Issue 37 – Things Sam is freaking out about

Things are heating up as the FTX trial looms, various crypto companies try to outmaneuver the SEC in court, and mainstream media crypto boosterism enjoys an unexpected revival.

Before jumping into crypto news, I wanted to share that this newsletter has just achieved its 1,000th paid subscriber! [confetti cannon]

I'm so grateful to all of you who regularly read my writing, and I really mean it when I tell you paid subscribers that you are the wind beneath my wings. Especially now as I am approaching the end of my year-long fellowship at Harvard and needing to decide what's next, your support is critical in enabling me to continue doing this work.

If you aren't a paid subscriber and would like to become one, check out the pay-what-you want subscription options. As always, my writing will continue to be paywall-free; paid subscribers get the opportunity to join in the lively comments section and, of course, my sincere gratitude.

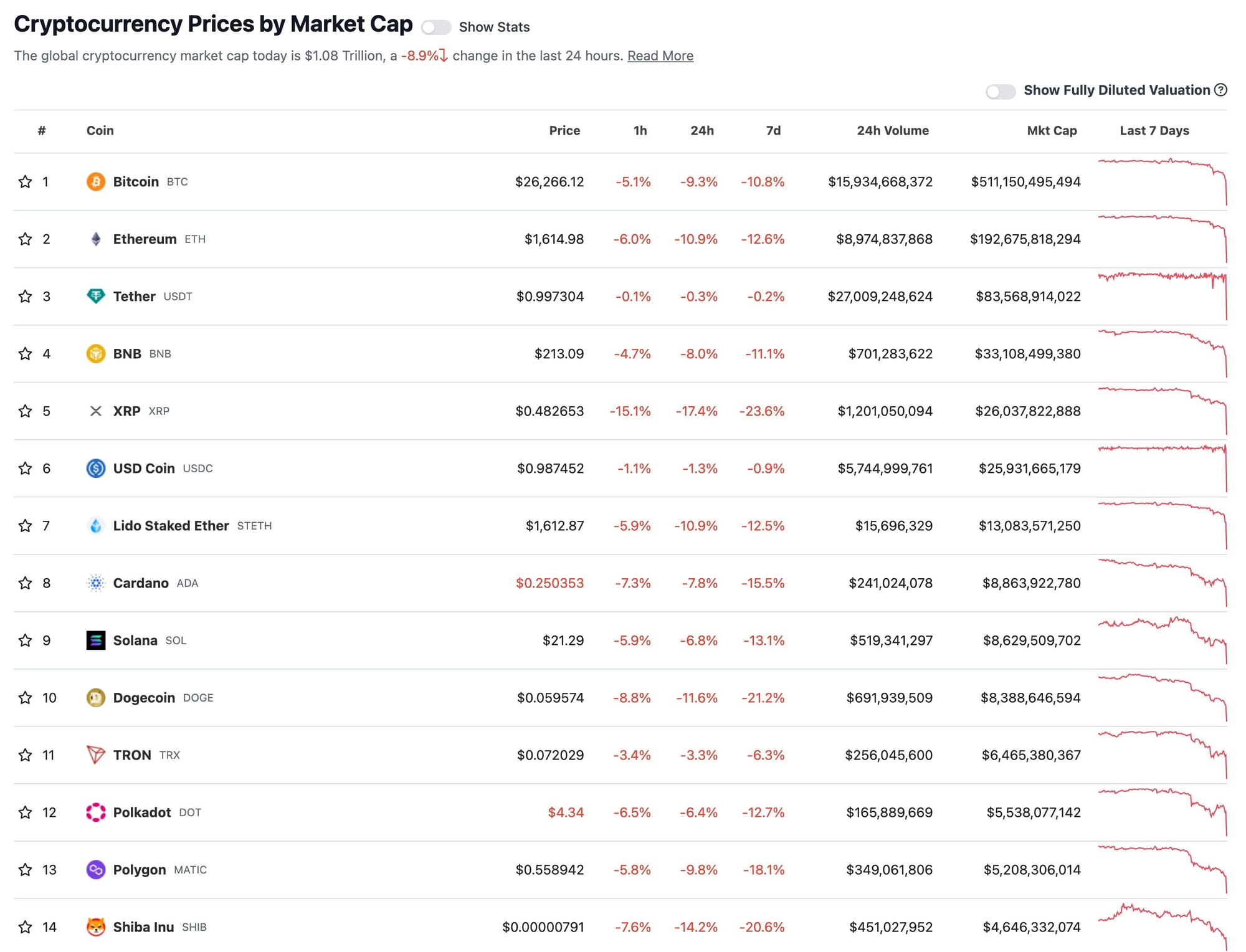

As for crypto, it's been a rough week. A sudden marketwide dump on August 17 surprised everyone — myself included — and altogether traders suffered more than $1 billion in liquidations as a result of the sudden sell-off.

People have floated various theories as to why cryptocurrencies tanked in the span of minutes: U.S. interest rates are high, a bunch of Bitcoin options contracts expired all around the same time, China's Evergrande Group announced it had filed for bankruptcy, and the Wall Street Journal published an article that mentioned SpaceX selling off its bitcoin holdings. I'm not sure any of these is particularly convincing, though — interest rates have been high for a while now, Evergrande has been floundering for some time, and the WSJ article published hours before the dump (and described SpaceX as already having sold off its holdings, so the crash definitely wasn't SpaceX suddenly selling hundreds of millions of dollars worth of bitcoin, as some erroneously believed).

Among the positions liquidated was one belonging to the perpetrator of the massive October 2022 hack of the BNB Chain bridge [W3IGG]. In June, the BNB Chain team intervened in a loan the attacker had taken out with the BNB-based Venus defi protocol [W3IGG], where the thief had put up 900,000 BNB (then ~$244 million) to cash out $150 million in stablecoins. When BNB crashed along with other token prices earlier this week, the BNB Chain team (likely manually) liquidated 6.89 million $vBNB (~$30 million), presumably to try to prevent a potentially devastating effect on the BNB Chain.1

Other liquidation stories going around crypto social media in the wake of the dump included that of Andrew Kang, co-founder of the Mechanism Capital venture capital firm, who was liquidated fourteen times in that day and lost around $432,000. He had taken out positions with up to 100x leverage going long BTC, ETH, and ARB, leading crypto watcher Lookonchain to remind their followers that "high leverage is a very dangerous trading behavior".2

The largest single liquidation involved an unknown trader (or trading firm) who lost almost $56 million.3

In the courts

Sam Bankman-Fried

It's been ten days since Sam Bankman-Fried was uprooted from his parents' five-bedroom in Palo Alto to the rather appalling MDC Brooklyn, and the briefly-discussed move to the comparably cushier and laptop-friendlier Putnam County Jail doesn't seem to have materialized. Instead, the prosecutors intend to supply him with hard drives of material he can review during his "frequent" opportunities to access prison computers and during his "unlimited" access to legal visitation hours.4 SBF's legal team says that's "entirely inadequate" and will interfere with his rights to effectively participate in his defense, and so they want him released five days a week to meet with his attorneys in a room with laptops and internet.5 As of the time of writing, the judge has not ruled on this.

Meanwhile, the two teams are filing their motions in limine, where they argue about the evidence that can and can't be presented at trial. SBF's team wants all evidence produced to their team after July 1 to be excluded, arguing that the government has failed to meet discovery deadlines and has instead produced prodigious quantities of material (including 750,000 pages of Slack messages from Gary Wang's laptop) much later than they agreed. They say that they won't have time to review the material before the trial date, which (as of now) is looming mere months away in October. SBF's team also wants to exclude any evidence or testimony pertaining to FTX's bankruptcy due to the fear that "the jury will improperly infer that the bankruptcy itself is proof that FTX and Alameda collapsed because of fraud, as opposed to outside market forces, and that Mr. Bankman-Fried committed the crimes of which he is accused." They also don't want the government to be able to suggest that FTX creditors will ultimately lose money, or to be able to refer to SBF's resignation, which they continue to maintain was forced by other members of FTX leadership for their own benefit.6 [Twitter thread]

The government's motion confirms that the three other former FTX execs who've struck plea deals — Alameda Research CEO Caroline Ellison, FTX CTO Gary Wang, and FTX head of engineering Nishad Singh — will testify against SBF at trial. This isn't exactly a surprise, but we now have an explicit confirmation from the prosecutors on it. They also include quotes from a recording of an Alameda Research all-hands meeting days prior to the FTX groups' bankruptcy, which they wish to present at the trial. After an employee asks Caroline Ellison, "Who made the decision on using customer deposits [to cover Alameda Research's shortfalls]?", Ellison replies: "Um… Sam, I guess." They also want to produce some of Ellison's copious notes on a criminal fuckin' conspiracy, which include a list helpfully labeled "Things Sam is Freaking Out About". The motion also mentions why fellow exec Ryan Salame won't be testifying: his lawyers have informed the prosecution that, if subpoenaed, he'll invoke the Fifth. They do, however, have access to his private messages from him to "a trusted family member", where he explains that SBF was using him as a straw donor to Republicans in furtherance of his general goal to "weed out anti crypto dems for pro crypto dems and anti crypto repubs for pro crypto repubs". Other evidence and arguments the prosecutors are seeking to exclude: that customers and investors didn't do enough due diligence on FTX, that the type of activity at FTX is happening elsewhere in the crypto industry, that regulators failed to oversee the industry, and that SBF expressed after the collapse that he wanted to compensate affected customers.7 [Twitter thread]

Finally, the government has told the judge that SBF's team has informed them that SBF intends to assert an advice-of-counsel defense (i.e., "my lawyers said it was okay"), but has not given them any more detail about who these lawyers were or what they advised.

The Government is left to guess whether it is the defendant's assertion that he received legal advice relating to his deletion of Slack and Signal messages […], or that his fraudulent misappropriation of billions of dollars was somehow laid fully before legal counsel, who approved of the conduct, or that the defendant received legal advice on any other particular aspect of the conduct at issue, or a combination of these defenses, or something else entirely.

They want the judge to force SBF's team to fork over the additional information, and soon.8

Binance

Binance has petitioned the judge for a protective order against the SEC, which they say is trying to engage in a "fishing expedition" as they go through the discovery process.9 They write: "[Binance] has worked in good faith, but the SEC has been steadfast in its belief that the Consent Order gives it carte blanche to investigate every aspect of [Binance]'s asset custody practices without any discernible limitation whatsoever."

They're also arguing that the SEC should not be allowed to depose the CEO or CFO of Binance's US affiliate, because they "do not have unique firsthand knowledge that is relevant to this action".

Economist Frances Coppola wrote: "really not sure 'we don't know anything about our core business' is a credible defence..."

Tornado Cash

Back in October, I wrote of the two lawsuits filed against the Department of Treasury pertaining to the August OFAC sanction of the Tornado Cash crypto tumbler [W3IGG]. The first lawsuit was filed by a group of people who argued that they had previously used Tornado Cash for legal purposes, and were suffering financial damages because they couldn't anymore [W3IGG]. They also argued that their First Amendment rights had been violated, because they would have used Tornado to donate to "important political and social causes" had it not been sanctioned.10 The lawsuit enjoyed the financial support of Coinbase, who was not a party, though two of the six plaintiffs were Coinbase employees.

That Coinbase-backed group has just lost the suit, with the judge finding their First Amendment argument and the argument that "Tornado Cash isn't an entity!" weren't remotely convincing.11 Coinbase maintains that this loss was all part of the plan, with Chief Legal Officer Paul Grewal writing on Twitter that "We've always known that Fifth Circuit review is required to resolve these issues, and we continue to support [the plaintiffs] on appeal."12

Meanwhile, the other lawsuit against the Treasury — filed by the Coin Center lobbying group — plods on.13 You may remember it as the one that makes a pretty convincing argument against using Ethereum, essentially arguing that it requires people to essentially launder their own money in order to maintain any shred of privacy.

See, us critics don't disagree with crypto boosters on everything!

Everything else

In a somewhat impressive display of judicial red tape, the SEC asked Judge Analisa Torres "hey, can we request to request an appeal of your motion in the Ripple case?" Torres said sure, and granted their request for leave to file a motion to file an interlocutory appeal. Anyway, I have a headache now.14

Gemini has filed its motion to dismiss the SEC v. Genesis & Gemini case, arguing that the SEC hasn't clearly stated its complaints.15

In bankruptcies

FTX

The team in charge of the FTX bankruptcy wanted to claw back almost $4 billion from the estate of also-bankrupt Genesis Global Capital. They've agreed to make a claim of only $175 million — that is, about 5% of the original amount. FTX CEO-in-bankruptcy John J. Ray III submitted a declaration in support of the settlement, writing: "Settling the Parties' disputes now for the valuable consideration provided by the terms of the Settlement Agreement is in the best interest of the Debtors' estates, and in my opinion the benefits of the Settlement Agreement outweigh the alternative of continued litigation."16

Not everyone's as satisfied as Ray, though. A Twitter account representing a group of FTX creditors wrote that "this must be the worst deal to date, especially in light of the new DCG <> Genesis DOJ investigation."17 They've urged the Official Committee of Unsecured Creditors to reject the deal.18

In governments and regulators

In the US

USDC stablecoin issuer Circle thinks the US government really needs to do something about stablecoin issuers. "Candidly, should anyone anywhere be able to counterfeit US dollar using cryptographic methods or should there be a rule-set around competing with digital dollars on the internet where the safety and soundness and monetary policy of the United States is respected?" said Dante Disparte, Circle's chief strategy officer, in a Bloomberg interview.19

I can already predict an upcoming statement from Circle: "Wait, no, not like that!"

Coinbase has been approved by the National Futures Association to operate a Futures Commission Merchant (FCM): that is, to sell crypto-based futures contracts to US retail consumers. This means that, once Coinbase rolls out the feature, retail traders will be able to place leveraged bets on the price movements of crypto assets like bitcoin without actually owning the underlying token itself. Until now, these crypto derivatives have been out of reach for US retail traders,a largely due to the degree of risk involved. This is the first time a crypto firm has been designated a FCM, and is a pretty huge win for the crypto industry.20

In the UK

PayPal has announced that it will "temporarily pause" crypto purchases for its UK users, citing "new regulatory requirements".21

In the United Arab Emirates

After blowing up their Three Arrows Capital hedge fund in rather spectacular fashion [W3IGG], founders Kyle Davies and Su Zhu launched a new endeavor in March 2023: an exchange to trade claims against bankrupt crypto firms [W3IGG]. By May, OPNX had already managed to incur a 10 million dirham ($2.7 million) fine from Dubai's Virtual Assets Regulatory Authority. On August 15, VARA issued a statement that the fine was still unpaid, warning that they may seek further consequences — possibly including referral to law enforcement.22

In Kenya

Kenya has put together a committee of fifteen MPs to investigate the eyeball-scanning Worldcoin project, after shutting down the company's operations there due to security concerns. The group has 42 days to report their findings back to Parliament. Other Kenyan agencies have also "commenced inquiries and investigations to establish the authenticity and legality of [Worldcoin's] activities", according to local newspaper The Star.23

In other crypto news

Binance

Binance has lost yet another payment processor as UK-based Checkout.com cut ties with the exchange, citing concerns over money laundering, sanctions evasion, and other compliance issues. Binance has said they are considering legal action against the firm for breaking their contract, and claimed on August 18 that there would not be any impact to customers.24

On August 20, a customer tweeted at Binance that they were having issues withdrawing "a large amount of EUR", and the company's customer support account replied that they had "temporarily suspended EUR withdrawals and deposits". They blamed payment processor Paysafe, who decided to cut ties with the firm in late June. Binance later claimed the customer support message was sent in error, stating that Paysafe withdrawals would continue until late September as originally planned. That doesn't seem to have helped the customer in question, though.25

OpenSea

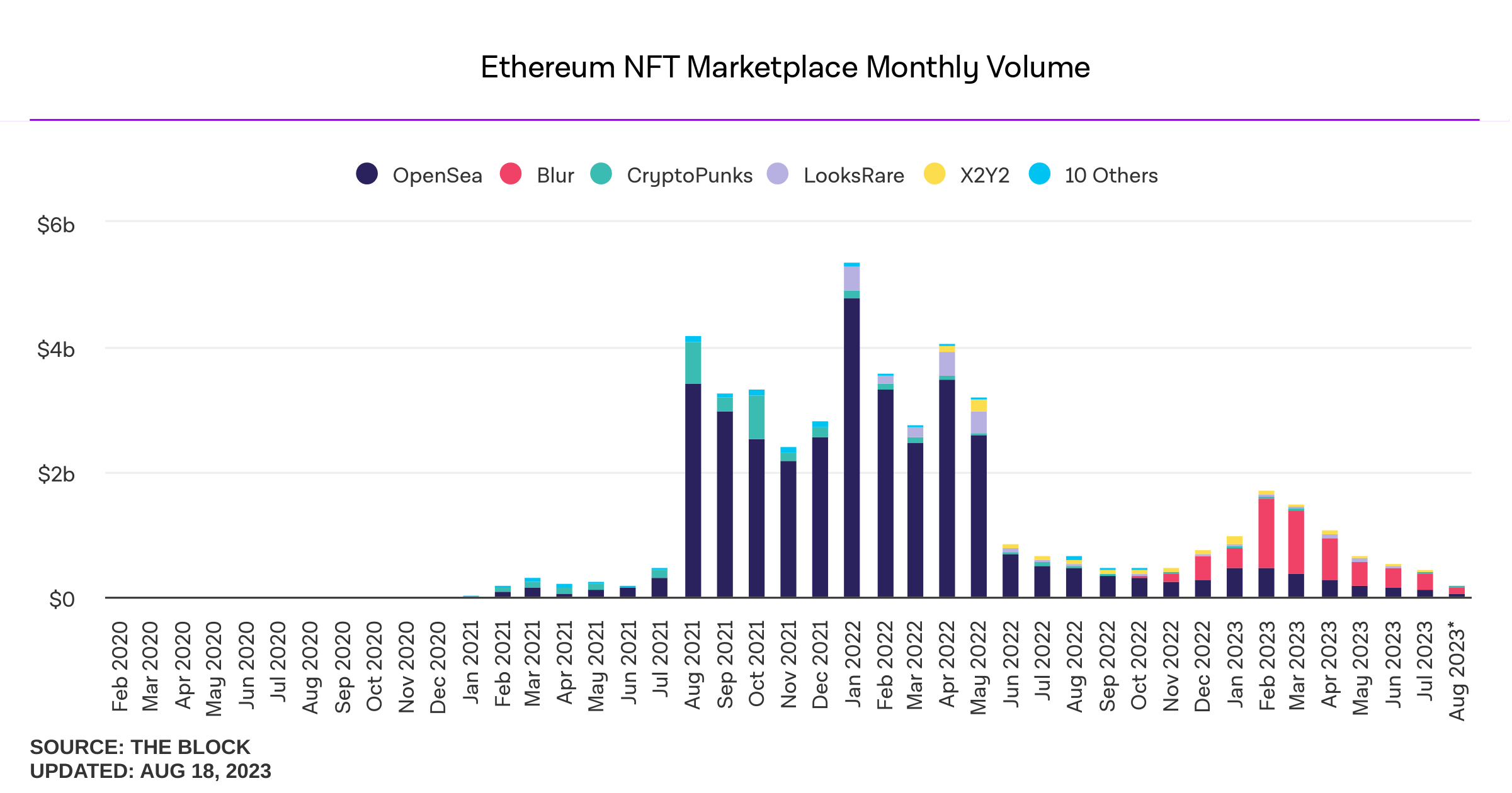

OpenSea is an NFT marketplace that once enjoyed a near monopoly on NFT sales. However, competitor Blur swept up a significant portion of market share beginning in late 2022.

Blur took the controversial step of not requiring buyers to pay the royalty fees set by the creator — that is, the ongoing fees sent to NFT creators upon each resale, which were often trumpeted as a unique boon for creators that was only made possible thanks to web3.

Now, OpenSea is joining the race to the bottom in an apparent bid to become competitive again with Blur. In a blog post, they wrote that they would be "moving to optional creator fees on OpenSea in an effort to better reflect the principles of choice and ownership that drive this decentralized ecosystem".26 I imagine their PR folks really burned the midnight oil trying to come up with that one.

Meanwhile, some NFT creators are feeling duped after being told that they'd get to earn a cut of resales forever thanks to the unique promise of blockchains, and the move by OpenSea has been widely panned in the crypto world as bad news for small creators.27 Yuga Labs (the company behind Bored Apes and other major NFT collections) has promised to block some of its smaller NFT collections from being traded on the platform in the near future as an act of protest, though Yuga is hardly the "small creator" that people are most worried about.28

New York Times boosterism

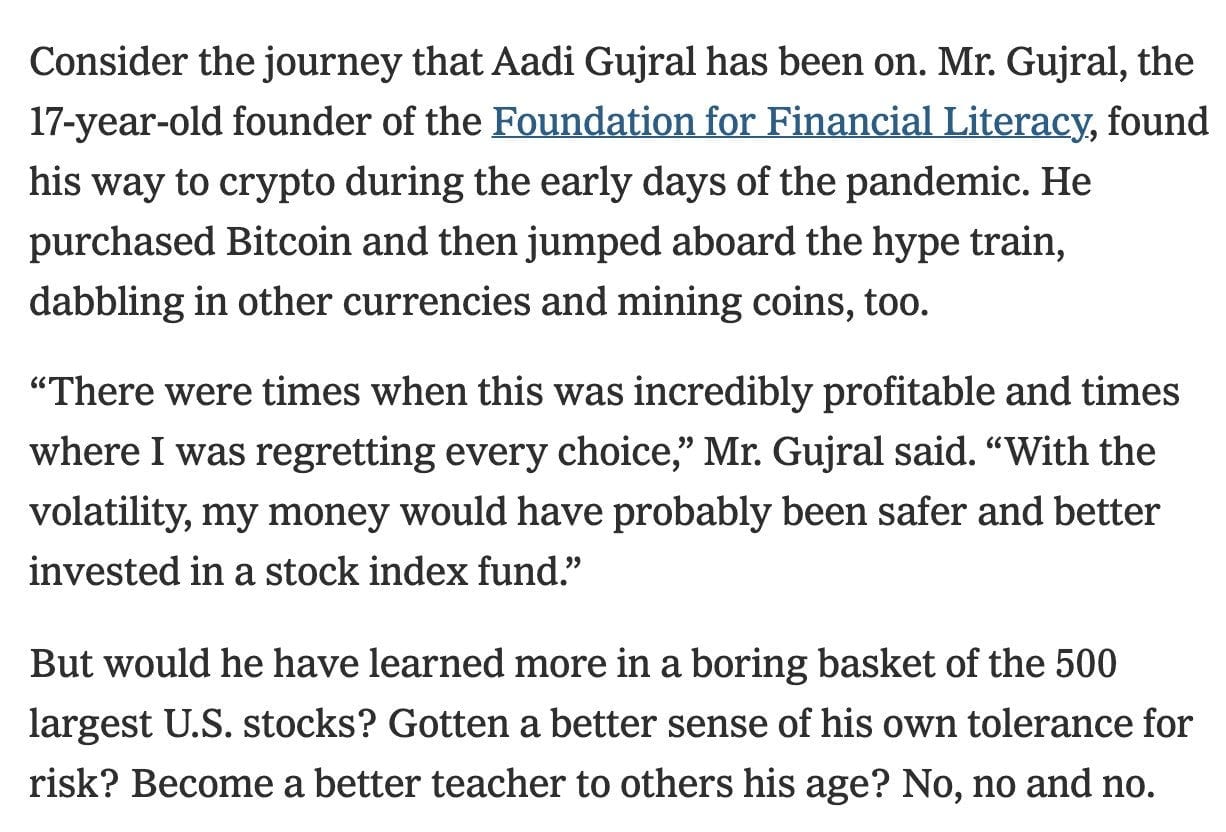

Having apparently learned nothing from the "Latecomer's Guide to Crypto" clusterfuck of March 2022, the New York Times is back to wondering if maybe 14-year-olds should try losing money in crypto for the experience of it all.

Soon, from the Times: "Would he have learned more had he not stuck a fork in an electrical outlet and experienced the searing pain of 120 volts surging through him? No."

The teenager they talk to is apparently worth interviewing because his connections want to make sure his Foundation makes it to the news by college application season he created an educational web game where you roleplay as a child selling lemonade to learn about financial responsibility.

![Game screen. Caption reads "In fact, he [Dad] is so supportive of your long-term financial goal, he's boosting your allowance by another $10.00. That's a $15.00 allowance now. Sweet!"](https://www.citationneeded.news/content/images/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https-3a-2f-2fsubstack-post-media.s3.amazonaws.com-2fpublic-2fimages-2f0532afa5-d9d1-47e1-8bfe-bcc31986b8fa_2402x1624.jpg)

By the end of the game, if you make the most optimal financial decisions, you will have earned:

- $165 from family, minus $40 in loans to repay = $125

- $140.50 from the lemonade stand, minus $90.20 in supplies = $50.30

I suppose it was generous of Mr. Gujral to bestow upon these youngsters the real secret to becoming a successful entrepreneur: make sure to have wealthy parents who can give you money.

Gitcoin

Gitcoin, a platform to crowdfund blockchain projects, has announced a partnership with Shell to save the environment.

I assume we have fallen into an alternate timeline, which regularly features headlines like:

- Nike and Nestle team up to end child labor

- U.S. Army and Palantir work together to advocate demilitarization

- Amazon and Pinkerton join forces to support trade unions

The decision has been roundly criticized by Gitcoin's supporters, leading the foundation's executive director to write a long Twitter post about how the deal used to be so much worse before he "redlined the fuck out [of] it". How reassuring.

"We, (me and the team) fucked up. We moved too quickly with our comms, didn't consider the implications and generally lent our legitimacy to an organization we shouldn't have," he wrote, before launching into another few paragraphs in which he carefully sidesteps explicitly admitting that the partnership is still going forward.29

The Web3 is Going Just Great recap

There were 11 entries between August 12 and August 20, averaging 1.2 entries per day. $17.41 million was added to the grift counter.

Shibarium gets itself into a bind

[link]

Depending on who you ask, the $1.7 million that was bridged to the brand new Shibarium network was either irrecoverably lost due to a smart contract bug, or is merely temporarily unaccessible thanks to the fabulous success of the network. Who's to say.

The blockchain, with its snicker-inducing name, is a spin-off of the Shiba Inu dog-themed memecoin, and represents an attempt to make Shiba Inu into a "serious blockchain project".

On a somewhat related note, rest in peace to Balltze (aka Cheems), a real-life Shiba Inu responsible for one of the popular meme photos that helped inspire the token.

Recur shuts down after burning through $50 million

[link]

The Recur NFT platform had a strong start: it raised $50 million in a September 2021 Series A round that saw the startup valued at $333 million. It launched a set of "Recur Passes", $300 NFTs that promised holders perks on the platform, in December 2021 — near crypto's peak. Someone paid $88,88830 in February 2022 to buy one on the secondary market.

Now, Recur is shutting down, and those Recur Passes have been reselling for around $8. Oof.

Everything else

- Harbor Protocol exploited [link]

- Crypto founder loses over $250,000 to crypto scam [link]

- Terra website hijacked by phisher [link]

- Exactly Protocol hacked for at least $12 million [link]

- Fed issues cease and desist to FTX-connected Farmington State Bank [link]

- SwirlLend rug pulls for around $460,000 [link]

- Prime Trust files for bankruptcy [link]

- RocketSwap exploited after key compromise [link]

- Zunami Protocol exploited for more than $2.1 million [link]

In the news

I'm always delighted to chat with Paris Marx, and I thought this conversation was a really good one. After catching up on why Sam Bankman-Fried is back in a jail cell, we talked about the Worldcoin project, and I got to go a lot deeper into some of my thoughts about it than a few thousand words allows.

I talked to Bobby Allyn about some of my concerns with the Worldcoin project, including the perhaps best case scenario: that they don't actually want to follow through with their dystopian plans, and are just trying to pump the token price. There was also a radio version of the story that aired on All Things Considered.

I had a chat with Paco de Leon on her personal finance-focused podcast.

A Betteridge's law headline out of Town & Country. They asked me a little bit about one-time crypto influencers fleeing to the greener pastures of the AI bubble.

Worth a read

I loved this conversation between AI researcher Timnit Gebru and Ethan Zuckerman, where they talk about AI. Among my favorite parts were their conversation about how corporations stand to benefit from the existential risk hype (and fearmongering) that has dominated the news cycle, and their conversation about the overlap between AI and the archivist professions.

Hadas Thier did a great job on this article, which serves as both an accessible overview of the events leading up to the impending FTX trial, as well as a look at where the crypto industry stands now that some of the shine has worn off.

That's all for now, folks. Until next time,

– Molly White

Footnotes

Or at least for those unwilling or unable to skirt offshore exchanges' often cursory attempts to exclude US customers. ↩

References

"BNB Chain Exploiter Liquidated for $30M on Venus Protocol", CoinDesk. ↩

"Bitcoin Calm Shatters With Sudden Tumble, Mass Liquidations", Bloomberg. ↩

Letter filed on August 18, 2023. Document #209 in United States v. Bankman-Fried. ↩

Letter filed on August 18, 2023. Document #210 in United States v. Bankman-Fried. ↩

Sam Bankman-Fried's motions in limine filed on August 14, 2023. Document #204 in United States v. Bankman Fried. ↩

The government's motions in limine filed on August 14, 2023. Document #204 in United States v. Bankman Fried. ↩

Letter motion filed on August 18, 2023. Document #211 in United States v. Bankman-Fried. ↩

Motion for protective order filed on August 14, 2023. Document #95 in Securities and Exchange Commission v. Binance Holdings Ltd. ↩

This reminds me of all the coiners who argued that the Wikimedia Foundation should never have stopped accepting cryptocurrency donations in 2022, because they would have donated their crypto to the project (despite not having done so for the eight years or so that that was an option). ↩

Order filed on August 17, 2023. Document #94 in Joseph Van Loon v. Department of the Treasury. ↩

"SEC Can Try to Appeal Groundbreaking XRP Ruling, Judge Rules", Coinbase. ↩

Reply memorandum of law in support of motion filed on August 18, 2023. Document #42 in Securities and Exchange Commission v. Genesis Global Capital, LLC and Gemini Trust Company, LLC. ↩

Declaration of John J. Ray III in Support of Debtors' Motion for Entry of an Order (A) Authorizing the Debtors to Enter into Settlement Agreement with the Genesis Entities, (B) Approving the Settlement Agreement, and (C) Granting Related Relief filed on August 16, 2023. Document #2191 in In re: FTX Trading, Ltd. ↩

"[T]he new DCG <> Genesis DOJ investigation" refers to reports that federal prosecutors are actively investigating transfers between Digital Currency Group (DCG) and its Genesis subsidiary. ↩

"Circle Criticizes Crypto Firms That 'Counterfeit US Dollars'", Bloomberg. ↩

"Coinbase secures approval to offer crypto futures to US retail investors", Financial Times. ↩

"PayPal Confirms It Is 'Pausing' Crypto Purchases for UK Customers", Decrypt. ↩

VARA Notice of Fines – OPNX Exchange. August 15, 2023. ↩

"Parliament forms Committee to investigate Worldcoin project", The Star. ↩

"Payment Processor Checkout.com Drops Binance Over Money Laundering, Compliance Concerns", Forbes. ↩

"Binance limits withdrawals in Europe, cites payment processor issues", CoinTelegraph. ↩

"Changes to creator fees on OpenSea", OpenSea. ↩

"A key feature of NFTs has completely broken", The Verge. ↩

"Bored Ape Yacht Club creator to block OpenSea in fight over payments", The Verge. ↩