Issue 51 – It's quiet... too quiet

It's been a quiet few weeks in the world of crypto disasters... too quiet.

This is by far the lowest rate of Web3 is Going Just Great entries per day I have ever seen, an entry roughly every three days. I gave it two weeks between recap issues to see if maybe something would finally happen, but there have been only four incidents in the crypto world during that time.a

Don't get me wrong: it's very good news that there have been few incidents these past two weeks, since it hopefully means less harm to those who choose to engage with this industry.

However, with the bitcoin price on a tear lately (briefly surpassing $50,000 on Monday, then again today) and other crypto prices following, there's likely to be renewed interest among attackers as the assets they target can now be sold for more money.

Should these prices continue, it's likely to drive more interest in the space from laypeople who had previously not taken an interest in crypto, like what we saw in 2020 and 2021 — although now, in its search for new retail money, the industry is fighting against would-be investors' recent memory of collapses and catastrophes in 2022, many of which made international headlines.b While bitcoin has not yet regained the $60,000+ highs it saw at its peak in November 2021, it's certainly gotten a lot closer to it in recent months than it had during the nearly two years of what people have been calling the "crypto winter".

From looking at past periods of high crypto prices, there's often a delay between price spikes and the sort of mass mania that often follows, but I for one am bracing myself. And we're certainly seeing the marketing efforts out of the cryptocurrency industry to try to come up with the new story to tell, to try to convince people that really, finally, now is why you should care about crypto. Chris Dixon's recent Read Write Own book (and the enormous marketing efforts put behind it by his Andreessen Horowitz employer, including apparently gaming the New York Times bestseller list1) are a recent example.

But in this downtime, I've been enjoying the time to read, write, code,c and think about more pleasant things, like the kind of web I do want to see and how I can shift my own online life so that I both experience and model more of that. More writing on that soon.

In the courts

Readers of this newsletter may or may not be familiar with Craig Wright, the creator of the bitcoin fork "Bitcoin SV", who has claimed for years that he is also the creator of the original bitcoin — that is, Satoshi Nakamoto. He's sued or threatened to sue a whole bunch of people who've said he's a liar, including Vitalik Buterin and a guy called "Hodlnaut".d Personally, I don't think he's remotely credible, and I really hate when people fling around bogus defamation lawsuits to try to stifle speech, so I mostly try not to give him any more attention. However, he's been in court in the UK over the past week or so, defending his claims. It's kind of an odd case, because the whole thing is mostly focused on establishing that Wright is not Satoshi. The lawsuit is funded by a group called COPA, which is backed by Twitter founder Jack Dorsey and lists Coinbase, Meta, and MicroStrategy among its members.2 They argue that Wright's litigiousness is stifling work on bitcoin, because he keeps filing intellectual property lawsuits against developers. For people who enjoy a good legal drama, this might be up your alley. There are claims of forged documents, destroyed hard drives, and "industrial scale" fraud by Wright. The case doesn't seem to be going well for him, with opposing counsel at one point saying to Wright, "This is just another fairy story, isn’t it?"3

Sam Bankman-Fried's new legal team has thrown a bit of a wrench in things. As I noted two issues ago, the lawyers from Mukasey Young are also representing Alex Mashinsky in his crypto fraud trial. The Department of Justice is worried about potential conflicts of interest as a result, and has requested Curcio hearings in both cases to allow Bankman-Fried and Mashinsky to acknowledge that they are aware of the potential conflicts and waive their rights to conflict-free representation. The government doesn't think the potential conflict of interest is so severe that the lawyers will need to be disqualified (though that is ultimately up to the court), but they're covering their bases so that one or both of the defendants can't come back and appeal on this basis.45

The New York Attorney General now wants $3 billion in restitution from Digital Currency Group and its affiliates, instead of the $1 billion they originally sought in the fraud lawsuit filed in October 2023 [I42]. "The fraud and deceit were so expansive that many additional people have come forward to report similar harm," says the amended complaint.6

Do Kwon's still in Montenegro after yet another hiccup.e First he was going to be extradited, then he wasn't, then he was, then there was all this back and forth around where he would be extradited to, and now the extradition has been revoked for a second time.7 When the judge overseeing the case against him from the US SEC okayed a delay to hopefully allow Kwon to participate in his case, he was wise to note that he would not grant indefinite extensions even in the event that Kwon is still stuck in Montenegro by the new court date rolls around in March [I49]. Kwon's partner in crime, Han Chang-joon, the former CFO of Terraform Labs who was arrested along with him in Montenegro for the same document forgery charges, has just been extradited. He is now in the custody of South Korean authorities. I don't believe the US sought his extradition, so that probably simplified things.8

Speaking of South Korea, authorities there have arrested three executives of Haru Invest, reportedly including its CEO.9 Things seem to be ramping up in that investigation; last issue, I noted that an arrest warrant had been issued for a key figure involved with Haru's counterparty, B&S Holdings [I50].

Ryder Ripps and his codefendant are appealing the final judgment in the Yuga Labs v. Ripps case, which orders them to pay $1.38 million in disgorgement, $200,000 in damages, and around $7 million in Yuga Labs' attorneys' fees.10 I wonder how much they've had to pay their own lawyers so far... Still, additional fees for an appeal will be well worth it if they have any chance of achieving a reduction to that whopping ~$9 million they owe (though I don't know what their odds look like).

In bankruptcies

John Reed Stark, the crypto-critical former chief of the SEC's Office of Internet Enforcement, has some choice words for the lawyers overseeing FTX's bankruptcy. "The FTX bankruptcy team’s lawyers should send thank you notes to all FTX customers. Why? Because thanks to the FTX customers, each member of the FTX legal bankruptcy team can now probably afford to buy a new beach house in 2024." He writes that the FTX liquidation was the obvious outcome, and that all the talk of reorganizing or restarting the FTX exchange just wasted massive amounts of money that went to legal fees instead of FTX creditors.11

FTX creditors' displeasure at the firm's attempt to repay them at a price-per-bitcoin of $16,871 has materialized into an adversary lawsuit.12

Genesis is seeking approval to sell $1.6 billion worth of crypto assets held in Grayscale's various trust products. Some are worried that such a massive sale could have an adverse impact on prices.13

In governments and regulators

The United Nations has reportedly been working on an investigation into North Korea's state-sponsored cyberattacks on cryptocurrency firms, which have netted around $3 billion in the last six years. These groups have been linked to profitable hacks including the $625 million theft from the Axie Infinity blockchain bridge [W3IGG], the roughly $100 million theft from the Harmony blockchain bridge [W3IGG], and more than $100 million in thefts from the users of the Atomic Wallet software [W3IGG]. According to Reuters, the report will come out in the next month or so, and will outline how the profits of these attacks have funded North Korea's nuclear weapons program.14

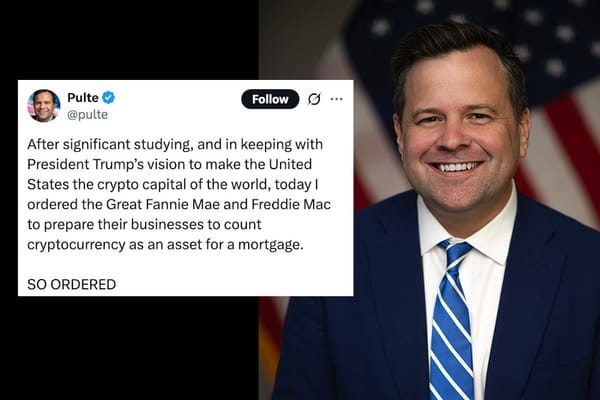

That Fairshake super PAC (funded by Coinbase, Andreessen Horowitz, and others [I47]) has just spent around $2 million of the $80 million in its war chest on attack ads against California Senate candidate, Democrat Katie Porter. The ad attacks Porter for receiving three contributions of $500, $2,000, and $2,900 from individuals who are executives at a pharmaceutical company, oil company, and bank (respectively), and claim she has received more than $100,000 in such contributions from "Big Pharma, Big Oil, and the Big Bank executives". The irony of Big Crypto spending 20x this amount on an attack ad is, apparently, lost on them.

(via Twitter)

Why the crypto super PAC sees Porter as such a threat is not immediately clear, as during her time in the House of Representatives, she hasn't been terribly outspoken about crypto. It may have less to do with her own views on the topic, and more to do with her close allyship with Elizabeth Warren, who has earned a name as one of the most anti-crypto people in Washington.15 Or, it could be nothing to do with Porter, and instead an attempt to support her opponent, Democrat Adam Schiff. Schiff has a statement in his platform positions about supporting "the forefront of new developments in technology, from Web3 and quantum computing to cryptocurrency and blockchain technology" and making sure "that these companies and jobs stay here and grow here, and that the United States remains the global leader in these important new technologies."16

The TradeStation Crypto platform has settled with the US SEC and a slew of state regulators over allegations that they had failed to register their interest-bearing lending product. TradeStation will pay $3 million in penalties, to be split among the regulatory agencies. The company had stopped offering its products in the US in February 2023.17

Thailand's SEC has filed charges against the former CEO of Zipmex, who they allege committed fraud by making false statements and concealing information from the public. Zipmex was ordered to suspend services in Thailand after the SEC discovered assets had been transferred out of the country before customers were informed.18

Elsewhere in crypto

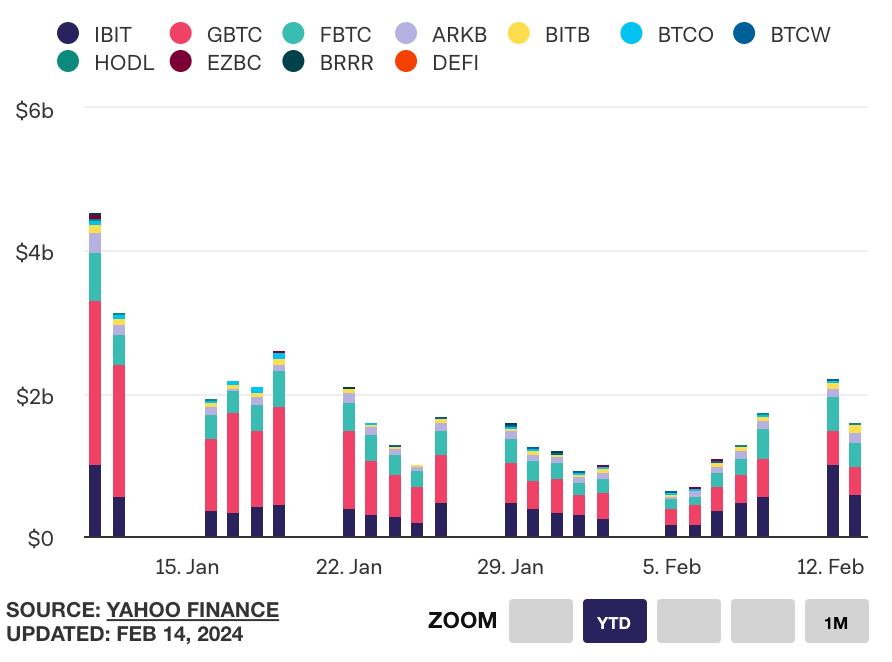

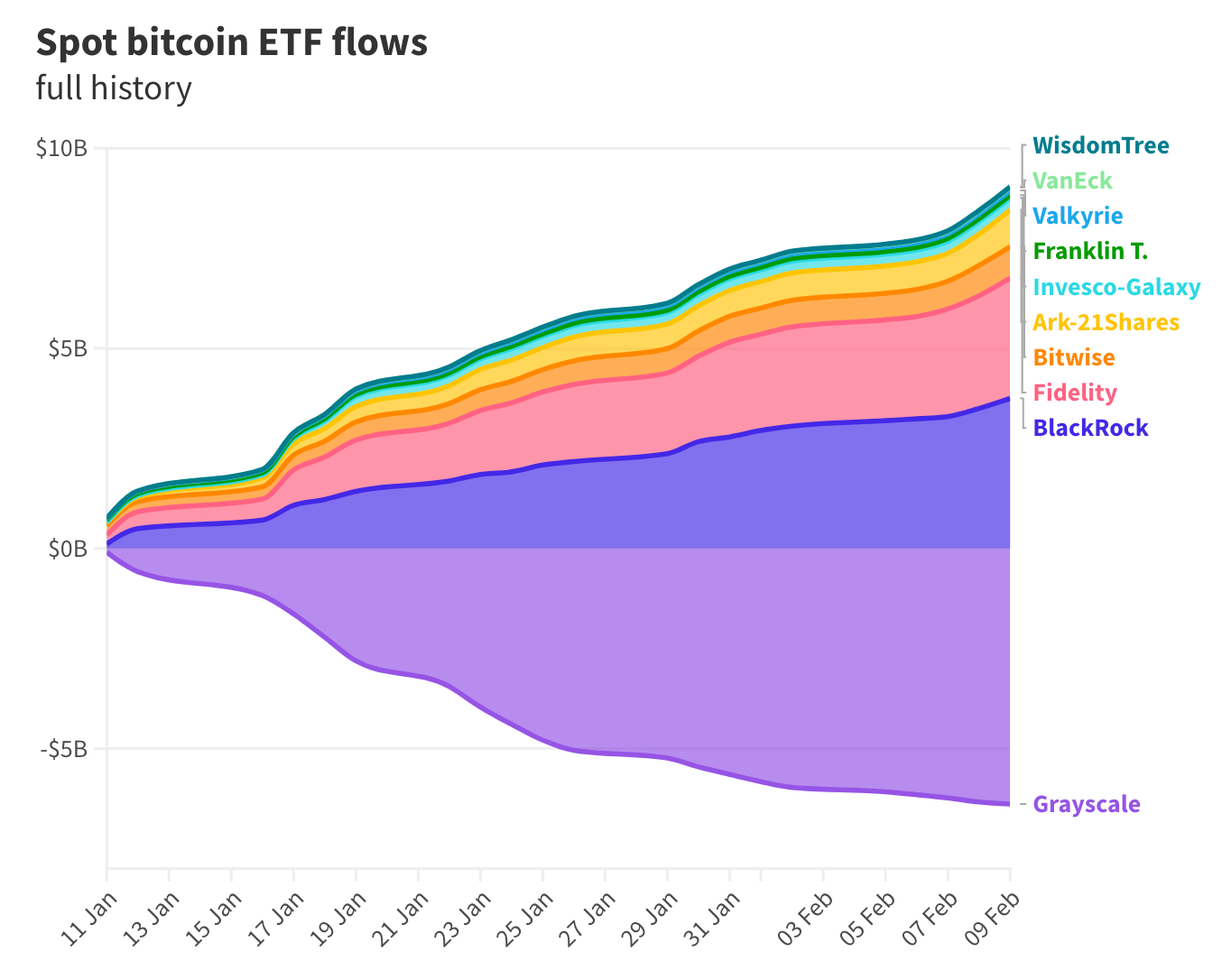

We now have about a month of data since the launch of spot bitcoin ETPs.

Spot bitcoin ETF volumes (via The Block and Yahoo! Finance); spot bitcoin ETF flows (via BlockWorks and BitMEX research)

The first chart shows absolute flows (combining both in- and outflows); the second gives a better picture of how much of this volume has been money flowing into the ETPs versus out of the Grayscale Bitcoin Trust. I'll be curious to see how interest in the ETPs continues over future months, and how net flows will look now that all that GBTC dumping is leveling out a bit.

Bakkt is a crypto platform that launched in 2018, and has enjoyed advertising that it is majority owned by the same company that owns the New York Stock Exchange. Part of their launch marketing included a partnership with Starbucks, where they promised to try make it easier to buy coffee with bitcoin.19 Over five years later, they don't seem to have made much progress on that front. Now, an SEC filing has people even more worried than they already were over Bakkt's quarter after quarter of reported losses. "Subsequent to [previous filings], we have determined that we do not believe that our cash and restricted cash are sufficient to fund our operations for the 12 months following the date of this Amended Form 10-Q," they write, adding that if they are unable to increase revenues or raise additional capital, they may not be able to continue to operate.20

The Web3 is Going Just Great recap

There were 4 entries between February 2 and February 14, averaging 0.3 entries per day. $41.1 million was added to the grift counter.

PlayDapp reminds us of the importance of distinguishing between actual value and notional value

The South Korean blockchain gaming platform PlayDapp was exploited by an attacker who was able to grant themselves the ability to mint new PLA tokens. They minted 200 million tokens, notionally priced at around $36.5 million. However, with only 577 million PLA in circulation, the likely value they actually would have been able to obtain for these tokens was substantially lower.

This was even more the case when they came back a few days later and minted another 1.59 billion PLA. Despite the fact that this was almost 3× the number of tokens that had ever been issued, several news outlets reported a "$290 million hack", even though actual losses were probably a tenth of that at most. Hats off to Bleeping Computer, which updated their article and headline later on to clarify this point.

Yuga Labs botches another NFT release

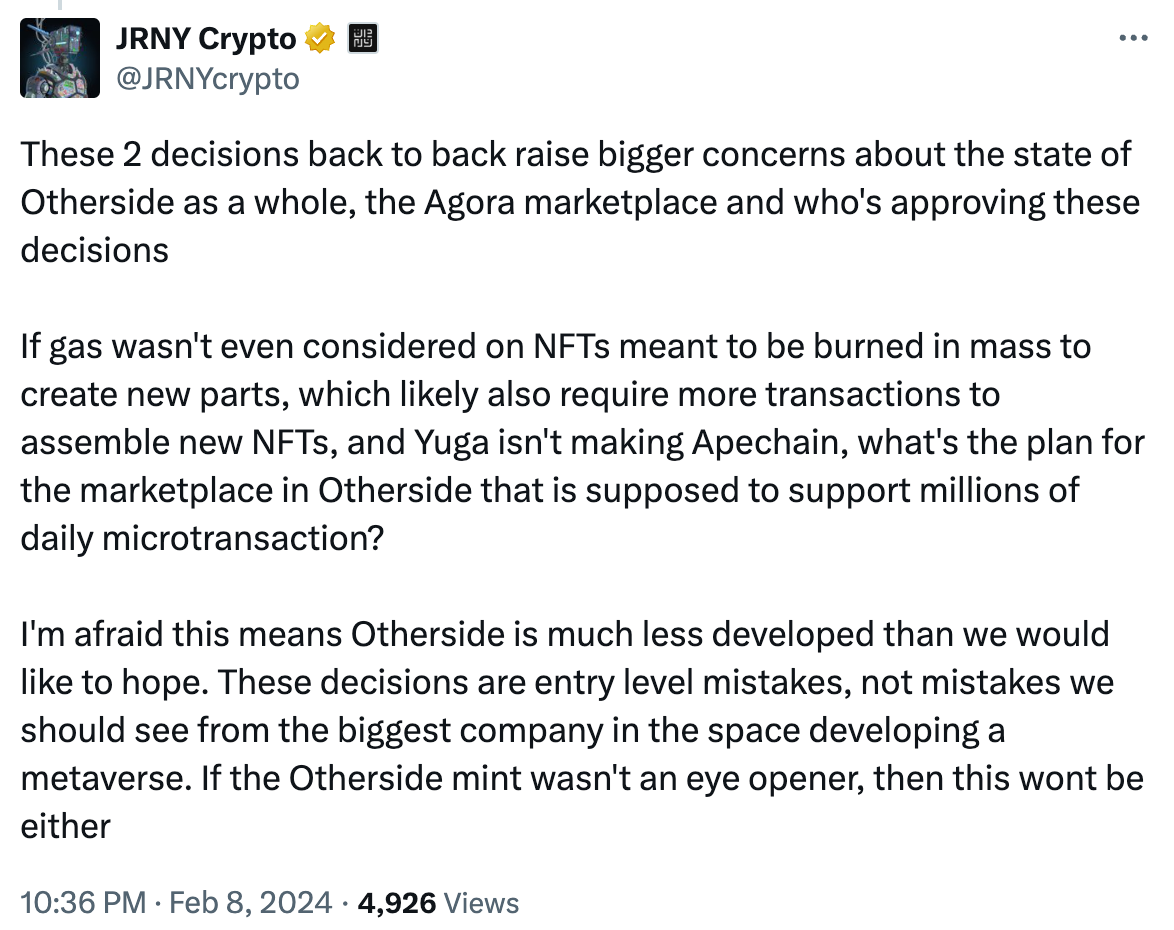

Some fans of Yuga Labs (the company behind Bored Apes and the much-anticipated Otherside metaverse gaming project) are questioning how much progress the company can really have made on the as-yet-unreleased flagship Otherside gaming project, if they managed to screw up an NFT design this badly.

Yuga released a new NFT, intending to function as ship parts that could be combined to create a ship to be used in the game. Players who had completed an Otherside minigame would be eligible to mint these NFTs for free. However, the "free" NFT cost around $30 in gas fees to mint. Worse still, the parts were meant to be repeatedly traded and combined to make new parts and ships, leading fans to wonder why on earth they decided to release the project on a blockchain where each transaction often costs tens of dollars.

Apparently realizing they'd made a mistake, Yuga first responded by announcing they would gift people free "Catalyst" NFTs to make it up to them. This only sparked further outrage, though, as it was seen to dilute the value of the Catalyst NFTs and throw off incentives. Yuga later reversed course on this decision, instead deciding to reimburse the gas fees.

This was not Yuga Labs' first gas-related fiasco, after they caused gas fees to spike into the thousands of dollars across the entire Ethereum network in April 2022 during the initial Otherside land sale [W3IGG].

Everything else

Worth a read

I don't know how I missed this when it was originally published a month ago, especially since several blogs I read published responses to it, but alas. Better late than never. This is a great post on how, as we preach about the value of controlling your little corner of the web, we need to make it extremely straightforward to do so. When you start saying the words npm install you've gone too far.

Cory Doctorow elaborates on his idea of "enshittification", and tells us why we should care about it and why we need to join the disenshittification coalition. I'm a card-carrying member.

Charley Johnson (of the Untangled newsletter) wrote a tiny book on crypto. The "untangling" in this case focuses more on things like the systems of power and the ideologies behind crypto, which are arguably more important to untangle than just going into another technical explanation of how blockchains work.

In the news

I spoke with Emily Nicolle over at Bloomberg for her article about how people who didn't buy crypto over the past few years shouldn't feel too much FOMO now that prices are back up, given the fairly substantial chance they'd have lost it to one collapse or another. I'm quoted talking about how, even if you try to diversify your crypto holdings across multiple projects and platforms, you can still be subject to a ton of undisclosed counterparty risk.

I chatted with Bradley Tusk on his Firewall podcast about Wikipedia. I love talking about Wikipedia. We also got a little bit into conversations around overhyped technologies including crypto and the metaverse.

I loaned my Github spelunking skills to Aleks Gilbert over at DL News, who was trying to determine if company A stole publicly visible but not necessarily open source code from company B — or vice versa. Still not 100% clear, but I have a pretty good guess. Personally, I think projects should just stop using licenses like the BSL, but that's a conversation for a different soapbox.

That's all for now, folks. Until next time,

– Molly White

Correction: It was opposing counsel, not the judge, who told Craig Wright "This is just another fairy story, isn’t it?"

Footnotes

At the time of writing, at least. Things regularly come to light after the fact, and I backfill W3IGG when that happens. ↩

Unfortunately, memories seem to be short. The 2014 Mt. Gox collapse didn't stop a 2017 crypto boom, for example. ↩

Not the name of my book. ↩

Not to be confused with the collapsed Hodlnaut platform [W3IGG], the Hodlnaut that Wright sued is an individual with no connection. ↩

I initially wrote that Kwon was "getting jerked around" by Montenegrin courts, but that seems unfair given that the battle that has been keeping him in custody there has largely been thanks to his attorneys, who have twice appealed the extradition decision. ↩

References

"How Tech Firms Made a Crypto-Boosting Book an NYT Best Seller by Gaming the System", Vice. ↩

"London High Court hears allegations of Craig Wright’s forgeries", Protos. ↩

"The Puzzling Testimony of Craig Wright, Self-Styled Inventor of Bitcoin", Wired. ↩

Letter filed on February 6, 2024. Document #45 in US v. Mashinsky. ↩

Letter filed on February 6, 2024. Document #397 in US v. Bankman-Fried. ↩

Amended complaint filed on February 9, 2024. Document #17 in The People of the State of New York v. Gemini Trust Company, Genesis Global Holdco, Digital Currency Group, Soichiro Moro, and Barry Silbert. ↩

"Do Kwon’s extradition revoked again, granted appeal by Montenegro court", The Block. ↩

"Former Terraform Labs CFO Han Chang-joon Extradited to South Korea by Montenegro", CoinDesk. ↩

"Haru Invest Execs Arrested in South Korea for Allegedly Stealing $828M Worth of Crypto: Report", CoinDesk. ↩

Notice of appeal filed on February 12, 2024. Document #456 in Yuga Labs v. Ripps. ↩

Tweet by John Reed Stark. (Non-Twitter mirror). ↩

Adversary case 24-50012 filed on January 31, 2024. Document #6863 in In re: FTX Trading Ltd. ↩

"Genesis Seeks Approval to Sell $1.6B in Bitcoin, Ether Trust Holdings", CoinDesk. ↩

"Exclusive: UN experts investigate 58 cyberattacks worth $3 bln by North Korea", Reuters. ↩

"Crypto PAC Jumps Into Senate Race, Opposing Katie Porter in California", The New York Times. ↩

"Adam's Plans for the Senate: Affordability Agenda", Adam Schiff for Senate. ↩

"TradeStation Crypto settles charges by SEC, 26 states over asset lending", Cointelegraph. ↩

"Thai SEC Files Charges Against Former Zipmex Thailand CEO", CryptoPotato. ↩

"Buying Your Starbucks Fix With Bitcoin Is Now Closer to Reality", Bloomberg. ↩

Form 10-Q/A filed by Bakkt Holdings, Inc. ↩