Issue 23 – Here for crime

SBF gets slapped with a bribery charge, Binance gets sued by the CFTC, and Arbitrum bungles decentralization.

Hello! It's been a busy, busy week-and-change in the crypto world, so let's jump right in.

In FTX

Yet another superseding indictment has been filed in the criminal case against Sam Bankman-Fried. The latest, unsealed on March 28, adds a thirteenth charge to the twelve fraud, conspiracy, and campaign finance violations that SBF was already facing. Now, he's being accused of bribing at least one Chinese government official with around $40 million in cryptocurrency. According to the CFTC, in November 2021, SBF allegedly sent $40 million to one or more Chinese officials to induce them to restore Alameda Research's access to accounts frozen by the Chinese government. The freeze was reportedly due to an investigation into a counterparty of Alameda's, and the accounts reportedly had balances of around $1 billion.

SBF was already looking at up to 155 years in prison before this charge was added to the list, and the case against him sure looks pretty strong from the outside, so there's some question as to whether a thirteenth charge is likely to really change the outcome for someone already facing the prospect of spending a meaningful percentage of the rest of his life in prison. Ken White, aka Popehat, just so happened to address why the USAO might have decided to add the charge anyway on the most recent episode of , opining that if someone bribes a Chinese official with tens of millions of dollars, it's "just too big to let go by". He also added that the piling on of charges may be a strategy by the government to convince SBF to accept a plea deal.

SBF showed up in New York shortly after the newest indictment was filed, where he pled not guilty to this charge and the four other new(ish) charges from an earlier superseding indictment in late February.

The judge, US attorneys, and defense have also finally reached an agreement around SBF's bond conditions, which have been quite contentious: at times, the prosecutors and defense agreed on proposed terms only for the judge to reject them as too lenient. SBF's new conditions of release are intended to keep him from contacting other former FTX executives in apparent attempts at witness tampering, or from using a VPN to, uh, "watch the Super Bowl".

He's now allowed access to two devices, and two devices alone: a dumbphone without Internet access, from which he will be allowed to make calls and texts, and a laptop preinstalled with software to monitor his activities, prevent the usage of external drives, and limit his access to a list of pre-approved websites. No more League of Legends, no more Storybook Brawl, no more Substack, no more Twitter. For a man who claims the worst part of his week-long incarceration in The Bahamas' notoriously unpleasant Fox Hill Prison was the lack of Internet access,1 hopefully he was just talking about his lack of Netflix, Uber Eats, and Cointelegraph, or else he's going to be going pretty stir crazy between now and October. Maybe they'll give him a dumbphone with Snake. Maybe he'll pick up a book.

In Binance

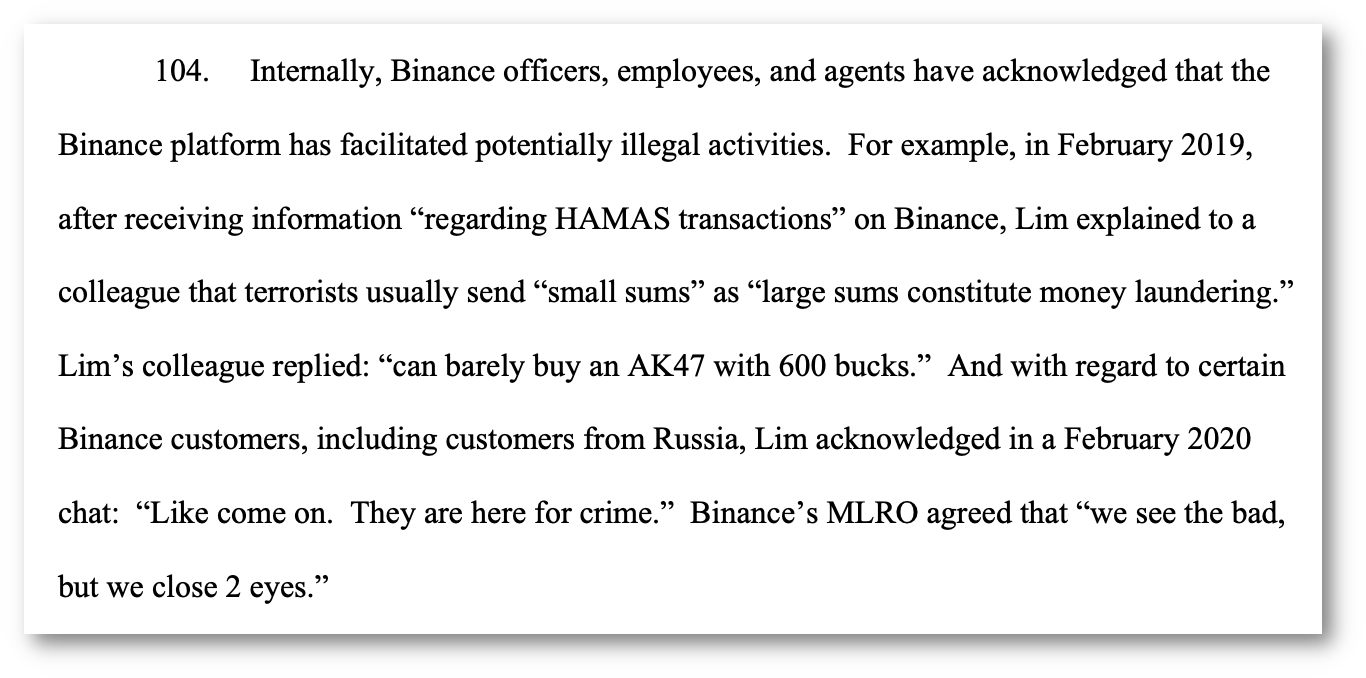

After rumors that the Department of Justice was considering filing criminal charges against Binance following four years of investigation, actual legal trouble has emerged from a somewhat unexpected place: the CFTC. [W3IGG]. In the civil complaint filed on March 27, the CFTC is suing Binance, its CEO Changpeng "CZ" Zhao, and its former Chief Compliance Officer Samuel Lim for seven violations of commodities regulations, including failure to register with the CFTC, failure to diligently supervise, and issues with their anti-money laundering and know-your-customer programs.

The complaint is 74 pages long and goes into great detail about the alleged malfeasance happening at Binance with the full knowledge of Zhao — some of which seems criminal and beyond the CFTC's remit. It's juicy.

I've detailed a lot of it in a tweet thread, and instituted a new rule: if you absolutely must put your crimes in writing, don't write them in "I CAN HAZ CHEEZBURGER" style. It's embarrassing.

Investigators somehow got hold of internal Binance communications, including Signal messages from CZ's own cell phone, which seems like really bad news for both him personally and for Binance.

It seems likely to me that criminal charges against CZ are coming soon, or are perhaps already filed under seal and the DOJ just hasn't managed to arrest him yet. While the CFTC doesn't have the ability to throw CZ in jail, they do have the ability to shut down Binance's operations in the US, and that could be a blow to Binance. Despite the fact that Binance is largely seen as a non-US exchange, the CFTC complaint reveals that one of the US trading firms that was circumventing US georestrictions made up a whopping 12% of Binance's trading volume. Other charts reflected that Binance had 2.5 million US customers in the US in September 2020 — around 16% of all registered users at the time.

Binance US's hopes to acquire the remains of the bankrupt Voyager company are now in jeopardy again, too. The SEC had tried to block the sale in early March, but was denied by the bankruptcy judge.2 The Attorney's Office for the Southern District of New York and the Office of the US Trustee then appealed that in mid-March, also asking that the sale be put on hold until the appeal is decided,3 but the hold was denied by the bankruptcy judge.4 Now, a federal judge has intervened, granting a hold pending the outcome of the appeal.5

Elsewhere in the courts

Terra/Luna

Police finally caught up to Do Kwon, who has been on the run since an arrest warrant was issued for him in South Korea in September 2022 in connection to the collapse of his Terra/Luna project. [W3IGG] The US SEC also filed charges against him in February 2023, [W3IGG] and the US DOJ filed charges against him only hours after his arrest. [W3IGG].

Kwon was nabbed in an airport in Montenegro, where he was reportedly using a fake Costa Rican passport to try to board a plane to Dubai. He now also faces charges in Montenegro pertaining to his use of forged documentation. Both the US and South Korea are seeking Kwon's extradition.

For now, Kwon is finishing a standard precautionary quarantine, after which point he will go to a not-so-cushy Montenegrin jail while his local charges and extradition are all sorted out — which could take a while. Meanwhile, Montenegro's Interior Minister revealed to Bloomberg that they had seized three laptops and five phones, and that they "found [a] significant amount of information that is very interesting".

Three Arrows Capital

Three Arrows Capital founders Kyle Davies and Su Zhu have been ordered to appear in court in the British Virgin Islands in May, as a part of the ongoing liquidation proceedings for the collapsed hedge fund. The pair have not been cooperating with liquidation to date, at least according to the liquidators, and now face being held in contempt of court if they don't show.

The Web3 is Going Just Great recap

There were 16 entries between March 19 and April 2, averaging 1.1 entries per day. $12.42 million was added to the grift counter.

Arbitrum disastrously attempts to decentralize

Arbitrum is one of the most popular Ethereum layer 2 scaling solutions — that is, a category of projects built atop of Ethereum that seek to provide solutions to the blockchain's sluggish speeds and hefty gas fees. The Arbitrum mainnet was first launched in August 2021, and has been developed by a centralized company that controlled the decisionmaking and development.

The project followed a familiar pattern in crypto: start off as a centralized company while making promises to decentralize things at some point down the road. However, now that Arbitrum has attempted to do so… well, it's gone just great.

First they needed to distribute governance tokens — crypto tokens that are used to represent votes, but can also be bought and sold on secondary markets as with other tokens. They devised a scheme to airdrop these tokens to people based on their usage of the Arbitrum chain, leading to widespread attempts to game the airdrop by commandeering hacked crypto wallet addresses. The popularity of the airdrop also caused the distribution site to crash and gas fees to spike, and phishing websites proliferated in the days and weeks before the airdrop. Fake Twitter accounts trying to trick people into falling for scams were so common that Twitter accidentally suspended the real Arbitrum account believing it to be a fake. An attacker compromised the Discord account of a member of the Arbitrum team, sending a phishing link that appeared genuine. Altogether, at least $1.32 million was taken by various miscreants.

Despite the bumpy start, the governance tokens were distributed and the newly-formed DAO embarked on its first vote: whether to approve some governance protocols proposed by the Arbitrum team, and approve a 750 million ARB token distribution to the Arbitrum team's "Administrative Budget Wallet", which could then be spent without DAO approval. Those 750 million tokens comprise 7.5% of the 10 billion supply, and were priced at over $1 billion based on the ARB token price at the time of the proposal. However, DAO members rejected the proposal — it ends April 3, but as of writing, 83% of voters opposed it.

Things got messy when it turned out that Arbitrum had already begun spending the tokens they planned to allocate to themselves, sending a 40 million ARB loan (~$52 million) to what they only described as "a sophisticated actor in the financial markets space" (later determined to be Wintermute) and converting 10 million ARB to stablecoins (~$13 million). This prompted accusations from some in the community that the Arbitrum team was "selling off".

An Arbitrum team member later wrote a post claiming that the DAO vote was actually a "ratification" of decisions that had already been made, angering many who accused the team of running a "sham vote" and rendering the DAO pointless.

Coinbase receives a Wells notice

[link]

Coinbase received some unwelcome mail from the SEC last week. The SEC sent them what's known as a Wells notice: a letter that basically says "we're about to sue you, convince us why we shouldn't". Instead of responding to the SEC, Coinbase predictably went into full PR mode, writing a blog post titled, "We asked the SEC for reasonable crypto rules for Americans. We got legal threats instead." Coinbase trotted out their usual talking points: that the SEC signed off on their business and is now reneging on that, that they've tried to work with the SEC but the SEC won't cooperate, that the SEC is undercutting the "innovation" of the crypto industry and trying to drive it overseas by regulating by enforcement rather than providing clear guidance.

John Reed Stark, former Chief of the SEC Office of Internet Enforcement, provided a helpful response to the saga, which I thought was particularly useful in explaining how "the SEC approved our business!" is nonsense.

And from Matt Levine:

The position of Coinbase — and of the crypto industry more broadly — is "look, SEC, if you want to have a flourishing system of legally compliant, safe, trustworthy crypto assets, you will need to work with us a little bit to write new rules," and the position of the SEC is "no, we don't want that, we want all of you to go away forever." If Bernie Madoff came to the SEC and said "if you want a higher class of more trustworthy Ponzi schemes, you will need to write a few new rules adapting the disclosure regime to Ponzi schemes," the SEC would have said "no we absolutely do not want that, we want much less Ponzi scheming, and we certainly do not want to give our approval to Ponzi schemes by writing rules for them." One gets the sense the attitude to crypto is similar.

Regulatory clarity: wait, no, not like that

Two crypto companies fell victim to regulatory clarity this week, ironically both claiming that it was the lack of regulatory clarity that was their downfall.

First, the SEC shut down the Beaxy crypto exchange: a historically shady exchange that liked to pay for undisclosed influencer promotions. According to the SEC, the executives agreed to shut down Beaxy as a part of their settlement agreement. However, according to a statement by Beaxy, it was "due to the uncertain regulatory environment surrounding our business".

Then, Bittrex announced they would be closing up shop in the US. In October 2022, they paid a combined $29 million fine relating to actions from both OFAC and FinCEN, pertaining to their widespread service of sanctioned individuals and "willful violations" of anti-money laundering regulations and requirements around suspicious activity reporting. [W3IGG] Now, they too are shutting down "due to continued regulatory uncertainty".

It seems to me that it is the disappearing regulatory uncertainty that is causing these exchanges to shut their doors. The regulatory uncertainty was what allowed them to operate in the first place.

Everything else

- Allbridge cross-chain bridge exploited for around $574,000 [link]

- $8.9 million stolen from SafeMoon [link]

- US CFTC sues Binance and CEO Changpeng Zhao [link]

- Latest Sotheby's NFT sale is decidedly tepid [link]

- Collector accidentally burns their $123,000 CryptoPunk [link]

- US prosecutors file criminal charges against Do Kwon [link]

- Terra/Luna founder Do Kwon arrested [link]

- Kraken to suspend ACH transfers after Silvergate collapse [link]

- Lindsay Lohan, Jake Paul, and other celebrities charged for illegally touting Justin Sun's tokens [link]

- Justin Sun charged with offering unregistered securities and market manipulation [link]

- SpankPay payments service for sex workers shuts down [link]

In the news

David Yaffe-Bellany presented some of the same points that I did in my "No, Bitcoin isn't pumping because it's a 'safe haven' from banks" piece last week, which he cites when discussing the fact that it may well have been belief that the Fed would slow interest rate increases that caused a Bitcoin price pump around the time of the SVB collapse. Bad news for the blood pressure of the Bitcoiners who were positively apoplectic in my direction a week ago, and who had to get worked right back up at the Times for also challenging the Bitcoiner narrative.

IEEE's Spectrum publication did a quick profile on me for their "five questions" series, politely describing me as "not impressed" with web3.

Worth a read listen

Two of my favorite people discussing the collapse of SVB and the peek behind the venture capitalist curtain that it provided. Jacob Silverman is kind of the perfect person to discuss the whole fiasco, given his deep knowledge of the crypto space and of the various influential technocratic political ideologues in Silicon Valley.

If you have zero appetite for listening to folks who have a more pro-crypto viewpoint, this might not be for you, but Digitally Rare is one of my favorite crypto podcasts. Both hosts are very into the NFT world, mostly from the artist perspective, and I find them really thoughtful about the whole space — and quite willing to acknowledge its major issues (hell, they had me on the pod a while ago). Anyway, in this episode they host Brian L. Frye, a law professor interested in intellectual property and copyright law, who created the "SEC No-Action Letter Request" NFT. In the episode, they talk about Frye's belief that all NFTs are securities, but also that that's a good thing. I didn't agree with everything they said, but I found the episode thought provoking.

Thats all for now, folks. Until next time,

– Molly White

References

"Exclusive: Sam Bankman-Fried Recalls His Hellish Week In A Caribbean Prison", Forbes. (Archive). ↩

"Binance.US Gets Judge's Approval to Buy Voyager Digital Despite Regulator Objections", Bloomberg. ↩

"U.S. Justice Dept. Appeals New York Judge's Decision to Approve Voyager's Sale to Binance.US", CoinDesk. ↩

"Voyager-Binance.US Pause Denied by Bankruptcy Judge", CoinDesk. ↩

"U.S. Government Case Against Voyager-Binance.US Deal Has 'Substantial' Merits, Judge Says", CoinDesk. ↩