XRP: Schrödinger's security

The recent order on whether Ripple's XRP is a security has some declaring victory for not just Ripple, but all of crypto.

An order on motions for summary judgment in the long-running SEC v. Ripple case caused quite the stir in the crypto world this week. Fans of Ripple — or at least those who were excited for the possible implications of the decision on their favorite altcoin or on other ongoing SEC litigation — were quick to declare this a huge victory for Ripple, a huge loss for the SEC, and some kind of personal rebuke of SEC Chair Gary Gensler. Some Bitcoin maximalistsa and crypto skeptics, on the other hand, were quick to dismiss it as a wacko ruling doomed to immediate and successful appeal.

In December 2020, the SEC filed a lawsuit against the US-based company Ripple and some of its executives, alleging that their various sales and other distributions of the XRP token constituted unregistered securities offerings. It's been a pretty fierce battle since, and a closely-watched one, since a determination in either direction will have strong ramifications for the crypto industry and the SEC's status as its regulator.

On July 13, District Judge Analisa Torres made a decision on the parties' motions for summary judgment, finding that the institutional sales of the XRP token did constitute the unregistered offer and sale of investment contracts in violation of securities laws, but that the programmatic and other sales of XRP did not. She also explicitly declined to rule on whether secondary market sales of XRP — that is, the vast majority of XRP sales — constituted offers and sales of investment contracts.1

The Court does not address whether secondary market sales of XRP constitute offers and sales of investment contracts because that question is not properly before the Court. Whether a secondary market sale constitutes an offer or sale of an investment contract would depend on the totality of circumstances and the economic reality of that specific contract, transaction, or scheme.

The ruling quickly spawned ecstatic tweets from the cryptoverse like "US judge rules Ripple XRP is not a security", which of course is not quite what happened. Nevertheless, the XRP token price immediately leapt something like 60% on the news. Coinbase's stock rallied, because the ruling was interpreted by some to have positive implications for Coinbase as they defend their lawsuit from the SEC. Coinbase jumped to relist XRP on their exchange, and Kraken, Crypto.com, and Bitstamp followed suit.

Various folks with more knowledge about securities laws than I have think the ruling was pretty weird, including Bloomberg's Matt Levine (a must-read, in my view), former SEC enforcement attorney and crypto critic John Reed Stark, former SEC attorney Mark Fagel, and law professors Ann Lipton and Hilary Allen. CoinDesk columnist and Bitcoin maximalist George Kaloudis wrote "Ripple's XRP Ruling Does Nothing for Regulatory Clarity", stating his opinion that "Either XRP is a security, or it is not. These should be mutually exclusive."

Others think the decision is reasonable, particularly those associated in some way with Ripple, Coinbase, or other entities likely to directly benefit from its ramifications. Venture capitalist and Coinbase board member Katie Haun wrote that she thought "the Court drew a reasonable line", and further opined that she would be surprised to see an immediate appeal from the SEC "both because the agency would have to ask the court to split this decision from the portion going to trial and because I'm skeptical the SEC actually wants legal clarity". She took the opportunity to toe the Coinbase party line, writing that "the Commission benefits from the current confusion".

Consensus generally seems to be that the SEC will try to appeal the order at some point, though it could happen either as an interlocutory appeal (i.e., immediate) or only after the final judgment (i.e., potentially in a year or more). "This finding strikes me as probably erroneous and vulnerable to challenge on appeal," wrote Preston Byrne, Brown Rudnick partner and Bitcoin enthusiast. "When the SEC appeals this finding or raises it in other litigation in other federal courts, as is virtually certain to occur, the SEC is going to have plenty of precedent on its side". On the other hand, the SEC will run the risk that if they appeal and then lose in the Second Circuit, the decision would then become binding on some federal courts.

Probably the most reasonable people in all this are those who acknowledge that this appears on its face to be good news for Ripple, but is far from being set in stone or precedent-setting at this stage.

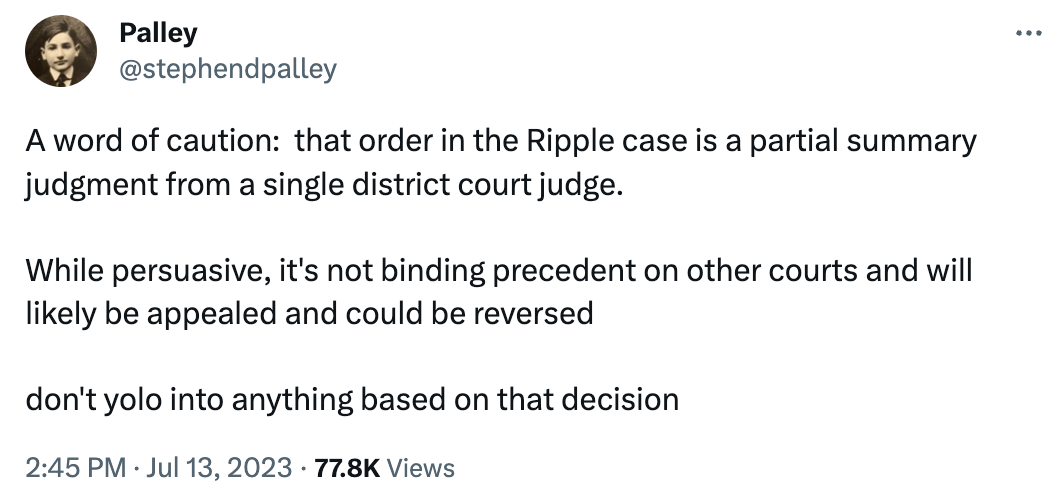

Brown Rudnick partner Stephen Palley (who has expressed his belief in the past that XRP is a security) wrote:

Crypto company general counsel Matt McGuire similarly wrote that "this is the opening round [in my opinion]". Crypto lawyer Jason Gottlieb noted that the order was not binding on anyone besides XRP, writing: "this is one decision, from one district court, very facts & circumstances-specific. Other federal judges may find this decision persuasive and adopt it. (They should!) But they can also just ignore it."

Personally, regardless of the outcome of any future appeal, I wonder if this ruling might serve to strengthen the arguments of crypto advocates that "we need regulatory clarity". The SEC and Gary Gensler have maintained that it is very clear that basically every crypto token is a security, to which people can now say "well, obviously it wasn't clear enough for this judge".

Footnotes

Bitcoin maximalists are a subgroup of Bitcoiners who not only love Bitcoin, but hate all other cryptocurrencies. ↩