Issue 36 – Sam Bankman-Jailed

"Just because the defendant was more subtle than a mobster doesn't mean it's OK."

Sam Bankman-Fried revived an otherwise low-key week in the crypto world: a few million-dollar hacks here, a few project shutdowns there, and — as usual these days — a lot of court filings.

In the courts

Sam Bankman-Fried

We've finally reached a conclusion to the saga in which Sam Bankman-Fried leaked to the New York Times some private diary writings of his ex-girlfriend and former Alameda Research CEO Caroline Ellison:

For a brief moment at the hearing on August 11, it sounded like the government was going to relent on their request that he be remanded to jail, and instead agree to yet another tightening of SBF's terms of release that would have left him confined to his home, but Internetless except for when he needed to have Zoom calls with his legal team. As I wrote last week, however:

I previously got the vibe that Judge Kaplan is fed up with SBF's incessant antics and quite ready to stick him back in jail, but we shall see.

Today, Kaplan outlined Sam Bankman-Fried's repeated transgressions in the time he's been out on bond. So far he's racked up:

- Sending Signal messages to FTX US General Counsel and witness in the case Ryne Miller, stating: "I would really love to reconnect and see if there's a way for us to have a constructive relationship, use each other as resources when possible, or at least vet things with each other." (late January, covered in Issue 18)

- Using a VPN (February, covered in Issue 20)

- Leaking private diary entries by Caroline Ellison to the New York Times (July, covered in Issue 34)

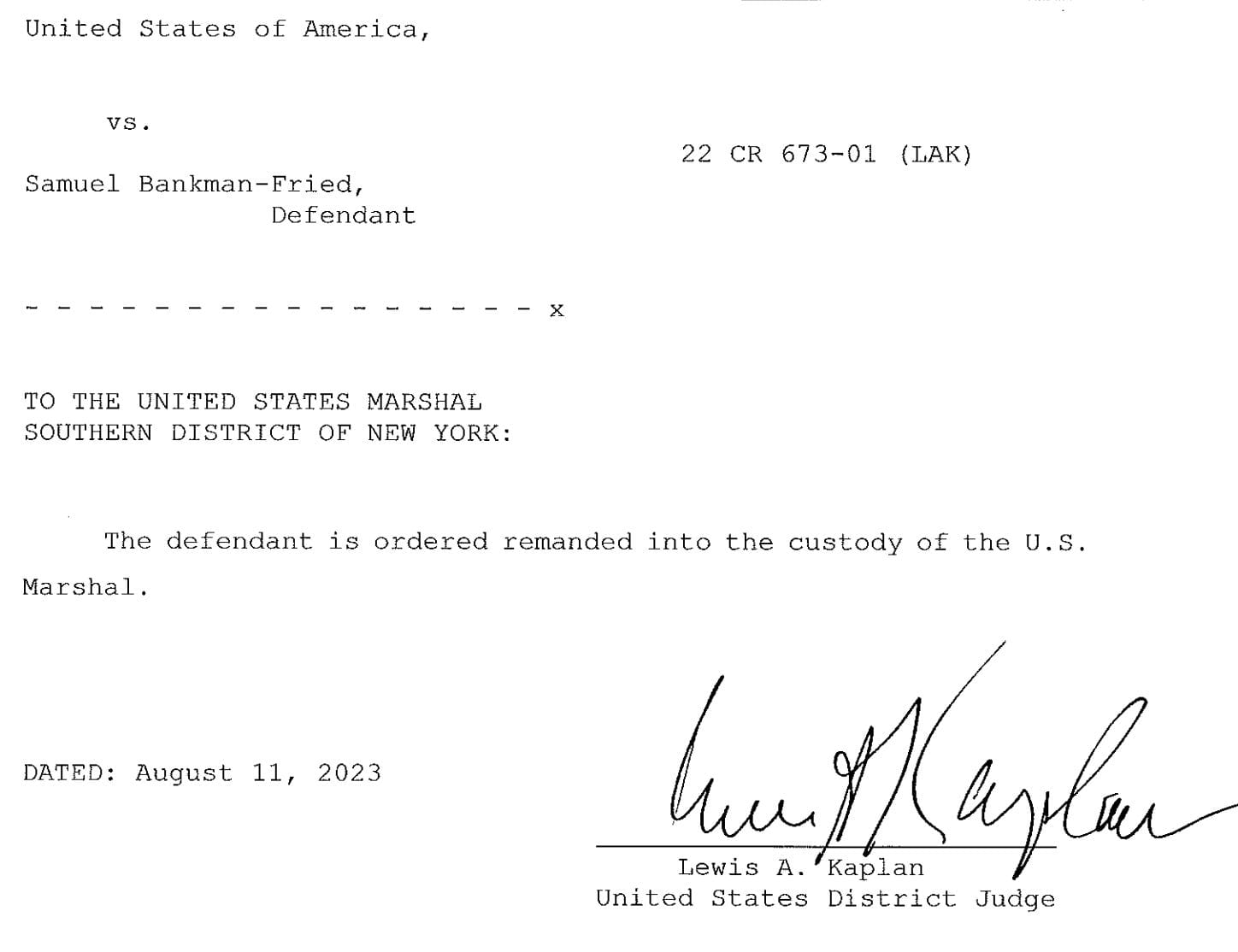

Kaplan cited the contents of the documents shared by SBF, the way in which he shared them with the reporter, and the fact that he was not disclosed as the source in the article as reasons why he did not believe SBF's activities surrounding the NYT article were a legitimate exercise of his First Amendment right to defend himself in the media:

I come to the more recent event, the New York Times July 20 article, "Inside the Private Writings of Caroline Ellison". Her insecurities are described and her personal relationship with the defendant. The article doesn't state the source of the materials.

Mr. Bankman-Fried entertained the reporter at his parents' home in Palo Alto and showed some portion of Ms. Ellison's private writings. The [US Attorney's Office] said it was to intimidate her and others. The defense says it's about a First Amendment right.

Was he motivated in part by a desire to intimidate? The defense says he's gotten bad press and has a right to try to repair his reputation. Fair enough. But I find that there is a practical possibility it was intended to have them back off.

The defendant had the reporter come to his home and didn't give him copies but rather see it and take notes. There are quotes in the New York Times identical to the language in those documents…

The documents are in part personal and intimate. They are personally oriented, not business oriented. There's something that someone who has been in a relationship would be unlikely to share with anyone except to hurt and frighten the subject.

In view of the evidence, my conclusion is that there is probable cause to believe that the defendant has attempted to tamper with witnesses at least twice under Section 1512(b).1

Tampering with a witness under Section 1512(b) is a felony, by the way.

SBF's legal team informed Judge Kaplan that they intend to appeal the decision to the Second Circuit. They asked Kaplan to stay the order, which he declined: "I disagree there's anything novel here other than the factual issue." They filed the notice of appeal minutes after stepping out of the courtroom.2 I will, of course, closely watch that as it makes its way through the Second Circuit.

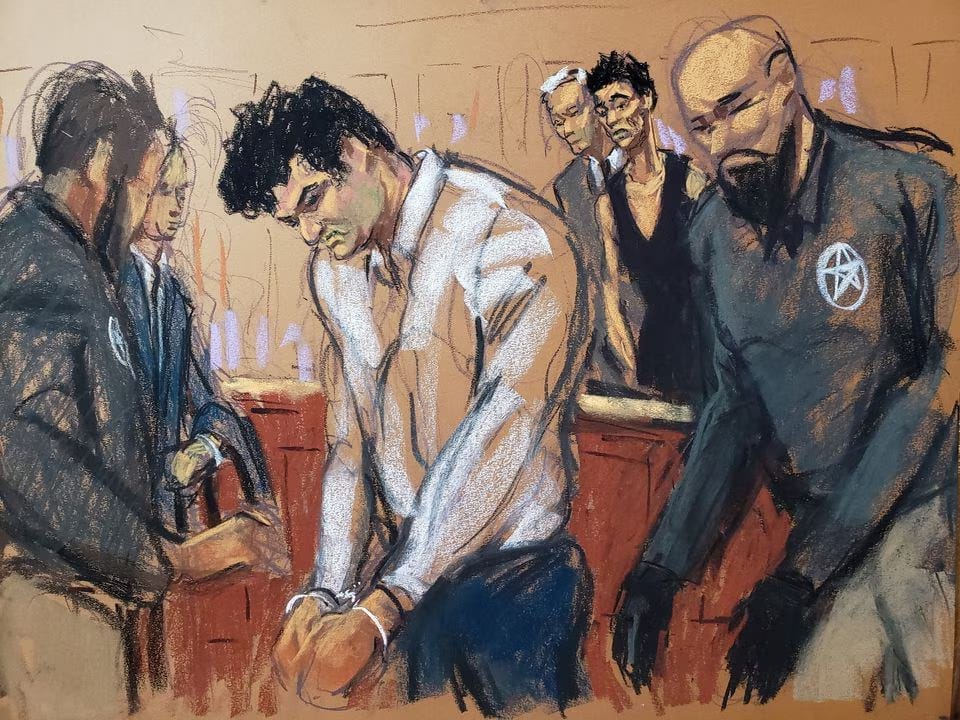

SBF was taken from the courtroom in handcuffs, and will likely be jailed at either MDC Brooklyn (the usual choice) or Putnam County Correctional Facility (which might entertain giving SBF his Internet-limited laptop to use for preparing his defense).

I've gotten a lot of questions about whether the collateral supporting his $250 million bond — including, notably, his parents' home — will be forfeited. It will not.3

Somewhat overshadowed by SBF's move to the finest cells New York has to offer is some news from earlier this week: a letter outlining prosecutors' intent to file a superseding indictment containing the same seven charges currently slated to be tried in October, but incorporating the evidence pertaining to SBF's campaign finance conduct.4 I wrote last week about how the government had to drop the campaign finance charge when The Bahamas informed them that they did not intend to extradite him on it, and about how that led to some outcry from the group of people who think SBF's going to get off easy thanks to his connections and wealth. Now, prosecutors have written that "The superseding indictment will make clear that Mr. Bankman-Fried remains charged with conducting an illegal campaign finance scheme as part of the fraud and money laundering schemes originally charged." Long story short: they can't charge the specific statute, but they still intend to incorporate the evidence into the other charges.

Ryan Salame, the FTX executive also known as a massive donor to Republican political candidates, is reportedly negotiating a plea deal. "People familiar with the case" cited by Bloomberg say that campaign finance violations are among the charges he's looking at. He wasn't extradited from anywhere, so the government shouldn't run into the same Bahamian hiccup as with SBF.5

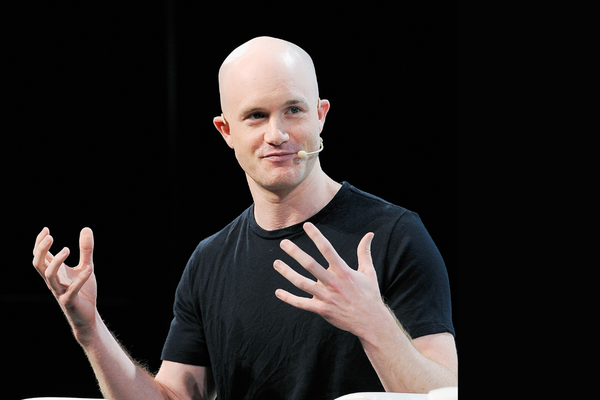

Coinbase

Coinbase has filed its motion to dismiss the lawsuit from the SEC.6 In it, they argue that cryptocurrencies are not inherently securities, and are rather an asset that can be sold as a security, commodity, etc. depending on the structure of the sale. This is not an absurd argument, but some of Coinbase's analogies sure don't make them look terribly serious as a company that still announces prominently on its website that crypto is "the future of money":

As I wrote on Twitter, it's pretty remarkable to see Coinbase making the argument that crypto is just like baseball cards, American Girl dolls, or Beanie Babies. "It's the future of finance!" except when the SEC comes knocking, then it's just a harmless little toy, your honor.

Ripple

The SEC has informed the court7 of its intent to file a motion for leave to file an interlocutory appeal of portions of the July 13 order on motions for summary judgement. For non-lawyers, this means they're asking for permission to appeal the decision right now, in the middle of the case, rather than waiting until it's all over.

Among other things, the SEC is worried about the impact of the decision on other court cases: "Timely appellate review is particularly warranted given the number of actions currently pending that may be affected by how the Court of Appeals resolves these issues." They certainly have some reason for that worry — the order has already been cited in arguments by defendants in other cases, though as I mentioned last week, it isn't precedential and one judge has already explicitly declined to follow it.

Alex Mashinsky

A judge has denied former Celsius CEO Alex Mashinsky's motion to dismiss the civil case against him from the Attorney General of New York, so that'll be moving forward.8

Also, Mashinsky's got a fancy new ankle bracelet ahead of his federal criminal trial. The judge approved that and a $10,000 cap on the amount that he can transfer into, out of, or among bank accounts in exchange for the removal of his First Republic brokerage account as an account securing his $40 million bond.9 Oh, and he has to pay for the location monitoring.10

DCG

Digital Currency Group has filed its motion to dismiss a fraud lawsuit from the Winklevoss twin-owned Gemini cryptocurrency exchange, describing the lawsuit as a "continuation" of the Winklevoss twins' "public, Twitter-based character assassination campaign" against DCG and its founder Barry Silbert. In the motion, DCG describes the lawsuit as an effort to deflect blame from Gemini's own bankruptcy.11

Meanwhile, the New York Attorney General has joined the lineup of agencies looking into DCG — a group that reportedly already includes the SEC and federal prosecutors. All of them are poking around to learn more about DCG's financial dealings with its subsidiary company, the Genesis crypto lending firm, which filed for bankruptcy in January.12

In bankruptcies

FTX

FTX creditors and FTX management have been butting heads over the draft reorganization plan that was filed on July 31.13 The Unsecured Creditors' Committee claims that FTX's management didn't engage with the Committee when coming up with the plan,14 but FTX hit back that they engaged substantially with the Committee, who they say are are just unhappy that FTX wasn't willing to "pursue an unrepresentative plan that vests control of the debtors' billions of dollars in liquid assets in the hands of unrestricted crypto traders and market makers regardless of the potential impact on other stakeholders".15

In government and regulators

You may or may not have heard that PayPal announced a stablecoin. It looks to me mostly like a marketing ploy, though a poorly timed one given the state of the crypto hype cycle. It's caught the attention of US lawmakers, though. Pro-crypto Republican Representative McHenry, Chair of the House Financial Services Committee, says that the move highlights the importance of passing stablecoin regulation.16 The more crypto skeptical Democratic Rep. Maxine Waters agreed that the stablecoin industry needs regulation and oversight, but is still not on board with the Republicans' proposed bill, which she says has zero chance of passing.17

Meanwhile, the US Federal Reserve issued a supervisory letter only one day after PayPal's announcement, requiring any banks that want anything to do with stablecoins to receive special permission and undergo continued monitoring.18

The bankrupt Bittrex exchange has settled with the US SEC for $24 million. [W3IGG]

Worldcoin is racking up more and more privacy-related investigations. I wrote last week that the project was facing inquiries by French, German, and British regulators, and that it had been booted out of Kenya. Since then, they've had a warehouse in Nairobi raided by Kenyan authorities [W3IGG], and Argentina has joined the list of countries investigating the endeavour.19

In other crypto news

American-born co-founder of Three Arrows Capital, Kyle Davies, thinks he's found the One Weird Trick to dodge being held in contempt of court by renouncing his US citizenship. It actually might have worked, now that the judge has discovered he in fact renounced his citizenship in December 2020 after marrying a Singaporean national and becoming a citizen of Singapore. Singapore does not allow dual citizenship.20

97 crypto hedge funds have already shut down this year. That's around 13% of the more than 700 or so tracked by Swiss investment adviser 21e6 Capital AG.21

The Web3 is Going Just Great recap

There were 13 entries between August 4 and August 11, averaging 1.6 entries per day. $10.57 million was added to the grift counter.

Oh boy, Huobi

[link]

More than $100 million has exited the Huobi crypto exchange amid rumors that executives have been arrested in China. Hong Kong crypto news outlet Techub wrote on August 5 that "at least three executives" at Huobi had been detained for investigation, kicking off an apparent run on the exchange. Influential crypto analyst Adam Cochran added to concerns, writing of "likely Huobi insolvency".

Huobi used to be the most popular crypto exchange in China, though the country's crypto ban certainly put a damper on that. They are #9 on CoinMarketCap's list of top cryptocurrency exchanges, which calculates its ranking based on factors including traffic, liquidity, and trading volume.

Huobi owner "advisor"22 Justin Sun tweeted "4" in response to the rumors: crypto shorthand for dismissing a concern as nothing more than "FUD". Well, in that case.

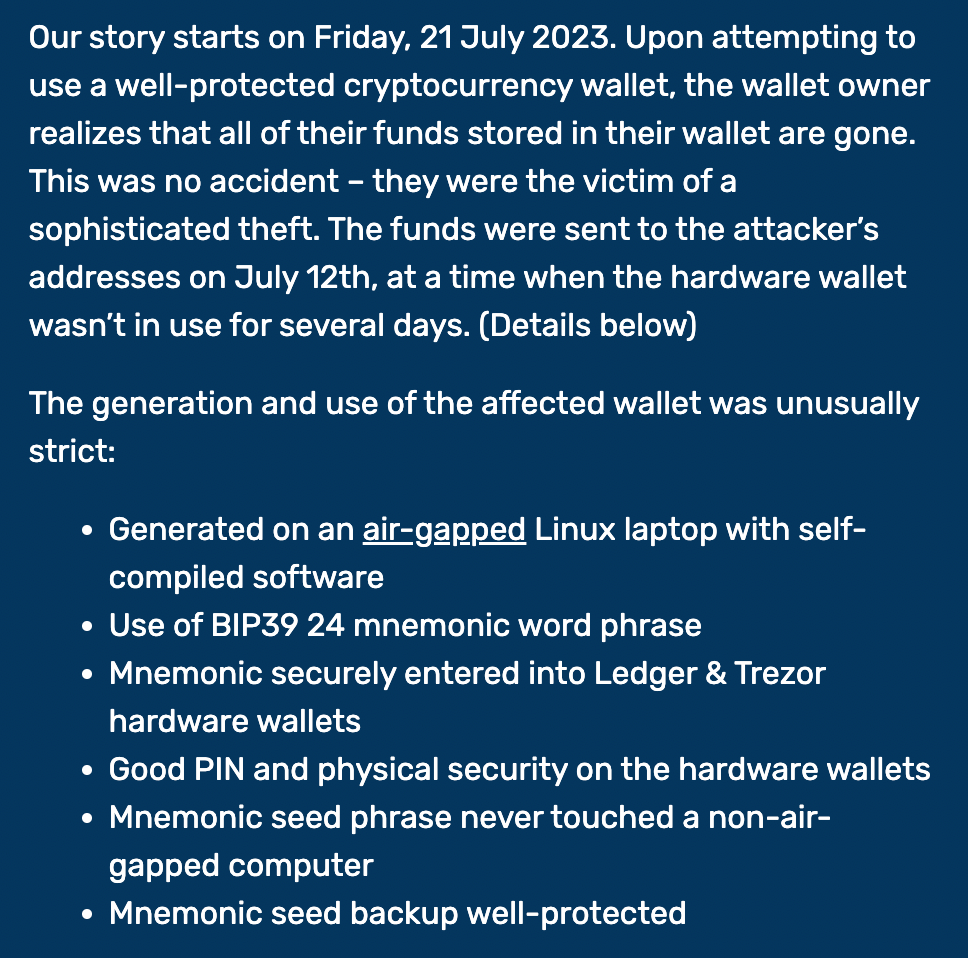

Milksad vulnerability affects multiple crypto wallets

[link]

Security researchers have disclosed the "milksad" vulnerability in the popular Libbitcoin project. This vulnerability allowed attackers to brute-force private keys in "a few days of computation on the average gaming PC, at most". The team has not yet disclosed which wallets were impacted by the vulnerability, but estimate that around $900,000 was stolen as a result of it.

When the team contacted Libbitcoin, Libbitcoin developers replied first that they were too busy, then twice that "they do not feel this is a bug".

Everything else

- Bittrex settles with SEC for $24 million [link]

- SpiritSwap to shut down after Multichain collapse [link]

- Hundred Finance shuts down after hacks [link]

- Disney exits the metaverse [link]

- Scammers target victims via web3 job search boards [link]

- Bitsonic CEO arrested for allegedly stealing $7.5 million [link]

- Cypher protocol exploited for around $1 million [link]

- Steadefi exploited for over $1 million [link]

- Worldcoin warehouse in Nairobi raided by authorities [link]

- Copytrader asks for "stolen" funds back after someone tricks their bot [link]

- Revolut shuts down crypto business in the US [link]

In the news

Max Chafkin referenced my Worldcoin piece when writing that "critics have asked why, exactly, anyone would scan their eyeballs". Why, indeed.

Worth a read

The fabulous Emily M. Bender and Alex Hanna offer a dose of reason amid all of the AI doomerism. AI has real harms that are impacting people today, and we should focus on those more than the humanity-destroying visions offered by AI doomers and criti-hypers.

Ed Zitron has launched a podcast, and I'm excited for it. Ed's always done great work over at the excellent newsletter, so I expect the podcast to be of similar caliber. In the first episode, they discuss Twitter, its new proprietor's shift rightward, and Ben Collins' experience covering some of the gnarly underbellies of the online and political world.

That's all for now, folks. Until next time,

– Molly White

References

Notice of appeal filed on August 11, 2023. Document #199 in United States v. Bankman-Fried. ↩

Letter filed on August 8, 2023. Document #195 in United States v. Bankman-Fried. ↩

"Ex-FTX Executive Salame Talking to Prosecutors About Plea Deal", Bloomberg. ↩

Motion to dismiss filed on August 4, 2023. Document #36 in Securities and Exchange Commission v. Coinbase, Inc. ↩

Letter filed on August 9, 2023. Document #887 in Securities and Exchange Commission v. Ripple Labs Inc. ↩

Decision and order on motion filed on August 4, 2023. Document #17 in The People of the State of New York by Letitia James, Attorney General of the State of New York v. Alex Mashinsky. ↩

Memo endorsement filed on August 9, 2023. Document #21 in United States v. Mashinsky. ↩

Order filed on August 9, 2023. Document #21 in United States v. Mashinsky. ↩

Memorandum of law in support of defendants' motion to dismiss the complaint filed on August 10, 2023. Document #17 in Gemini Trust Company, LLC v. Digital Currency Group, Inc. ↩

"Silbert's Crypto Empire DCG Faces NY Attorney General Probe Over Genesis Ties", Bloomberg. ↩

Chapter 11 Plan filed on July 31, 2023. Document #2100 in In re: FTX Trading Ltd. ↩

Statement of the Official Committee of Unsecured Creditors in respect of the debtors' draft plan of reorganization and accompanying term sheet filed on July 31, 2023. Document #2103 in In re: FTX Trading Ltd. ↩

Debtors' response to the statement of the Official Committee of Unsecured Creditors filed on August 9, 2023. Document #2143 in In re: FTX Trading Ltd. ↩

"Rep. McHenry pushes for stablecoin bill following PayPal move", The Block. ↩

"Rep. Maxine Waters criticizes PayPal's stablecoin, demands regulation on par with financial institutions", CryptoSlate. ↩

"SR 23-8 / CA 23-5: Supervisory Nonobjection Process for State Member Banks Seeking to Engage in Certain Activities Involving Dollar Tokens", Board of Governors of the Federal Reserve System. ↩

"Worldcoin Regulatory Scrutiny Grows as Argentina Opens Investigation", CoinDesk. ↩

"3AC co-founder avoids contempt charges following evidence of Singaporean citizenship", CoinTelegraph. ↩

"Crypto Hedge Funds Are Being Hit by Shutdowns, Lagging Returns in 2023", Bloomberg. ↩

See "Who really owns crypto exchange Huobi?", Protos. ↩