Issue 21 – Other-than-temporary impairments could make banks less than well-capitalized

Silvergate spirals, another exec flips on SBF, and no one wants NFTs anymore.

There's been so much to cover in these newsletters lately that I realize I haven't been updating you on everything else I've been up to, so let's catch up:

A few weeks ago I dropped in on a group that's putting on a series of events for policy and regulatory officials. My aim was to provide a 101- (or maybe 201-) level introduction to the attendees, many of whom are suddenly finding themselves needing to learn about these topics and are also facing a lot of lobbying around the "innovative potential of blockchains". I started off with some quick definitions, to help get people up to speed for the rest of the series, before diving into analysis of some popular claims about blockchains' supposedly inherent decentralization, immutability, anonymity, and transparency. I've published my portion of the event:

Looking forward, I've been preparing for a three part mini seminar series that I'm hosting as a part of the Harvard Law School Library's "HLS Beyond" program, titled "Blockchain Solutions to Socio-Political Problems: An Exploration of Current Issues in Web3". I'm also working on following up the series with something suitable for a wider (hopefully public) audience, so stay tuned for that. In the meantime, I've uploaded the list of reading material in case anyone's curious to read along.

Next week I will also be heading to SXSW in Austin, where I'm lined up as a featured speaker. I'll be there from March 10–14 (plus traveling for a day on either end) and am speaking on the 14th. If you're going to be there too, let me know so we can say hi, or at least come catch my session! And if you know any good tips or things I shouldn't miss, slide on in to the comment section or my DMs. Despite the downturn in both crypto prices and general hype, there are a substantial number of other crypto/web3/metaverse sessions that I'll be trying to attend, like "Sex and Web3: Is the Future of Sex On-Chain?" (I hope not!) The schedule is also of course flooded with AI-focused content, which I'll probably dip into.

Because of the seminar on Monday and then SXSW, it's likely that I will have to skip next week's edition of the newsletter. I'll do my best to keep up with W3IGG in a timely fashion, but it's just unlikely I'll get enough uninterrupted time to write a full newsletter. I'll be sure to cover everything that happens during that period in the following newsletter edition, and cross my fingers that nothing completely explodes while I'm otherwise engaged.

I'm sure I've just guaranteed it will.

In FTX

Four new charges have been added to Sam Bankman-Fried's criminal indictment, bringing the total number of charges to twelve. The indictment accuses SBF of some new shady business with regards to banks, including making up a fake company called "North Dimension" because FTX was having trouble getting a bank account. [W3IGG]. SBF pled not guilty to the original eight charges in early January; he has not yet entered a plea for the new ones.

In terms of bond, not much new has transpired since my special edition interview with Popehat last week on SBF's bond conditions. At the judge's request, SBF's legal team has put forth two candidates for a technology expert who the judge can consult as he sees fit. One of them's a former FBI agent, and both have around two decades of experience with tech consulting in legal cases and digital forensics. It's not clear to me if they're expected to serve as consultants throughout the whole trial, or if it's just for the particulars around SBF's bond, but I notice neither of them seems to have much specific experience with cryptocurrency or blockchains (save for one who attended a couple of trainings and webinars on the topic). If their job is just to explain VPNs and ephemeral messaging, I'm sure either of them is perfectly suitable, although the judge could also just listen to Professor Nick Weaver and SBF's team could save the $650/hr fees. Better yet, he could bring Weaver on as the consultant, and let me be a fly on the wall during those conversations. (For those unfamiliar with the name, Weaver is known for his "Blockchains and Cryptocurrencies: Burn It With Fire" lecture, and similar such sentiments expressed in print).

Meanwhile, last week's rumors that FTX co-founder and former director of engineering Nishad Singh was nearing a plea deal stopped being rumors, with Singh pleading guilty to six criminal charges: conspiracy to commit wire fraud on customers, wire fraud on customers, conspiracy to commit commodities fraud, conspiracy to commit securities fraud, conspiracy to commit money laundering, and conspiracy to make unlawful political donations and defraud the Federal Election Commission. [W3IGG].

He has also agreed to cooperate against his former boss. As with all others charged in this case so far, Singh also faces civil complaints from both the SEC and the CFTC. Like Caroline Ellison and Gary Wang, the other cooperating members of SBF's inner circle, Singh is out on $250,000 bond.

I wrote a Twitter thread as I read through the three complaints against Singh if you'd like to get my full reaction, or scroll on for just the highlights:

As tends to be the case, the SEC and CFTC complaints went into more juicy detail than the one out of the DOJ. They implicate Singh in helping Sam Bankman-Fried falsify FTX records, and allege that he not only managed the engineers who were coding in the backdoors and exemptions for Alameda, but that he wrote some of the code himself.

The complaints contain the expected and already-known allegations that funds were being shared between the various SBF-owned entities. They also go into new detail, though, about events like the one in late 2021, when SBF apparently really wanted FTX to hit the milestone of $1 billion in annual revenue for that year. According to the SEC, he instructed Singh to transfer $50 million in funds from another SBF-owned entity to FTX, and then Singh falsified records to auditors. In for a penny, in for a pound, I guess — if you're already committing massive fraud, why not cook the books so you can tweet about your supposed 1,000% revenue increase after someone "leaks" your financial reports to CNBC?

The complaints also give more context on Alameda's loans to Singh. We knew from the bankruptcy filings that Singh was the beneficiary of a $543 million loan from Alameda, but now the SEC alleges that that was mostly for Sam Bankman-Fried's "other purposes, including additional venture investments and acquisitions". Singh did borrow money from Alameda for his own use, though it was on the order of tens of millions rather than hundreds of millions. He gave those funds away to friends and family, donated them, and used them for personal purchases like a multi-million-dollar house.

When the sky began falling at FTX, Singh allegedly expressed interest in "unwind[ing]" and "get[ting] rid of" his loans, suggesting to SBF that he could backdate transactions as though he had sold FTT or SRM "earlier in 2022". SBF said "I think that's probably fine". Singh never followed through on this plan, and by November 9 he had jumped ship — even before bankruptcy had been filed.

In other bankruptcies

In late February, the SEC objected to Binance US's proposed purchase of the bankrupt Voyager crypto lender, saying that the deal could violate securities laws and that "regulatory actions" could stymy the deal's closure. In a hearing on March 2, the bankruptcy judge made it clear he isn't impressed with the SEC for this, criticizing them for whacking the emergency stop button without providing any insight as to how things can move forward. The Committee on Foreign Investment in the United States (CFIUS) has also expressed reservations on the sale, citing similarly vague national security concerns.

In banking

Two issues ago I wrote about the difficulties facing crypto-friendly US banks, as well as the crypto companies who need banking. Things now seem to be rapidly worsening for one major player: Silvergate Bank. [W3IGG] The California-based bank had already requested an extension to file its 2022 annual report, but has now filed a notice with the SEC that it doesn't expect to be able to meet the extended deadline, either. The notice divulged "certain regulatory and other inquiries and investigations that are pending with respect to the Company" as a delaying factor, and dropped the bombshell that the bank is questioning whether it may be able to stay afloat at all.

The Company sold additional debt securities in January and February 2023 and expects to record further losses related to the other-than-temporary impairment on the securities portfolio. These additional losses will negatively impact the regulatory capital ratios of the Company and the Company's wholly owned subsidiary, Silvergate Bank (the "Bank"), and could result in the Company and the Bank being less than well-capitalized. In addition, the Company is evaluating the impact that these subsequent events have on its ability to continue as a going concern for the twelve months following the issuance of its financial statements. The Company is currently in the process of reevaluating its businesses and strategies in light of the business and regulatory challenges it currently faces. – Silvergate's Notification of Late Filing

It was no big secret that Silvergate had a rough 2022. Several months ago, it reported that they had experienced a $1 billion net loss in the fourth quarter of 2022. Short sellers descended on the company, making the most shorted stock on Wall Street. However, today's news appears to have been worse than even the market expected, triggering a stock sell-off that caused the share price to tumble more than 55%. Congrats to all those short sellers.

Meanwhile, crypto companies are abandoning Silvergate like rats fleeing a sinking ship. Coinbase, Galaxy Digital, Paxos, CBOE, Gemini, Crypto.com, and Bitstamp all announced that they would cease transfers to and from Silvergate, and Circle announced they were also "unwinding certain services" with the bank. This may only contribute to Silvergate's spiral, as previous sources of liquidity are cut off.

The problem for the crypto companies is that there's not exactly another great ship for them to flee to. Coinbase said they'll be moving to Signature Bank, but that may not be a viable option for others — Signature jettisoned many of its crypto clients in the wake of the FTX debacle, and have reportedly been imposing limitations that have affected clients including Binance and Kraken. Signature, like Silvergate, found itself having to tap the Federal Home Loan Banks (FHLB) system for liquidity in Q4 to meet massive outflows.

Although there are blessedly few banks that have gotten as entangled with the crypto industry as Silvergate, it will be an interesting case study in contagion from crypto to traditional finance. I suspect that lawmakers and regulators may not smile upon a bank failure caused in large part by the cryptocurrency industry, should it come to pass.

Matt Levine and the Castor/Gerard duo have both written more about the Silvergate saga for curious readers.

The Web3 is Going Just Great recap

There were 14 entries between February 18 and March 2, averaging 1.1 entries per day.

Code Law is law

[link]

Oasis changed the rules of the game to allow the massive trading firm Jump to recoup more than $100 million in assets that were stolen in February 2022 via the hack of the Wormhole project. This, they said, was only possible due to a "previously unknown vulnerability" that they were forced to exploit thanks to a court order, though that does seem an awfully convenient story for a team who knew their actions would be seen as contradictory to the fundamental ethos of decentralized finance.

In a deep dive this week, I wrote up what happened and why it has massive implications for defi:

Galois Capital pulls the plug

[link]

As I wrote in November, there can be a pretty long tail on crypto contagion. With a big explosion like FTX, there are usually a few firms in the blast radius that go under pretty immediately (e.g. BlockFi), but there are plenty that limp along for a while before eventually acknowledging that they can't continue.

The latter was the case for Galois, who disclosed to investors in November that around half of the firm's roughly $100 million in assets were trapped on FTX. Now, Galois has finally thrown in the towel, selling their claims on FTX to a distressed debt investor for 16 cents on the dollar.

In spite of that, I am proud to say that although we lost almost half our assets to the FTX disaster and then sold the claim for cents on the dollar, we are among the few who are closing shop with an inception-to-date performance which is still positive.

— Galois Capital (@Galois_Capital) February 20, 2023

Tumbleweeds roll through the WazirX NFT marketplace

[link]

If the name WazirX rings a bell, it may be because I've written about them before as the Indian crypto exchange that Binance didn't want to admit to owning. In mid 2021, as NFTs were becoming popular, WazirX launched an NFT platform. Now, the market for NFTs is on life support, and WazirX has decided to call it quits.

According to them, their platform enjoyed a whopping $112.24 of transactions over the last month, generating around six dollars in platform fees. That amount represented 354 transactions between 71 unique active wallets.

WazirX's community (all 71 of them, I guess?) seemed infuriated at WazirX for "abandoning" them, and were miffed that WazirX gave them no warning of the shutdown.

Metroverse NFT game melts down

[link]

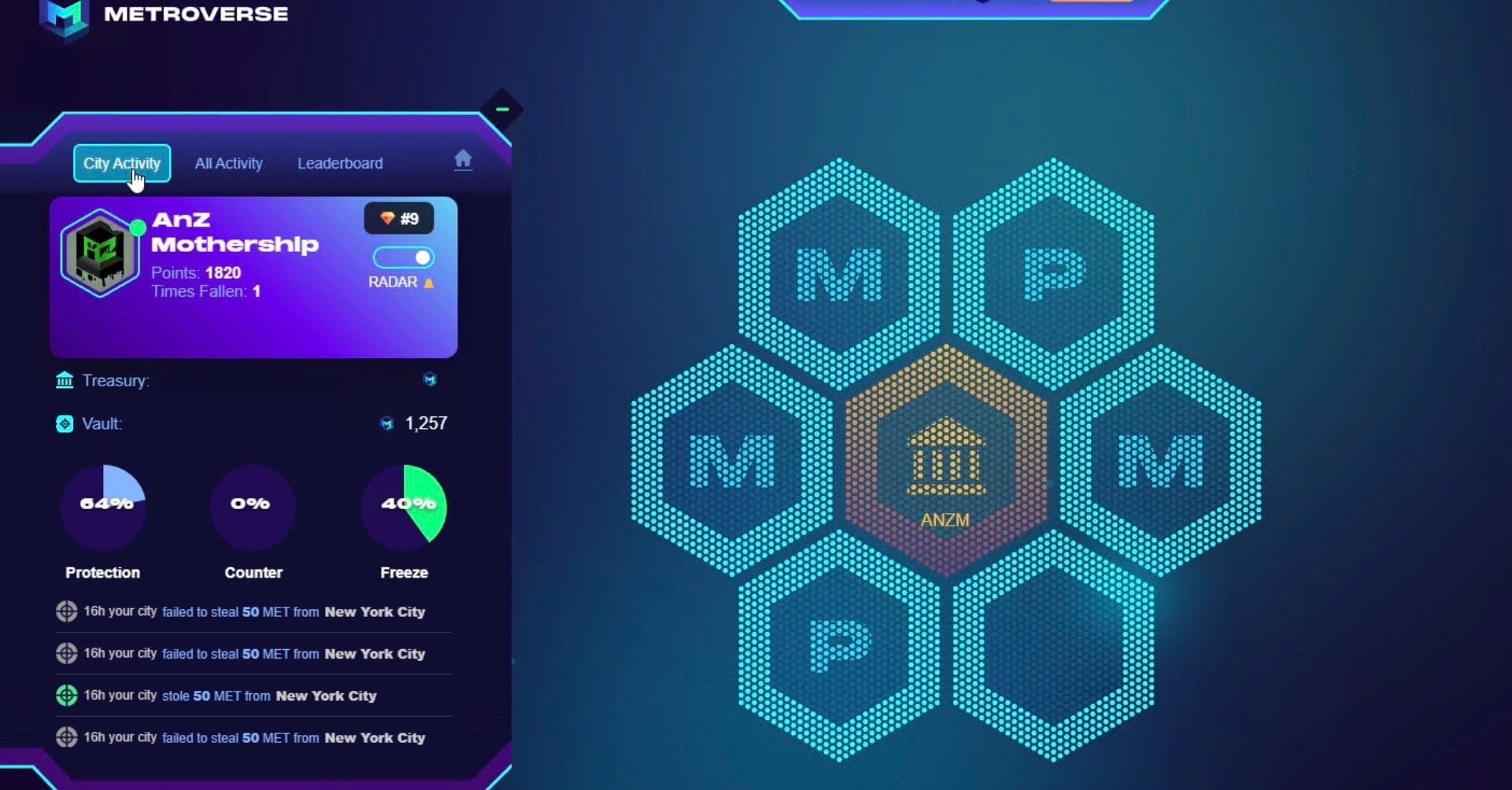

The Metroverse NFT-based game (nothing metaverse-related, despite the name) stumbled to an unpleasant end amidst a community meltdown, with community members accusing the project team of not listening to their feedback and inadequately fulfilling roadmap promises, and the team members accusing the community of widespread harassment against the team and "sabotage" of the project.

The team had promised a "land trading NFT strategy game" with mechanics they said would be "similar to Sim City".b Between that and some flashy animated artwork, the project pulled in millions of dollars from NFT mints. At its peak, the project's "Genesis" NFTs were selling for a minimum of 2 ETH (at the time, around $7,000) and in January 2022 some sold for as much as 15–19 ETH (~$36,400–$46,000). However, the ultimate product was a far cry from Sim City: a rudimentary web interface allowed only some NFT holders to play, with the rest relegated to watching a text feed from the sidelines as city "leaders" repeatedly launched attacks on other cities to try to steal those cities' "treasuries". That's about it.

The team ended up shutting down the project's Discord, saying the "FUD" and attacks from the community was damaging team members' mental health. They claimed that players were blaming them for the low price of the NFTs, which they said was simply a result of the ongoing NFT winter and outside of their control. Shortly after locking down the Discord, the team shuttered the project entirely, promising an airdrop to tick off the last item of the roadmap — presumably in hopes of dodging future claims that they hadn't fulfilled their promises. The remaining community was enraged, with some threatening to try to uncover the identities of the anonymous team so they could take legal action.

Everything else

- Silvergate crypto-focused bank faces crisis [link]

- BitBNS discloses that they were hacked in February 2022, hid it as "system maintenance" [link]

- FTX co-founder Nishad Singh pleads guilty, agrees to co-operate against SBF [link]

- Two BNB-based projects attacked for around $700,000 each [link]

- Large Algorand holders have wallets drained [link]

- hideyoapes suffers $200,000 wallet drain [link]

- Solana tries turning it off and on again (twice) [link]

- Crypto investment scheme with links to UK Parliament vanishes [link]

- Sam Bankman-Fried indicted on four new charges in criminal case [link]

- Canadian regulators tighten rules for crypto exchanges [link]

In the news

I did the blockchain spelunking for some journalists at ABC News on their story about allegations that Steve Bannon's "FJB" shitcoin project is a scam. Yeah, I know, I was totally shocked too.

The now year-old "(Edited) Latecomer's Guide to Crypto" annotation project — a labor of love great irritation between myself and a dozen or so other crypto skeptics — gets a shout-out in Tatiana Walk-Morris's much-needed piece. She asks the question: "isn't it the job of journalists—who have the power to lead and shape the conversation—to do due diligence, ask the difficult questions and delve into the industry as deeply as possible, so readers understand what they're getting into?"

Two Bloomberg columnists — including the oft-mentioned-here Matt Levine — quoted heavily from my essay about Oasis and the centralization of crypto it exemplified. Fortunea also published an article about the Oasis hack that cited my work, but then yanked the piece with no explanation. Curious.

Worth a read

I somehow missed this chapter in the Wikipedia@20 book, which was published a few years ago to celebrate Wikipedia's 20th birthday. Perhaps because it doesn't appear in the table of contents? Not sure what's going on there. Anyway, I stumbled across it as I was looking for material on the various "Wikipedia but on the blockchain" projects that have emerged, like Everipedia (RIP) and now Golden. It is excellent.

An obituary to Politiwoops, a casualty of the changes that have been made to Twitter's platform that are rapidly making it less usable by researchers and watchdogs.

Elizabeth Weil wrote an excellent profile of an incredible person: the linguist Emily M. Bender. It sometimes feels a little grim being a technology critic amidst all of these seemingly never-ending tech hype bubbles, but seeing such thoughtful and constructive technology criticism as hers is reinvigorating. The piece also brought about some déjà vu, as the hype and "build! build! build!" and "move fast and break things!" we're seeing around large language models in many ways echoes the crypto hype bubble of yesteryear.

"I feel like there's too much effort trying to create autonomous machines blockchain projects rather than trying to create machines projects that are useful tools for humans."

That's all for now folks. Until next time,

– Molly

Footnotes

If you're seeing Fortune's obnoxious text-blurring paywall, stick this in your browser console:

document.querySelector('.paywallActive').classList.remove('paywallActive')It works on the archived versions too. ↩

Less than three hours after I published the W3IGG post about Metroverse, which quoted a December 2021 tweet promising "mechanics similar to Simcity", Metroverse deleted the tweet. I'd already archived it, though. ↩