A preview of the Sam Bankman-Fried trial

Key witnesses and the likely legal strategies about to unfold in the historic case ahead.

Programming note: I will be actively covering the Sam Bankman-Fried trial, which will mean more newsletter issues than usual. Coverage specific to FTX will go in the new "FTX Files" section.

If you're not interested, or if you find the frequency to be too much for you, you can opt out of just this category of newsletter in your subscription settings while continuing to receive my usual posts. And if you want to catch up on the much more detailed FTX backstory up to this point, check out my past posts in that section!

Tomorrow, all eyes turn to New York as Sam Bankman-Fried goes to trial for his role in the multi-billion-dollar collapse of the FTX cryptocurrency exchange. With FTX widely viewed as synonymous with the cryptocurrency industry in the eyes of the public, the case will be historic for a sector already scarred by fraud and failure. It's significant even outside of the crypto bubble, too: the magnitude of the monetary losses and the number of victims involved have already drawn widespread comparisons to Bernie Madoff, Theranos' Elizabeth Holmes, and other notorious fraud cases.

About eleven months ago, the then second-largest cryptocurrency exchange in the world imploded over the course of only a few days as trust in the company crumbled and it failed to meet a surge of customer withdrawals. It rapidly became apparent that customer money was missing. A lot of it.

Since then, it's come out that FTX allowed its sister trading firm, Alameda Research, to dip into FTX's customer funds with effectively no limit to backstop their own trading losses. Much of FTX's balance sheet was also revealed to be denominated in flimsy crypto tokens worth far less in reality than on paper, and a substantial portion of them had been created out of thin air by FTX itself. And the FTX group of companies had spent money they didn't have, splashing out for extravagant celebrity endorsements and advertisements, buying real estate, and donating massive sums to curry favor among seated politicians and bankroll the industry boosters running for office.

Altogether, somewhere around $8 billion was gone.

CEO and founder Sam Bankman-Fried resigned on November 11, 2022, as the company filed for bankruptcy and appointed an experienced bankruptcy CEO to try to comb through the rubble. That CEO once led Enron through bankruptcy. He's said that this situation is worse.

Only a month after his resignation, Bankman-Fried was arrested in The Bahamas as the U.S. Justice Department brought criminal charges against him. Ten days after that, he decided he no longer wished to fight extradition, and was shipped to the U.S. to begin preparing his defense. Since then, a whirlwind preparation has been underway as attorneys on both sides race to prepare for trial. Leading that effort on Bankman-Fried's side is Mark Cohen, the high-powered white collar defense attorney previously known for representing sex trafficker and Jeffrey Epstein co-conspirator Ghislaine Maxwell.

The trial begins tomorrow, October 3, with jury selection slated to last just one day. The most recent trial schedule1 estimates the whole ordeal will last six weeks, ending on November 9. The government has a very strong case, with access to troves of internal documents and the cooperation of executives and members of Bankman-Fried's inner circle who were central to FTX operations.

The charges

Bankman-Fried faces seven charges relating to fraud and money laundering.

- wire fraud on FTX customers

- conspiracy to commit wire fraud on FTX customers

- wire fraud on Alameda Research lenders

- conspiracy to commit wire fraud on Alameda Research lenders

- conspiracy to commit securities fraud on FTX investors

- conspiracy to commit commodities fraud on FTX customers

- conspiracy to commit money laundering

The two non-conspiracy charges are "substantive" charges, which means that the prosecutors will need to prove that Bankman-Fried himself actually committed the crimes in question. The remaining charges only require the prosecution to prove that he planned with at least one other person to commit those crimes, and took steps towards doing so; they don't necessarily need to prove that the crimes actually happened.2

An additional five charges, added in superseding indictments after Bankman-Fried's extradition, will be tried separately in March 2024 [see Issue 30]. Bankman-Fried has pleaded not guilty to all twelve charges.

Sentencing

At the risk of getting too far ahead of ourselves, let's look at what kind of sentence Bankman-Fried is facing if convicted of any or all charges.

Several of the charges — wire fraud, conspiracy to commit wire fraud, and conspiracy to commit money laundering — each carry a 20-year maximum prison sentence. The commodities fraud and securities fraud charges against him come with 5-year maximum sentences. Some headlines3 have suggested that Bankman-Fried could be sentenced to as many as 115 years in prison if convicted, though that estimate is calculated by assuming that he will be convicted of all charges, that each conviction would be considered separately rather than grouped, that the maximum sentence would be applied to all charges, and that sentences would run consecutively.

Some legal experts have predicted more realistic sentences of 10–20 years if convicted, though they note that Judge Kaplan has broad authority over the duration.4 Others have suggested that such a huge sentence, akin to Bernie Madoff's 150 years, could plausibly happen in such a massive and historic fraud case.5 Furthermore, sentencing enhancements related to the enormous monetary losses could add considerably to the calculated sentence. Judge Kaplan himself has said that Bankman-Fried "could be looking at a very long sentence" if convicted.6

Whether it's likely to be 10 years or 100 years, Bankman-Fried is inarguably looking at a very strong possibility that he will spend a significant portion of the rest of his life behind bars.

The key witnesses

Besides Sam Bankman-Fried, four other high-level executives at the FTX group of companies have been charged, and all four have reached plea deals. Three of them agreed to cooperate with the investigation as a part of their plea, and will almost certainly appear as witnesses at the trial. They were not just Bankman-Fried's employees and co-workers, but also his friends, roommates, confidants, and, in one case, a former romantic partner.

Caroline Ellison

At the time of the collapse, Caroline Ellison was CEO of Alameda Research, the trading firm that tapped into FTX customer funds to finance its bets. The 28-year-old shares a very similar background to Bankman-Fried: she's the child of two elite university professors (hers at MIT rather than Stanford), the graduate of an elite university (her from Stanford rather than MIT), a former Jane Street intern (where she met Bankman-Fried), and an effective altruist. She and Bankman-Fried sometimes dated, in what was apparently a tumultuous on-and-off relationship. Ellison is likely to be the government's star witness, as she was Bankman-Fried's top lieutenant. However, she is also likely to face the fiercest cross-examination over her role in the collapse, and she has already been the target of Bankman-Fried's attempts to shift blame.

Ellison was one of two additional executives charged in December. As Sam Bankman-Fried was on a plane being extradited from The Bahamas, prosecutors announced they'd reached a plea deal and that she would be cooperating with the investigations. Ellison pleaded guilty to the same seven charges that Bankman-Fried is facing in this trial [I14].

Since the collapse, Bankman-Fried has been trying to shift blame from himself to Ellison, claiming that he hadn't been involved in Alameda's operations for a long time, and that he had no idea what was going on at his company under Ellison's leadership. His decision to leak some of her personal diary entries to the New York Times in July was described by Judge Kaplan as an attempt to tamper with a witness (the second such incident), and was what finally landed him back in jail in August, after several months of house arrest spent at his parents' California home [I36]. Kaplan described the diary entries as "something that someone who has been in a relationship would be unlikely to share with anyone except to hurt and frighten the subject".

In a draft of a long Twitter thread that he never ultimately published, but that was leaked to the Times after Bankman-Fried was remanded, he blamed "Alameda's failure to hedge" on Ellison and described her as unsuited for her role [I39]. He also claimed that their strained personal relationship influenced her actions, in what seems to be an ongoing attempt on his part to portray her as a jilted ex who singlehandedly tanked his empire. The extent to which this strategy has been endorsed by his legal team, versus being a scheme Bankman-Fried came up with on his own, is not quite clear.

By all accounts Ellison appears to have been a prolific notetaker, at one time compiling a list of "Things Sam is Freaking Out About" [I37]. This is an incredibly undesirable trait if you happen to be someone engaging in massive fraud, but I'd imagine the prosecutors who have secured her cooperation in the investigation are just over the moon about it. Prosecutors also have a recording of her speaking to Alameda employees at an all-hands meeting held as the FTX group of companies was falling apart, in which she replied to an employee who asked "Who made the decision on using customer deposits [to cover Alameda Research's shortfalls]?" with "Um… Sam, I guess."

Gary Wang

Gary Wang co-founded both Alameda Research and FTX with Bankman-Fried, and held the Chief Technology Officer title at FTX. Wang, 30, was roommates with Sam Bankman-Fried at MIT. A lot less is known about Wang than about other executives, and he kept a much lower profile. However, he played an instrumental role in starting and operating FTX, and was knowledgeable about the technical implementation of the FTX software.

Lawyers for the FTX estate and for the SEC7 and CFTC8 have both claimed it was Gary Wang who, at Bankman-Fried's direction, coded the secret "backdoor" that allowed Alameda Research to borrow billions in FTX customer funds. He pleaded guilty to four fraud charges filed in December, and agreed to cooperate with the investigation [I14].

Nishad Singh

Former FTX engineering director Nishad Singh pleaded guilty to six charges in February 2023 and agreed to cooperate with the investigation. In addition to similar fraud and money laundering charges as those filed against Bankman-Fried and Ellison, he was also charged with violating campaign finance laws by acting as a straw donor to help Bankman-Fried circumvent political donation limits.9 He was 27 when he was charged.

Allegations in parallel lawsuits from the SEC and CFTC suggest that Singh also helped to create the "backdoor", and that he falsified records at Bankman-Fried's instruction to inflate FTX's supposed revenue, then lied to auditors about it [I21]. He was also a recipient of at least $543 million in "loans" from FTX — much of which was money actually funneled through Singh for Bankman-Fried's purposes, including political donations — but tens of millions of which were for Singh's personal benefit.

Ryan Salame

Ryan Salame, former CEO of FTX's Bahamas-based subsidiary, squeaked in a plea deal on September 7, just weeks before his boss's trial was set to begin. Of the four executives to plead guilty, he's the only one not cooperating with the investigation, and prosecutors had previously indicated that Salame's lawyers had informed them that if subpoenaed, he'd just take the Fifth [I37]. He's pleaded guilty to two charges: operating an unlicensed money transmitting business and a campaign finance law violation.

Like Singh, Salame served as a straw donor for Bankman-Fried. While Bankman-Fried and Singh mostly donated to Democratic causes, Salame was in charge of funneling FTX money to Republican candidates in furtherance of Bankman-Fried's hopes to, as Salame put it, "weed out anti crypto dems for pro crypto dems and anti crypto repubs for pro crypto repubs".

Others

The prosecution has indicated they intend to bring customers and investors in FTX as witnesses. One customer they're hoping to present is a young Ukrainian man who lost "a substantial portion of his life savings" that he had put into FTX after the Russian invasion in 2022. Prosecutors have asked for permission for him to testify via video link, since travel is not likely to be possible due to the ongoing war;10 the defense has opposed this request.11 The prosecutors are clearly looking for sympathetic victims to tug at the heartstrings of the jury, and this certainly sounds like one such individual.

The prosecution also intends to call FTX employees who will be testifying under grants of immunity, which should be interesting. As of yet, there's been no indication of who these people will be, but my list of conspicuously missing executives [I39] might be a good place to start speculating.

The strategy

Prosecution

There's no question that billions of dollars of customer funds went missing from FTX. Instead, prosecutors are tasked with convincing a jury that they're missing thanks to intentional fraud by Sam Bankman-Fried. The "intentional" part is the sticky bit, with prosecutors needing to convince all twelve jurors beyond a reasonable doubt that Bankman-Fried intended to defraud people. If even one juror holds out, Bankman-Fried could (for now) dodge a guilty verdict thanks to a hung jury — and trying to appeal to just one sympathetic juror may be his only hope in what looks like a pretty overwhelming case against him. However, in the case of a hung jury, the government could retry the case against him.

However, the government has access to some of the most key players in the FTX empire, and they've agreed to fully cooperate in hopes of lighter sentences for their own roles in the fraud. Other key participants could still be coming, depending on who the prosecution produces under promise of immunity.

The prosecution also have practically unlimited access to FTX's internal records, thanks to the cooperative replacement executive team helming FTX's bankruptcy, who also want to see Bankman-Fried found guilty in hopes of aiding the bankruptcy efforts.

Finally, Bankman-Fried himself has helped prosecutors by embarking on a whirlwind media tour that began during FTX's collapse and continued for months afterwards. He spoke to not only journalists, but seemingly to anyone who would listen, venting in Twitter DMs to a journalist, writing lengthy blog posts, posting on social media, speaking unguardedly in several hours-long livestreamed Twitter Spaces, and sending private documents to journalists and crypto influencers. Prosecutors can use any of these recorded statements to impeach his testimony during the trial, and will be sure to highlight any inconsistencies between the two.

Defense

Bankman-Fried will be arguing that FTX's collapse was thanks to forces outside of his control, and that he didn't knowingly commit any crimes. Crypto markets are notoriously volatile, he'll probably say, and we've seen unexpected market movements wipe out poorly-run companies before.

He may try to blame the whole thing on a "bank run",a and say that the company would have been fine if it wasn't for the rush of customers all trying to withdraw at once. This is an argument being echoed by Michael Lewis, who made the jaw-dropping claim on 60 Minutes while promoting his new SBF biography (or perhaps hagiography?b) that "if there hadn't been a run on customer deposits, they'd still be sitting there making tons of money."12

Bankman-Fried will also repeat the arguments that he's been making since November: that he really "fucked up", but was acting in good faith, mistakenly believing up until the end that FTX was solvent due to poor accounting and incompetent oversight. That he's just a naive, smol boy who got in over his head. He's repeatedly claimed that he was somehow unaware of the multi-billion-dollar hole in FTX's balance sheet — claims also now helpfully being bolstered by Michael Lewis, who says Bankman-Fried told him that the missing funds seemed to him like "a rounding error… it felt like we had infinity dollars in there."

Bankman-Fried will also likely repeat his past claims that he was ignorant to what was happening at Alameda and not closely involved with that side of the business, despite apparent contradictory evidence showing that he was in fact deeply involved and often directing Ellison's actions.

His team has also gestured at an argument that Bankman-Fried was acting on advice of counsel, and thus did not have fraudulent intent. However, they've stopped short of bringing a formal advice-of-counsel defense, which would require them to show that Bankman-Fried gave his lawyers a full understanding of what he intended to do, then dutifully followed their advice in doing it. This is typically a tricky defense to pull off, and his team may have decided against pursuing it due to concerns that those lawyers could respond by sharing documents that further implicate him. However, the defense still may try to make allusions to bad legal advice to try to introduce doubt around Bankman-Fried's intent. The judge has barred his team from mentioning any reliance on attorneys in opening statements, but decided that he may still allow them to refer to attorney advice on a limited basis, agreeing that it could be useful information for a jury towards determining his intent.

Bankman-Fried's team will also attempt to discredit the cooperating witnesses brought by the government, and potentially even say that if someone helmed a fraudulent scheme at FTX, it was them, not Bankman-Fried. They may point to Ellison's own writings, where she admitted she felt unqualified to run Alameda Research. It's likely that they will argue that those who've agreed to plea deals are simply regurgitating what they think the prosecutors want them to say in hopes of reducing their own punishment. This, however, may be challenging with contemporaneous evidence of those same witnesses blaming Bankman-Fried for FTX's fall even before criminal charges were brought, such as in the recording of the all-hands meeting.

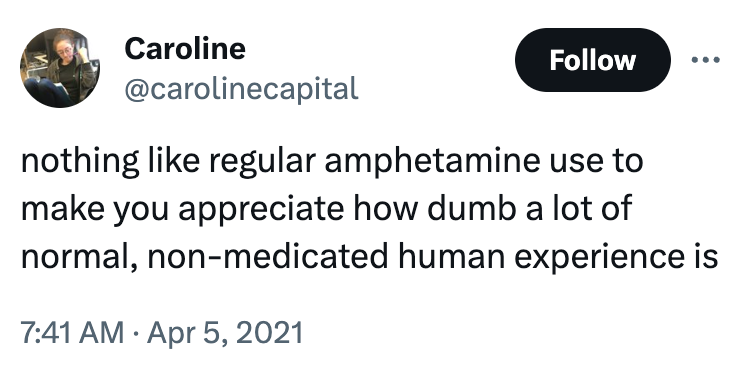

The defense team has also requested permission to cross-examine witnesses on topics including their recreational drug use, a strategy that will almost certainly be aimed at Ellison (among others). However, the judge has ruled that the defense will need to provide advance notice of this line of questioning.

The defense will have to tread a careful line between discrediting potentially damning witness testimony and alienating a jury, who could interpret this strategy as an attempt to make underlings take the fall for Bankman-Fried's actions. In particular, a jury may view Bankman-Fried's attempts to blame Ellison as an attempt to throw an ex-girlfriend under the bus — an ex-girlfriend he also exercised considerable power over, given he was also her boss.

What's next

Things kick off tomorrow with jury selection. We have some preview of how this will go, as both the prosecution and defense have submitted the questions they hope the judge will ask prospective jurors to evaluate their suitability, although some last-minute requests by the defense for reconsideration are still unresolved.

Some of the questions will be very standard, asking prospective jurors if they have any anticipated scheduling conflicts, medical or other issues that could interfere with their ability to participate, and so on. Others are much more specific, asking about jurors' past involvement with and knowledge of cryptocurrencies, startup companies, or FTX itself.

After that, each side will present opening statements, and the trial will begin in earnest. Needless to say, I'll be following along closely.

Footnotes

References

Trial calendar filed on September 28, 2023. Document #297 in United States v. Bankman-Fried. ↩

"Sam Bankman-Fried (Probably) Won't Get a 115-Year Prison Sentence", CoinDesk. ↩

e.g. "Sam Bankman-Fried Could Face Up to 115 Years in Prison, If Convicted", Time and "Sam Bankman-Fried faces up to 115 years in prison on charges he organized 'one of the biggest financial frauds in American history'", Fortune. ↩

"Sam Bankman-Fried (Probably) Won't Get a 115-Year Prison Sentence", CoinDesk. ↩

"Prosecutors have damning evidence of Sam Bankman-Fried's fraud: Why isn't he pleading guilty?", Fortune. ↩

"Judge rejecting Sam Bankman-Fried jail release 'wondering' if onetime crypto titan 'would seek to flee'", Fortune. ↩

Bankman-Fried was also at one point charged with a violation of campaign finance laws, but that charge was ultimately dropped due to extradition-related issues [I35]. Evidence pertaining to those activities will still be incorporated into the trial by prosecutors as proof of wire fraud and money laundering. ↩

Letter motion filed on September 30, 2023. Document #302 in United States v. Bankman-Fried. ↩

Letter filed on October 2, 2023. Document #308 in United States v. Bankman-Fried. ↩

"Sam Bankman-Fried 'thinks he's innocent,' author Michael Lewis says ahead of book about FTX founder", CBS News. ↩