Meet Trump’s memecoin dinner guests

Trump's crypto-for-access dinner triggers broad ethics alarms, and 73% non-US attendance raises fresh concerns over foreign influence

Citation Needed is an independent publication, entirely supported by readers like you. Consider signing up for a pay-what-you-can subscription to support this kind of deep analysis and reporting.

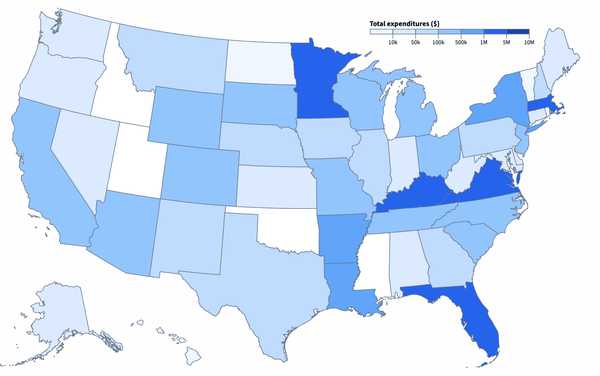

Foreign investors have spent millions scrambling for access to President Trump at an upcoming private dinner. Of the 220 largest holders of Trump’s $TRUMP memecoin currently listed on a public attendee leaderboard, 73% are likely based outside the United States. And among the top 25 “VIP” guests offered additional private access to the president, 23 are likely foreign entities. These findings emerge from an extensive analysis of blockchain transactions, tracking thousands of transfers through major offshore cryptocurrency exchanges including Binance, Bybit, OKX, and others.a

The event, scheduled for May 22 at Trump’s Virginia golf club, likely violates federal ethics laws that explicitly prohibit presidents from exchanging access and influence for money.1 The prevalence of non-US attendees also raises additional concerns with respect to foreign influence, implicating laws and ethics requirements surrounding foreign emoluments and foreign agents.2

The rush for tokens began April 23, when Trump’s memecoin project announced that the top 220 holders of the token would be invited to a private dinner with Trump where they can “Hear close-up, from President Trump, about the future of Crypto!” The announcement sparked some renewed interest in the token, which had collapsed by 90% from its peak of nearly $75 to around $7.50. While the price rose briefly to around $15 after the dinner announcement, it remained far below its previous highs.

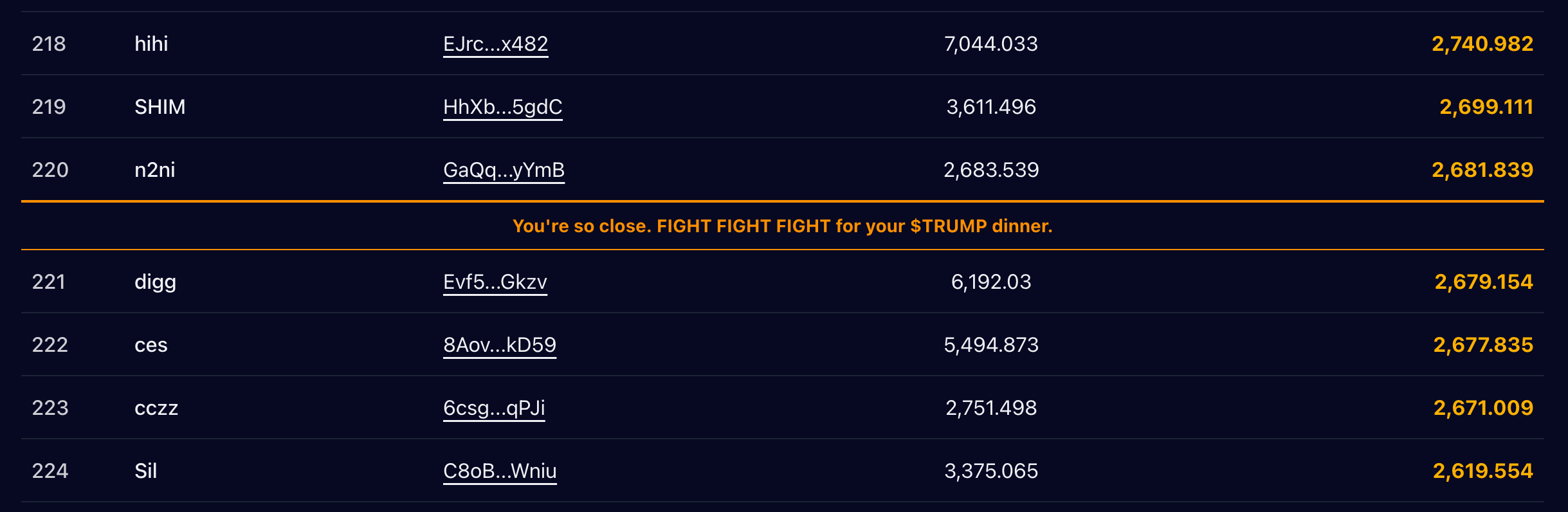

The website encourages people to “climb the leaderboard” by buying tokens, providing a live-updating list of the top 220 holders who have secured invitations. Those just below the threshold are encouraged to “FIGHT FIGHT FIGHT for your $TRUMP dinner”.

In order to appear on the list, holders must both hold a sufficient number of tokens and specially register on the Trump website. The website also notes that invitees will be required to pass a background check and “wallet screening” before attending, adding that people from “KYC watchlist countr[ies]”b will not be permitted.

The 220 wallets currently listed on the leaderboard of token holders hold a combined 12.5 million $TRUMP, notionally priced at around $137 million. These wallets likely represent fewer than 220 distinct individuals. Blockchain analysis shows several clusters of two or three wallets with similar trading patterns and funding sources, or wallets which have transferred tokens to other wallets on the leaderboard, suggesting some investors are qualifying for multiple spots through different wallets. Without access to identification documentation that will be submitted privately to the Trump team, only a small number of wallets can be connected to identifiable individuals with any degree of certainty based on public data.

161 of the wallets on the leaderboard, or 73%, likely belong to non-U.S. investors. This conclusion stems from tracking token transfers through offshore cryptocurrency exchanges that explicitly prohibit U.S. customers. While some Americans may have access to these exchanges because they operate foreign businesses, it is not trivial to establish such a business, and it’s generally prohibited to set up a shell company solely to circumvent trading restrictions. Some of these exchanges, namely Binance, have in the past encouraged customers to illegally circumvent their restrictions using VPNs or offshore shell companies, although regulatory enforcement actions in the past few years have limited the practice somewhat.3 Two wallets received transfers from US-only entities and so are likely American; an additional four are likely American based on their online presence. The remaining 53 have used exchanges and other trading platforms that allow US and non-US traders alike.

Of the top 25 “VIP” holders, who will also be treated to an exclusive pre-dinner reception with Trump and a tour,c 23 of them are individuals or entities likely based outside of the United States.

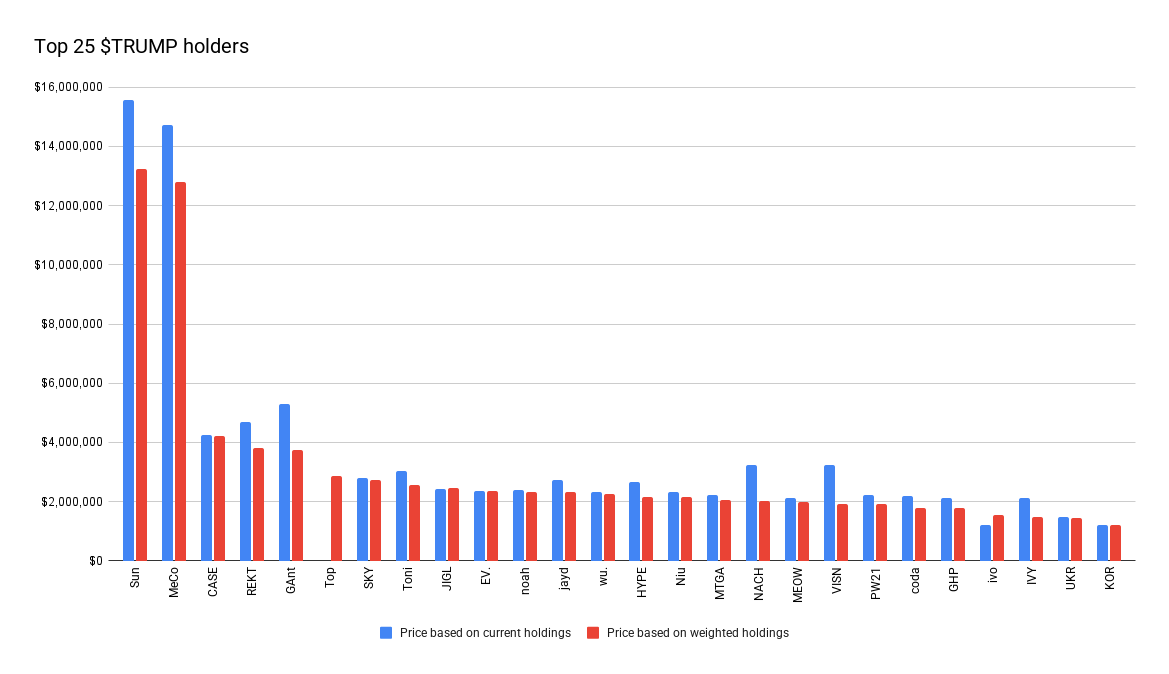

Each of these VIP attendees currently holds $TRUMP tokens priced at between $1.25 million and $16 million.

Out of all 220 invitees, most have holdings priced in the mid-five figures, with a median of around $83,600. 34 attendees have holdings currently priced at $1 million or more.

The largest wallet on the list is currently holding onto a $16 million dinner ticket. It’s likely the shady crypto billionaire Justin Sun, who has registered with the nickname “Sun” using a hot wallet belonging to the HTX exchange (formerly Huobi). HTX was founded in China and is now registered in the Seychelles; Sun describes himself as merely an adviser to the company, though it’s more likely that he owns it.d Sun, who as a foreign national was prohibited from contributing to Trump’s campaign, has been keen to rub elbows with Trump and his family in recent times. In September and January, Sun purchased a total of $75 million in WLFI tokens issued by another of Trump’s crypto ventures, World Liberty Financial, earning an advisory position with the project. 75% of protocol revenues go directly to Trump, granting the president a personal claim on $56 million of Sun’s purchase. Shortly after Sun’s WLFI purchase and Trump’s inauguration, the SEC paused a case against Sun and his company Tron, which had alleged fraud and securities law violations.

Sun also recently appeared onstage with Eric Trump and World Liberty Financial co-founder Zach Witkoff at an event in Dubai, where he later posed for a picture with the junior Trump.

The appearance of an exchange hot wallet on the invite list raises significant questions about the source and control of these funds. When customers deposit cryptocurrency with a centralized exchange like HTX, their funds are combined into large pooled wallets under the exchange’s control — customers don’t get individual wallets, but rather a claim against the exchange for their deposited value. This means that Sun may well be relying on the funds of his customers to obtain a seat at the table, rather than his own assets or those belonging to his company. HTX has not responded to an inquiry on this point.

The second largest holder is an entity called MemeCore, which seems to be based out of Singapore, and describes itself as a “blockchain secured by Proof of Meme”. The company has been posting heavily on social media about the event, writing on Twitter that “We’re not just aiming for #1 on the $TRUMP leaderboard — we’re here to conquer the entire meme space.”4 To achieve its position, it has invited followers to send their $TRUMP tokens to the MemeCore wallet listed on the leaderboard, promising to return the tokens with additional rewards after the event.5 MemeCore has not responded to a request for comment.

Other entries on the list include a fledgling endeavor called LuckyFuture, whose two-week-old website boasts that it will be an “AI-based ETF” that will also provide lending. It’s not clear where it’s based, though it’s likely outside of the US, as its TRUMP tokens were purchased using wallets at Binance and OKX. The firm responded to an inquiry as to its basis of operations to say that the firm is “globally based”, and explained that they had purchased the token because “We believe $TRUMP is the Best Meme Coin ever given that President Trump is the 1st US President to actively support Crypto.” They added that they would be attending the dinner, and that they hope that the event will feature Trump “sharing more about his vision and plan about Crypto, including Bitcoin and $TRUMP.”

Another attendee is likely to be “Ogle”, a pseudonymous crypto security researcher recruited as an adviser by World Liberty Financial in September 2024. Shortly after he joined, Ogle said in an interview that he was motivated to accept the advisory position to increase “the likelihood of [World Liberty Financial] not hurting a lot of people.”

BugsCoin, a crypto trading simulator that appears to be based in Korea, also secured a spot on the invite list for its founder, who goes by “INBUM”. When contacted, they explained that they purchased $TRUMP “to promote our own coin by attending a dinner hosted by the president of the most powerful country in the world.” However, they were unsure as to whether they would be able to retain a position in the top 220 and ultimately be able to attend the dinner, explaining that they “took profits before the recent drop in the Trump token and redistributed the gains to our investors.” BugsCoin did not respond to a question clarifying where the company is based.

Other identifiable wallets include one associated with the Asian BTOK crypto messaging app, and crypto traders who go by “Smooth Operator”, “Booblino”, “GiantBabyCorn”, and “0xSolarcurve”. None of these individuals or entities have responded to requests for comment; GiantBabyCorn and 0xSolarcurve could not be reached.

Others trying to secure spots on the list have spent as much as $180,000 only to find themselves well below the threshold for an invite,6 battling against an opaque time-weighting mechanic meant to prioritize those who’ve held the token for longer. Apparent bugs in this mechanism have allowed some wallets to remain high on the invite list even days after selling all of their $TRUMP tokens, with 20 entrants having less than the 1 $TRUMP minimum required for entry.

62% of those on the invite list had never purchased a $TRUMP token prior to the announcement,e suggesting they were primarily drawn in by the promise of access to Trump rather than any longer term interest in the token itself. Adding to this, another 13% had traded the tokens in the past but had sold them all by the time dinner was announced, having to repurchase tokens to earn an invite. Only 25% held tokens predating the dinner announcement, and many of those held modest amounts, later acquiring more to earn their spot.

Some, despite registering on the leaderboard, seem more interested in trading than in securing a seat at the dinner table, and have repeatedly sold off their entire holdings since the announcement in an attempt to turn a profit. Many others are sitting on unrealized losses, purchasing substantial amounts shortly after the announcement which have since declined in price.

Although the tokens are primarily trading on the secondary market rather than being sold directly by Trump, Trump and affiliated entities are still profiting handsomely from trading fees. A large spike in trading volume following the dinner announcement generated millions of dollars in fees, much of which goes to Trump-affiliated entities.

And although known Trump wallets are not permitted to sell tokens directly at the moment, Trump and affiliates still hold 80% of the supply of remaining $TRUMP tokens, meaning that they stand to benefit financially from price increases driven by announcements and gimmicks like this one. The project dictated a schedule on which insiders would be permitted to sell portions of their holdings, but they’ve already deviated from it, postponing the first unlock by 90 days.7 Furthermore, the limited degree of transparency provided by public blockchain records does not allow us to know with confidence whether insiders may be trading the tokens with undisclosed wallets.

The $TRUMP dinner represents the latest in a series of crypto ventures that have enriched Trump and his family while creating unprecedented conflicts of interest, as the president simultaneously shapes crypto policy and intervenes in regulatory actions. Even prior to its transformation into a dinner invitation, ethics watchdogs and legislators alike sounded the alarm over the memecoin as “the single worst conflict of interest in the modern history of the presidency”.8 Now, even some of Trump’s biggest allies are getting uncomfortable, with Republican Cynthia Lummis admitting the dinner “gives [her] pause”.9 Democrat Jon Ossoff, speaking at a town hall, commented that “granting audiences to people who buy his memecoin” is “no question ... an impeachable offense.”10

I have disclosures for my work and writing pertaining to cryptocurrencies.

May 9, 2025: This article has been updated with comment by LuckyFuture and BugsCoin.

References

“Lim is also charged with conducting activities to willfully evade or attempt to evade applicable provisions of the CEA, including promoting the use of ‘creative means’ to assist customers in circumventing Binance’s compliance controls and implementing a corporate policy that instructed Binance’s U.S. customers to access the trading facility through a virtual private network to avoid Binance’s IP address-based controls or create ‘new’ accounts through off-shore shell companies to evade Binance’s KYC-based controls.” March 27, 2023 CFTC press release. ↩

Solana wallet AVUBqJAvoeEazRKMuBr7AEyRDs6eqfLg3jLAWYgBMTB6. ↩

“Trump promotes meme coin, raising ethics issues as value soars”, The Washington Post. ↩

“Senate Republicans raise red flags about Trump's private dinner with his meme coin holders”, NBC News. ↩

“Sen. Jon Ossoff signals support for Trump impeachment”, NBC News. ↩

“Justin Sun fights a lot of lawsuits on behalf of companies he doesn’t own”, Protos. ↩

Footnotes

Analysis is based on a snapshot of the $TRUMP leaderboard taken at approximately 9am ET on May 6, 2025. The leaderboard updates hourly, and continues to change since this snapshot was taken. ↩

“KYC” is short for “know your customer”, and refers to the process of establishing the real-life identity of an individual controlling a crypto wallet. It’s not clear specifically what the Trump team is referring to by “KYC watchlist countries”, but this likely refers to countries subject to US sanctions or increased financial monitoring. ↩

Evidently of the White House and not the golf club, according to an early version of the Trump memecoin website, although that detail was later removed to leave it unclear. ↩

Justin Sun regularly claims mere affiliation with companies he likely owns or exerts significant control over, including HTX, Techteryx, and BiT Global.11 ↩

It is possible, however, that some of those who control these wallets previously purchased $TRUMP tokens using separate wallets. ↩