX, collateralized only by FTX's FTT token, knowing that the token did not provide meaningful security against a default by FTX but not disclosing this to customers.

AMAs and other public statements

Much of the marketing took place in weekly livestreamed AMAs — an acronym usually meaning "ask me anything", but repurposed by Celsius to "Ask Mashinsky Anything". These were informal conversations where Mashinsky provided updates on the company and its services, and also answered questions from customers. They regularly attracted more than a thousand viewers, and were widely referenced in letters from customers as a reason they trusted the platform. Customers had an almost parasocial relationship with Mashinsky, which he cultivated, telling them that not only could they trust the company but that he personally was looking out for them.

As described by the examiner, Mashinsky routinely knowingly and overtly lied to customers in these videos, to a point where the company instituted a whole process to remove false or substantially misleading statements made in the live videos before republishing the recordings. The company made no attempt to inform their customers of the lies or the retractions, and in fact employees repeatedly expressed concern internally that if they made too many edits, customers or other viewers of the video who had watched live might notice the difference.

Some Celsius employees discussed prepping Mashinsky more thoroughly before the AMAs to reduce the number of false statements they would later have to edit out, but it seems no serious attempt at this was made, in part due to some employees' apparent fear of angering Mashinsky by pointing out in front of a larger employee group his tendency to make misleading statements. The attempts that were made to speak to him didn't have much impact on Mashinsky's propensity to lie:

Maybe we send an email to him and cc a very limited number of others where we say 'FYI Alex, we removed the following items…' I think this would feel more 'private' for Alex… I have at times mentioned to him in our one on one's about avoiding certain statements e.g. don't say we take no leverage, whereas banks are leveraged 50 times. (Last year, I provided him data that showed both banks and Celsius were ~10-20x. Fortunately, nowadays he says banks are 10-20, not 50x, but even as recently as March he said we have 1.0-1.2 leverage.).

– Email from Rodney Sunada-Wong, former Chief Risk Officer, April 8, 2022

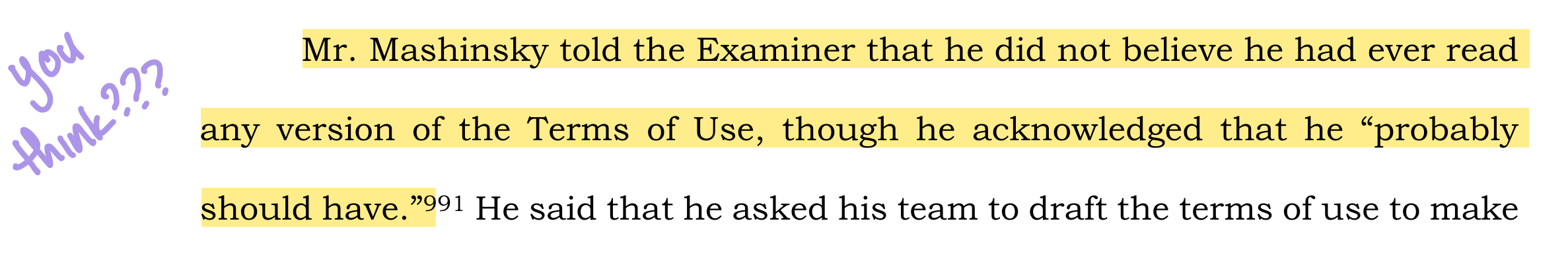

Mashinsky himself did not appear to make any attempts to understand the company or ensure his statements were accurate. He admitted to the examiner that he had never personally read his own company's Terms of Use, which often contradicted his public statements. For example, Mashinsky constantly claimed that customers retained ownership over the crypto they deposited with Celsius's interest-bearing accounts, despite the Terms of Use clearly stating that Celsius held ownership rights over those assets. This was actually a point of contention during the bankruptcy case, since a lot of customers took Mashinsky at his word, but the judge ultimately determined that the Terms of Use was the binding agreement and that the assets belonged to Celsius.

One employee, Celsius Head of Intelligence and Credit Officer Peter Graham, seemed to actually be one of the closest things resembling an adult in the room, writing in an email to Sunada-Wong on March 15, 2022:

I believe that regulatory has underestimated the risk of these [public] forums to Celsius… With respect to misrepresentations, this is defined under federal securities law as: Statements are material if reasonable investors would consider truthful disclosure of the information significant in making their investment decisions. Scienter is established where representation or opinions are given without basis and in reckless disregard of their truth or falsity.

– Email from Peter Graham, Celsius Head of Intelligence and Credit Officer, March 15, 2022 (italics in the original)

Then again, thanks to him putting this in writing and then the company failing to change anything, the SEC could probably make a strong argument that they were knowingly breaking the law.

SEC registration, or lack thereof

Hey, speaking of the SEC: Mashinsky repeatedly claimed that CEL was a "registered" token, and that Celsius had "registered with the SEC". Celsius's website also referenced being SEC-regulated. Barron's even published a quote by Mashinsky that "The regulators looked into us and said these guys know what they're doing."

Per the examiner:

Celsius, in fact, had not registered with the SEC. Celsius had filed a FormD with the SEC in April 2018 and in September 2020, which stated that Celsius was taking the position that its ICO and subsequent token sale were exempt from registration.

The examiner quotes a letter from a customer that Celsius's representations that it was regulated by the SEC and FinCen influenced their decision to trust assets with the company. This shows up in the excerpts of letters to the judge, also:

The fact that Celsius is regulated by the state of New York and SEC compliant was a significant reason I decided to trust Alex and move my money on to this platform.

Loosing access to my funds has taken a toll on me physically and mentally. Your Honor, I have worked hard all my life and it has taken me years to save this money. I don't understand how this can be allowed to happen. Celsius Network was operating in New York and New Jersey which are under SEC rulings. The SEC has been so stringent regarding cryptocurrency regulations yet this was allowed to happen.

Propping up CEL

Celsius issued the CEL token. When talking to the examiner, Mashinsky tried to claim that the token price had little correlation with the company's success, and was rather "like airline miles". This is something you might do if you're trying to avoid admitting that your token is an unregistered security.

In other places, however, Mashinsky "repeatedly equat[ed] the value of CEL with Celsius's value" and "present[ed] CEL as the barometer by which Celsius's financial health should be measured."

Celsius was active in what it described as "market making" for the CEL token: that is, propping up the price by buying substantial quantities of it on the open market. At first they only purchased the amount they needed to fulfill interest obligations, but at some point in 2020 Celsius began making regular, huge purchases to push the CEL price higher.

According to the examiner, Celsius's purchases were "100% of markets" for CEL. Celsius did not inform their customers of the extent to which they were supporting CEL price. Celsius spent at least $558 million buying its own token on the market, purchasing at least 223 million CEL on the secondary market from 2018 to the petition date. This was a greater number of CEL than the 203 million CEL released in their IPO, causing the examiner to comment that "In effect, Celsius bought every CEL token in the market at least one time and in some instances, twice."

CEL on the balance sheet

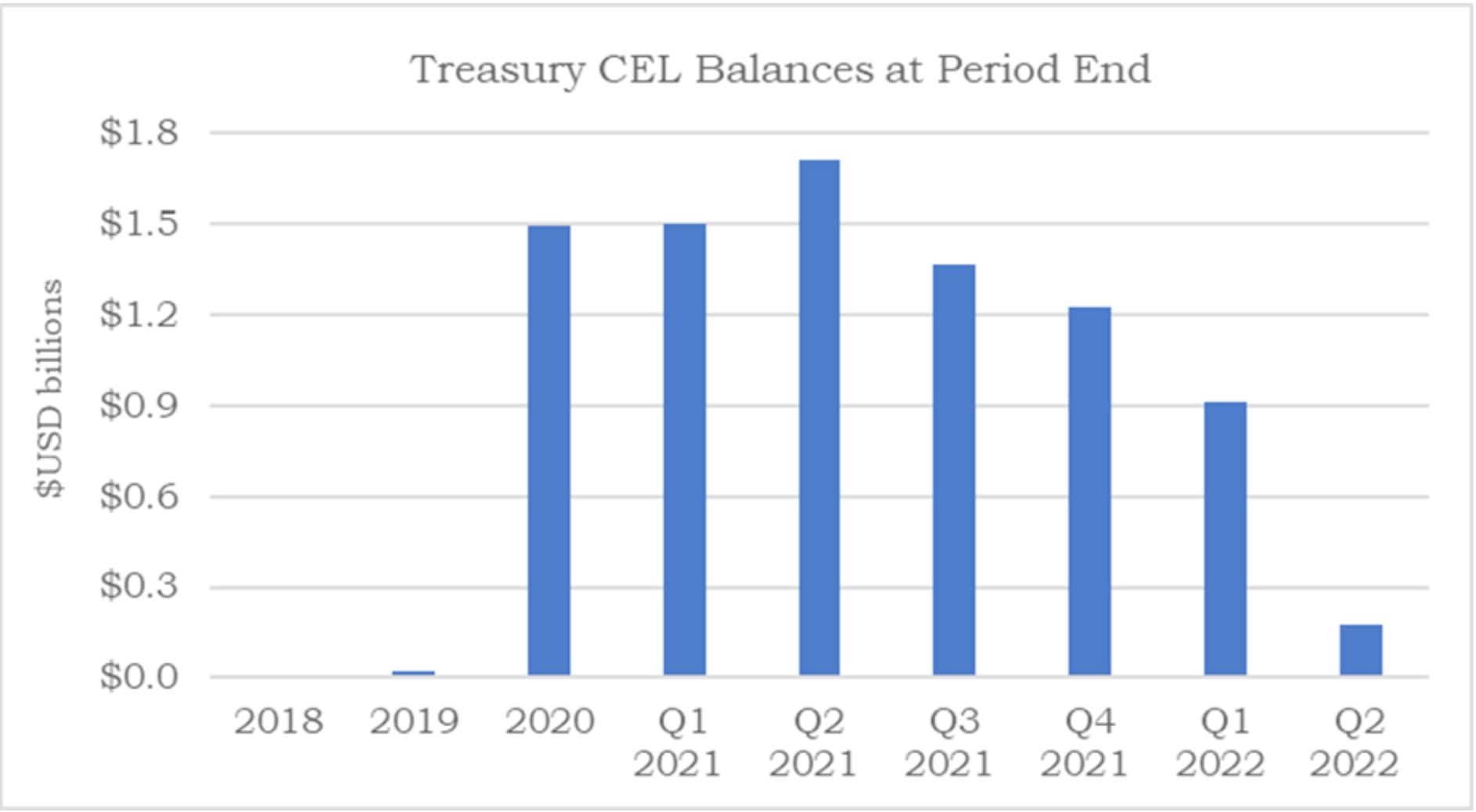

Celsius listed CEL on its own balance sheet, listing the value of its treasury CEL at above $1.5 billion in Q2 2021.

Celsius even at times intentionally pumped CEL price to get better business deals with counterparties.

Despite this, Celsius also at times acknowledged that the value of the CEL they held was effectively $0, particularly given that they were the only ones trading it. Per the examiner:

In 2022, Celsius employees routinely discussed that CEL was "worthless," stating that its price "should be 0," and that Celsius should "assume CEL is $0 since we cannot liquidate our current CEL position," and questioning whether any party (other than Celsius itself) was purchasing CEL.

Celsius never liquidated any of its CEL to address its liquidity needs, even as it scrambled to find liquid assets in the run up to June 12, 2022, the date on which it paused all customer withdrawals. Today, Celsius holds essentially the same amount of CEL as it did on January 1, 2022 (an amount which constitutes approximately 95% of all CEL in existence).

Despite all this, "Celsius classified CEL as a Tier 1 asset, meaning it was essentially capable of being liquidated on demand."

Mashinsky's self-enrichment

Mashinsky and other executives earned substantial amounts of CEL tokens. At one point in August 2020, Mashinsky was earning $28,000 a week in CEL rewards. Beginning some time in 2019, Mashinsky also regularly sold off substantial quantities of his own CEL tokens. Other executives did as well, though not to the degree of Mashinsky:

Between 2018 and the Petition Date, Mr. Mashinsky sold at least 25 million CEL tokens, realizing at least $68.7 million on these sales. S. Daniel Leon, also a founder of Celsius, sold at least 2.6 million CEL tokens for at least $9.74 million.

At points, Celsius's CEL purchases were directly providing liquidity to Mashinsky as he sold off his personal holdings, and preventing his massive sales from causing price to "drop like a stone" (per Johannes Treutler, Head of Trading Desk). At times in 2020, Mashinsky's sales "constituted between 20–25% of the daily trading volume" and Celsius had to act quickly to absorb this volatility by purchasing CEL.

Mashinsky's own CEL holdings presented a clear conflict of interest when he directed the company to prop up the CEL price, which was acknowledged by various employees. According to the examiner, "there were several internal discussions about the fact that Celsius's purchases of CEL were designed to help the insiders who owned, and were selling, large amounts of CEL." At one point, Mashinsky instructed employees to "take unilateral action" to pump the price of CEL, then sold around $440,000 worth of CEL days later. Harumi Urata-Thompson, CFO and Chief Investment Officer, characterized trades like that as "possibly illegal and definitely not compliant". Ya think?

One employee wrote on Slack, "if anyone ever found out our position and how much our founders took in USD could be a very very bad look… We are using users USDC to pay for employees worthless CEL… All because the company is the one inflating the price to get the valuations to be able to sell back to the company."

Incredibly bad recordkeeping

The failures of recordkeeping within Celsius were impressive. The company had no visibility into its assets or liabilities, and employees found themselves cobbling together reports that kind of sort of reflected maybe an idea of what the company's financial status might be. Possibly.

These reports were then used for all kinds of decisions, despite frequently being completely inaccurate, and despite executives directly acknowledging that they were ludicrously insufficient.

Head of Model Risk and Quantitative Analytics Tamas Antal at one point described a report used for crucial decisionmaking as "one analysts's lonely guess of what the firm's positions are".

Celsius paid out higher rewards than it could sustain

A substantial portion of the examiner report is dedicated to the topic of the reward amounts that Celsius paid to its customers. These varied by token, but the weighted average of reward rates were between 5% and 7.5% at points throughout 2020.

These rates were determined arbitrarily, typically by Mashinsky personally, despite the veneer of various "committees" that ostensibly chose the rates based on a "democratic" process. Mashinsky often chose to increase rates, or veto rate decreases, based on his concern that if they did not have higher rates than competitors (particularly BlockFi, a company that went underwater at two separate points in 2022), customers would leave.

The yield generated by Celsius's investments could not support the rates that they were paying to customers. Rather than reduce rates, Mashinsky repeatedly insisted that his traders simply find more profitable trades — something traders had to repeatedly explain to him was simply not possible at some points during the bear market.

This had the effect of pushing Celsius into more and more risky trading strategies, and far riskier trading strategies than what they represented publicly. At some points, Celsius's trading strategies contradicted its internal risk policies or calculations. In these cases, employees simply ignored the policies, or changed the calculations. When it did calculate risk, the risk ratings employees assigned tended to be "extremely generous".

Attempts to get Mashinsky to change the business plan to shift it towards profitability either went unheard or were met with outright hostility.

Celsius lost money in some really dumb ways

Celsius was hemorrhaging money pretty much from day one, even during the bull run of 2021.

Among the ways Celsius managed to lose money:

- Celsius took two loans from an institutional investment group called Equities First in 2019 and 2020, pledging BTC and ETH as collateral. During the bull run of 2021, this collateral went up substantially in value, but Celsius was not protected by any provision allowing for reverse margin calls as collateral appreciated, nor was Equities First required to provide them with financial statements. When Celsius went to repay the loans and regain its collateral, Equities First couldn't return it, and Celsius suffered a $280 million loss.

- Celsius transferred around 25,000 ETH to Stakehound, which Stakehound promised to stake on its behalf. Several months later, Stakehound lost the keys to the validators, rendering the ETH inaccessible. Celsius lost $105 million.

- Celsius tried to pull off the GBTC trade that was so popular in 2020, but lost $160 million on it. Mashinsky tried to claim that the company only lost money on this because his "incompetent" team "forgot to sell the shares". However, the examiner determined that "at most, this could only be partially correct", because the lockup period would have prevented the team from selling many of the shares for a profit. Not only that, the team had to talk Mashinsky out of doubling down on GBTC when the trade became unprofitable.

- Mashinsky "forced" Celsius into a deal to acquire KeyFi, a venture founded by Jason Stone. Mashinsky had lost money investing in Stone's previous company, "Battlestar Capital", but apparently wanted to do business with him so badly that he allocated coins to Stone to deploy before any contracts were actually inked. Stone and KeyFi mismanaged Celsius's funds, and there are now competing lawsuits in which each group is accusing the other of theft. Celsius has estimated they lost "tens of millions" of dollars thanks to KeyFi, and allege that at times Stone was not just trading badly but blatantly "siphoning money off the account, stealing money".

- Celsius's recordkeeping was so bad that they sold the BTC and ETH they needed to have on hand to process customer withdrawals. This required them to buy it back on the market at a higher price.

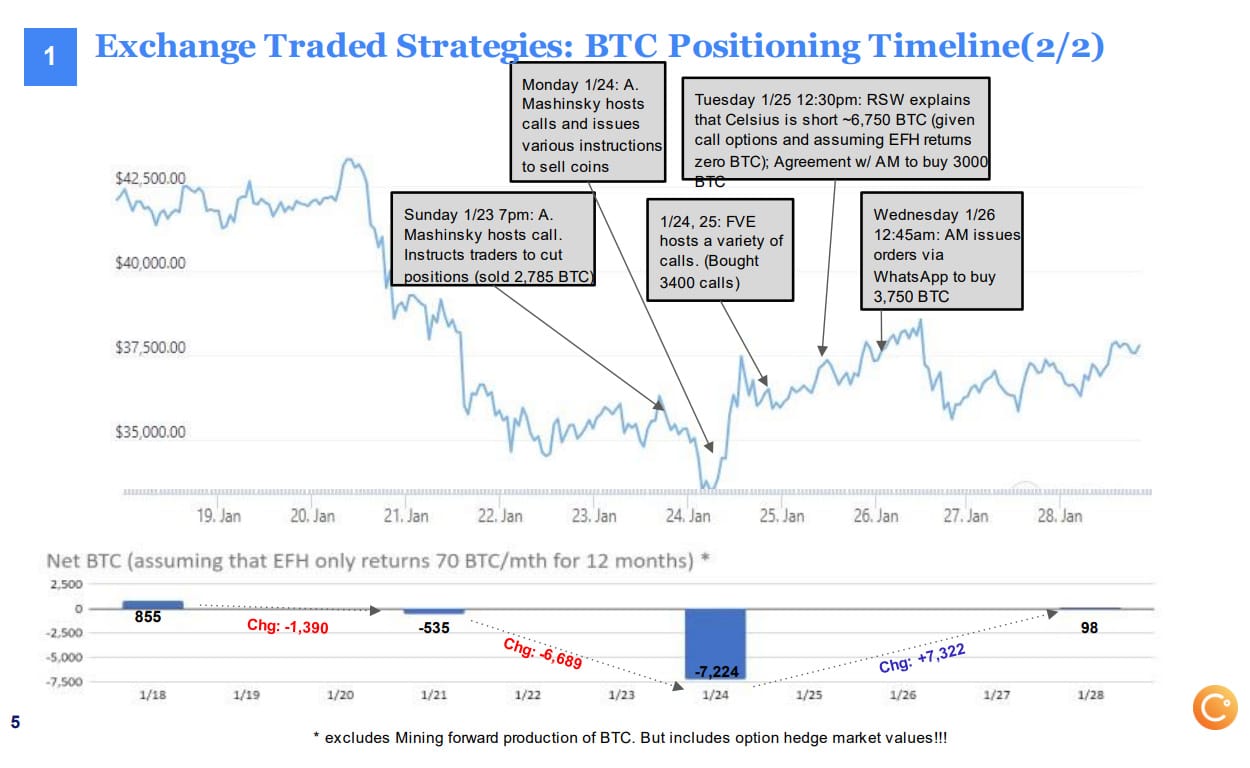

When BTC began dropping in early 2022, Mashinsky apparently "wrested control over the trading decisions" and panic sold. He ended up selling too much, putting Celsius into a net negative position, and so Celsius had to repurchase BTC at higher prices. "Mr. Mashinsky, meanwhile, blamed the trading team for taking directional positions, while claiming that he had not."

Celsius employees later spoke about how Mashinsky "lack[ed] being well versed in capital markets and understanding tradeoffs", and had "a tendency to micromanage things in areas where he has no expertise".

Ponzi scheme?

For some reason, Pillay stops short of outright stating that "Celsius was a Ponzi scheme", but the facts speak for themselves.

In addition to the facts, some of the employees spoke to Celsius being a Ponzi: not just in informal settings but in written communications that they should have known could later come up in discovery. Come on guys, you know the rules: don't do crimes, but if you're going to do crimes, for god sakes don't write them down.

In my opinion, she gets into some strange territory where she's almost analyzing tokens as though they are non-fungible assets, and trying to trace which specific tokens went where, but in the end she identifies several specific instances where customer funds were used by Celsius to fund customer withdrawal requests.

As Celsius began to run out of liquidity shortly before it paused withdrawals, "the likelihood that some new deposits were used to fund withdrawals increased". She also writes that, importantly, Celsius would not have been able to make good on all withdrawals without using new customer deposits.

Takeaways

This was criminal. We already knew this was criminal, but this was so blatantly criminal. Part of me wonders if the only reason that criminal charges haven't been filed against Mashinsky yet is that the prosecutors are just so busy with all the other blatant criminal frauds in crypto that have floated to the surface.

Probably because Pillay used to be a federal prosecutor, they've basically had an indictment wrapped up in a nice bow and dropped on their doorstep, so maybe that will speed things along.

I just hope that the Feds have a close eye on him, because if I had just pulled such a blatant fraud and I still had some of those $69 million I'd siphoned from customer and investor funds, I would be on a boat to some non-extradition and preferably tropical country.

If Mashinsky's on a boat, he's still got signal, because he's currently trying to place blame with anyone but himself:

Or at least that's what I'm told.

Further reading

As you might imagine, I'm not the only crypto watcher who decided to read through such an important report. You can read some excellent analysis and/or commentary from several others:

- "Celsius Network: Final report from the examiner — lies, incompetence and Ponzi schemes", Amy Castor and David Gerard

- "Zero Degrees Celsius",

References

A common refrain in the cryptocurrency and web3 industries, which I describe in my essay "Predatory community". ↩