Issue 67 – Bug out bitcoin

Crypto resurfaces on the campaign trail and the FTX fallout continues to unfold. Also, merch!

Before we get into this week’s crypto news, I wanted to let you know that I have finally gotten around to setting up a little shop for my stickers and various other items. My [citation needed] stickers from XOXO were a big hit, and I received a lot of requests to make them available more widely, so now you too can show your support for this newsletter (or affix them to your local questionable advertisement or political campaign messaging — they’re highly versatile).

![A [citation needed] sticker on a laptop, a linocut print of a raccoon with “Ignore all previous instructions” around the border, a black sweatshirt with the aforementioned raccoon design on it, and a white t-shirt with [citation needed] on the front.](https://www.citationneeded.news/content/images/2024/09/items.webp)

I’m also experimenting with selling some of my linocut prints, although those are temporarily out of stock as I wait for a paper resupply — so check back in a few days if you’re hoping to snag one of those.

If you have any ideas for fun merch, please send them my way!

Now, with that out of the way:

In the courts

FTX

Caroline Ellison

Next in line for sentencing in the FTX case is Caroline Ellison, the one-time CEO of Alameda Research. She pleaded guilty to seven criminal charges very shortly after FTX collapsed, and has cooperated extensively with prosecutors and the FTX bankruptcy team. She was the star witness in the prosecution of her former boss and on-and-off boyfriend, Sam Bankman-Fried, where she testified about the seven versions of a balance sheet she had prepared to convince lenders that the trading firm was on solid footing and not, say, trading with customer funds from its sister cryptocurrency exchange. She was consistent in her story that she was guilty of committing fraud, and that she had done so at Bankman-Fried’s explicit instruction.

Her seven criminal charges hold a maximum prison sentence of 110 years, and sentencing guidelines recommend that substantial term. However, she’s not likely to serve anything close to that. She has submitted a sentencing memo asking that she be sentenced to “time served”, which for her amounts to zero jail time. Attached to her memo include the usual character references from friends and family, but also a letter from the CEO-in-bankruptcy in charge of the FTX estate, who attested to her “valuable assistance and cooperation, which resulted in the recovery of hundreds of millions of dollars in Debtor assets for the benefit of creditors.” He also describes an impending settlement in which she’s likely to forfeit to the FTX bankruptcy estate “substantially all of her remaining assets after satisfying her forfeiture obligations”.1 Ellison’s lawyers describe her moral compass as having been “warped” by her “fundamentally unequal” relationship with Bankman-Fried, who is portrayed as a manipulative and unavailable partner who she was desperate to please. “After years of serving Mr. Bankman-Fried’s interests, Caroline reasserted her own in November 2022, when she stopped lying for Mr. Bankman-Fried,” her lawyers write, arguing that granting leniency in her case would encourage others who might consider cooperating in prosecutions pertaining to their own crimes.2

Despite the sentencing guidelines recommendation, the probation department has also submitted a recommendation of time served, with three years of supervised release. Prosecutors have not submitted any specific sentencing recommendation, but have attested to Ellison’s “extraordinary cooperation that was crucial to the Government’s successful prosecution of Samuel Bankman-Fried”.3

I’m curious to see how things go for her during her sentencing hearing on September 24. It will give us a hint at the likely outcomes for the remaining two defendants, Nishad Singh and Gary Wang, who are set to be sentenced in late October and November, respectively.

Sam Bankman-Fried

Two groups have filed amicus briefs in Sam Bankman-Fried’s appeal: a group of bankruptcy lawyers, and a group of neurodiversity experts. The former say that they take no position on the verdict, but have outlined “the government’s unusual and problematic use of the chapter 11 reorganization” in their prosecution, describing the “potential for unfairness and inefficiency when a bankruptcy estate cooperates too closely with criminal prosecutors.”4 The neurodiversity experts write that Bankman-Fried’s autism and ADHD “posed serious challenges during proceedings in this case”, and that some errors asserted in his appeal may have been impacted by judicial prejudice stemming from his disorders. In particular, they single out the choice to require Bankman-Fried to testify on some topics outside of the presence of the jury, the denial of his requests for access to some FTX documents, and the failure to provide Bankman-Fried with his Adderall medication at various points before and during his trial.5

If anyone was hoping for a quick decision on Bankman-Fried’s appeal, I have some bad news: the government’s brief is not even due until December 13.

Michelle Bond

Michelle Bond, the partner of FTX executive Ryan Salame, has pleaded not guilty in her separate criminal trial on campaign finance charges pertaining to her 2022 Congressional campaign [I65]. Although her prosecution is not bundled with that of her partner, the charges are somewhat related — the government alleges that she accepted a $400,000 payment from FTX, set up by Salame and disguised as a consulting fee, and then lied to a congressional committee and the Federal Election Commission about the source of the funds.

Although Salame originally intended to argue that the judge in his case should force the government to drop the case against Bond, as he says they promised they would during his plea negotiations, he later attempted to withdraw that motion with the idea that Bond would instead make that argument in her own courtroom. However, Salame’s judge did not approve his motion to withdraw the request, and is contemplating how to proceed now that Salame has argued that he was improperly induced to plead guilty [I65, 66].

Everything else

I apologize for my error from last issue, when I wrote that the trial of Celsius CEO Alex Mashinsky was about to begin. I had missed that, back in April, the judge had postponed his trial to January 28, 2025.6 The delay was partly because both parties expressed that they needed more time to evaluate the “voluminous” discovery, and also because AUSA Allison Nichols was expecting to be out on maternity leave at the time of the originally scheduled trial.

Binance founder and former CEO Changpeng Zhao is due to be released from his California halfway house on September 29 after completing his four-month sentence [I57].7

Avraham Eisenberg, the Mango Markets exploiter who was found guilty of fraud and market manipulation in April [I6, 43, 55, 56], has been trying to argue that the jury’s verdict should be overturned and that he should be acquitted or retried. This is based on arguments that the case was considered in the improper venue, that the government failed to prove that commodities laws applied to the activities at issue in the case, that the government failed to prove Eisenberg’s intent to manipulate the price of the assets he was trading, that it was not possible for Eisenberg to deceive a smart contract (i.e., “code is law”), and finally that the government failed to prove that Eisenberg used interstate wires.8 Prosecutors have responded, rejecting all of his arguments and blasting him for “try[ing] to take the case out of the jury’s hands by trying to portray factual issues the jurors were asked to, and properly decided, as pure legal questions.”9 It’s not clear yet what the judge plans to do with this motion, but six days after Eisenberg filed it, the judge scheduled his sentencing for December 12.

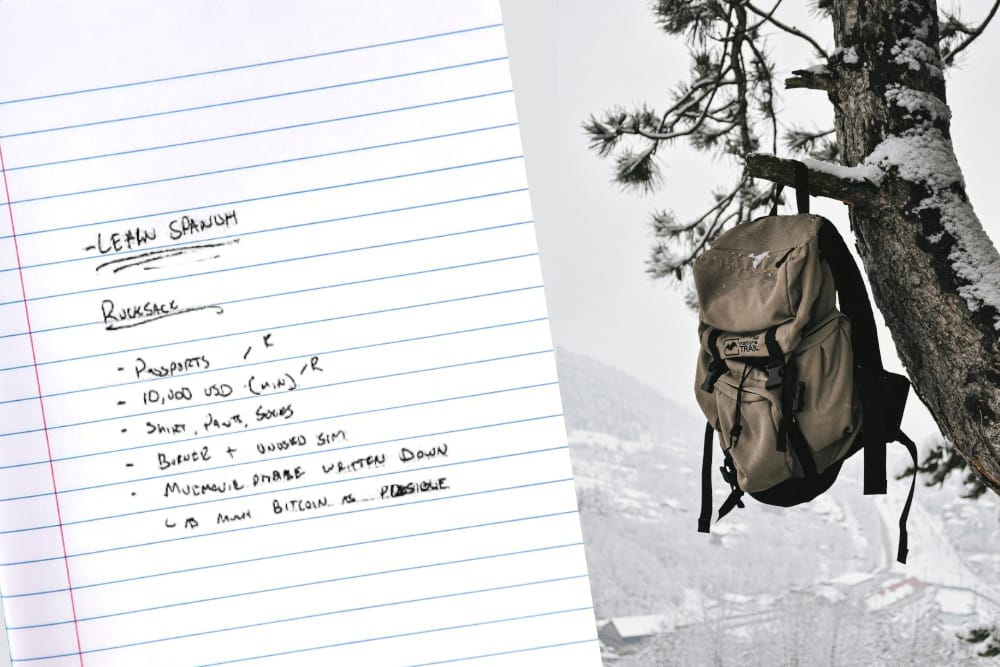

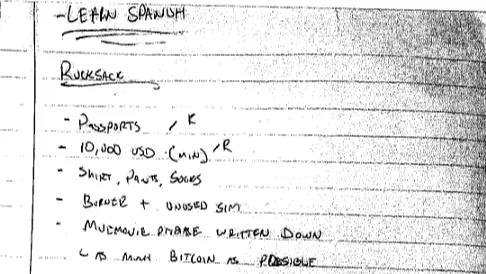

Samourai Wallet co-founders Keonne Rodriguez and William Hill appeared for their first hearing in the criminal case pertaining to their operation of the crypto mixing service [I56, 57]. Rodriguez has been confined to house arrest, which he requested be lifted during the hearing. However, after prosecutors produced a handwritten note in which Rodriguez detailed his “bug out prep” plans — which included “learn Spanish” and reminders to set aside “10,000 USD (min)” and “as much bitcoin as possible”, the judge opted to keep the restriction in place.10 His defense team claimed those were just plans for a general emergency.

An arrest order has been issued in Finland for Richard Heart, the founder of the Hex cryptocurrency project. He has been accused of tax evasion, allegedly owing several hundred million euros in taxes, and he has also been charged for an assault that allegedly occurred in February 2021.11 Heart’s whereabouts have been unknown for some time now, and have presented issues not just to Finnish authorities, but also to the US SEC [I35, 45].

In bankruptcies

The judge overseeing the Terraform Labs bankruptcy has approved the company’s plans to wind down. Terraform will likely only be able to repay between $184.5 million and $442.2 million to creditors, out of an estimated $40 billion in losses.12

In governments and regulators

The SEC has approved the Nasdaq’s application to list and trade options on BlackRock’s spot bitcoin ETP, although they still need to be approved by the CFTC before trading can begin.13

Prager Metis, one of the auditors used by FTX before its collapse, has settled charges from the SEC that they violated auditor independence rules and aided and abetted their clients’ violations of federal securities laws in relation to more than 200 audits. The original September 2023 press release from the SEC announcing the charges made no mention of FTX [I44, W3IGG], but the collapsed company took a central position in the complaint, where the SEC wrote that the firm “fundamentally did not understand FTX, or the crypto asset markets in which it operated”, and “assembled an engagement team that collectively lacked the competence, experience, and knowledge to appropriately conduct the audits.”14 Prager Metis will pay a $745,000 penalty in connection to the FTX audits, and a bit over $1.2 million for violating auditor independence requirements. Altogether they will pay $1.95 million, and they will also bring in an independent consultant to review policies and face restrictions on accepting new clients.15

Rari Capital, a twice-hacked defi lending program that effectively wound down after an $80 million exploit in April 2022 [W3IGG], has reached a settlement with the SEC [W3IGG]. The SEC alleged that the company and its co-founders had misled investors about the supposedly automatic re-balancing of crypto portfolios, and about the supposedly high yield opportunities that, in reality, mostly lost their customers money. The company and its co-founders will pay as-yet-unknown fines, and the co-founders agreed to five-year bans from serving as officers or directors.

A Texas court has dismissed the lawsuit filed by Consensys against the SEC in April [I57]. Consensys filed the suit shortly after they received a Wells notice, and alleged in their complaint that the agency was “attempting to unlawfully regulate ether”. The SEC later informed Consensys that they were not planning to bring charges pertaining to their ETH sales [I60], although they did bring charges against the firm for other alleged violations [I61]. Because of this, the Texas judge decided that because there was no clear threat to Consensys from the SEC in connection to their claims regarding ETH, “the claim lacks a ripe case or controversy”.16 Consensys had hoped to get the Texas court to declare that ETH is not a security, that their MetaMask offering is not a broker under securities law, and that MetaMask’s staking service doesn’t violate securities law. It doesn’t seem they will succeed in the first, and the two other questions will now have to be decided in the SEC lawsuit against the company in New York.

The SEC has taken its first action against pig butchering scammers, a category of scammers that has mostly had to deal with the Justice Department thus far. The SEC charged five entities and three individuals in connection to platforms called NanoBit and CoinW6, which were allegedly used by romance scammers to solicit investments. The scammers then showed their victims fictitious “returns” on their investments, and when they tried to withdraw funds, claimed that they could not do so without paying more for “taxes” or various other fees.17

The CFTC has won a case against William Koo Ichioka, who was found to have operated a forex and cryptocurrency investment scam. He will pay $31 million in restitution and another $5 million in penalties for the scheme, which beginning in 2018 promised victims 10% returns every month. Instead of paying those returns, he spent the money on luxury cars, jewelry, and other personal expenses.18

The Treasury Department has sanctioned Cambodian senator and businessman Ly Yong Phat and some of his businesses for his alleged role in human trafficking, torture, and other human rights abuses perpetrated as part of a pig butchering operation in the country. One of the hotels he operates is reportedly a major compound where trafficked individuals are forced to work as scam operators in pig butchering schemes.19

Custodia Bank is appealing its April loss of its lawsuit against the Federal Reserve for denying them a master account [I54]. Now, they’re arguing that the Federal Reserve Board lied about the bank’s business model in order to deny the application, and that the denial was politically motivated. “The weight of the federal regulatory infrastructure was deployed to crush a small Wyoming bank,” they complain in the appeal.20 However, eleven Federal Reserve banks submitted an amicus brief earlier this month, warning that Custodia “asks this Court to reach the dangerous conclusion ... that Reserve Banks are required to provide account access to any entity that meets the definition of a ‘depository institution’ under the FRA, regardless of the risks the institution poses. Appellant’s extreme argument is that it—and every other depository institution—is automatically entitled to a master account on a no-questions-asked basis. If the Court were to become the first to adopt this misplaced position, it would strip Federal Reserve Banks of a critical authority necessary to both manage their own risks and to carry out the central bank’s statutory mandate to promote the safety and stability of the U.S. financial system.”21

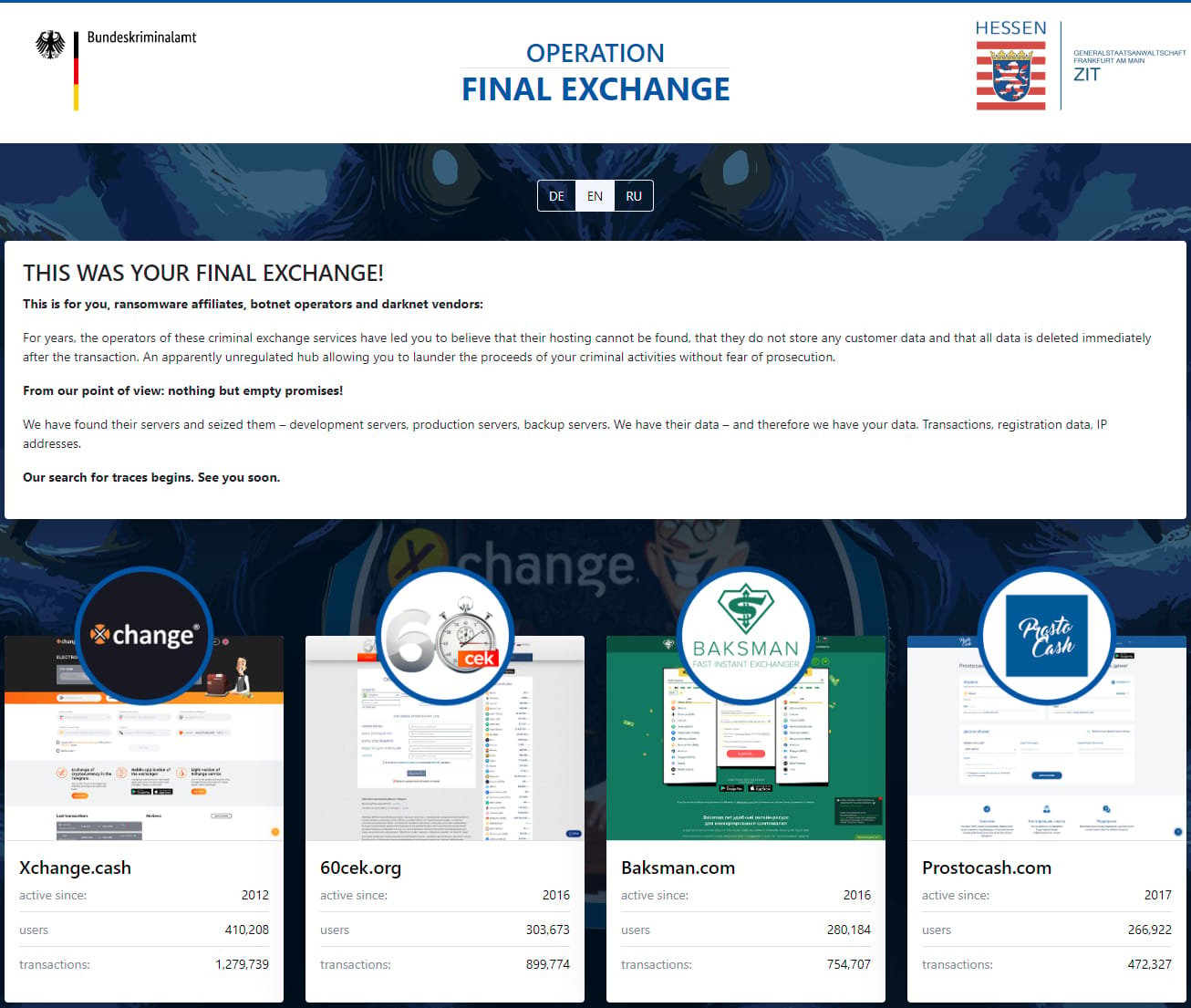

In a project they’re calling “Operation Final Exchange”, Germany has shut down 47 cryptocurrency exchanges they allege have been used to launder stolen assets by ransomware groups [W3IGG]. Seized websites for the exchanges now show a warning to the various ne’er-do-wells who previously frequented the no-KYC crypto services, with rather theatrical warnings that they have obtained the data from the seized servers, and that “Our search for traces begins. See you soon.”

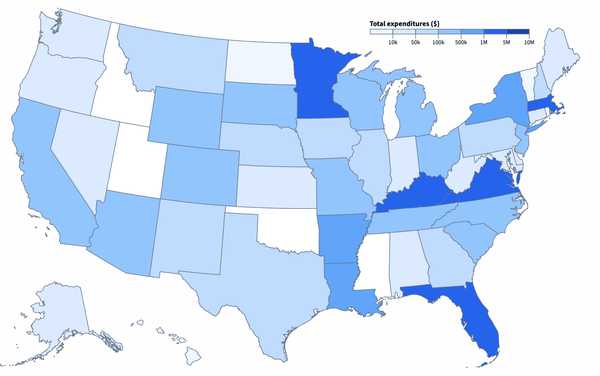

In elections and political influence

Kamala Harris has made her strongest yet statement about cryptocurrency, but that’s not saying much. At a fundraising dinner, she reportedly remarked, “We will encourage innovative technologies like AI and digital assets, while protecting our consumers and investors.”22 In my view, this is the same type of insipid statement that we’ve seen from her campaign in the past (a campaign adviser stated “She’s going to support policies that ensure that emerging technologies and that sort of industry can continue to grow” in late August). Who doesn’t want to “encourage innovative technologies” while protecting consumers? I think even the biggest crypto skeptics in Congress would probably say this is their goal. Headlines have been making much of her recent statement, though, with various outlets describing it as “embracing crypto” (Axios), “vow[ing] to aid ... [the] crypto sector” (Bloomberg), “extend[ing an] olive branch” (Fortune), and “vow[ing] to boost crypto” (Fox Business). Whether I’m naive about interpreting campaign trail messaging or the media is too eager to read meaning into these vague non-answers remains to be seen.

Over in Trumpland, the presidential hopeful’s most recent crypto stunt involves him buying a hamburger with bitcoin at PubKey, the self-described “bitcoin bar”. Or at least that’s how PubKey tells it, but video of the interaction shows Trump briefly fumbling with a phone handed to him by a helper after he’s instructed to scan a QR code on a tablet. Failing to do so, he hands it back to the helper, who then unsuccessfully tries before handing it to the bar employee who gives it a shot. “Slight technical difficulty...” the employee murmurs, before Trump’s helper exclaims “and fantastic, it went through!” After a few more seconds of fumbling, the bar employee says, with some surprise, “oh, it did go through!” before falsely stating that he had just witnessed “the first transaction by a president on the bitcoin protocol. History.” Not one to be bothered with the fact that he is not the president, or the contradiction with his past claims to have purchased bitcoin, Trump then parrots, “That’s history. History in the making.”23

Robert F. Kennedy Jr. is apparently using his newfound free time to blast authors of a recent piece in The Economist about “Why Texas Republicans are souring on crypto” for “perpetuat[ing] common myths about bitcoin mining while neglecting the real story”. Although Kennedy has been known for his environmental advocacy, he writes simply that “bitcoin mining is different”, going on to explain the concept of demand response programs.24 Why he felt the need to do so when the article he objected to explicitly described such demand response programs is not clear to me.

The digital assets subcommittee of the House Financial Services Committee held a rather pointedly-titled hearing called “Dazed and Confused: Breaking Down the SEC’s Politicized Approach to Digital Assets”. Once again [I66], the witnesses list was pretty one-sided, with crypto-skeptical Lee Reiners facing off against four witnesses from or adjacent to the crypto industry.25 Much has been made of the fact that “ex-SEC commissioner” Daniel Gallagher heavily criticized the agency’s current approach to digital assets, with headlines generally omitting the fact that Gallagher is also a revolving-door hire at Robinhood, a firm whose crypto division has been scrutinized by the SEC [I57].

Letters to the SEC have also been flying out of the House of Representatives, with a September 10 letter from Republicans Jim Jordan (OH), Patrick McHenry (NC), and James Comer (KY) accusing Chairman Gary Gensler of hiring people based on their left-wing political leanings,26 and a September 17 letter from Republicans Tom Emmer (IN) and Patrick McHenry challenging the SEC’s position that cryptocurrency airdrops are securities transactions.27

Elsewhere in crypto

WazirX is now trying to blame Binance for the massive hack of the WazirX platform in July [I62, W3IGG]. Prior to the hack, the two companies were engaged in a bizarre dispute in which WazirX claimed that it was owned by Binance, while Binance denied it (despite blog posts of their own announcing an acquisition) [W3IGG]. The latest claims were made in sworn affidavits submitted by WazirX co-founder Nischal Shetty as part of an application for bankruptcy protection. Binance has, again, denied the relationship, and posted that Shetty is “trying to deflect the blame and claim that Binance may somehow be responsible for the losses suffered by WazirX users and creditors as a result of the cyber-attack”.28

Sky, the project previously known as MakerDAO, has voted strongly in favor of no longer using the WBTC token as collateral on the project.29 The vote involved concerns over the reliability of the token, which is issued by BitGlobal, yet another company Justin Sun tries to pretend he doesn’t operate [I45, 49]. According to a post by defi risk management group BA Labs:30

To summarize:

- Based on available evidence, it is highly likely that Justin Sun or affiliates control BitGlobal, with ownership concealed through shell companies and nominee directors

- Justin Sun affiliated stablecoins and custodial products have a significant negative track record and pose elevated counterparty risk

- Given evidence of concealment and concerns about validity of previous disclosures for Sun affiliated entities and products, we find that legal due diligence would not provide an adequate level of assurance

The post then went on to list examples of this “negative track record”, including the significant de-pegging of TUSD and its failure to provide proof of reserves [I49, W3IGG], and the collapse of HUSD [W3IGG]. The community ultimately supported the decision with 88% voting in favor, and so will begin removing support for the asset in a process that should take about two months.

Although the celebrities who’ve launched memecoins have tended to forget about them shortly afterwards, Iggy Azalea has yet to do so. After launching her $MOTHER token in June [I59], she’s continued posting constantly about it. Then, just a few days ago, she turned up at the Solana Breakpoint event in Singapore, where she announced that she would be launching a crypto casino for some reason, reading a prepared statement about “merging culture and entertainment beyond hype cycles to create long-term value”.31 She was also supposed to participate in a debate over whether celebrity coins are bad with bitcoiner and Taproot creator Eric Wall, although she later refused to attend, claiming that it was because conference organizers wouldn’t allow her to “throw ass on [Wall]” over concerns it “would go too viral and then people won’t talk about the other serious things at the conference in the press”.32 Why Iggy Azalea twerking would be newsworthy, much less a “viral moment”, is beyond me.

The ever-present phenomenon of social media accounts being hacked to promote crypto hasn’t slowed down any, with one of the latest targets being the YouTube account belonging to the Indian Supreme Court. Scheduled to stream cases including an appeal of a decision to ground SpiceJet planes and a hearing on an issue in a decades-long dispute over a mosque that was possibly built atop the birthplace of Hindu deity Krishna, the YouTube channel instead treated surprised visitors to streams promoting Ripple’s XRP tokens.33

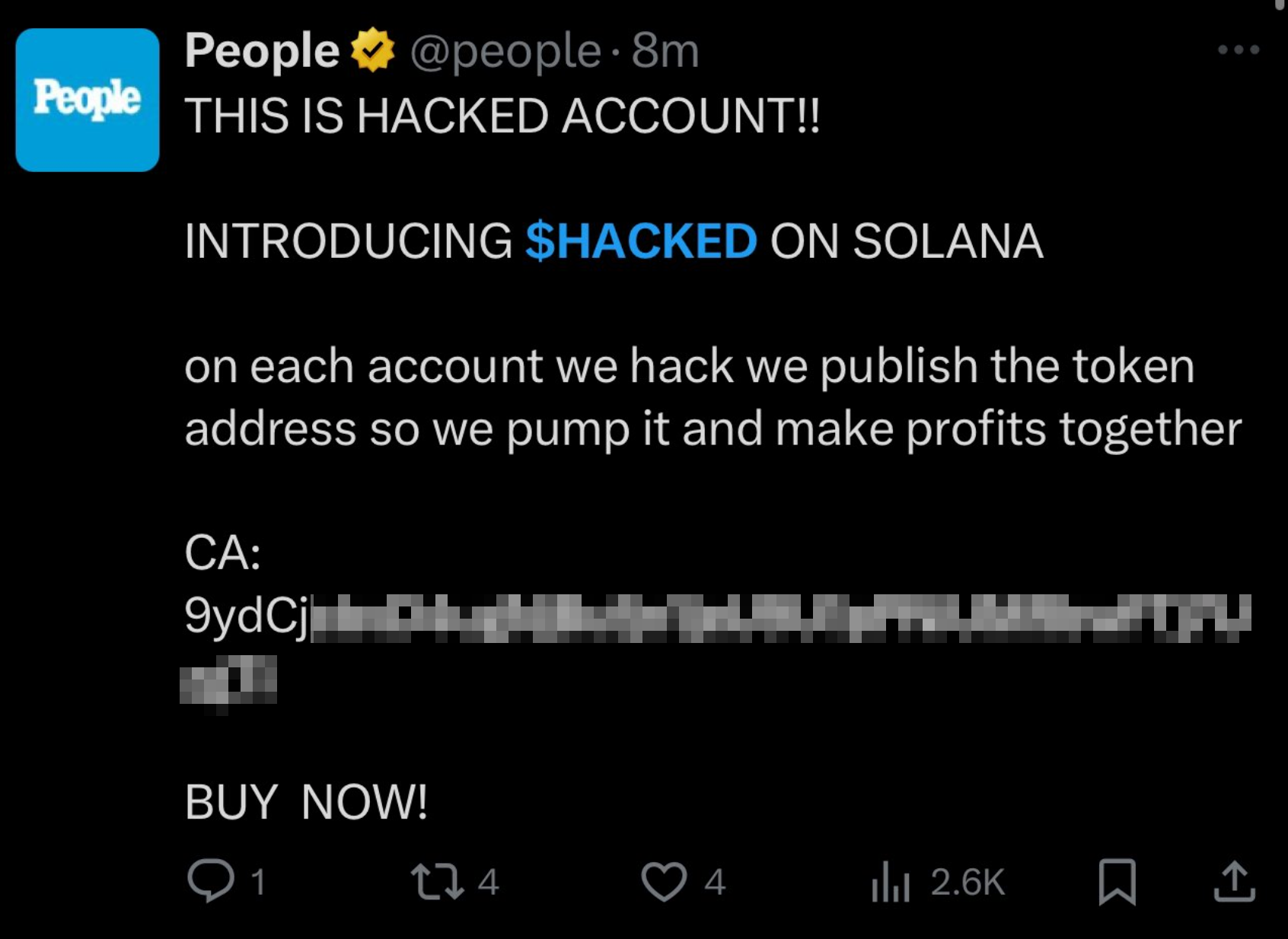

Another social media hack targeted numerous large accounts belonging to individuals and groups including Lenovo India, Yahoo News UK, German satire site Der Postillon, People magazine, film director Oliver Stone, and Brazilian and French soccer players Neymar Jr. and Alexandre Lacazette. Instead of following the usual playbooks in which scammers claim the actual owners of the accounts are launching tokens or crypto projects, the hackers plainly stated that the accounts were hacked, publishing identical tweets across accounts:

The new technique wasn’t exactly a winner, earning the scammers only about $8,000 despite the massive accounts they’d managed to compromise.34

The Web3 is Going Just Great recap

There were seven entries between September 17 and September 23, averaging 1 entry per day. $297.88 million was added to the grift counter.

“Banana Gun” users lose almost $2 million

[link]

At least 36 users of the “Banana Gun” Telegram crypto trading bot have lost a combined $1.9 million after their accounts were evidently compromised and drained. People primarily use the bot to “snipe” cryptocurrency trades, and it also has copytrading and other functionality.

The operators of the bot shut it down after acknowledging the attack, then blamed it on a “front-end vulnerability” — with little detail about what this might have actually entailed.

Gemini phishing

[link]

One person had a really, really bad day after falling for a phishing scam in which a scammer impersonated a Google employee and convinced them to reset their two-factor authentication on the Gemini cryptocurrency exchange. Doing so allowed the scammers to drain a massive $243 million from that person’s account.

The potentially good news for this victim is that, with the help of zachxbt and other crypto sleuths, authorities have since raided a Miami home and arrested two young men in connection to the theft.

Everything else

- Shezmu hacked for almost $5 million, negotiates bounty [link]

- BingX hacked for $52 million [link]

- Germany seizes 47 cryptocurrency exchanges reportedly used by ransomware groups [link]

- Rari Capital settles with the SEC [link]

- Ethena website compromised [link]

In the news

This newsletter got a shoutout from Michael Hitzlik of the Los Angeles Times, who quoted my observation that many in the crypto world are less than enthused about Donald Trump’s new defi project.

I once again filled in as the third head of the This Week in Google Cerberus, where we chatted about moral panics about child safety online, various crypto grifts including Trump’s, and the omnipresence of online foot fetishists.

That's all for now, folks. Until next time,

– Molly White

I have disclosures for my work and writing pertaining to cryptocurrencies.

References

Exhibit to sentencing memorandum of Caroline Ellison, filed on September 10, 2024. Document #497-1 in US v. Bankman-Fried. ↩

Defendant Caroline Ellison’s sentencing memorandum, filed on September 10, 2024. Document #497 in US v. Bankman-Fried. ↩

Caroline Ellison sentencing document, filed on September 17, 2024. Document #502 in US v. Bankman-Fried. ↩

Amicus brief on behalf of amicus bankruptcy law professors, filed on September 20, 2024. Document #38 in US v. Bankman Fried (2nd Cir.) ↩

Amicus brief on behalf of neurodivergence experts, filed on September 20, 2024. Document #41 in US v. Bankman-Fried (2nd Cir.) ↩

Transcript of proceedings as to Alexander Mashinsky re: Conference held on 2/20/2024 before Judge John G. Koeltl, filed on April 5, 2024. Document #56 in US v. Mashinsky. ↩

“CZ Set to Be Released From Prison on September 29”, CoinDesk. ↩

Avraham Eisenberg’s memorandum of law in support of motion for judgment of acquittal or, in the alternative, a new trial, filed on August 5, 2024. Document #183 in US v. Eisenberg. ↩

Response in opposition to motion, filed on September 18, 2024. Document #186 in US v. Eisenberg. ↩

“Samourai Wallet Founder to Remain Under House Arrest After Judge Sees His 'Bug Out Prep’ Notes”, Decrypt. ↩

“HEX founder Richard Heart suspected of tax evasion in Finland”, Cointelegraph. ↩

“Terraform Labs approved for bankruptcy wind-down after US SEC settlement”, Reuters. ↩

“SEC Approves Nasdaq to List Options on iShares Bitcoin Trust ETF”, Bloomberg. ↩

Complaint filed on September 17, 2024. Document #1 in SEC v. Prager Metis CPAs LLC. ↩

“FTX Auditor Prager Metis Settles SEC Charges Over 'Negligence'”, Decrypt. ↩

“Consensys Suit Against U.S. SEC Dismissed by Texas Court”, CoinDesk. ↩

“SEC Charges Multiple Individuals and Entities in Relationship Investment Scams”, US Securities and Exchange Commission. ↩

“CFTC secures $31m restitution for forex and crypto scam victims”, DL News. ↩

“U.S. Treasury Sanctions Cambodian Tycoon With Ties to Pig Butchering Scams”, CoinDesk. ↩

Appellant/petitioner’s reply brief filed on September 18, 2024. Document #148 in Custodia Bank v. Federal Reserve Board of Governors (10th Cir.). ↩

Amicus curiae brief filed by Federal Reserve Banks on September 5, 2024. Document #010011106271 in Custodia Bank v. Federal Reserve Board of Governors (10th Cir.). ↩

“Harris Vows to Aid AI, Crypto Sectors in Pitch to NYC Donors”, Bloomberg. ↩

“Bitcoin Bar: Trump meets with supporters and uses crypto currency for first time”, LiveNOW from FOX. ↩

“Letters to the editor: Bitcoin mining and energy”, The Economist. ↩

“Hearing Entitled: Dazed and Confused: Breaking Down the SEC’s Politicized Approach to Digital Assets”, US House Financial Services Committee. ↩

“US House Republicans probe SEC’s Gensler on political hiring claims”, Cointelegraph. ↩

“House Republicans demand SEC’s Gensler clarify crypto airdrops stance”, Cointelegraph. ↩

“Binance Denies Responsibility in WazirX Hack, Says It Never Acquired the Company”, Decrypt. ↩

“DeFi Lender Sky Ratifies Plan to Offboard Wrapped Bitcoin, Due to Sun Concerns”, CoinDesk. ↩

“WBTC Update - 12 September 2024”, post by monet-supply on behalf of BA Labs. ↩

“Iggy Azalea to Release Online Casino Motherland in Boost for MOTHER Token”, CoinDesk. ↩

“Supreme Court’s YouTube channel hacked, streams videos promoting cryptocurrency”, The Times of India. ↩

Tweet thread by zachxbt. ↩