Issue 52 – I am Sam's low-level culpability

Bitcoin prices are spiking. Are we in for another round of crypto mania? Also, Sam Bankman-Fried doesn't want to go to jail for 100 years.

Bitcoin's still on a tear, yesterday surpassing the $60,000 mark. Recall that the all-time high for Bitcoin is around $69,000 — achieved in November 2021 at the peak of crypto mania — so we're approaching those levels again. Other cryptocurrencies are following similarly upwards trends.

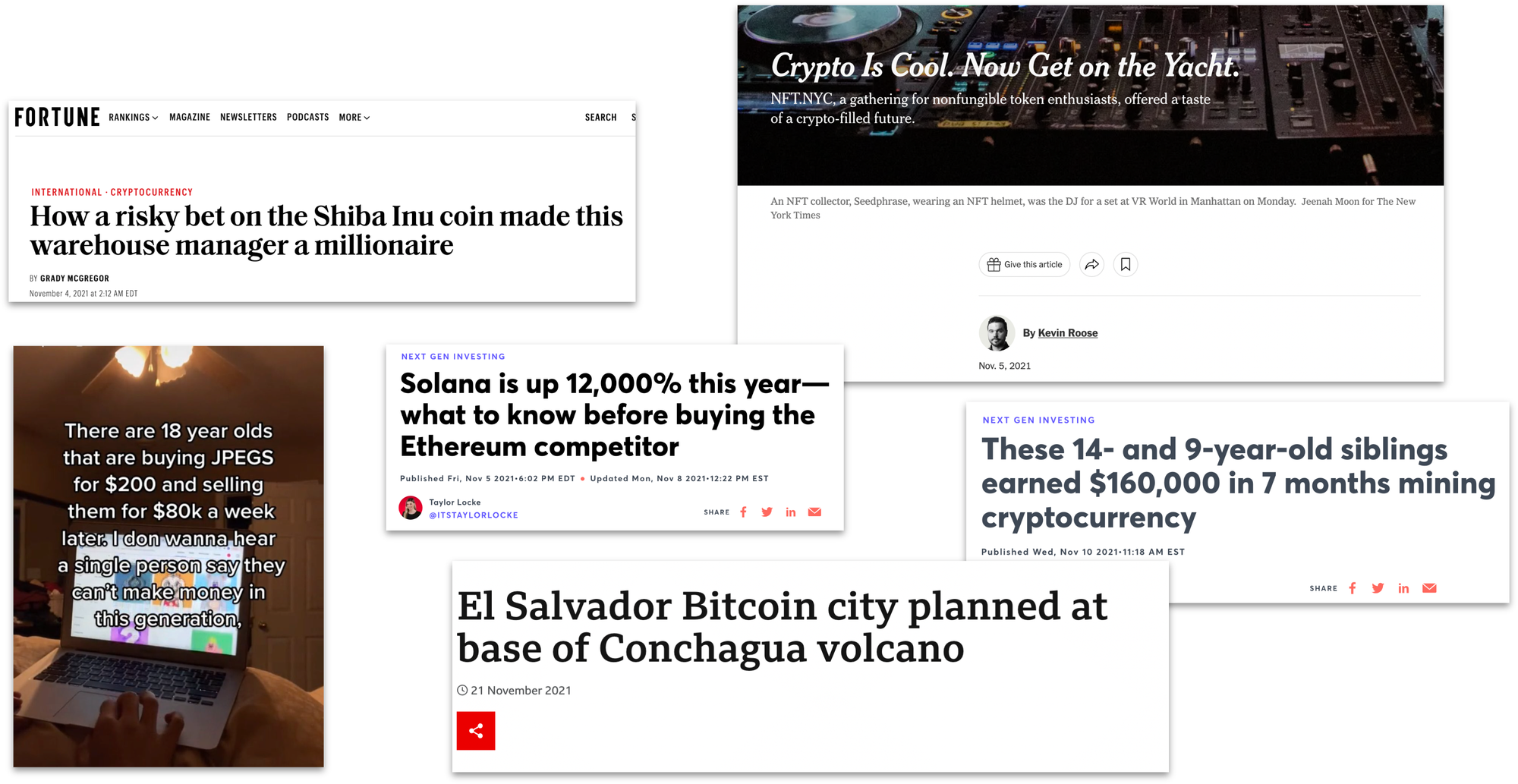

But things feel very different this time around. Here's a glimpse of headlines from around Bitcoin's last peak, from publications including The New York Times, Fortune, CNBC, and others.

That was right around when I started Web3 is Going Just Great, largely out of frustration at mainstream media outlets like these, which were only adding to the hype and encouraging average people to put their money into an extremely risky, speculative asset. An asset that would go on to lose around 75% of its value over the next year.

Now, the only mention of cryptocurrency in the New York Times is describing Sam Bankman-Fried's hope that he'll be sentenced to only six years in prison.

As I mentioned last issue, there's probably some delay between price spikes and breathless media coverage. But I am very interested to be able to look back on this moment in a year or two and compare it to the previous price highs: will the mania reach similar (or worse) levels? Or has the crypto industry exhausted the narratives they came up with a few years ago (web3! NFTs to help artists earn a living! tokenized real world assets! really own the items you buy in video games!) and failed to come up with new ones to drive a similar spike? "Web3? isn't that thing all these AI grifters were talking about two years ago?"

Meanwhile, the failures of 2022 are still very fresh in people's minds, with high-profile collapses like FTX and Celsius all continuing to play out in bankruptcy and criminal courts. Journalists who were burned by reporting uncritically on the industry might be less likely to fall for the same PR pitches.a

The number is going up, but the crypto industry,b regulators, and legislators alike have yet to meaningfully fix any of the massive issues that have plagued the sector. Buckle up.

In the courts

FTX

Sam Bankman-Fried's sentencing is coming up in a month. He has now formally swapped out Mark Cohen and the rest of his rather unimpressive defense team for Mukasey Young [I49]. Concerns over potential conflicts of interest stemming from their simultaneous representation of Celsius's Alex Mashinsky have been formally acknowledged by both Bankman-Fried and Mashinsky, and both have waived the potential conflicts. It seems Mukasey Young is mostly focusing on Bankman-Fried's sentencing, because he's hired a separate attorney — former prosecutor Alexandra Shapiro — to focus on his inevitable post-sentence appeal.

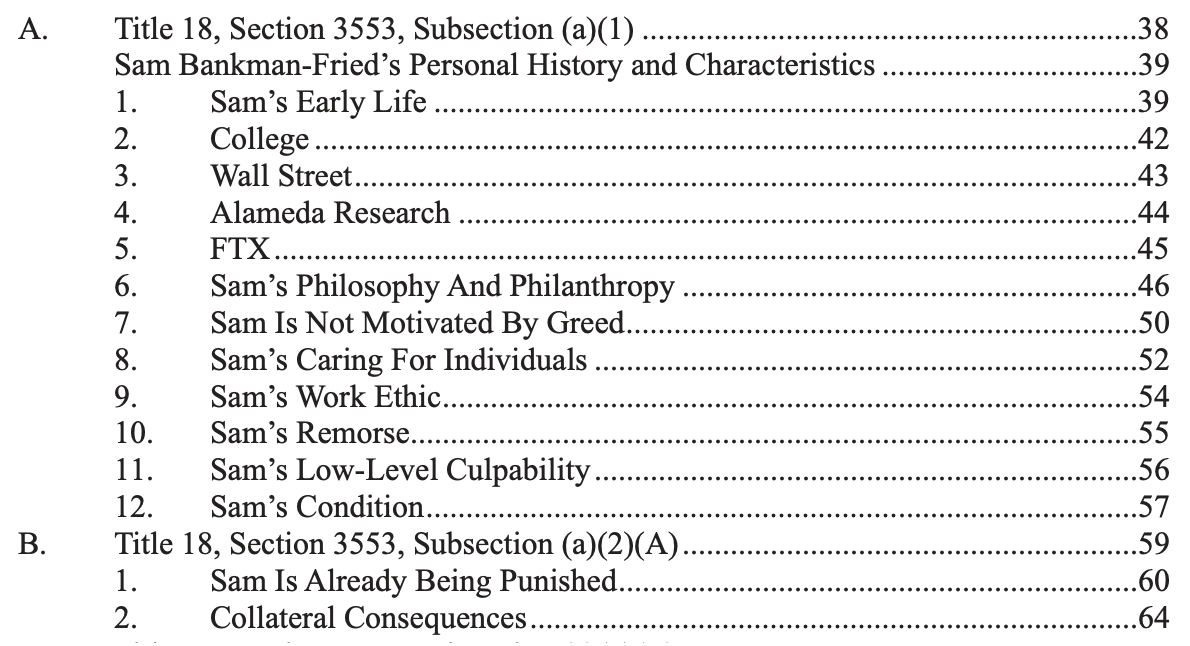

Mukasey and team have been busy on the sentencing side of things, on February 27 filing a 100-page-long sentencing memorandum that ends with a request that Bankman-Fried be sentenced to only 63–78 months imprisonment (5½ to 6½ years).1 The filing contains a long rebuttal to the as-yet-unfiled pre-sentencing report, which Bankman-Fried's legal team says recommends he serve 100 years in prison. They describe such a sentence as "grotesque" and "barbaric", and the kind that should be reserved only for "heinous conduct" like mass murder.

The filing also contains a glowing description of Bankman-Fried, starting at his early life, with headings like "Sam Is Not Motivated By Greed," "Sam's Caring For Individuals", and "Sam's Remorse".

A final section on "Sam's Condition" outlines Bankman-Fried's neurodiversity, and says that he has already been suffering in jail as a result of harassment from other inmates, poor food options as a result of his vegan diet, and the generally grim conditions of MDC Brooklyn. Much of this comes from a letter submitted by a fellow inmate,c which his counsel references heavily.

In total, the filing attaches 29 letters in support from:

| # | Name | Relationship |

|---|---|---|

| A-1 | David Arfin | Parent of childhood friend |

| A-2 | Joseph Bankman | Father |

| A-3 | Gabriel Bankman-Fried | Brother |

| A-4 | Michele Barry | Stanford Dean for Global Health, donation recipient |

| A-5 | Stephen P. Boyd | Stanford Professor of Electrical Engineering, friend of SBF's parents |

| A-6 | Jeremy Brest | Managing director of Framework Capital, corporate financial advisor to a company that wanted to acquire FTX assets after bankruptcy |

| A-7 | Paul Brest | Stanford Professor Emeritus of Philosophy, former dean of Stanford Law School, and friend of SBF's parents |

| A-8 | Madeline Chaleff | Parent of childhood friend |

| A-9 | Daniel Chapsky | Former FTX Head of Data Science |

| A-10 | Edward Dodds | Friend, fellow effective altruist |

| A-11 | Louis Dron | Donation recipient |

| A-12 | Mark Dybul | Georgetown Professor of Medicine, Interim Chairperson at Purpose Africa. Spoke to Bankman-Fried about pandemic prevention at a workshop |

| A-13 | Jamie Forrest | Executive Advisor at Purpose Africa who spoke to Bankman-Fried about a pandemic resesarch proposal. |

| A-14 | Barbara Fried | Mother |

| A-15 | Wayne Hsiung | Animal rights activist |

| A-16 | George Lerner | Former FTX company therapist, personal psychiatrist to Bankman-Fried |

| A-17 | Barbara Levitt | Parent of childhood friend |

| A-18 | Judy Mark | Disability rights advocate and autism expert |

| A-19 | Barbara Miller | Aunt |

| A-20 | Edward Mills | McMaster University Professor of Health Sciences, COVID-19 clinical researcher who sought funding from Bankman-Fried |

| A-21 | Hassan M. Minhas | Clinical psychiatrist who evaluated Bankman-Fried in July 2023 at the request of his defense team |

| A-22 | Matthew Nass | Childhood friend |

| A-23 | David Pearce | Effective altruist |

| A-24 | Ross Rheingans-Yoo | Friend, FTX Foundation employee, and fellow effective altruist |

| A-25 | Carmine Simpson | Fellow inmate at MDC Brooklyn, former NYC police officer charged with sexual exploitation of minors |

| A-26 | Douglas Slemmer | Someone who had business dealings with Bankman-Fried |

| A-27 | Natalie Tien | Former Head of Communications at FTX and Executive Assistant to Bankman-Fried |

| A-28 | Francois Venter | University of the Witwatersrand Professor who sought funding for clinical trials in Africa |

| A-29 | Kat Woods | Victim of FTX collapse who lost "most of what [they] had" |

Bankman-Fried's veganism comes up... a lot. Like a lot. In this sort of "ah, well your honor, I know he committed one of the largest financial crimes in history, but have you considered that he is a vegan?" way. One fellow effective altruist and vegan, David Pearce, writes of Bankman-Fried's veganism: "here we have a person who (literally) wouldn't hurt a fly incarcerated in a place that wasn't built for folk with such soft hearts".d I actually found myself looking up if Judge Lewis Kaplan is himself vegan, because it's so (excuse my phrasing) hamfisted that I wondered if it was an attempt to appeal to a bias of his.e My guess is that so many of the letter-writers are effective altruists and vegans themselves that they see it as an impeccable testament to his character, and don't realize others don't necessarily assign it the same moral value. That, or they realize that "vegan" is a convenient way to signal "white, wealthy, and well-connected" without having to say it. Probably both.

Another weird thing I noticed: in her letter, Barbara Fried writes of her son's empathy: "To this day, Sam is the first person we would call if we needed an angel of mercy in a pinch." This is a wild thing to say, given the term's common usage. Thanks mom!

Moving past Bankman-Fried, the sentencing hearing for Ryan Salame, former co-CEO of the Bahamian FTX entity, has been scheduled for May 1. It's the first sentencing hearing for any of the four co-conspirators who pleaded guilty, and Salame was the only one not to cooperate with the investigation. He faces up to ten years in prison, and is already forfeiting over a billion dollars.2

Binance

A judge has signed off on the record $4.3 billion judgment against Binance.

Prosecutors want former CEO Changpeng Zhao to surrender his passport and be subjected to various other modifications to his bond conditions. Zhao says he's willing to accept the terms "with limited exception", but is annoyed that the prosecutors might be giving the impression that he's done something wrong to necessitate the changes.3

Binance is evaluating potential nominees for the monitorship role, and Sullivan & Cromwell is apparently on the shortlist.4 Sullivan & Cromwell has provided legal services to FTX both pre- and post-collapse, and have been paid more than $180 million for their bankruptcy work alone. Now they're positioned for another windfall.

Nigeria's Department of State Security detained at least two employees of the company in Abuja, in connection with an investigation into the company's operations in the country. One detained employee is an American citizen, the other British. The action seems related to the country's recent crackdown on Binance's local presence, which they say has facilitated $26 billion in transfers "from sources and users who we cannot adequately identify."5

Elsewhere

The "Craig Wright isn't Satoshi" case [I51] continues on, and accusations of forgery are flying. COPA says Wright forged a whole bunch of documents purporting to prove that he's Satoshi Nakamoto. Now Wright's own lawyers have raised concerns that some of the emails they submitted as evidence could be forged. Wright says any forgeries are attempts by his enemies to frame him as a liar, which does seem rather like the sort of thing a forger might say. CoinDesk's Daniel Kuhn has nailed the general vibe around this case with the headline "Stupid Things Craig Wright Said in His Latest Stupid Trial". Their coverage of the case has been good, as has Protos's, and I thank them both for paying attention to it so I don't have to.

Ilya Lichtenstein, arrested in February 2022 for his involvement in the 2016 Bitfinex hack, is now cooperating as a government witness in a case against Roman Sterlingov, operator of the Bitcoin Fog crypto tumbler. Lichtenstein testified about how he repeatedly used the service to launder money he stole from various cryptocurrency exchanges, and that in addition to Bitfinex, he also improperly accessed accounts on the Coinbase and Kraken cryptocurrency exchanges. Although Lichtenstein was reportedly the person actually behind the massive hack, he has somehow been eclipsed in media coverage by his aspiring rapper wife, Heather "Razzlekhan" Morgan, who just helped with the laundering end of things. I suppose the lesson in this is that if you intend to commit major crimes, marry the most cringeworthy person you can find.

I apologize for what you're about to listen to

In bankruptcies

Genesis has been given the okay to sell $1.6 billion in GBTC shares. This has Genesis parent company DCG quite worried. Although some of their complaints are based in purported concerns for the company's creditors, for example when they say the repayment plan "disproportionately favors a small controlling group of creditors over others",6 I suspect their real concern may be that "sheer quantity of the Trust Assets at issue will pose a serious risk of value destruction."7 More plainly: such a huge dump could tank crypto prices.

Gemini has reached a settlement in principle with Genesis, though it still needs to be approved by the bankruptcy court.8

FTX has sold the European division of its company back to its original owners for $32.7 million. FTX acquired the company in 2021 for $323 million. Pretty sweet deal for those guys.9

In governments and regulators

The European Central Bank released a scathing report on Bitcoin and Bitcoin ETPs, which begins with the statement:

Bitcoin has failed on the promise to be a global decentralised digital currency and is still hardly used for legitimate transfers. The latest approval of an ETF doesn’t change the fact that Bitcoin is not suitable as means of payment or as an investment.

Bitcoiners are furious, of course.

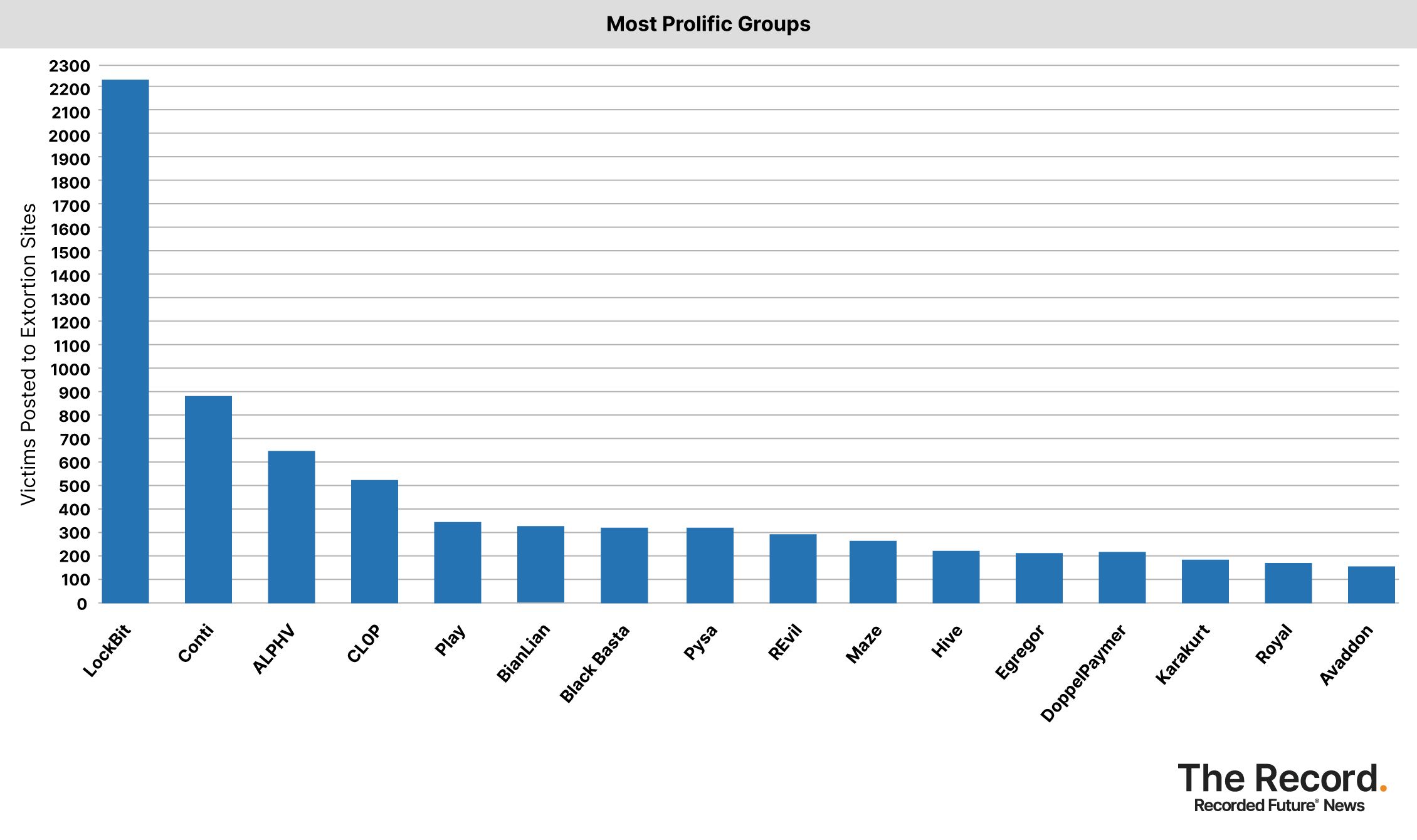

Various international law enforcement agencies cooperated to take down the Russian LockBit ransomware group, which was one of the most prolific ransomware groups by quite a margin:

According to the agencies, they were able to take advantage of a server the group was using, which had an unpatched PHP vulnerability. How they convinced the ransomware operators to load a random PHAR file, I don't quite know. Since then, the UK National Crime Agency has been mocking LockBit by uploading a lookalike version of their site to the domain they once used.10 Meanwhile, the US Office of Foreign Asset Control (OFAC) has added ten crypto wallets associated with two LockBit-affiliated Russian citizens to US sanctions lists.11

The New York Department of Financial Services has reached a settlement with Gemini in which they will fully repay the $1.1 billion owed to the customers of the Gemini Earn program, who have had their assets tied up since late 2022 [W3IGG]. Gemini will also pay a $37 million fine. This settlement is separate from Gemini's settlement with the SEC, where they will pay a $21 million fine, and it's separate from the ongoing lawsuit from the New York Attorney General.8

The U.S. Energy Information Administration's plan to collect energy usage data from cryptocurrency miners [I50] has hit a stumbling block, with a judge granting a temporary restraining order in a lawsuit filed by the Texas Blockchain Council and Riot Blockchain. They argue that crypto mining businesses will be "irreparably harmed" if they have to disclose information about their electricity use. The irreparable harm to Texans who are facing skyrocketing electrical bills, or to the environment as miners waste massive quantities of electricity, naturally go unmentioned.12

The Sacramento Bee has done a nice fact check of the claims in the $2 million Katie Porter attack ad by the Fairshake crypto superPAC that I mentioned last issue [I51]. They've described the ad as "mostly false", noting that the roughly $5,000 in individual donations by "Big Pharma, Big Oil, and the Big Bank executives" that are singled out in the ad in fact come from executives of pharmaceutical and oil companies that are not part of those industries' lobbying groups, and that the "Big Bank" is in fact a community development financial institution in California that specializes in offering financial services to first generation immigrants from Asian countries, who were not getting adequate services from other banking institutions.13 And here I thought the crypto folks were all about banking the unbanked! The bank in question comes in at #274 on the Federal Reserve's list of "large commercial banks", with around $4 billion in consolidated assets.14f Meanwhile, Porter has fired back at these "shadowy crypto billionaires":

Californians aren’t fooled: Shadowy crypto billionaires don’t want a strong voice for consumers in the Senate. They fear people who call out corporate greed, so they're spending millions on dishonest dark-money ads against me.

— Katie Porter (@katieporteroc) February 13, 2024

Their ads will never stop me from fighting for YOU. https://t.co/reVyV4Ntnn

Fairshake has now rolled out new ads, directly targeting crypto holders on social media:

A spokesperson for Fairshake has said they simply want to "mak[e] sure the 8 million crypto owners in California – who are disproportionately young voters who support Democrats – know about her hostility toward the technology and how that would hurt American jobs." This is kind of a strange thing to say, given she hasn't been terribly outspoken against crypto, and Fairshake has yet to identify any statements of hers they find objectionable.15

Elsewhere in crypto

Why are crypto enthusiasts so obsessed with sending their stuff to the moon? Less than two months ago, BitMEX tried to "send bitcoin to the moon". Instead, it spent six days as space junk before burning up in the Earth's atmosphere. Now, artist Jeff Koons has sent 125 small sculptures of moon phases to the moon aboard the Odysseus. Purchasers of these sculptures also receive a larger physical moon sculpture and — you guessed it — an NFT. According to a random person in the project's Discord,g each sculpture is selling for $1 million.

Bad news: The company that made the spacecraft cheaped out on testing, and missed that they had forgotten to flip a switch to enable the moon lander's laser positioning system. Although the company's engineers were ultimately able to land the craft on the moon anyway, it tipped over onto its side. Because of its orientation, its solar panels won't be able to charge the lander properly, and it's about to run out of juice.

Good news: Buyers of the sculptures still have their NFTs, I guess.

Bad news: Koons promises that the NFT will have "an image of the sculptures installed on the moon's surface". But according to the spacecraft company, the only payload installed on the side of the craft that's currently mashed against the surface of the moon is... the sculptures. A spokesperson says they'll still try to get a picture of them... somehow.16

Good news(?): Perhaps the sculptures cushioned the fall?

The Web3 is Going Just Great recap

After last issue's dry spell, we're back with a vengeance. There were 24 entries between February 14 and February 28, averaging 1.6 entries per day. $271.53 million was added to the grift counter.

Crypto people won't stop shitting up open source for everyone else

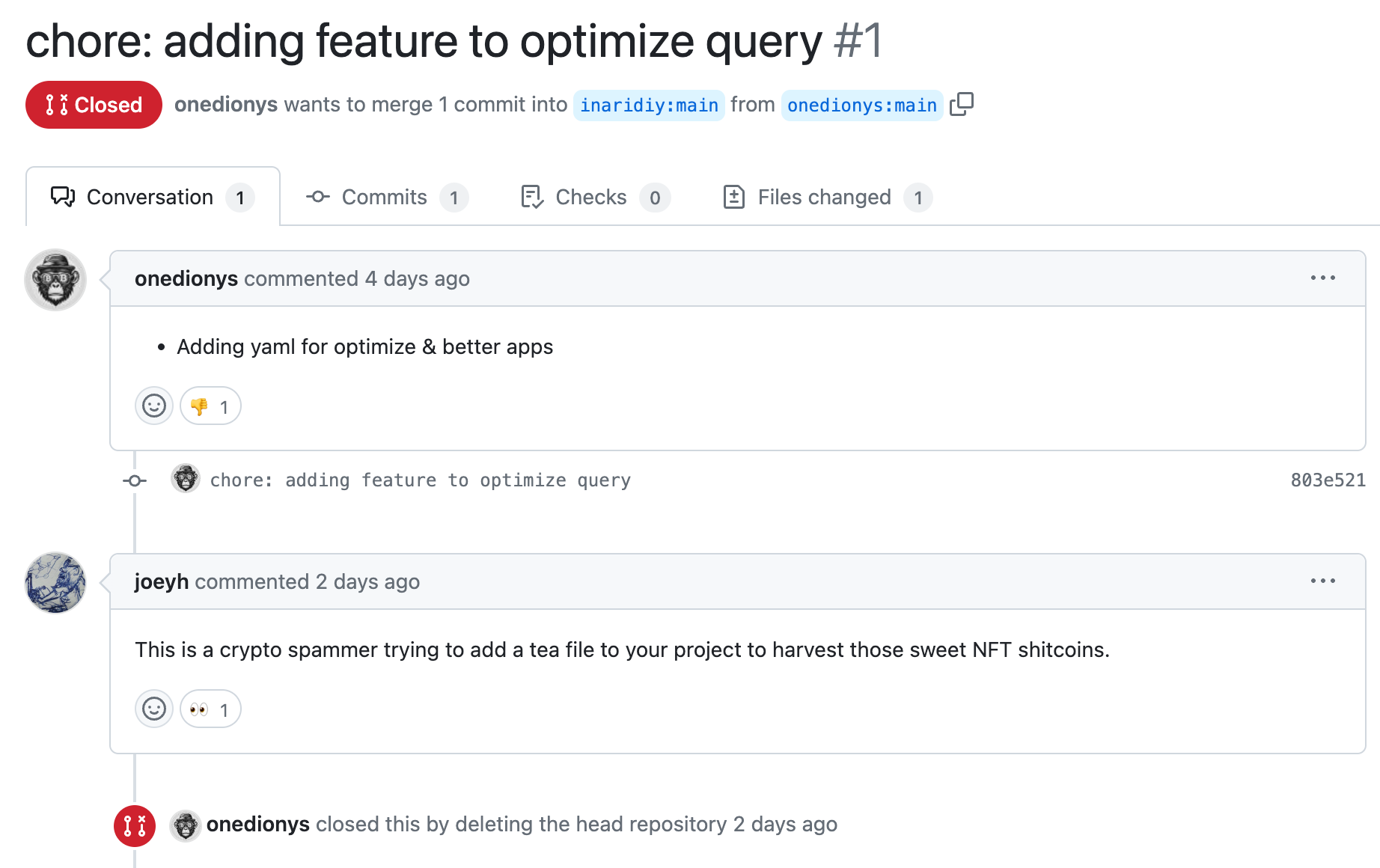

In their defense, the first time it happened, it mostly impacted crypto open-source projects. After projects like Starknet and Celestia calculated airdrop distributions based on factors including whether a person had contributed to their open source repositories,h airdrop hunters began madly filing pull requests on open source code repositories for other crypto projects that had yet to issue a token, but might someday. "Please don't submit a GitHub issue just for farming purposes," wrote one beleaguered crypto project maintainer. "The [project] core team is stretched thin enough as it is, please don't make our lives harder."

Worse still, another project called tea.xyz came along, promising to incentivize open source contributions by distributing crypto tokens to anyone who could "prove" they had commit access to popular open source repositories. The project leader, homebrew creatori Max Howell, claimed they somehow didn't forsee the obvious outcome of such an incentive, which is that people started spamming pull requests to add themselves as "code owners" to repositories they'd never touched before. This makes me wonder if he's never observed the crypto world until today, or various other attempts at introducing external incentives to open source contribution that have had similar outcomes.j

Particularly affected was the open source project Ghost, which happens to be what powers this newsletter, and which was used as an example in their demo video. A Ghost maintainer wrote: "[I]n practice the TEA project is not helping to support the Ghost project, but is instead causing a rush of self-serving PRs to be submitted to cash-in on other people's work. ... This [is] why people hate on crypto."17

Howell promised they would fix the problem going forward by banning those who spam open source repositories, and requiring people to be able to prove they have direct commit access to a repository before trying to register it for the tea.xyz program.

Tornado Cash merged malicious code

[link]

Malicious code was apparently merged into the Tornado Cash cryptocurrency mixing service two months ago, through a successful governance proposal where no one noticed the function that would send the private notes associated with a deposit to a separate "private malicious server" maintained by the developer.

Private notes are the keys associated with a Tornado Cash deposit that allow the depositor to later withdraw their funds. This means that any funds with leaked private notes that have not yet been withdrawn are at risk.

If I was involved with the Tornado Cash project, I would be wondering who exactly introduced this exploit — given the enormous motivation for various governments and other groups to compromise what was once the primary crypto laundering service.

Two individuals suffer multi-million dollar wallet compromises

Two people separately learned the hard way that it's really hard to securely store millions of dollars in crypto assets, particularly when you're using a hot wallet.

One trader who goes by kirilm.eth fell victim to a phishing attack in which they lost 180 million BEAM tokens, which are issued by the Beam blockchain gaming network. Though they were ostensibly priced at $5.14 million at the time of the theft, slippage meant the attacker could only sell them for around $4.5 million, and the sale caused the token price to drop 10%.

Later, a co-founder of the Axie Infinity blockchain gaming project suffered a wallet compromise, losing around 3,248 ETH (~$9.5 million). The large flow of funds out from Axie Infinity's Ronin Bridge led some to briefly fear that the project's bridge had been hacked again [W3IGG], but the co-founder later stated that it was his wallet that was hacked and not the bridge.

Everything else

- Seneca Protocol bug enables at least $3 million in stolen user funds [link]

- "Crypto inheritence" project Serenity Shield hacked, token price plummets 99% [link]

- Scammers hack Twitter account of late actor Matthew Perry, solicit "donations" for "substance abuse charity" [link]

- $440,000 stolen as MicroStrategy's Twitter account is hacked [link]

- Dechat announces its token launch with a link to the wrong token [link]

- BitForex shuts off website after $57 million withdrawal [link]

- "Fully private" Aleo blockchain accidentally sends out copies of users' identification documents [link]

- Myanmar-based romance scam operation pulls in $100 million in less than two years [link]

- RiskOnBlast gambling platform rug pulls for $1.3 million [link]

- Australian disappears with more than US$585,000 erroneously transferred to his cryptocurrency account by OTCPro [link]

- Blueberry Protocol narrowly avoids $1.3 million hack [link]

- DeezNutz_404 hacked for $170,000 [link]

- Influencer "Crypto Rover" accused of pump-and-dump and other shady behavior [link]

- Over $55 million taken from defunct AAX crypto exchange [link]

- FixedFloat exchange hacked for $26 million [link]

- Yuga Labs acquires Moonbirds amid speculation of insider trading [link]

- YouTuber KSI accused of pump-and-dump [link]

- "Decentralized" social network Farcaster criticized after confiscating channel name to be used by influential crypto podcasters [link]

- Creator of "Robotos" NFT project, once collaborating on a TV series with TIME studios, accused of rug pull [link]

Worth a read

I really enjoyed this recent piece by Cory Doctorow, where he addresses something that I say often: that web3 folks and I often agree on a lot of things, including that the web has been trending in a worse direction with the proliferation of advertising, tracking, and general rent-seeking. However, Doctorow highlights the very important additional point: despite agreeing that there is a problem with the web today, we diverge drastically on the web we would like to see. It isn't "just a matter of who you agree with on a given issue – the real issue is what you're trying to accomplish." Hear, hear.

I love this recent piece by Soatok, which echoes a long-standing gripe I recently voiced in response to the report about Automattic, the owner of WordPress and Tumblr, selling user data to train AI (original report, registration-walled; derivative report). He goes further to tie in the trend of tech services allowing you to opt in to features or choose "not right now", promising to keep bugging you in apparent hopes that they will wear you down eventually — which is not how consent should work.

Right as I was thinking I would need to write about the halving (also called the halvening), Amy and David wrote their own piece explaining what it is, and giving their opinions/predictions. I may still write about it, but this is worth a read either way.

In the news

I rejoined Cas and Bennett over at the Crypto Critics' Corner to talk about Chris Dixon's Read Write Own, which I reviewed in this newsletter if you missed it. It was a really fun conversation. Others have also reviewed that book recently, notably Dave Karpf.

I joined the TWiG crew and had a grand old time talking about crypto, Wikipedia, AI, and... sneakerphones.

That's all for now, folks. Until next time,

– Molly White

Footnotes

Or perhaps I am overly optimistic that they will learn from their mistakes, given a general ongoing willingness by some of the same journalists to reprint PR fluff from companies in other technology fields, like AI. ↩

Despite repeated pleas from crypto lobbyists that legislators and regulators need to take a hands-off approach to crypto and instead let the industry self-regulate, they have yet to do any real self-regulation. Perhaps they should try giving it a shot before arguing that it's the solution to all of the problems in the sector. ↩

Carmine Simpson is a former New York City police officer who was charged with sexual exploitation of children for posing as a minor on Twitter and soliciting sexually exploitative material from minors. He was charged in January 2021, and faces a mandatory minimum sentence of 15 years if convicted.18 ↩

He would for sure steal all a fly's money, though. ↩

I couldn't find any indication that he is. ↩

For comparison, this is 0.1% of the consolidated assets of JP Morgan, and 8% of the assets that would qualify the bank as a "too big to fail" bank.14 ↩

The project website has no price listed, and instead encourages prospective buyers to contact the gallery. One person said they did so, and got the $1 million quote. Take it with a grain of salt, because this is a random person on the internet. ↩

Poorly calculated, I might add. One guy received 1,800 STRK (~$3,350) for submitting an as-yet-unmerged pull request to fix a typo. ↩

Despite creating homebrew, Howell apparently hasn't been actively involved in its development for quite some time. tea.xyz has no affiliation with homebrew, so don't get mad at the current project maintainers! ↩

Perhaps most notably, DigitalOcean's Hacktoberfest, where people did a similar thing in hopes of scoring a free t-shirt. Hacktoberfest later required code owners to opt in to participating in Hacktoberfest to limit the burden on maintainers, and introduced anti-spam measures. ↩

References

Sentencing submission by Sam Bankman-Fried filed on February 27, 2024. Document #407 in US v. Bankman-Fried. ↩

"Former FTX exec Ryan Salame to be sentenced on May 1", Cointelegraph. ↩

Defendant's response to Government's motion to modify bond filed on February 27, 2024. Document #65 in US v. Zhao. ↩

"FTX bankruptcy firm Sullivan & Cromwell tipped for Binance monitor role", Protos. ↩

"Nigeria detains US and British Binance staff as authorities probe market manipulation", DL News. ↩

"Genesis Approved to Sell $1.6 Billion Grayscale Bitcoin Trust Shares", Decrypt. ↩

"Crypto collapse: Genesis vs. DCG, Celsius payouts failing, Terra-Luna extraditions, what 3AC did next, Craig Wright", Amy Castor and David Gerard. ↩

"Winklevoss-led Gemini agrees to return over $1 billion to customers in deal with N.Y. regulator that includes $37 million fine", Fortune. ↩

"FTX settles dispute, sells European arm for $33M", Cointelegraph. ↩

"LockBit ransomware gang disrupted by international law enforcement operation", The Record by Recorded Future. ↩

"United States Sanctions Affiliates of Russia-Based LockBit Ransomware Group", press release from the US Department of the Treasury. ↩

"Crypto Miners Sue to Keep Us in the Dark", Texas Monthly. ↩

"Fact check: Did Katie Porter get campaign cash from Big Pharma, Big Oil and Big Banks?", The Sacramento Bee. ↩

"Federal Reserve Statistical Release: Large Commercial Banks", U.S. Federal Reserve. ↩

"Crypto Political Operation Targets California's Katie Porter by Undermining Her Base", CoinDesk. ↩

"The Odysseus lunar lander is on its side and will likely run out of energy soon", The Verge. ↩

Github comment by markstos. ↩

"New York City Police Officer Charged with Production of Child Pornography", press release by the U.S. Attorney's Office in the Eastern District of New York. ↩