As he builds US power, Justin Sun fights to control his story

A crypto billionaire who once feared arrest in the US is now a Trump business adviser and White House guest. His lawsuit against Bloomberg reveals what he doesn't want Americans to know about his crypto fortune.

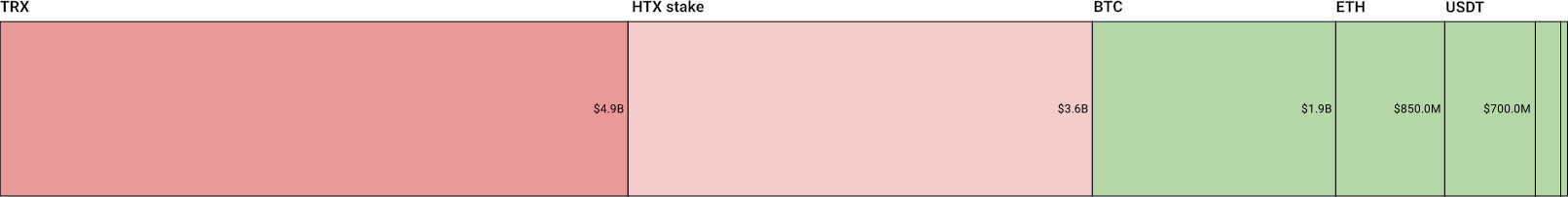

Crypto billionaire Justin Sun has sued Bloomberg for publishing details about his wealth that he himself provided to qualify for their Billionaire Index. While Sun was initially eager for Bloomberg to publicize his multibillionaire status, he became furious when he learned they planned to publish a rough breakdown of the assets comprising his crypto fortune. This may be because it reveals an inconvenient detail: the majority of his assets are TRX, the cryptocurrency issued by his company Tron — and he owns most of the TRX in circulation (63%). This concentration is somewhat reminiscent of the 2022 revelation that Sam Bankman-Fried had built his crypto empire on a foundation of FTT, the token issued by his own company FTX, sparking concerns about the solvency of his businesses and the value of FTT that ended in the collapse of both.

Sun’s fury could also stem from Bloomberg’s reporting that Sun owns the HTX cryptocurrency exchange (renamed from Huobi in late 2023 [I40]). Though it has long been clear that Sun holds more control over the exchange than he claims to have as a mere adviser, he has refused to admit he owns the company. This is a pattern with Sun, who has also denied ownership of other companies with which he’s heavily involved, such as Poloniex (which he later acknowledged owning), BiT Global, and Techteryx.

While Sun claims the lawsuit stems from fears over his privacy, personal safety, and financial security, these concerns are difficult to reconcile with his frequent public displays of wealth. Sun instead appears to be continuing his years-long pattern of trying to dictate his image in the media — downplaying his shady past1 and attempting to suppress reporting about his Tron network’s heavy use by criminal enterprises23 — now with heightened urgency as he works to reinvent himself for an American audience. Less than a year ago, Sun was a crypto entrepreneur dogged by SEC fraud allegations,4 so concerned about a reported criminal investigation into suspected financial crimes that he refused to step foot in the United States out of fear he would be arrested.5 Now he’s working to rebrand himself as a legitimate businessman, taking Tron public in US markets and securing an advisory role with one of the president’s own crypto ventures. This transformation has been aided by the mysterious easing of his legal troubles, which coincides with hundreds of millions in investments into Trump-linked businesses.

Sun’s wealth

According to Bloomberg, Sun owns more than 60 billion TRX,6 which at current prices would be worth $21 billion on paper. With approximately 95 billion TRX in circulation,7 Sun controls approximately 63%. Due to the low likelihood that Sun could liquidate a significant portion of his holdings for anywhere near this amount, Bloomberg applies a massive 75% discount to the paper valuation of his holdings for their estimate.

Because the Tron blockchain operates on a delegated proof-of-stake consensus (DPoS) mechanism, Sun’s substantial holdings do not directly translate to outsized control over network validation as they might in a traditional proof-of-stake network. However, these holdings do grant Sun power in choosing the delegates who perform validation, giving him substantial indirect control over the network. TRX is also the governance token used for voting in the Tron DAO, the decentralized autonomous organization ostensibly controlling the Tron network. This means that Sun could unilaterally control the outcome of DAO votes. (A Sun spokesperson did not address a question about Sun’s participation in Tron DAO votes, including the selection of delegates.)

Bloomberg also reports Sun holds approximately 17,000 bitcoin (around $1.9 billion at recent prices), 224,000 ETH ($850 million), and $700 million in the Tether stablecoin.

According to Bloomberg, much of Sun’s wealth also stems from his 90% ownership stake in the HTX cryptocurrency exchange, which Bloomberg also discounts by 50%. Sun has previously denied that he owns the exchange,89 and publicly describes himself as a mere “adviser”. When reached for comment, a Sun spokesperson didn’t address whether Sun disputes Bloomberg's reporting about his HTX ownership.

It’s not clear to what extent Bloomberg has verified the valuation of HTX, which has been alleged by crypto media outlet Protos to double-count reserves belonging to other Sun-involved companies, raising solvency concerns.1011 It’s also not clear whether Bloomberg has evaluated whether any of Sun’s personal holdings are simultaneously claimed as assets or reserves for his companies. In May, when Sun topped the leaderboard of $TRUMP memecoin holders, he registered with a hot wallet belonging to HTX. This was extremely unusual, as exchange hot wallets typically contain pooled funds from many customers. A Sun spokesperson stated that “all $TRUMP token holdings that qualified Mr. Sun for the gala dinner belong personally to Mr. Sun.”

Bloomberg’s analysis excludes tokens held on centralized crypto exchanges like HTX or Binance because his ownership couldn’t be verified. This may be why Sun’s self-reported holdings of the Trump-affiliated tokens WLFI and TRUMP aren’t included in the net worth report. It’s also possible that they were excluded because they are comparatively small compared to his other cryptocurrency holdings. WLFI may also have been excluded because it is not currently resalable, and does not have a clear valuation. Bloomberg does separately mention Sun’s investment into and advisory role with World Liberty Financial in the biography portion of the Billionaires Index entry.

With 40% of Sun’s net worth reportedly denominated in TRX (even at Bloomberg’s heavily discounted estimate), and another 30% attributed to his HTX ownership (also discounted), it’s perhaps more evident why Sun was unhappy to discover that Bloomberg planned to report his net worth in more detail than just the $12.3 billion top-line figure. While Sun claims the lawsuit is about protecting his privacy and personal safety, the information he’s fighting to suppress tells a different story.

The lawsuit

Sun writes in the lawsuit that a Bloomberg journalist contacted him to ask if he was interested in being listed in the ranked list of the world’s wealthiest people, but informed him that the publication would need to verify his financial condition. Sun says that he was interested, but was concerned about confidentiality due to the “sensitivity of his substantial cryptocurrency holdings”. However, he says he decided to provide Bloomberg with the information after reviewing similar profiles of other crypto billionaires like Binance’s Changpeng Zhao, Coinbase’s Brian Armstrong, and Gemini’s Cameron Winklevoss, which he said provided only broad overviews of their wealth and were based largely on public disclosures.

Sun was horrified, he says, when the journalists came back to him with a draft that included “specific financial holdings — in granular detail”, which he says threatens “significant harm to [Sun], including but not limited to, an invasion of privacy” and could subject Sun to “significant risk of theft, hacking, kidnapping, and bodily harm to him and his family.” Though the lawsuit attaches multiple news reports outlining horrific incidents in which people were kidnapped, tortured, or violently attacked by thieves who learned they held substantial crypto wealth, it does not explain how Bloomberg’s reporting puts him at any more danger than his own frequent public displays of wealth already do. (A Sun spokesperson did not address a question to this effect.)

Sun claims that Bloomberg had agreed to keep confidential the information he shared with them, and that their draft article and alleged sharing of his wealth valuation with other Bloomberg colleagues for use in a separate article showed they had brazenly violated the agreement. He also alleged that their reporting contained significant factual errors to do with his “personal history and his wealth”. Sun sent a cease and desist to Bloomberg around August 2, and was informed they still intended to publish. He then filed the lawsuit on August 11, charging Bloomberg with public disclosure of private facts and violation of confidentiality promises.

Although Sun’s lawsuit initially sought a temporary restraining order and a permanent injunction to prevent Bloomberg from publishing his Billionaires Index entry and an “unrelated” article based on his disclosures, a short filing by Bloomberg noted that they had published his Billionaires Index profile on August 11, two hours prior to receiving notice from Sun’s lawyers that Sun had filed for a temporary restraining order.12 It’s not clear that the second article written by other Bloomberg journalists has been published.a Sun later withdrew the motion for the TRO and injunction, though without prejudice for refiling.13

The exhibits

Telegram conversations and email exchanges attached as exhibits in Sun’s lawsuit appear to tell a somewhat different story than the one he laid out in the complaint.14b A message from a member of Sun’s team on February 28 indicates that a fellow employee named Timothy “will share with u the documents once get [sic] the approval from Justin ”. Several hours later, Timothy confirms he shared the material with Bloomberg journalist Dylan Sloan. Later that evening, Timothy asks about security policies to “prevent data leakage”, and Sloan describes cybersecurity practices and plans to analyze Sun’s crypto wealth using the Arkham cryptocurrency analysis platform. The subsequent week, on March 4, Sloan provides a more detailed plan for their Arkham analysis and outlines that they use a custom API. He assures them that “the file of Justin’s wallet addresses won’t leave our office”. “Are you all OK with that plan as it relates to data security?” he asks. Timothy responds, “ok, [no problem]”; Sun himself also responds “Ok”.

Then, on March 27, Sun suddenly posts what looks like several paragraphs of a confidentiality agreement in the Telegram chat — a month after his team had already shared his financial information.

(Stylization of Exhibit B)

Bloomberg employees don’t seem to acknowledge the legalese, but engage in conversations describing their estimates of Sun’s net worth in several partially redacted messages, and the group discusses estimated publication dates. The Telegram chat turns confrontational in late July, when Sun’s team accuses Bloomberg of breaching ethics by sharing information internally with other reporters, and violating Sun’s privacy with a draft article that includes a rough breakdown of Sun’s largest crypto holdings.

Bloomberg’s Tom Maloney replies that they had clearly explained their intention to publish estimated asset breakdowns during a March meeting with Sun’s team. “Nobody at Bloomberg agreed to the terms sent by Justin, weeks after the data was shared with us,” Maloney states.

Other claims from Sun’s employees that Bloomberg’s draft contains errors are followed by apparent refusals by those employees to identify or correct the errors unless Bloomberg agrees to Sun’s belated confidentiality terms, which they do not.

Later, a Tron employee insists that Bloomberg may only publish the total estimate of Sun’s wealth, with no additional specifics.

(Stylization of Exhibit B)

The conversations between Justin Sun, his employees, and the journalists reflect eagerness by Sun to provide financial information that would reflect a generalized dollar estimate of his net worth, followed by concern and then regret once it became evident that Sun would not be allowed to dictate the format or contents of Bloomberg’s reporting.

(Stylization of Exhibit B)

Though Sun and his team have tried to argue that Bloomberg violated previously agreed confidentiality terms, the chat logs appear to show an attempt by Sun to retroactively impose extreme terms on the data they’d already shared — including that the Bloomberg team could not use the data for any reporting. An attempt to hold the Bloomberg team to retroactive terms to which they never agreed seems profoundly unlikely to hold up in court.

An August 14 filing by Sun withdrew the request for a TRO and injunction, claiming that the two parties are “engaged in discussions that may moot the emergency relief originally sought”.13 The Bloomberg profile was updated on August 15 to correct an error in the size of Sun’s Tether holdingsc; other clarifications were made, but not related to his finances. Though this correction could bolster some future claim that Bloomberg’s original draft was erroneous, the transcripts showing the Tron team refusing to identify specific statements they believe to be erroneous, and Bloomberg’s apparent willingness to rectify actual errors, could weaken a future defamation claim. A public figure like Sun can typically only prove defamation if he can establish that Bloomberg was knowingly publishing false statements, or statements made with reckless disregard for the truth. At this stage, Sun has not alleged defamation, though an August 12 statement suggests that Sun is “prepared to hold Bloomberg fully accountable for knowingly publishing false information” along with legal threats about Bloomberg’s alleged failure to respect Sun’s privacy.15

When reached for comment with a series of questions, including about the quantity and concentration of Sun’s TRX holdings, a representative responded on August 18, “Bloomberg’s reporting on Mr. Sun was blatantly inaccurate in a number of ways, including but not limited to their claims regarding the composition of his assets and token portfolio. This flagrant misrepresentation and Bloomberg’s violation of the confidentiality agreement between Mr. Sun and Bloomberg necessitated the lawsuit by Mr. Sun. The result has already been efforts by Bloomberg to correct this false information.” In a separate press release issued on August 12, Sun representatives claimed that “Bloomberg’s reporting attributes to Mr. Sun cryptocurrency holdings he has never owned, controlled or had any beneficial interest in, and fails to report cryptocurrency holdings he does own. The assertions made by Bloomberg concerning Mr. Sun’s assets are false, materially misleading and based on unverified sources.”15

A pattern of legal threats

This is only the most recent incident in which Justin Sun has used legal threats to try to shape media narratives around himself and his companies.

Journalist Ryan Mac has said that Sun threatened to sue him in 2018 after he published a story at BuzzFeed News noting that Justin Sun’s Tron project had been accused of plagiarizing sections of its whitepaper from one published by Filecoin. (Sun blamed the duplications and lack of citations on translation issues.)1617

In 2023, Tron sent a retraction demand to crypto publication CoinGeek over a post that noted “Justin Sun’s Tron blockchain is once again being flagged as terror groups’ go-to financing option”.d That portion of the CoinGeek post was based on a Wall Street Journal report that Hamas-linked money exchanges were “overwhelmingly” using the Tether stablecoin on the Tron blockchain.2 Other statements in the CoinGeek piece challenged by Tron were direct quotes from a letter sent by the Campaign for Accountability ethics watchdog group to the Senate Banking Committee.18 It’s not clear if Tron also demanded a takedown from the Journal or any other outlets that quoted the Journal’s reporting. Neither CoinGeek nor the Journal issued a retraction, and it doesn’t appear that Tron followed through on the threats against CoinGeek by filing a lawsuit.

In late 2024, Justin Sun and his team demanded crypto media outlet CoinDesk take down an article about Sun’s $6.2 million purchase of Comedian, a conceptual artwork appearing as a banana duct taped to a wall. Shortly after Sun purchased the artwork, he captured additional headlines by eating the banana at a press conference in Hong Kong.e According to the Wall Street Journal, Sun’s team had objected to the “tone” of the CoinDesk article, which described Sun’s desire for fame, then-ongoing SEC lawsuit, and legal threats against media outlets, and suggested that his headline-making art purchase could be an attempt to distract media attention from less flattering coverage. (As I noted in a past issue of Citation Needed, “The [banana] stunt was timed right around Sun's first WLFI token purchase, diverting some press attention from it.”) CoinDesk had just been acquired by the crypto exchange Bullish, and Bullish executives reportedly were the ones who ordered the article’s deletion [I72]. According to some CoinDesk employees, Bullish executives had been pressuring reporters to avoid critical coverage or negative opinion pieces about important sponsors of CoinDesk’s annual Consensus conference, a major income stream for the struggling media outlet; Sun’s Tron was among them. Not long after the article was removed, CoinDesk fired its editor-in-chief Kevin Reynolds and deputy editors-in-chief Nick Baker and Mark Hochstein. CoinDesk said the firings were part of a downsizing effort and unrelated to the demand from Sun.19

The Trump connection

Sun’s aggressive attempts to fend off critical media coverage mirror the litigation playbook of his latest business partner and ally. Barred from donating to political campaigns because he is not a US citizen, Sun has nevertheless joined the deep-pocketed crypto pack in buying favor with President Trump, out-splurging any other single crypto donor by funneling $213 million toward Trump’s crypto businesses. It began in November 2024 with his $30 million purchase of $WLFI, which earned him an advisory position with the token’s issuer, the Trump family’s World Liberty Financial. He bought more in January, bringing his total investment in the project to $75 million.f He would go on to top the leaderboard at Trump’s controversial pay-for-access memecoin dinner in May by outspending other attendees on $TRUMP,g and in July he announced plans to pour another $100 million into that token [I88].

Sun’s business and legal future in America brightened substantially after the payments began, with the February pause of an ongoing SEC lawsuit against him and his company that had alleged not only unregistered securities sales, but that he had personally directed a wash trading scheme to inflate the price of Tron’s TRX token — a token that we now know forms the majority of his personal wealth. Sun, reportedly once so afraid of a possible warrant for his arrest that he spent years refusing to step foot in the United States and even forfeited a $28 million trip to space in 2021,5 has evidently had those fears assuaged, posting photos of himself touring the White House (at Trump’s personal invitation, he says).20 He also cashed in on the spaceflight opportunity, spending 10 minutes in sub-orbit on an August Blue Origin flight.

In June, Sun announced he would be taking Tron public in the US through a reverse merger with a company that previously sold theme park merchandise. The deal was brokered by Dominari Securities, a small investment firm that had added Eric Trump and Donald Trump Jr to its advisory board in February [I86].

Buying legitimacy

While Sun’s lawsuit against Bloomberg may look like just another attempt to control media coverage, his extreme reaction raises questions as to whether he believes the reporting could threaten the foundation of his American ambitions. Unlike his history of empty threats against smaller outlets, Sun actually followed through with legal action against a major publication. The details he wanted to suppress — likely his overwhelming concentration in TRX, his ownership of HTX, and the echoes of FTX — should concern Americans, particularly now that Trump has welcomed him as a business adviser.

Sun’s history of secretly concentrating ownership of TRX to the point that he could control the token’s price and governance, and misconduct allegations from regulators, raise alarming questions about his advisory role at Trump’s World Liberty Financial project, which issues a WLFI governance token that will soon become available for trading on the secondary market. Will investors know they’re trusting someone previously accused of orchestrating wash trading schemes to artificially inflate token prices?

While the SEC has paused multiple cases against crypto donors since Trump took office, Sun’s case stands out: unlike other cases alleging regulatory violations, his included allegations of outright fraud. But the concerns extend beyond the SEC’s civil complaint. A reported criminal investigation — one serious enough to keep Sun out of the United States for years — that suddenly disappeared amid massive contributions to Trump-connected project only heightens concerns around his growing influence with the Trump family.

As Sun attempts to bury the details of his wealth and business practices, Americans should question what other revelations about Trump’s crypto partners might be suppressed through legal threats or political payments. Sun’s transformation from persona non grata to White House VIP sends a clear message: in Trump’s America, everything has a pricetag.

Have information? Send tips (no PR) to molly0xfff.07 on Signal or molly@mollywhite.net (PGP).

I have disclosures for my work and writing pertaining to cryptocurrencies.

Footnotes

It’s possible that the secondary article mentioned in the lawsuit was actually the biography accompanying Bloomberg’s valuation estimates, although Muyao Shen, the journalist with whom the wealth analysts reportedly shared their valuation, is not included in the byline. ↩

Some screenshots shared within the Telegram chat are broken in the court exhibits, and so there is some uncertainty in this discussion. ↩

An early version of the report said Sun held 700,000 Tether (a dollar-pegged stablecoin). This was corrected to 700 million. ↩

Among the retractions demanded by Sun’s lawyers was the removal of a sentence that “But given that Sun has spent much of his life on the run from multiple agencies, we assume his [threat to contact law enforcement in connection to a series of hacks against his companies [I49]] is more hollow than a dollar store chocolate Easter bunny.” Points to CoinGeek for evocative metaphors. ↩

Sun’s $6.2 million purchase actually entitled him to a certificate of authenticity and a set of instructions for displaying a duct taped banana. The actual banana has to be regularly replaced anyway. ↩

With 75% of WLFI token sales going to Trump and his family, $56.25 million went directly from Sun to the Trumps. ↩

Sun’s $TRUMP holdings were priced at around $18 million around the time of the dinner, though an analysis of price at purchase suggest he spent $37.7 million on his holdings.21 ↩

References

“The many escapes of Justin Sun”, The Verge. ↩

“Hamas Needed a New Way to Get Money From Iran. It Turned to Crypto.”, The Wall Street Journal. ↩

“2025 Crypto Crime Report”, TRM Labs. ↩

Complaint filed on March 22, 2023. Document #1 in SEC v. Sun. ↩

“A Crypto Billionaire Who Feared Arrest in the U.S. Returns for Dinner With Trump”, The Wall Street Journal. ↩

“Bloomberg Billionaires Index: Justin Sun”, Bloomberg. ↩

“Justin Sun fights a lot of lawsuits on behalf of companies he doesn’t own”, Protos. ↩

“Justin Sun denies being 'real buyer' of Huobi stake sale: Exclusive”, The Block. ↩

“Justin Sun-advised HTX plays games with its reserves”, Protos. ↩

“Justin Sun stored USDD reserves at HTX for proof-of-reserves”, Protos. ↩

Letter filed on August 12, 2025. Document #9 in Sun v. Bloomberg LLP. ↩

Notice of of withdrawal of plaintiff's motion for a temporary restraining order and preliminary injunction filed on August 14, 2025. Document #15 in Sun v. Bloomberg LLP. ↩

Exhibit B to the declaration of Sprina Wang in support of plaintiff’s motion filed on August 11, 2025. Document 8-2 in Sun v. Bloomberg LLP. ↩

“Justin Sun’s Representatives Issue Statement Asserting Bloomberg Billionaires Index Contains Knowingly False Reporting on His Assets”, press release by Tron DAO. ↩

“Want To Make Millions? Copy Someone’s Cryptocurrency Project.”, BuzzFeed. ↩

Bluesky post by Ryan Mac. ↩

Letter from the Campaign for Accountability to the Senate Banking Committee on November 9, 2023. ↩

“CoinDesk Dismisses Top Editors After Story Draws Crypto Executive’s Ire”, The Wall Street Journal. ↩

“Trump's crypto dinner cost over $1 million per seat on average”, NBC News. ↩