Issue 95 – The pardon was the payoff

Binance’s Changpeng Zhao earns a gold-plated pardon as other industry figures fund Trump’s $300 million ballroom

After months of lobbying, President Trump has pardoned Binance founder Changpeng Zhao. Zhao, who in 2017 founded what would later become the largest crypto exchange in the world, pleaded guilty in late 2023 to one felony charge of failing to maintain an effective anti-money laundering program at Binance. The company itself pleaded guilty to three additional charges: conspiracy to conduct an unlicensed money transmitting business and to fail to maintain an effective anti-money laundering program, conducting an unlicensed money transmitting business, and sanctions violations. CZ served four months of prison time, and was released in September 2024 [I68]. He paid a $50 million fine, and his company paid another $4.3 billion in penalties.

The indictment was damning, with evidence suggesting that CZ himself had directed Binance to implement a sham compliance program that would fool US regulators into believing they were screening for suspicious or illicit activity, while simultaneously allowing illicit transactions to continue unimpeded. While the primary Binance platform was not permitted to serve US customers, the company actively encouraged US-based users to circumvent Binance’s own geofencing, with CZ instructing: “On the surface we cannot be seen to have US users but in reality, we should get them through other creative means.” Binance was simultaneously aware that it was offering services to sanctioned users, with the company’s Chief Compliance Officer writing that “There is no fking way in hell I am signing off as the CCO for the ofac shit” out of fear he could go to jail. (OFAC is the Treasury office that administers sanctions.) Another compliance team member acknowledged the prevalence of illicit activity on Binance, writing: “we need a banner ‘is washing drug money too hard these days - come to binance we got cake for you’.” In discussions regarding Binance’s use by designated terror groups like ISIS and Hamas, or sanctioned customers from Russia, Binance’s CCO urged other employees not to freeze the assets, and acknowledged “Like come on. They are here for crime.” Another employee in charge of money laundering reporting agreed, “we see the bad, but we close 2 eyes.”

Nevertheless, the White House press secretary has positioned the pardon as relief from an unfair prosecution, asserting that “The Biden administration’s war on crypto is over” and describing Zhao’s conviction as evidence of the previous administration’s “desire to punish the cryptocurrency industry”. While the crypto industry and the Trump administration have tried to portray any regulatory oversight or enforcement in the crypto space as an unjust “war on crypto”, I think the Trump administration has overplayed its hand by describing this prosecution as such. Most outsiders can distinguish targeted enforcement against clear misconduct from hostility toward innovation, and excusing justifiable prosecutions as mere political persecution only serves to highlight how frequently the Trump administration and the crypto industry use this tactic to try to dodge justice, accountability, and reasonable regulatory oversight.

In a statement to the press, Trump acknowledged that Zhao “had a lot of support... and so I gave him a pardon at the request of a lot of good people.” Some of these “good people” were lobbyists hired by Zhao and/or Binance, including BakerHostetler lawyer Teresa Goody Guillén. While she lobbied the president for Zhao’s pardon, Goody Guillén simultaneously represented Trump’s World Liberty Financial cryptocurrency project; she wrote the brief May retort from the company in response to Senator Blumenthal’s questions about Trump’s conflicts of interest [I83, 84, 90]. Also helping facilitate CZ’s pardon was Ches McDowell, a lobbyist with little in the way of credentials besides being a big-game-hunting buddy of Donald Trump Jr.1

But while Trump acknowledged he was being urged behind the scenes to pardon the crypto billionaire, he did not address his own financial gains linked to Binance. Taken together, his personal profits and the subsequent executive leniency toward the company and its figureheads create the clear appearance of a quid pro quo — and only one of many swirling around crypto interests during Trump’s second administration.

In May, Binance accepted a $2 billion investment from the Emirati investment fund MGX, denominated in the Trump family’s USD1 stablecoin. The stablecoin had only just been announced, and it would have been odd for either entity to wish to use a brand new, untested stablecoin for such a high-value transaction — that is, unless they both had substantial interests in buying favor from the president. With that $2 billion to invest in money market funds, World Liberty has likely already made around $35 million in interest from the Binance/MGX deal alone,a and they stand to make hundreds of millions if the stablecoins are not redeemed over Trump’s term. And Binance has promoted the USD1 stablecoin to customers on its platform, driving more business to the Trumps (though the Binance deal still comprises around 70% of the USD1 issued to date).

Not long after the deal was announced, the Trump administration negotiated a highly favorable AI chips deal benefitting MGX [I93], and shortly afterwards announced that MGX will take a 15% stake in the TikTok deal brokered by the Trump administration [I94]. For Binance, the SEC dismissed with prejudice a fraud and unregistered securities case looming over the company [I85] — one in which Binance’s Chief Compliance Officer was quoted admitting that “we are operating as a fking unlicensed securities exchange in the USA bro”. Now, Zhao has earned his pardon. And discussions to prematurely remove independent monitors installed to oversee Binance’s compliance programs seem to remain ongoing [I93].

Binance has also reportedly discussed other, more direct business deals with the Trumps, including the possibility that the family would take a stake in Binance’s US division [I79]. Such a deal has not yet emerged, though the pardon may be an attempt to mitigate reputational concerns that might otherwise complicate any future arrangement. And the pardon would certainly smooth the pathway for Binance to expand its business in the US — potentially with CZ back at the helm. (CZ was required to step down as CEO as part of his plea agreement, which also permanently banned CZ from regaining a leadership role at the company, though he has maintained substantial influence over the company and owns a majority of its shares.)

The pardon has infuriated Congressional Democrats like House Financial Services Committee Ranking Member Maxine Waters:2

Trump is doing massive favors for crypto criminals who have helped line his pockets. Trump’s pardon of Binance founder Changpeng Zhao—who pleaded guilty to enabling money laundering and facilitating suspicious transactions with child abusers, drug dealers, and terrorists—is an appalling but unsurprising reflection of his presidency: one defined by corruption, self-interest, and loyalty to criminals over working-class American families.

Let’s be clear about why this happened. CZ has spent months lobbying Trump and his family while funneling billions into Trump’s personal crypto company, World Liberty Financial. The pardon was the payoff and a blatant example of the kind of pay-to-play corruption that Trump and his Administration continue to engage in.

Democratic Senators Warren and Schiff introduced a (mostly symbolic) Senate resolution to condemn the pardon, “calling for Congress to use its authority to stop this form of corruption.”3 Warren has specifically urged Congress to address corruption as part of its ongoing negotiations over crypto market structure legislation,4 and more crypto-friendly Democrats like Senator Gallego have begun to agree that Trump’s corruption needs to be addressed in the bill.5 While this is likely to be unpopular with Republicans, some in the GOP are beginning to show unease with Trump’s activities. “I don’t like it. ... [CZ] was convicted. He’s not innocent,” stated Republican Senator Thom Tillis. And some of Trump’s crypto-adjacent allies have questioned the move as well, with venture capitalist and Trump backer Joe Lonsdale writing, “POTUS has been terribly advised on this; it makes it look like massive fraud is happening around him in this area.”6

Citation Needed is an independent publication, entirely supported by readers like you. Consider signing up for a free or pay-what-you-want subscription — it really helps me to keep doing this work.

In the courts

Fellow crypto felon Sam Bankman-Fried has been working to rehabilitate his image as he prepares for his upcoming appeal hearings. He’s spent the last 19 months or so in prison after being found guilty on all counts in the FTX fraud trial, though he has continued to maintain his innocence. Since Trump’s election, he’s attempted to jump on the same bandwagon of complaining that his prosecution was based on not on the billions of dollars in customer funds he illegally squandered and his other various crimes, but instead on “Biden’s anti-crypto SEC/DOJ [that] went after me”. Earlier this year, SBF used prison interviews with the New York Sun and Tucker Carlson to spread his message [I78, 79]; now he’s proxying social media posts through a friend on the outside. Though once known as a Democratic megadonor, Bankman-Fried has begun emphasizing his history of dark-money contributions to Republicans, posting, “In 2020, I was center-left. By 2022—having seen Gensler/Biden's DOJ on crypto—I was a centrist, and (privately) donated tens of millions to Republicans.”7’

Bankman-Fried seems to be angling for a pardon of his own if his appeal is unsuccessful, though whether Trump would oblige is less clear. Unlike CZ, who is one of the wealthiest men in the world and continues to be a powerful and relatively well-liked figure in the crypto industry, Bankman-Fried is staring down the remainder of a 25-year prison sentence, with few assets to his name, high-profile links to Democrats, and a radioactive reputation within crypto. I don’t see why Trump would agree to a pardon, though Trump’s recent commutation for the similarly broke and detested (though consistently Republican) George Santos suggests it would be foolish of me to rule out the possibility entirely.

Roger Ver, also known as “Bitcoin Jesus”, has reached a deferred prosecution agreement over his alleged $50 million in unpaid expatriation taxes [I57, 91]. According to the Justice Department, Ver has repaid “nearly $50 million in back taxes, penalties, and interest stemming from his willful failure to properly report his bitcoin holdings on tax returns when he expatriated from the United States in 2014. ... Ver admitted that his failure to report capital gains from all these bitcoins caused a loss to the United States of $16,864,105.” It’s not quite clear how the DOJ got from initially accusing Ver of evading nearly $50 million in taxes to saying he evaded only about a third of that (bringing his total payment, with penalties to $50 million).8 Anyway, I suppose this is all probably good news for Trump, whose crypto pardon list may now have shrunk by one. Ver was previously working with Roger Stone to lobby the president for a pardon [I91], and posting videos saying things like, “Mr. President, I am an American, and I need your help. Only you, with your commitment to justice, can save me.”9

The two brothers who’ve been accused of exploiting Ethereum MEV bots [I58] are on trial in New York, where jurors are being subjected to a highly technical discussion of crypto “sandwich attacks” — a process in which automated trading bots add transactions before and after another person’s trade, “sandwiching” it and earning money from the slippage. The brothers, Anton and James Pepaire-Bueno, have been hit with wire fraud and money laundering charges after earning $25 million by exploiting a vulnerability in popular Ethereum software called “MEV-Boost” to siphon funds away from people operating sandwich bots — essentially, attacking the attackers. The Pepaire-Buenos are relying on a “code is law”-style defense, arguing that the actions they took were permitted by the software, and that they merely out-traded the bot operators.10 However, the brothers’ Google search history in the weeks after the theft for phrases including “how to wash crypto”, “top crypto lawyers”, “wire fraud statute / wire fraud statue [sic] of limitations”, and “prison or jail worse” suggest that perhaps the brothers had some clue that their actions could be interpreted criminally, as do the brothers’ own descriptions of their plan as “sus”.1112

The Justice Department has seized 127,271 BTC, priced at $14.4 billion, from Chen Zhi, a Chinese national who allegedly ran The Prince Group, a massive Cambodian crypto investment scam operation. Zhi remains at large. In their ten Cambodian compounds, The Prince Group kidnapped and held hostage people who were forced to then scam other victims online. This is the largest bitcoin seizure in DOJ history, and it brings the US government stash of bitcoin to around 326,588 BTC (~$37 billion), though it remains to be seen whether the funds (or a portion of them) will be returned to victims.13

In Congress

Crypto executives flocked to Washington to advocate for their desired crypto market structure legislation. Some legislators and crypto industry figures had been optimistic that such a bill would speed through the Senate, but many of their estimated deadlines have come and gone by now. With the government still shut down, and lawmakers beginning to shift their attentions to campaigning for next year’s midterm elections, hopes of a bill passing by the end of the year are faltering.

Donald Trump isn’t exactly helping matters by becoming only more brazen in his crypto corruption. His supporters in Congress are now stuck with the prospect of explaining why they wouldn’t support language in the bill to limit crypto-related conflicts of interest by officeholders, while, in the background, Trump is swan-diving Scrooge McDuck–style into his more than $1 billion in crypto profits in under a year14 and flashing plans for a gold-plated ballroom funded by his crypto patrons.

Some pro-crypto Senate Democrats have reportedly blown up at the crypto executives in these meetings, urging them: “Don’t be an arm of the Republican Party — they used you and your megaphones to fuck us.”15 This was likely in response to the recent leak by Senate Republicans of a Democratic draft proposal to regulate decentralized finance, which sparked dramatic backlash from crypto industry figures who fear it would effectively outlaw defi. Paradigm lobbyist Alexander Grieve bashed the proposal as “worse than anything Gensler cooked up”,16 and industry advocate Jake Chervinsky described it as “basically a crypto ban”.17

Other Democrats have expressed annoyance at Republicans for pushing them to agree to a markup date without having had much time to negotiate the draft. “Democrats have shown up ready to work but our Republican counterparts are crashing out,” said a staffer for Arizona Senator Ruben Gallego. “Their demand to set a markup date before text is agreed to is like setting a wedding date before the first date. It’s nonsensical.”18 But the Republicans are feeling the time crunch. A source familiar with the meetings, speaking to Decrypt, said, “[T]he Republicans are like: ‘If we don't move this in November, we don't get it done by the end of the year, then the whole thing derails.’”19

Senate Republicans scheduled their own meeting after the crypto execs’ session with their Democratic counterparts. The meeting was reportedly presented as the true route to getting crypto legislation through Congress, and Republicans in attendance likely used it to gain insight into Democratic strategy around the draft.1520

Democratic Representative Maxine Waters has also repeated her concerns about market stability after the recent crypto flash crash, issuing a statement that “This highlights the volatility in the crypto market that Ranking Member Waters has long warned about. These risks are only amplified as Trump and Republicans in Congress work to integrate crypto into the traditional financial system without first establishing the proper guardrails—increasing the likelihood of future crashes just like this one that could more rapidly spread to traditional finance.” She also highlighted how the current government shutdown has left regulatory agencies like the SEC and CFTC unable to respond to ongoing matters or emergencies, and she cited my writing about possible insider trading surrounding Trump’s tariff announcement, calling for an investigation by financial regulators.2

Representative Ro Khanna (D-CA) announced he intends to introduce legislation banning elected officials from holding or issuing cryptocurrencies. “I think that people think this is a tech issue. This is not a tech issue. This is a corruption issue. This is money that's going into someone at the White House and the White House having official acts like pardons in exchange,” he said.21 This would follow other similar attempts like Senators Merkley (D-OR) and Schumer’s (D-NY) May 2025 “End Crypto Corruption Act” [I83], Representative Waters’ May “Stop TRUMP in Crypto Act”, and Representative Liccardo’s (D-CA) February “Modern Emoluments and Malfeasance Enforcement (MEME) Act” [I78] — none of which have amounted to much.

Some of the pro-crypto Senate Democrats have shown the slightest hint of a spine when it comes to crypto corruption in the Trump administration, sending a letter to Steve Witkoff about his ongoing conflicts of interest regarding his crypto holdings and his role as “Special Envoy for Peace Missions”.22 Though a World Liberty Financial executive announced in May that Witkoff was “in the process of fully divesting from WLFI” and had “no operational role, no financial interest in WLFI deals, and no influence on day-to-day decisions”, a recently released financial disclosure shows that he continues to hold a stake in World Liberty and in two other associated businesses. His son, Zach Witkoff, is co-founder and CEO of World Liberty. The Senators’ letter notes the elder Witkoff’s involvement in his White House role in recent AI chip negotiations with the UAE and Sheikh Tahnoon, and its coincidence with World Liberty’s windfall from a deal involving an investment firm controlled by Sheikh Tahnoon [I93]. The Senators have asked Witkoff whether he was granted an ethics waiver to participate in discussions surrounding the UAE chips deal, and if not, “how your financial holdings do not violate federal ethics laws and regulations, which prohibit government officials from participating in matters which could benefit them or their relatives.” The letter was signed by Senators Schiff (CA), Wyden (OR), Kim (NJ), Durbin (IL), Cortez Masto (NV), Peters (MI), Slotkin (MI), and Booker (NJ). Five of the eight signatories had previously supported the GENIUS Act, a stablecoin bill favored by the industry [I86, 92]. The other three — Wyden, Durbin, and Peters — have been more critical of crypto.

In regulators

Trump has selected Mike Selig as his replacement nominee for CFTC Chair, after the crypto industry’s Winklevoss twins torpedoed his previous nominee, Brian Quintenz [I90, 92, 93]. Selig has served as chief counsel for the SEC’s Crypto Task Force since March and was previously a partner working on crypto cases for Willkie Farr & Gallagher [I94]. He’s earned a warm endorsement from AI & Crypto Czar David Sacks, who credited him as “instrumental in driving forward the President’s crypto agenda” in his role at the SEC.23

The Trump administration is also working to push the Federal Reserve in a more pro-crypto direction, interviewing various candidates for a shortlist of nominees for the central bank’s board of governors and, eventually, chair.24 Among them is Michelle Bowman, who’s criticized bank regulators of being “overly cautious” and recommended loosening restrictions on Fed staff investments to allow them to own crypto.25 Another candidate for the list of possible nominees is Trump economic adviser Kevin Hassett, who served on Coinbase’s Academic and Regulatory Advisory Council and has disclosed holding $1 million–$5 million in Coinbase stock.26 Current Fed Governor Christopher Waller might also be a candidate for eventual chair. He’s recently made headlines for proposing issuing crypto firms “skinny” versions of master accounts, which grant financial institutions direct access to the Federal Reserve payment rails. The Fed has typically been hesitant to issue master accounts to crypto firms due to high risk, but Waller has urged the central bank to “embrace the disruption, don’t avoid it.”27

Meanwhile, the Office of the Comptroller of the Currency is sifting through a growing pile of applications for national trust bank charters from cryptocurrency firms. Circle, Ripple, BitGo, and Erebor applied for theirs earlier this year [I88], and Paxos followed not long after. This month, Coinbase, Stripe’s recently acquired stablecoin firm Bridge, and Crypto.com have all added their applications to the stack. Erebor’s is the first application of the lot to be granted preliminary approval. As I wrote in July:

Another bank called Erebor, which as you might guess by the Lord of the Rings name is backed by Peter Thiel, Joe Lonsdale, and Palmer Luckey, has also applied for a bank charter. According to the Financial Times, the new bank will aim to “fill the gap left by Silicon Valley Bank” — the tech startup-focused bank that failed in March 2023. Around 85% of Silicon Valley Bank’s deposits, mostly belonging to venture capitalists and venture-backed tech companies, were uninsured; the FDIC nevertheless covered those uninsured depositors and spent $20 billion on the whole boondoggle. As is so often the case with “tech visionaries”, yesterday’s warning lesson is tomorrow’s blueprint.

A statement by Comptroller Jonathan Gould suggests that the approval was at least partially motivated by a desire to cast off accusations from the crypto industry that government agencies had targeted it for “debanking”. In a statement, Gould announced that the approval “is also proof that the OCC under my leadership does not impose blanket barriers to banks that want to engage in digital asset activities.”28 But approving a risky charter to rebut “debanking” accusations is rather like approving a bridge design because the engineers accused you of being anti-infrastructure — and never mind that their last one collapsed into the river.

In the states

Nevada’s Financial Institutions Division (NFID) has issued a cease and desist order against Fortress Trust [W3IGG], a crypto custody company founded by Scott Purcell. Purcell had previously founded Prime Trust, which filed for bankruptcy in 2021 after raising tens of millions in seed funding, giving half of it to executives, and then promptly losing a hardware wallet storing customer funds [I31, 38]. The company’s bankruptcy filing came only after the firm was placed into receivership by NFID, which alleged they were insolvent and ordered them to halt operations.

Now, NFID is ordering Fortress Trust to halt operations because — you guessed it — Fortress is “on the verge of insolvency”. NFID elaborates that Fortress has about $1.3 million in custodial assets, but they owe clients around $12.3 million; and have acknowledged that they “failed to safeguard assets under its custody and is unable to meet all customer withdrawals”. (I’m not quite sure why NFID describes this as merely “on the verge” of insolvency.)29 Fortress previously made it to this newsletter in September 2023 after suffering a $15 million theft. At the time, Fortress announced it would be acquired by Ripple, which had agreed to cover the losses; however, the deal fell through later that month [I39, W3IGG]. It’s not clear how — or if — Fortress ever plugged that hole.

Fortress is a state-chartered trust company — the very same category of company that the SEC just greenlighted to serve as crypto custodians earlier this month. In her dissenting statement, Commissioner Crenshaw noted that such state trust companies are not allowed to act as custodians for any other types of assets. “Why are we making this special exception just for crypto assets? No idea! This relief doesn’t contemplate the idea of allowing state trust companies to custody anything other than crypto assets. While the letter fails to address why, this feels like an admission that state trust companies do not otherwise meet the requirements of a custodian under our rules. And even though these assets have a notoriously high risk of loss, we offer no real explanation for why we are comfortable with crypto assets receiving less custodial protections than traditional assets.” [I94]

In elections and political influence

Tens of millions of Americans are days away from losing lifesaving food, childcare, and utility support,30 and many are weighing the risk of going without health insurance next year as their premiums double (or more).31 In the middle of it, Trump has begun demolishing the East Wing of the White House to build a gold‑plated ballroom bankrolled by crypto industry and other benefactors — symbolism so blunt no novelist could get away with it.

Among those funding the $300 million project are Coinbase, Ripple, Tether, and Gemini’s Winklevoss twins. The size of their contributions to this effort have not been published, but the contributions only add to the millions these groups have already poured into Trump super PACs, his inauguration fund, and other pet projects like the June military parade. Other donors funding the ballroom include tech megafirms like Amazon, Apple, Google, Microsoft, and Palantir, as well as a motley crew ranging from weapons manufacturers to tobacco companies to sugar barons.32

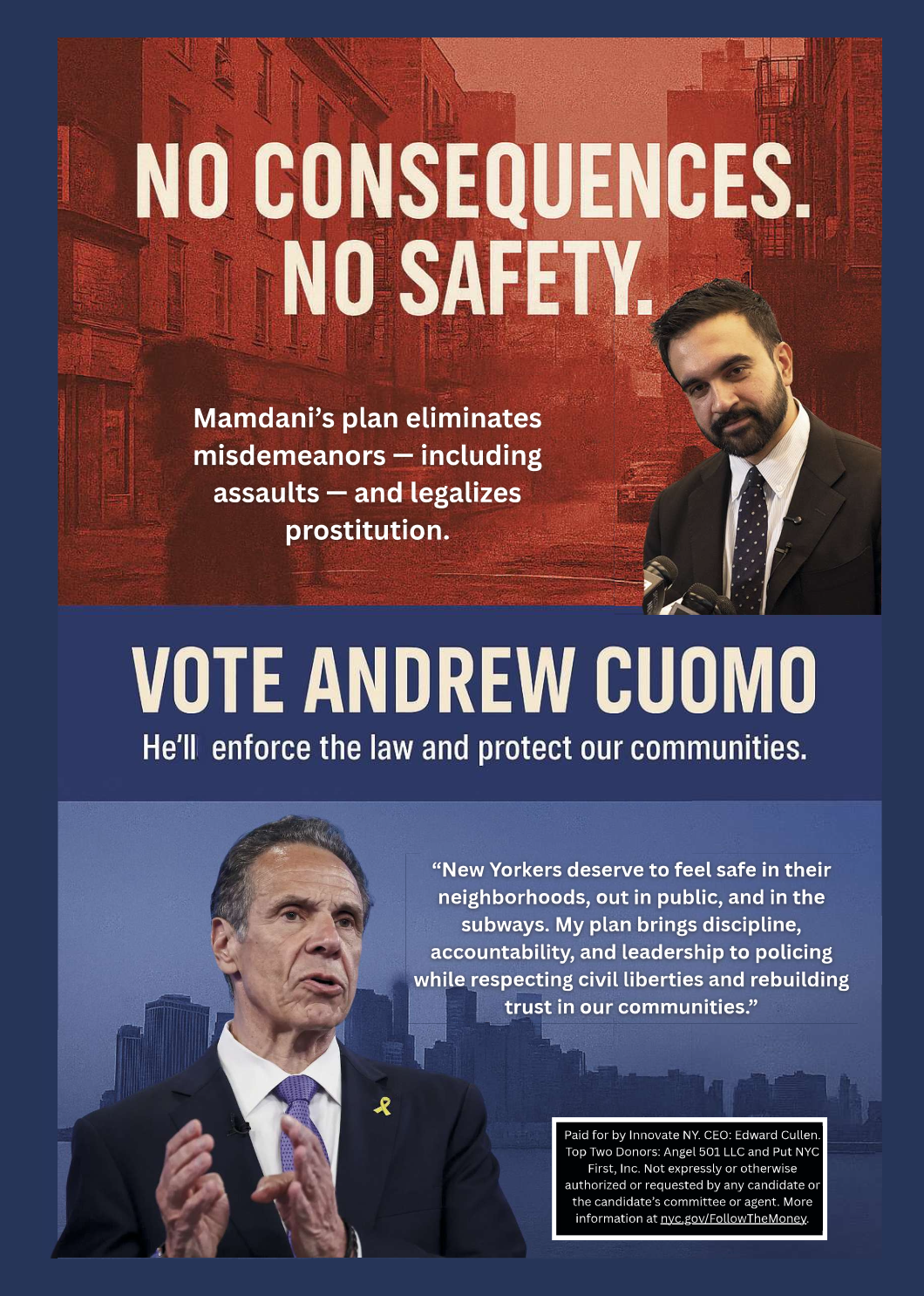

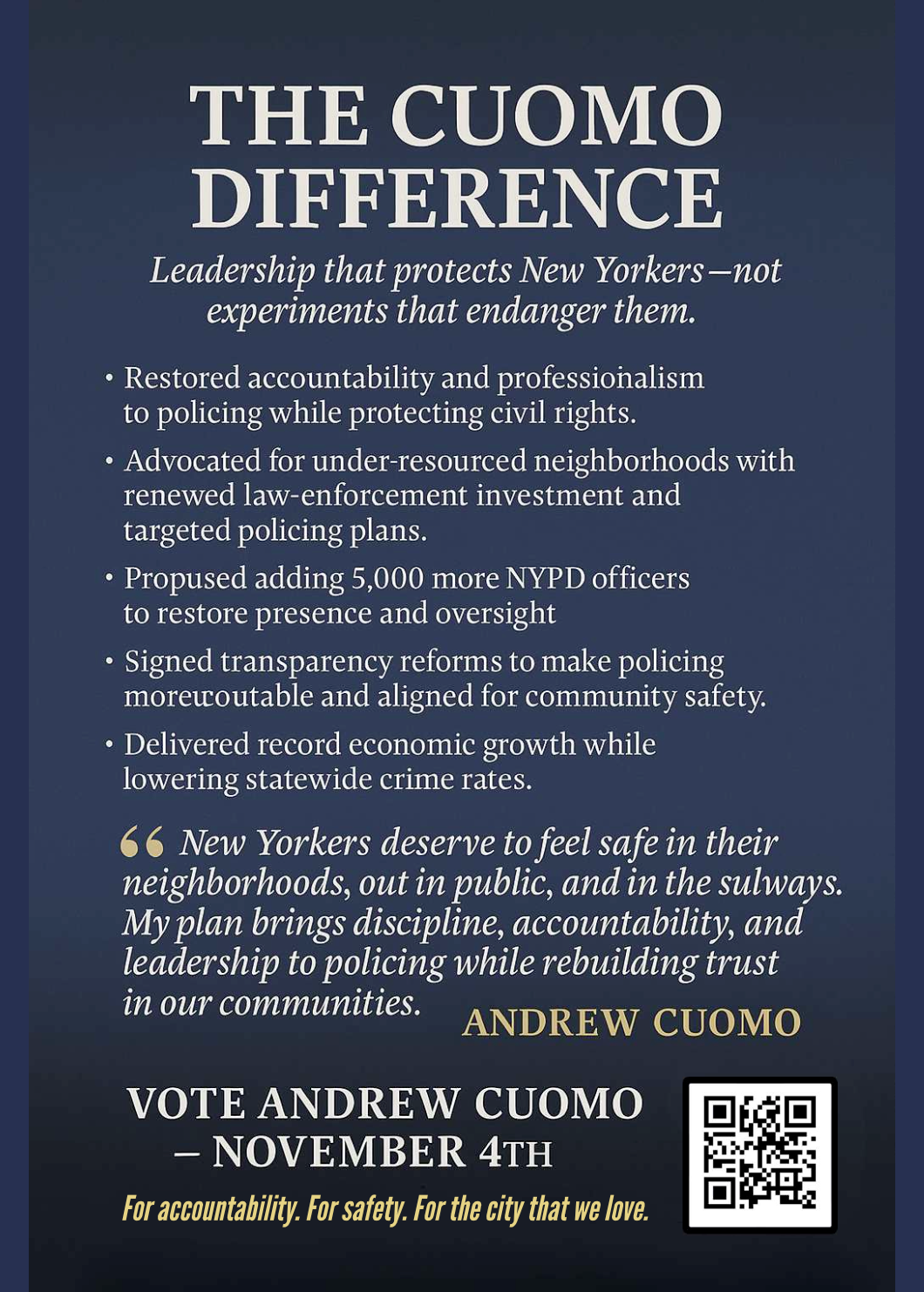

Andrew Cuomo seems to be in the “panicked flailing” portion of his NYC mayoral campaign. Besides posting (and then quickly deleting) an astonishingly racist AI-generated “criminals for Mamdani” spoof video33 and suggesting his opponent would revel in another terrorist attack on the city,34 Cuomo has signaled his distress in another way: by trying to appeal to the crypto industry. Perhaps hoping for a last-minute infusion of cash, à la the New Jersey gubernatorial race earlier this year [I85], Cuomo has announced plans to bolster the tech sector in the city, including by installing an “Innovation Council” headed by crypto, biotech, and artificial intelligence executives.35

This helped draw an endorsement from a tiny PAC called Innovate NY, which issued an enthusiastic statement about Cuomo’s “forward-looking economic agenda that leverages blockchain, tokenization, public-benefit stablecoins, and artificial intelligence”.36 The PAC made its first expenditure in the race shortly after, spending $30,000 to disseminate a typo-ridden and evidently AI-generated flyer including false claims about Mamdani’s platform suggesting he would endanger the city.

Two pages of Innovate NY’s flyer

Innovate NY is headed by Edward Cullenb of Tennessee, who is also the CEO of a company that plans to issue The Catholic Token™.

The more substantial crypto involvement in the NYC mayoral race came from Tether and Bitfinex’s Brock Pierce, who contributed $1.1 million to Eric Adams on September 23.37 Adams dropped out of the race less than a week later, though Pierce reportedly continued to lobby Adams to re-launch his campaign.38 Besides that, much earlier this year, Peak6’s Matthew Hulsizer contributed $250,0000, Anthony Scaramucci’s SkyBridge Capital contributed $100,000, and Addition’s Lee Jared Fixel contributed $100,000 to Cuomo’s campaign.39

Reform UK leader Nigel Farage appears to be modeling himself after Donald Trump by anointing himself a “champion” of the crypto industry and announcing plans to establish a bitcoin reserve.40 This new branding comes amid growing attention to UK politics from companies like Coinbase [I90].

Outside the US

Canada’s financial crime enforcement agency has issued a record fine to the Canadian Cryptomus exchange, which they say failed to report more than 1,000 suspicious transactions linked to darknet markets, distribution of child sex abuse material, fraud, ransomware, and sanctions evasion. It additionally failed to report more than 7,500 transactions originating from Iran, and more than 1,500 high-value transactions. The CA$177 million (US$127 million) shattered the agency’s previous record for the largest penalty ever imposed, which was only just set in September with a CA$20 million (US$14.3 million) fine against the KuCoin exchange [W3IGG].

The UK has sued Justin Sun’s HTX exchange for unlawfully promoting crypto assets.41 The UK had issued a warning both to the public and to HTX (then Huobi) about its unlawful promotions two years ago [W3IGG]; at the time, the company denied operating or marketing in the UK.

Norway’s Nobel Institute has been investigating a possible leak after observing possible insider betting on the Polymarket prediction market on who would win the Nobel Peace Prize. Shortly before the prize announcement, a brand new account without any prior betting activity placed a $70,000 bet that Venezuelan opposition leader Maria Corina Machado would win the prize, earning $30,000 in profits when the results were announced. Two other new accounts profited another combined $90,000. Prior to those large bets, bettors had estimated her chances of winning the prize at below 5%. Polymarket took a celebratory tone after the winner was announced, writing on Twitter, “Once again, Polymarket had the news more than 12 hours before it was announced.”4243

Switzerland’s gambling regulator has sued FIFA over their blockchain collectibles, which include NFTs that provide buyers a “right to buy” tickets to the 2026 World Cup. Holders are allowed to bypass the typically onerous process of purchasing World Cup tickets, and some of the tokens grant access only if a specified team qualifies — apparently running up against gambling and lottery restrictions.44

In prediction markets

I recently wrote about the regulatory tangle surrounding prediction markets, questioning whether trading on insider information could be prosecuted and, if so, by whom.

A recent high-profile case centered on illicit sports gambling suggests the Justice Department may not only be interested in prosecuting such cases, but willing to take a rather creative approach to do so. Miami Heat guard Terry Rozier has been arrested for allegedly sharing inside information about teams and athletes, such as when specific athletes would remove themselves from games due to purported illness or injury. He gave this private information to proposition bettors, who profit from making bets on the performance of individual athletes rather than the outcome of the game. These bets were made on traditional sports betting platforms — not prediction markets — but even though securities laws even more clearly don’t apply to those platforms, the Justice Department is pursuing an insider trading case. However, some of the case appears to be predicated on the platforms’ terms of service which prohibit making bets based on non-public information, and not all prediction markets impose such terms, which could make a similar case more challenging.45 I’ll be curious to see how this case plays out, as it seems like a somewhat novel legal theory.

Meanwhile, the traditional sports betting platform DraftKings is getting into prediction markets, reportedly with the explicit hope they can take advantage of the muddy regulatory situation to launch in states that prohibit sports betting.46

And of course President Trump is getting in on the whole thing, with his Truth Social platform recently announcing that its previously established partnership with Crypto.com will also include plans to launch prediction markets on politics, sports, economic policy, commodity prices, and other events.47

The Web3 is Going Just Great recap

There were four entries between October 9 and October 28, averaging 0.2 entries per day. $32 million was added to the grift counter.

- Cryptomus fined $127 million for compliance failures [link]

- Fortress Trust is insolvent [link]

- Paxos accidentally mints more than twice the global GDP in PayPal stablecoins [link]

- Hyperliquid user loses $21 million to private key leak [link]

Worth a read

Jacob Silverman recently published a guest essay underlining how Trump’s crypto corruption is unlike anything else in American history. “You can tick off notorious executive branch scandals — President Ulysses S. Grant’s rogues’ gallery of corrupt advisers, Teapot Dome’s bribes for oil leases in the Harding administration, Watergate and the downfall of Richard Nixon — but none of them featured this scale of mixing of personal and government interests, much less the sheer accumulation of profit, of Mr. Trump’s multibillion-dollar crypto windfall.”

As Elon Musk crows about his “AI-powered Wikipedia competitor” (which is mostly just Wikipedia-powered), there’s no better time to read this excellent bit of satire from McSweeney’s.

In the news

In his essay on crypto, libertarianism, and Trump, Finn Brunton quoted my observation that the 2020 boom weakened crypto’s ideological base: high prices and flashy marketing drew in gamblers, crowding out talk of “digital gold” and uncensorable finance.

CNBC cited my recent newsletter on the October crypto flash crash, highlighting my concerns that this may have just been a preview of a much more serious catastrophe.

That's all for now, folks. Until next time,

– Molly White

Have information? Send tips (no PR) to molly0xfff.07 on Signal or molly@mollywhite.net (PGP).

I have disclosures for my work and writing pertaining to cryptocurrencies.

Footnotes

References

“The MAGA Lobbyists Upending Washington With McDonald’s and Bear Hunting”, The Wall Street Journal. ↩

“DAY 21 OF THE TRUMP-REPUBLICAN SHUTDOWN: Crypto JUST Experienced a Major Meltdown. How is the Trump-Republican Shutdown Paving the Way for a Repeat?”, U.S. House Committee on Financial Services Democrats. ↩

Warren and Schiff resolution. ↩

“Senator Warren’s Statement on President Trump Pardoning Binance Founder Changpeng Zhao”, U.S. Senate Committee on Banking, Housing, and Urban Affairs. ↩

“GOP senator denounces Trump’s pardon of crypto billionaire CZ”, Politico. ↩

October 14 Gettr post by Sam Bankman-Fried. ↩

“Early Cryptocurrency Investor Known as ‘Bitcoin Jesus’ Admits to Misconduct and Enters into Deferred Prosecution Agreement”, U.S. Attorney's Office, Central District of California. ↩

“Crypto Investor Known as ‘Bitcoin Jesus’ Reaches Deal With Prosecutors”, New York Times. ↩

“The feds say two brothers stole $25 million in crypto in 12 seconds. The defense says they merely outsmarted bots.”, Business Insider. ↩

“DOJ seizes $15 billion in bitcoin from massive ‘pig butchering’ scam based in Cambodia”, CNBC. ↩

“Trump’s Take”, Center for American Progress. ↩

“Morning Minute: Crypto Caught in Middle of Democrat vs Republican Battle”, Decrypt. ↩

“Crypto Market Structure Talks Stall Over Leaked Dem DeFi Proposal”, Crypto in America. ↩

“Big Gaps Remain After Crypto Execs Meet With Senators on Market Structure Bill”, Decrypt. ↩

“Senate Republicans Call for Own Meeting With Crypto CEOs After Democrats’ Sitdown”, CoinDesk. ↩

“Democrat Seeks Crypto Trading Ban for Politicians Following Binance Founder’s Pardon”, Decrypt. ↩

Letter from Senator Schiff to Assistant to the President and Special Envoy for Peace Missions Steve Witkoff. ↩

“Bessent narrows Trump list for next Fed chair to 5 candidates”, Yahoo! Finance. ↩

“Fed's Bowman suggests allowing central bank staff to own small amounts of crypto products”, Reuters. ↩

“Trump Aide Hassett Reveals Coinbase Stake of at Least $1 Million”, Bloomberg. ↩

“Gov. Waller: U.S. Fed to 'Embrace Disruption,' Pitches 'Skinny' Master Account Idea”, CoinDesk. ↩

“OCC Announces Conditional Approval for Chartering Erebor Bank”, Office of the Comptroller of the Currency. ↩

Order to cease and desist from violations of NRS 669, State of Nevada Department of Business and Industry Financial Institutions Division. ↩

“Government Shutdown Imperils SNAP and Other Antipoverty Programs”, The New York Times. ↩

“New Federal Policies Spur Higher Health Insurance Premiums for Consumers in 2026, Insurer Filings Show”, The Commonwealth Fund. ↩

“Who’s paying for Trump’s $300 million ballroom?”, PBS News. ↩

“Cuomo condemned over racist AI ad depicting ‘criminals for Zohran Mamdani’”, The Guardian. ↩

“Cuomo suggests Mamdani would cheer a future terror attack”, Politico. ↩

“Cuomo Announces Creation of Chief Innovation Officer to Make New York City the Global Hub of the Future”, press release by Andrew Cuomo. ↩

“Innovate NY Backs Andrew Cuomo for Mayor; Championing Public Benefit Stablecoins with a $779 Million Annual Impact for New York Families”, press release by Innovate NY. ↩

Brock Pierce contribution to Empower NYC. ↩

“Crypto Billionaire Wants NYC Mayor Adams to Stay in the Race”, Bloomberg. ↩

“Nigel Farage tells crypto conference ‘I am your champion’”, Financial Times. ↩

“Crypto Exchange HTX Sued by UK for Unlawful Promotion of Assets”, Bloomberg. ↩

“A Mystery Trader Scored With Prescient Bets on the Nobel Peace Prize”, The Wall Street Journal. ↩

“Norwegian Officials Probe Major Polymarket Bets on Nobel Peace Winner”, CoinDesk. ↩

“FIFA Faces Criminal Complaint Over World Cup Ticket Offer”, SwissInfo. ↩

“Indictment Alleging Participation in Sports Betting Scheme”, The New York Times. ↩

“DraftKings Prediction Market App Will Focus on States Without Legal Sports Betting”, Decrypt. ↩

“Truth Social to Become World’s First Social Media Platform Offering Prediction Markets via Exclusive Partnership with Crypto.com”, press release by Trump Media & Technology Group. ↩