The FTX trial, day six: A constant state of dread

"Alternate" balance sheets, bribes, Saudi financing, and a painfully intertwined personal and professional life were among the topics described by Sam Bankman-Fried's former employee and girlfriend.

Caroline Ellison broke down in tears on the witness stand when she recounted the relief she felt after FTX collapsed. "That was overall the worst week of my life," she said, "but one of the feelings I had was an overwhelming feeling of relief because… this had been something I had been dreading for so long. … I felt a sense of relief that I didn't have to lie anymore."

"I think it probably moved the jury. I know in the room where I was at, you could hear a pin drop," said the crypto crime detective known as Coffeezilla, who joined the throng of people lined up to hear the prosecution finish questioning their star witness today.

Ellison had previously testified that she was in "a constant state of dread" because Alameda Research was dipping into FTX customer funds to the tune of billions of dollars — an amount she knew they could never repay if it came down to it.

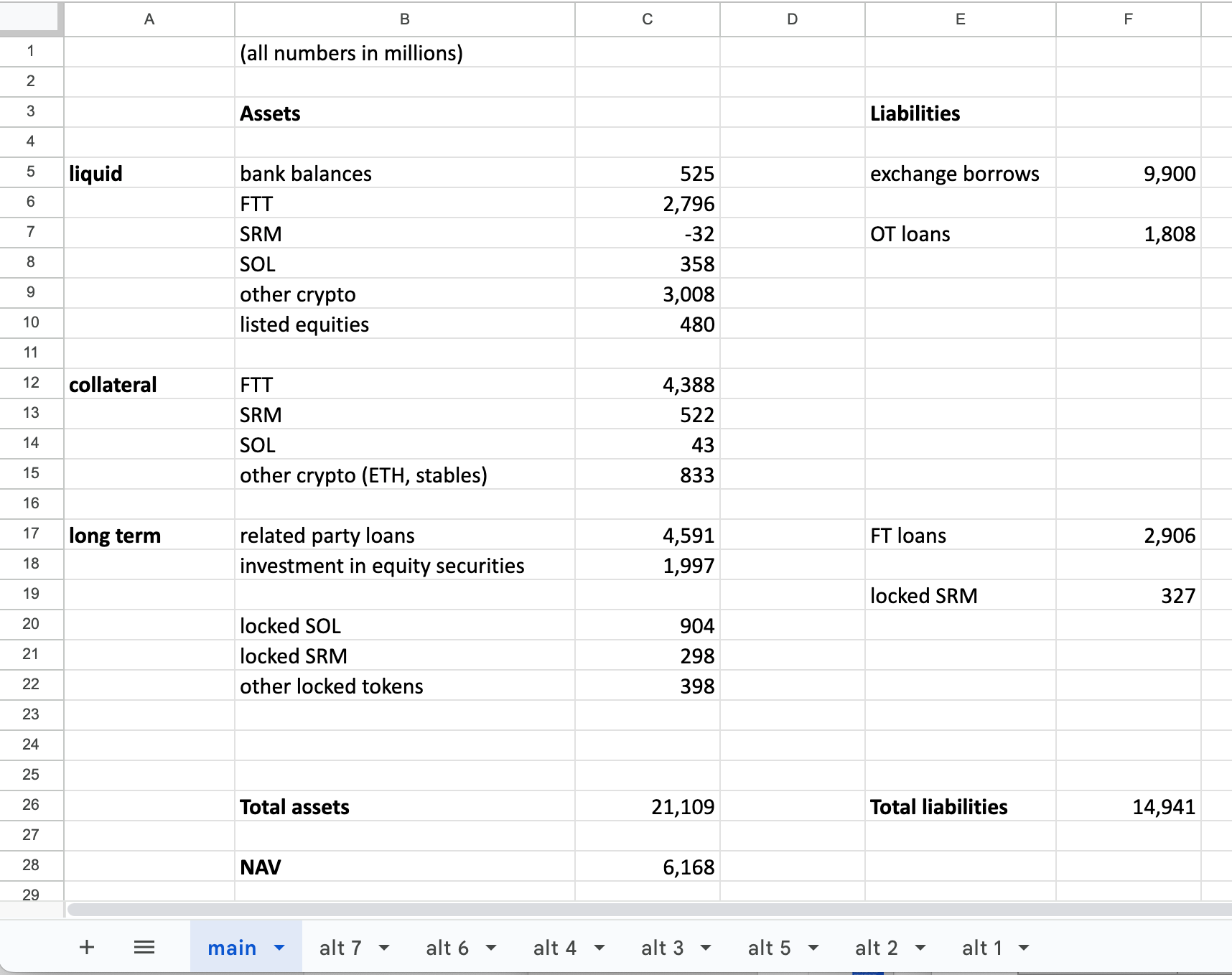

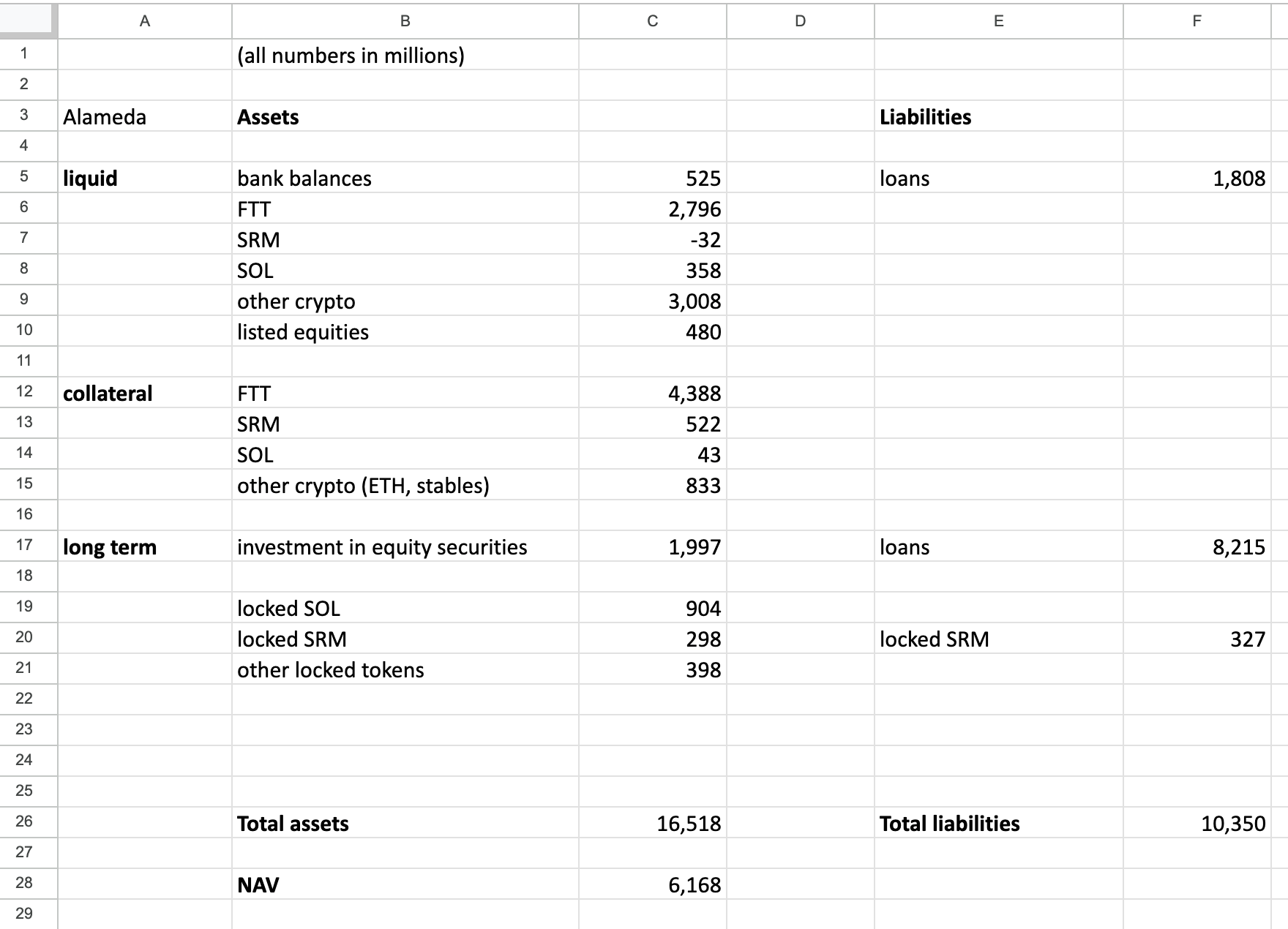

The spreadsheets

Ellison spent much of the day testifying to spreadsheets she prepared that were somewhat like balance sheetsa to estimate Alameda's financial condition. She testified to creating seven different "alternative ways of presenting the information" at Sam Bankman-Fried's direction, hoping that by fudging descriptions and lumping in Alameda's borrowed FTX customer funds into other loan categories, Alameda's lenders would be more likely to lend them money — or at least not recall all outstanding loans and run screaming. When asked what she thought Bankman-Fried meant by "alternatives", she explained that she believed he was instructing her to "come up with ways to conceal the things in our balance sheet that we both thought looked bad."

While the spreadsheet titled "main" was the most accurate reflection of Alameda's finances, it was not one that she shared outside of the company, or even outside of the very narrow circle of insiders that included Sam Bankman-Fried.

In the spreadsheet, she referred to "exchange borrows". She testified that she had considered writing something like "FTX customer money", but had been repeatedly warned by Bankman-Fried not to put anything in writing that could someday be used in court. According to Ellison, Bankman-Fried had held multiple company-wide meetings to drive that point home with employees, saying that they should consider the "New York Times test" before writing something in a messaging app: would you be comfortable reading this on the front page of the New York Times? I don't suppose Ellison took it as a direct threat at the time, but I imagine recounting that story on the witness stand feels a little different after the person talking about the "New York Times test" has themself leaked your intimate diary entries to the Times.

Ellison testified about a rocky period during June 2022, when in the wake of the Three Arrows Capital collapse [W3IGG] and the massive shockwave it sent through the crypto markets, lenders including Genesis began recalling loans to Alameda. Many of these were the open-term loans Ellison had described the previous day: a riskier type of loan for the borrower, because the lender could demand repayment at any time. Genesis themselves were in pretty dire straits at that time, with Bankman-Fried reportedly telling Ellison that they might "go under or have to default on some loans" if Alameda couldn't return the funds quickly. (Genesis ultimately was able to flounder along for several more months, before filing for bankruptcy in January 2023 [W3IGG]).

Bankman-Fried instructed Ellison to repay all the loans that were getting recalled, which she did, and which she testified he knew meant she would need to draw down the line of credit with FTX. At this point, she knew she was repaying Alameda's loans with FTX customer funds. According to her, she thought "there was some chance that we would be able to fix things somehow, that maybe Sam would be able to raise money to repay our loans."

Bankman-Fried did eventually try to raise money, or at least he talked about trying to. While FTX was in the process of acquiring BlockFi during an emergency bail-out in June of 2022 [W3IGG], Bankman-Fried talked about trying to "get BlockFi's assets moved on to FTX" — and thus, presumably, made available to Alameda just like all the others. In October 2022, the month before FTX's collapse, Bankman-Fried was talking about selling FTX equity to outside investors, primarily Saudi prince Mohammed Bin Salman, who like Bankman-Fried is arguably better known by a three-letter acronym. This doesn't appear to have ever happened, which is probably for the best for Bankman-Fried given MBS's… ah… methods.

The Thing

The prosecution quizzed Ellison for a while on the topic of the alleged bribe to Chinese officials to unfreeze around $1 billion of Alameda's assets, which had been frozen in early 2021 at the direction of the Chinese government as part of a money laundering investigation into a (reportedly) unrelated third party who had traded with Alameda. Although Bankman-Fried has been charged with conspiracy to violate the anti-bribery provisions of the Foreign Corrupt Practices Act, it's one of the charges that will be tried in a subsequent trial tentatively scheduled for March, and so the judge was careful to instruct jurors that discussion of alleged bribery was only to be considered in the context of establishing the degree of trust between Bankman-Fried and Ellison.

The story Ellison told about the FTX and Alameda executives' attempts to regain control of these assets over the period of about a year was pretty wild. First, they tried hiring a Chinese lawyer to negotiate on their behalf, which was fruitless. Then, they used "various trading strategies" to try to move the funds to accounts that were not frozen. One such strategy involved creating several accounts with credentials belonging to Thai prostitutes, then performing imbalanced trades such that the frozen accounts lost money and the new accounts made money. This apparently didn't work either.

Finally, Ellison referred to "doing things David Ma's way", referring to a trader at Alameda. This suggestion very much upset another trader, named Handi Yang, whose father was a Chinese government official. Ellison said that Handi was "very upset and protesting a lot and saying that she thought it was a bad idea and would get us in trouble." At one point, Ellison said that Bankman-Fried grew frustrated that Handi wasn't letting others speak, and after asking a few times, "yelled at her to shut the fuck up."

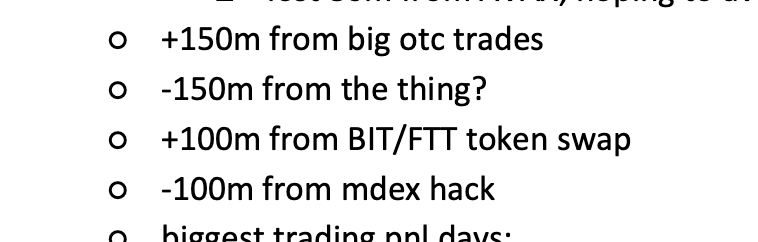

Ellison was never explicitly told what "doing things David Ma's way" meant, but inferred from the coded language and Handi's reaction that they were talking about bribing a Chinese official. An employee at Alameda asked her about the payment, even asking if she was aware that it might violate the FCPA. Ellison lied that lawyers had signed off on it. Later, when creating a summary of Alameda's large gains and losses, Ellison wrote that the firm had lost $150 million from "the thing?" to avoid recording the bribe in writing.

The hedges

The defense has already hinted that one of the ways they intend to blame Ellison for FTX's collapse will be by claiming that Bankman-Fried told her to hedge Alameda's positions more, and she didn't.

This is a plainly ridiculous line of argument, because if you're taking customer funds that you're not allowed to take, using them to trade, but hedging those trades… you're still taking customer funds that you're not allowed to take. Still, ridiculous lines of argument seem to be all the defense has left.

Apparently anticipating this line of questioning, the prosecution dove into the subject of Ellison's and Bankman-Fried's conversations about Alameda's hedges. At one point, she described a dramatic conversation between her and Bankman-Fried in around August 2022, which occurred in the study of the luxe Bahamian penthouse they shared.1 The pair had just broken up for a second time that spring, and things were already strained between them.

Bankman-Fried unloaded on her, saying that Alameda should have hedged far more than it had, and that it was a huge mistake on her part not to have. He said that Alameda's dire financial condition was her fault. This adds to testimony from previous days, including where the prosecution produced a document written by Bankman-Fried and shared with Nishad Singh and Gary Wang (but not with Ellison) in which he outlined wanting to shut down Alameda Research. In it, he wrote: "The fact that we didn't hedge as much as we should have alone cost more in EV than all the money Alameda has ever made or ever will make, and that's the kind of critical mistake we're likely to make if I'm not actually running the show there."

According to Ellison, his anger largely revolved around an incident earlier in 2022 when Bankman-Fried had mentioned selling short some S&P 500 futures to hedge against crypto prices falling. When crypto prices did fall substantially, she testified: "Sam sent a bunch more messages being angry at Alameda for not doing that".

Speaking about the conversation in the study, Ellison stated that "he was speaking pretty loudly and strongly", to the point that she "got very upset, started crying, and had trouble continuing the conversation". While she acknowledged during her testimony that she "could and should have done things differently", and could have hedged more sooner, she "also thought that Sam was the one who chose to make all these investments that put us in a leverage position in the first place".

"I thought that hedging could have helped our situation, but I felt that the fundamental reason we were in the situation was that we had borrowed these billions of dollars in open-term loans and used them for illiquid investments," she summarized.

The hair

Ellison threw a wrench in the defense's attempts to argue that Bankman-Fried couldn't have stolen money, because look at his slobbish outfit choices, unkempt hair, and modest choice of a Toyota Corolla!

Speaking about his public image, Ellison described it as carefully crafted. "He said he thought his hair had been very valuable," Ellison explained, saying that he believed that he had gotten higher bonuses while interning at Jane Street because of his unkempt mane.

Asked about the Corolla, she told prosecutors that they had both been assigned luxury company vehicles in The Bahamas, but that she and Bankman-Fried had traded theirs for a Toyota Corolla and a Honda Civic, respectively, believing it to be "better for his image".

As for the famed beanbag, well… he did sleep on the beanbag a lot, she said. When he wasn't sleeping in the multimillion dollar penthouse, or one of his other apartments, that is.

The defendant's reaction

Bankman-Fried has spent most of the trial thus far glued to his air-gapped laptop, either typing notes or reviewing documents. During Ellison's testimony, however, prosecutors requested a sidebar with the judge. "The defendant has laughed, visibly shaken his head, and scoffed," accused Assistant U.S. Attorney Danielle Sassoon. She expressed her concern to the judge that, given their romantic history, his past attempts to intimidate her, and the imbalanced power dynamic that defined much of their relationship, his response might be impacting Ellison's testimony. Judge Kaplan told Mark Cohen, Bankman-Fried's lawyer, to talk to his client during the break, and instruct him to cut out any visible reactions he may or may not be having to her testimony.

The lawyers

Sidebars such as this were somewhat frequent today, as the defense team — mostly unsuccessfully — objected to various lines of questioning. At one point, Cohen tried to prevent the prosecution from presenting a document about the working relationship between Modulo and Alameda, two trading firms. Described to me by a journalist who was attending in person at the courthouse2 as a "stream of consciousness"-style document in which Bankman-Fried occasionally referred to himself in the third person, Cohen asked, "what conceivable relevance is it that he wrote these items, only to show that he's some sort of crazy person?" Ultimately, the prosecution's arguments for showing the document won out over the defense's.

The day wrapped up with some conversation between the legal teams and the judge. The prosecution had asked to prevent the defense team from bringing up the fact that one of Alameda's investments in an AI startup called Anthropic has reportedly skyrocketed in value since FTX's $500 million investment. According to the defense, this is relevant because Alameda was engaged in a "portfolio" trading strategy, where many of their investments could be duds if just a few of them were highly successful. According to the prosecution, this risks suggesting to the jury that the fraud wa s okay if the money can eventually be recouped. Judge Kaplan sided with the prosecution, stating, "This is like saying that if I break into the Federal Reserve Bank, make off with a million bucks, spend it all on Powerball tickets and happen to win, it was okay." He did, however, leave the door open to the defense calling a witness qualified to speak on the nature of venture investing.

As for the question of whether the defense is allowed to cross-examine Ellison about whether lawyers were involved in Bankman-Fried's policy of setting Signal chats to auto-delete, Kaplan declined to rule on it this afternoon. However, the defense faces an uphill battle even if they are allowed to pursue this line of questioning. While Cohen said that he expected Ellison would answer affirmatively that "lawyers were involved" in the auto-deletion policy, he seemed reticent when the judge asked if he was willing to ask if they were involved and aware that the reason for the policy was to ensure that evidence would disappear.

The prosecution wrapped up their questioning shortly before court was due to end for the day. The defense began their cross-examination, but it was more like a false start. In attempting to clarify some terms used by Ellison to refer to Alameda's trading accounts on FTX, they so thoroughly befuddled not only the judge but Ellison herself — to the extent that Judge Kaplan suggested they give up and try again in the morning.

Not an auspicious start to what is likely to be a grueling cross-examination for all parties involved, including the spectators.

Footnotes

I am loath to describe these spreadsheets, which were little more than napkin math that just happened to occur in Google Sheets, as true "balance sheets". ↩

References

Or perhaps once shared? Michael Lewis's Going Infinite book, which may not be altogether reliable, suggests that Bankman-Fried was "booted" by Ellison to a separate apartment after things went south, but Ellison refers to it as "our apartment" in the testimony when speaking about that time period. Who knows. ↩

The document seems to have been accidentally omitted from the exhibits I have access to, so I'm relying on third-party characterizations of it for now until I can get my mitts on the original.

October 12 update: The missing document was uploaded. See my tweets or toots. ↩