The FTX trial, day fourteen: Same events, new stories

Taking the stand before the jury for the first time, Sam Bankman-Fried recounts familiar events we've heard described by previous witnesses, but gives a very different version of those stories.

Programming note: While I'm in New York City covering the trial, the best way for me to put out updates quickly has been via video livestream, which I then follow up with a proper post such as this one. The livestream corresponding to day fourteen of the trial is on YouTube. If you want to try to tune in live, I will stream Monday evening (tonight — typically around 6 or 7 ET, but dependent on when court wraps up). On Tuesday evening I will be traveling, but will either stream late that night or on the following day.

A generous explanation of what happened on Friday would be that Sam Bankman-Fried's defense team was trying to be thorough, asking him to redefine terms that had already been described by previous witnesses and letting him ramble about tangentially related topics.

A less generous explanation would be that they were stalling for time. Several of my fellow onlookers shared a theory that his team was just running out the clock, not leaving time for cross-examination to begin that afternoon, in hopes that jurors would spend the weekend cementing in their minds the view of Bankman-Fried as the regretful CEO who should have done more to manage risk at his companies, but who did not willfully defraud his customers of their assets.

That is, before Assistant U.S. Attorney Danielle Sassoon has the opportunity to tear that whole impression to shreds, now with the benefit of an entire weekend to hone her cross-examination.

Friday was the first time the jurors had heard Sam Bankman-Fried tell his version of events, after they'd just spent four weeks listening to his former employees and business partners explain how he'd willfully committed fraud and, in the former case, pushed some of them to do so, also.

Throughout the day he only answered questions posed by his own defense team, which meant he didn't have to break much of a sweat. A lot of the questions were softballs intended to tee him up for responses that would endear him to the jury, like "did you make any mistakes along the way?" (yes), "Why was having a more built-out regulatory structure important to you?" (they thought regulation was important).

He offered a few possible explanations for how things had gone so wrong. "I wish I had a better understanding than I did," he said mournfully, of the internal systems intended to track FTX customer deposits that were being deposited with Alameda Research because "FTX had not yet been able to get bank accounts in its own name", a process they expected "would take a year or two" to be approved. (He, of course, did not offer any explanation for why this process was taking so long — such as, for example, that FTX's applications were being repeatedly denied).

He painted a picture of himself as a man stretched too thin by the demands of running two major companies at once. Asked to give an idea of what hours he worked from 2019 to 2021, he replied: "On a light day, I would work 12 hours or so; on a heavy day, 22, roughly. I probably took off one day every couple months." He described reading thousands of emails a day, and striving — but usually failing — to maintain "inbox 60,000".a

Several familiar stories were recounted, but with quite a different perspective than when we heard them during the prosecution's case from witnesses who directly implicated Bankman-Fried in wrongdoing.

Going into dramatic detail about an "auto de-leveraging event" in which the FTX risk engine became so backlogged that it repeatedly tried to close a customer's position of only a few thousand dollars, he explained that the automated system rapidly spiraled out of control until FTX's internal accounts reflected trades in the trillions of dollars, with Alameda Research was unable to provide backstop liquidity for the absurd amounts. No money was ever moved, and they were eventually able to untangle the disaster by taking FTX offline for an hour and unwinding all of the trades, but it scared Bankman-Fried, he said, and made him realize there needed to be safeguards to prevent erroneous liquidations. This must have been how the allow_negative flag came to be, he said, but he wasn't sure because Gary Wang and Nishad Singh had just told him they'd "implemented some feature" to prevent future catastrophes of that sort.

We once again heard the story of the EcoSerum staking, which Nishad Singh had recounted on day ten. In Singh's telling, Bankman-Fried so terribly wanted FTX's 2021 revenue to breach the $1 billion mark that he instructed Singh to falsify backdated EcoSerum staking rewards that would give the company the $50 million or so of additional revenue required to hit the milestone. In Bankman-Fried's version of events, he acknowledged wanting to hit the $1 billion mark because "it's just a round number", and had asked Ramnik Arora to review revenue numbers in case anything had been overlooked. Arora later told him Singh had updates for him on that topic, and when he spoke to Singh, "Nishad told me that he had dealt with it." Bankman-Fried said he was "a little surprised" by the found money, but didn't question it. "Did the topic of backdating any document come up?" his counsel asked. No, said Bankman-Fried, refuting Singh's testimony that Bankman-Fried had explicitly directed him to falsify transaction dates so that it appeared the staking fees had occurred throughout the year.

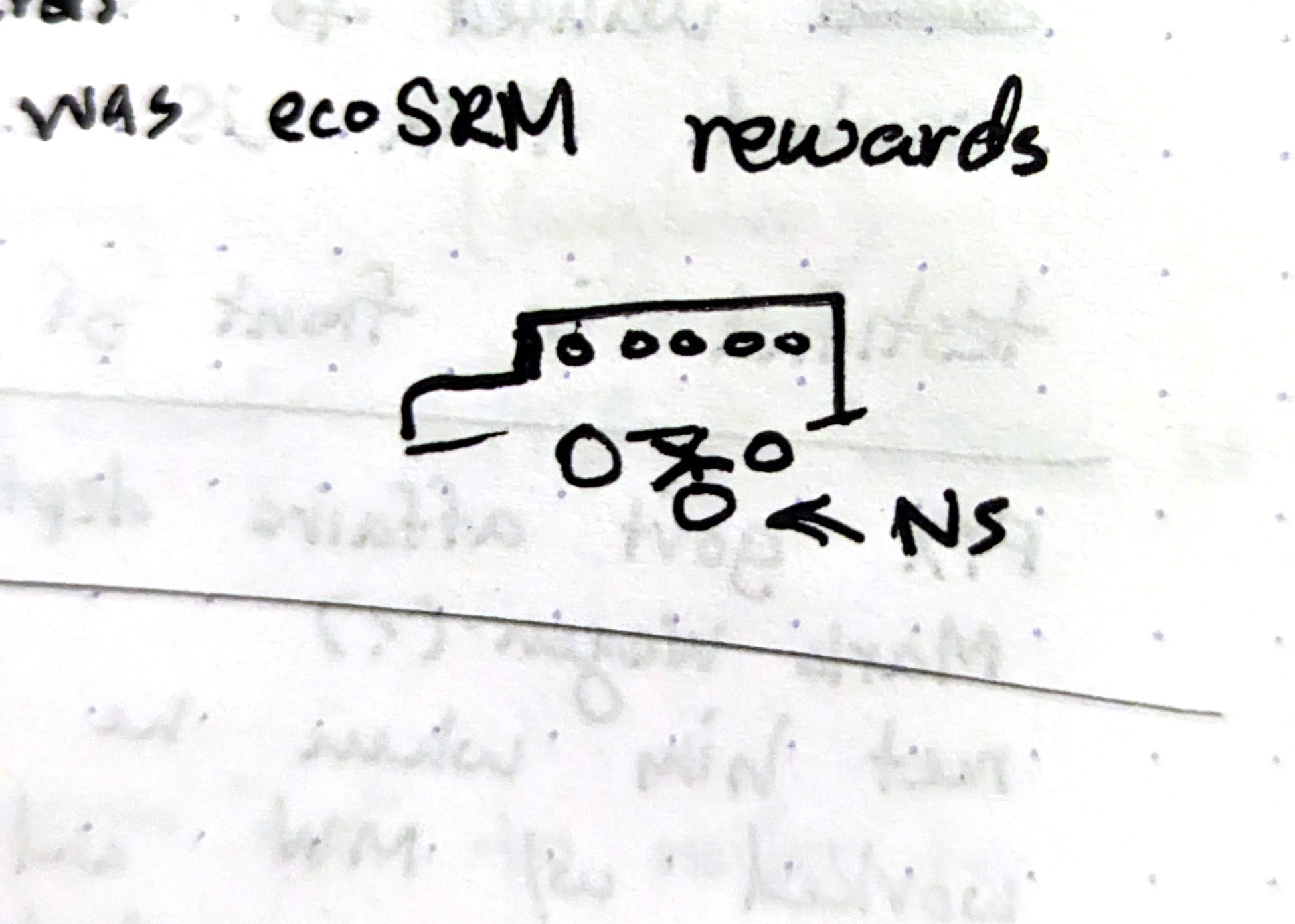

At this point, I doodled a small bus, with Singh thrown under it, as Bankman-Fried earnestly recounted a story in which Singh was inexplicably committing fraud on Bankman-Fried's behalf for no personal benefit and without Bankman-Fried's knowledge or instruction.

The story of the MobileCoin incident, originally recounted by Gary Wang on day four, also got a new spin. When Gary Wang, Nishad Singh, and Ryan Salame discussed their concerns with Bankman-Fried that a customer had opened an unusual position in MobileCoin and another illiquid token called BTMX, Bankman-Fried promised he'd personally monitor the account and take necessary action if it seemed that the customer was indeed engaging in market manipulation. "I probably didn't do as good a job as I could have," he said dolefully, because the trader ultimately was able to exploit the system for a substantial amount. He had had Alameda Research take on the position, he acknowledged, but only because he felt guilty for failing to monitor the account, so it seemed "appropriate that Alameda Research, which I owned, should be the one to end up with that position." No mention was made to Wang's testimony that the position had been moved to Alameda because its balance sheets were less visible to outsiders. He also sidestepped any suggestion that the position was moved so as not to draw down on FTX's insurance fund, which held a balance far below what would be necessary to cover the loss, and which Bankman-Fried liked to boast had never had to be substantially used.

The dramatic conversation between Bankman-Fried and Singh, from the balcony of their shared penthouse, also got a different spin. Rather than the tense conversation we heard about from Singh, who said he confronted Bankman-Fried over the apparent massive hole in Alameda Research's balance sheet and pleaded with him to stop spending so much on marketing when the company was in such dire financial straits, we heard Bankman-Fried describe a much more routine conversation. Singh seemed "very nervous, very halting", he acknowledged, but Bankman-Fried didn't share the same level of concern because he was confident that Alameda Research had a positive net asset value. When Singh expressed concerns about some of the companies' recent marketing expenditures, Bankman-Fried agreed that some projects had been duds and that the marketing team "was a little bit of a mess", but that there had been some successes too. He said he would be happy for Singh to dig into the marketing side of things and offer some suggestions if he wished to do so, but that when Singh asked him what he thought he should be focusing on at the company, Bankman-Fried praised his technical contributions and management of the software engineering department, and told him he thought that was where he felt Singh's efforts would be most valuable.

This was a substantially different end to the conversation than the one we heard from Singh, who said Bankman-Fried finished the conversation by stressing to him that the "chances to rebuild this hole depended enormously on [Singh] continuing to try to make the company successful". After this, Singh said he had felt he had no choice but to stay and become complicit in the fraud. "How could I live with myself if my departure precipitated a fall that might have been avoidable?"

It's hard to say to what extent the jury found Bankman-Fried's version of events credible compared to those of his past colleagues, who provided more detail, and at times seemed to independently corroborate each others' versions of events.

However, it was an admirable effort by him and his defense team to present some alternative explanations for some of the more damning incidents that had been raised during the prosecution's case. The problem, I think, will come when the prosecution has the opportunity to revisit these on cross-examination, and grill him on not only the glaring conflicts between his versions of events and the recollections of his colleagues, but also point out documents and other pieces of evidence that seem to directly conflict with some of his claims.

Bankman-Fried's defense team took considerably longer to question him than they'd originally predicted, so it's hard to say for sure that they'll finish by 11:30am on Monday, October 30 as Cohen said he thought they would on Friday. However, without the incentive to stall through the weekend, I suspect it may wrap up fairly expeditiously.

Though the direct questioning was at times even a little yawn-inducing, the preview of cross-examination we saw on Thursday left me with the distinct mental image of a cat playing with a rodent it has caught before eventually devouring it. Like watching a cat do this, it was sometimes painful to watch — though not that painful. Cats are typically not going after rodents who have been credibly accused of ruining countless lives through massive financial fraud.

I will be in the courthouse on Monday and Tuesday to catch what I hope will be the entirety of Bankman-Fried's cross-examination. The case could possibly be in the hands of the jury as soon as the end of this week; otherwise, the beginning of the next.

Footnotes

For the unfamiliar, this is a reference to the term "inbox zero", which refers to the aspiration to keep one's inbox with zero unread or unhandled emails. ↩