The FTX trial, day thirteen: Sam Bankman-Fried gets a dress rehearsal

After a few other brief witnesses, it was time for the main event — or, at least, a preview of it.

Programming note: While I'm in New York City covering the trial, the best way for me to put out updates quickly has been via video livestream, which I then follow up with a proper post such as this one. The livestreams corresponding to day thirteen of trial are on YouTube (part 1, part 2). If you want to try to tune in live, I will stream Monday evening (typically around 6 or 7 ET, but dependent on when court wraps up). On Tuesday evening I will be traveling, but will either stream late that night or on the following day.

On Thursday, October 26, the government rested after twelve days and sixteen witnesses.a Seven former FTX or Alameda Research employees, one FTX customer, one CEO of an Alameda Research lender and institutional FTX customer, and one director of a company that invested in FTX were called to the witness stand, as were six investigators or subject matter experts.

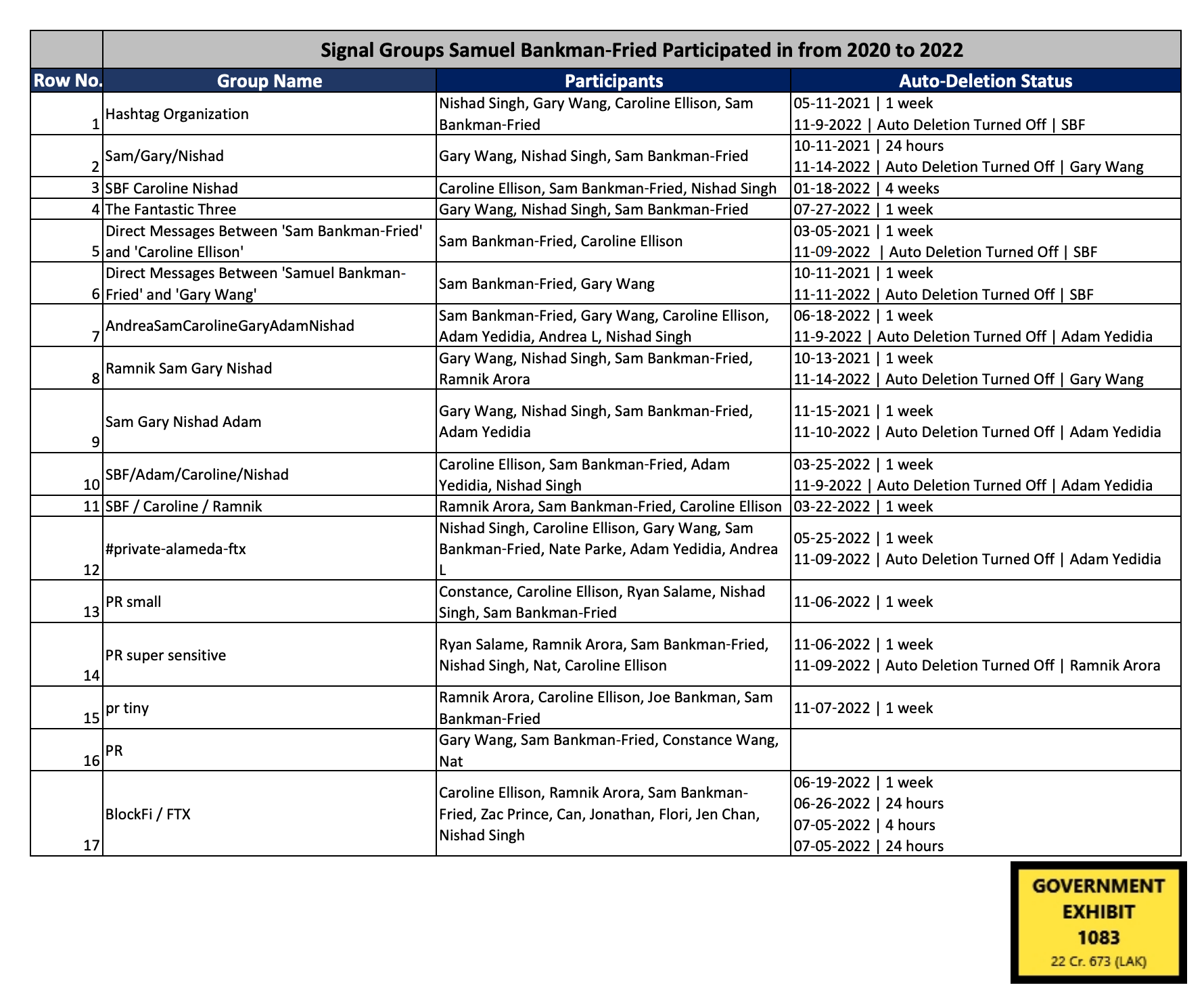

The last of the prosecution witnesses was Marc Troiano, an FBI special agent who was brought in to authenticate a document that had been created to summarize the vast number of Sam Bankman-Fried's Signal chats (325, to be precise). These chats had names like "Hashtag Organization" and "Money Moving Notes" and "vertex".

Conspicuously missing from this list was the infamous "wire fraud" chat. This actually came up in court — albeit in a sidebar — because Bankman-Fried's defense attorney, Mark Cohen, wouldn't quit questioning the FBI agent during cross-examination about whether the prosecutors asked him to exclude any Signal groups. During the sidebar, the prosecution had to remind Cohen that they had excluded two Signal groups, but that it had been at the defense's request: one was called "wire fraud", and another called "fake fraud site". The defense seemed to believe that a chat called "wire fraud" might prejudice the jury in a wire fraud case, for some reason. Ultimately, the question was stricken entirely from the record.

After Troiano, the prosecution rested their case.

The defense case begins

The defense team brought two witnesses before putting Bankman-Fried on the stand. One was a Bahamian attorney named Krystal Rolle,b who Bankman-Fried had retained personally post-collapse. She accompanied him to a meeting with the Bahamas Securities Commission on November 12, 2022. The defense primarily seemed to be using her to establish that Bankman-Fried had complied with instructions from the BSC and later the Bahamian Supreme Court because he faced the possibility of a contempt charge and imprisonment had he not done so. This was likely motivated by Gary Wang's testimony earlier in the case, where he had suggested that Bankman-Fried might have been so cooperative with Bahamian regulators simply because they might let him retain control over FTX.

The second witness was Joseph Pimbley, a financial consultant brought on by the defense team to analyze a snapshot of the FTX database. He produced charts for them that captured Alameda Research's in-use line of credit over time, as well as the portion of customers on FTX who had enabled spot margin or spot margin lending, or had traded futures. While I think these were intended to suggest that perhaps the money borrowed by Alameda Research had all come from customers who acknowledged their funds could be loaned out, the defense failed to paint a very clear picture for the jury of the meaning they were supposed to infer. Further weakening this portion of the defense's case was what felt to me like quite effective cross-examination, where the prosecution pointed out that Pimbley had been instructed only to incorporate data on Alameda Research's line of credit that was associated with accounts under Alameda's name. The now-infamous "fiat@" liability and the debt that had been tucked away under the name of "our Korean friend" were omitted, and previous witnesses for the prosecution's case had acknowledged that you got a much rosier picture of Alameda's financial positions if you fail to include some of its obfuscated liabilities. They also established that dollar amounts for cryptocurrencies had been calculated from the "fair market value" column within FTX's own database — numbers that were not validated against external datasources to confirm their accuracy, and which did not account for token illiquidity.

Advice of counsel

Finally, it was time for what some had lined up a full eight hours early to see: Sam Bankman-Fried would take the stand to testify in his own defense.

However, there was a hiccup. The prosecution and the defense couldn't come to an agreement on whether Bankman-Fried would be allowed to testify on several matters in which he had solicited advice from his attorneys, and so the defense had asked the judge to make a ruling. The judge found that, because of "insufficient detail" in the defense team's filing, he could only rule on the admissibility of the testimony after hearing it, meaning he would need to take the rare step of having Bankman-Fried testify on those specific topics first out of the presence of the jury.

For that reason, the judge opted to send home the jury at 2 p.m. I was sitting in one of several overflow rooms, which was filled with the usual hodgepodge of journalists, crypto enthusiasts, lawyers, and others who for some reason or another were sufficiently interested in the case to come watch it from the courthouse. After an audible groan of disappointment, about a third of the room emptied. Bankman-Fried had briefly stepped down from the witness stand, and they believed the afternoon would be little more than boring procedural back-and-forth between counsel and the judge.

They couldn't have been more wrong.

Sam Bankman-Fried takes the stand

The defense and then the prosecution peppered Bankman-Fried with questions pertaining to subjects on which he'd solicited legal advice from various lawyers, which included his companies' document retention policies, the loans made to various individuals, and payment agent agreement between FTX and Alameda Research. And those of us watching got our first taste of how Bankman-Fried would hold up on the stand, including in front of a capable cross-examiner.

It did not go well.

Bankman-Fried's characteristic meandering, long-winded replies had not been noticeably reined in by any coaching his defense team might have offered. If they had instructed him, as defense attorneys typically do, to answer just the questions without volunteering additional detail, there was no evidence of it. In fact, it was the prosecutors who occasionally objected to how far he was straying afield of some questions — but for the most part, they just let him keep talking. At some points, he sidestepped questions entirely, only to prattle on about something else for a minute or more, though this did not go unchallenged by the cross-examiner. Judge Kaplan himself expressed frustration several times at Bankman-Fried's rambling, at one point scolding him, speaking slowly: "Listen to the question and answer the question directly."

While Bankman-Fried seemed relatively comfortable, and in some cases transparently coached, when answering questions by his own defense attorney, he at several times was clearly rattled by questions posed by the prosecution. If you recall his sudden change in demeanor when George Stephanopoulos pushed back on a question during a post-collapse, pre-arrest interview with Good Morning America, the same long pause followed by a halting response featured quite heavily in his replies to the prosecution.

At one point, while holding a paper document in front of him, it was possible even from my tiny video feed in the overflow room to observe that he was visibly shaking. The water bottle with which he was supplied was one of those thin plastic Poland Spring bottles, which audibly snapped and crinkled into the microphone as he clutched it to take drinks of water, sometimes mid-sentence. He did this so often that I noticed he had been provided a second bottle the following day.

When observed repeatedly over a short time period, rather than in reply to a question or two in a friendlier interview environment, it became painfully obvious when Bankman-Fried was trying to dodge a question or stall for time — which was most of the time. Some phrases became so common that the person next to me joked we should start a drinking game: "I may have misinterpreted your question". "I wish I could tell you more". "I apologize if this isn't responsive to the question". "I am going to answer what I think the question you are asking is". At one point I mused in my notes that court reporters should be eligible for pain and suffering pay.

At several times, the absurdity of his replies elicited laughter from my overflow room. When the prosecutor asked him if he could produce a document upon which much of his testimony relied (a document retention policy), Bankman-Fried decided to draw on his own legal expertise: "I'm not sure if my answer is admissible." The judge reminded Bankman-Fried that he was perfectly capable of determining admissibility, and instructed Bankman-Fried to just answer the question.

At another point, the prosecutor had backed him into a corner around Alameda Research's spending of FTX customer funds:

AUSA Sassoon: So is it your understanding that under the [payment agent] agreement Alameda was permitted to spend FTX customer deposits?

Bankman-Fried: I wouldn't phrase it that way. But I think that the answer to the question I understand you to be trying to ask is yes.

After pulling the agreement up in front of him, Sassoon instructed him to point out which line in the agreement he believed permitted such behavior. After pausing for a minute or so to search the document for something he could offer in reply, he finally broke the excruciating silence with the funniest thing he could have possibly said at that moment: "So I should preface this by saying I'm not a lawyer."

His response ultimately took up an entire page of the transcript published after the fact. Once he was finally finished speaking, Sassoon simply repeated the question. His lawyer objected, arguing the topic had already been covered. Judge Kaplan overruled the objection, agreeing with Sassoon that at no point in his longwinded reply had he actually addressed the question that had been posed to him.

By the end of the day, it seemed that Bankman-Fried's tactics were frustrating Sassoon — and even his own lawyers. When Sassoon asked Bankman-Fried to clarify if he meant that ensuring that assets were protected from hacks was the sole way someone might go about "safeguarding assets", he replied that no, "there are a number of things that I would have considered to be related to that."

AUSA Sassoon: Would that include not embezzling customer assets, for example?

Defense attorney Mark Cohen: Objection.

Judge Kaplan: Sustained.

Bankman-Fried: Yes, it would include that.

Cohen: You didn't have to answer if it has been sustained. Haven't you been sitting here for four weeks?

Bankman-Fried: I felt the need to answer that one.

Ultimately, much of what was discussed on Thursday won't make it to the jury. Of the five topics on which Bankman-Fried's defense team wanted Bankman-Fried to be allowed to refer to his lawyers' advice, only the questions and answers pertaining to the document retention policy will be permitted.

On the others, Judge Kaplan decided that the fact that lawyers had drafted legal documents that were only tangentially related to alleged malfeasance was too likely to be confusing or prejudicial to the jury. He gave an illustrative example:

Let's assume that somebody robs a bank, knocks over Wal-Mart, whatever, and comes upon a large sum of illegally obtained money and the person decides it might be a good idea to salt this away and make sure nobody is going to discover it. … [T]he guy says, let me figure out how to do this, and he goes to a lawyer. And he says to the lawyer, I want to buy an expensive condo on billionaire's row and I want to form a limited liability company, which we ought to call Gold Dust, and I've got just the apartment and I'd like you to prepare a contract of sale, and the lawyer is not told where the money came from, not one word, not one word about why the objective is to hide the money or the source, and the lawyer incorporates or organizes the LLC, the lawyer prepares the contract of sale. The lawyer represents Gold Dust at the closing and now the defendant is apprehended, the buyer, the true buyer, and charged with money laundering.

And the defense is, well, but I had a lawyer. I had a lawyer who organized the LLC. I had a lawyer who did the contract of sale. I had a lawyer at the closing. And I offer this as evidence that I didn't have a criminal intent in hiding the money. I did just exactly what the lawyer said. And how is that different from what you are trying to do in principle? I am not saying anything about your client's guilt or innocence.

On the remaining topic, Bankman-Fried will eventually repeat his testimony from Thursday. He has one slight advantage now, which is that he will have had the opportunity to confer with his defense team and prepare more polished answers.

From the looks of it, that slight advantage won't make much of a difference.

Footnotes

A complete list of the prosecution's witnesses:

Antoine Julliard, individual FTX customer

Adam Yedidia, FTX software engineer (not charged with crimes, testifying with immunity grant)

Gary Wang, Alameda Research co-founder and chief technology officer of FTX (pleaded guilty to four charges)

Caroline Ellison, Alameda Research CEO (pleaded guilty to seven charges)

Christian Drappi, former Alameda Research software engineer (not charged)

Zac Prince, co-founder of BlockFi, which made loans to Alameda Research and was an institutional customer on FTX

Nishad Singh, director of engineering at FTX (pleaded guilty to six charges)

Richard Busick, FBI agent who geolocated Bankman-Fried's cell phone activity

Eliora Katz, FTX US director of government relations and policy (not charged)

Peter Easton, accounting professor who reviewed the flow of FTX and Alameda Research funds

Cory Gaddis, Google records custodian who authenticated some Google Drive metadata

Shamel Medrano, USAO investigative analyst who authenticated Bankman-Fried's Twitter direct messages

Paige Owens, FBI forensic accountant who reviewed FTX entities' bank statements

Can Sun, general counsel at FTX (not charged)

Robert Boroujerdi, managing director at the Third Point institutional asset management firm, which invested in FTX

Marc Troiano, FBI special agent who authenticated Signal chat summaries ↩

Eagle-eyed readers might observe that the BSC executive director is named Christina Rolle. This came up briefly in the courtroom; there is no relation, and Rolle is apparently the most common surname in The Bahamas. ↩