Issue 85 – All the President’s tokens

As Trump’s web of crypto projects gets tangled up in itself, a regulator warns of “regulatory Jenga” in the crypto sector that echoes the 2008 financial crisis

After I broke the news that Magic Eden and the $TRUMP memecoin project would be announcing an “Official $TRUMP Wallet by President Trump”, things exploded into chaos — and not just because the President of the United States continues to demolish his own records for self-dealing.

Magic Eden pushed out their announcement quickly after I published my story, only for all three of the Trump sons to repudiate the project within hours. “I run [the Trump Organization] and I know nothing about this project!” tweeted Eric Trump. Donald Trump Jr. made a similar post, reiterating that the World Liberty Financial project was working on their own version of a Trump wallet. Even Barron Trump, who is normally fairly absent from social media, posted that “our family has zero involvement with this wallet”.

This potential conflict with the World Liberty Financial project, which is more closely affiliated with the Trump sons, was something I noted in my original post. I wrote that there seemed to me to be “questions as to whether these various Trump-affiliated crypto projects, some of which are managed by separate entities, might wind up competing with one another.” Evidently such questions never even occurred to the Magic Eden team or the $TRUMP memecoin team while they were working on this announcement, because they seemed caught completely off guard.

Confusion quickly spread throughout the crypto world, with many questioning if Magic Eden’s social media accounts had been hacked to announce a fake project. A Twitter account associated with the new Trump wallet, which had been verified with a badge associating it to the Magic Eden company, was briefly suspended, and announcement tweets were annotated with Twitter Community Notes highlighting the Trump family’s disavowal. Others wondered if Magic Eden — a fairly large player in the crypto world, as they go — had been so brazen as to completely fabricate a partnership with the Trumps or Trump-affiliated entities.

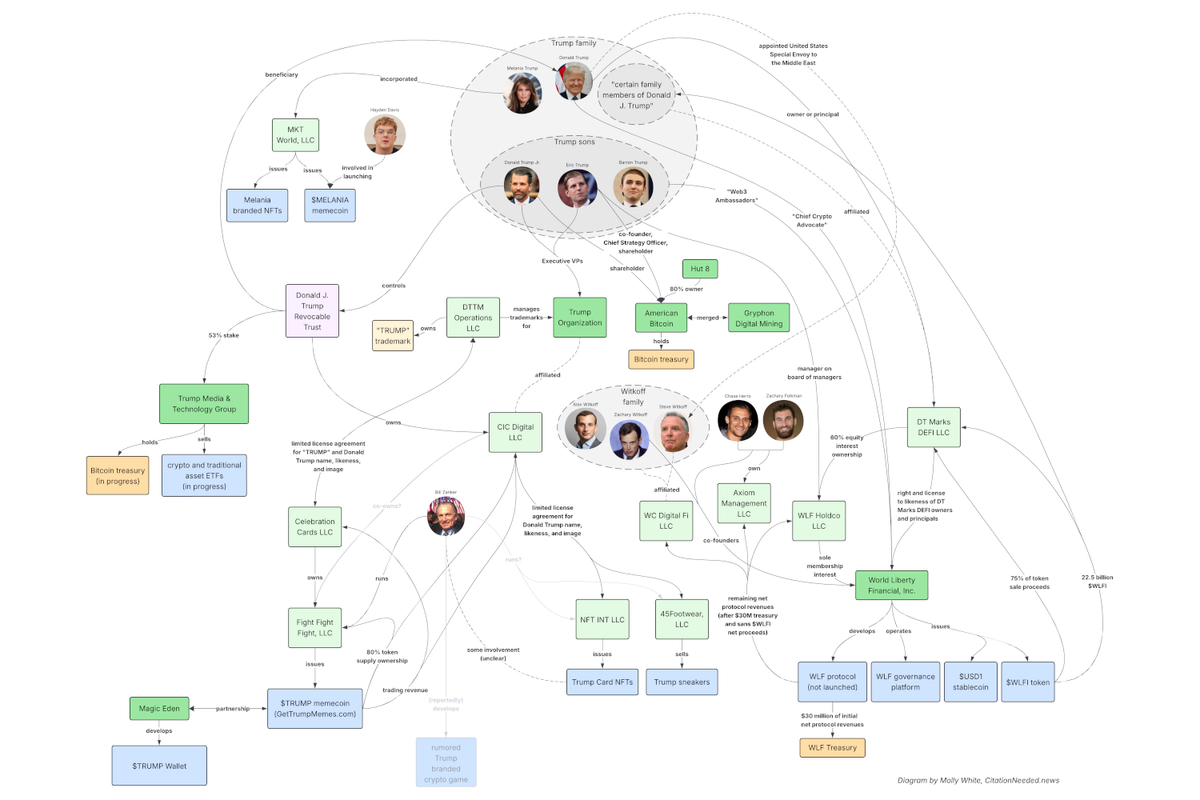

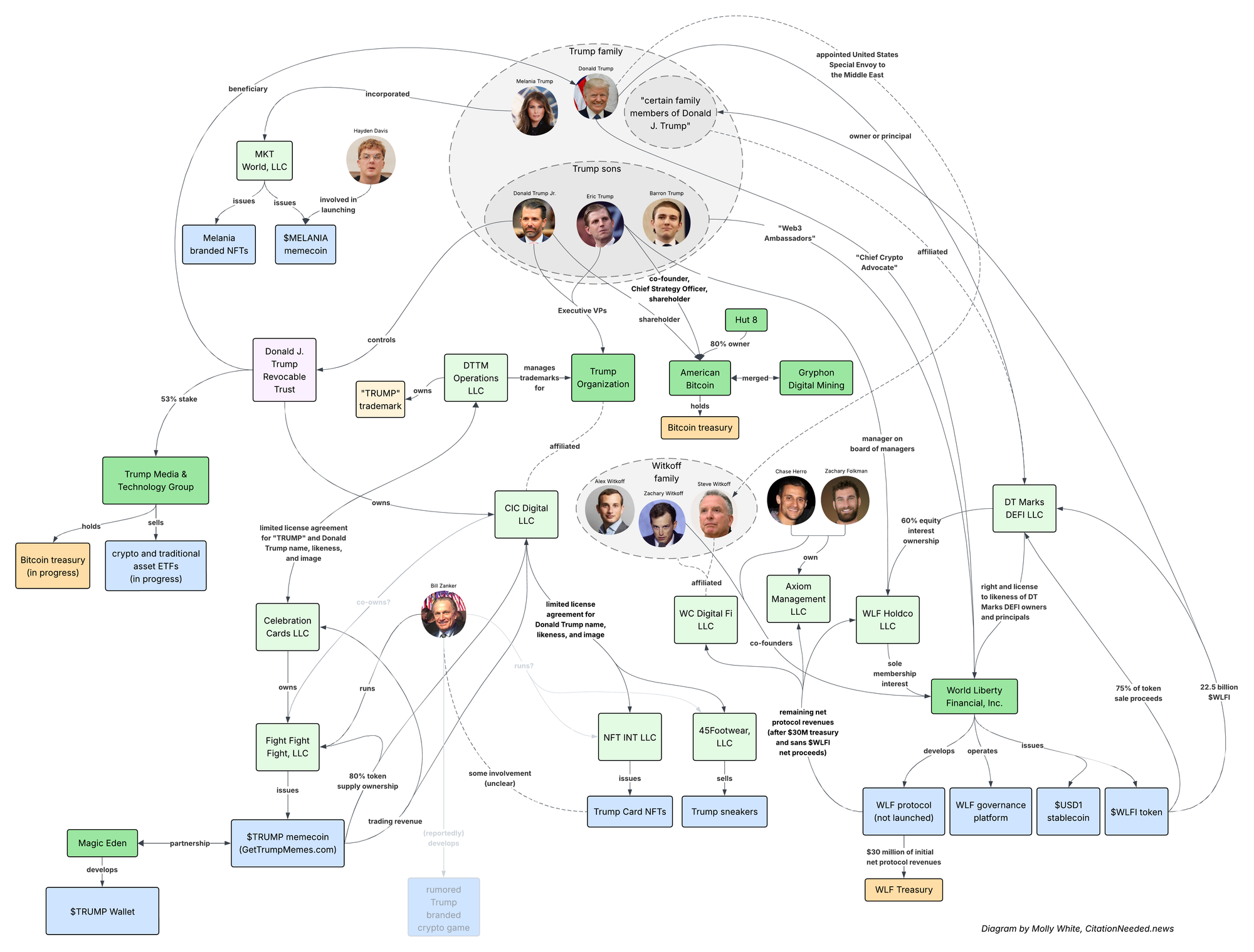

Neither is the case. The Magic Eden announcements legitimately came from the company, and the $TRUMP memecoin project confirmed its involvement with the wallet project. This leaves the most likely explanation, in my opinion, that Trump has sold his likeness to so many separate projects led by separate entities, while his sons also actively exploit the “Trump” branding, that no one really knows what’s going on in aggregate. I have mapped out all of the people, LLCs, and crypto projects associated with the Trump family, and the tangled web illustrates the chaos. (I should also note that the diagram is limited to what’s publicly known, and there are many missing links and entities whose operators are partially or completely unknown.)

The distance between the memecoin end of the business, run by entities affiliated with businessman Bill Zanker,1 and the World Liberty Financial project, which is more closely tied to Trump’s sons, is the likely culprit for the communications breakdown. However, it’s still not fully clear to me how the memecoin business could legitimately sign off on a wallet project using Trump’s name and likeness without the sons’ knowledge or sign-off from the Trump Organization, unless the original licensing agreement for the memecoin was exceptionally broad.

On June 5, two days after the original announcement, Bloomberg reported that the Trump sons had sent a cease-and-desist order via World Liberty Financial to the Trump memecoin project and to Magic Eden.2 Shortly after this story was published, the TrumpWallet.com site hosting the waitlist signup went offline, though it’s not clear if this is a direct result of the threat of legal action or an unrelated outage. Since Tuesday’s announcement, Magic Eden, the $TRUMP memecoin project, and the Trump family have otherwise maintained complete radio silence about the wallet project, deepening the confusion around its status. Even Trump himself, usually quick to promote projects bearing his name, has remained uncharacteristically quiet. Behind the scenes, Magic Eden is likely scrambling to salvage what has become an embarrassing public relations disaster.

In the courts

SafeMoon CEO John Karony was convicted on all three charges [I83, 43, W3IGG] after a jury found that he had committed fraud by diverting funds from the supposedly “locked” liquidity pool for his own personal use. He faces up to 45 years in prison.3

A committee representing creditors in the Genesis bankruptcy has filed two lawsuits against Barry Silbert, the founder and CEO of Genesis’ parent company, Digital Currency Group. Digital Currency Group is also named in the suit, as are several other executives and entities. The lawsuits, one filed in bankruptcy court and one in Delaware Chancery Court, allege misconduct by Silbert and others that led to Genesis’ collapse, and accuse them of covering up Genesis’ insolvency and falsely reassuring creditors that Genesis was in strong financial condition.4 Among their claims are allegations that Silbert, his brother, and other company executives took millions of dollars in loans from the foundering company as they simultaneously tried to convince investors not to call back loans or withdraw funds. The creditors seek $2.3 billion in restitution. DCG has refuted the allegations in the lawsuits, which it says “recycles the same tired, two-year old claims in an opportunistic attempt by sophisticated investors to extract additional value from DCG”.5

Avraham Eisenberg, who was just sentenced to over four years in prison on a charge of possessing child sexual abuse materials, just caught something of a break when the judge in his case overturned his April 2024 crypto fraud conviction on the basis that prosecutors had failed to prove that Eisenberg made false representations to Mango Markets in the course of his $110 million maneuver (which one might classify as either a “theft” or a “trade”, depending on whose side they’re on).6 This has some potentially interesting ramifications for the crypto world, as it lends some weight to the “code is law” arguments Eisenberg made throughout his case. However, as the judge had previously said, the CSAM sentence is likely to be the bulk of his prison term regardless, so this may not have much of a practical difference for Eisenberg [W3IGG, I6, 43, 55, 56, 67, 81, 83].

Coinbase has moved to remove the Oregon Attorney General’s securities case against them to federal court, arguing that the case is a “regulatory land grab” by an AG “dissatisfied with the federal government’s recent enforcement decisions” [I82].7

Trump crypto projects

When the Financial Times reported on May 26 that Trump Media & Technology Group planned to raise billions of dollars to buy bitcoin, TMTG slammed the publication as “dumb writers listening to even dumber sources”.8 The following day, TMTG issued a press release announcing that they would be raising billions of dollars to buy bitcoin.9

TMTG has also filed a registration statement for a “Truth Social Bitcoin ETF”. As previously announced, the ETF will be created via a partnership with the Singapore-based Crypto.com [I80]. Crypto.com had been facing an investigation from the SEC, until the company announced three days after its partnership with TMTG that the agency had dropped their investigation.

Memecoin dinner

Trump held his memecoin dinner on May 22, drawing a crowd of crypto elite who spent anywhere from $55,000 to nearly $38 million to secure a seat at the dinner table, with the event driving almost $150 million in token sales. Some of the attendees I’d previously identified indeed were there, including the leaderboard-topping Justin Sun, at least one delegate from MemeCore (who wore a mask throughout), and someone from LuckyFuture, an embryonic company that plans to launch an “AI-based ETF”.

Crypto executives were also in attendance, including Magic Eden’s Jack Lu, Wintermute’s Evgeny Gaevoy, Axie Infinity’s Jeffrey Zirlin, and Unstoppable Domains’ Sandy Carter. There was also former NBA player Lamar Odom, who just launched an “anti-addiction themed memecoin” where 5% of the token is allocated to supporting drug rehabilitation centers and mental health education (but only once the token hits $10 billion market cap). 20% goes to a “special allocation for the ‘Trump Dinner Program’”.10

Trump’s own attendance at the dinner was brief: precisely 23 minutes, according to one attendee.11 Trump disembarked from the Marine One helicopter; gave a characteristically rambling speech about transgender athletes, autopens, Joe Biden, and, eventually, his favors to the crypto industry; shuffled and pumped his fists to the beat of “Y.M.C.A.”; and then left without taking any pictures or speaking even to VIP attendees.1213 Attendees were served mediocre food and presented with “Fight Fight Fight” ballcaps and collectible plastic-sheathed trading cards.

Standing in the rain outside the dinner, about 100 protesters held large coin-like signs with Trump’s face that read “Stop Crypto Corruption”; others had handmade signs with slogans like “America is not for sale” and “Release the guest list”. Congressman Jeff Merkley (D-OR) made an appearance, describing the event as the “crypto corruption club”.14

There’s been a push for Trump to disclose the list of guests, though Press Secretary statements dodging the question suggest he’s not likely to do so by choice. The Wall Street Journal editorial board published an op-ed ahead of the event urging the president to cancel the dinner or, barring that, to “at least disclose his crypto contest’s winners so Americans know who may be trying to buy access to the President”.15 A letter by House Judiciary Committee Ranking Member Raskin (D-MD) demanded Trump release by June 4 the names of attendees and information on the source of the money used to purchase Trump tokens. (Raskin, I will note, cited this newsletter twice in his letter).16

In Congress

The GENIUS Act stablecoin bill has yet to go to a full vote, but stablecoin giant Circle (which issues the USDC stablecoin) nevertheless just filed to go public, targeting a massive valuation that would rival the likes of Visa.17 It’s kind of weird timing, given that it means they have to include statements in their prospectus like “we are hopeful that a comprehensive U.S. federal-level regulatory framework for stablecoins will emerge in the near term”.18 My sense is that they’re anticipating major competition, likely from huge financial or tech companies, once such a framework exists, and so they’re rushing to go public fast.

This anticipation seems justified, given Wall Street Journal reporting that major banks — JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo — are considering launching a joint stablecoin venture.19 Does anyone else remember when crypto was supposed to be the antidote to banks, not their next product line? Ah, well.

Someone (read: the crypto industry) also lit a fire under the ass of Congresspeople working on the crypto market structure bill, which has since received one of those kitschy acronyms Congress can’t seem to resist. Now known as the CLARITY Act, the bill seeks to establish a joint regulatory environment between the SEC and CFTC, carving out something called an “investment contract asset” to exempt some kinds of crypto assets from securities regulations. It’s a complex and convoluted bill, and it’s pretty clear to me from reading it that it was written by industry lobbyists. I don’t actually think, at least as drafted, that it’s likely to introduce that much in the way of “clarity” to crypto regulation: there are still weird and vague definitions that would still seem to require the same kinds of securities analyses that the industry has been trying to sidestep. However, the bill’s authors may be relying on the fact that, at least for now, the SEC doesn’t seem terribly interested in crypto enforcement.

The CLARITY Act also introduces a poorly defined concept of a “mature blockchain system”, which seems to be the evolution of FIT21’s “decentralized system” evaluations. However, under the bill, blockchain system developers need merely state that they “intend” to become a mature blockchain and they’re granted four years and allowed to raise up to $75 million without significant scrutiny. One need only take the briefest glance at Web3 is Going Just Great to see how many scams people can pull off in much less than four years, and to the tune of less than $75 million, while nevertheless doing substantial damage.

As for consumer protections, the bill’s authors devote very little attention to it, leaving much of it for the CFTC to figure out later. The same CFTC, as I explain in a moment, that may well have one single Commissioner out of its usual five. The bill’s clear purpose is deregulation, and it carves out significant areas of activity (such as all of decentralized finance) from both securities and commodities regulations without specifying anything to fill the vacuum.

The bill is on a rocket schedule, with a hearing already held on June 4 and markup scheduled for June 10. The June 4 hearing featured as witnesses two crypto-friendly former regulators, and two members of the crypto industry.20 Ranking Member of the House Financial Services Committee Maxine Waters subsequently requested a Minority Day Hearing with a panel of witnesses selected by Democrats, which she said would discuss “President Trump’s crypto conflicts of interest and corruption...; the effects of H.R. 3633, the Digital Asset Market Clarity (CLARITY) Act of 2025, on consumer and investor protection, national security, and existing securities and commodity futures regulation; and the potential effects of the proposed legislation on the digital asset industry and broader financial system.”21

The speed at which this bill is being pushed through is perhaps not surprising given the attention to crypto industry desires from the top echelons of government, and concern that changes need to happen fast while there’s enough concentration of power to force them through. JD Vance, speaking at the Bitcoin 2025 conference on May 28, was blunt: “I hope that our party is in charge for a long time, but nothing is ever guaranteed in politics. So the best way to ensure that crypto is part of the mainstream economy is through a market structure bill that champions and doesn’t restrict the extraordinary value that bitcoin and other digital assets represent.”22 Voices from the crypto lobby have expressed similar sentiments, that crypto bills need to happen rapidly before there’s any chance for crypto advocates to lose their dominance in Congress after the midterms [I84].

In regulators

Last recap issue, I wrote that only one current CFTC Commissioner would likely remain after the confirmation of a new CFTC Chair [I84]. Well, the one holdout is planning to leave, too.23 If Trump nominee Brian Quintenz [I77] is confirmed by the Senate, he may end up with unilateral authority over the agency. This is particularly concerning as crypto legislation underway in Congress seeks to delegate a substantial portion of crypto industry oversight to the CFTC, and directs the Commission to engage in substantial crypto-related rulemaking. It also means that Trump will have the ability to nominate an entirely new slate of Commissioners, which will not likely include anyone cautious about cryptocurrency.

The Department of Labor has rescinded guidance from 2022 that instructed 401(k) plan fiduciaries to exercise “extreme caution” before providing any cryptocurrency options to plan participants. In a statement, the Labor Department justifies the change by saying that they historically take a neutral approach to investment types and strategies, and that the rescission should not be interpreted as either an endorsement or disapproval of the choice to offer crypto options in retirement plans.24 Some have interpreted the rescission as a “green light” for crypto in 401(k)s by the Trump administration; others have expressed skepticism that plan managers will widely incorporate these types of assets given their fiduciary duty to manage risk and prioritize the best interests of plan participants.25

SEC

The SEC has also done a 180 on a previous stance, now issuing a staff statement that crypto staking does not fall within their jurisdiction.26 The agency had previously brought enforcement actions against Binance and Coinbase involving crypto staking programs, and in 2023, Kraken paid a $30 million settlement and shut down its staking-as-a-service program after being charged by the SEC [W3IGG]. State securities regulators have also taken enforcement actions against crypto staking services, such as a group of ten state securities regulators who all sued Coinbase in 2023 [I33]. Interestingly, within days of Trump’s inauguration in January, Kraken had relaunched the staking program they’d shut down as part of the settlement agreement [I76] — seemingly confident of not only the regulator’s new general stance on staking, but also that they would not enforce the permanent injunction on such activities imposed by the settlement agreement.

Commissioner Crenshaw issued her own statement on the SEC’s about-face, writing that it was “yet another example of the SEC’s ongoing ‘fake it till we make it’ approach to crypto.” Those remarks echo her speech earlier in the month, where she warned:

My remarks today offer a word of caution as the agency chips away at decades of our own work – and, at the same time, as we stare down alarming market volatility, emerging risks, and calls for deregulatory action in all corners of our markets.

As we careen down this path full speed, it almost feels like we’re playing a game of regulatory Jenga. Our proverbial Jenga tower is made up of a set of discrete but interrelated rules and laws, deeply and carefully developed over the years, and implemented by a strong agency of experts, skilled in overseeing and regulating our increasingly complex markets.

Of course, in Jenga, the tower remains standing when you pull out a block or two here and there. But, how many blocks can you pull before the tower gives way? When it comes to the stability of our markets, how far are we willing to take our dangerous game? Who would ultimately be the loser when the foundation gives way? I worry, as we all should, that those losing the most won’t be the influential, monied interests; rather, it will be the Main Street Americans – the investors and small business owners who can least afford the greatest loss.

She then went on to outline the agency’s recent actions to push out experienced staff, statements that “dilute or effectively rescind” securities laws, failures to enforce securities laws, and choices to ignore significant risks in crypto and other portions of the market. She concludes: “This is a dangerous game. We are pulling apart our own regulatory foundation – block by block, case by case, and rule by rule. It feels all too familiar to those of who have lived through 2008.”27

Crenshaw’s concerns certainly haven’t slowed down the agency any, though. After submitting a joint filing quickly after Trump’s inauguration to stay the ongoing enforcement case against Binance [I77], the SEC has now submitted a joint stipulation to dismiss the case with prejudice.28 The SEC says they have decided as an “exercise of its discretion and as a policy matter” to dismiss the case, which features a written statement from a Binance Chief Compliance Officer that “we are operating as a fking unlicensed securities exchange in the USA bro” and evidence that Binance was not just violating securities laws pertaining to registration but was also committing fraud. A week before the dismissal, Binance listed World Liberty Financial’s USD1 stablecoin for trading on their platform. Trump owns a 60% stake in World Liberty, and receives a substantial share of token and protocol revenues. The stablecoin has also been used to facilitate a $2 billion investment from the Emirati MGX investment firm into Binance — a huge boon for World Liberty and, by extension, for Trump personally.29

Crypto kidnappings, and Coinbase

The slew of physical attacks against wealthy cryptocurrency holders has continued [I84, 75]. Two cryptocurrency investors and entrepreneurs have been arrested in New York after allegedly kidnapping and brutally torturing an Italian man for nearly three weeks, hoping to steal millions of dollars in bitcoin holdings. The victim was a former partner in an investment fund with one of the attackers.30 The men reportedly tortured their victim with electrocution and beatings, urinated on him, forced him to smoke drugs, threatened his family, and dangled him off a five-story building and threatened to drop him. When he finally agreed to hand over his bitcoin to his torturers, they went to get a laptop, and the victim was able to escape the Manhattan townhouse where he was being held captive and alert police. One of the alleged captors, 32-year-old William Duplessie, co-founded a cryptocurrency investment fund; the other, 37-year-old John Woeltz, works in cryptocurrency mining. Both men have pleaded not guilty.3132 A 24-year-old actress was also initially charged in connection to the kidnapping, but her prosecution was deferred. The case has grown somewhat messier as two detectives with the New York Police Department were found to have provided security at the Manhattan apartment, and one of them — who also serves on Mayor Eric Adams’ personal security detail — allegedly drove the victim from the airport to the apartment where he was later tortured. Both policemen were placed on “modified desk duty” as the department investigates their possible connection.33

All of this has made the victims of the recent Coinbase data breach, which exposed identification information, physical addresses, and account balances, all the more concerned. Thanks to a data breach disclosure filed in Maine, we now know that Coinbase thinks precisely 69,461 customers were affected by the data breach.34 Some Coinbase customers have indicated they think the scale of the breach is much wider than that, citing a noticeable uptick in phishing attempts since the approximate time of the data theft despite no notification from Coinbase that their account data was compromised in this breach. However, it can be challenging to distinguish phishing attempts likely tied to this breach from wide-scale phishing attacks by scammers merely targeting a list of phone numbers or who are using old leaked credentials from other platform data breaches in hopes of finding reused passwords.

Many have begun seeking recourse in the courts, where Coinbase is now facing at least fourteen separate customer class actions35 and one shareholder class action.36 Another class action lawsuit was also filed against TaskUs, an outsourcing company plaintiffs believe Coinbase used to hire the customer service agents who were bribed to share sensitive data.37 One of the plaintiffs behind one of the customer class actions has also filed a motion to transfer the whole pile of lawsuits to the Judicial Panel on Multidistrict Litigation, which consolidates multiple cases across multiple districts that involve common underlying issues.38

The class action lawsuits against Coinbase are likely to face challenges, thanks to Coinbase’s class action waiver that seeks to force aggrieved customers into arbitration. New customer terms of service that went into effect almost simultaneously with the breach announcement also seek to force plaintiffs to sue in New York [I84], which could pose additional challenges to the nine of the lawsuits that were filed in other states.

Elsewhere in government

When he’s not rubbing elbows with detectives who moonlight as chauffeurs for crypto kidnappers, New York Mayor Eric Adams has been busy getting back to his crypto boosterism. He’s been a crypto guy for a while — in November 2021, shortly after his election, he announced a stunt in which he opted to take his first three paychecks in bitcoin.a Now, he’s reappeared onstage at Bitcoin 2025, wearing a t-shirt emblazoned with the logo of David Bailey’s new bitcoin treasury company, Nakamoto [I84], and dubbing himself “the Bitcoin mayor”.

There, he called for the end of the New York Department of Financial Services’ fairly strict BitLicense cryptocurrency regulatory regime. He also proposed the idea of issuing “BitBonds”, which would evidently be some kind of bitcoin-backed municipal bonds.39 This idea was quickly smacked down by the New York City Comptroller Brad Lander, who is also hoping to challenge Adams in the upcoming mayoral race, and who described the idea as “legally dubious and fiscally irresponsible”.40 Elsewhere, Adams has proposed creating a crypto advisory council for the city, using crypto to pay city taxes, and issuing birth and death certificates on the blockchain.41

Coinbase’s crypto lobbying group Stand With Crypto apparently forgot to vet its choice of entertainers, and had to awkwardly cancel a scheduled performance by Soulja Boy at a get-out-the-vote event for the New Jersey governor race after Politico pointed out that he was found liable a month ago for abusing and sexually assaulting a former assistant.42 Oopsie.

While Stand With Crypto has previously focused its lobbying mostly at the federal level, they have suddenly grown very interested in the New Jersey gubernatorial race. In addition to the upcoming event, both of the state’s Republican and Democratic primary debates were sponsored by Stand With Crypto.4344 New Jersey gubernatorial candidate and current Congressman Josh Gottheimer has been a strong ally to the crypto industry, which may be what’s drawing the group’s interest.

Outside the US

The International Monetary Fund has published its first regular report on a funding agreement with El Salvador [I72, 76]. Despite Salvadoran President Bukele’s promises after the original deal was made that he would continue to buy more bitcoin on behalf of the country, the IMF says that “efforts will continue to ensure that the total amount of Bitcoin held across all government-owned wallets remains unchanged, consistent with program commitments, while also securing the unwinding of the public sector’s participation in the Chivo [bitcoin] wallet by end-July.”45

In Argentina, President Milei has disbanded the unit that was supposed to investigate the $LIBRA memecoin scandal in which he was implicated [I77, 79, 82]. The committee did not publish a report on their findings or communicate any result. Some Argentinian lawmakers have pushed for continuing investigations, but they have so far been blocked by members of Milei’s party.46 However, there’s been some progress in the States, where a district judge overseeing a lawsuit against Kelsier Ventures, KIP Protocol, Hayden Davis, and others involved in launching the token granted a temporary restraining order and preliminary injunction to freeze $LIBRA tokens, $110 million in $LIBRA proceeds belonging to Hayden Davis, and another $57.7 million in USDC plus any additional $LIBRA proceeds in two other wallets.47

In the Czech Republic, Justice Minister Pavel Blažek has resigned amid a scandal in which the ministry accepted a donation in bitcoin from a person previously convicted of drug dealing and other crimes in connection to his operation of a darkweb marketplace. The ministry then sold the donated tokens for more than $45 million earlier this year. Despite his resignation, the former Justice Minister has defended his behavior as “so ultra-legal that it couldn’t be more legal”. Ah, well, in that case.4849

Police have arrested a Vietnamese woman wanted by Interpol in connection to a $300 million scam operation that solicited thousands of investors with promises of 20–30% returns on a forex and crypto trading platform.50

Australia’s securities regulator has finally filed suit against a former director of the collapsed ACX/Blockchain Global, after previously failing to investigate the massive collapse and allegations of wrongdoing [I46, 48, 50, 53].

The Web3 is Going Just Great recap

There were three entries between May 21 and June 5, averaging 0.2 entries per day. $83.5 million was added to the grift counter.

Cetus Protocol exploited for $223 million

[link]

The Cetus Protocol, a decentralized exchange on the Sui blockchain, was exploited for $223 million by an attacker who manipulated vulnerabilities in the project smart contracts.

Shortly after the theft, validators on the Sui blockchain collaborated to blocklist addresses associated with the theft, effectively freezing approximately $163 million of the stolen funds. While this was successful in mitigating the damage, it drew criticism from decentralization advocates who noted that the ability for validators to censor transactions in such a way proved that the network was not truly decentralized.

A week after the theft, validators on the Sui network passed a governance vote to return the stolen assets to Cetus. The remaining $60 million in stolen funds will also be repaid to customers through a combination of project treasuries and a loan from the Sui Foundation.

Everything else

- Cork Protocol exploited for $12 million

- Taiwanese BitoPro exchange belatedly disclosed $11.5 million hack

Worth a read

Adam Levitin, a law professor and blogger at Credit Slips whose excellent piece on the crypto industry’s debanking story I’ve previously featured in this newsletter, has recently published an analysis of the insolvency provisions in the GENIUS Act, which is the stablecoin legislation currently under consideration in the Senate.

Jason Koebler at 404 Media put out a call for letters from teachers who have experienced changes in how they teach as a result of generative AI. “One thing is clear: teachers are not OK,” he writes.

In the news

The New York Times, Wired, CNN, Fortune, and The Verge cited my reporting on the Trump crypto wallet.

NBC, ABC, Fast Company, The Dispatch, and The American Prospect quoted me or cited my work in connection to Trump’s memecoin dinner. The American Prospect article, “Three Coin Monte”, is by Jacob Silverman, and it’s particularly good.

The Lever, DL News, and CoinDesk cited my reporting about Coinbase’s data breach and the timing of their terms of service change.

Business Insider and Vice wrote stories based on my reporting about OpenAI’s incel chatbot, and The Verge shared my story. OpenAI has since taken down the GPT, after initially refusing to act on moderation reports.

I joined the Electronic Frontier Foundation’s “How to Fix the Internet” podcast for a wide-ranging conversation about tech criticism, loving the web, decentralized social media, and Wikipedia.

That's all for now, folks. Until next time,

– Molly White

Have information? Send tips (no PR) to molly0xfff.07 on Signal or molly@mollywhite.net (PGP).

I have disclosures for my work and writing pertaining to cryptocurrencies.

References

“Behind Trump’s ‘Most Exclusive’ Dinner, a Partner Sells Access”, Bloomberg. ↩

“Trump Crypto Feud Heats Up With Cease-And-Desist Letter”, Bloomberg. ↩

“Chief Executive Officer of Digital Asset Company Found Guilty in Multi-Million Dollar Crypto-Fraud Scheme”, US Attorney's Office, Eastern District of New York. ↩

“Genesis LOC’s Two Major Lawsuits Against DCG, Barry Silbert, and a Network of Insiders Now Available to the Public”, press release by the Genesis Litigation Oversight Committee. ↩

“Crypto Billionaire Accused of Defrauding Creditors, Propelling Industry’s 2022 Collapse”, The Wall Street Journal. ↩

“Judge Overturns Convictions in Mango Markets Exploiter’s Crypto Fraud Case”, CoinDesk. ↩

Notice of removal of action filed on June 2, 2025. Document #1 in The State of Oregon, ex. rel. Dan Rayfield, Attorney General for the State of Oregon v. Coinbase, Inc. ↩

“Trump media group plans to raise $3bn to spend on cryptocurrencies”, Financial Times. ↩

“Trump Media Announces Approximately $2.5 Billion Bitcoin Treasury Deal”, press release by Trump Media & Technology Group. ↩

“NBA Champion Lamar Odom Launches Anti-Addiction Meme Coin, Sparking Disruptive Innovation in Web3”, press release by $ODOM. ↩

“At Trump’s $148 million meme coin dinner, ‘the food sucked’ and security was lax, attendee says”, CNBC. ↩

“A Helicopter, Halibut, and ‘Y.M.C.A’: Inside Donald Trump’s Memecoin Dinner”, Wired. ↩

“Disclose the Trump Crypto Dinner Guests”, The Wall Street Journal. ↩

Letter by Representative Raskin to President Trump, May 28, 2025. ↩

“Beware Stablecoin Hype in Circle’s $6 Billion IPO”, Bloomberg. ↩

Form S-1, Amendment No. 3 filed by Circle Internet Group, Inc. with the Securities and Exchange Commission on May 27, 2025. ↩

“Big Banks Explore Venturing Into Crypto World Together With Joint Stablecoin”, The Wall Street Journal. ↩

“Hearing Entitled: American Innovation and the Future of Digital Assets: From Blueprint to a Functional Framework”, House Financial Services Committee. ↩

“Ranking Member Waters and Committee Democratic Caucus Request Minority Day Hearing to Properly Explore Trump’s Crypto Crimes and Analyze Republican Market Structure Bill,” House Committee on Financial Services Democrats. ↩

“JD Vance Calls Crypto Market Structure Bill a ‘Priority’ for Trump Administration”, CoinDesk. ↩

“Statement of Commissioner Kristin N. Johnson on Her Departure from the CFTC”, CFTC. ↩

“Compliance Assistance Release No. 2025-01”, U.S. Department of Labor Employee Benefits Security Administration. ↩

“Trump administration axes Biden-era barrier for crypto in 401(k) plans”, CNBC. ↩

“Statement on Certain Protocol Staking Activities”, US Securities and Exchange Commission. ↩

“A Reckless Game of Regulatory Jenga”, remarks by Caroline Crenshaw at SEC Speaks. ↩

Joint stipulation to dismiss and releases filed on May 29, 2025. Document #301 in SEC v. Binance. ↩

“How to make millions from a deal that does not involve you”, The Context by Protos. ↩

“Third Arrest Made in Manhattan Bitcoin Kidnapping, Torture Case”, CoinDesk. ↩

“Suspects in Manhattan Crypto Kidnapping, Torture Case Plead Not Guilty as Investigation Widens”, CoinDesk. ↩

“He Was Urinated On, Cut with a Saw and Forced to Smoke Crack: What Police Say Happened to Tourist Lured to N.Y.C. — and Why”, People. ↩

“Police Investigate Detectives Who Worked at House in Crypto Torture Case”, The New York Times. ↩

Coinbase Data Breach Notification, Office of the Maine Attorney General. ↩

Panthaki v. Coinbase (SDNY), Belian v. Coinbase (ND Cal), Shakib v. Coinbase (ND Cal), Scheuber v. Coinbase (SDNY), McAfee v. Coinbase (SDNY), Quito v. Coinbase (WD Wash), Ortiz v. Coinbase (ND Cal), Bender v. Coinbase (SDNY), Edlin v. Coinbase (CD Cal), Squeo v. Coinbase (ND Cal), Neu v. Coinbase (ND Cal), Eisenberg v. Coinbase (CD Cal), Rahman v. Coinbase (SDNY), McGuire v. Coinbase (ND Cal). ↩

Nessler v. Coinbase (ED Pa). ↩

Estrada v. TaskUs (SNDY). ↩

In re: Coinbase Customer Data Security Breach Litigation (MDL No. 3153). ↩

“NYC Mayor Eric Adams Calls for the End of NYDFS' BitLicense, Proposes ‘BitBond’”, CoinDesk. ↩

“Comptroller Brad Lander Pours Cold Water on Mayor Adams’ BitBonds Proposal”, Office of the New York City Comptroller. ↩

“Death certificates on the blockchain? New York Mayor Eric Adams touts new crypto initiative”, DL News. ↩

“Stand With Crypto Removes Soulja Boy From NJ Governor Rally After Discovering Sexual Assault Fine”, CoinDesk. ↩

“IMF Reaches Staff-Level Agreement on the First Review under El Salvador’s Extended Fund Facility Arrangement”, International Monetary Fund. ↩

“Milei cierra la unidad especial que había creado para investigar el ‘caso $Libra’”, El País (in Spanish). ↩

Order on Motion for Preliminary Injunction AND Order on Motion for TRO filed on May 29, 2025. Document #19 in Hurlock v. Kelsier Ventures. ↩

“Czech justice minister resigns over a donated bitcoin scandal”, AP News. ↩

“Drug dealer bitcoin scandal risks upending Czech election”, Politico. ↩

“Vietnamese Woman Arrested in Thailand Over Alleged $300M Crypto Scam”, CoinDesk. ↩

Footnotes

He later discovered this was not permitted by Department of Labor regulation, which prohibit the city from paying its employees in crypto, but announced he would receive the paychecks as normal and then convert them. ↩